25% of my growth portfolio is invested in U.S. Long Term Treasury Bonds (more than 20 years duration). I use bond index tracker funds rather than actual bonds as they are easier to buy, sell and back-test. UK investors can also buy Bond ETF’s in GBP as there are GBP denominated funds you can buy based on the both the UK and USA bond markets. If you would like even more diversification, there are also global bond funds that enable access to bonds from many different countries.

Overview

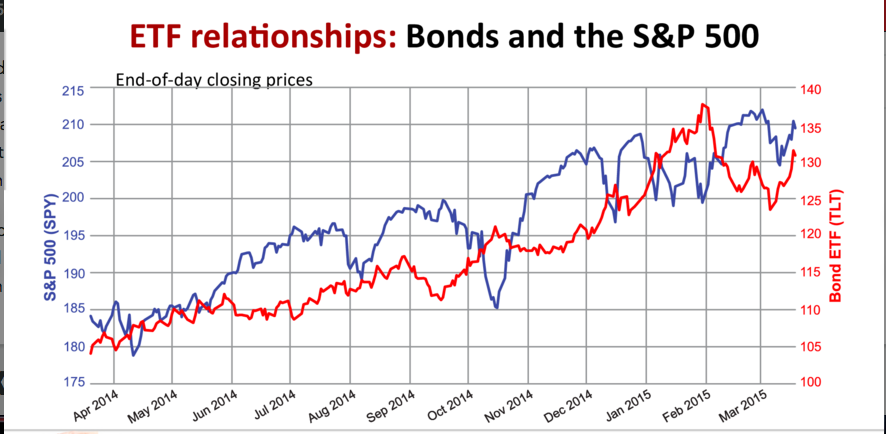

Bonds have always been part of most investors portfolios. Historically they have moved in an opposite correlation to stocks, i.e. stocks go up, bonds go down and vice-versa.

Long Term Bonds have also historically paid reasonable coupons (yield, or interest payments), but since the 2008 financial crisis when interest rates around the world came down to nearly nothing in most places, the payout has not been so good, so we rely more on their price movement than the coupon, but they still work well as a hedge against falling stocks.

Bond ETF

I honestly don’t pretend to be an expert on bonds, bond ladders and the like. I just use a long term bond ETF as this enables me to back-test for a few years and has almost the same effect on the overall portfolio as regular long term bonds without the hassle. That way I don’t need to worry about building ladders, buying and selling at maturity etc. Just buy the ETF and hold it (as part as an overall strategy of course).

Another huge point is that there are many services based on U.S. market data that allow me to “backtest” my investment strategies using ETF’s for many years in the past, in order to get an idea of how they “might” perform in the future. I say “might” because there is no guarantee that what investments have done in the past, they will continue to do in the future, but for me it’s better than following some “guru” who has a knack for predicting market movements.

More on Treasury Bonds

The following info is quoted from Investopedia, if you’re interested in knowing more about bonds you can read it here. For the prupose of following my investments you don’t really need to know all this though as there are plenty of bond funds out there you can buy without having to hold actual bonds.

What is a ‘US Treasury Bond – T-Bond’

A Treasury bond (T-bond) is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury bonds make interest payments semi-annually, and the income received is only taxed at the federal level. Treasury bonds are known in the market as primarily risk-free; they are issued by the U.S. government with very little risk of default.

Next Up

Treasury Direct

Federally Guaranteed Obligations

Treasury Budget

Government Security

BREAKING DOWN ‘Treasury Bond – T-Bond’

Treasury bonds (T-bonds) are one of four types of debt issued by the U.S. Department of the Treasury to finance the government’s spending activities. The four types of debt are Treasury bills, Treasury notes, Treasury bonds and Treasury Inflation-Protected Securities (TIPS). The securities vary by maturity and coupon payments. All of them are considered benchmarks to their comparable fixed-income categories since they are virtually risk-free, backed by the U.S. government, which can raise taxes and increase revenue to ensure full payments. These investments are also considered benchmarks in their respective fixed-income categories as they offer a base risk-free rate of investment with the categories’ lowest return.

Treasury Bond Maturity Ranges

Treasury bonds are issued with maturities that can range from 10 to 30 years. They are issued with a minimum denomination of $1,000, and coupon payments on the bonds are paid semi-annually. The bonds are initially sold through auction in which the maximum purchase amount is $5 million if the bid is noncompetitive or 35% of the offering if the bid is competitive. A competitive bid states the rate the bidder is willing to accept; it is accepted depending on how it compares to the set rate of the bond. A noncompetitive bid ensures the bidder gets the bond, but he has to accept the set rate. After the auction, the bonds can be sold in the secondary market.

There is an active secondary market for Treasury bonds, making the investments highly liquid. The secondary market also makes the price of Treasury bonds fluctuate considerably on the trading market. As such, current auction and yield rates of Treasury bonds dictate their pricing levels on the secondary market. Similar to other types of bonds, Treasury bonds on the secondary market see prices go down when auction rates increase, as the value of the bond’s future cash flows is discounted at the higher rate. Inversely, when prices increase, auction rate yields decrease.

In the fixed-income market, Treasury bond yields help to form the yield curve, which includes the full range of investments offered by the U.S. government. The yield curve diagrams yields by maturity and is most often upward sloping, with lower maturities offering lower rates than longer-dated maturities. However, when longer maturities are in high demand, the yield curve can be inverted, which shows longer maturities with rates lower than shorter-term maturities.