I regularly get questions such as these from email contact from the website:

What is Peer to Peer Lending? Is Peer to Peer Lending Safe? How much ROI % (Return On Investment) can I make from Peer to Peer Lending in the UK or Europe? Who Are The Best Peer to Peer Lenders in the UK & Europe? What is P2P Lending?

So I decided to write this handy 101 page: Read my Peer to Peer Lending overview & in-depth P2P lender reviews below which should answer some or all of the questions for you. If you have other questions, please feel free to drop me a note and I’ll add the answers here to help others.

Overview – Peer to Peer Lending (P2P Lending)

Offering enticing returns anywhere from 3% to 25% – Peer to Peer Lending is the new(ish) kid on the block as far as alternative investments are concerned.

Even through the COVID pandemic, Peer to Peer lending still delivered. Several platforms closed down or stopped lending to retail lenders (meaning they only accept investment capital from banks or funds), because of the pandemic. However most investors still got their capital returned from these platforms, and most complete with all interest earned.

This confirms that Peer to Peer lending is indeed a viable alternative investment strategy in my opinion.

Peer to Peer lending has been around as a sector for about 18 years. In that time it has become a formidable alternative investment option. Having lent billions in investment capital to consumers and business around the world.

Individual investors have many investment options, including lending to consumers & businesses though standard lending accounts. Or though tax efficient retirement accounts such as Peer to Peer Lending ISA’s & IRA’s.

Now bringing this relativity new investment vehicle within reach of anyone who has any amount of capital to invest. Just about anyone can become a Peer to Peer Investor!

So is Peer to Peer Lending Safe? Read on to find out! See in-depth Peer to Peer Lender Reviews and more here!

What is “Peer to Peer Lending (P2P Lending)”?

Peer to Peer (P2P) lending is a method of financing which enables individuals and businesses to borrow and lend money.

No need for a bank or building society.

Peer to Peer lending removes the middleman (Bank/Building Society/Credit Union etc.) from the process. It connects lenders (investors) directly with borrowers.

P2P lending involves more time, effort and a little more risk than lending through other financial institutions. However it also offers much better rates of return.

You can always see my current rates of return from each lender in my Peer to Peer lending portfolio by clicking here.

How does Peer to Peer lending work?

For the past 100 or more years, individuals and businesses who want a loan typically apply through the bank.

The bank would run many financial and credit checks on the applicant’s financial history. This determines if the party would qualify for a loan. And if it does, determines the interest rate that will be charged on the loan.

Anyone having less than perfect credit would be refused or charged outrageous interest rates.

Loan Agreements Directly Between Lender and Borrower

With Peer to Peer lending, borrowers get loans from individuals or corporate investors.

These investors lend their own money for an agreed interest rate directly to the borrower.

The loan agreement with P2P is typically directly between the investor and the borrower. All the P2P company/website does is put the two together.

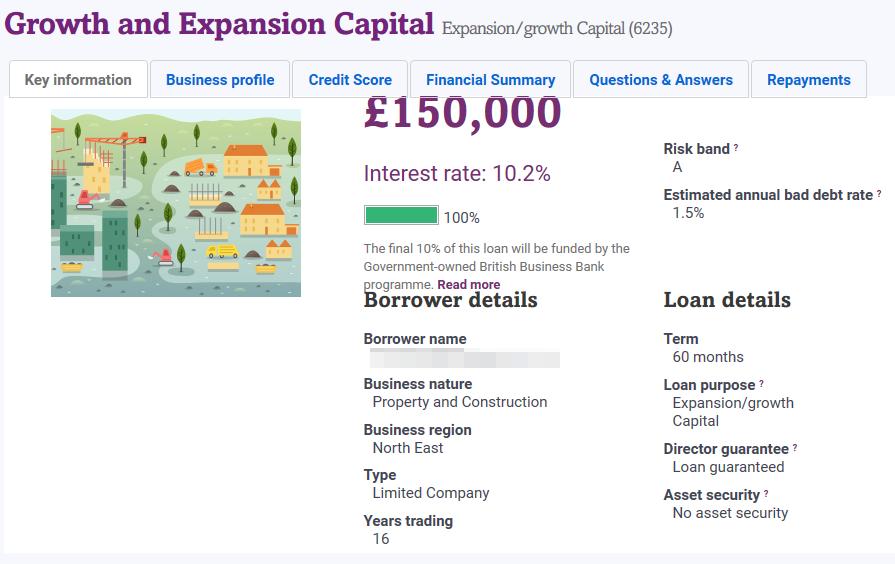

The credit history and other information is typically displayed for the investor to see so they can make an informed decision on the borrower.

Many companies have “auto-investing” which enables almost hands-off investing.

Typically you will need to adjust a few settings around how to invest repayments of capital and interest when you first start lending, as well as how much capital to place in to any one loan (diversification).

Once everything is set up, with most lenders there is not much else to do. All investments are completed automatically. From time to time you may need to make adjustments to the lending criteria, for example if a different type of loan becomes available, or loan originators are added or subtracted etc.

Returns on Peer to Peer lending can be anywhere from 3% to 25% depending on risk of the loan and the currency you’re lending in. Risk is a factor of asset security, length of the loan, amortization, environment and creditworthiness of the borrower, as well as many other factors.

Often when a lender specifies a Rate of Return (ROI) they will quote a “Target Rate” which they think, based on their experience, you should be able to achieve in their current loan market. Also based on “normal market conditions” meaning the economy is progressing as expected (no major recession).

This rate usually assumes you will be reinvesting all of your interest and returned capital at their current lending rate.

Lenders ROI should eventually meet actual XIRR (see next paragraph). That is not always the case though, so it’s always good to track XIRR to see how you’re really doing. You can register to download my P2P Tracking Spreadsheet here.

For measuring returns on investment, XIRR has become the de-facto standard in Peer to Peer lending.

XIRR or Extended Internal Rate of Return is a measure of return used when multiple investments (at different points in time) are made in a financial instrument.

As capital is added or subtracted from a Peer to Peer lending account, and interest is earned, XIRR calculates that actual return based on capital in the account at each given point. XIRR does not however take into consideration future compounding effects of interest reinvestment in P2P lending.

As an example, a lender might quote 5.3% targeted annual returns on its lending account. XIRR would not show that number until there was at least 12 months of data from the account. When compound interest would then be figured in to the equation.

Sometimes it can take longer than 12 months as payments from loans can be sporadic for the first few months an account is established and new loans are added.

I list all of my current ROI’s plus XIRR for each lender here. Updated monthly.

Many loans are secured by assets, so if the borrower defaults, the loan platform (P2P Lender) can go after these assets and eventually sell them to recoup their investors capital.

Assets can come in many forms from development property to mortgages on long term rental houses. From pawn items like watches and jewelry to private jets and luxury yachts. Anything you can imagine.

When taking into consideration the assets securing a loan, it’s important to consider the LTV or Loan To Value Ratio. This is how much the asset is worth in comparison to the loan value which is being lent on it.

For example, if an apartment complex has a market value of 1,000,000 and the developer is looking for a loan for 500,000, then the LTV is 50%. Simple as that! It’s always worth paying attention to the assets LTV, the lower it is, the safer your capital is.

LTV (Loan to Value Ratio)

You’ll see with some lenders like Assetz Capital, Kuflink or Loanpad LTV’s can be very low. For example I recently picked up a loan on a commercial building that had a LTV of 28%. That means if the borrower defaulted on the loan, the asset would have to lose 72% of it’s value before I would lose money. I’m not sure if that has ever happened in history.

Even in the 2008-2009 financial crisis, buildings were losing 40% or 50% of their value, but 72%? Very rare in my experience. And the recent COVID pandemic had virtually no effect on real estate prices, and even if there is a delayed effect down the road, I doubt it will be more than 15%-20%.

Another thing to take in to consideration when looking at asset security in P2P lending is; how quickly can the asset be sold? A gold watch might be quicker to sell at auction than an office development or old manor house that needs refurbishing. So if you might need quick access to your capital, think about the assets you are lending on and how long they might take to sell if the worst happens and the borrower defaults.

Provision Fund

Many P2P lending companies offer another level of loan security called a “Provision Fund”. This is a pool of money which is usually charged to borrowers as part of their loan fees which is put aside in case a loan defaults.

Should a default occur, the Provision Fund pool is used to cover lenders capital, and sometimes also interest on the defaulted loans.

Buyback Guarantees

Some P2P lending companies also offer “Buyback Guarantees” which work similarly to a Provision Fund. Typically if a loan defaults (default definition is lender-specific and depends on the length of time a loan has not been paid, the standard seems to be 60 days).

A platform or loan originator will buyback the loan from the lender (investor) so there are no losses realized on the loan.

Some platforms/originators even payback interest on the loan in the period the borrower was not paying the loan. Currently it seems to be mostly European lenders that offer Buyback Guarantees. Mintos being the largest Euro lender offering buyback guarantees on most of its loans.

Skin-In-The-Game

Another form of loan security is what it referred to as “skin-in-the-game”. This is when a P2P lending platform or loan originator lend money along side the lender/investor on a first-loss basis. So if the loan goes bad, the originator loses their money before the investor. Kuflink was the first lender in the UK to offer skin-in-the-game. Many of the Euro lenders have been offering this type of security for a while.

Amortization

There are many types of loans available out in the Peer to Peer Marketplace; fully amortizing, partially amortizing, interest only and bullet loans (balloon payment).

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over time (capital and interest in the case of P2P loans). It reduces the risk of the loan compared to a non-amortizing loan in which nothing is received until the end of the loan period, or only interest is received monthly (interest only), and then the capital repaid at the end of the loan period.

Balloon loans offer lower payment up front with a larger payment at the end of the loan period.

If you choose non-amortizing loans when they’re available, please make sure you understand the risk-reward, and also double check asset security values.

Regulation

Peer to Peer Lending in the UK is not insured by government banking insurance like the FSCS in the U.K. or FDIC in the U.S.A.

However in some countries P2P Lending companies are regulated by some entity like the Financial Conduct Authority (FCA) in the U.K. and the Securities and Exchange Commission (SEC) in the U.S.A.

Is Peer to Peer Lending Safe?

Is Peer to Peer lending Safe? If you do your research, Peer to Peer lending is as safe as virtually any other form of investment.

However do not compare P2P lending to storing your capital in a bank account with government insurance.

Peer to Peer lending in the UK is an investment, not a bank account with the associated insurances.

When investing through Peer to Peer lenders, as with most other investments, your capital is at risk and technically you could potentially lose it all.

Although in my opinion, providing you remember the investment “Prime Directive” and diversify properly, it would take a financial disaster much worse than the 2008 financial crisis to lose everything.

It would mean that every entity you loaned capital to would default. Unlikely in even the very worst scenarios.

A couple of companies like Zopa in the U.K. and Prosper.com in the U.S.A came through the 2008 crisis and are still around today!

When the 2008 crisis hit, investment returns went down for lenders, but most did not lose their capital.

Personally I don’t invest anything that I can’t afford to lose in a very worst case scenario.

That doesn’t mean it’s money that I can just throw away, it means that if the worst-case scenario did happen, I wouldn’t be bankrupt, but it sure as heck would hurt and cause me a lot of problems!

Risks of Peer to Peer Lending

What are the perceived risks with Peer to Peer Lending? The new Alternative Investment.

Defaults

The first of course are “defaults”. When borrowers don’t repay their loans as they have agreed in their loan agreements.

This happens all of the time in any type of lending environment and is an acceptable part of lending.

Pretty much all P2P lending companies will display to you an expected default rate based on your portfolio, and the interest rate you might expect to get after losses and fees.

These statistics are based on “normal market conditions” and would likely go out the window in a severe recession, high unemployment or other situation which caused borrowers to default on their loans.

Statistics

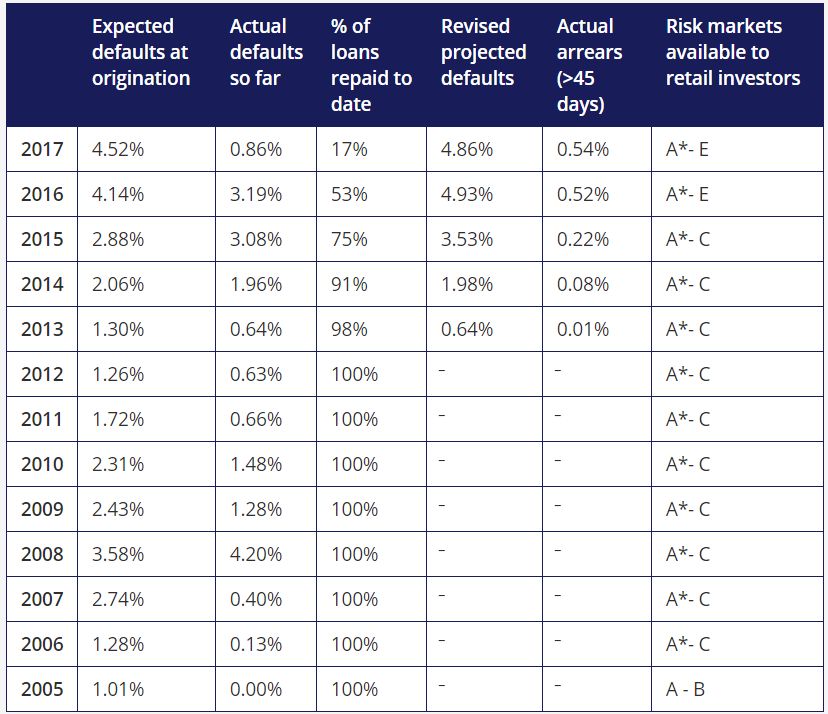

When they’re asked the question “is Peer to Peer lending safe?”, Most Peer to Peer lenders will point you to their publicly displayed loan default statistics on their websites, along with many other statistics so you can see how they’re doing.

The key here is to try and loan to borrowers with acceptable credit ratings, and even better when the loan is secured by an asset, which they often can be.

Here are Zopa’s (the oldest P2P Lender) default statistics, which they publicly display on their website:

The risk of early or late repayment

If your loan is repaid early or late, you could make less profit than you’d expected.

If a loan is repaid early, you can simply lend out the money again. But there is a chance that you might not be able to lend out at the same interest rate.

P2P lending and tax (this section specific to Peer to Peer lending UK investors)

Money earned through peer-to-peer lending is usually classed as income, so is taxable. Some people won’t pay any tax at all because of the personal savings allowance.

The personal savings allowance allows basic rate taxpayers to earn up to £1,000 of tax-free interest. Higher rate tax payers only have an allowance of £500.

Any interest earned above your allowance is paid at your highest marginal rate of tax. HMRC Has a special process for submitting Peer to Peer Lending income.

An Innovative Finance ISA (IFISA) allows P2P loans to be held in an individual savings account (ISA). This means you can receive interest from P2P loans tax free and avoid being taxed on any capital gains (usually only applicable for very large investments).

An IFISA allows you to lend up to an overall limit of £20,000 per tax year. The £20,000 annual contribution allowance is shared between all types of ISA: IFISAs, cash ISAs, lifetime ISAs, and stocks and shares ISAs.

You won’t need to declare any ISA interest, income or capital gains to HM Revenue & Customs on any gains in an IFISA.

Peer to Peer Lender Failure

The next risk is the Peer to Peer platform (Company) your are lending through goes out of business.

If this happened, who would service the loans and make sure you are getting your loan payments on time?

Remember you are mostly lending to the end borrower, not to the Peer to Peer platform.

Most Peer to Peer lenders have provisions in place in case the company was to go in to liquidation, in fact they have to if they are FCA regulated. They will need to have designated some other entity who would continue to service the loans until they are all paid off, and borrowers recoup their investments.

These provisions are usually publicly available for investors to see on the Peer to Peer lenders website. If they are not, then before you consider investing, make sure you contact the company and make sure you are comfortable with the provisions they have in place.

Fraud

Another risk is if owners of the Peer to Peer lender just decided to close shop. And run off with your money!

This is why it’s a good idea to invest in the larger and mostly regulated Peer to Peer lenders. Until you understand how they work it’s a good idea to be cautious.

P2P Lenders that are regulated by the FCA must adhere to certain standards around where they hold, and how they treat clients money.

There are exceptions to the rule like Mintos which is one of my favorite lenders, but is based in Latvia and therefore is not regulated by the FCA.

Mintos sheer size makes them a safer bet in my opinion. However that is just an opinion based on my experience so far.

I personally feel fairly safe with the Peer to Peer lenders I invest with that fraud won’t happen. But again, you never really know, even if they are regulated.

So make sure you diversify correctly and don’t invest anything that you couldn’t afford to lose if the very worst happens.

Summary

So is Peer to Peer lending safe? My feeling is that Peer to Peer lending is a relativity safe investment providing you do your research and be sure to diversify correctly.

I’m sure there are many other potential risks that I’m not discussing above, but I think these are the main risks to consider.

The key is to do some research on the Peer to Peer platforms you are looking to invest with. Then decide if the return you can potentially get is worth it for the risk you will be taking.

Remember; it’s your money and you’re responsible for investing it wisely.

Peer to Peer Lending in the UK is certainly a great option.

Here you can see Peer to Peer Lender Reviews and the P2P Lenders I currently invest with.

You can also see the actual return rates I am getting from each lender here.

THE HISTORY OF PEER TO PEER LENDING UK

History of Peer to Peer Lending UK

The first company to offer P2P lending loans in the world was Zopa. Since its founding in February 2005, it has issued over £3.5 billion in loans. Funding Circle became the first significant peer-to-business lender launching in August 2010 and offering small businesses loans from investors via the platform.

Funding Circle has lent over £1.93 billion as of January 2017. Both Zopa and Funding Circle are members of the Peer 2 Peer Finance Association (P2PFA).

In 2011, Quakle, a UK Peer to Peer lender founded in 2010, closed down with a near 100% default rate. This after attempting to measure a borrower’s creditworthiness according to a group score, similar to the feedback scores on eBay; the model failed to encourage repayment.

£250 million of loans issued

By June 2012, the top three Peer to Peer companies in the UK – RateSetter, Zopa, and FundingCircle – (Peer to Peer lender reviews here) had issued over £250 million of loans. In 2014 alone, they issued over £700 million.

In 2012, the UK government invested £20 million into British businesses via Peer to Peer lending in the UK. A second investment of £40 million was announced in 2014. The intention was to bypass the high street banks, which were reluctant to lend to smaller companies. This action was criticised for creating unfair competition in the UK, by concentrating financial support in the largest platforms.

Innovative Finance Individual Savings Account (IFISA)

Investments have qualified for tax advantages through the Innovative Finance Individual Savings Account (IFISA) since April 2016. In 2016, £80bn was invested in ISAs, creating a significant opportunity for P2P lending platforms. By January 2017, 17 P2P providers were approved to offer the product.

Many more Peer to Peer lending companies have also set up in the UK. At one stage there were over 100 individual platforms applying for FCA authorisation, although many have now withdrawn their applications.

Regulation

Since April 2014, the Peer to Peer lending UK industry has been regulated by the Financial Conduct Authority (FCA). This increases accountability with standard reporting, and facilitate the growth of the sector.

P2P lending investments do not qualify for protection from the Financial Services Compensation Scheme (FSCS). Which provides security up to £75,000 per bank, for each saver. Regulations mandate the companies to implement arrangements to ensure the servicing of the loans even if the platform goes bust.

In 2015, UK Peer to Peer lenders collectively lent over £3bn to consumers and businesses. Although on an annual equivalent basis the value of the loan book figure was £2.3bn in 2015. Which increased to £3.2bn in 2016.

According to the Cambridge Centre for Alternative Finance (Entrenching Innovation Report). £3.55B was attributed to Peer to Peer alternative finance models. The largest growth area being property showing a rise of 88% from 2015 to 2016.

History of Peer to Peer Lending in the USA

The P2P lending industry in the U.S.A started in February 2006 with the launch of Prosper.com. Followed by LendingClub.com and other lending platforms soon thereafter. Both Prosper and Lending Club are located in San Francisco, California.

Early Peer to Peer platforms had few restrictions on borrower eligibility. This resulted in adverse selection problems and high borrower default rates. In addition, some investors viewed the lack of liquidity for these loans. Most of which have a minimum three-year term, as undesirable.

SEC

In 2008, the Securities and Exchange Commission (SEC) required that P2P lending companies register their offerings as securities, pursuant to the Securities Act of 1933. The registration process was an arduous one; Prosper and Lending Club had to temporarily suspend offering new loans. While others, such as the U.K.-based Zopa Ltd., exited the U.S. market entirely.

Both Lending Club and Prosper gained approval from the SEC to offer investors notes backed by payments received on the loans. Prosper amended its filing to allow banks to sell previously funded loans on the Prosper platform.

Both Lending Club and Prosper formed partnerships with FOLIO Investing to create a secondary market for their notes, providing liquidity to investors. Lending Club had a voluntary registration at this time, whereas Prosper had mandatory registration for all members.

Liquidity

This addressed the liquidity problem and, in contrast to traditional securitization markets, resulted in making the loan requests of Peer to Peer companies more transparent for the lenders and secondary buyers who can access the detailed information concerning each individual loan (without knowing the actual identities of borrowers) before deciding which loans to fund.

The Peer to Peer companies are also required to detail their offerings in a regularly updated prospectus. The SEC makes the reports available to the public via their EDGAR (Electronic Data-Gathering, Analysis, and Retrieval) system.

Financial Crisis

More people turned to Peer to Peer companies for lending and borrowing following the financial crisis of late 2000-s. This was because banks refused to increase their loan portfolios. On the other hand, the P2P lending market also faced increased investor scrutiny because borrowers’ defaults became more frequent and investors were unwilling to take on unnecessary risk.

The interest rates range from 5.6%-35.8%, depending on the loan term and borrower rating. In the U.S.A. The default rates vary from about 1.5% to 10% for the more risky borrowers through Prosper and Lending Club.

Also we are seeing big-shot executives from traditional financial institutions are joining the Peer to Peer companies as board members, lenders and investors. Indicating that the new financing model is establishing itself in the mainstream.

Is Peer to Peer Lending Safer in the USA than in Europe or the UK?

So taking everything in to consideration; is Peer to Peer lending safer in the USA? I don’t believe so personally. My feeling is that the regulation in the UK makes it a safer environment than the USA. And Euro Peer to Peer lenders pay much higher rates than the USA lenders for a similar risk. P2P lenders in the USA generally don’t offer provision funds or buyback grantees either.

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.