Funding Circle is now closed to retail investors. Review maintained for historical relevance.

What is Funding Circle?

Funding Circle is one of the largest Peer to Peer lenders with operations in 4 countries.

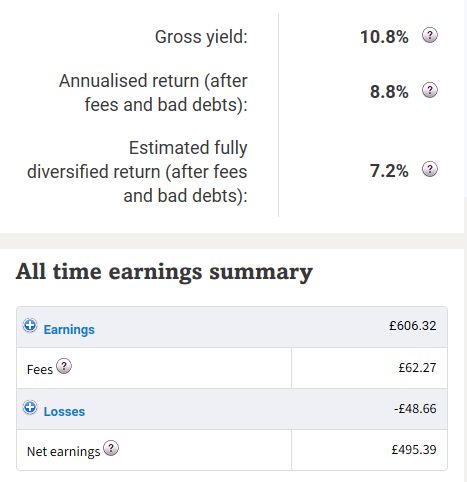

Targeting returns from 4% – 6.5% on their balanced investment options, from their Funding Circle UK office by providing Peer to Peer loans to property developers and small businesses throughout the United Kingdom. Returns are reliant upon sensible diversification (which is accomplished automatically for you), and their due-diligence and experience with its borrowers. There is no provision fund or buyback guarantee, so target returns include expected default rates which are just part of the lending process and are factored into overall return projections. This is part of why the recent default increase discussed below is affecting income numbers so much.

Funding Circle have lent over £5 billion since they started in 2010 which makes them one of the largest P2P lenders in the world, and certainly the largest in the United Kingdom.

In 2018, Funding Circle went public with a share price offer of 440p. Since the IPO, the share price has come down significantly which grabbed some media attention. They have been one of the top players in the Peer to Peer lending market for quite some time. Moving forward it remains to be seen how successful they will be.

- What is Funding Circle?

- Easy-Info Table© – Funding Circle Review

- My Overall Experience So Far

- Latest Update & Current State of Account

- Account Screenshots

- Funding Circle Return Charts

- Detailed Overview – Funding Circle Review

- Summary – Funding Circle Review

- Points to Consider When Investing with Funding Circle

- Obvious Investor Risk Rating*

- Who Can Invest with Funding Circle

- Funding Circle Cashback Offers & Signup Links**

- Similar Lenders to Funding Circle

- Other UK Peer to Peer Lender Reviews

Easy-Info Table© – Funding Circle Review

| Overall Rating*: |  (3 / 5) (3 / 5) |

| Who can invest: | |

| Loan Currencies: | £ |

| Estimated Return: | 4.3% - 6.5% depending on account (my projected 7.2%) |

| Target Annual Return (Platform Number): | 4.20% |

| My Calculated XIRR: |  |

| My Current Investment:(click to see amount in £) | See My Investment £ |

| Risk Rating*: | 5/10 -Medium  |

| Early Exit: | Yes, fee of 1.25% |

| Min. Investment: | £100 initial deposit. |

| Deposit Funds: | UK bank, or a UK debit card. Same or next working day. |

| Auto-Invest: | Yes - 2 accounts |

| Manual Invest: | No |

| Lending To: | Borrowers |

| Loan Types: | Various Business Loans. Mostly unsecured. |

| Default Rates: | Projected 4.4% - 6.4% |

| Loans Amortize: | Yes |

| Loan Security: | Some (not all) loans secured by property, land or personal guarantees. |

| Provision Fund: | No |

| Time to Invest: | Usually Quick. few days depending on loan availability |

| Time to Mange: | None (auto-invest) |

| Lender Fees: | 1% fee to lenders |

| Payments Received: | Monthly - Various times throughout the month. |

| Amount Lent: | £5 Billion (UK) |

| Number of Investors: | 81,000 |

| Loan/Dflt Stats: | Yes, Click Here |

| Regulated: | Yes: FCA |

| Location: | HQ - London, UK. Germany, and the Netherlands |

| Launched: | August 2010 |

| Website: | http://fundingcircle.co.uk/ |

| Email: | contactus@fundingcircle.com |

| Telephone: | 0800 048 8747 (UK) |

| IFISA/IRA: | Yes: IFISA |

| Cashback**: | None Currently Learn More >> |

| How to Sign Up**: | Sign Up Here! |

Visit The Funding Circle Website

My Overall Experience So Far

I invested with the platform for several years before writing this Funding Circle Review. They used to be considered one of the better options for reasonable returns from an experienced, larger company. Even before the pandemic there were a few problems with defaults. I’ve been caught with a few myself where XIRR has been falling rapidly and monthly income has been negative.

Now because of COVID & the Funding Circle problems, they are only loaning through the Coronavirus Business Interruption Loan Scheme (CBILS) which doesn’t allow retail lending so you and I can’t invest there for now. I still have a medium size investment there but I’m withdrawing as it’s paid off.

If looking for somewhere else to invest with similar returns to Funding Circle but with asset security, take a look at Kuflink, Assetz Capital or CrowdProperty as they offer similar loans but with a better track record and asset security.

My latest lending experiences can always be found in my Monthly Portfolio Updates.

Latest Update & Current State of Account

No recent changes with Funding Circle. I am just withdrawing capital every month as it’s repaid because there is no option to reinvest currently.

On March 10th, 2022 investors received an email from Funding Circle saying they will no longer accept retail clients.

Account Screenshots

Latest Screenshots from my personal account.

Funding Circle Return Charts

(Click on image for interactive chart)

Detailed Overview – Funding Circle Review

When Did Funding Circle Launch? – History

The platform has been around since 2010, so they have a good amount of experience under their belt.

As of writing this Funding Circle Review, figures suggest they have lent almost £5 billion to UK businesses, from 81,000 investors in the time they have been in business.

The platform also has German, Netherlands and USA divisions lending to businesses in their respective locations. Funding Circle’s shares & share price are on the UK stock market.

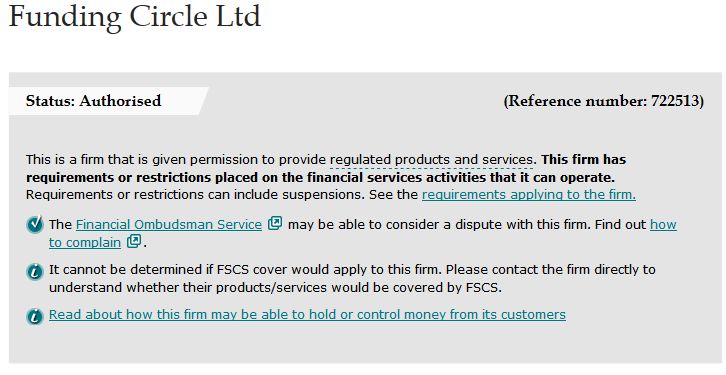

Is Funding Circle Regulated?

Funding Circle UK are regulated by the United Kingdom’s Financial Conduct Authority (FCA) with full permissions under FCA number 722513. Funding Circle are also regulated since they launched their share price offering in their IPO.

They gained FCA permissions in May, 2017. It’s important to note in this Funding Circle Review that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

How Can I Sign Up with Funding Circle? – Signup Process

Opening an account is fairly easy. Just the usual ID checks.

If they can verify you though one of the United Kingdom’s credit agencies, you will be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

Residents of most countries can sign up with Funding Circle in the United Kingdom if they can pass the ID checks and have a UK bank account. as of the date of this Funding Circle Review.

If you don’t have a UK bank account, see my Wise Borderless Account review for more information on how it may be possible to get UK banking details even if you’re not a UK resident.

Residents of countries where the company operates will need to contact their local office for requirements for your specific location. As this is beyond the scope of this Funding Circle review.

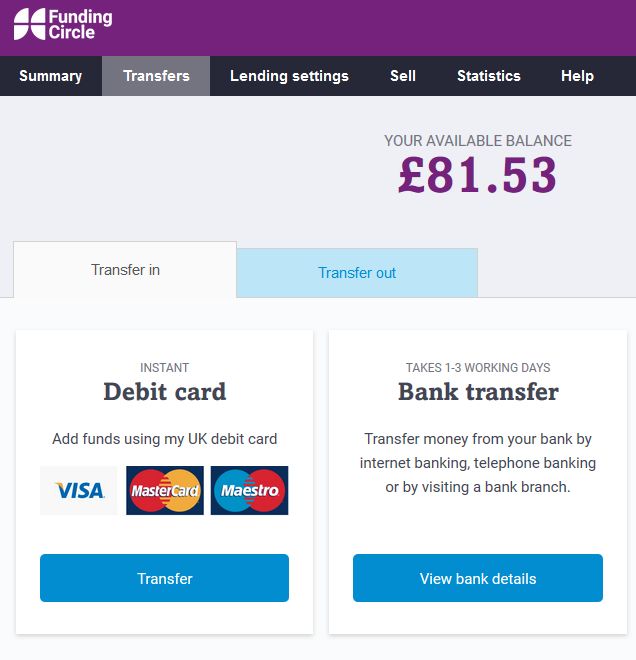

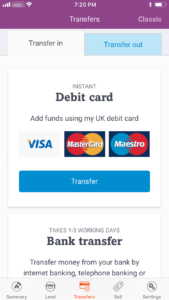

How Can I Make Deposits & Withdrawals with Funding Circle?

Deposits and Withdrawals are made by bank transfer from a UK bank, or a UK debit card.

From a bank account, deposits usually show up in your account the same or next working day.

Debit card deposits show up instantly. Withdrawals are only to a bank account and typically take 2 – 3- business days.

How Long Does it Take to Become Invested?

It can take a few days to get invested into loans when in any of the accounts.

I’ve found it varies based on the amount of capital I am investing, as well as the loan book.

All of the accounts are auto-invest accounts, so we are reliant on the platform as to how long it takes to distribute capital.

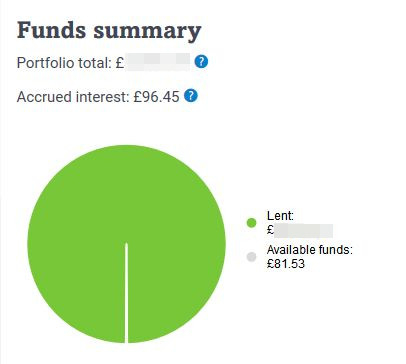

You can always see from the website dashboard how much is invested (Lent out). And how much is waiting to be invested (Available funds).

Who are we lending to with Funding Circle?

They are a true Peer to Peer Lending Platform. Lenders are lending directly to borrowers who are typically small to medium size British businesses.

Loan agreements are directly between the lender and the borrower. The platform just acts as a middle man, managing loans, payments and debt collection etc.

How Safe is Funding Circle? – Loan Security

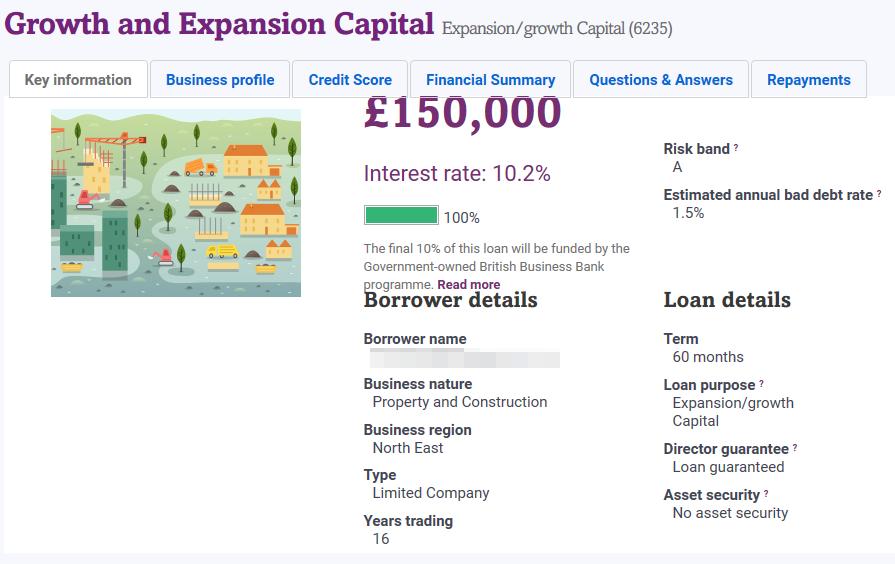

Most loans are unsecured apart from director personal guarantees. There are a few loans, mostly property development loans, which are secured by property.

On their website you can always drill down to see information on security.

As you can see below, it clearly states if loans are secured or not.

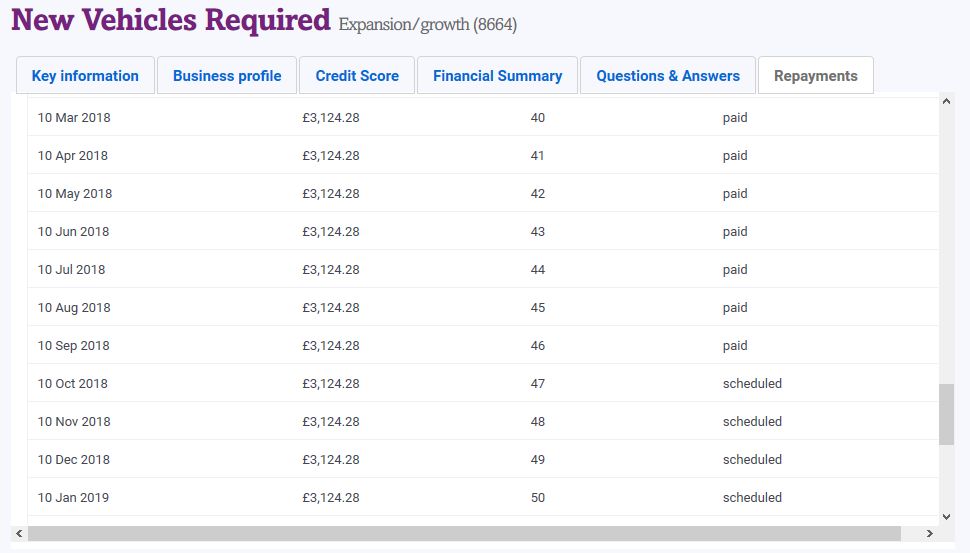

Do Funding Circle Loans Amortize? – Amortization

Most of the loans amortize, meaning you receive capital and interest payments every month.

When loans amortize, it reduces the risk compared to a non-amortizing loan, in which neither capital or interest is received until the end of the loan, or only interest is received monthly and then the capital repaid at the end of the loan period.

Amortization is paying off a debt with a standard repayment schedule in regular amounts over time. It is an book keeping technique used to reduce the cost value of an intangible asset little by little through scheduled payments.

It’s easy to see on their website when loan payments have been made. And when payments are scheduled by drilling down in any loan listing.

How Can I Sell Loans and Withdraw Capital from Funding Circle?

There is no exit fee for selling loans. Under “normal market conditions”, loans can be sold and capital withdrawn within a few days, sometimes faster, providing there are enough other lenders to cover your loans (typically not a problem). Capital in a Funding Circle ISA are obviously subject to retirement account rules. Lately though, with the Funding Circle problems, loans have been taking much longer to sell.

Here you can see the screen for selling loans and withdrawing capital:

How are Loans Diversified?

Diversifying loans is something that the platform does an excellent job of. One of the best of all lenders out there with auto-invest for diversification.

Their systems aim for diversification of 0.5% of your account balance per business you are lending to. Providing you have at least £2000 in your account, it will usually achieve that number or better.

This means when loans go bad, there should not be a big chunk of capital disappear and affect your account too much.

As you can see below, I am lending to hundreds of businesses with no more than 0.5% in any single business.

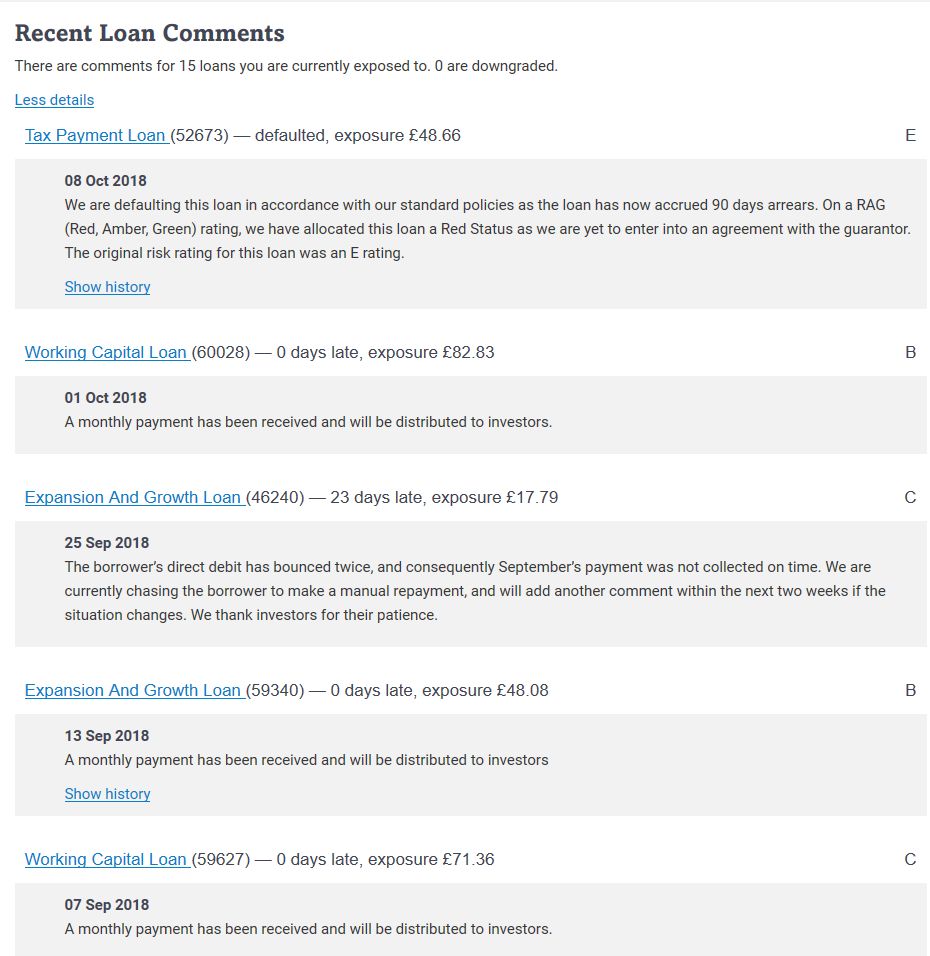

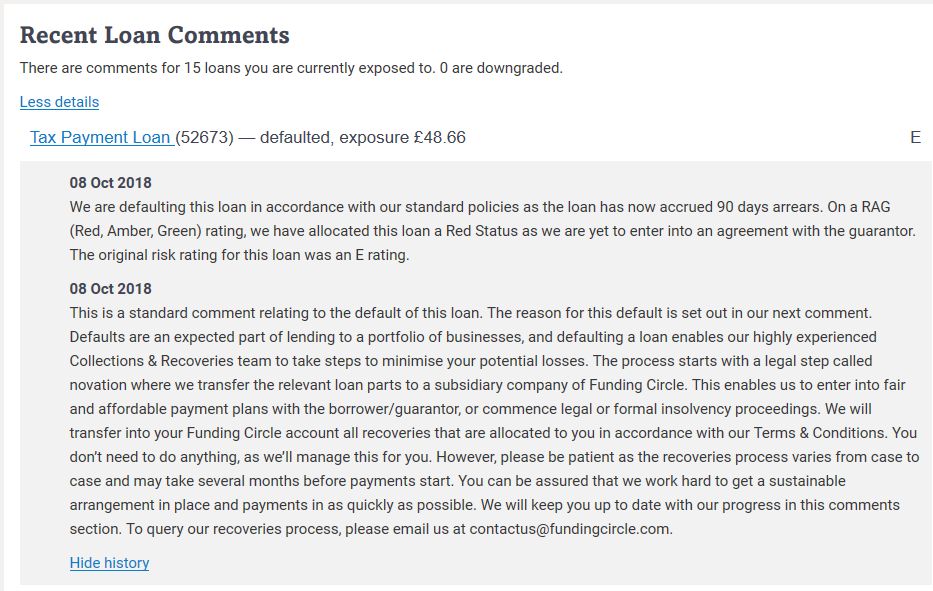

Another thing you can see on the website is a page where loan comments are made.

As a result you can typically see if loans are late, or other comments regarding the individual loans. Although I do have to say, since the Funding Circle default problems, the comments have been less it seems.

Does Funding Circle Have a Provision Fund?

There is no provision fund (one of the problems in my opinion). Their target rate takes into account expected default levels and loan losses under normal market conditions.

It’s always easy to see from the summary screen where your account stands with tracking those numbers.

You can see by the screenshot above that I have losses on this account. It’s not necessarily as bad as it seems yet though. Even though this loan is marked as a loss, there is still a chance that some of the capital could be recovered. See comments below from drilling down.

Defaults are an expected and accepted a part of lending.

The team are very experienced at loan recoveries, so there is always a chance down the road that some of this could be returned to my account.

Is There a Tax Efficient Funding Circle ISA?

The Platform offers an Innovative Finance ISA (Funding Circle ISA) which was launched in November 2017 for UK residents. Target rates are the same as their Classic Accounts.

Account Options (Classic Account or Funding Circle ISA)

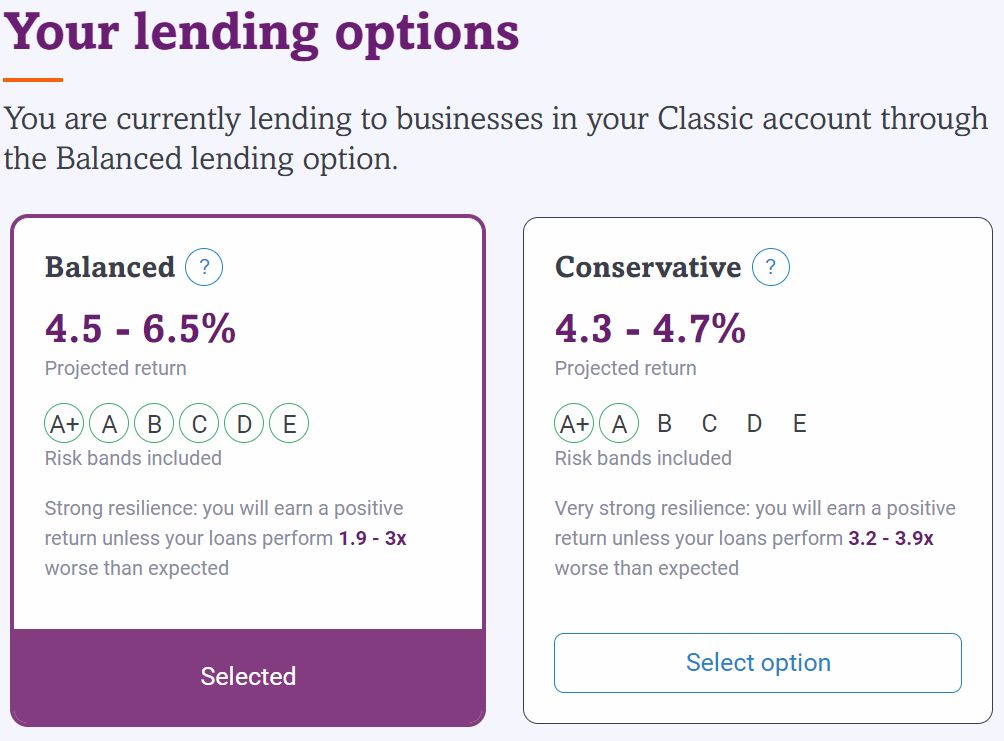

There are 2 automated lending options, one a “Conservative” approach targeting 4.3% – 4.7%% returns and what they call a “Balanced” approach targeting 4.5% – 6.5%.

Personally I only use the “Balanced” approach as it can take longer to get invested only investing in the two top (A & A+) risk bands, plus I really don’t consider 4.3% to be a great return considering most of their loans are unsecured.

They used to have a manual investing option. However it is no longer available so I have not covered it in this Funding Circle review.

Loan Information – Funding Circle Review

The website offers the ability to drill down and see what loans you are actually invested in, as well as information on the individual loan.

As you can see there is a wealth of information available about who you are lending your money to.

Mobile Apps – Funding Circle Review

Funding Circle is one of the few Peer to Peer lenders that have produced an app for phones and tablets. Available on iOS and Android.

As a result you can do with the Funding Circle App much of what you can do with the website, including adding or withdrawing funds.

The summary screen gives you similar information to the website. Portfolio total and orders etc.

It is easy to drill down to see what actual and expected returns you are looking at.

Summary – Funding Circle Review

Although they used to be one of my favorite UK Peer to Peer lenders. The recent Funding Circle problems with defaults has caused me to hold off on investing any more capital with them for now. Plus they are only lending through CBILS programme currently.

Funding Circle are still one of the larger, older, more established Peer to Peer lenders with a lot to offer if they can get their act together. Hopefully things will turn around soon and they will become a viable operation to invest in again.

The Funding Circle ISA also makes the platform a good possibility for possible tax efficient investing once they get back to normal.

Points to Consider When Investing with Funding Circle

Thumbs Up Points

- Large, Profitable Platform – Is Funding Circle Safe? – they are a big company, regulated by the UK Financial Conduct Authority. They became profitable in the second half of 2020.

- Auto-Invest – means virtually no time managing investments. Just send your money over, decide which portfolio you would like to invest in.

- Reasonable Rates – from one of the larger, peer to peer lenders, the ability to get as much as 6.5% (as of 05/2019) or more is not too bad at all.

- Website – the website is very easy to use and understand. Some P2P websites leave a lot to be desired.

- Large Investments – because the loan book is big, it can easily gobble up large amounts of capital, again reducing cash drag for larger investors.

- £100 minimum investment – easy to get started without a huge initial commitment

- Zero cost exit – the platform doesn’t charge any points for exiting your investment early (providing there are buyers available to buy your loan parts).

- Low Default and Bad Debt Rates – this is important because there is no protection fund. Current expected bad debt rates are between 1.4% and 3%

- Public Company – Means it’s easy to see Funding Circle’s share price, as well as an audited account of how the company is doing.

- Financial Conduct Authority (FCA) Regulated.

- Tax Efficient Innovative Finance ISA (IFISA)– Funding Circle ISA available for potential tax free investing for UK investors

Thumbs Down Points

- Initial Investment Time – It can take a couple of weeks to get your money invested initially. .

- Falling Return Rates – target returns have been falling lately.

- Unsecured Loans – many of their loans are unsecured loans given to businesses, so if things were to go bad, you don’t have any collateral.

- Funding Circle Share Price – dropped after IPO which makes people nervous. My personal opinion is that it won’t affect their business and will recover in time.

- Lender Fees – lenders are charged a 1% fee from the loan repayments. Most P2P lenders charge their borrowers rather than investors.

- Defaults – Funding Circle Problems – they have been seeing a lot of loan defaults recently.

Obvious Investor Risk Rating*

– 5/10 – Medium

– 5/10 – Medium

How safe is Funding Circle? I consider them to be at the medium level of the risk scale. Taking in to consideration that many loans are unsecured. In most market conditions asset security is not so important providing default rates have been factored in to target returns. However in a severe recession it could come in to play if many loans defaulted. Currently they are having issues with defaults so it may be wise to wait until they recover before investing.

Also the recent defaults don’t look good for them. I don’t consider that to be an indicator of overall safety though. This was mostly due to some bad decisions to relax lending criteria for a short spell. Hopefully when those loans have gone through the system, things will be back to normal.

Either way, I intend to leave a portion of my Peer to Peer lending portfolio with Funding Circle as I believe they have plenty of experience and they will get through this rough patch.

Who Can Invest with Funding Circle

Only residents of the United Kingdom with a U.K. address and bank account can invest with Funding Circle UK.

USA and European residents can invest in their individual locations. However rules differ per location. Contact Funding Circle for further information.

Funding Circle Cashback Offers & Signup Links**

No Funding Circle cashback offers currently as they are not accepting retail investors

Click here to check for new Funding Circle cashback offers >>

Signup for a Standard Account >>

Similar Lenders to Funding Circle

Assetz Capital, Kuflink, Ablrate, CrowdProperty

Other UK Peer to Peer Lender Reviews

No post found!

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.