LendingCrowd – Pros & Cons

PROs 👍

- Unique Diversification – LendingCrowd are based in Edinburgh so focusing on business in Scotland makes sense.

- Auto-Invest –there are auto-invest accounts if you don’t have the time to self select loans.

- Manual Bid – you can get higher interest rates if you have time to watch the loans as they are live and place live bids.

CONs 👎

- No Provision Fund –target interest rates are based on an expected default rate.

- Smaller Company – with a shorter track record, they haven’t had to deal with a financial crisis yet, so we won’t know how they fair until the next one.

- No Quick Access Account – depending on demand, you could have to wait a while to withdraw funds early.

Visit The LendingCrowd Website

What is LendingCrowd?

LendingCrowd – is a medium size Peer to Peer lender based in Edinburgh, Scotland. Providing loans to businesses around the UK, they have a unique focus.

LendingCrowd are the only P2P lender based in Edinburgh focusing on loans to Scottish businesses.

Offering higher returns (up to 14.25% on the Self Select Account) on business loans, many (but not all) of which are asset secured. LendingCrowd are growing.

With great customer service and an average of around 20 new loans per month. They have a unique offering that I enjoy investing in. LendingCrowd also offer an ISA for potential tax free investing.

My Overall Experience With LendingCrowd So Far…

So far my experience with LendingCrowd has been overall good. They went through a stage back in 2018 of more than average defaults which turned out in the end not affect overall income at all and be a non-event. They have a good experienced team chasing debt and they do a good job of getting arrears caught up. Defaults have always been managed well and my actual rate of return (XIRR) has always been in the high 6%, which is great for a GBP business Peer to Peer lender.

Of course now with the Covid pandemic, they are not currently lending out retail capital.

My LendingCrowd Strategy.

All I can do is retrieve capital as it’s paid back now. As soon as LendingCrowd starts retail lending again I will likely increase my investment with them as overall they have done what it says on the tin.

Easy-Info Table© – LendingCrowd Review

| Overall Rating*: |  (3.6 / 5) (3.6 / 5) |

| Who can invest: | |

| Loan Currencies: | £ |

| Estimated Return: | 4.6% to 14.25% depending on account. |

| Target Annual Return (Platform Number): | 1.7% |

| My Calculated XIRR: |  |

| My Current Investment:(click to see amount in £) | See My Investment £ |

| Risk Rating*: | 5/10 - Medium  |

| Early Exit: | Yes. Loans can be sold. 1% fee on auto invest accounts. 0.50% on self select and ISA under normal market conditions. |

| Min. Investment: | £100 minimum deposit. £20 per loan minimum investment. |

| Deposit Funds: | UK bank account 24-48 hours. Debit card - instant. |

| Auto-Invest: | Yes |

| Manual Invest: | Yes. Manual select and auto bid. |

| Lending To: | Borrowers |

| Loan Security: | Yes (not all). Some director guaranteed, some secured on assets. |

| Default Rates: | Lifetime expected rate 1.52% Actual 1.41% |

| Provision Fund: | No |

| Loans Amortize: | Yes. Most loans amortize. Any that don't are clearly shown. |

| Time to Invest: | Quick on Auto-Invest accounts. Medium on Self Select account. Around 20 new loans per month. Loans can also be purchased on secondary market. |

| Time to Mange: | None (auto-invest). Medium (self select). |

| Lender Fees: | 1% all accounts ongoing lender fee. |

| When are Payments Received: | Monthly. Various time throughout the month. |

| Amount Lent: | £58m + |

| Number of Investors: | 6000+ |

| Loan/Dflt Stats: | Click Here for Stats |

| Regulated: | Yes: FCA |

| Location: | Edinburgh, UK. |

| Launched: | 2014 |

| Website: | https://www.lendingcrowd.com |

| Email: | investor@lendingcrowd.com |

| Telephone: | 0131 564 1600 (UK) |

| IFISA/IRA: | Yes: IFISA |

| Cashback**: | Yes! £50 Cashback for £2,000 investment! Learn More >> |

| How to Sign Up**: | Sign Up Here! (if investing less than £2,000) |

Latest Update & Current State of Account

LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors. All I can do for now is withdraw capital as it is paid back.

Hopefully as things get back to normality, LendingCrowd will open its doors to retail investors again. I enjoyed lending with them before the pandemic.

Account Screenshots

Latest Screenshots from my personal account.

LendingCrowd Returns

LendingCrowd Review – Overview

History

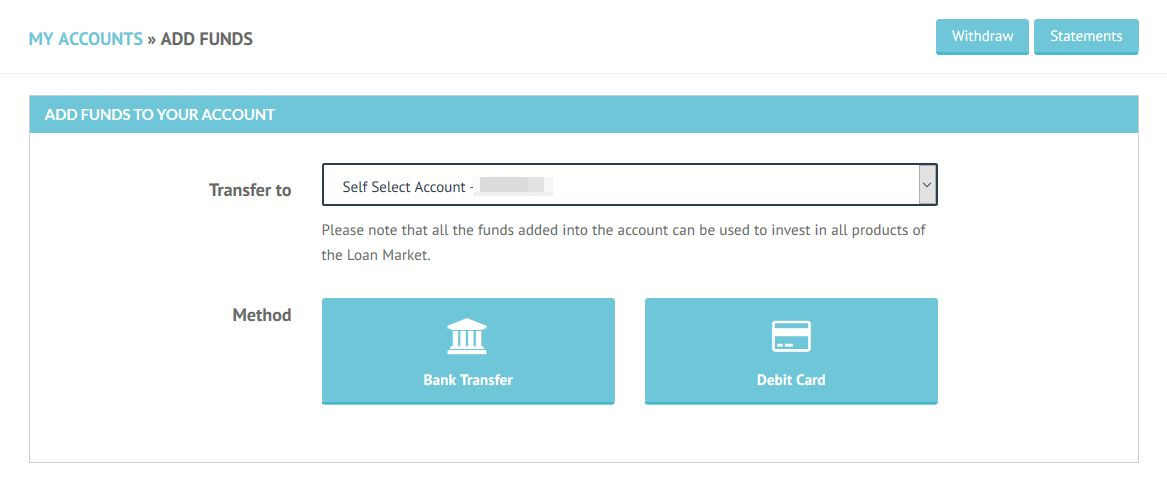

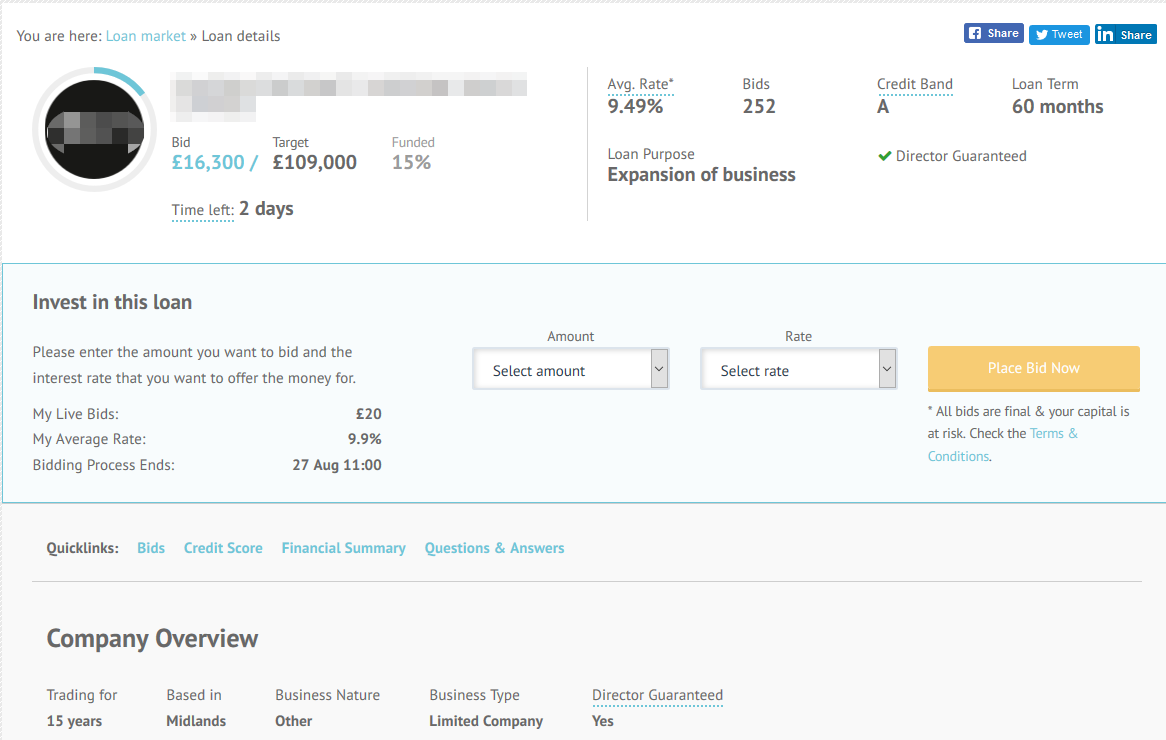

LendingCrowd were launched in 2014 in Edinburgh, Scotland. In the 5 or so years they have been in business, they have lent in excess of £58 million from over 6,000 active investors. They are one of the few lenders left that still offer a loan auction. This means we can bid on loans in order to get the best rates. I actually enjoy watching how other people bid on loans. I like bidding at the last minute to get the best possible rate on a loan.

Regulation

LendingCrowd (AKA Edinburgh Alternative Finance Ltd.) are regulated by the UK’s Financial Conduct Authority (FCA) with full permissions under FCA number 670991.

They gained FCA permissions in November, 2016. It’s important to note that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

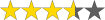

Signup Process – LendingCrowd Review

Opening an account is fairly easy. Just the usual ID & anti money-laundering checks. Same for the LendingCrowd ISA, although if you need to transfer an ISA from another institution to your LendingCrowd ISA, there is more paperwork to do.

If LendingCrowd can verify you though one of the UK’s credit agencies, you will be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

Only residents of the UK with a UK bank account can signup with LendingCrowd Edinburgh.

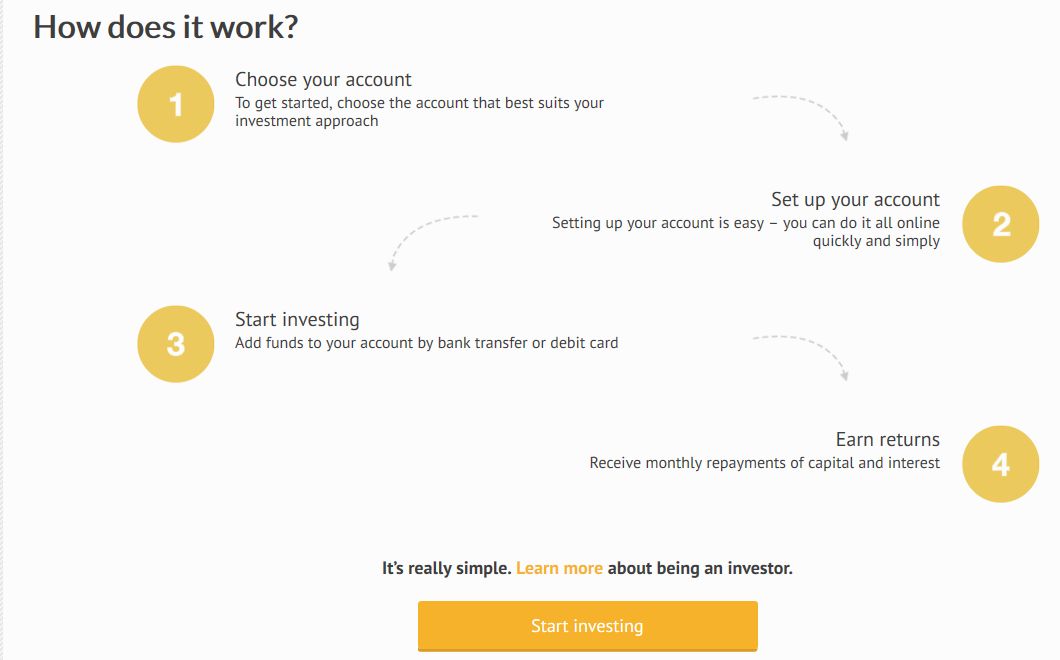

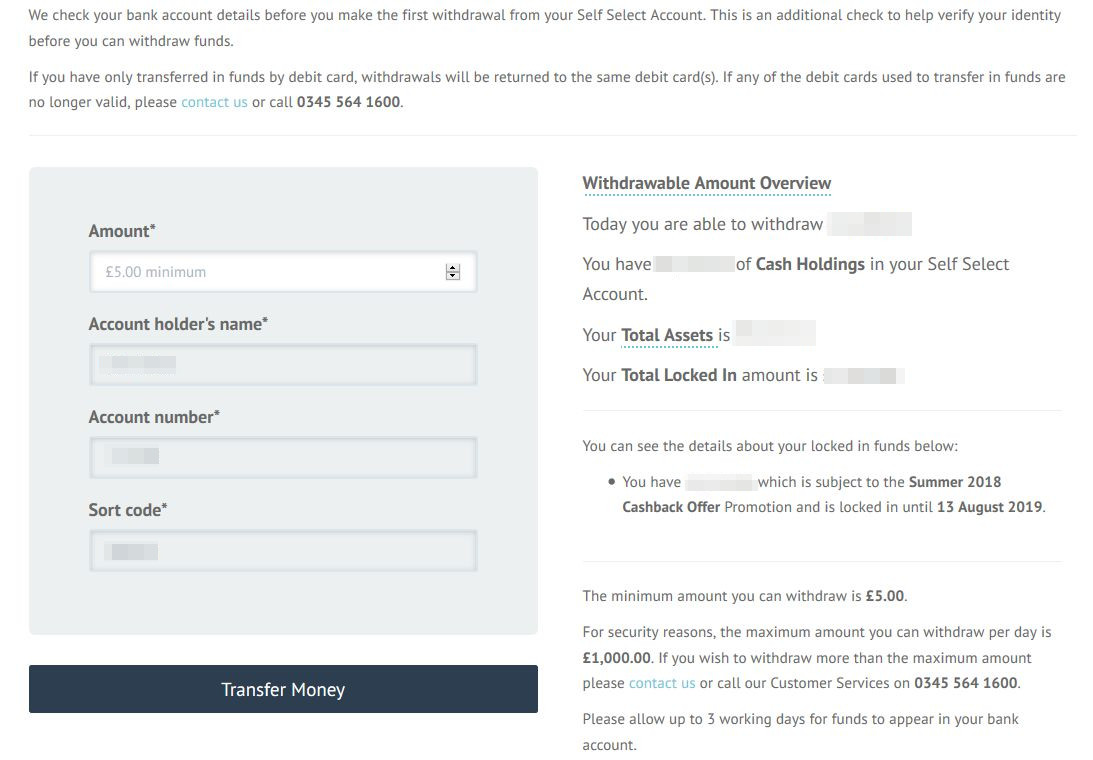

Deposits & Withdrawals

Deposits and withdrawals are made by bank transfer from a UK bank, or from a UK debit card.

From a bank account, deposits usually show up in your account the same or next working day. Debit card deposits show up instantly.

Withdrawals are only to a verified bank account and typically take 2 – 3- business days.

Time to Become Invested

Getting invested into the auto-invest accounts is fairly quick, depending on loan supply. Same day typically depending on the level of capital you are depositing.

In the manual Self-Select account, it all depends on the loan supply and level of diversification you want.

LendingCrowd have a steady new loan flow, between 20 and 30 per month usually, plus they have a good supply of secondary market loans to purchase, so it should be easy to get capital lent out fairly quickly.

Who are we lending to?

LendingCrowd is a true Peer to Peer Platform. Lenders are lending directly to borrowers who are typically small to medium size British businesses.

Loan agreements are directly between the lender and the borrower. LendingCrowd just acts as a middle man, managing loans, payments and debt collection etc.

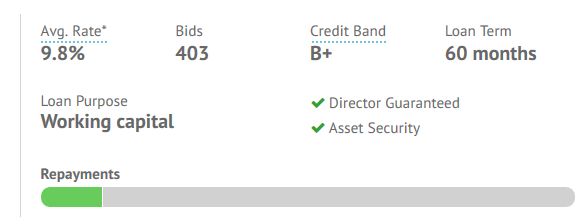

Loan Security – LendingCrowd Review

Most of LendingCrowd loans are secured by either director personal guarantees or physical assets. Personally I don’t put a lot of faith in personal guarantees as they can be very difficult to collect on.

You can always see clearly with the Self-Select account loans, on each loan screen, if a loan has security. Although it’s not as detailed as some lenders as to exactly what that security is.

Default Rates

Current actual lifetime default rates are running at 1.41% against an estimated 1.52%.

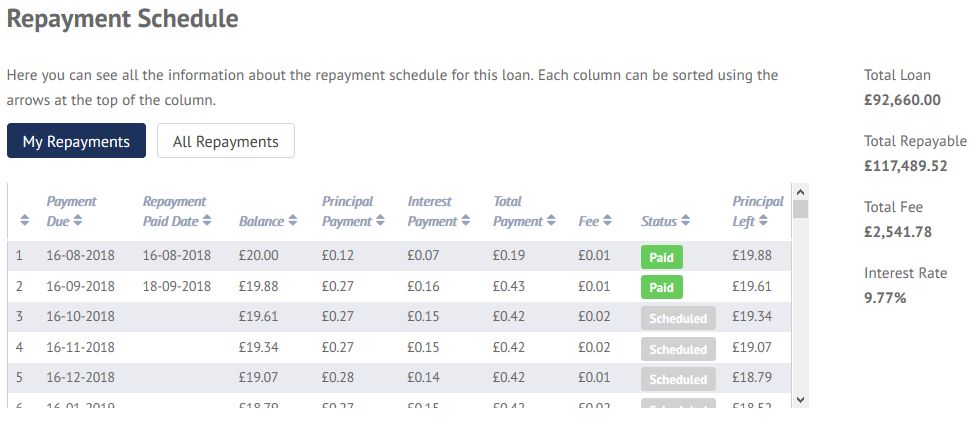

Amortization – LendingCrowd Review

Most of LendingCrowd’s loans amortize, meaning you receive capital and interest payments every month.

This reduces the risk of the loan compared to a non-amortizing loan in which nothing is received until the end of the loan period, or only interest is received monthly and then the capital repaid at the end of the loan period.

Any loans that are non-amortizing are clearly shown on the loan payment screen of each loan.

As you can see on this screenshot, both capital and interest payments are due each month so this loan is amortizing.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over time. Any loans that are interest only are marked clearly on the LendingCrowd website.

Selling Loans and Withdrawing Capital

There is 0.5% fee for selling loans on the secondary market with the Self-Select account. On the Auto-Invest accounts the fee is 1%. Under “normal market conditions”, loans can be sold and capital withdrawn as soon as loans are sold.

In practice this can take anywhere between a few days and a few weeks depending on how many other investors are looking to buy loans from the secondary market.

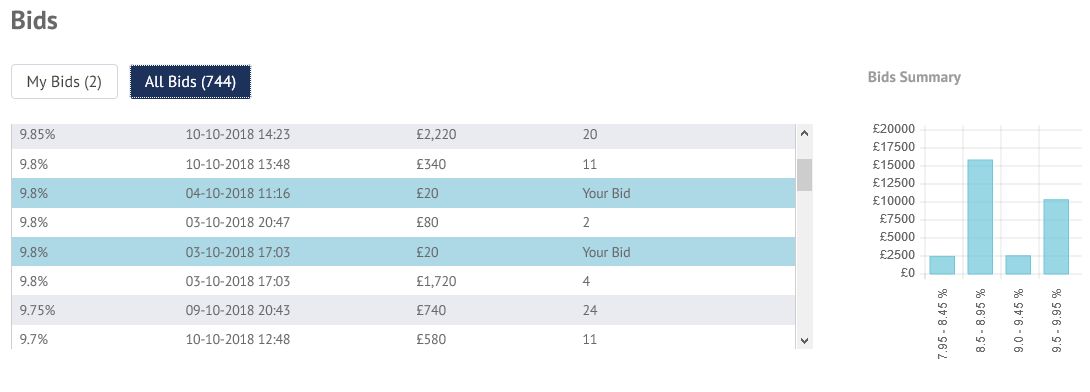

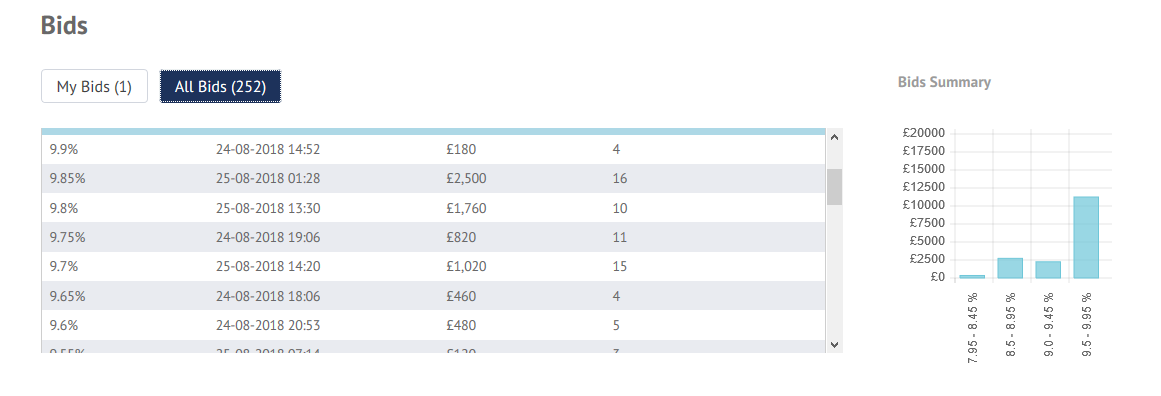

One thing I’ve learned from buying and selling loans on the LendingCrowd secondary market (Self-Select account); it is much easier to sell loans that have a return rate higher than the average loan return.

When bidding on Self-Select loans, there is an “average rate” that is bid on any loan. Many people bid to the lower end of the return rate spectrum just to make sure they get in to the loan, so these bids will typically come in below the average rates for the loan, and can be difficult to sell on the secondary market.

Bids that are in the higher range, above the average rate, are easier to sell.

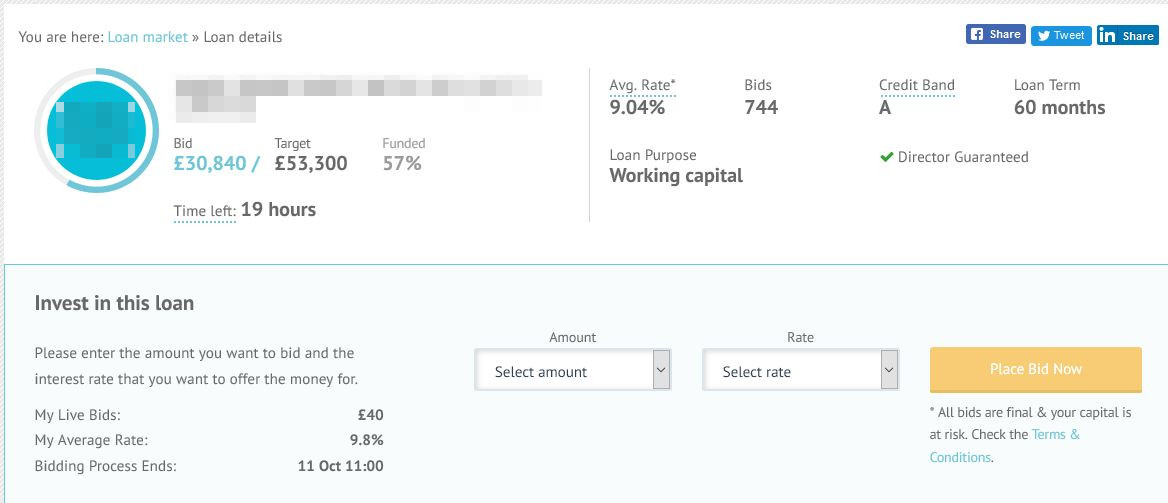

In the screenshot below you can see the average rate for this loan. To the right of the second screenshot you can see where most of the bids lay.

Getting back to withdrawals, once loans are sold, the withdrawal screen is easy to navigate.

There is a £1000 per day withdrawal limit set after account verification, however you can call LendingCrowd for further verification in order to withdraw larger amounts.

Note that funds added by debit card will be returned to the same card.

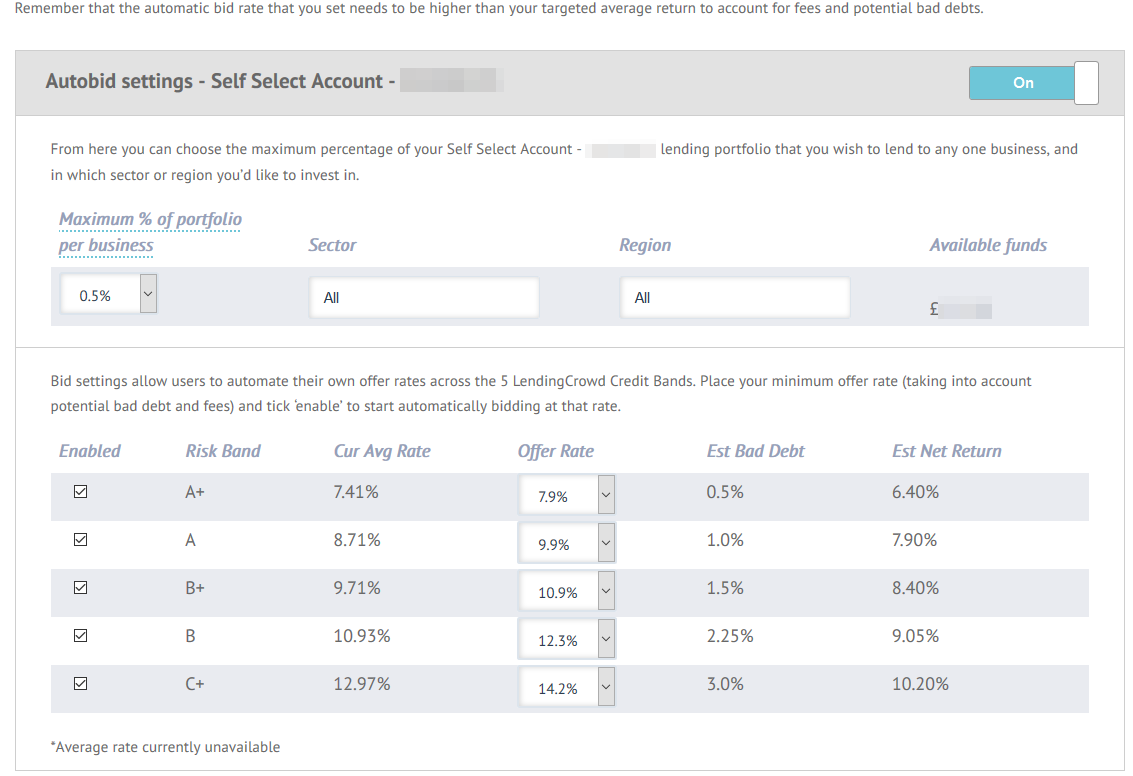

Diversification

Diversifying into loans in the auto-invest accounts is achieved automatically when funds are deposited.

With the Self-Select account you are responsible for diversification. As LendingCrowd has no provision fund on this manual investment account, you should take extra care to ensure good diversification.

The good news is that there are plenty of loans available, plus new loans coming thorough most days, so it should be relativity easy to diversify in to loans at no more than 0.5% of capital in any one loan.

Provision Fund – LendingCrowd Review

There is no provision fund to protect LendingCrowd accounts. Including the LendingCrowd ISA.

Their target rate on Auto-Invest accounts is based on expected default levels, and loan losses under normal market conditions.

With Self-Select loans, make sure you diversify correctly as mentioned earlier in order to keep losses low as an overall percentage of account value.

You can see by the screenshot above, I have loans which are late on payments or in arrears with this account.

It’s not necessarily as bad as it seems yet though. Even though these loans are late, they could (and often do) still catch up with payments. If they don’t, defaults are an expected and accepted part of lending.

LendingCrowd’s team are very experienced at loan recoveries, so there is always a chance down the road that some of this could be returned to my account.

Tax Efficient Innovative Finance ISA (IFISA)

LendingCrowd Edinburgh offers an Innovative Finance ISA (LendingCrowd ISA) which was launched in February 2017 for UK residents.

The LendingCrowd ISA is certainly worth looking at and has multiple investment options (see below).

Website – LendingCrowd Review

LendingCrowd provide good loan information on their website.

This enables us make an educated decision on how much to lend. And what interest rate we would like for the risk we are taking with the Manual Self-Select Account.

You can see what levels other investors are bidding at.

So you can see what rate the bulk of the loan money is sitting at, then place your own bid.

Manual Bid

I usually find when I manual bid the loans, I can get around 1% more than the average rate achieved for the loan.

Honestly it’s become as much of a game as an investment. However I do have quite a bit of capital invested, and over the last few weeks, I’ve been able to diversify into loans to over 360 different businesses, with no more than 0.50% of my capital invested in any one loan.

So sticking to the “Prime Directive” with diversification is easy to achieve.

Auto-invest

If you don’t have the time, or don’t want to manually invest, LendingCrowd do have two auto-invest accounts you can use:

The LendingCrowd Growth Account with a target rate of 4.9%. And the Income Account with a target rate of 4.6%.

Neither account has any fixed term, however they do charge a 1% withdrawal fee when you want to withdraw your money.

I do need to point out here though that there is a 0.50% fee for selling loans in the Self Select Account too. If you keep the loans until maturity though there is no exit fee.

If you like the idea of higher rates, plus the lower fee, the Manual Self Select Account does have an auto-bid feature which will automatically place bids on new loans at a predetermined rate for you:

This way it’s almost like auto-investing, however you control the interest rate you want to get, and also the diversification level you want.

Summary – LendingCrowd Review

Overall I think LendingCrowd in Edinburgh is a great company and I hope they keep on growing as they have done so far.

I like their friendly, helpful customer service. And the stream of new loans which keep coming through.

I really hope that they don’t take away the manual Self-Select account (as some of the other P2P lenders have), as this enables me to get the very best interest rates, and it gives me something to do in the morning 🙂

Thumbs Up for LendingCrowd

-

Unique Diversification – LendingCrowd are based in Edinburgh so focusing on business in Scotland makes sense. This can give you options outside of London, enabling you to diversify more.

-

Auto-Invest –there are auto-invest accounts if you don’t have the time to self select loans.

-

Auto-Bid – if you can spend a little bit of time managing your investments, then using the auto-bid feature should provide a better return than the auto-invest accounts, plus no exit fee if you keep the loans until maturity.

-

Manual Bid – you can get higher interest rates if you have time to watch the loans as they are live and place live bids.

-

Website – very easy to use and understand.

-

Diversification – if you use the Self-Select account, you can be sure that you adhere to the “Prime Directive” and diversify to your own comfort levels.

-

Low minimum investment – £1000 to start. If your portfolio is still small, it’s still easy to invest with LendingCrowd.

-

Financial Conduct Authority – (FCA) Regulated.

-

IFISA available – for UK investors there is the LendingCrowd ISA for potential tax free investing.

Thumbs Down for LendingCrowd

-

No Provision Fund –target interest rates are based on an expected default rate. If rates exceed what is expected, returns could be less, or you could lose some or all of your capital.

-

Smaller Company – with a shorter track record, they haven’t had to deal with a financial crisis yet, so we won’t know how they fair until the next one.

-

Exit Fee – LendingCrowd charge a 1% exit fee plus any difference in interest rates for both iterations of their Auto-Invest accounts, and 0.5% for early exit from the Self Select Account. Similar to other lenders so nothing out of the ordinary.

-

No Quick Access Account – depending on demand, you could have to wait a while to withdraw funds early.

Visit The LendingCrowd Website

Risk Factor – 5/10 – Medium

Is LendingCrowd safe? I consider LendingCrowd to be in the middle of the risk scale. Even taking in to consideration that some loans are secured, there is no Provision Fund. And they are still a young but growing company.

I enjoy investing through LendingCrowd. I hope they continue on the road they are currently on.

Who Can Invest with LendingCrowd

U.K. residents with a U.K. bank account and a U.K. address and phone number can invest with LendingCrowd. Contact LendingCrowd for further information.

Offers & Signup Links**

No current offers.

Click here to check for new LendingCrowd cashback offers >>

Use this link to signup for a free LendingCrowd standard account (£20 minimum investment) >>

Similar Lenders to LendingCrowd

Assetz Capital, Funding Circle, Kuflink, Ablrate