25% of my growth portfolio is invested in gold. I use mostly physical gold stored in locations outside of both the U.S.A. and the U.K. by companies that specialize in storing gold such as BullionVault. A little bit is kept in GLD (SPDR Gold Shares ETF) which is an electronic fund that works like a stock and tracks gold. This makes it easy to buy and sell gold when needed to rebalance my portfolio without too much trouble.

Pet Rock?

Investors have a love/hate relationship with gold as do I. Some even go as far as to call it a “pet rock” that people get attached to. However gold is more than a pet rock. It’s a store of value, and has been for 10,000 years.

LET’S BE HONEST, IT’S A PET ROCK, RIGHT?

No dividends

One problem with gold as an investment is that is doesn’t pay dividends, and it has very little correlation to the Stock, Bond or Real Estate markets. Gold pretty much does it’s own thing and has a bad habit of bombing a growing portfolio when markets are booming. However when the markets go in to turmoil, gold usually shines.

Store of Value

Gold has been used as a store of value (real money) for over 10,000 years. It really is the only “real” money. This is why central banks (and high street banks for that matter) own tons of the stuff and store it in very well guarded vaults. They know when the “you know what” hits the fan, gold will likely save their overall portfolio as it has for the past several thousand years.

STORE OF VALUE

Markets Crash

Investors know that gold is a store of value, so when markets crash, nervous investors tend to move their money into gold (and bonds) until the crisis is over, which of course makes the price of gold rise rapidly. Take a look at it in 1987 with the US market crash, in 2000 in the dot com crisis and in the 2008 financial crisis and you’ll see what I mean.

Insurance Policy

I have come to look at gold as an “insurance policy” rather than an investment vehicle. You can absolutely do just fine with only stocks and bonds in a growth portfolio, but when the “you know what” hits the fan, gold will save you from that big drawdown, which sure does make you feel a whole lot better, trust me on this one, I went through two major financial crisis’s already invested in the Growth Portfolio and it made things seem a lot less volatile.

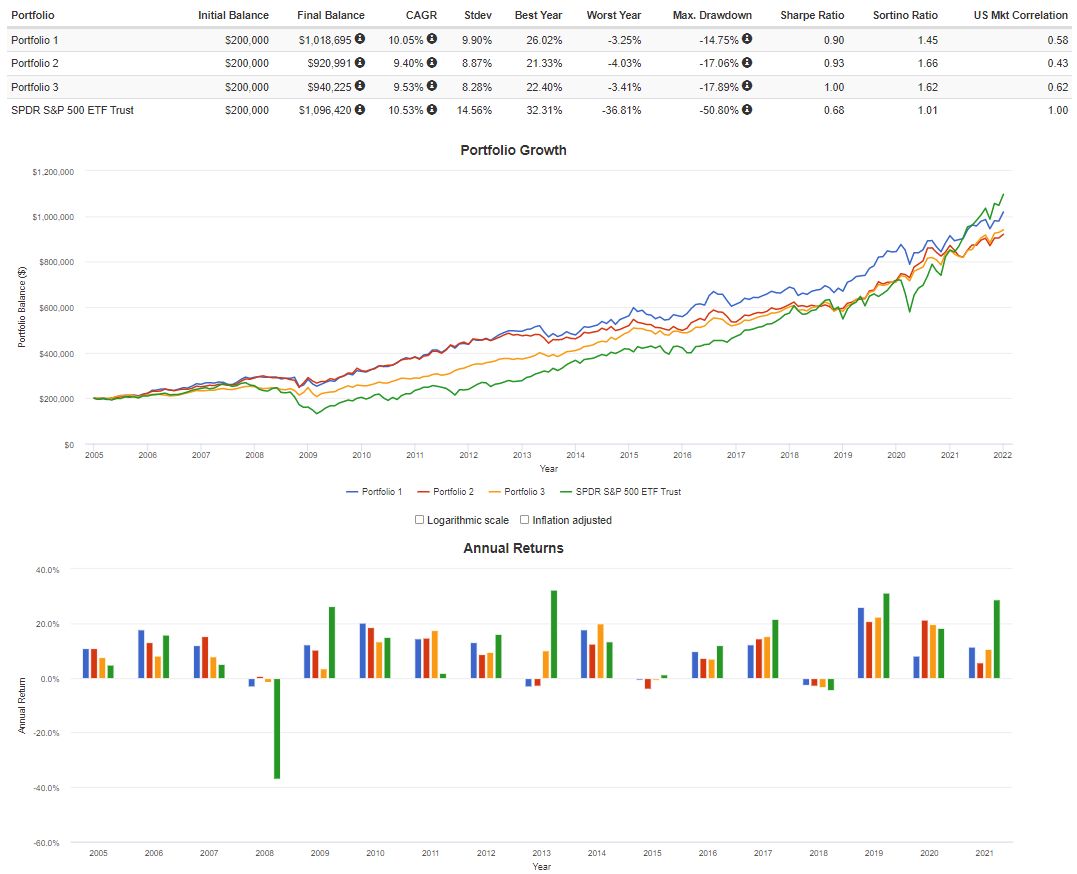

When you add gold to a portfolio is when it really shows you how it helps. Look at the chart below.

Below is a comparison of how a data model of my $ – USD Growth Portfolio compares to other popular portfolios over the last few years. As you can see, the % returns and drawdowns are better than the original Harry Browne Permanent Portfolio. Portfolio 1 is my current USD Growth Portfolio Allocation (US Stocks, US Bonds, Gold, US REITs). Portfolio 2 is the original Harry Browne’s Permanent Portfolio mix: US Stocks, US Bonds, Gold . Cash has been left out, as I think that skews it to the downside unfairly. Here is also a link to my USD Permanent Portfolio which I track monthly here on my website. Portfolio 3 is made up of a 50/50 mix of US Stocks & US Bonds using ETF’s. The S&P ETF is there as a representation of the US Stock Market Baseline. NOTE: The returns shown in this simulation are INFLATION ADJUSTED meaning they are returns after inflation. The returns shown in my portfolios are BEFORE inflation. BALANCES shown are just there to show growth as an example. They are not actual portfolio values. — If you would like to read about backtesting, see my Backtesting page.

As you can see on both my Personal Portfolio and the original Permanent Portfolio, the drawdowns are less. Gold comes in to play when the market gets nervous.

On my portfolio (because of my special mix of ETF’s with REIT’s) the drawdowns are considerably less for the higher returns.

And who would have wanted to have exposure only to stocks in 2008? Not me!

Summary

Every investor has their own views on gold. Any portfolio will do just fine without it, until the next big financial crisis hits. The problem with not having it as part of your portfolio now is that by the time the world knows a financial crisis has hit, gold seems to have already figured it out months before and has taken off to the moon. So you end up buying it when it’s high instead of at it’s lows when recessions seem far away.

I just like knowing it’s there as insurance. It’s best to buy (mostly) physical gold because you don’t have the 3rd party risk of a gold backed ETF. Some people like to have some in a vault at home in case of that “end of the world as we know it” event. Personally I let BullionVault store most of my gold in different locations around the world. You can see a review on BullionVault here. I buy a small amount in gold ETF’s as they tend to be easier to buy and sell quickly for portfolio rebalancing.