Ablrate – Pros & Cons

PROs 👍

CONs 👎

- Currently winding down loan book.

What is Ablrate?

Ablrate is (was) a medium size Peer to Peer lender based in the United Kingdom.

Providing loans mostly to businesses on a selection of interesting assets from private jets, luxury yachts and power generating stations, to property development and bridging loans.

Offering annual returns of up to 15% on secured loans, they have a unique spin on Peer to Peer lending and offer some of the best rates in the business for secured lending.

Ablrate’s loan flow is unfortunately quite slow, so it’s hard to diversify into a lot of different loans. This means you will need to do due diligence on each loan you decide to invest in to ensure you are comfortable with the asset value provided and the terms available for the loan.

That being said, they have a very good reputation and history with the Peer to Peer lending community and their loans are known as some of the safer asset secured loans where borrowers are vetted very well by Ablrate with very in-depth due diligence.

Ablrate are also known for having very good default recovery success on the limited number of loans that have defaulted on their platform.

Latest Update & Current State of Account

UPDATE: 18/07/2022 – Ablrate decide to wind down the platform

EMAIL from Ablrate:

Orderly Wind Down of Ablrate Loan Book

8 years ago this month, on the 14th July 2014, was the official opening day of the Ablrate platform. Since that day we have done our best to provide good returns to investors and innovate in the P2P space.

So it is with regret that I am informing you of our decision to execute the orderly wind down of the Ablrate loan book and its P2P activities.

Firstly, let me say this; we are not going out of business, this has been a voluntary restriction we have placed upon ourselves and we will continue to work until the loan book is settled. We have a reasonable outlook financially as we continue to receive our commission element from loans that are paying or settling as well as recovering direct costs from others. So the business, barring any outside financial pressure, should be able to continue with loan recoveries until the book is settled or brought to a conclusion.

The decision is to put in place the voluntary restriction to not to take on new customers, amongst other commitments. The FCA have been notified of the commencement of the wind down, Ablrate remains a regulated firm and will do so until the process is complete.

The decision has not been taken lightly so I would like to explain why we are now on this path as it is a combination of the economic outlook, some of the challenges on our loan book, and regulatory trajectory.

It is a challenging environment for small businesses. Interest rates are likely to rise putting pressure on incomes and already retail sales are being hit putting pressure on the wider economic outlook. Strikes and resultant potential wage hikes may fuel inflation in the short term and add to the volatility of the economy adding additional risk to lenders and our business.

An element of the loan book, as you know, has seen some challenges and we are expended a huge amount of time on sorting out a few of the borrowers. Fortunately, we have stabilised some loans and we can see the light on the servicing and settlement of some of these loans.

There are also loans from a small number of borrowers we cannot recover from our own efforts, so collection has been passed to insolvency specialists, and inevitably there maybe others that enter that process as the collection procedure continues. When loans enter this process, our work does not stop and we feel our small team is better focused now on recovery of those loans than new business.

A consequence of the wind down is that the Loan Exchange will not reopen. There are some borrowers on the platform that are exploring other ways that your loans could be traded and we are assisting them with this. For clarity this does not involve low-ball bids for them, we will make it clear to borrowers that our wind down procedure increases our capacity to work on recovery, it does not diminish it.

Lastly, the P2P industry was an excellent innovation, and something designed to allow lenders to have the opportunity to gain good returns by lending directly to small companies and consumers. Light touch regulation allowed the industry to grow but some failures in the P2P industry, and the wider alternative finance industry, prompted a review of the space and further regulations followed, with a complete ban on the mini bond market for example.

When planning for the future as a business we have to make assumptions on the trajectory of rules. Our opinion, having read the consultation documents, is that the trajectory of regulation is more restrictions, more complex platform reporting to prove those restrictions are working and, one would assume, if they are not working to the regulators’ stated goals then further restrictions will apply. If the proposed ruling of banning incentives to invest comes to pass, our opinion is that it is likely that Instant Returns would be banned, of which borrowers have paid over £200,000 since it was implemented. Put all this together and, commercially, it is a difficult circle to square as it is uncertain where that trajectory ends. You can view the consultation here.

The FCA’s job is to protect customers from what they see as potential harm so more restrictions and rules is always going to be a factor. We have not always agreed with the FCA on their interpretation of the rules nor their implementation of some of them. However, we have always had cordial relations with the regulator and respect the fact that they have a job to do.

It is the combination of the above factors, not any one individually, that has created an environment where it is the Director’s opinion that an orderly wind down of the company’s P2P activities is best for lenders and the best for our business.

Operational Arrangements

Changes to our Website

We will shortly be making the necessary changes to our website and landing pages, however, access to your account will be unaffected via the usual login button.

Access to your Ablrate Account

You will continue to be able to access your Ablrate account in the normal manner, as we will no longer be offering new loans, we would encourage you to withdraw any surplus cash balance on your account.

We have begun contacting a number of customers who have had funds on account for some time and we are encouraging them to return those funds to their accounts as there will be no new loans and the account is not interest bearing.

Payments to your Lender Account

Standard monthly interest, capital & interest, and settlement payments will continue to be credited to your account upon receipt from the Borrowers in the normal manner.

Monthly Payments / Deposits

If you currently deposit funds to your Ablrate account on a regular basis via standing order, we would ask you contact your bank to cancel the instruction.

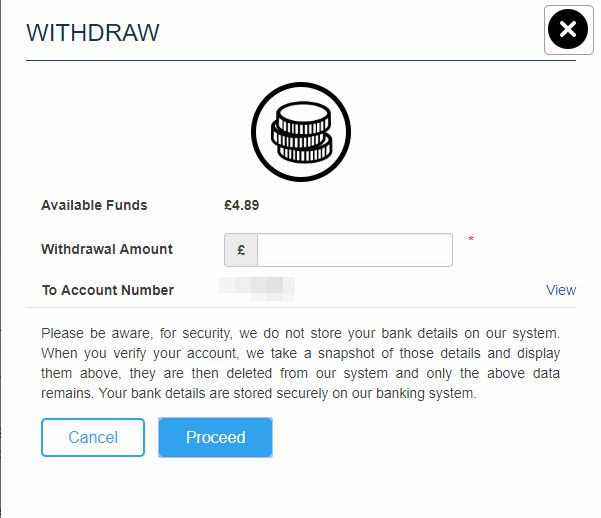

Withdrawals from your Lender Account

Withdrawals will be processed twice weekly (currently proposed to be Tuesday & Friday) with effect from 1st August, until that date, withdrawals will continue to be processed daily. The request procedure remains the same.

Tax Statement

Your tax statement will continue to be generated annually.

Your IFISA

To withdraw any cash balance from your IFISA account to your designated bank account, you should follow the normal withdrawal process. You should however be aware that this type of withdrawal will result in the loss of the ISA (tax free) wrapper.

To maintain the ISA wrapper, funds (cash only) can be transferred out a new ISA provider. Please contact your new ISA provider to initiate their transfer in process.

Ablrate will waive our standard fee and cover the cost of the first transfer out from your IFISA account in each financial year, thereafter our usual charge will apply.

Your SIPP/ SASS

Any withdrawals will continue to be paid to your designated SIPP provider’s bank account via the normal process.

Adjustment in Service Levels

Going forward Ablrate will have a smaller team, and thus we will be operating with reduced staffing levels and replies may take a little longer.

Getting in contact with us

The most effective way to contact with us, will be as before, via email. All queries should be directed to the mailbox info@ablrate.com rather than any personal email accounts that maybe not or infrequently monitored.

Our contact telephone number remains +44 (0)1491 410400, if you do wish to contact us via telephone, however, the customer service line with only be available between 10am-12noon Monday to Friday.

Ablrate Communications

Lenders will continue to receive the standard system generated email notifications as well as ad hoc updates from the Ablrate team in the normal way as we have material news.

An update for each loan will be provided on a quarterly basis, or more frequently if there is a significant change in the loan or the borrower.

Wind Down Plan

Our wind down plan lays out certain actions that may happen in the event of a wind down. We are reviewing this plan with Thistle Compliance and aim to update lenders on the wind down plan when those have been formalised. It does not affect the way we are dealing with your loans and does not delay repayments or action taken against borrowers, it is an internally agreed procedure for moving forward.

Complaints

We are aware that lenders may have concerns and may also have complaints. Our Complaints policy can be viewed here and if you have a query please use the info@ablrate.com email as it feeds into a central ticketing system where the team can deal with your query.

I want to assure you that our number one priority is getting the book settled/serviced as quickly as possible. The alternative trading of loans is something we are willing to work with borrowers on and we are looking at the possibility of loans being sold to other lenders at par (but you will, of course, have the ultimate say on if you sell or not). We will update you as we unwind your positions and as any such offers come in.

Finally, 8 years ago we started receiving feedback, good and bad, from lenders, it has never stopped since and for this I would like to thank you. In the good times you always kept us in check, when things didn’t go to plan and dealing with things was incredibly stressful, there was always an email from a random customer with words of encouragement.

This is just one of the reasons that it is important to us to continue the work on the book for our lenders to get the best result possible. We cannot promise full recovery but by the time the book is closed we aim to have wrung everything out of it for lenders.

Kind Regards,

David Bradley-Ward

- Ablrate Review

- What is Ablrate?

- Latest Update & Current State of Account

- Easy-Info Table© – Ablrate Review

- Account Screenshots

- Ablrate Investment Return Charts

- What Annual Returns Can I Expect With Ablrate?

- Detailed Overview – Ablrate Review

- Summary – Ablrate Review

- Points to Consider When Investing With Ablrate

- Obvious Investor Risk Rating*

- Who Can Invest with Ablrate?

- Ablrate Cashback & Signup Links**

- Similar Lenders to Ablrate

- Other UK Peer to Peer Lender Reviews

Easy-Info Table© – Ablrate Review

| Overall Rating*: |  (3.8 / 5) (3.8 / 5) |

| Who can invest: | |

| Loan Currencies: | £ |

| Estimated Return: | 6% to 15% |

| Target Annual Return (Platform Number): | 12.00% |

| My Calculated XIRR: |  |

| My Current Investment:(click to see amount in £) | See My Investment £ |

| Risk Rating*: | 5/10 -Medium  |

| Early Exit: | Yes. Secondary Market. |

| Min. Investment: | £1 for account. Min Amt Per Loans Varies. |

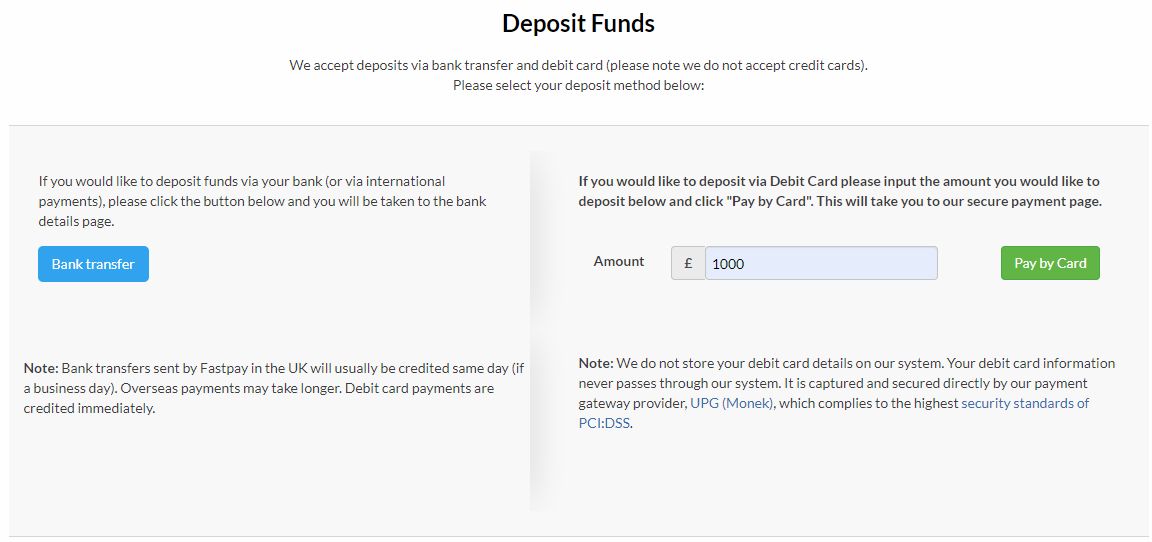

| Deposit Funds: | By Bank Transfer or Debit Card. Usually same day. |

| Auto-Invest: | No |

| Manual Invest: | Yes |

| Lending To: | Agreements directly with borrowers |

| Loan Types: | Various Asset Secured Loans. Corporate Aircraft, Generating Stations, Property Development etc. |

| Default Rates: | Not Published. |

| Loans Amortize: | Some do but not all. Some interest only. |

| Loan Security: | Yes, most loans asset secured. |

| Provision Fund: | No |

| Time to Invest: | Manual |

| Time to Mange: | Manual |

| Lender Fees: | No. |

| Payments Received: | Interest or Interest and Capital Received Monthly. Depending on loan type. |

| Amount Lent: | Not Published. |

| Number of Investors: | Not Published. |

| Loan/Dflt Stats: | Not Published. |

| Regulated: | Yes: FCA |

| Location: | Henley-on-Thames, UK |

| Launched: | August 2014 |

| Website: | www.ablrate.com |

| Email: | customerservices@ablrate.com |

| Telephone: | 01491 410 400 (UK) |

| IFISA/IRA: | Yes. ISA |

| Cashback**: | Yes! £50 for £1000 Investment Get Cashback >> |

| How to Sign Up**: | Sign Up Here! |

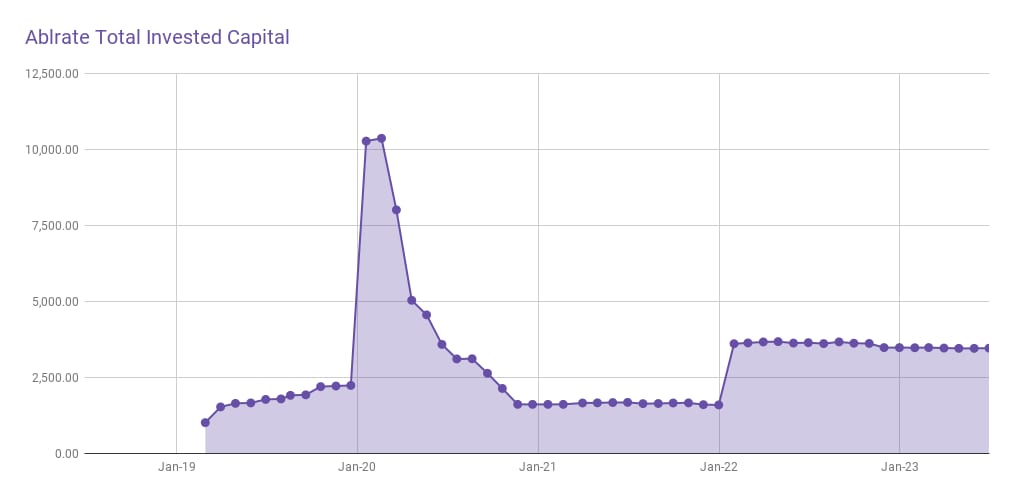

As with many of the higher paying/higher risk platforms, I drew down much of my investment capital when the COVID19 pandemic hit. I’ve since been watching waiting to see how they did an for any changes and adjustments in their lending strategy.

Things are back to normal now with Ablrate and they are bringing in some really well vetted (and what look like) solid loans. I finally decided to start increasing my investment with them again so in January 2022 I sent over a few thousand pounds and started to look at some loans I might like to invest in.

Ablrate’s returns are just so good that I really need to increase my investment significantly in this lender as I get more time to look at the loans.

Account Screenshots

Latest Screenshots from my personal account.

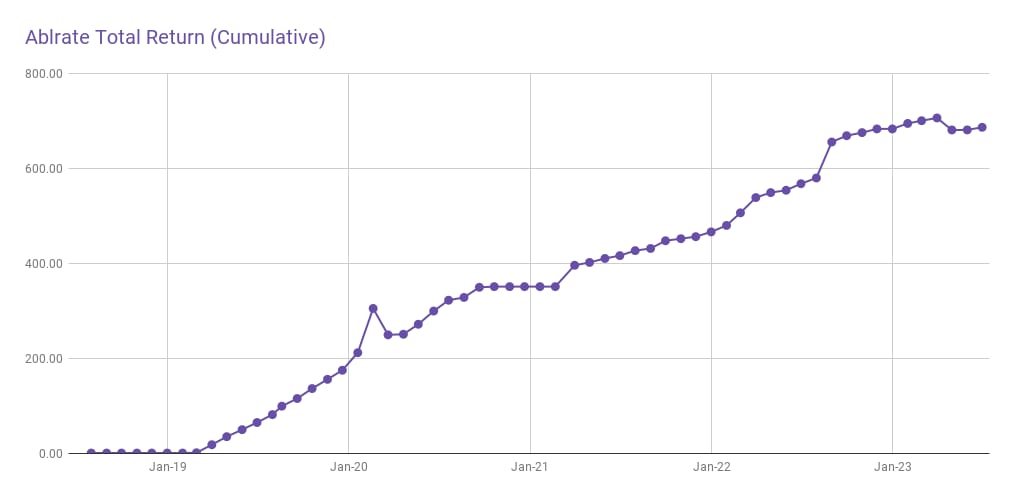

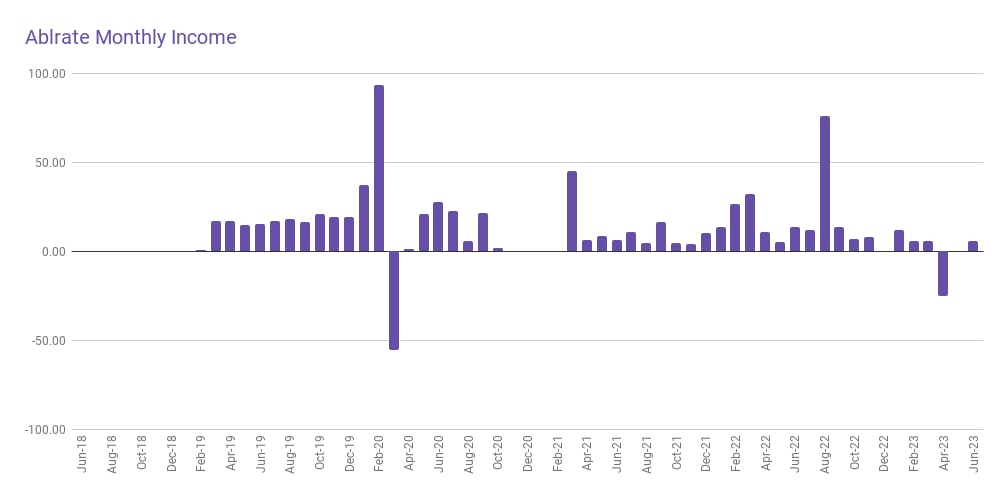

Ablrate Investment Return Charts

(Click on image for interactive chart)

What Annual Returns Can I Expect With Ablrate?

If we choose the loans carefully, there is good reason to conservatively expect Ablrate annual returns of between 10% & 15%. My returns over the time I was investing before COVID averaged around 14%. Since then, they have dropped significantly, however that’s more to do with the fact that I haven’t been reinvesting or have had the time to do research & choose loans. If you put in the time, you should be able to easily average above 10%.

Detailed Overview – Ablrate Review

Abltate Plaform History

Ablrate’s Peer to Peer business was incorporated in February 2014 and their platform was launched in July 2014 in Henley-on-Thames in the United Kingdom.

The platform does not publish their lending figures as far as amounts lent out and default statistics. So I am unable to publish that information for this lender, however as far as I understand, default rates are very low. Default recovery has been very well handled.

Their last filed financial accounts are publicly available from Companies House.

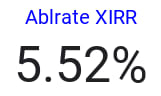

Is Ablrate Regulated?

Ablrate P2P (AKA Aviation and Tech Capital Ltd.) are regulated by the UK’s Financial Conduct Authority (FCA) with full permissions under FCA number 724444

They gained FCA permissions in March, 2017.

It’s important to note in this Ablrate Review that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

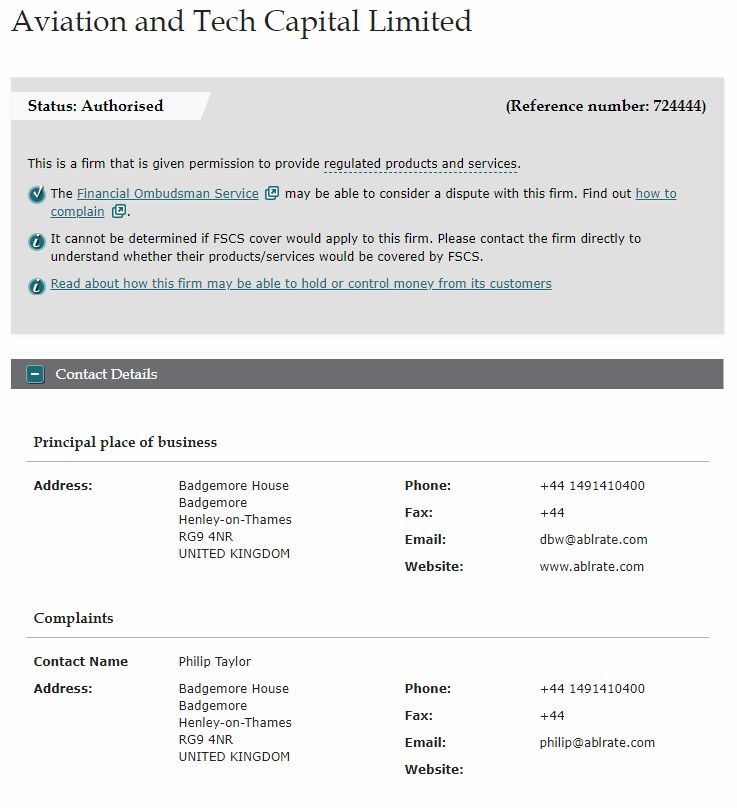

How to Signup with Ablrate & Open An Account.

Opening an account with Ablrate is fairly easy. Just the usual ID and anti-money laundering checks.

If they can verify you though one of the UK’s credit agencies, you may be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

Any resident of the United Kingdom who is 18 years old or over can signup with Ablrate if they can pass the ID checks & anti-money laundering checks.

A U.K. bank account is also required to signup.

How Are Deposits & Withdrawals Made?

Deposits are made by bank transfer from a UK bank or a debit card drawn on a UK bank.

Typically card deposits are in your account immediately and bank transfers show up in your account the same or next working day depending on the time you send them.

Withdrawals are directly to a UK bank and can typically take 1 – 2 business days.

How Long Does It Take Become Invested with Ablrate?

Ablrate P2P loans are all self-select manual investments. No auto-invest accounts. So loans must be selected and invested into individually.

When you choose “Available Loans” from the main screen menu, you can see loans that are still available for investment on the primary market.

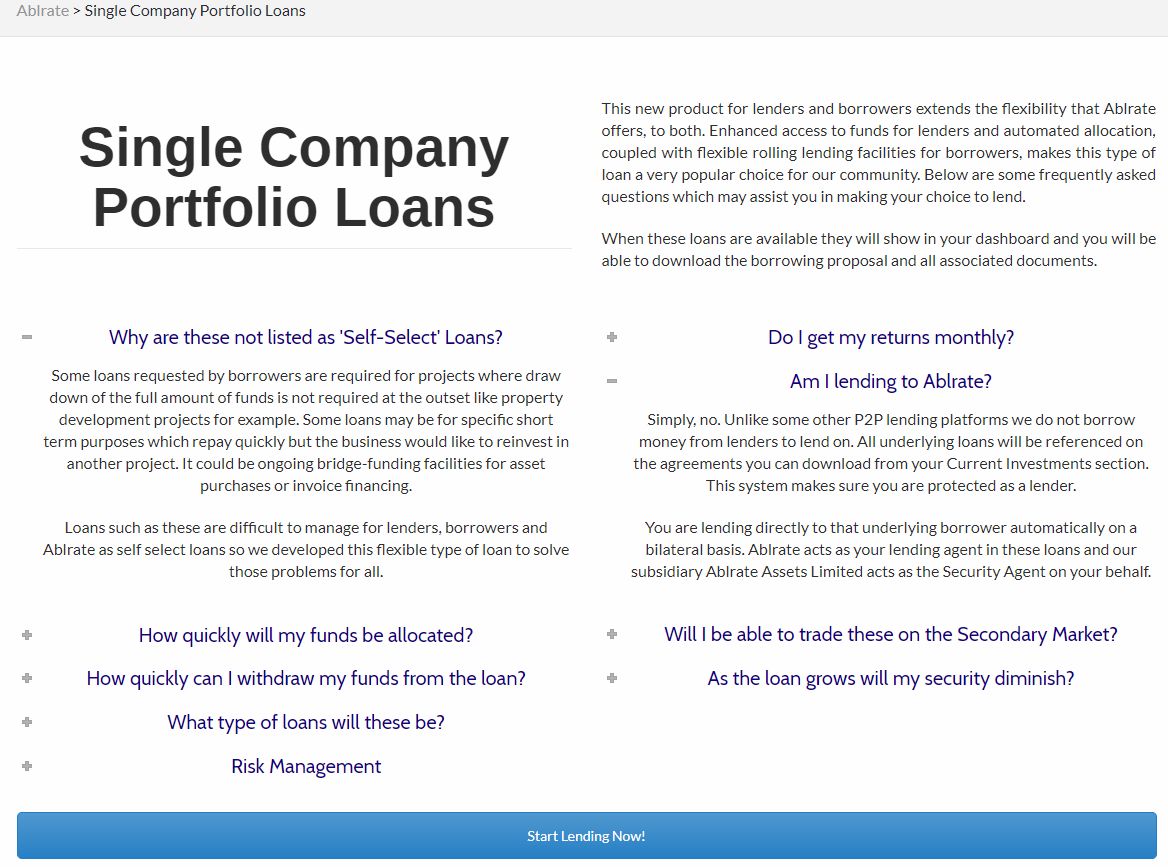

As you can see in the screenshot above, there are currently only two loans available for investment. One of the loans is a standard Self Select Loan, and the other is an Ablrate Portfolio Loan.

Portfolio Loans are a new type of loan offered by the platform. The description of how these loans work are here on Ablrate’s website and an overview is below.

Who Are We Lending To With Ablrate?

Ablrate is a true Peer to Peer platform.

Lenders are lending directly to borrowers who are typically small to medium size British businesses.

Loan agreements are directly between the lender and the borrower. The platform just acts as a middle man, managing loans, payments and debt collection etc.

What Loan Security Do Abrate Loans Offer? – Is Ablrate Safe

The platform provides very good and detailed information about their loans & loan security. Including detailed explanations of the deal and descriptions of assets, including LTV’s and all documents associated with the valuation.

Also available are borrower credit documents and all other documentation relating to a specific asset such as ecological reports and flood assessments depending upon the asset in question.

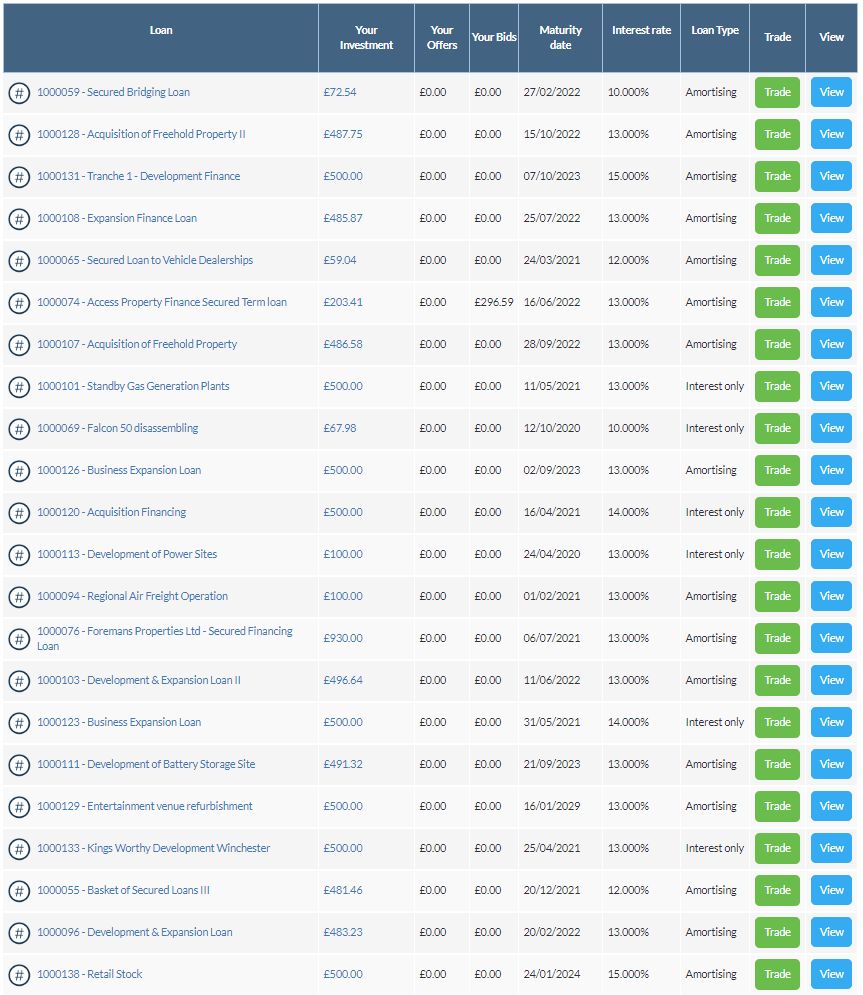

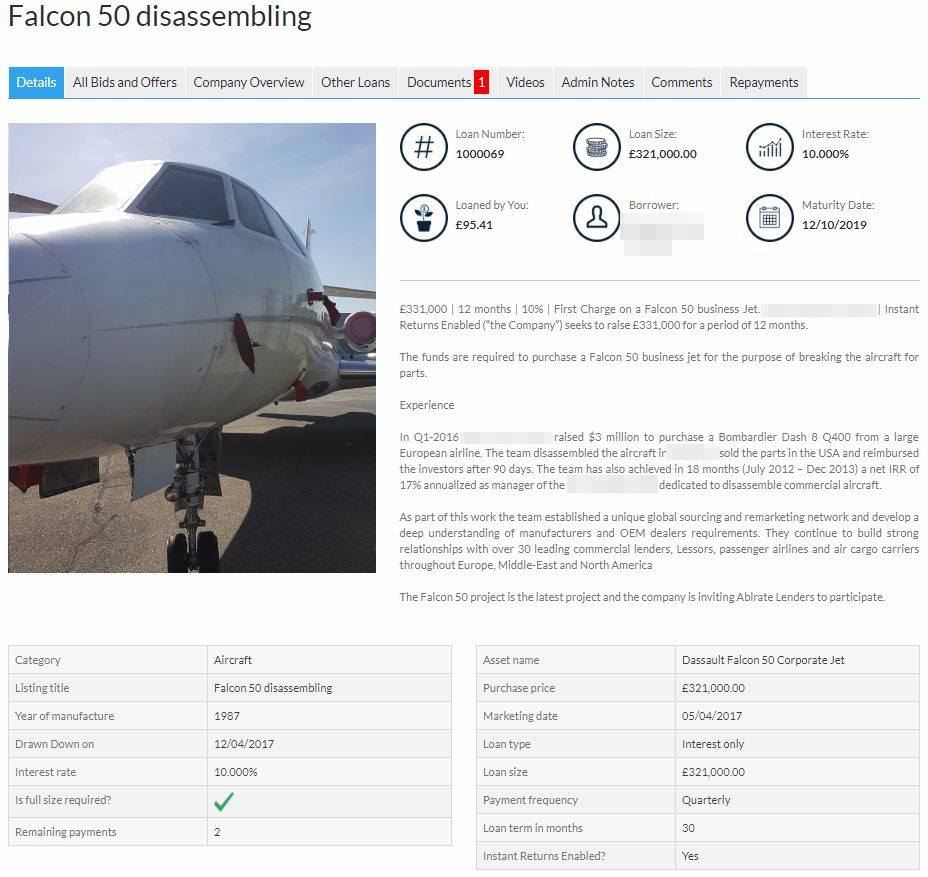

Here is a list of a few of my current loans:

You can see the top-level information on each loan. And when you drill down, you can see the detailed information is still available, and it is updated regularly.

I know this is probably one screenshot too many for this Ablrate review, but I wanted to show the different loans available, and who doesn’t want to brag that they own (part of) a private jet. Even if it is being broken up for parts 🙂

You’ll notice below the red number “1” indicating a new document is available for this loan.

Again if you switch to the “Documents” tab, you’ll see that a new document is available for download (in this case the document was added in 2018 but it was after the loan was established).

When Do Ablrate Loans Start To Pay Interest?

Many (but not all) loans pay what they call “Instant Returns” which means they start paying interest as soon as you invest, before the loan is even drawn down by the borrower. Others loans start to pay interest after the loan is drawn down.

You can always see on the loan thumbnail and loan details if this loans is an “Instant Returns” loan.

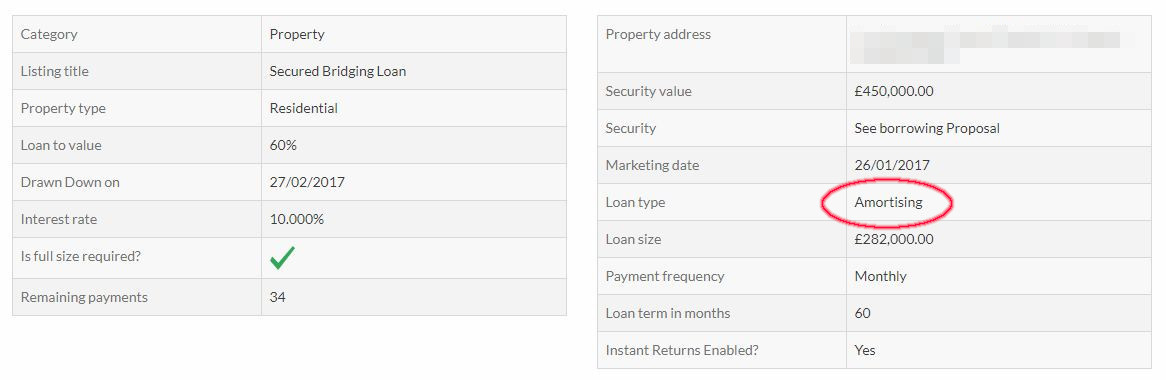

Do Ablrate Loans Amortize?

Many loans amortize, meaning you receive capital and interest payments every month. Many loans are interest only though, mostly the shorter term bridging loans and capital equipment loans. The interest only loans tend to have higher return rates associated with them as they are typically classed as higher risk.

When loans amortize, it reduces the risk compared to a non-amortizing loan, in which neither capital or interest is received until the end of the loan, or only interest is received monthly and then the capital repaid at the end of the loan period.

Amortization is paying off a debt with a standard repayment schedule in regular amounts over time. It is an book keeping technique used to reduce the cost value of an intangible asset little by little through scheduled payments.

It’s easy to see if loans amortize from the detail on the loans listing screen where it is clearly marked.

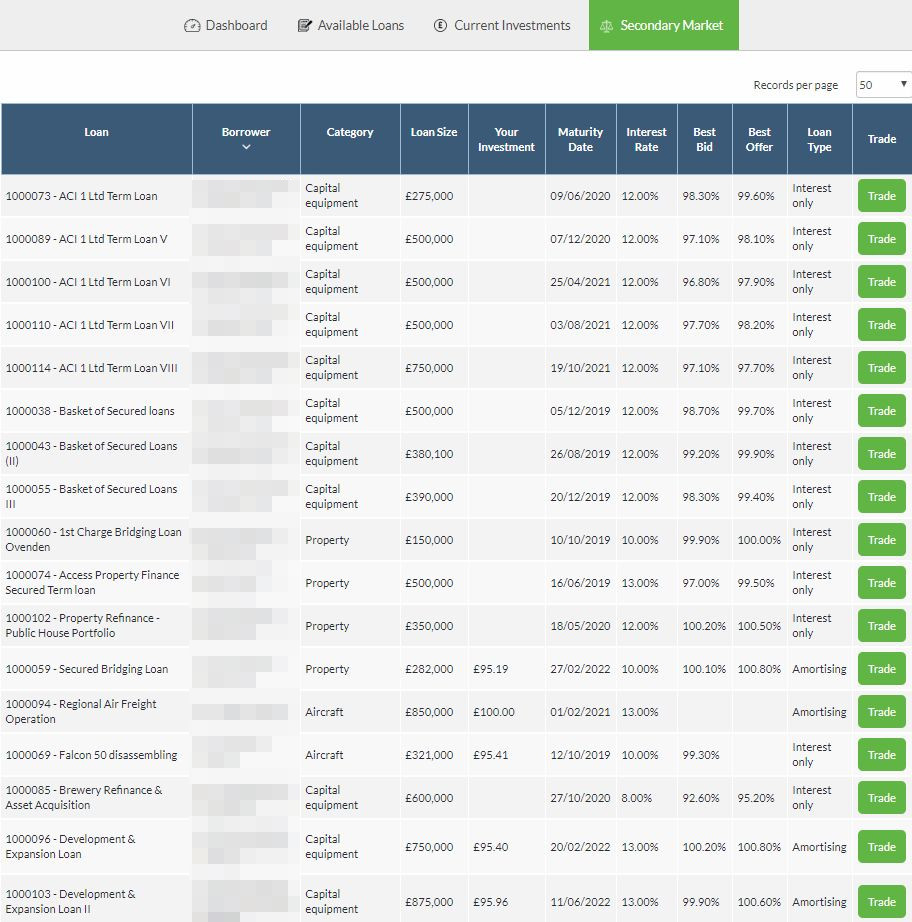

How To Sell Loans & Withdraw Capital Early From Ablrate.

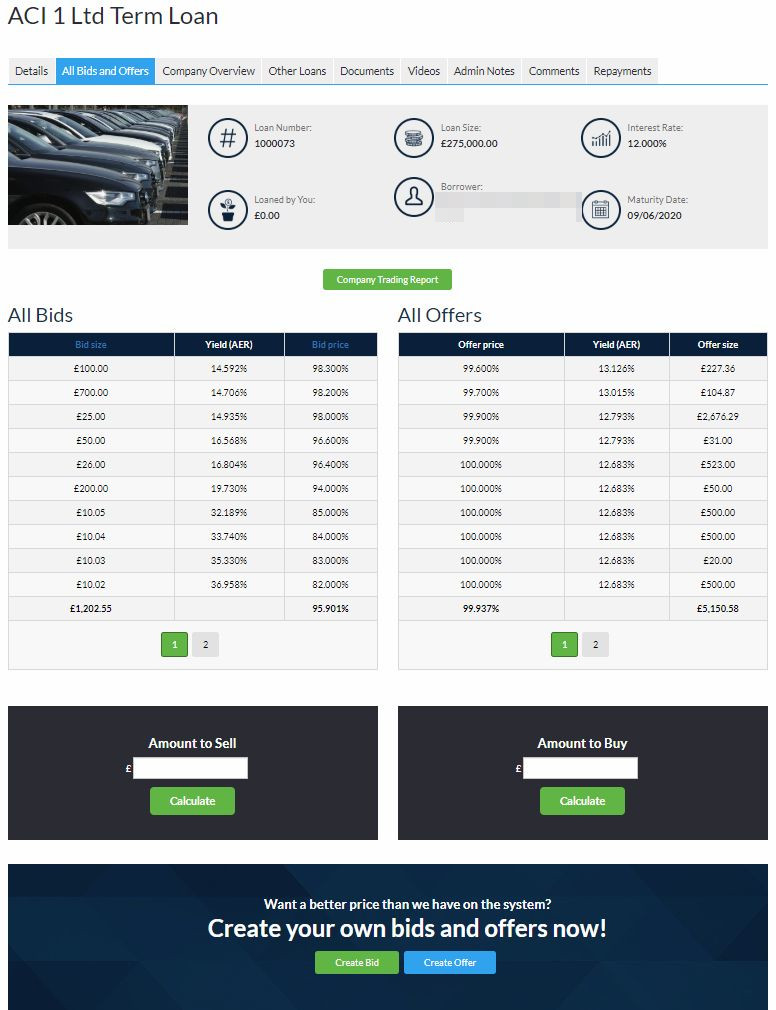

Selling loans is done through the Ablrate Secondary Market. They have a very active secondary market where you can buy and sell loans.

There is even the ability to bid on loans at a price you want to pay. Or offer loans you want to sell at a price you’re comfortable with.

The Ablrate P2P secondary market is a little complicated. However once you get the hang of using it, it’s not so bad.

It is actually very versatile once you understand it. Enabling you to name the price you want to pay for a loan through bidding.

I actually bought most of my loans on the secondary market.

I placed low-ball bids on some loans which got accepted after a couple of weeks. This makes the actual return rate higher than it would have been purchasing the loans when they were initially offered. You can see on the bids and offers screen what rates are equivalent to different sales and purchase prices.

How Easy Is It To Diversify With Ablrate Loans?

Because loans are all self-select loans, diversification is a manual process.

As mentioned previously, although loans are very well secured, the loan flow is not huge. So if you have a lot of capital to invest, you’re going to end up with more than you would probably like to have in each loan.

So best to make sure you do due diligence to a level your comfortable with before investing any of your hard-earned capital.

Does Ablrate Have A Provision Fund Or Buyback Guarantee?

There is no provision fund or buyback guarantee with Ablrate.

You are relying on the Ablrate lending team’s due-diligence, your ability to seek out safe profitable loans, and the asset security on the loan itself in case of default.

Is There an Ablrate ISA for Tax Efficient Investing?

Their Innovative Finance ISA (Ablrate ISA) was launched in August 2017 for residents of the United Kingdom enabling tax free investments for Peer to Peer lenders.

What Is The Ablrate Website Like?

Ablrate’s website is relativity easy to use. Everything makes sense and is easy to access.

All of the account information is right there in front of you on the main account screen all laid out in a manner which is self explanatory.

Summary – Ablrate Review

All loans are secured by assets typically with good LTV’s (Loan to Value ratios). So even if you were to make a mistake on a loan, you would likely still get your capital back. It just might take a while if it has to go through a long legal situation. Ablrate have an excellent history of low defaults, but more importantly of recovering capital promptly when things go bad.

I hope you found my Ablrate review useful. There are not too many high-return lenders out there who are genuinely focused on investor capital preservation and ensuring the best returns possible for their lenders. I believe Ablrate P2P are one of the better platforms with these qualities and I intend to slowly increase my investment as new loans come up moving forward.

Points to Consider When Investing With Ablrate

Thumbs Up Points

- Great Returns – returns of 12% – 15% on secured assets with good LTV’s.

- Interesting Diverse Loans – loaning on items like private jets and boats is out of the norm for Peer to Peer lending, so it enables you to diversify away from the typical bricks & mortar assets.

- Low minimum investment – There is no minimum to open an account. Minimum investment in loans is on a case-by-case basis but is typically small.

- Good Default Recovery – Ablrate Peer to Peer have a good history of recovering on defaults, which is good to know when things go bad.

- Tax Free Innovative Finance ISA (IFISA) – the Ablrate ISA is available for tax free investing.

- Financial Conduct Authority – (FCA) Regulated.

Thumbs Down Points

- Smaller Company – but focused on a unique offering. Founded in 2014 and survived one of the biggest economic downturns in a generation. Surviving for several years in the Peer to Peer sector is no small feat.

- Low New Loan Flow – Loan flow is very sporadic. I’ve only been lending with them for a couple of years now but loans have averaged only one to two new loans per month so far.

- Smaller Loan Book – This is really just a function of the last bullet point, not many loans with too many investors trying to get them.

- Secondary Market Complex – can take a while to get familiar with using the secondary market. Although once you do, it’s very flexible and enables you to increase your return rates if you’re patient enough to bid on loans.

- Manual Investing Only – time consuming and requires due diligence to pick out the best loans.

Obvious Investor Risk Rating*

– 5/10 – Medium

– 5/10 – Medium

Is Ablrate Safe? I consider the platform to be in the middle area of the risk scale.

Even taking in to consideration that loans are asset secured, they are still a smaller company. Plus with a smaller loan-book, it’s harder to diversify to minimize risk. There is a very active secondary market to help with diversifying capital though, as well as being able to increase returns by bidding on loans.

Who Can Invest with Ablrate?

Residents of the United Kingdom with a U.K. bank account can invest with Ablrate. Contact them for further information.

Ablrate Cashback & Signup Links**

Use the link below when you sign-up and receive £50 Ablrate cashback bonus on your first investment of £1000 or more.

Click here to qualify for the Ablrate cashback bonus >>

or

Click Here to Visit The Ablrate Website

Similar Lenders to Ablrate

Other UK Peer to Peer Lender Reviews

Proplend Review

London House Exchange Review

Assetz Exchange Review

Find UK Property Review

Loanpad Review

easyMoney Review

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Hi Tony,

Thanks for the comment!

I think Ablrate is probably a little more risky than say Assetz Capital or Kuflink, however probably not as risky as you would think. Pretty much all of their loans are asset secured and they have very few defaults, and a great record of collecting on defaults when they do happen.

The returns they offer certainly are worth the risk in my opinion. I’ve done quite a bit of research on Ablrate and the consensus is that their returns are about the best of the UK lenders for the risk taken. This is from seasoned Ablrate lenders who I’ve had discussions with.

There is indeed plenty of information available on each loan, so you’ll need to do your research to ensure you understand what you’re getting into. The biggest issue with Ablrate is their number of loans. It’s difficult to get diversified, so if you’re going to invest a lot of capital, you’ll really need to pay attention to the details on each loan.

I hear Ablrate are profitable, however because they are a smaller company they don’t need to file much information with Companies House, so I don’t have any figures proving that they are profitable.

Hope that helps,

Mark

Hey Mark,

Thanks that’s very helpful. It’s good to confirm that there are profitable from David’s comment. I’ve registered through your link.

Hi Tony,

Yes indeed. It’s good that they could confirm that info. for us.

Thanks for using my link to register!

Cheers,

Mark

Hi David@Ablrate

Thanks for the comment and clarification on the numbers!

It’s good to know you guys are keeping an eye on the review. It helps to keep me honest 🙂

Please feel free to comment if anything else is not accurate. I’ll be happy to update the review accordingly.

Cheers,

Mark