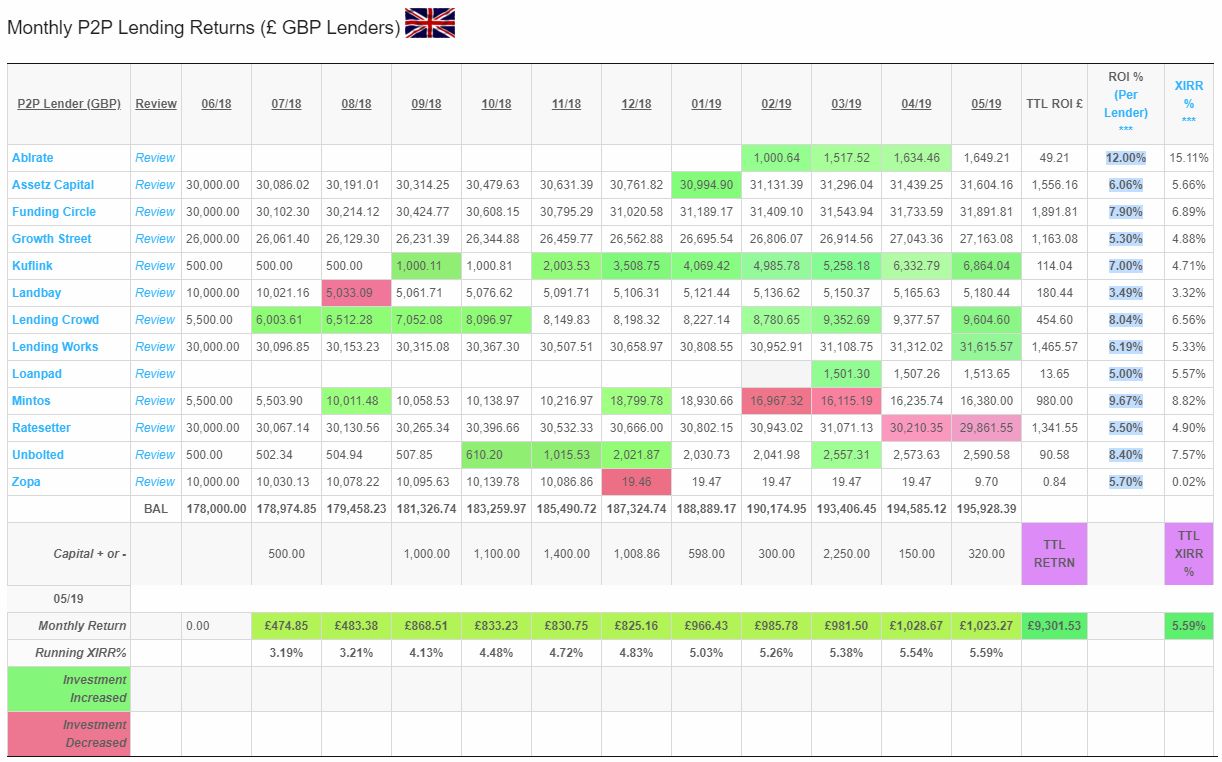

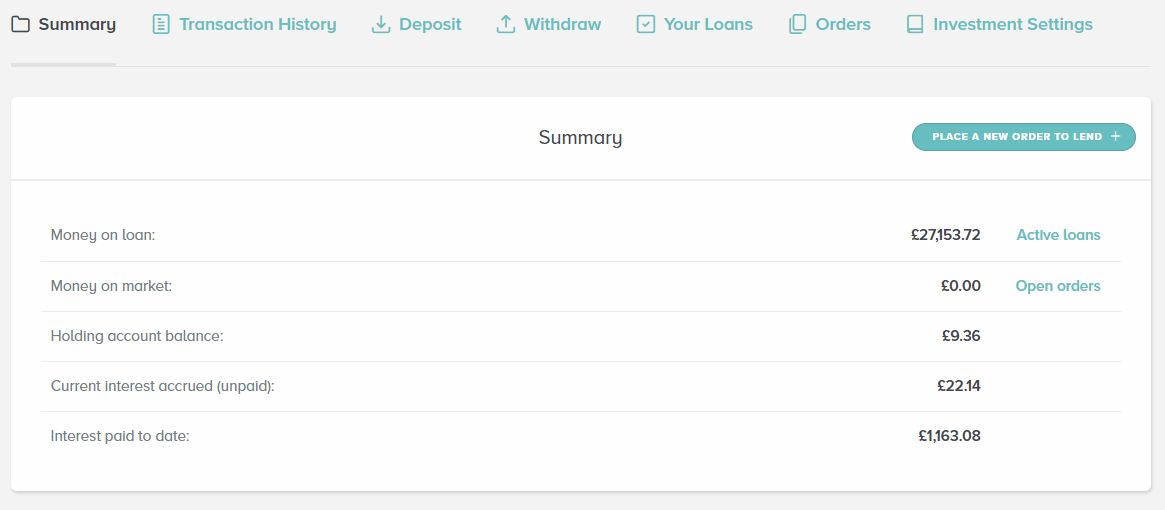

GBP Portfolio Overview

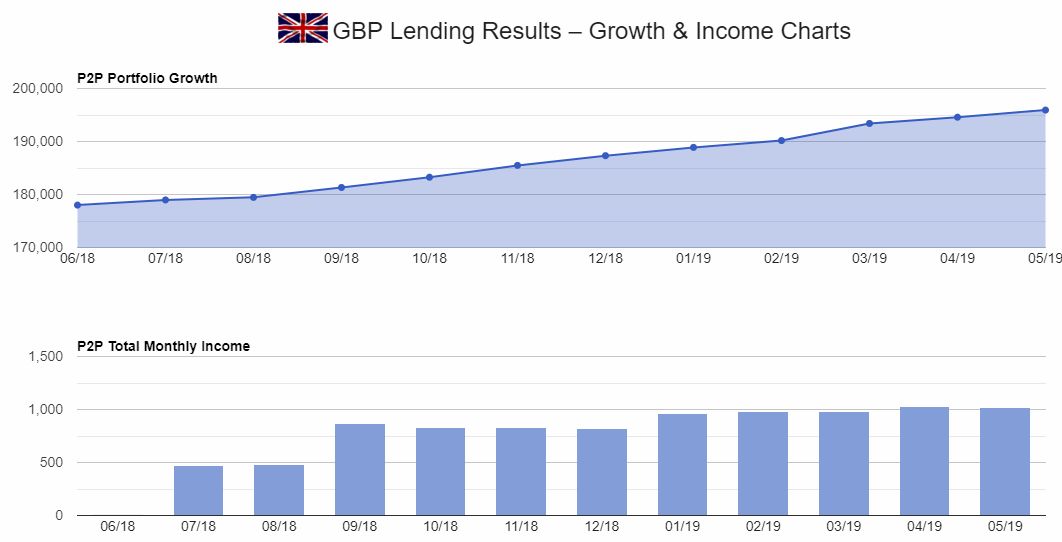

May was the 12th month, and the 1 year anniversary of the GBP Peer to Peer Lending Portfolio! It was also the second best month since inception. For the second time it crossed the £1000 per month income barrier, with a return of £1,023.27 in GBP! Only around only £5 less than April.

Total GBP XIRR rose just a little again from 5.54% to 5.59% in May, continuing its progression each month since the portfolio was started. I’m still expecting XIRR to keep rising at a steady rate for another couple of months. However it’s probably getting close to where it will stay now as I have a couple of lenders in there who have a return of less than 6%. So we my make just above 6% which I’ve been hoping for, but we’ll just have to see.

My Euro Lenders are coming along as I mentioned in last month’s update. I’m excited for the rates they are showing and the investment opportunities available in euros, but more on that later in the update.

Move money

I had to move some money from RateSetter again this month because rates are still so low and I’m still getting some cash drag at my 6.1% reinvestment setting.

As mentioned in last months update, I also decided to redistribute some capital from my larger accounts to balance things out a bit. I haven’t decided exactly how that’s going to work yet, but expect to see some of my larger accounts draw down a bit.

The Elephant in the Room – Lendy Collapses – My Thoughts.

The Elephant in the Room

I feel like I need to mention the Lendy (Saving Stream) collapse situation as everyone is up in arms about this “sudden” collapse?

A post on Lendy – The Elephant in the Room was written last week if you are interested in my thoughts on the subject.

It’s also worth mentioning that BondMason decided to wind down just a couple of days ago, although this is to be done in a much more orderly manner. I don’t have a lot to add about BondMason as I never really looked at them seriously so don’t have any information.

May 2019 Lending Update

On to the individual updates!

There are some great cashback incentives for new investors right now. I have listed them at the end of each lender update, or you can always see my cashback page for current offers on all lenders.

If you are considering investing in any of the lenders I write about, and you think my website is helpful in your research, please consider using my links as I can sometimes get a small commission from the lenders which costs you absolutely nothing and helps me continue to run the website.

Charts and spreadsheet updates are below. You can see live versions of these anytime here.

As a side note, if you missed the article I promised to write on early retirement in Portugal in the March update, here it is: FIRE – Financial Independence, Retire EARLIER! in Portugal

Individual Lender Updates

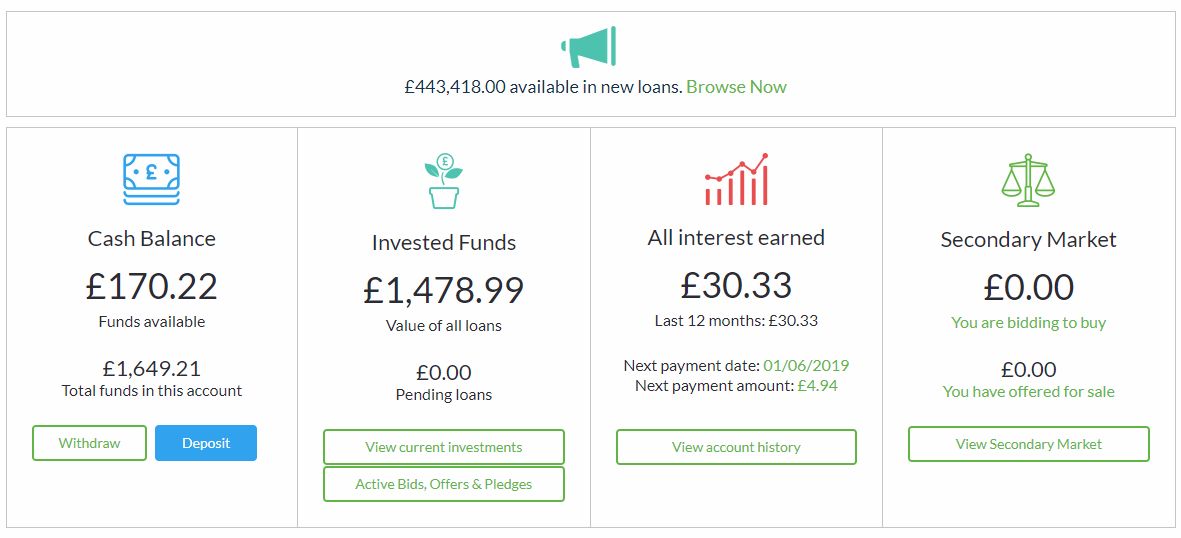

ABLRATE

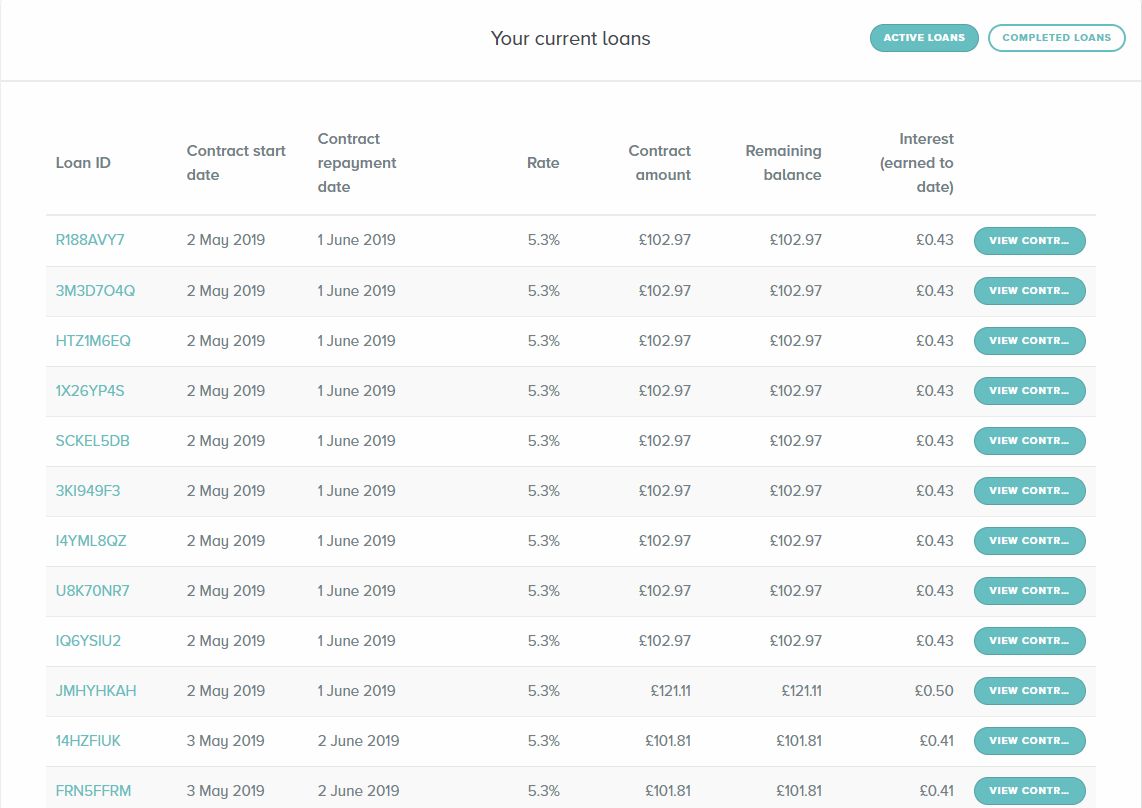

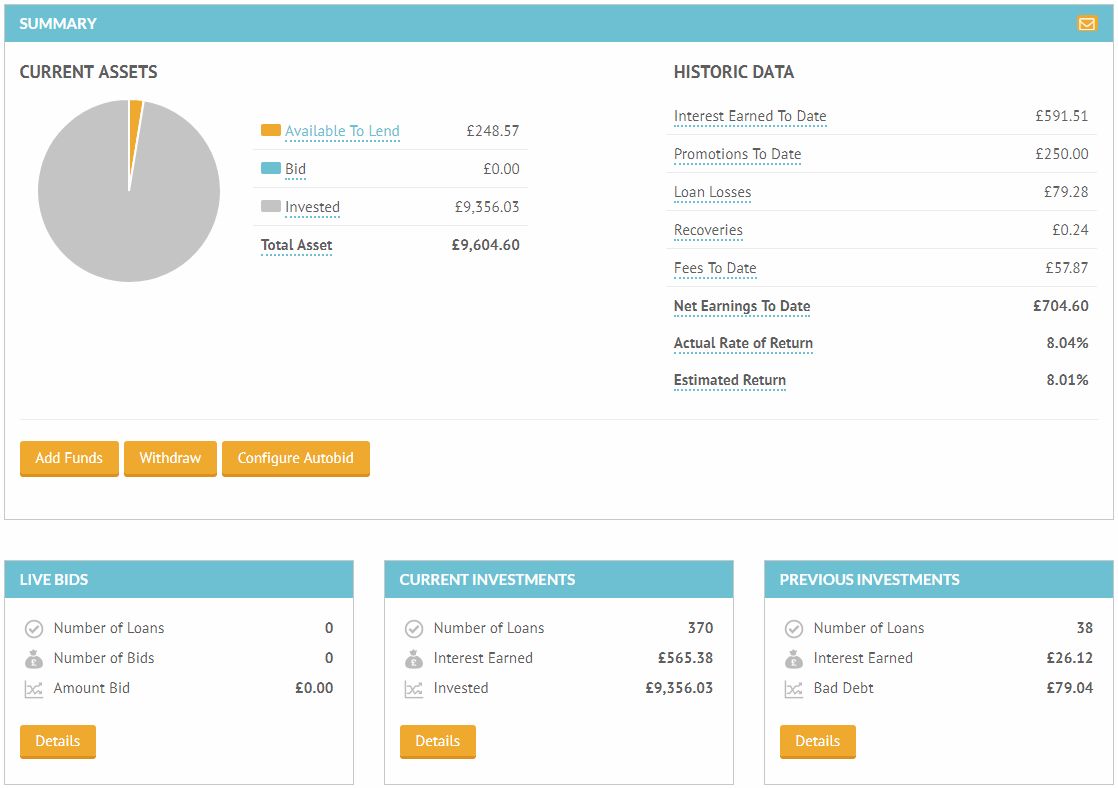

See Screenshots & Detailed Monthly Updates From My Ablrate Account

Pretty much the same as last month with Ablrate. They have some very strong loans available, but the loan flow is very slow. We are starting to see some XIRR calculations come through now which are looking very interesting at 15.11%. I think this has to do with the fact that many of the loans were picked up from the secondary market. When you low bid the loans on the secondary market, if the bid gets accepted, it increases the rate of return on the overall loan.

My strategy with Ablrate is to watch them for a while longer and then perhaps up the stakes on each loan a bit as I have with Kuflink and a couple of the Euro lenders based on some stricter due diligence I will need to do. I’ll see how that progresses though.

I completed a full review on Ablrate in May if you’re interested in taking a look.

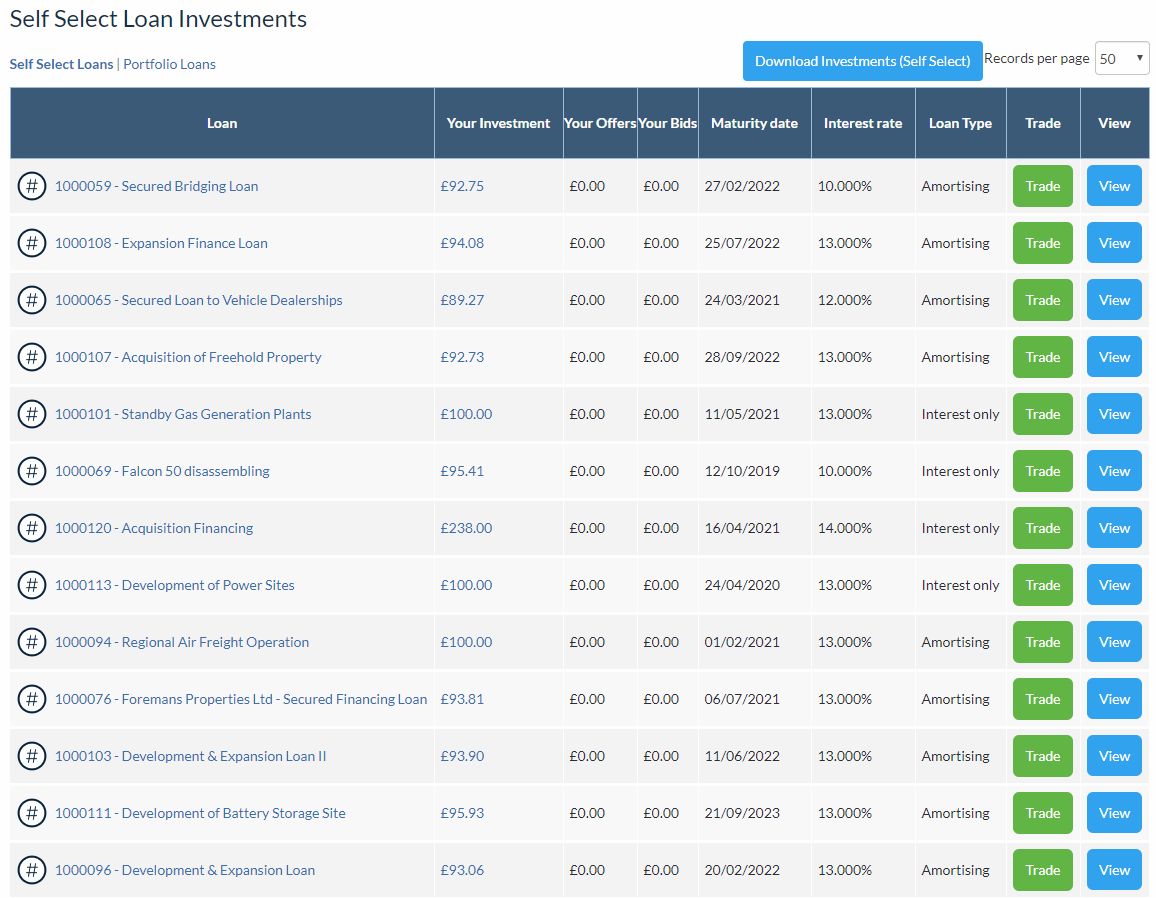

Below are the loans I’ve been able to pick up so far. There are a many more loans available on the platform, however many of them are different loans to the same company. For now, I like to keep 1 loan per company. Call me paranoid but in my eyes, if a company goes out of business, there’ll be problems with all of their loans, so if I have money in multiple loans to the same company, I have multiple problems and less diversification.

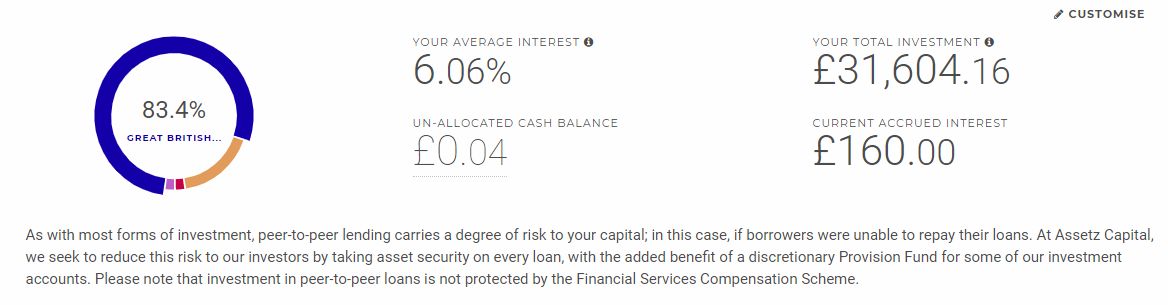

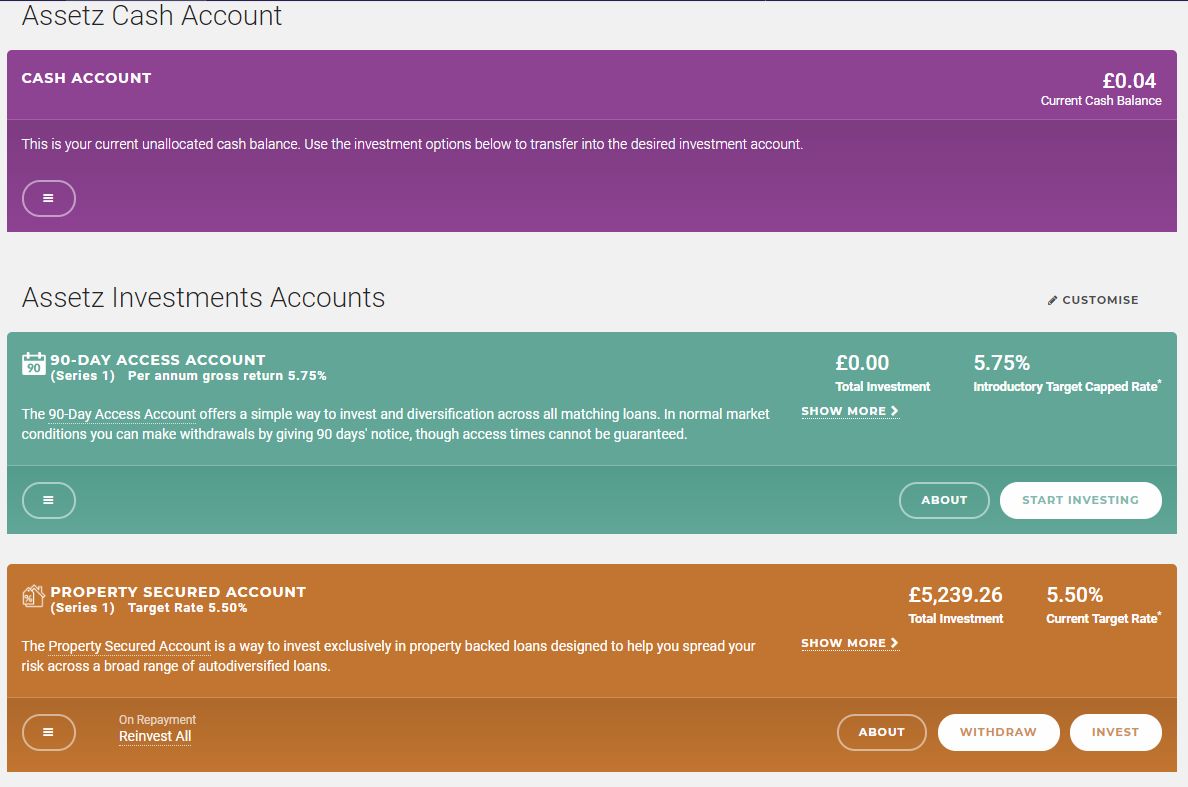

ASSETZ CAPITAL

See Screenshots & Detailed Monthly Updates From My Assetz Capital Account

Assetz Capital never fail to impress. I had a call from one of their representatives last week saying that one of my loans had been paid off early so I might want to check my reinvestment settings to make sure I didn’t have cash drag. The amount was around £600 I had into the loan in question so if I wasn’t doing auto-invest I could have had some unexpected cash drag.

It looks like they may have had a couple of loan bumps this month as I noticed both their target rate, and the XIRR had dropped a little. Once we get to the 12 month mark in the portfolio, which is where we just arrived at. It is likely we will see fluctuations in return rates. As long as they are not too big, it doesn’t’ worry me.

Assetz Capital’s cashback finished at the end of May so there is none currently. It won’t stop me from investing more money with them soon though, cashback or not.

Click here to see Assetz Captial’s latest offers or to open an account.

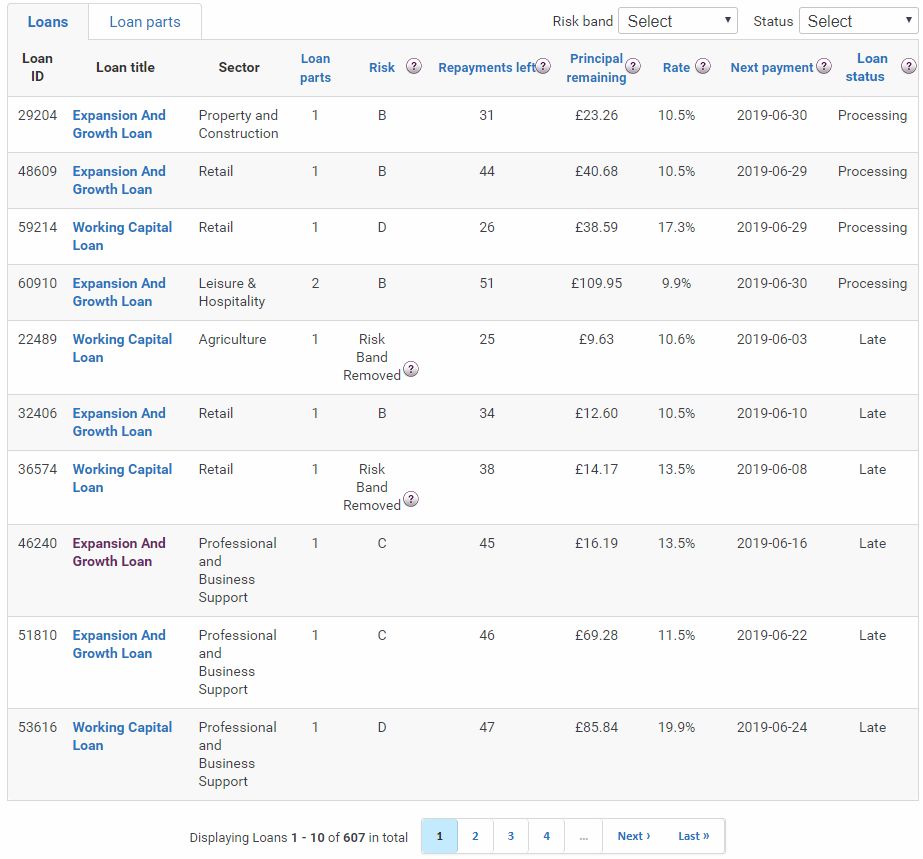

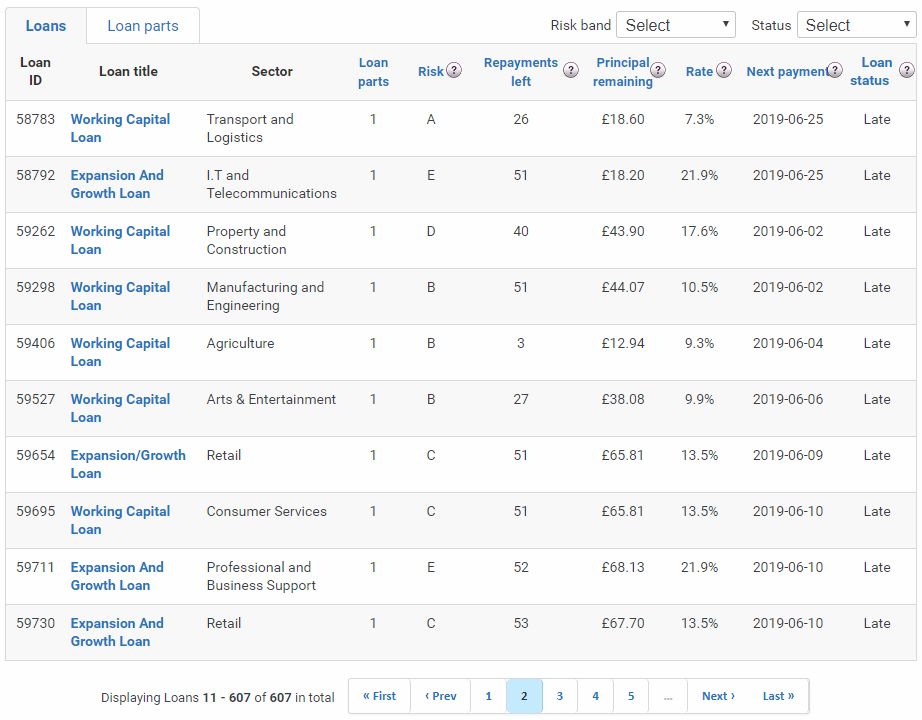

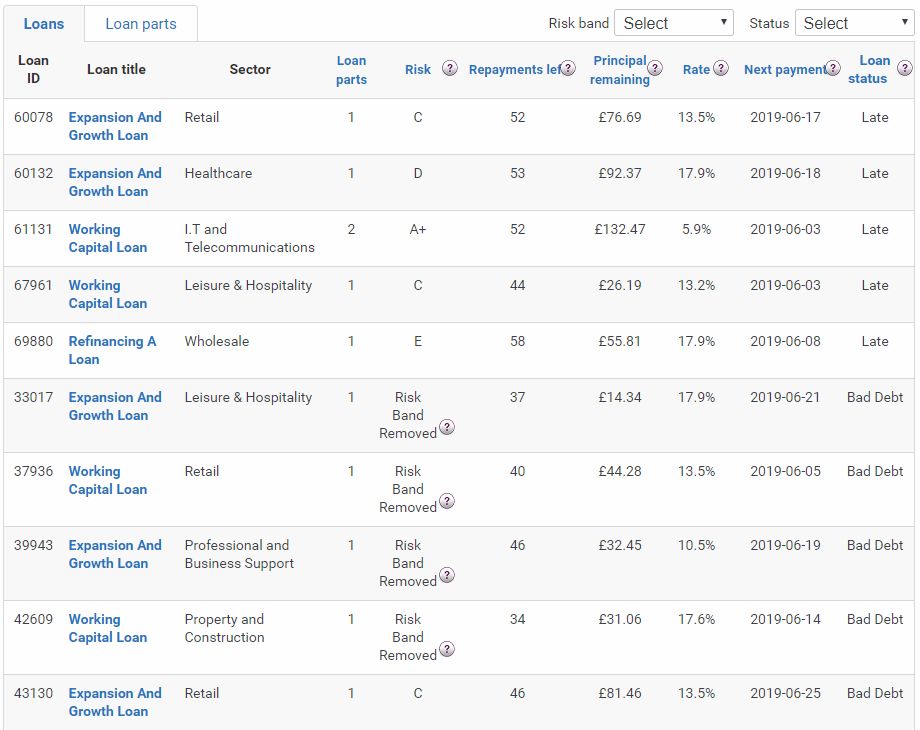

FUNDING CIRCLE

See Screenshots & Detailed Monthly Updates From My Funding Circle Account

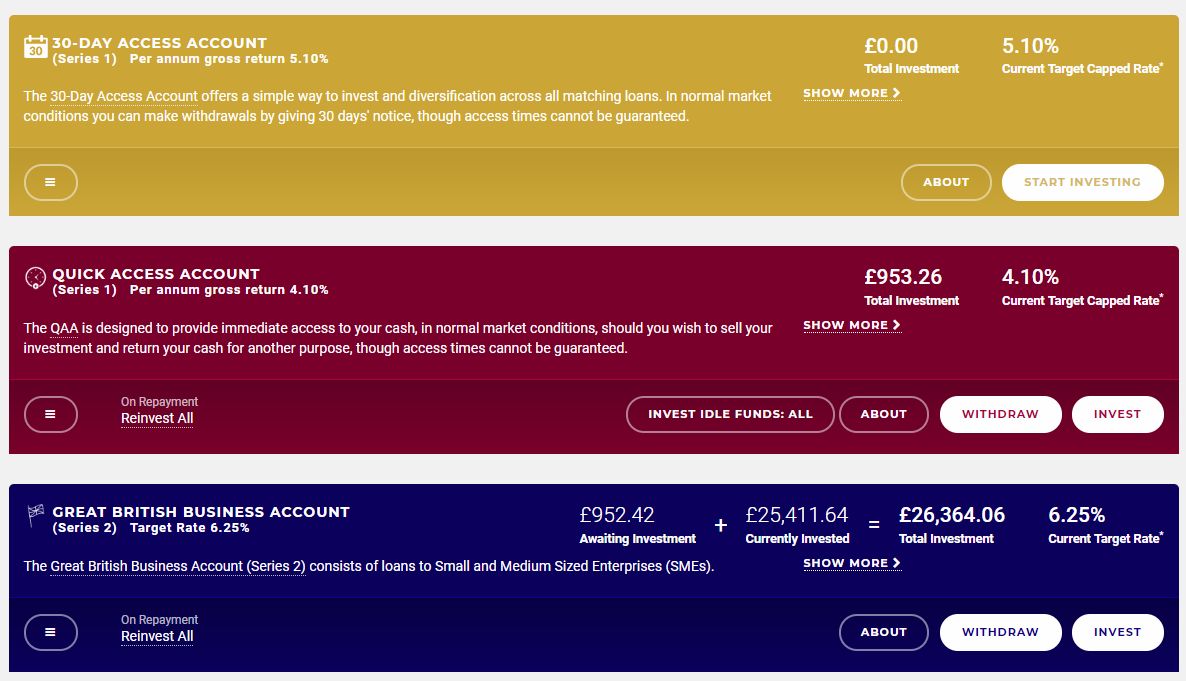

Funding Circle gave me about another £97 in losses in May. Not a problem though as this is right on target with their numbers. They are saying annual return is running at 7.9% on a target rate of 7.2 when I invested in this account right about a year ago, so we are all good.

Currently there are 21 loans marked as “late”. Typically only about half of these will actually go into default.

Funding Circle XIRR has settled down just a small amount from 6.98% in April to 6.89% in May. So it seems to be settling very close to the target rate of 7.20% for the year. It always takes a little more than a year to get the correct XIRR as for the first few months payments and investments are staggered so can reflect negatively.

I have decided to redistribute some of my Funding Circle account capital to other lenders to diversify my GBP portfolio a little more. As I mentioned earlier, I have decided to do this with a few of my largest accounts (except Assetz Capital and Mintos which I actually intend to increase my investments in). I will start to sell some Funding Circle loans next month.

If you’re a new investor thinking about investing with Funding Circle, they currently have a decent cashback offer for new investors: Invest £2000 and receive £50 Amazon Gift Certificate. Click here for more info. Use this link to qualify for the cashback.

GROWTH STREET

See Screenshots & Detailed Monthly Updates From My Growth Street Account

Growth Street are just one of the easiest investments in my opinion. Just set it and forget it!

XIRR rose a little again this month to 4.88%, bringing the number closer to the 5.30% target rate. I have no doubt the account will hit this target rate in the next couple of months.

As you can see below, everything is done automatically in the background. Interest accrues and is paid back after each 30 day period on each loan chunk. Along with the capital which is automatically reinvested into another loan.

For new investors, Growth Street have a good cashback offer: Invest £5000 or more for 1 year for £200 cashback. Click here for more info.

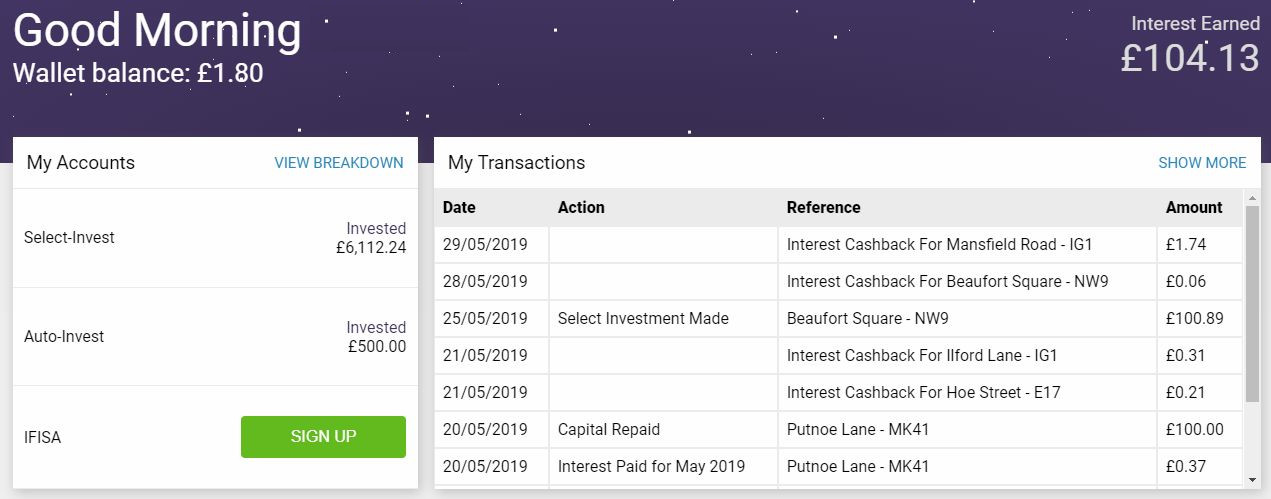

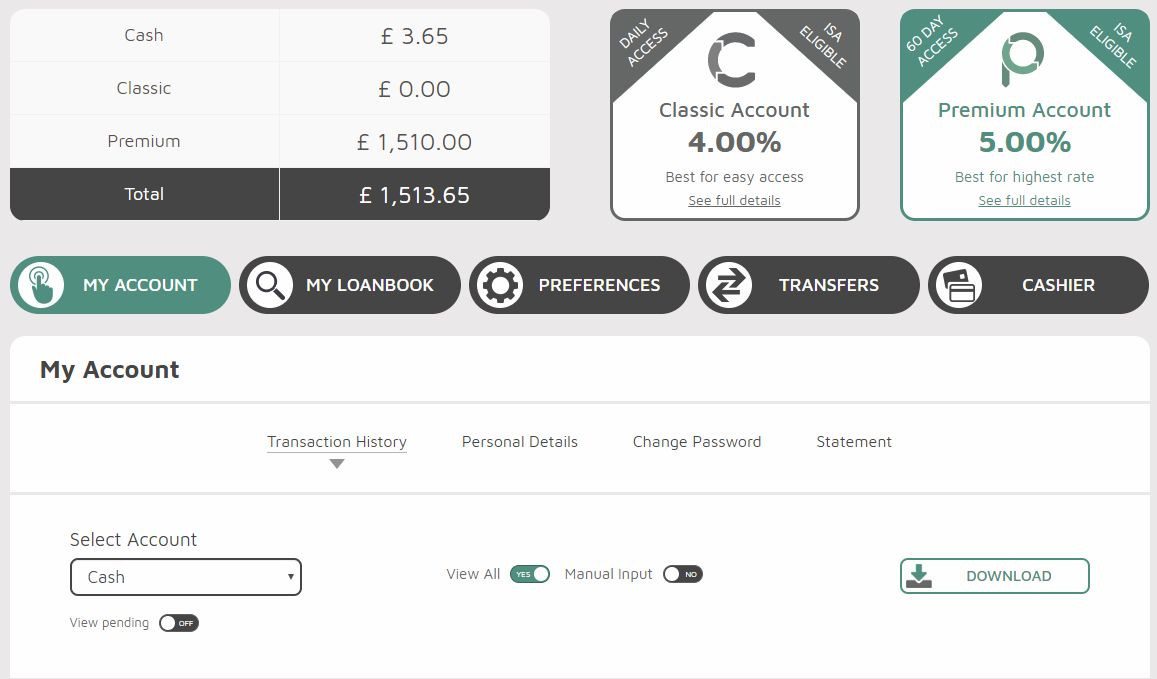

KUFLINK

See Screenshots & Detailed Monthly Updates From My Kuflink Account

Kuflink seems to keep up a positive loan flow. Their loans are just so well documented and they do huge due-diligence on them.

The XIRR on Kuflink rose a bit more this month from 4.36% last month to 4.71%. Interest is coming in more frequently now, plus I’ve had capital & interest paid back from some of the earlier loans I got into.

One thing I sometimes forget to point out is that some Kuflink loans pay interest at the end of the loan period, or annually, so XIRR for Kuflink looks low now, but when the payments from some of the delayed loans come in (mainly in the auto-invest portfolio), overall XIRR should jump up significantly, probably to around 6.5% – 7%.

Kuflink really are a very good option for lower risk – higher return investments in my opinion. I’ll be shooting more money over to them as more loans come out as I have done for the past year. They are one of the lenders that I will be increasing my account balance with substantially over the coming months.

I picked up a few more low LTV loans in May.

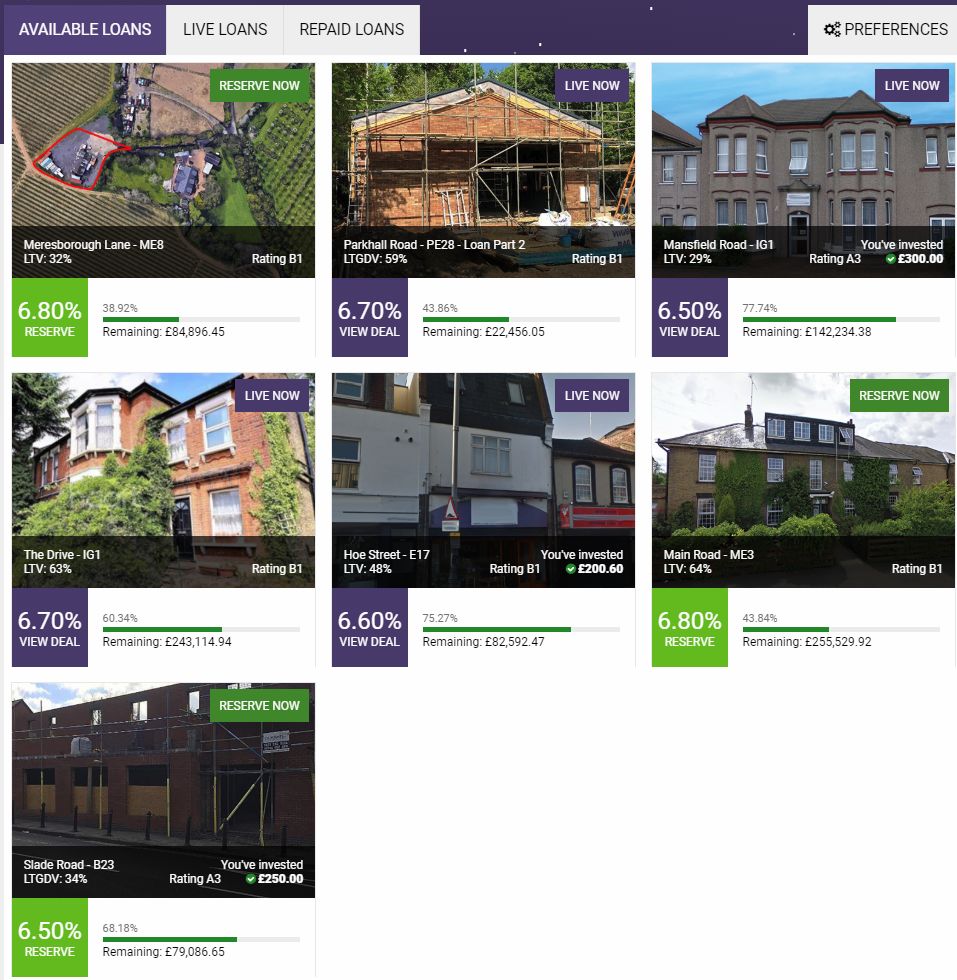

LANDBAY

See Screenshots & Detailed Monthly Updates From My Landbay Account

Landbay, they may as well be a bank. I know, I say the same thing every month. They are just as safe as houses, literally, and that makes them kind of boring for an active investor. So much so that I’ve actually been considering starting to move a bit of capital from them so I can put it into some higher paying lenders, albeit more risky.

Now, if I was really risk adverse, this is probably where much of my capital would be sitting. That being said though, I think there are some safe options out there now with risk similar to Landbay but better returns. As previously mentioned Kuflinks‘ low LTV loans I consider to be fairly safe, as well as the new lender Loanpad who also have loans with very low LTV’s and pay 5%+ with a 60 day notice window. Assetz Capital’s QAA account pays 4.2% on (mostly) asset secured loans with instant access to your money.

For the said-to-be-safer option for your money, or just for some diversification, Landbay currently have an incentive for new investors: £50 cashback when investing £5000 or more. Click here for more information. Taking this cashback offer increases your income on this investment by 1% for the first year which helps.

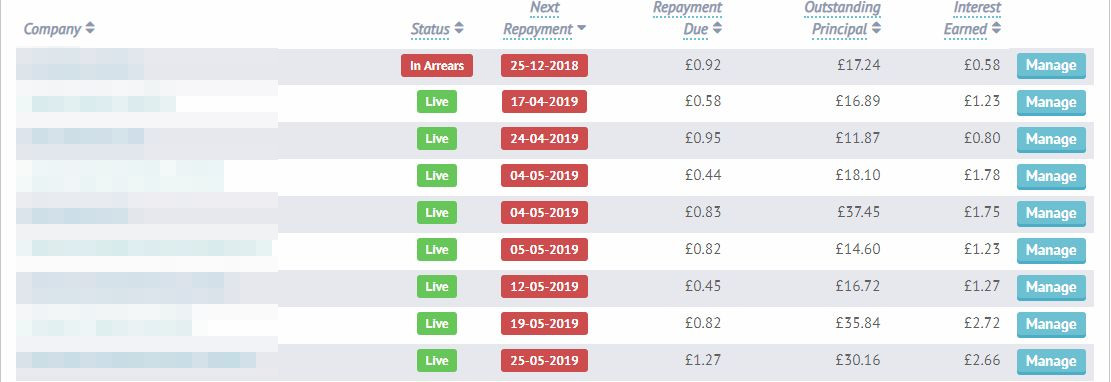

LENDING CROWD

See Screenshots & Detailed Monthly Updates From My Lending Crowd Account

Lending Crowd still have a nice steady loan flow. It dropped just a bit this month but overall they keep plodding along. No more defaults in May, which I find quite encouraging.

I sent some more money over to Lending Crowd again this month so I could keep bidding on loans. They seem to be getting a lot more investment in from new investors as the rates are getting a bit more competitive. That’s a good sign though. If there is a positive new lender flow, it typically means everything is good in the world and the lenders reputation is still on the rise.

XIRR jumped from 6.14% to 6.56% in May which is another good sign.

There are 8 loans late on payment and 1 in arrears. Normal stats for Lending Crowd so nothing to worry about here. They will likely get at least half of these back on track by next month.

Take a look at one of the last P2P lenders that still allow bidding on loans so you can get the best rates! Lending Crowd have Up to £400 cashback for £10,000 investment. Click here for more info. See my Lending Crowd Review if you would like to read about bidding on loans.

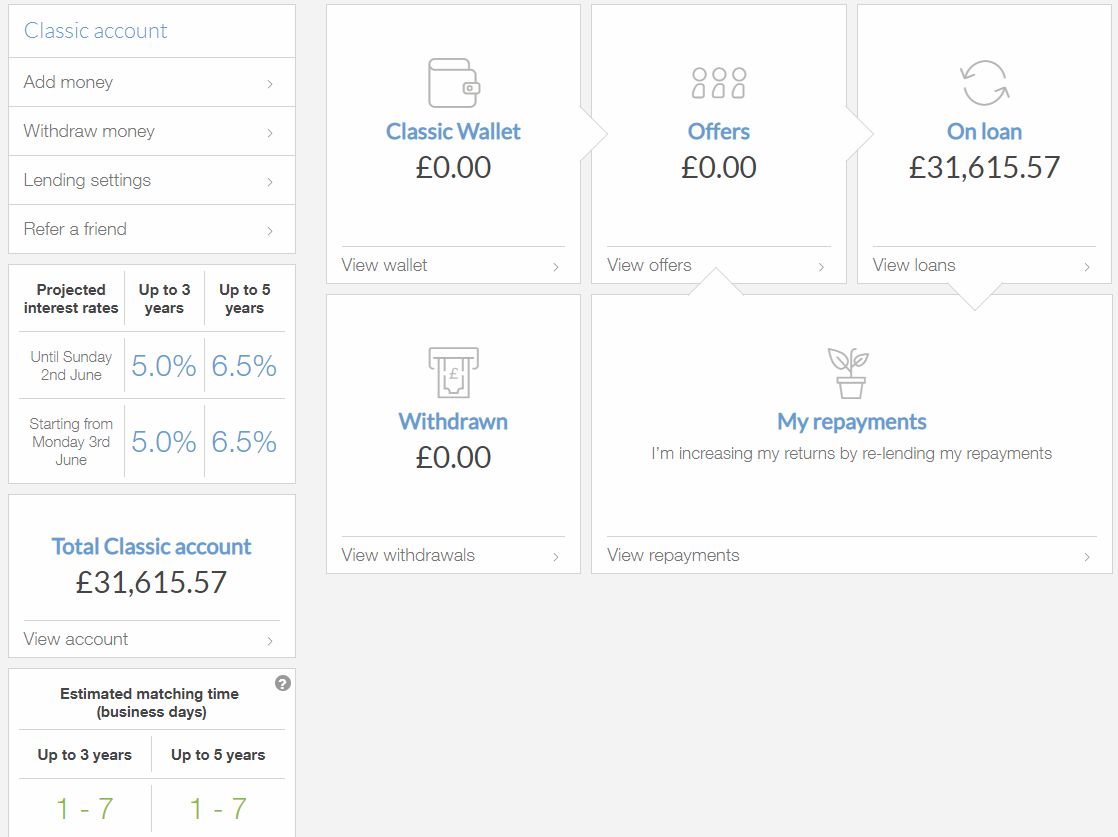

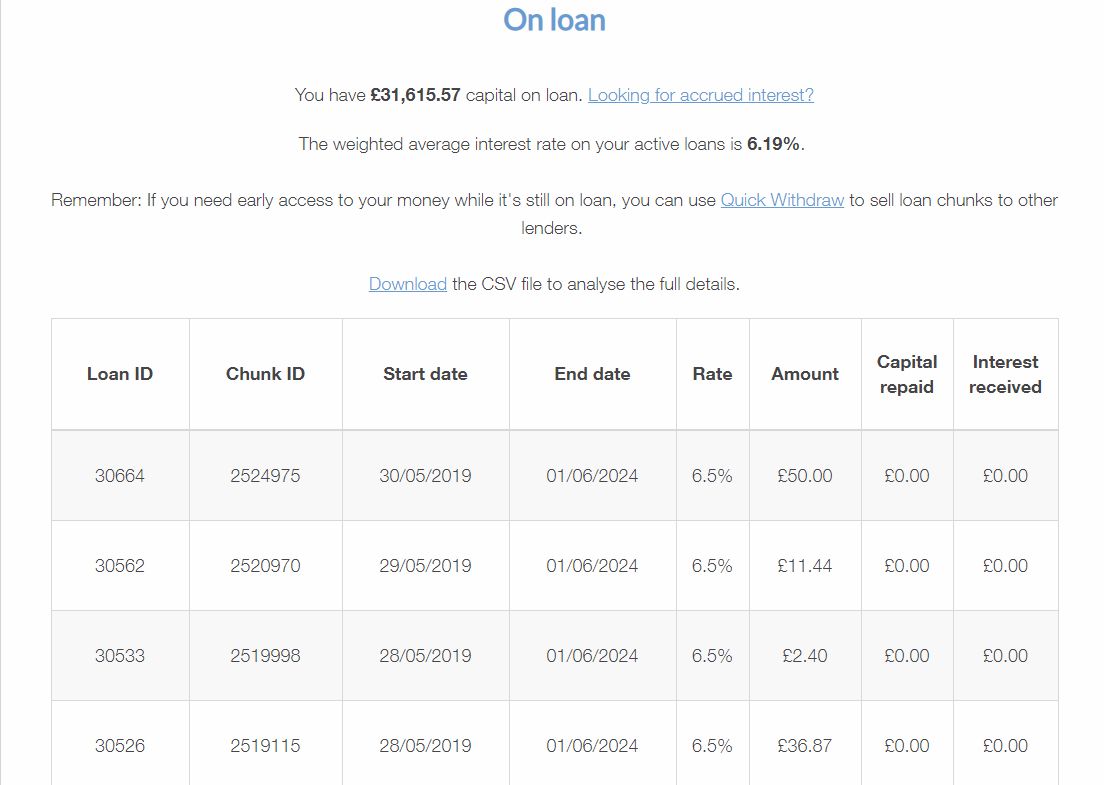

LENDING WORKS

See Screenshots & Detailed Monthly Updates From My Lending Works Account

Lending Works income was a little less this month than last, but still on target at £153.55. XIRR keeps slowly climbing from 5.27% last month to 5.33% in May. Even Lending Works own target numbers for my account rose a tiny bit from 6.18% to 6.19%. You really can’t go wrong with Lending Works. Great rates with the safety of the best provision fund in the business, the “Lending Works Shield”.

You can see below that my repaid capital is being invested at the 6.5%. I initially got in to Lending Works about a year ago at 6.0%, so it’s nice to see the rates climbing steadily as my reinvestment get into loans at the higher rates.

Lending Works still have the 6.5% available, so if you’re thinking of investing with them, consider doing it sooner rather than later.

Remember, RateSetter was at 6.7% just a few months ago, now they’re at 5.1% 🙁

Use this link to get £50 cashback for investing just £1000 with Lending Works (for new investors).

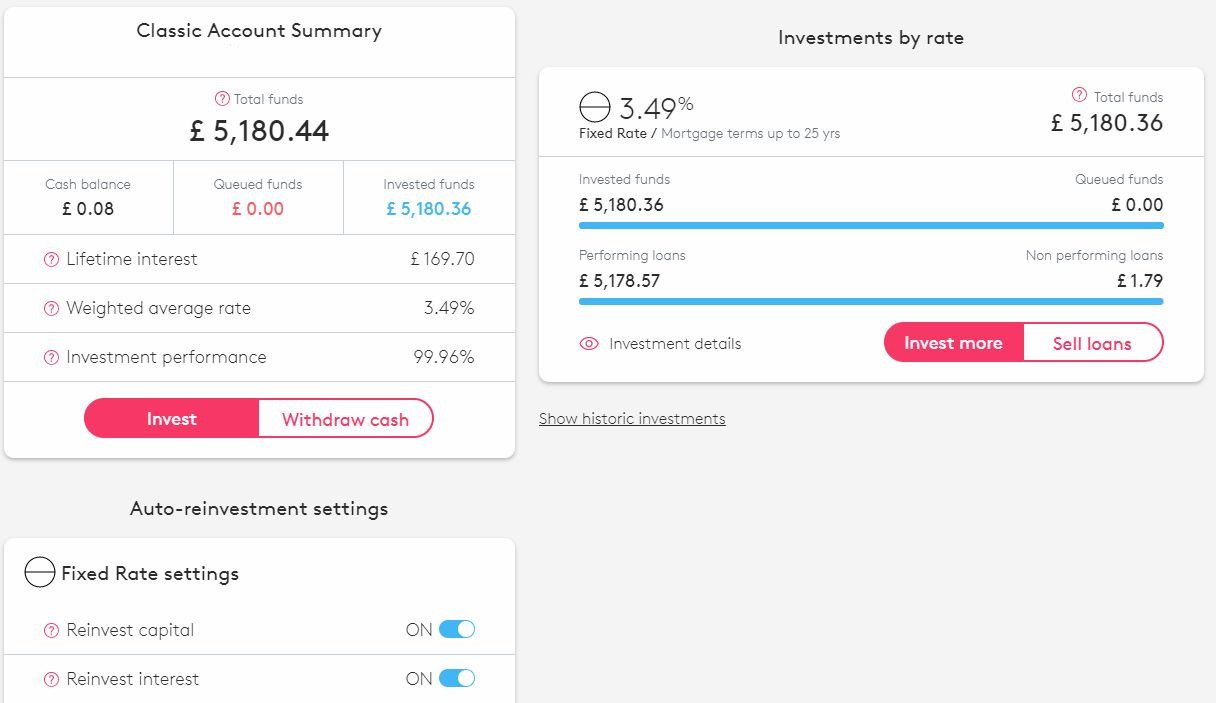

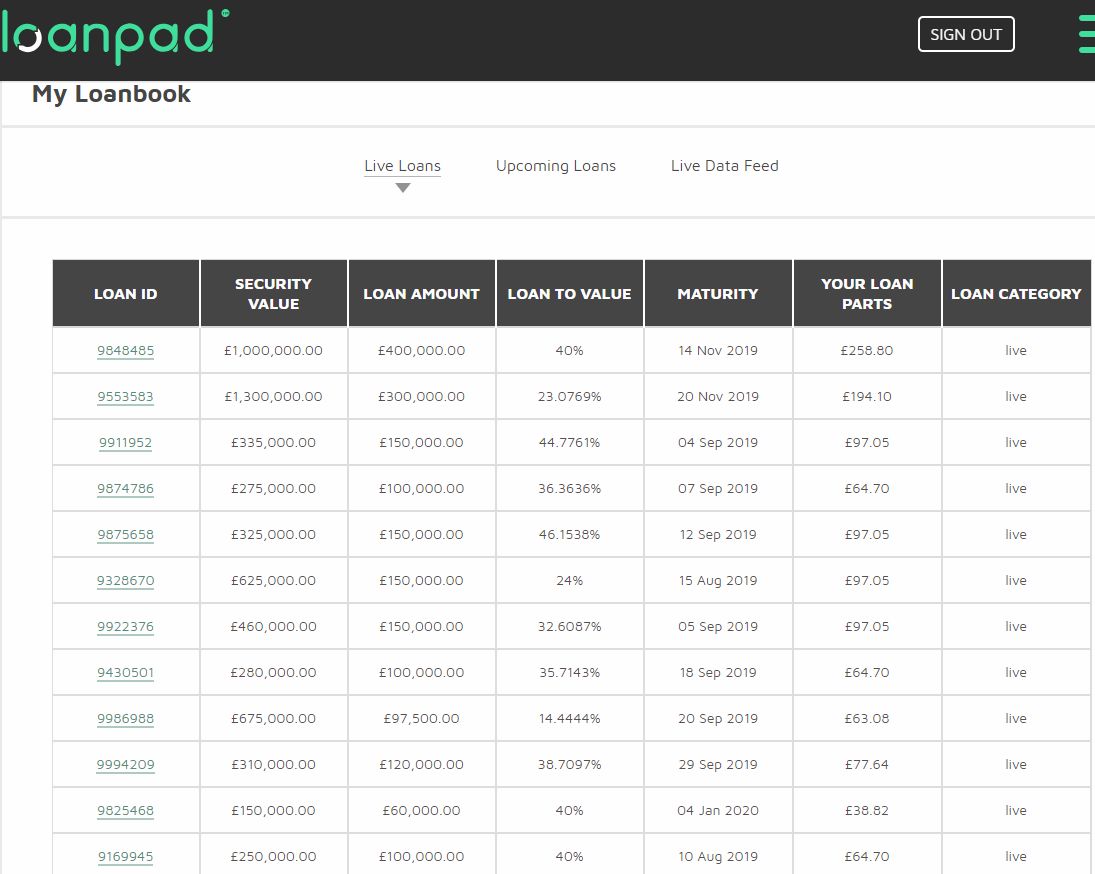

LOANPAD

See Screenshots & Detailed Monthly Updates From My Loanpad Account

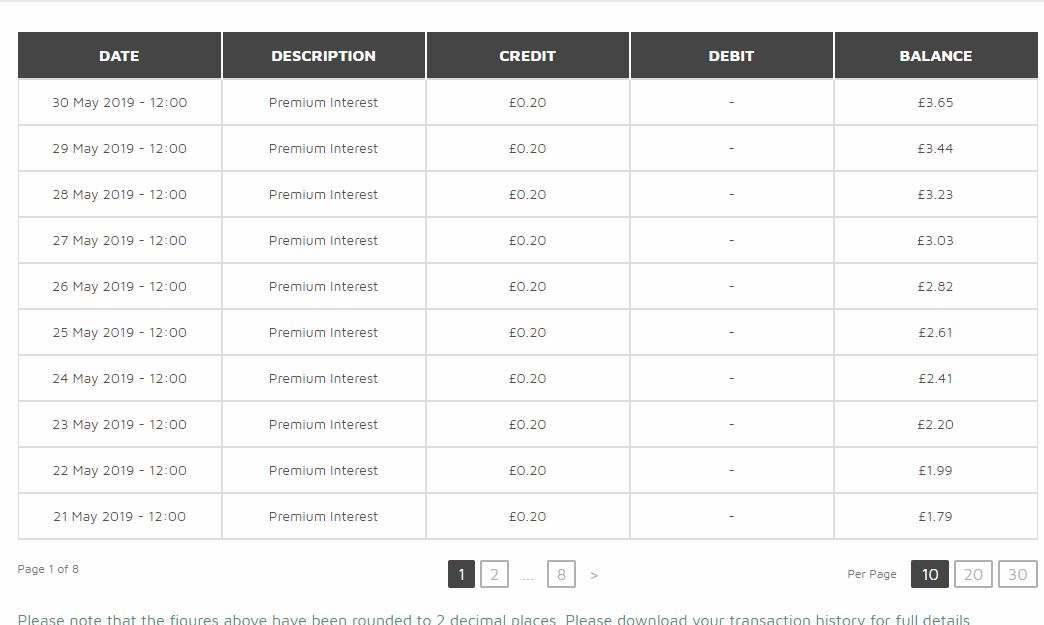

Loanpad is still quite new to me having only been investing with them for a few months now. Already I like them a lot. See the Loanpad Review for more detailed information, but it’s mainly due to the low LTV’s on ALL of their loans (see screenshot below), plus their loan originators 20% – 60% “skin-in-the-game“.

On top of that, both of Loanpad’s accounts have relatively early exit available (immediate on the Loanpad Classic Account, and 60 days notice on the Loanpad Premium Account for free, or immediate exit for a fee of 0.5%).

Interest is paid daily with Loanpad as you can see below. The only thing I’m not 100% happy with is that there is no way to reinvest this interest or repaid capital automatically. I understand that Loanpad are working on a solution for this which should be available soon though.

It’s really not a big deal, you just need to go on to Loanpads website when the interest repaid gets to £10 or over and hit the reinvest button. However it’s the only thing which keeps Loanpad from being almost a 100% hands-off auto-investment.

Loanpad introduced a new cashback offer! Up to £150 cashback for new investors. Click here for more information on the cashback offer and get the special cashback bonus code.

Loanpad also enable tax free investing through an ISA so click here if you are interested in reading more about the ISA.

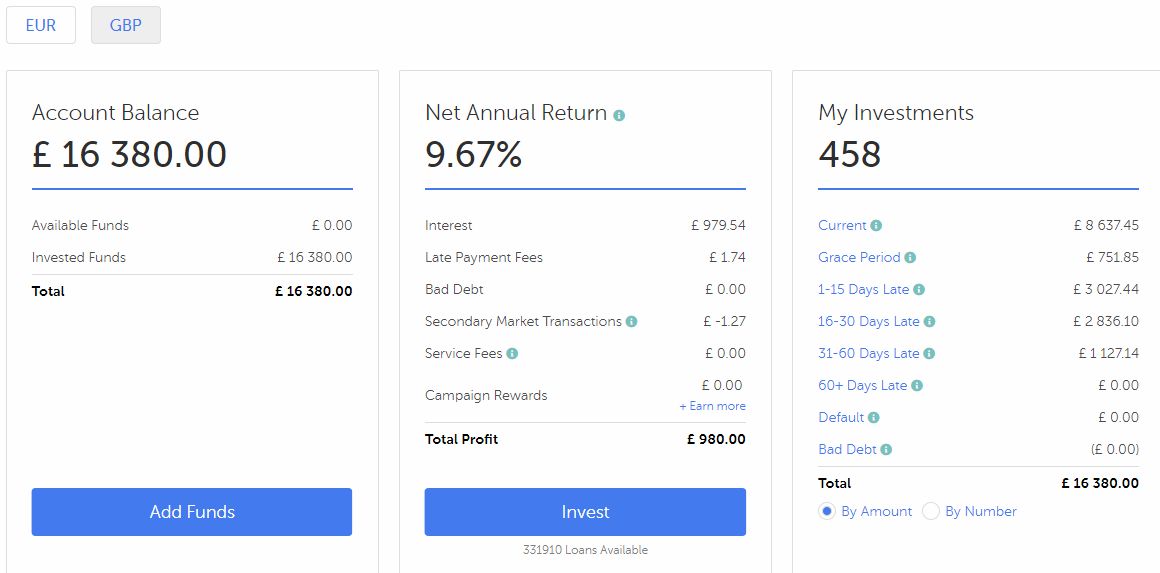

MINTOS (GBP Account)

See Screenshots & Detailed Monthly Updates From My Mintos Account

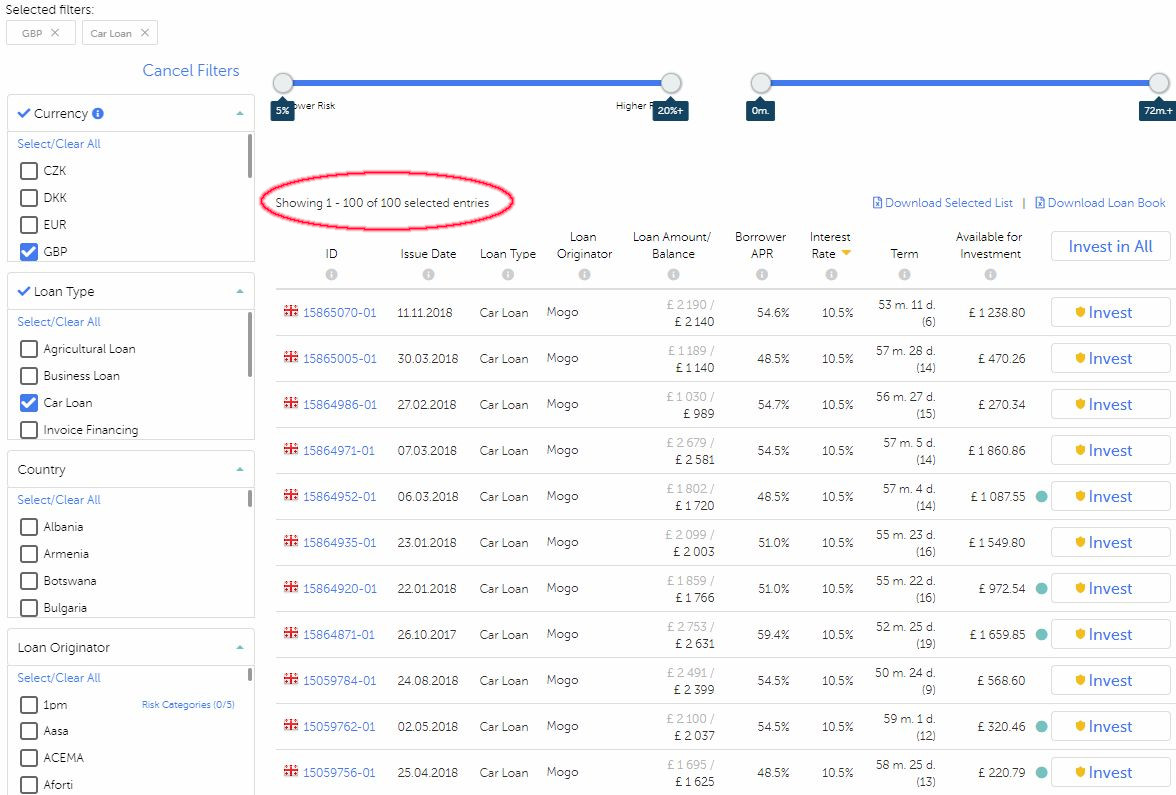

Mintos keeps adding more MoGo car loans each month, which I’m very happy about. It means no more cash drag and great returns!

Mintos is still my highest earning GBP account by XIRR which rose once again this month from 8.54% in April to 8.82% in May. Based on this, I believe there is still a good chance we will hit the Mintos target rate of 9.67%, probably around August or September.

I really like Mintos, and the more time I spend with them, the better I like them. Even though I started also lending Euros with Mintos in April, which already puts them as one of my largest lenders. My intention is to deposit more capital with them in the coming months.

I have become very comfortable with Mintos. I think one of the only things that keeps a lot of people from investing with Mintos is the lack of FCA regulation. In my opinion however (and based on the recent Lendy situation), there is something to be said for a huge company having lent over €2.4 billion, and who are profitable as far as safety and regulation are concerned.

Honestly, I would really feel like I was missing out if I didn’t have some capital in Mintos.

As you can see below, there are still GBP car loans available, although only 100 as of May 31st, however they keep adding them daily. 100 loans with buyback guarantees and skin-in-the-game are still enough to get a good bit of capital diversified into in my opinion. Remember though, these loans are just what’s left, there were a lot more earlier in the week.

Mintos are another lender who have a wonderful cashback bonus, one of the best in fact.

NOTE: I did hear some mumblings about Minots not taking on new UK investors currently, but that seems to change daily so if you want to invest with Mintos and you live in the UK, at least give it a try. I haven’t heard of any investors that I’ve referred from my site being refused, so try using my link above.

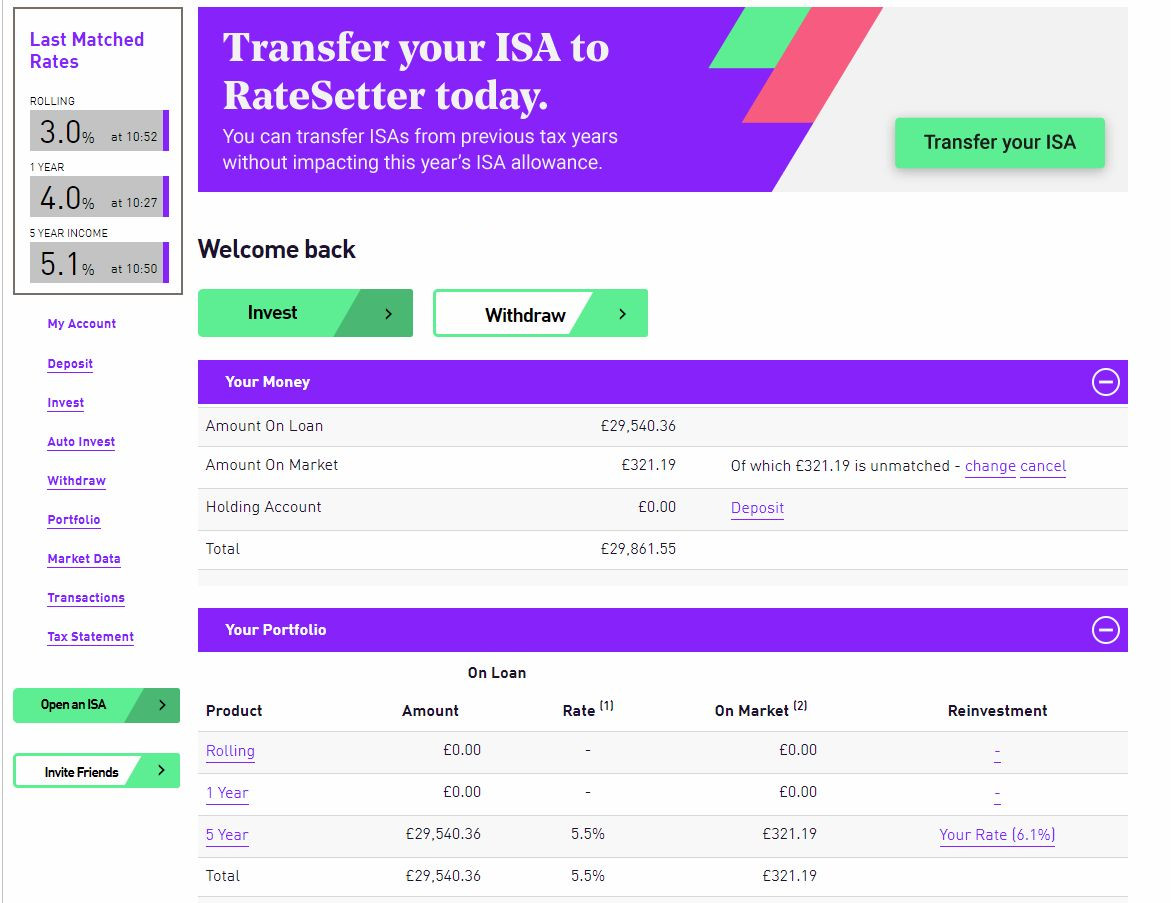

RATESETTER

See Screenshots & Detailed Monthly Updates From My RateSetter Account

I decided to move more money out of RateSetter in May, and once again placed it (mostly) into Kuflink loans which I can get almost 7% on secured, shorter term loans.

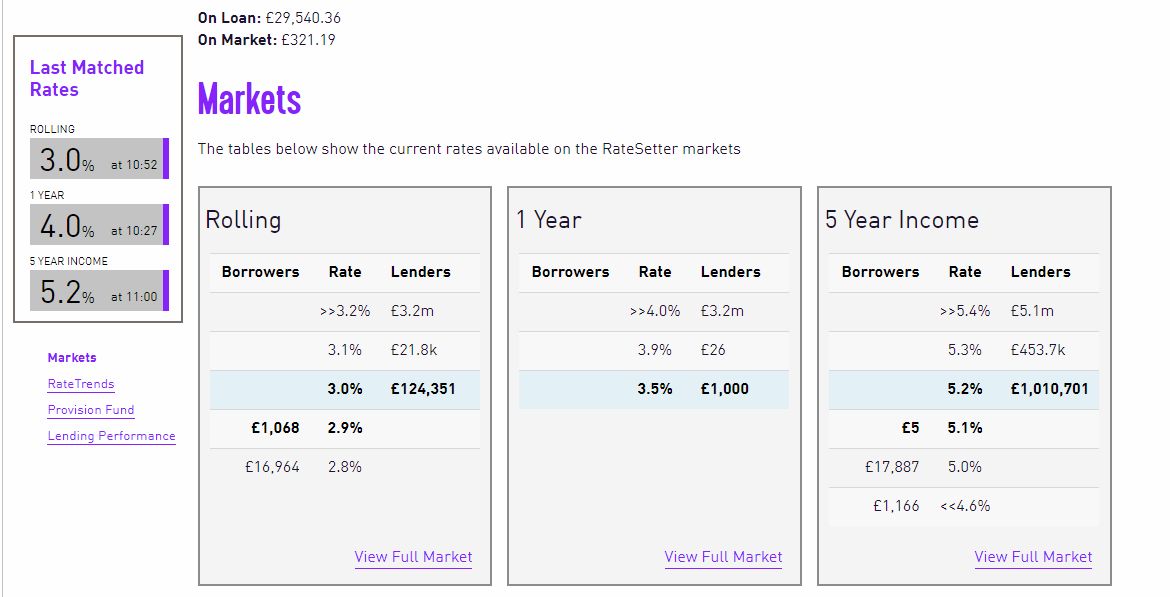

The rates for RateSetter are still so low now, it’s no longer worth reinvesting my income from them back into these low rate loans. 5% returns on 5 year mostly unsecured personal loans is just getting a little low for me. It’s not terrible if you are really risk adverse as RateSetter is for sure one of the safer lenders, but I just like a little more reward for my risk.

This withdrawal also goes inline with my strategy to redistribute from some of my larger accounts for diversification. I will still leave a substantial investment with RateSetter.

All that being said, if RateSetter rates get back up around 6.5% as they were a few months ago, you might see some of my capital migrate back over there 🙂

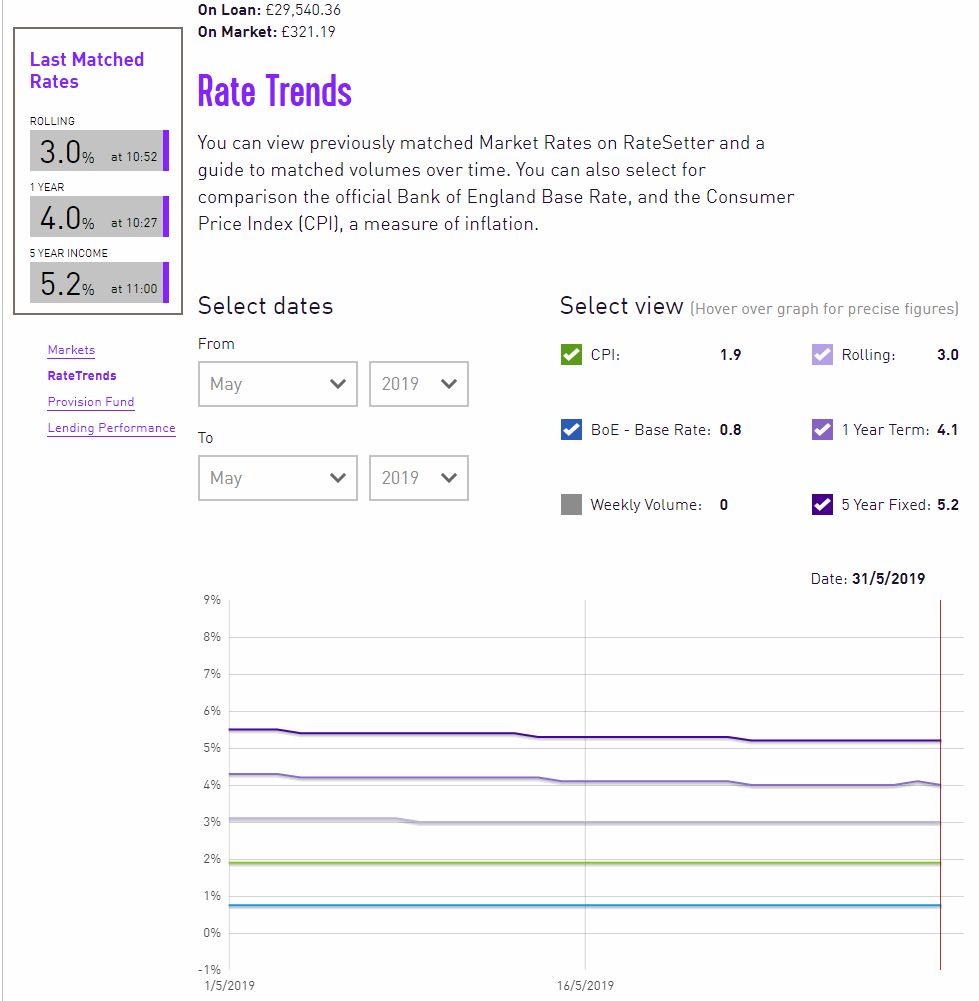

Below is a screenshot of RateSetters current rates and rate trends. You can see they have continued to fall in May.

Even with lower rates, RateSetter is still an excellent option for diversification and safer lending with a big lender. RateSetter’s very well funded provision fund doesn’t hurt either. Use this link to take advantage of a very decent cashback offer.

RateSetter is offering £100 cashback for investing £1000 for a year (10% ON TOP OF standard returns, so even if you only want to invest £1k, you’ll get 15%+ back for the first year), it is definitely worth considering. Click here for more information on the cashback offer.

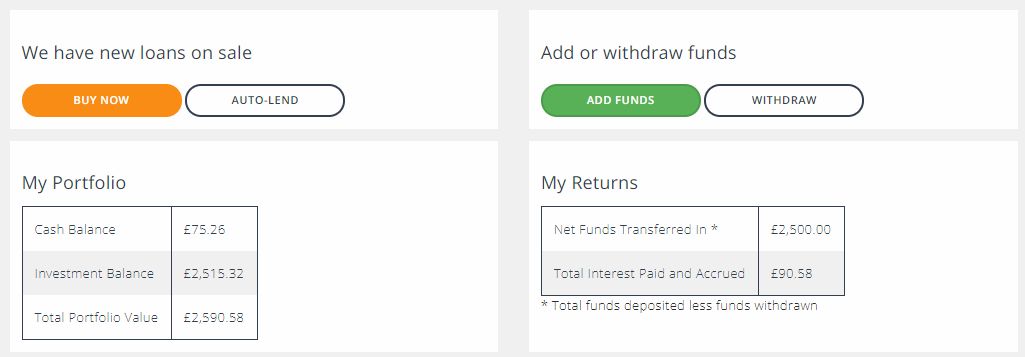

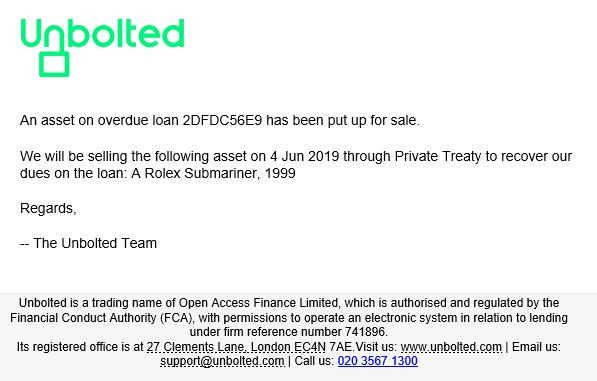

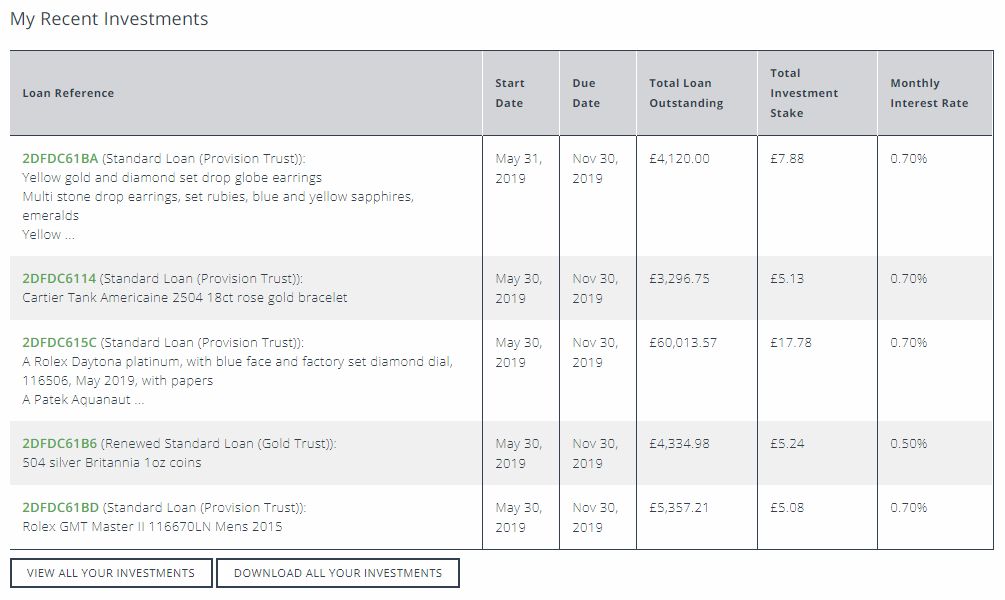

UNBOLTED

See Screenshots & Detailed Monthly Updates From My Unbolted Account

My Unbolted account keeps ticking along. If you remember in last months update, I showed a screenshot of loans which were overdue. This month I started to get emails about some of the assets being sold off at auction and within a few days the items are sold and capital is repaid.

Something I really like about the Unbolted business model is how quickly (most) assets can be sold and capital recovered.

XIRR rose again this month from 7.47 in April to 7.57% in May on a target rate of 8.40%.

I wish there was a way to get more capital distributed with Unbolted. Either way, I’ll likely trickle some more capital over to them as I draw down some of my larger lending accounts with other lenders.

Euro Portfolio Overview

In May I didn’t add any new Euro lenders, but I intend to do so moving forward. I am interested in observing how my investments are doing with the lenders I started with in April.

I am exited about some of these investments. The targeted return rates are big in Euro lending. The risks appear higher in some cases, but if we do our due-diligence on each lender, it will hopefully make the risks a little less. I’ll keep adding new lenders and capital as I get a better understanding of each lender and the loans available.

I decided to publish my first Euro Lender table this month. You can always see the real-time version here along with my GBP charts. You’ll notice we can already see €202.36 in returns for the month of May 🙂

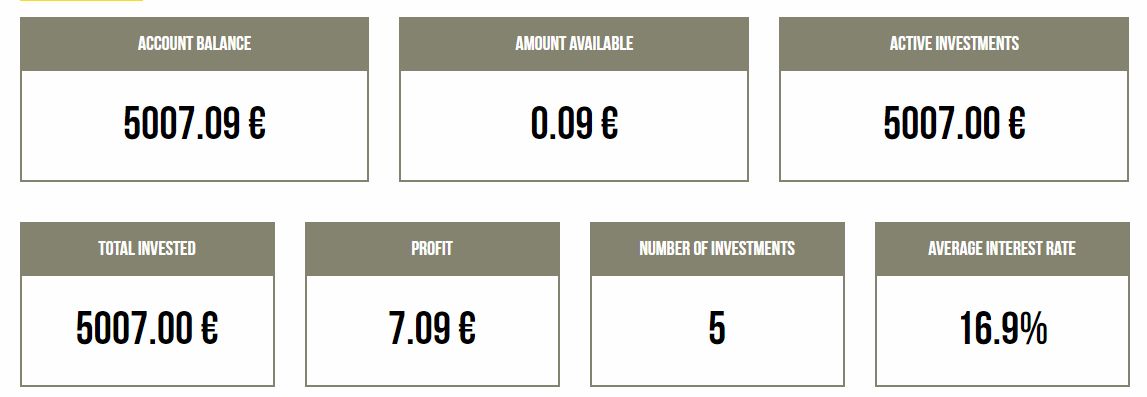

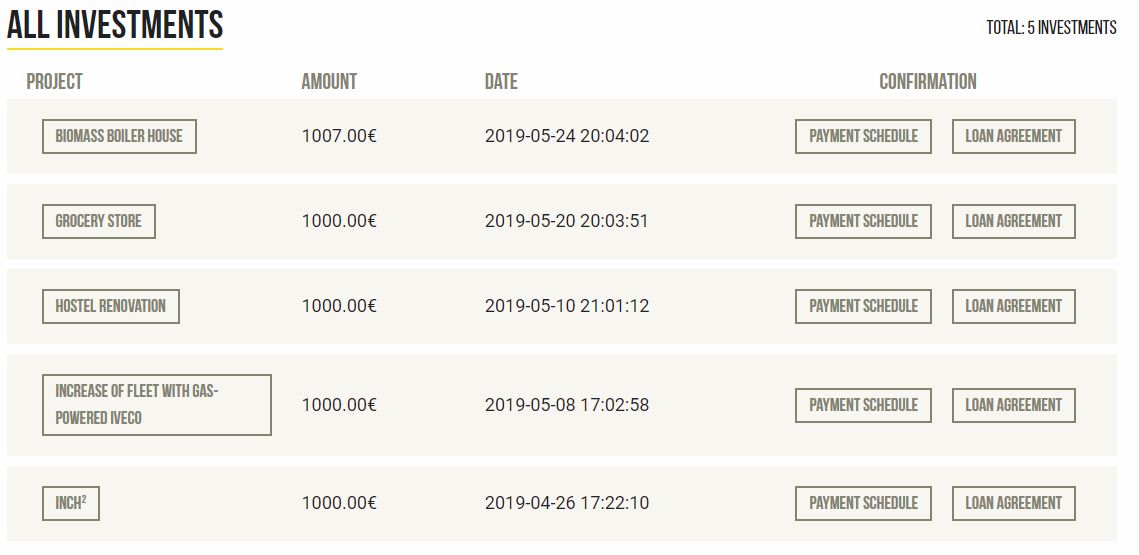

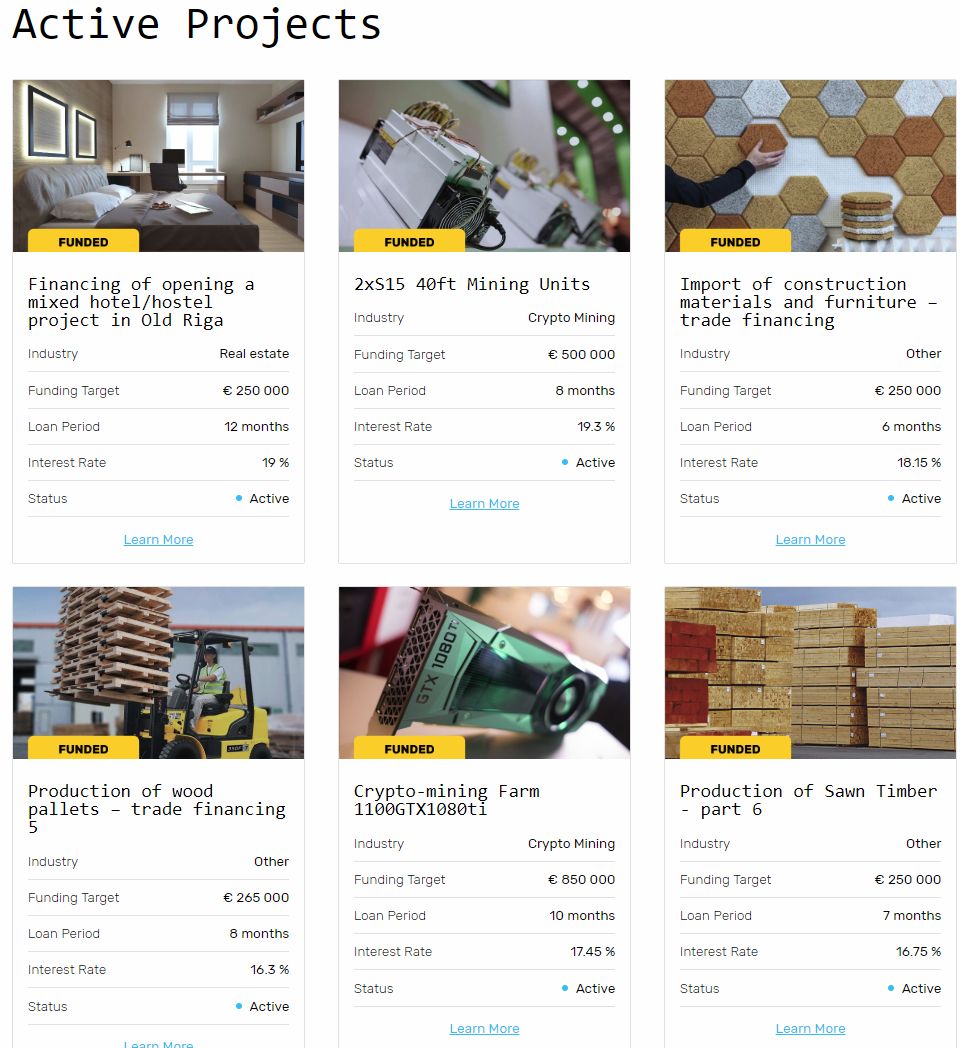

CROWDESTOR

I picked up 4 more loans in May from Crowdestor. Putting around €1000 into each loan. Not great diversification, however Crowdestor provide a buyback fund for some of their loans, so I figure the only way I’m going to lose a lot of money on a loan is if Crowdestor go broke, and then all of the loans default. Unlikely but could happen, hence the 16.9% rate of return. The buyback fund is still small but will hopefully grow moving forward.

These high-paying euro loans are not as frequently available as some of the lower paying loans, so you have to trust that the lender has done their due-diligence and can honer their buyback fund and use less diversification.

To highlight a couple of the loans I bought.

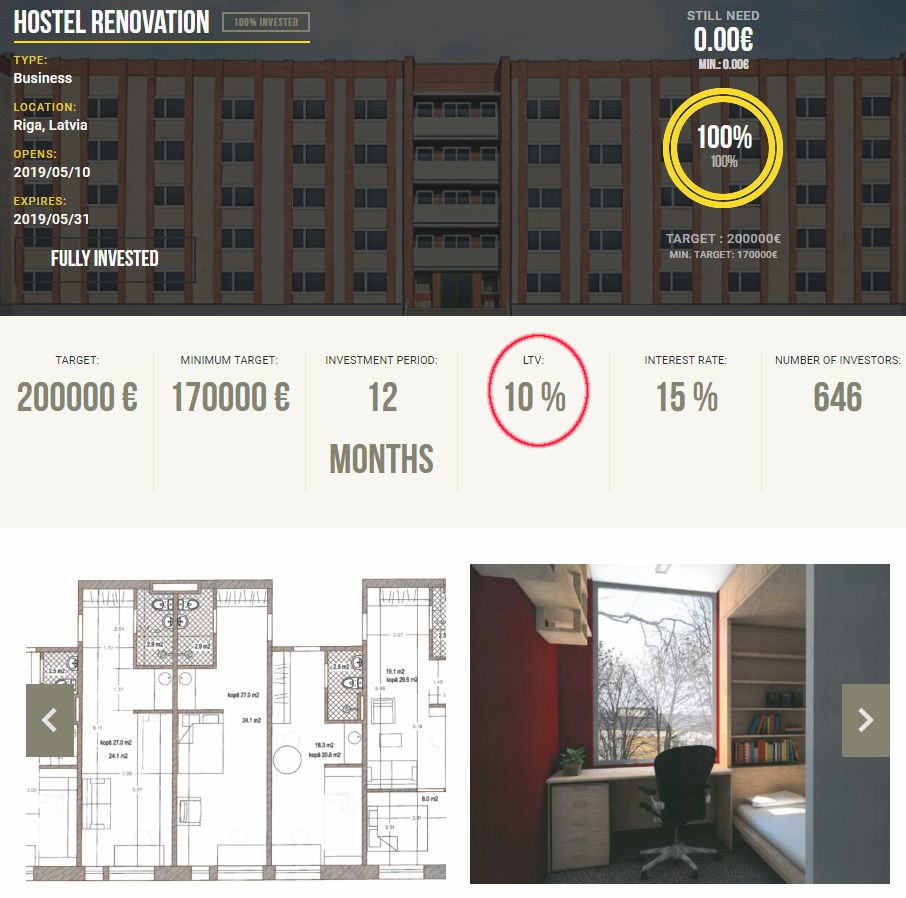

The first is for a Hostel Renovation in Riga, Latvia (so local to where Crowdestor are situated, so they can keep an eye on the loan). The loan is paying 15% returns, and the best part? It has a 10% LTV (Loan to Value ratio)! Compare that to all my raving about Kuflink and Loanpad loans who have some at around 30%, which is still very, very low.

The loan documents all seem in order, and if that 10% LTV can be enforced, which I assume it can, then literally if the borrower were to default, the building would need to lose 90% of its value before Crowdester would have to worry about losing capital.

There are obviously the risk factors of Crowdestor being a young company, and the fact that Crowdestor and the borrower are located in another country (unless you live in Latvia of course). But that’s what we’re getting the 15% return on our investment for with this loan.

Detailed information on this loan is public and can be seen on Crowdestor’s website

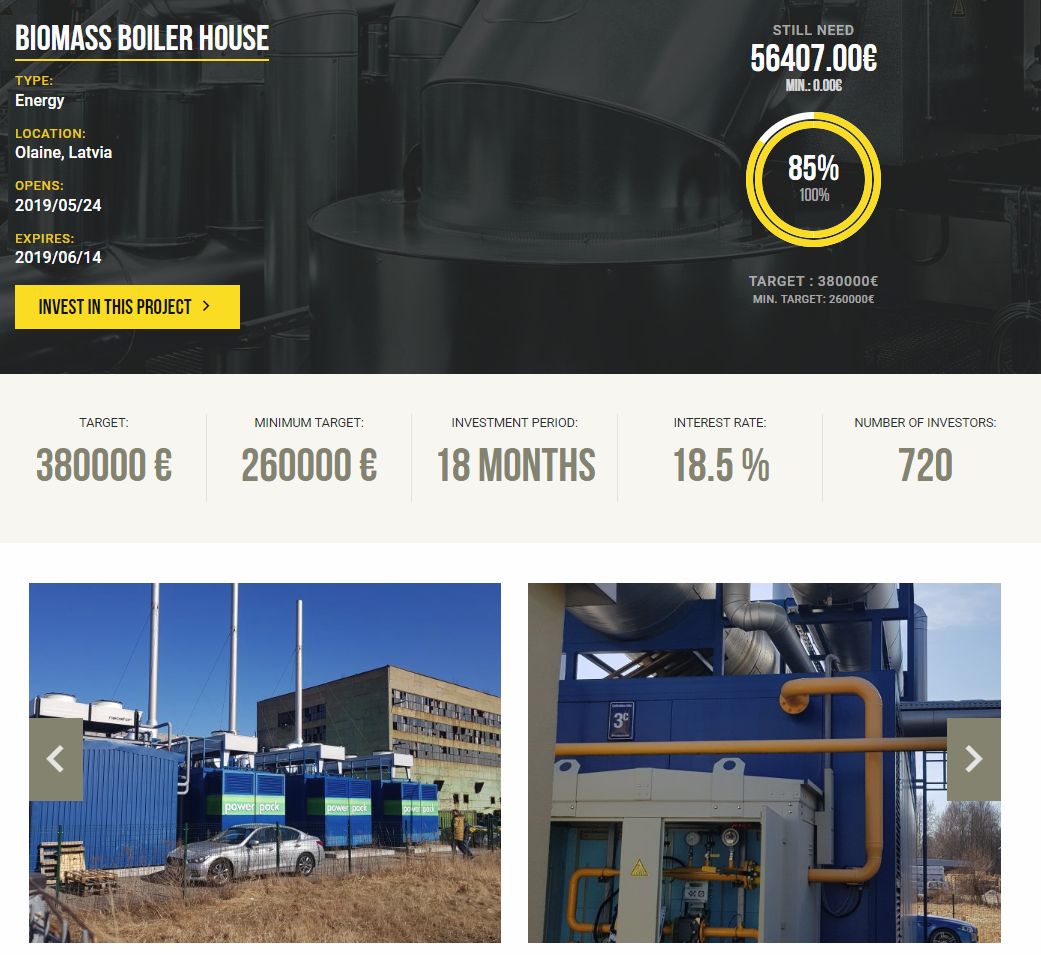

The second loan is a for a Biomass Boiler House. Again based in Latvia, in Olaine this time.

This project pays 18.5% interest, is for 18 months, and is secured by a grantee from the borrower SIA Olaines Enerģija, a large Cogeneration management company (kind of like a private electricity provider).

The loan is again covered by the Crowdestor Buyback Fund for another level of security.

Detailed information on this loan is public and can be seen on Crowdestor’s website

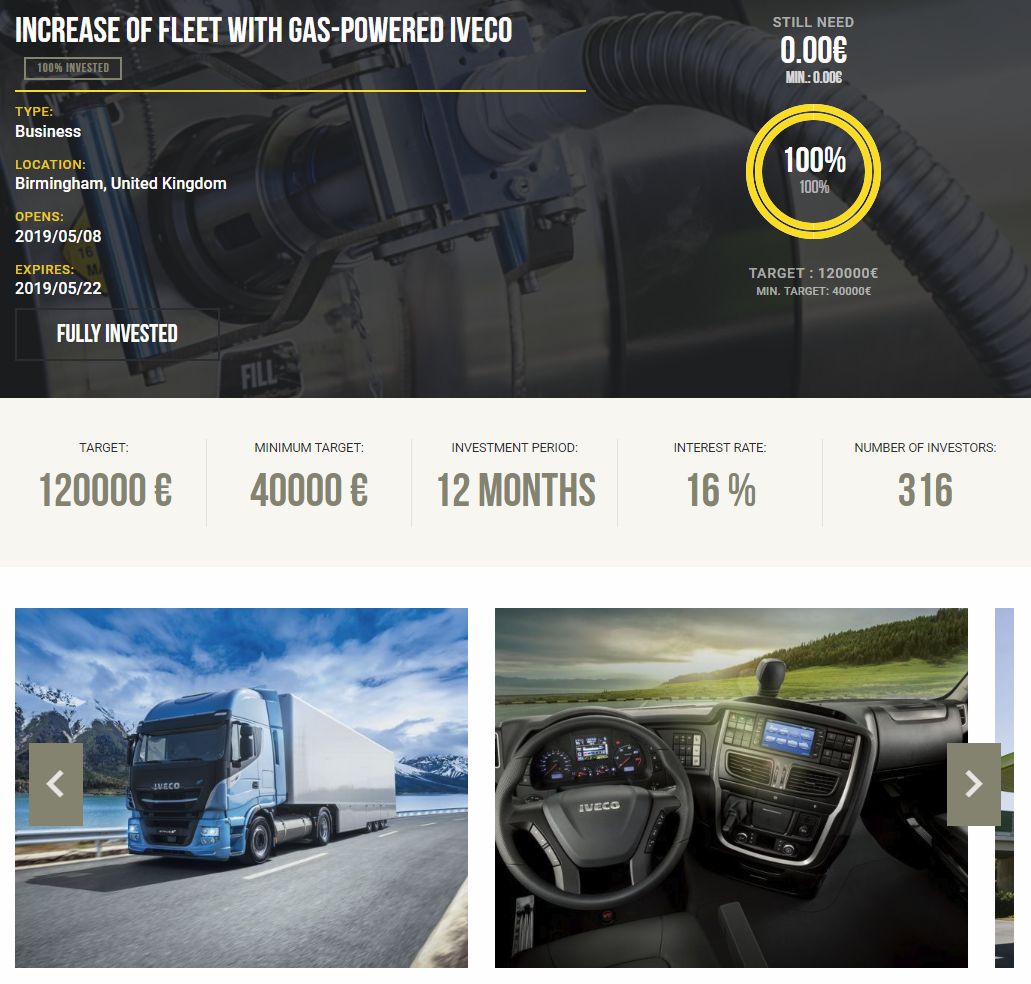

How about a UK based loan at 16%?

If you’re UK based and worried about lending on assets in other countries, even if they do have wonderful LTV’s, how about a loan in the UK?

Here’s a loan to a UK company for expanding its fleet of gas powered vehicles at 16% returns for a 12 month loan. The loan is once again covered by the Crowdestor Buyback Fund.

Detailed information on this loan is public and can be seen on Crowdestor’s website

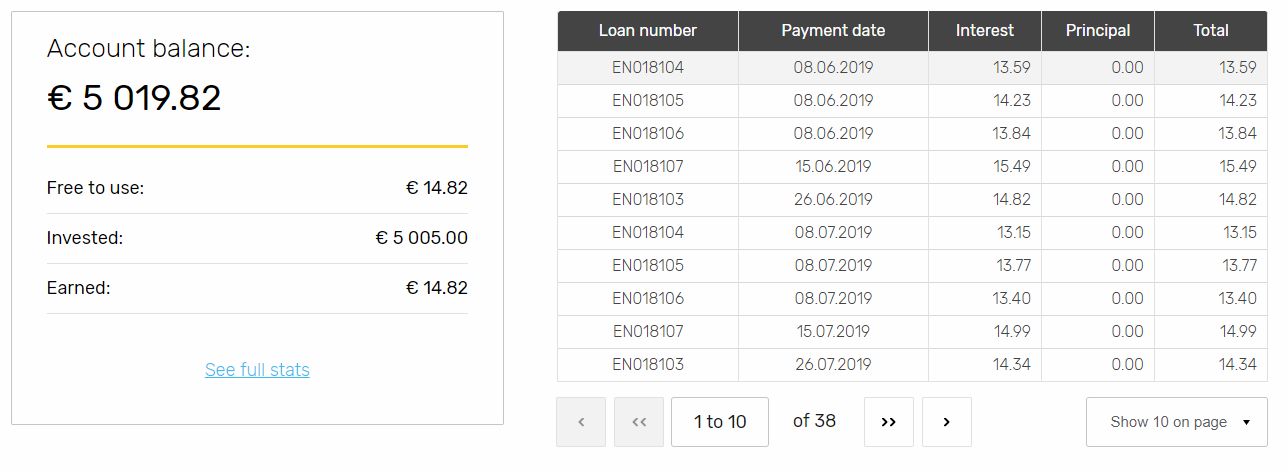

ENVESTIO

Envestio is another hidden gem like Crowdestor in my opinion. Although they’re becoming less hidden at the speeds the loans get gobbled up. The word is getting out!

Envestio is a hot commodity. When they introduce a loan, it often sells out in minutes. This is because they have some interesting and different loan ideas, with a reputation of looking after their investors by doing huge due-diligence on each and every loan.

Their loans typically have good asset backing with director guarantees. Envestio also operate a buyback guarantee, allowing investors to exit loans early if needed (at a fee). You can read more about Envestios’ buyback guarantee here.

I picked up 4 new loans in May, and not one of them lasted for more than about 45 minutes before they were fully funded, and a couple of them were less than 30 minutes. Not small loans either as you’ll see in the screenshot further down.

I have a total of 5 loans with Envestio now, all paying between 16% and 18.15% (gives an average of 16.93%). All loans are less than 10 months long, so capital is not tied up for a long time, and I can exit at any time using Envestio’s buyback guarantee with a 5% fee. 5% sounds like a lot but when you consider the loan is paying above 16% and money is only tied up for a maximum of 10 months, it’s really not a bad option in an absolute emergency.

Here are just a few of the loans which are already funded.

Detailed information on these loans is publicly available and can be seen on Envestio’s website

I’m really getting comfortable with Envestio the more I research them and do my due-diligence. Their management team is excellent, and they are very aware that they need to protect investors capital in order to grow their business. One bad default could be very problematic, not so much as damaging their business as it appears quite well backed, but for their reputation and gaining new investors.

If you’re interested in investing with Envestio, there is a €5 bonus for the first €100 deposit + 0.5% cashback from all investments for 270 days. Click here for further information.

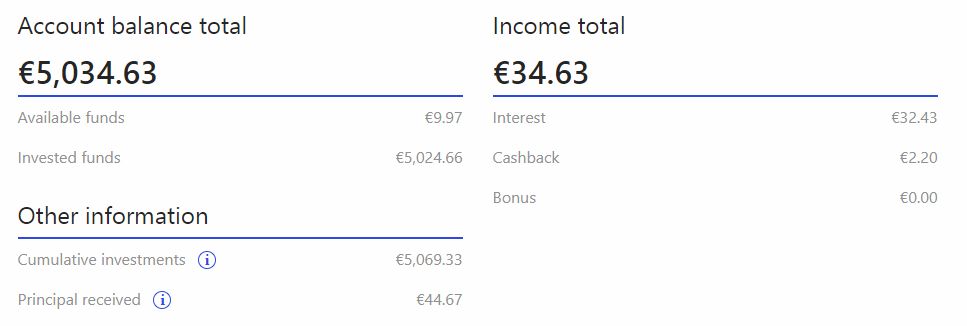

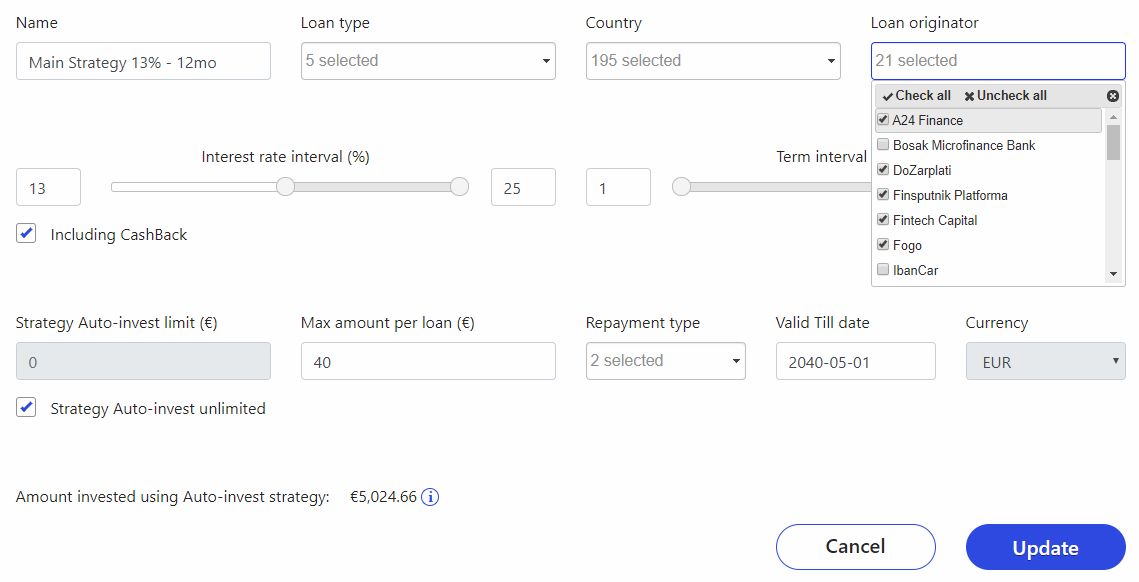

GRUPEER

Grupeer seems to be like a mini-Mintos in some ways. Investment is all automatic, and income just comes into your account and is reinvested.

They have 21 different loan originators (similar to Mintos) and you can set all of the auto-invest settings, including which originators you want use.

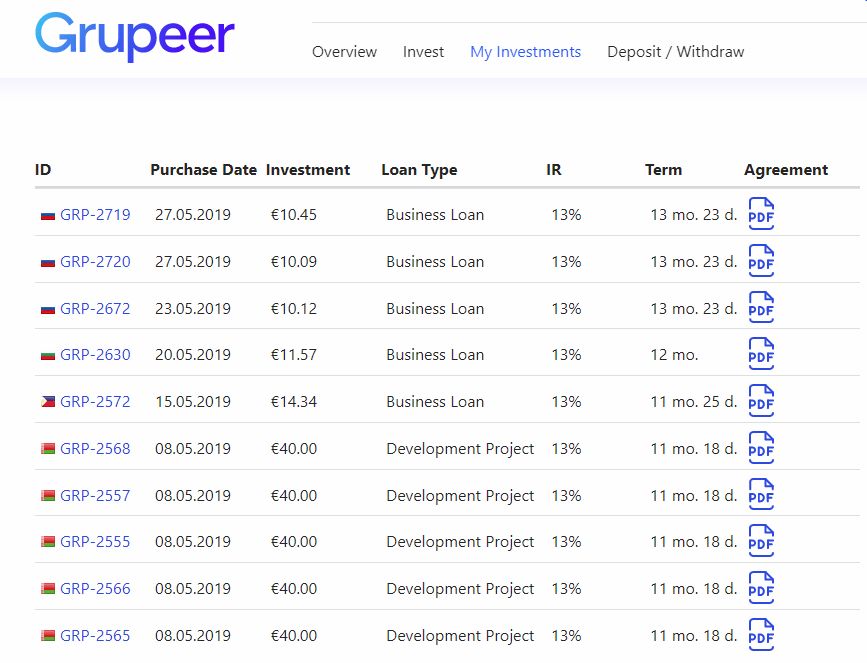

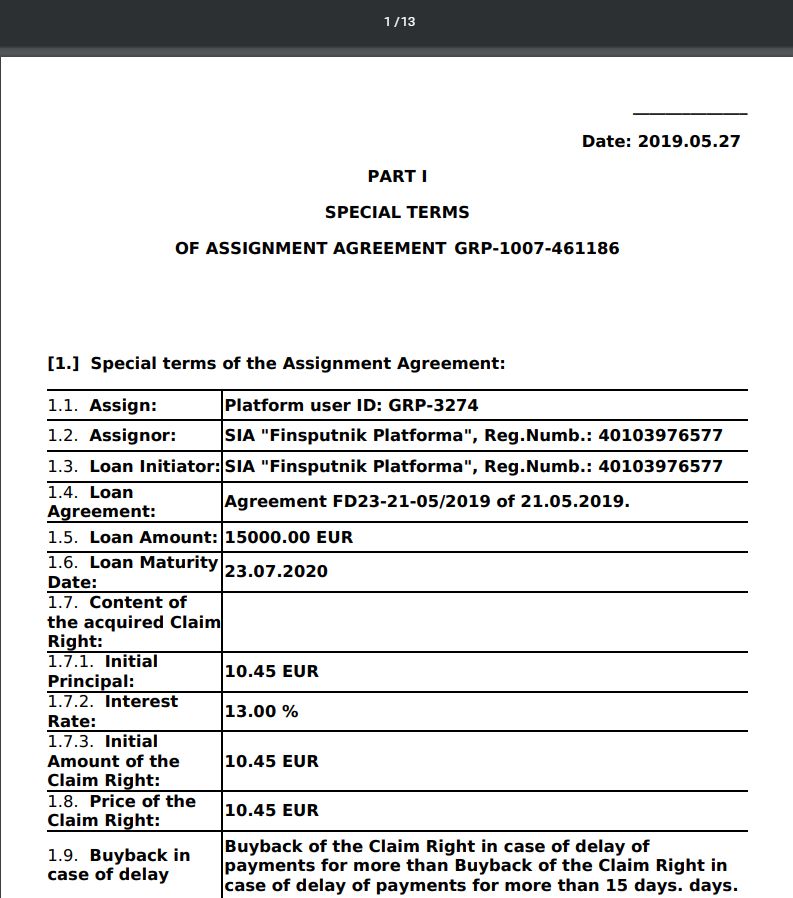

If you need to see the loans you’re invested into, it’s quite easy through the Grupeer interface (although I don’t really see the point with everything being auto-invest).

And if you’re really inquisitive, you can even dig down to the 13 page loan agreements and spend your weekend reading those 🙄

All in all I’m still happy with my decision to invest in Grupeer. It’s only been a couple of months of actual investments, but I have been watching them and doing research on them for well over a year. I have no doubt that they’ll deliver the 13%+ returns I’m expecting.

Grupeer are a good option for diversification of a euro portfolio in my opinion. If you’re interested in investing with Grupeer, click here to go to their website and see their current offers.

MINTOS (EURO Account)

See Screenshots & Detailed Monthly Updates From My Mintos Account

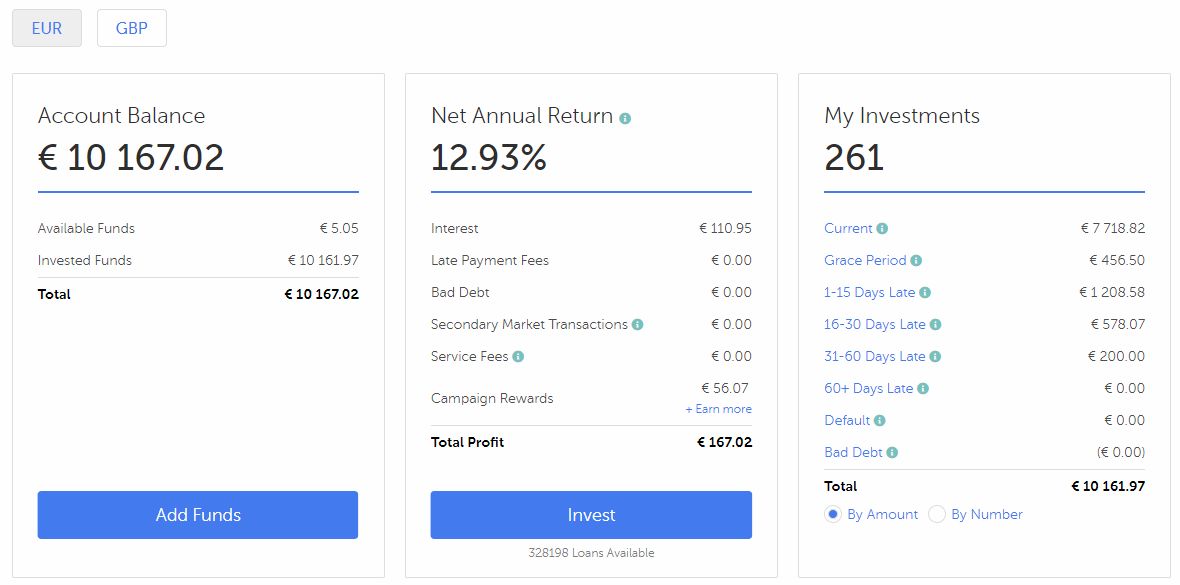

Oh Mintos, how I love thee 😀 You’ll note that out of the €202.36 earned for May, Mintos was responsible for €110.95 of it (of course my investment is double the other euro lenders). Net annual targeted returns keep rising at 12.93% (I’ll have some XIRR calculations for you next month, just need a bit more data).

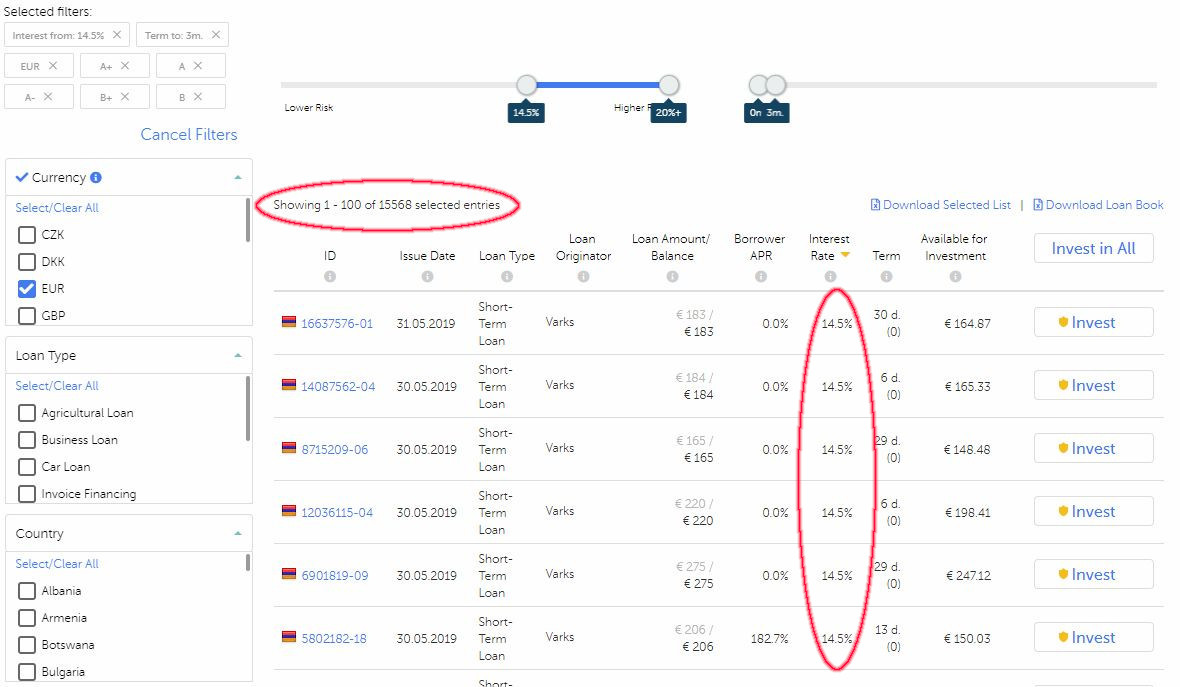

Solid returns with plenty of loans available, with buyback guarantees, skin-in-the-game and best of all, Varks (the loan originator for most of the short term loans I’m investing in) pays interest even on late or defaulted loans. If you want more information about my investment strategies and settings with my Mintos accounts, I recently updated my Mintos Review with all of that information.

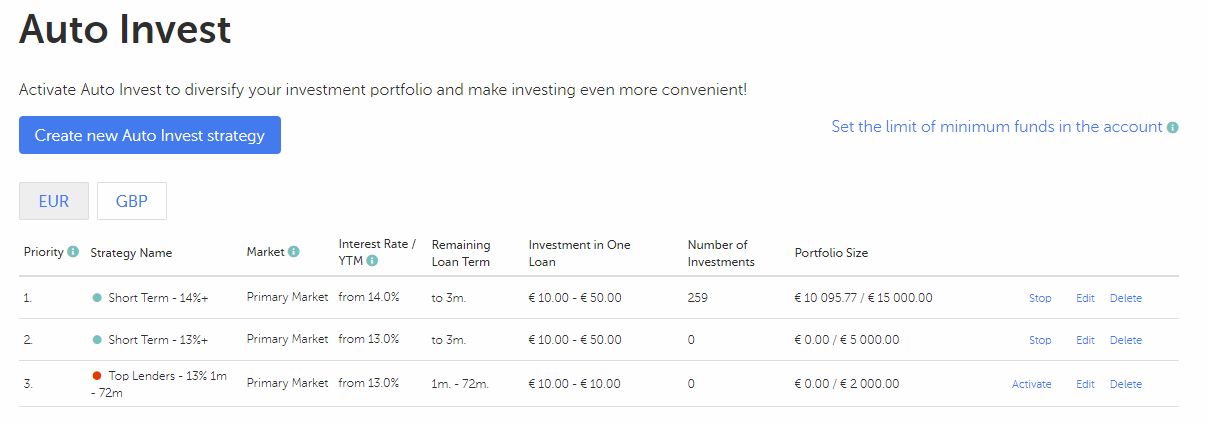

Currently we are seeing a lot of 30 day loans coming in from Varks at 14.5% interest. Over 15k loans makes it easy for any size investor to get diversified. And that’s just the 14.5% loans!

I have my auto-invest strategies set up to catch these first, before the 13% loans. Again, you can read more about how this all works in my updated Mintos Review.

Remember, if you are new to Mintos, they have a wonderful cashback bonus, one of the best in the business in fact.

ROBO.CASH

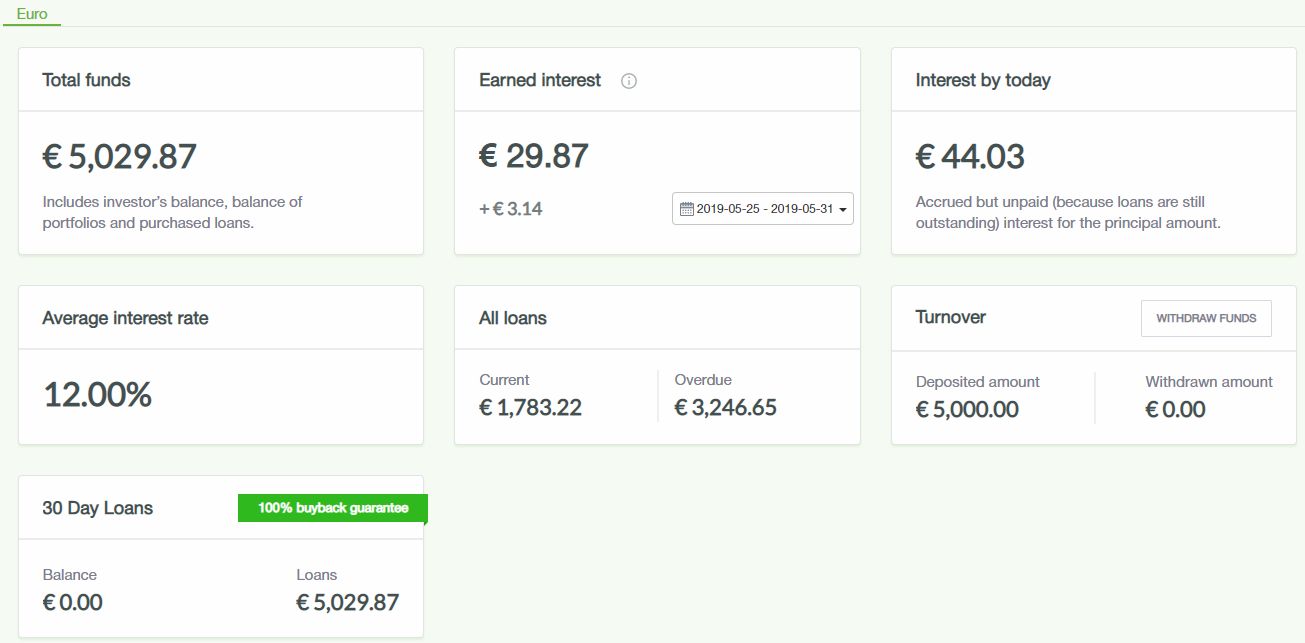

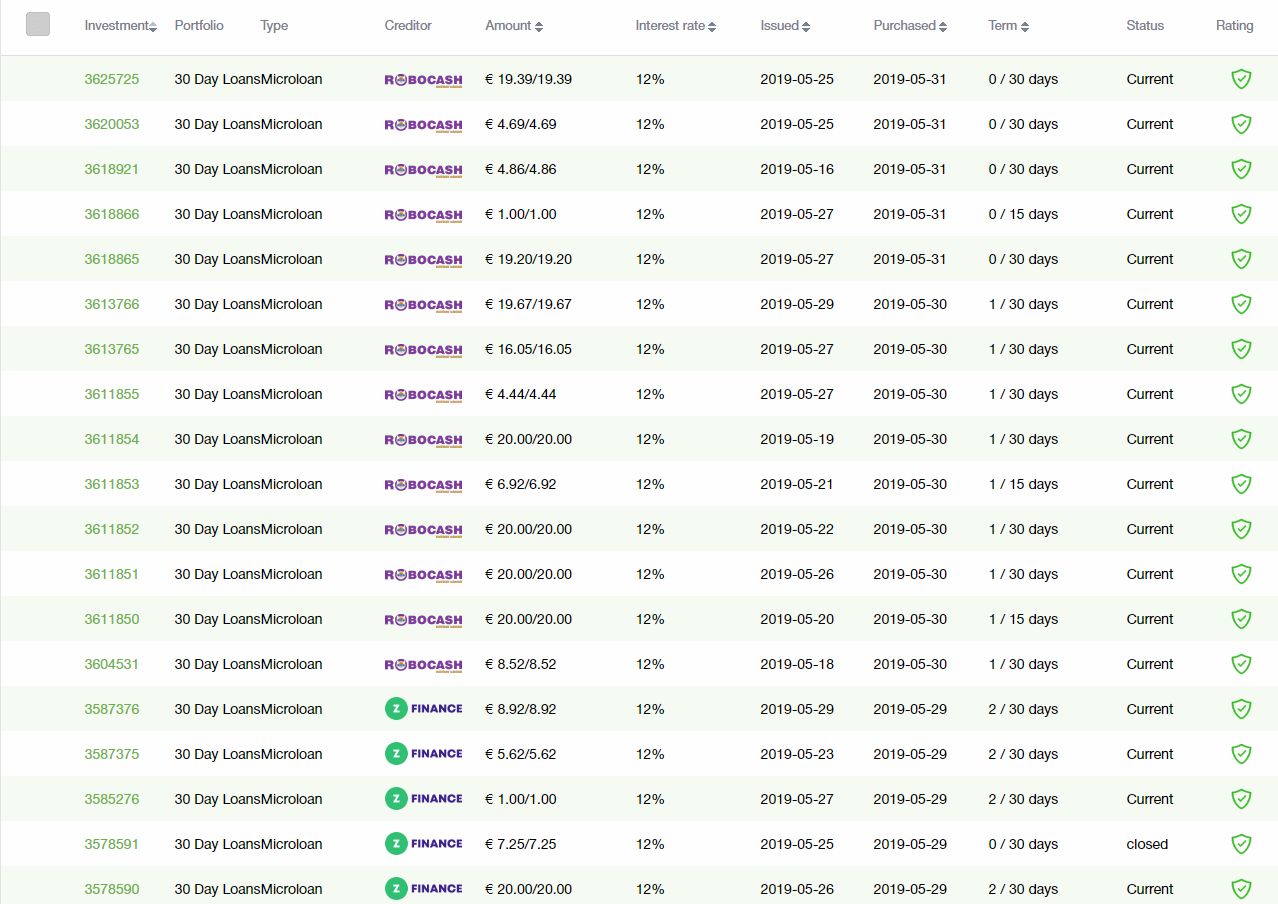

Robo.Cash is another euro lender I have been watching for many months. I’ve only been investing with them since April but already the overdue loans are a huge percentage of the portfolio (see above) 😯

I understood it was possible to see around 50% of loans late, however when you see around 70% overdue, it becomes alarming! Not to worry though, I called a few folks I know who have been investing with Robo.Cash for a while, and they say it’s normal with these types of payday loans.

Robo.Cash have 100% buyback guarantees on all of them, so it really doesn’t affect the individual investor (providing of course Robo.Cash and their loan originators stay in business).

Apparently the high interest rates they charge the borrowers cover all of the overdue loans, and with most of them, they are able to bring back to current by working with the borrower. Just another day in the office for these guys apparently.

You can see below again how Robo.Cash are similar to Mintos with the multiple loan originators.

Summary

That’s all for another month. A somewhat lengthy post again. Now I’m adding new lenders, this update at the beginning of each month is taking a long time. This one took me 3 full days! I hope you find the information useful? Please feel free to comment at the end of the post and let me know how I’m doing.

May turned out to be another great month for my P2P lending, surpassing the £1000 mark once again. Plus the €202 in euro return from euro investments.

I’m interested to see how my new euro lender accounts fair. I’m still expecting the euro to come down more against the USD, that’s the reason I didn’t change more USD to euro in May. As it comes down, I will buy more euros and then start some more euro P2P lending investments as I have ideas for a couple of new lenders I’m currently researching. I also want to put more money with Envestio and Crowdestor!

Finally I hope the month of June goes well for everyone, and you all enjoy the nice weather (assuming you are getting some of course).

I wish you all the best of luck with your investments. I will update you on my P2P Portfolio investments around the same time next month.

Thanks for reading my blog! Please feel free to comment below if you have comments, questions, criticisms or suggestions. You can also email me if you prefer. I love feedback!

Please note, most of the cashback offers on this site are for new lenders to a company. I suggest you do your own research before investing as cashback offers change daily.

If you’re new to Peer to Peer Lending, you can learn more about it on my page About Peer to Peer Lending. Also take a look at my Peer to Peer Lending Guide, Where to Start if you’re just thinking about getting your feet wet. Individual lender reviews are all here.

Disclaimers: This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website. * My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective. ** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations. Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences. Please read my full website Disclaimer before making investment decisions.

Another enlightening monthly review, your transparency is a breath of fresh air! It has inspired me to get involved with P2P, so you’ll be doing quite off of referral income 🙂

I’d love to hear you thoughts on the interest we don’t earn, (UK) taxes and fees! I appreciate that’s maybe a broad topic, but I’m sure you’ve learnt some things the hard way that aren’t immediately obvious to a new investor.

Keep up the good work!

Hi Ben,

Thanks for the positive comment! It’s good to hear the information is useful.

Unfortunately I’m not able to help much on taxes. Everyone’s personal situation is different and it can be complicated. Because of my investments in multiple countries and assets, I have accountants who take look after my taxes. The only place I’ve discussed taxes is in the Early Retirement in Portugal post, but that’s just specific to people living in, or moving to Portugal and the “Non Habitual Tax Residency”.

Good luck with your Peer to Peer investments! I’m sure you’ll do well. Let me know if there is anything else I can help with.

Cheers,

Mark

Hello again! I know you give a lot of thought to the allocation of your growth portfolio, but what about P2P? What is your distribution between property/personal/business/etc. loans, and why? Is diversification between types of loans as important as diversification between platforms, or is it all under a P2P umbrella? Thanks!

Hi Ben,

The thing with P2P is you have platform risk above the loans, which factors in things like asset security, LTV’s on the assets, provision funds, buyback guarantees, skin-in-the-game, diversification, platform financial strength and a host of other variables. Ideally I would like to keep a balance between business and personal lenders, and have at least 70% in well secured assets between the two. It’s difficult to achieve this when you also factor in the strength of the platforms.

So I have a mix of business and personal loans if you look at my ratios, some secured, some not, but it can change all the time. For example, many of Lending Works loans are unsecured personal loans, but I trust them just as much as I would asset secured business loans on some other platforms. This is because of the way they distribute risk between all lenders, and also their provision fund being (what I consider to be) one of the best in the business. Landbay have ultimate asset security, but 3.49% return for my capital is too low for the work involved, so I don’t have a lot with Landbay.

With Mintos, I will take short term unsecured personal loans at 13% to 17% returns (which are considered quite risky), depending on the originator and how strong they are. ID Finance and Varks for example are very strong companies with a history of dealing with short term, unsecured loans. They know what they’re doing and I trust them, Plus Mintos keeps a good eye on them too. If I went to some other lenders with similar offerings that were not on Mintos, or don’t have the history, I might not trust them as much. There are a few lenders on Mintos that offer 19% unsecured personal payday loans right now, but I won’t touch them because I don’t consider them to have the same qualities.

I hope that all makes sense? There is a lot of trust in the individual platforms & loan originators, which (for me at least) is just as important as the individual loan types. You can have loans with super low LTV’s, but if the platform is tardy at collecting on them when they default, it can be just as bad as loans with high LTV’s with a platform that has a history of chasing them down and recovering funds.

Hopefully that answers your questions?

Cheers,

Mark