My main Growth Portfolio is, in part, based on the original Permanent Portfolio (which I also use for some currencies) by Harry Browne. However it’s modified a little to account for the low interest rate returns offered by banks (cash has been removed and placed in my Peer to Peer Lender Portfolio), and REITs have also been added, as they help with stability and provide good dividend returns.

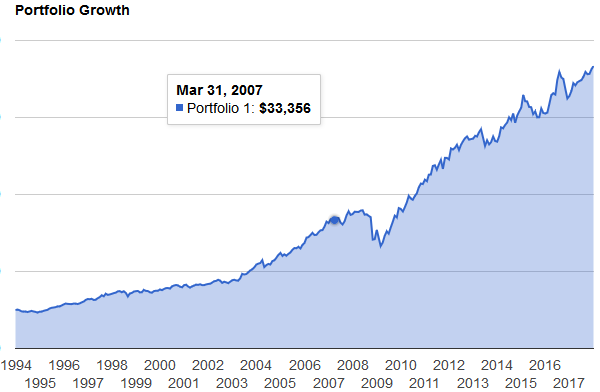

The original Permanent Portfolio can be backtested for 50 or more years. The results are stable and impressive. We could still choose to invest in the original Permanent Portfolio today and be very happy with the returns and stability. It is time tested and well respected. However some of the assets in my Personal Growth Portfolio were not available when it was invested, and adding them improves upon it’s returns so it is also worth consideration.

The ETF’s I use for the Growth Portfolio are US Dollar denominated as I like to diversify in currencies and their performance is superior to funds in other currencies. They can however all be purchased in GB Pounds or Euro denominated funds if preferred, as well as many other currencies. I also have standard Permanent Portfolio based accounts in GBP, Euros & USD which I track.

My main Growth Portfolio is simply made up of the following 4 assets (click on each asset to learn more about them and why I use them):

25% Stocks (total US Stock Market) – it is possible to purchase this market with funds available in GBP, USD, Euro and many other currencies.

25% Bonds (US Treasury Bonds) – I use ETF’s that track bonds instead of bonds themselves. Again funds are available in GBP, USD, Euro and various other currencies.

25% Gold – mostly physical gold, but sometimes gold ETF’s too as they are easier to buy and sell. I use BullionVault for most of my physical gold.

25% REITs – Real Estate Investment Trusts. Can be purchased in GBP, USD, Euro and several other currencies. There are many to choose from based in the UK and USA.

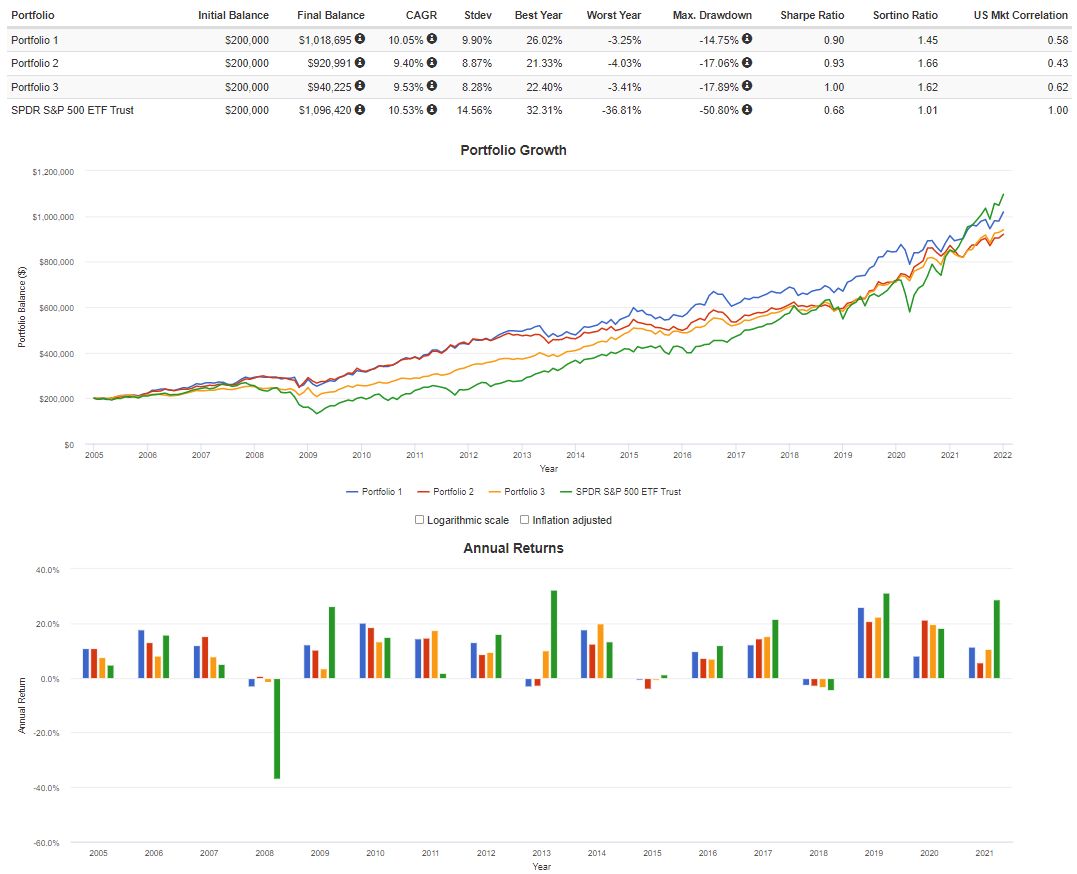

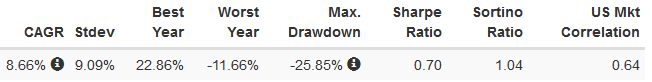

Just selecting these 4 asset classes in general would have produced results similar to the following (returns are inflation adjusted):

Personal Growth Portfolio ETF’s

The actual ETF’s (Electronically Traded Funds) & funds I use are below. A similar portfolio can easily be constructed in virtually any currency, including GBP and Euro.

STOCKS – 25%

VTI – US Broad Market Index ETF

VTI tracks the total US stock market which means I am investing in many companies instead of just a few individual stocks. The VTI ETF started trading in July 2001. More info on VTI.

To track this market in GBP currency denomination you could use the Vangaurd US Equity Index Fund which should give similar results to VTI.*+

BONDS – 25%

TLT – iShares 20+ Year Treasury Bond ETF

TLT tracks US Government long term treasury bonds. The ETF was founded in July 2002. TLT typically pays dividends monthly. Using TLT instead of regular bonds means we don’t need to build bond ladders and deal with trading them. I prefer the ETF as it is traded just like a stock. More info on TLT.

GOLD – 25%

GLD – StreetTRACKS Gold Shares ETF

GLD tracks the price of gold. I am using this ETF for ease of tracking and re-balancing in the portfolio we are tracking here. I use mostly physical gold stored with companies who specialize in gold storage such as BullionVault for my main portfolio. GLD began trading in 2004. More info on GLD.

To track Gold in GBP currency denomination you could use ETFS Physical Gold (GBP) PHGP*+ or better still go to BullionVault and buy physical gold in many different currencies.

REIT’s (Real Estate Investment Trusts) – 25%

UHT – Universal Health Realty Income Trust Common Stock Fund

UHT is a real estate investment trust specializing in healthcare and human service related facilities. The fund commenced operations on December 24, 1986 so we have a lot of data to backtest with.

FRT – Federal Realty Investment Trust Common Stock Fund

FRT – Federal Realty Investment Trust is an equity real estate investment trust, which engages in the ownership, management, acquisition and redevelopment of high quality retail focus properties. The company was in 1962

NNN – National Retail Properties Common Stock Fund

NNN – National Retail Properties, Inc. is a real estate investment trust traded on the New York Stock Exchange under the ticker symbol “NNN.” They own a diversified portfolio of freestanding retail stores across the United States. The fund was founded in October 1984.

There are many GPB denominated REITs. You would need to do some research as I’m not very familiar with these*+

*+ You would need to do your own research on these asset vehicles as I have not tested them, and I do not own them. Please read my Disclaimer before making any investment decisions.

Portfolio Comparison

Below is a comparison of how a data model of my $ – USD Growth Portfolio compares to other popular portfolios over the last few years. As you can see, the % returns and drawdowns are better than the original Harry Browne Permanent Portfolio. Portfolio 1 is my current USD Growth Portfolio Allocation (US Stocks, US Bonds, Gold, US REITs). Portfolio 2 is the original Harry Browne’s Permanent Portfolio mix: US Stocks, US Bonds, Gold . Cash has been left out, as I think that skews it to the downside unfairly. Here is also a link to my USD Permanent Portfolio which I track monthly here on my website. Portfolio 3 is made up of a 50/50 mix of US Stocks & US Bonds using ETF’s. The S&P ETF is there as a representation of the US Stock Market Baseline. NOTE: The returns shown in this simulation are INFLATION ADJUSTED meaning they are returns after inflation. The returns shown in my portfolios are BEFORE inflation. BALANCES shown are just there to show growth as an example. They are not actual portfolio values. — If you would like to read about backtesting, see my Backtesting page.