REITs (REAL ESTATE INVESTMENT TRUSTS)

25% of my growth portfolio is invested in real-estate funds. I use REITs to get exposure to real-estate rather than rental properties etc. They are just easier to deal with and easier to sell for portfolio rebalancing purposes. REIT’s are available in both the US and UK markets in USD and GBP, as well as many other currencies.

REIT’s (Real Estate Investment Trusts) are a great vehicle to use to get in to the real-estate market. We can buy and sell many of them on the stock market, just like we can stocks and funds. When you choose the right REIT’s, they can not only provide a great dividend income (4-5% in some cases), but they can also help hedge stock and bond investments because they tend not to move exactly as a stock or bond does. They move similar to stocks however they seems to move at slightly different times, which keeps the overall portfolio return-curve smoother. See below for a comparison of the stock market and REITs.

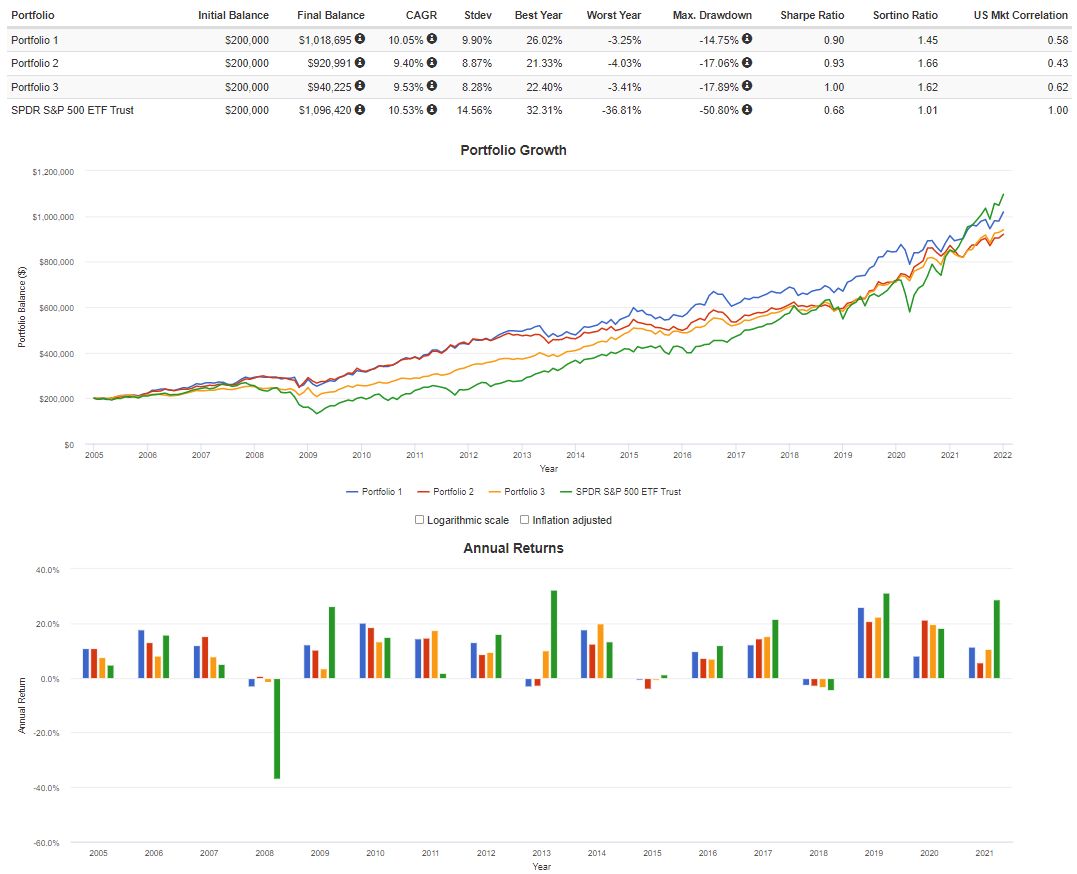

This is an example where Portfolio 1 contains only REIT’s, being compared against the benchmark. the US Stock Market.

You can see that although they move similarly, they are not by any means moving exactly the same. When I first added REIT’s to my portfolio; I immediately saw how they increased the Compounded Annual Growth Return (CAGR), They also reduced some of the drawdown levels I was seeing without them. On their own, the drawdowns are similar to stocks, but when you add them to a diversified portfolio, they all work in concert to make the total portfolio much smoother.

You can see in the backtest below how REITs improve the return and reduce the drawdown in a portfolio.

Below is a comparison of how a data model of my $ – USD Growth Portfolio compares to other popular portfolios over the last few years. As you can see, the % returns and drawdowns are better than the original Harry Browne Permanent Portfolio. Portfolio 1 is my current USD Growth Portfolio Allocation (US Stocks, US Bonds, Gold, US REITs). Portfolio 2 is the original Harry Browne’s Permanent Portfolio mix: US Stocks, US Bonds, Gold . Cash has been left out, as I think that skews it to the downside unfairly. Here is also a link to my USD Permanent Portfolio which I track monthly here on my website. Portfolio 3 is made up of a 50/50 mix of US Stocks & US Bonds using ETF’s. The S&P ETF is there as a representation of the US Stock Market Baseline. NOTE: The returns shown in this simulation are INFLATION ADJUSTED meaning they are returns after inflation. The returns shown in my portfolios are BEFORE inflation. BALANCES shown are just there to show growth as an example. They are not actual portfolio values. — If you would like to read about backtesting, see my Backtesting page.

More on REIT’s

A real estate investment trust, or REIT, is a company that owns, operates or finances income-producing real estate. For a company to qualify as a REIT, it must meet certain regulatory guidelines. REITs often trades on major exchanges like other securities and provide investors with a liquid stake in real estate.

REITs are not a new financial innovation. Established by US Congress in 1960 as an amendment to the Cigar Excise Tax Extension of 1960, REITs operate in a manner comparable to mutual funds as they allow for individual investors to acquire ownership in commercial real estate portfolios that receive income from properties such as apartment complexes, hospitals, office buildings, timber land, warehouses, hotels and shopping malls.

Most REITs specialize in a specific real-estate sector – for example office REITs or healthcare REITs. Within this space, REITS must purchase and operate its holdings as a part of its portfolio. In most cases, REITs operate by leasing space and passing on collected rent payments to its investors in the form of dividends.

REIT Guidlines for US Companies

A company must meet the following requirements to be qualified as a REIT:

- Invest at least 75% of its total assets in real estate, cash or U.S. Treasuries

- Receive at minimum 75% of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate

- Pay a minimum of 90% percent of its taxable income in the form of shareholder dividends each year

- Be an entity that is taxable as a corporation

- Be managed by a board of directors or trustees

- Have a minimum of 100 shareholders

- Have no more than 50% of its shares held by five or fewer individuals

Different US REIT Categories

REITs typically fall within three categories.

- Most REITs are equity REITs. Equity REITs invest in and own income-producing real estate properties and give investors the opportunity to invest in these portfolios. They must distribute at least 90% of the portfolio’s income to its shareholders in the form of dividends.

- Mortgage REITs invest in and own property mortgages. These REITs loan money to real estate owners and operators not only for mortgages but also for different types of real estate loans or through purchasing mortgage-backed securities. Their earnings are generated primarily by the net interest margin, the spread between the interest they earn on mortgage loans and the cost of funding these loans. This model makes them potentially sensitive to interest rate increases.

- Hybrid REITs invest in both properties and mortgages.

Overview of UK REITs

The UK Real Estate Investment Trust (“REIT”) regime launched on 1 January 2007, and immediately saw a number of the UK’s largest listed property companies convert to REITs. The following years have seen further

REIT conversions as well as the launch of a number of start-up REITs.

As at August 2018 there are over 40 UK REITs. Significant changes to the REIT regime came into effect in July 2012. Those changes to the REIT regime were far-reaching and significantly increased the attractiveness of the regime to a wider pool of property investors and providers of capital. The changes reduced barriers to both entry and investment in REITs. Further smaller changes in both 2013 and 2014 have continued to enhance the attractiveness of the regime.

Summary

Whichever way you look at it, REIT’s are a valuable addition to any portfolio. And with the right mix, they can help increase return and reduce drawdowns considerably.