Loanpad – Pros & Cons

PROs 👍

- Safety – Loanpad are one of the safer Peer to Peer lenders because of the loan security they offer.

- Lowest LTV’s – All Loan-to-Values below 50% (many below 15%)

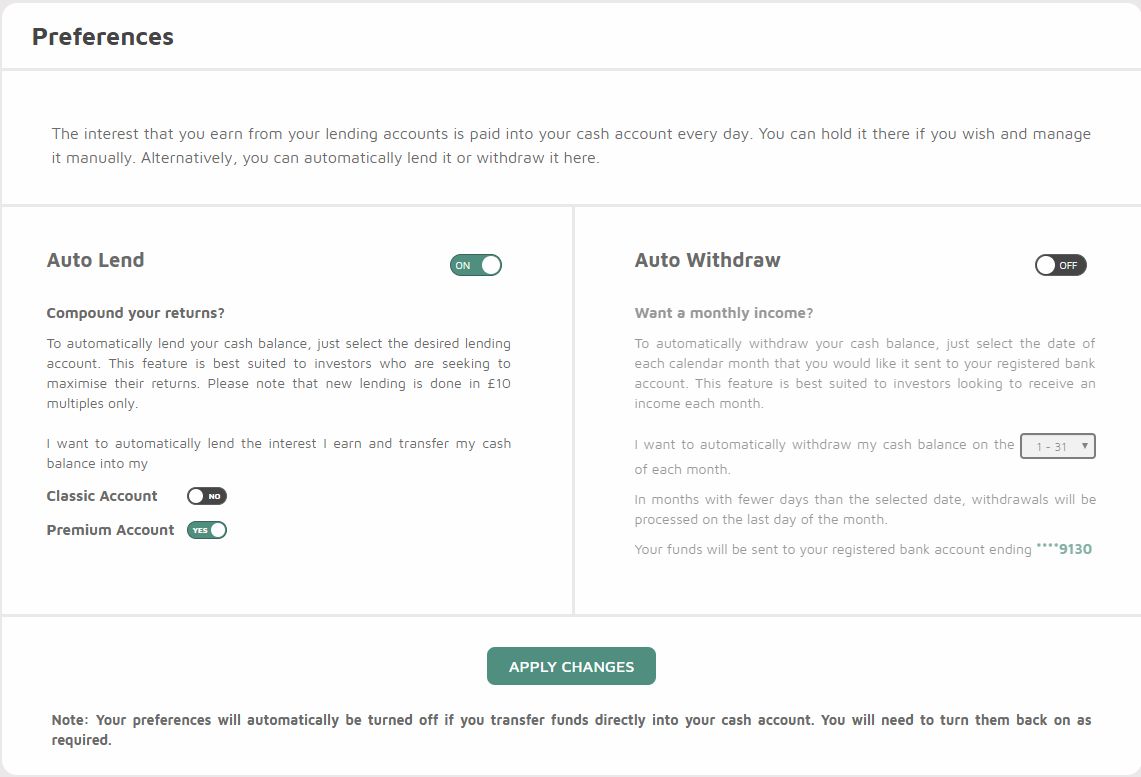

- Auto-Invest – very easy to invest, and hands off investing once set up.

- Instant, no cost exit – in Classic Account, easy to get out. Virtually unaffected by pandemic.

CONs 👎

- New(er) Lender – Loanpad launched in 2018.

- Lower Returns – lower risk investments generally mean lower returns.

What is Loanpad?

Loanpad is a UK based Peer to Peer lender providing loans to the short-to-medium term Peer to Peer investment market. Focusing exclusively on on safer, low LTV, asset secured loans. This platform is currently my largest Peer to Peer investment account as I believe they are one of, if not the safest platform in the UK.

They offer property development loans which are sourced through a variety of experienced third party lenders (originators) who have been around for many years and take a minimum 25% of each loan on a first loss basis.

Loanpad holds the senior position on all of its loans, so if a loan goes bad, they get first rights on capital recovery.

Easy-Info Table© Loanpad Review

| Overall Rating*: |  (4.6 / 5) (4.6 / 5) |

| Who can invest: | |

| Loan Currencies: | £ |

| Estimated Return: | 3..00% to 4.20% depending on account and if interest is reinvested. |

| Target Annual Return (Platform Number): | 4.20% |

| My Calculated XIRR: |  |

| My Current Investment:(click to see amount in £) | See My Investment £ |

| Risk Rating*: | 2/10 - Low  |

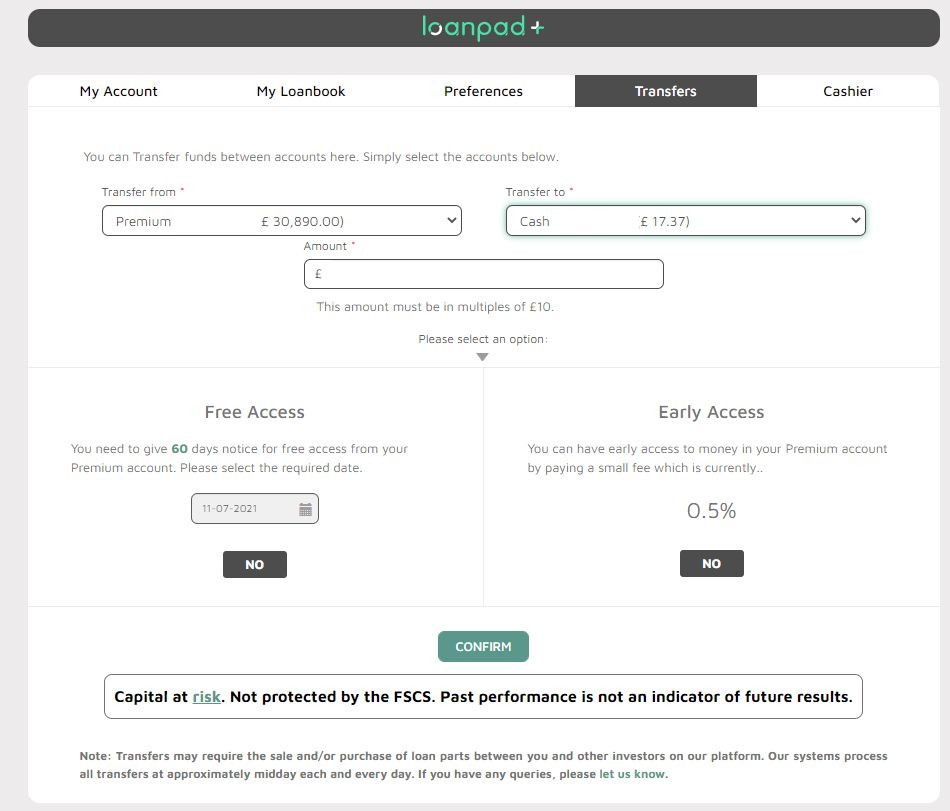

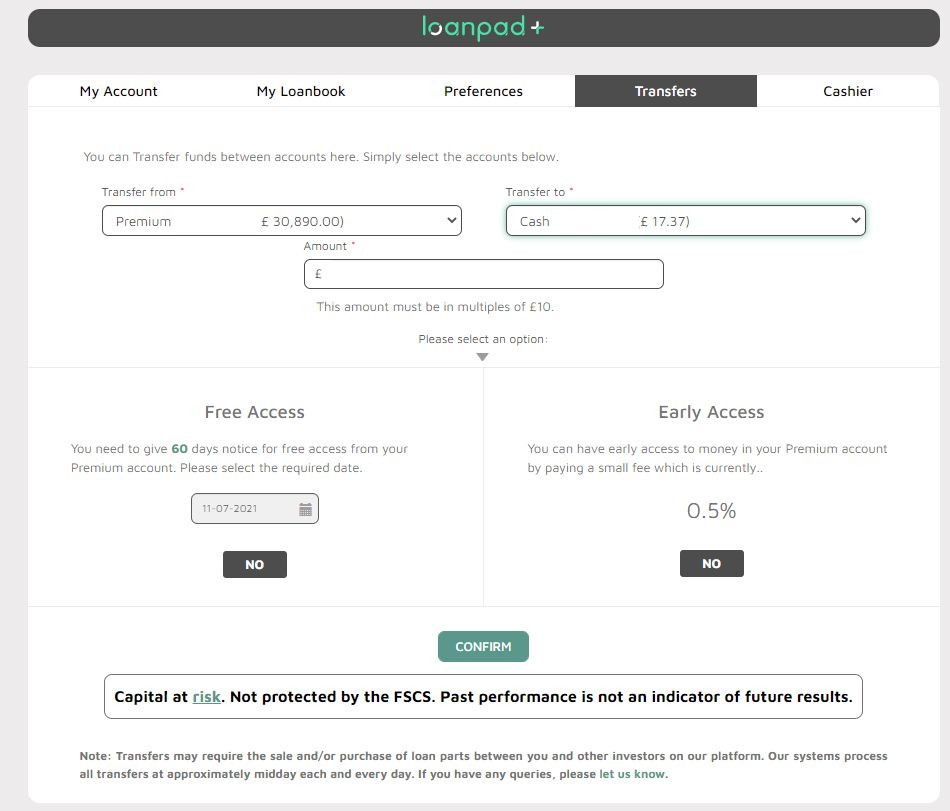

| Early Exit: | Yes. Under normal market conditions. No fee on Classic account. Free with 60 days notice on Premium account or 0.5% before 60 days. |

| Min. Investment: | £10 |

| Deposit Funds: | By bank transfer. Usually takes 24 - 48 hours for BACS bank transfer. Can be same day for Faster payments. |

| Auto-Invest: | Yes |

| Manual Invest: | No |

| Lending To: | Borrowers (via originator) |

| Loan Security: | Yes: on development property with LTV's typically below 50%. Loan originator has at minimun 25% skin in the game. |

| Default Rates: | None so far. |

| Provision Fund: | Yes, covers interest payments only. Plus minimum 25% lender skin in the game for capital protection. |

| Loans Amortize: | No, Loanpad pay interest only until capital is withdrawn. |

| Time to Invest: | Fast. Overnight depending on amount invested and loan availability |

| Time to Mange: | Almost None (Auto-Invest + Auto Reinvestment of Interest). |

| Lender Fees: | No |

| Payments Received: | Interest payments are received daily. |

| Amount Lent: | £65m + |

| Number of Investors: | N/A |

| Loan/Dflt Stats: | N/A |

| Regulated: | Yes: FCA |

| Location: | HQ - London, UK. |

| Launched: | Est 2018 - Platform Launched Jan 2019 |

| Website: | https://www.loanpad.com/ |

| Email: | support@loanpad.com |

| Telephone: | (0)203 829 4541 (UK) |

| IFISA/IRA: | Yes: IFISA Learn More >> |

| Cashback**: | Sometimes Learn More >> |

| How to Sign Up**: | Signup Here! |

My Overall Experience with Loanpad so far…

In the time I have been investing with Loanpad, I have increased my investment capital many times over from my initial amount. This is because I feel very comfortable with the platform as one of my largest P2P lending accounts.

Once capital is invested, it’s just a case of sitting back and watching the daily interest roll in. If you need to get your money back, it’s available instantly or in a maximum of 60 days depending on the account you choose. Even through the pandemic when other lenders were experiencing liquidity issues, Loanpad never faltered.

They tick all of the boxes: asset security, reasonable returns, liquidity and auto-invest for lazy investors like me. As an addition, I have to say that dealing with Loanpad’s staff is a pleasure. They are always helpful and courteous to a fault.

Loanpad definitely benefited from the COVID19 situation, growing more than 120% in 2020 as investors realized the safest place to put their capital while the pandemic was hitting almost every other lender hard, were the low LTV loans. They had zero liquidity problems throughout the whole of the pandemic, with investors being able to withdraw capital as needed in any amount immediately. Zero losses for investors since Loanpad started is obviously another attraction of the platform.

My latest lending experiences can always be found in my Monthly Portfolio Updates.

My Loanpad Investment Strategy

Once the account is opened & set up. The only strategy is to sit back and watch interest come in. That’s really all it takes.

LATEST LOANPAD RETURN RATES – ISA/CLASSIC 3.60% ISA/PREMIUM 4.80%

Even though I’ve been reducing my exposure to P2P a bit, I’m keeping my Loanpad capital where it is as they are raising rates and they have one of my ISA’s so income is tax free. Loanpad have always been reliable without any liquidly problems through think & think so I have no worries about keeping my capital there.

Account Screenshots

Latest Screenshots from my personal account.

What Annual Returns Can I Get From Loanpad?

They currently offer 3.60% on the Classic Account and 4.80% on the Premium Account. These returns do not take into consideration compounding as many platforms do, so actual returns will be a little higher if you turn on auto-invest (reinvest). You can see my returns for the last few years in the charts below.

Loanpad Investment Return Charts

(Click on Image for Interactive)

Detailed Overview – Loanpad Review

When Did Loanpad Launch? – History

Loanpad were established in 2018. The Loanpad platform was launched for investment in January 2019 in London in the UK.

Although they are still young, Loanpad have the benefit of sourcing their loans through a very experienced third party lender (originator), who has been around for a long time (40+ years).

All businesses have to start somewhere. I have been watching the platform since they started marketing for pre-launch in August 2018.

I like the way everything was professionally set up and communication was clear and on point.

As of the time of writing this Loanpad review, the platform has tens of millions of pounds in low LTV property development loans, and they have had a great response from early Peer to Peer lenders (investors). Very low default rates and zero losses from investors make Loanpad a very attractive proposition.

How Safe is Loanpad?

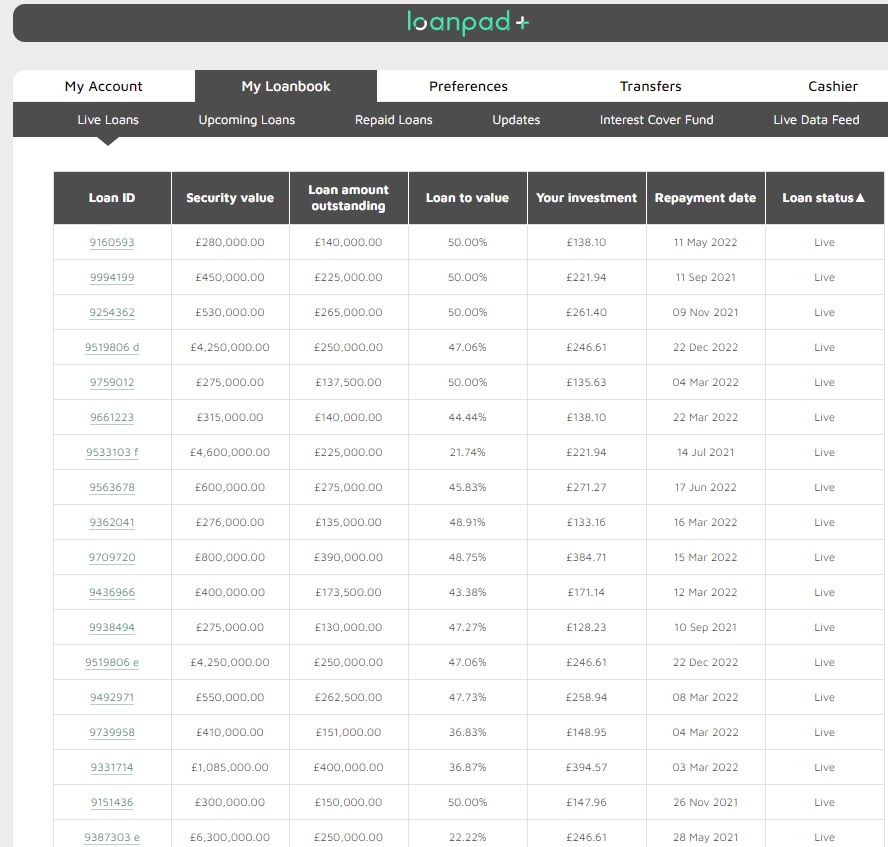

One of the other things which attracted me to them, and keeps me adding capital every month are the low loan-to-value (LTV) ratios they have on most of their loans, typically less than 50%. And often as low as 5%.

This literally means; if a loan were to default, before any investor would lose capital, the asset would need to lose between 50% and 95% of it’s value (after the 25% to 75% of the loan originators first loss percentage). Basically a scenario that has never happened to date, and is very unlikely to happen. So, similar to some of Kuflinks’ loans, it would take a real disaster to lose all of my capital (in theory).

Their CEO Louis Schwartz also worked as the lawyer of a property lender for several years, giving him experience & detailed insight in to how a property secured lender operates.

Loanpad pays daily interest, which is good if you’re looking for an income stream. Of course if you want to reinvest it, that is always an option too. Compounding effects then mean a higher annual percentage yield.

I decided to invest with The platform as they are also similar to Kuflink & CrowdProperty as far as loan security on short term property development loans. All three companies offer exceptional risk/reward opportunities for investment.

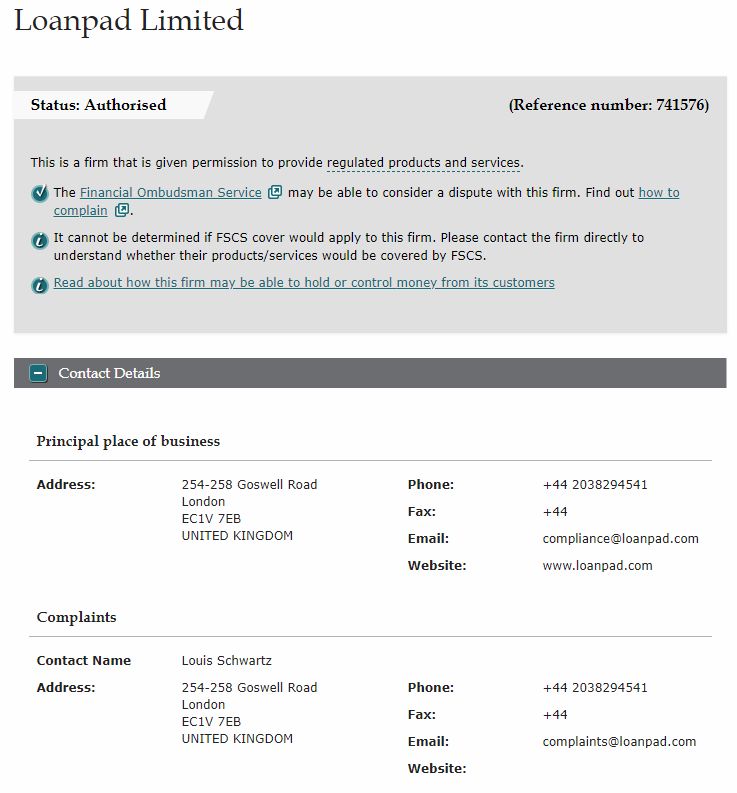

Is Loanpad Regulated?

They are a Peer to Peer lender regulated by the UK’s Financial Conduct Authority (FCA) with full permissions under FCA number 741576.

Loanpad gained FCA permissions in February, 2018, almost a year before their platform was officially launched and open for investment.

It’s important to note in this Loanpad review that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

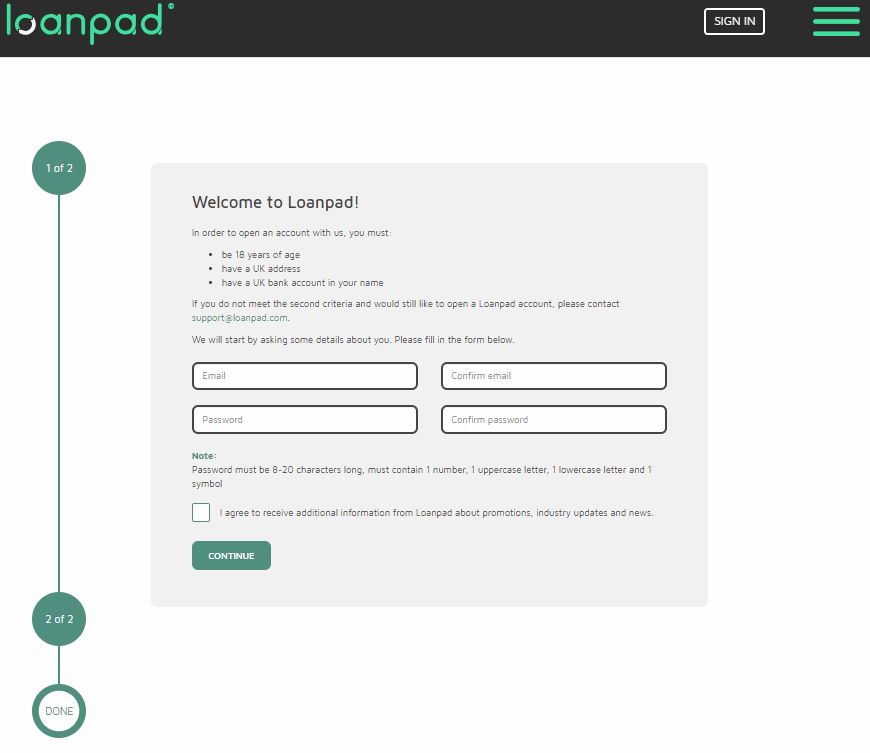

How Can I Signup with Loanpad? – Signup Process

Opening an account is super-easy. Just the usual ID & anti money-laundering checks.

If they can verify you though one of the UK’s credit agencies, you will be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

Only residents of the UK, with a UK bank account can signup with Loanpad (as of the time of this Loanpad review update).

How Can I Make Deposits & Withdrawals with Loanpad

Deposits and Withdrawals are made by bank transfer from a UK bank.

Your deposits will usually show up in your account the same or next working day.

Withdrawals are only to a verified bank account and typically take 1 – 3- business days.

How Long Does it Take to Invest with Loanpad?

Funds are usually dispersed at midday each day (U.K. time) into their auto-invest accounts.

I initially invested £1,000 as a tester. It was all easily dispersed in the first day. After adding more than £50,000 now, I can confirm that it has never taken more than 24 hours to get all capital invested. So almost zero cash drag helps keep returns up there.

I understand from speaking with the team they are still able to distribute funds quickly. Even though investor interest has been huge, so have new loan originations’, so there is plenty of room for both sides, borrowers & investors.

Who are we lending to with Loanpad?

Loanpad is a true Peer to Peer Platform. Lenders are lending directly to borrowers (through established originators).

Borrowers are typically experienced property developers.

The platform acts as the middle man, managing loans, collecting payments and dealing with debt collection etc.

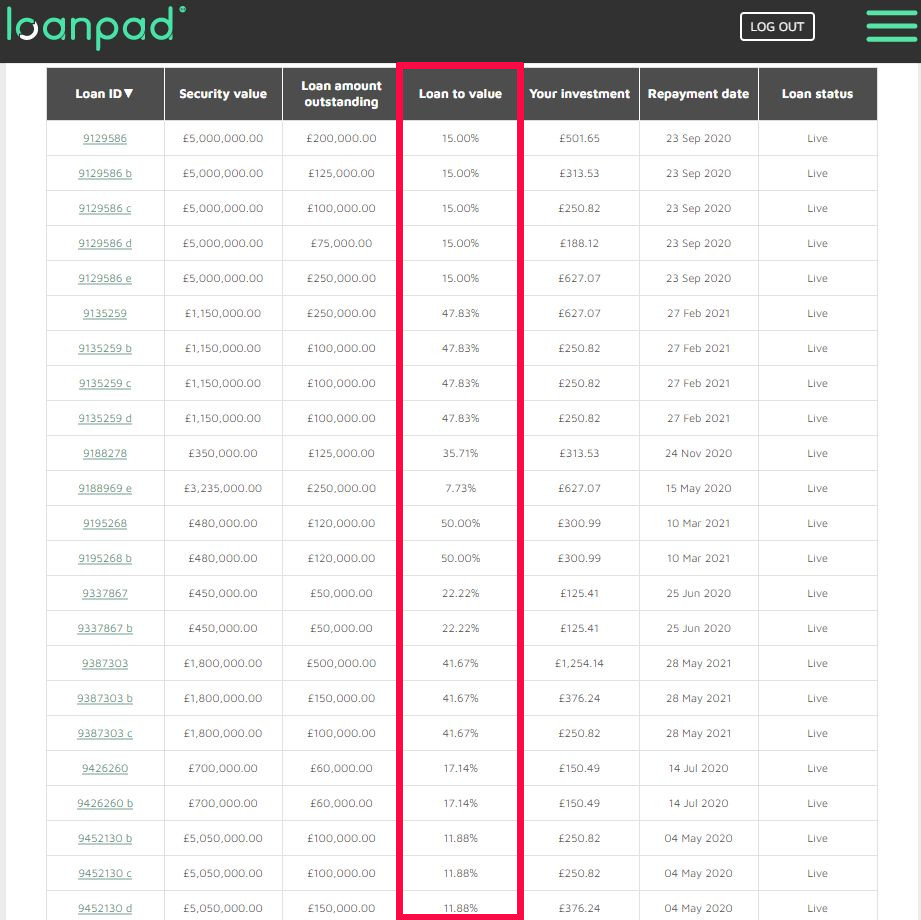

What Security Does Loanpad Offer?

As you can see from the image below, the LTV’s (Loan to Values) are very low. This means (in the loans outlined below) the secured property would need to lose more than half of it’s value before an investor would lose money. Much more than half of their value with many of them.

Loanpad also holds the senior position (also called “first charge”) on any property which defaults. So the platform lenders gets paid first, before other lenders who have 2nd (and higher) charges on the property.

On top of that, the 3rd party originators lends out a minimum 25% of each loan known as “skin in the game“, (the current rate is actually around 60%), so they take first loss on any loans that go bad IF capital cannot be recovered by sale of the property (unlikely at these LTV’s).

This means literally, the properties would need to lose a huge amount of their value (many over 75%) before an investor would lose their investment capital.

So is Loanpad safe? – Any one of the above items makes for a safer loan platform. These items together though make them one of the safer secured Peer to Peer Lenders in my eyes.

Has Loanpad had any Defaults?

As you would expect with such low LTV’s & investment set up, no investor has lost capital to date (at the time of writing this Loanpad review). I would expect very few defaults moving forward, if any, because of the low Loan to Values.

With these types of LTV’s, borrowers are far less likely to walk away from an investment (even if it is in trouble) knowing it puts the platform in control of how the property is sold.

Do Loanpad Loans Amortize?

Most loans don’t amortize as they are typically short term property development loans which historically pay interest only.

Capital is then repaid at the end of the loan period when the development is sold.

Loanpad pays daily interest on it’s loans, which is good if you’re looking for income to live on. Of course if you want to reinvest it, that is always an option too.

Just to point out here, the return rates advertised are actual rates, and do not take in to consideration compounding effects when interest is reinvested like most lenders advertise. So the actual return rate is higher than advertised because of the effect of compounding.

I publish the XIRR (actual return rate on my money) on my website along with the other lenders which you can see here anytime.

How Can I Sell Loans and Withdraw Capital from Loanpad?

You can get instant access to your money in the Classic Account with a 3.60% return, which rivals Assetz Capital’s QAA account, currently at 3.75%.

Then the Premium Account offers 4.80% returns with a 60 day notice to withdraw your money at no cost. You can get it faster in an emergency under normal market conditions for a fee of just 0.5%.

To withdraw capital, first you’ll need to use the “Transfer” tab to sell some of the loans (or give the required 60 days notice on the Premium 4.80% account) and move capital to your cash account.

Then go to the “Cashier” tab to enter the withdrawal instruction. Money is typically back in the bank the next day.

How are Loanpad Loans Diversified?

Diversifying loans is something they do automatically. Because of the way the platform works, diversification is all done in the background (at midday each day U.K. time).

You can still list the loans you are invested in, but it doesn’t really make any difference as you don’t have a choice in which loans the auto-invest system gets you into as risk is spread over all loans in the system.

They say this on their website about their diversification process which they call “Daily Spreading”: “Every day your capital is diversified across our entire loan book. Not only does this minimize the impact from any single borrower defaulting, but it also suggests there’s virtually no difference between slowly feeding money into your account or depositing in a large sum. You get the same rates at the same risk level both ways.”

Does Loanpad have a Provision Fund?

The platform has a provision fund which they call their “Interest cover fund (ICF)” however this only protects daily interest.

They safeguard your daily income using this unique ring-fenced fund which covers your daily interest payments if any borrowers fall behind on their payments.

With short-term property loans, delays can happen – this fund exists to make sure you get paid daily, in full.

There is no provision fund as such for capital, however loans are shared with lending partners who are carefully vetted, well established lenders.

Loanpad manages each lender and they are responsible for the higher risk part of the loan (called the ‘junior tranche’).

As the lending partners will always take at least 25% of the loan (“skin in the game”), there’s lower risk to you if a borrower defaults as the partner will take first 25% of any loss (after the property has been sold, if all capital is not recouped in the sale, which in my opinion with the low LTV’s is unlikely).

So if this does happen, your money will be repaid (plus interest) before the lending partner’s share is paid to them. This also means it’s in the lending partners’ interest to check potential borrowers extensively when they apply for credit.Visit The Loanpad Website

Is there a Tax Efficient Loanpad ISA Account?

The platform offers an Innovative Finance ISA (Loanpad ISA) which was launched in January 2019 with the Classic ISA Account offering the same 3.60% and the ISA Premium offering 4.80%.

The Loanpad ISA is for UK residents only.

What Type of Investment Accounts Does Loanpad Offer?

There are two standard investment accounts (Classic & Premium), and the Loanpad ISA account outlined above:

The “Classic Account” currently offers returns of 3.60% with instant access (under normal market conditions). This has no early exit fee so you can withdraw your money at will.

I like the “Premium Account” which pays 4.80%, however it still enables you to pull your funds out for free with just 60 days notice. Or in an emergency (under normal market conditions) they’ll let you take them immediately for a fee of just 0.5%.

Really very good rates for (almost) instant access on secured loans with such low LTV’s.

How Easy is Loanpad’s Website to Use?

Investing on Loanpad’s website is easy. You just choose your portfolio, transfer money into it from your cash account (it’s also possible to transfer money from one lending account to another) and then it gets distributed into loans.

Really couldn’t be simpler. The learning curve here is about 30 seconds.

Is Loanpad Profitable?

Loanpad became profitable in June 2021 after more than tripling their loan book in the prior 12 months. This is an amazing feat for a new platform, to be profitable in 2.5 years from startup, especially considering COVID. Most P2P platforms take at least 5 years to show a profit, and some are still not showing a profit after 10 years.

Summary – Loanpad Review

Having invested with Loanpad since they launched, I feel the platform has one of the safer Peer to Peer offerings in the UK.

This is because of the first charge (senior position) which they have on all of their short term development loans, some of the lowest LTV’s on the assets in the industry, and the loan originators minimum of 25% “skin in the game”.

The platform is still relatively young, however they have quickly become considered one of the safest places in the Peer to Peer lending sector to store large amounts of capital and receive a fair return for the associated risk.

The Loanpad website is easy to use, so even if you’re not a seasoned Peer to Peer investor, you can get started quickly & start making some return on your capital. Capital can be invested in a matter of seconds once the funds arrive from your bank account.

Points to Consider Before Investing

Thumbs Up Points

- Safety – Loanpad are one of the safer Peer to Peer lenders because of the loan security they offer – low LTV’s and senior positions on all loans. They are also a profitable company showing their first profits within 2.5 years of startup.

- Interest Provision Fund – another layer of protection covers lender interest if a loan is late paying (can happen a lot with short term development loans)

- Auto-Invest –very easy to invest, and hands off investing once set up

- Website – very easy to use and understand

- Diversification– funds automatically diversified between loans

- Instant, no cost exit – in Classic Account, easy to get out. Virtually unaffected by pandemic. Only 60 day notice and free exit on Premium Account or 0.5% for immediate exit in emergency.

- Financial Conduct Authority – (FCA) Regulated.

- Innovative Finance ISA (IFISA) available – Loanpad ISA for potential tax free investing for UK investors

Thumbs Down Points

- New(er) Lender – Loanpad launched in 2018, although their CEO is an experienced property lawyer with many years behind him.

- Lower Returns – lower risk investments generally mean lower returns. The 4.80% Loanpad is offering with only 60 days notice to exit free of charge is really very good though.

Obvious Investor Risk Rating*

– 2/10 – Low

– 2/10 – Low

Is Loanpad safe? In this Loanpad Review, I consider them to be in the lower end of the risk scale.

They are a profitable company with very well vetted, well secured, short to medium term loans. Loanpad was largely unaffected by the pandemic and continue to show they are one of the safest platforms out there.

Who Can Invest with Loanpad?

U.K. resident investors with a U.K. bank account and a U.K. address and phone number who can pass the ID checks can invest with Loanpad. Contact Loanpad for further information.

Loanpad Cashback Offers & Signup Links**

Click here to chech for Loanpad cashback offers >>

Open Classic or Premium Account >>

Signup for Loanpad ISA Account >>

Similar Lenders to Loanpad

Other UK Peer to Peer Lender Reviews

Proplend Review

London House Exchange Review

Assetz Exchange Review

Find UK Property Review

easyMoney Review

Unbolted Review

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.