Backtesting Investment Portfolios

My investment strategy in the markets (stocks, bonds, commodities, real estate etc.) is moderate-conservative (that’s investment strategy, not political standing 🙂 ). Translated that means that I will take calculated risks in order to increase my portfolio. However I hate to lose money, and I don’t like drawdown.

Drawdown

What I mean by “drawdown” is when my portfolio goes down in value. Take for example the 2007 – 2009 financial crisis. Anyone invested just in stocks, even blue chip stocks, or stock market index tracking funds, may have taken a 50% or more drawdown.

Can you sit and watch almost half of your money disappear in a few weeks? Not me! Many people think they can, until it happens. Then they take the pain of drawdown until they can take no more. They then often end up bailing out of the markets and selling everything to preserve what’s left, invariably right at the low.

Of course later everything picks up and the markets recover, and they buy back in at the very top not wanting to miss a bull run up. And there cycle starts again.

Even experienced investors can struggle with drawdown. Personally I hate it, but it is a necessary evil when investing, so my market strategy includes an acceptable (for me) historical drawdown for the return I get.

How do we know what the historical drawdown has been? By backtesting (simulating with a computer) for many years in the past the strategies we are going to use. Past performance is not a guarantee of what is going to happen in the future. However, for me at least, seeing what a strategy would have yielded in the past, say 10 to 50 years in the past, at least gives us an idea of how it “might” perform in the future in different market conditions. And really it’s all we’ve got. Apart from some “market guru” who sells their services on “how to make a million overnight”.

Know what’s going to happen in the markets? (small rant on gurus and brokers).

If I know anything it’s this; no one knows what is going to happen in the markets all of the time, even most of the time. NO ONE! Some people think they do, but it’s more a case of “how lucky can I get flipping a coin or throwing dice in Vegas” than predicting what’s going to happen. They’ll be right some of the time, just like a stopped clock is 100% accurate twice per day. Just my opinion from over 30 years investing and trying to find the perfect “guru” to follow who is going to make me rich, and giving them lots of my money in the meantime. In hind-site I would have probably done better in Vegas! Same thing with stock brokers.

If anyone knew what was going to happen in the markets; they wouldn’t need to sell you information or advertise how great they are on the internet, or cold call you at all hours to try and sell you the best stocks. They would just practice what they preach and fly around in their private G6 jet sipping their champagne!

I believe buying and holding a well diversified portfolio is a better way to increase my wealth, along with Peer to Peer Investments of course!

Backtesting

Returning to the article of discussion, backtesting, There are many software packages and services out there to help with testing strategies. Personally these days I just use the great free service Portfolio Visualizer Portfolio Visualizer. It allows backtesting of actual portfolios (using ticker symbols) or long term backtesting using different asset classes. It really is so good that I still can’t believe it’s free!

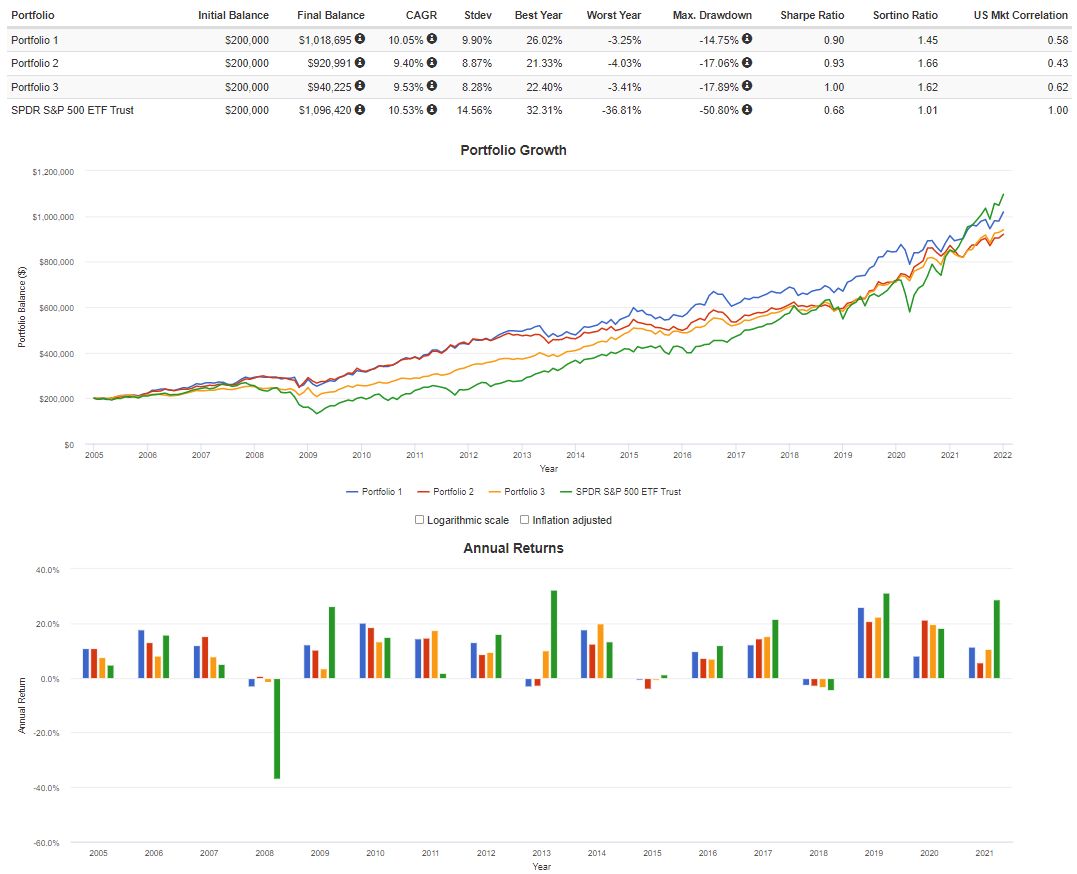

Here is a backtest of 3 portfolios using Portfolio Visualizer

Below is a comparison of how a data model of my $ – USD Growth Portfolio compares to other popular portfolios over the last few years. As you can see, the % returns and drawdowns are better than the original Harry Browne Permanent Portfolio. Portfolio 1 is my current USD Growth Portfolio Allocation (US Stocks, US Bonds, Gold, US REITs). Portfolio 2 is the original Harry Browne’s Permanent Portfolio mix: US Stocks, US Bonds, Gold . Cash has been left out, as I think that skews it to the downside unfairly. Here is also a link to my USD Permanent Portfolio which I track monthly here on my website. Portfolio 3 is made up of a 50/50 mix of US Stocks & US Bonds using ETF’s. The S&P ETF is there as a representation of the US Stock Market Baseline. NOTE: The returns shown in this simulation are INFLATION ADJUSTED meaning they are returns after inflation. The returns shown in my portfolios are BEFORE inflation. BALANCES shown are just there to show growth as an example. They are not actual portfolio values. — If you would like to read about backtesting, see my Backtesting page.

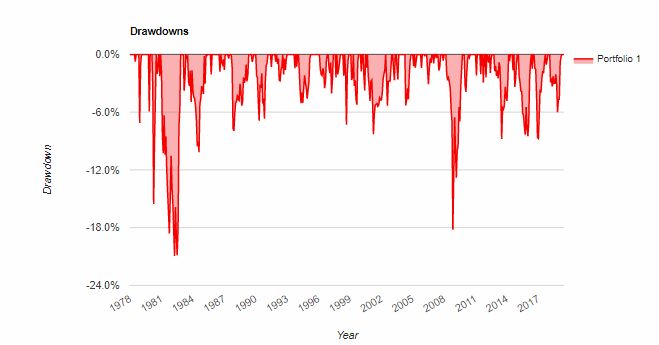

Permanent Portfolio Asset Class Backtest using Portfolio Visualizer

As historical REIT data only became available in 1995, here is a test of the original Permanent Portfolio asset classes (just the general assets as opposed to specific ETF’s).

You’ll notice the returns are still very good from 1978 (9.19%). Drawdowns are still reasonable too (20.95%).

Know anyone who wouldn’t want to turn 200k in to 7.6m in a little over 40 years? 🙂

If you’re just starting out on your FIRE (Financial Independence Retire Early) journey, I suggest you don’t wait too long for the “big move”. Get into a structured, mixed asset portfolio like the Permanent Portfolio now and hold, believe me, 40 years goes very quickly!

Services & Software you can use for backtesting include:

Portfolio Visualizer is the service I use now, and will likely be where the screenshots I use to show backtesting on my blog come from.

Curvo.eu is a ETF backtesting service targeted at EU residents.

TradeStation a very sophisticated system that I have used since my futures trading days. It requires either a brokerage account with TradeStation Securities with over $100k in it for free use. Or a monthly subscription payment if no brokerage services.

Kwanti is another very sophisticated backtesting service I’ve used before, but it’s very expensive and really is overkill for what I need.

ETFReplay is a good service, some of it free, for testing different strategies with ETF’s. Mostly based around ETF rotation which can show some good profits. I may review this site in the future.

MetaStock is another platform I used a long time ago. It was good back then but not free by any means.

FireCalc is an interesting website that takes many scenarios and tell you when you can retire and how your portfolio would have fared under lots of different circumstances. Worth a look for sure.

If you Google-it there are many backtesting platforms you can use to test your strategies.

If you have any further questions on Backtesting, please feel free to contact me