Finally an update! As per my last post, I’ve been working on updating the website with a new theme and look. So I thought it was time to actually give an update to the content subject of the site including an update on the Peer to Peer lending sites I’m still investing with.

I decided this month to call this an “Investment Update” instead of the usual “P2P Lending Update” as I’ve had some messages requesting I talk a little bit about the other investment portfolios on the site as wall as the P2P investments. I’ll do that at the end though so if you’re only interested in the Peer to Peer lending stuff, you can skip it if you choose.

So with that in mind, I’ll focus first of all on the P2P Lending Portfolio and explain what I’m doing with each lender now, and then move briefly to discuss my other investments. This update will cover investments to the end of March 2021.

Peer to Peer Lending Sites & Portfolio Update

At a high level, by the end of March 2021 I’m back up to about 55% of my highest GBP P2P investments with £122k invested in GBP Peer to Peer platforms. I’ll be increasing a lot more through April (as of this writing, April 13th, I’m already invested another £50k).

Many of the Peer to Peer lending sites I previously invested with have either gone out of business, or are no longer accepting retail investors because they have been purchased by a bank (RateSetter) or they are part of the UK Government CBILS program which guarantees loans to small businesses throughout the COVID pandemic. Retail investors are not allowed to invest in these types of loans.

I won’t be saying much about Peer to Peer lending sites I’m no longer invested in as I don’t see the point. So I’ll focus on the Peer to Peer lending sites I’m continuing to lend with and also I’ll be looking to add more platforms as we move forward. I already added easymoney in April which I’ll talk more about in my next update when I get a little more experience with them.

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all platforms, and it has no effect on my ongoing opinions on platforms, which are entirely focused on generating Income from my investments and preserving capital.

Individual Peer to Peer Platform Updates

Ablrate have kept plodding on throughout the pandemic. They’ve had some issues with late loans and defaults (as have many lenders), but generally I believe they are doing ok.

I drew down many of my loans with Ablrate as I was not sure how they would fair throughout the pandemic. My current investment balance is quite low and I’m not sure if I’ll increase it anytime soon. The main reason being the work involved to invest in Ablrate loans.

Ablrate still have about about 10% of their loans late or in default, but it’s going in the right direction (it got up to about 20% throughout the pandemic) so I think they faired quite well and are recovering slowly.

Ablrate still seem to be a strong platform with great returns available if you’re willing to put in the work.

Here is a view of my Ablrate account as it stands at the end of March 2021.

My current Ablrate Investments (as you can see, only 1 late currently)

My Ablrate Strategy.

There are some great returns available through Ablrate if you’re willing to put the time in to do the research and buy the best loans. Up to 15% per annum. One of the best rates of all UK Peer to Peer lending sites.

For some it will be totally worth the effort. For me with my “Lazy Investor” attitude, the time commitment required exceeds my enthusiasm at the moment. That may change in the next few weeks, but for now I don’t have the time to diversify a significant amount of capital in the way I would like.

If you do have the time to spare, Ablrate are one of the best paying lenders out there as far as returns go. The fact that they are still around after the pandemic also has to say something about their business model and the saftey of the platform.

Ablrate Signup & Cashback Offers

£50 Ablrate Cashback on £1000+ investment for New Investors

Use this link to qualify for Ablrate cashback or to signup >>>

See Full Assetz Capital Review

Visit WebsiteAssetz Capital are recovering well from the pandemic. I think they were surprised by the liquidity crunch in their Access Accounts, but to their credit they took action and sorted it out.

Assetz implemented a discounting system for the Access Accounts enabling investors who REALLY wanted their capital out now to offer a discount in order to do so. The discounts were as high as 10% at some points but it seemed the average since they launched the discount scheme was around 5% or 6%

Now things are almost back to normal and there is no discount required to get out of the Access Accounts early now unless its a huge amount of capital. In which case you might have to discount a bit to get out instantly. Otherwise you could wait a bit and get out for free.

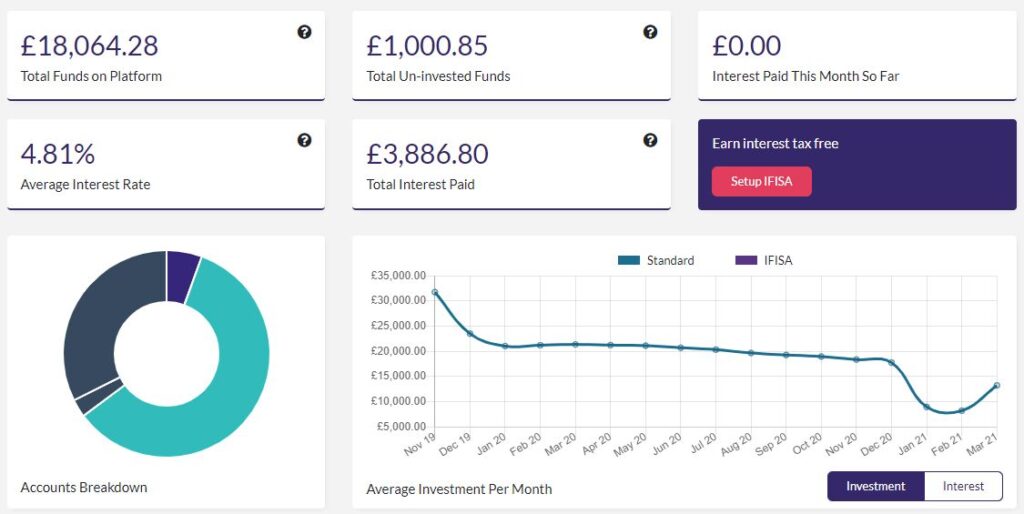

Here’s what my Assetz Capital account looks like now:

My Assetz Capital Strategy.

I started to increase my investment in Assetz Capital once things started to look like they were getting back to normality. Right now I’m a little over £18k invested with them and I’ll probably increase more as things get back to baseline normal.

I like Assetz, they were my biggest P2P investment account at one point, but when the pandemic hit and the liquidity squeeze came on, I think it surprised everyone (including me). Assetz Capital are still here after the pandemic, and I can see they are much stronger for the experience.

Assetz Capital Signup & Cashback Offers

No current Cashback Offers

Use this link to check for new offers or to open account >>>

CrowdProperty were largely unaffected by the pandemic. There were a few late loans but overall it was “business as usual”. If anything they benefited from COVID.

CrowdProperty wrote more loans in a month throughout the pandemic than they did in many months before the crisis.

Loans are filling up faster than ever! I used to complain that you had to be fast because loans filled up in a few minutes. Now they fill up in seconds (or less than a second in some cases).

You can still get a good chunk of capital into a loan if you’re fast, but you have to be sat near the computer when the loans go live (usually 10am UK time, then in 10 minute intervals after that if there are more than 1 loan for the day).

CrowdProperty offer property secured development loans, all with first legal charge and reasonable LTV’s. I continue to feel like the loans they have written are well vetted, and are some of the safer development loans available in the P2P market. In fact they all but proved this by the way their business prospered throughout the pandemic.

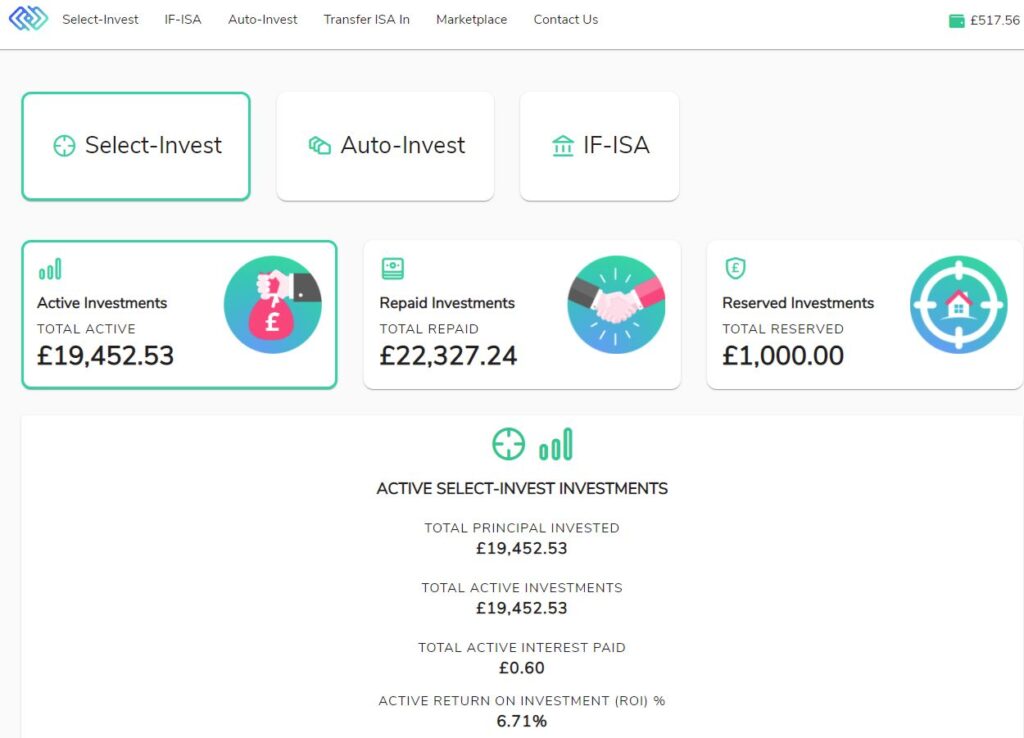

Here’s a screenshot of my CrowdProperty account at the end of March 2021.

Here are some of the loans I have been able to invest in recently

My CrowdProperty Strategy.

My strategy since the beginning with CrowdProperty is to invest £500 into almost every loan they have. I do a little due diligence on each loan before it goes live. Once in a while I see something I don’t like the look of and I don’t invest in that particular loan. Overall though, that happens very infrequently so it’s pretty much £500 into each loan.

Just as a side note, in April I’m already £10k more in to CrowdProperty with an account balance of around £30k.

CrowdProperty Signup & Cashback Offers

No current cashback offers from CrowdProperty.

Use this link to go to CrowdProperty’s website and check for new offers, or to open an account >>>

See Full Funding Circle Review

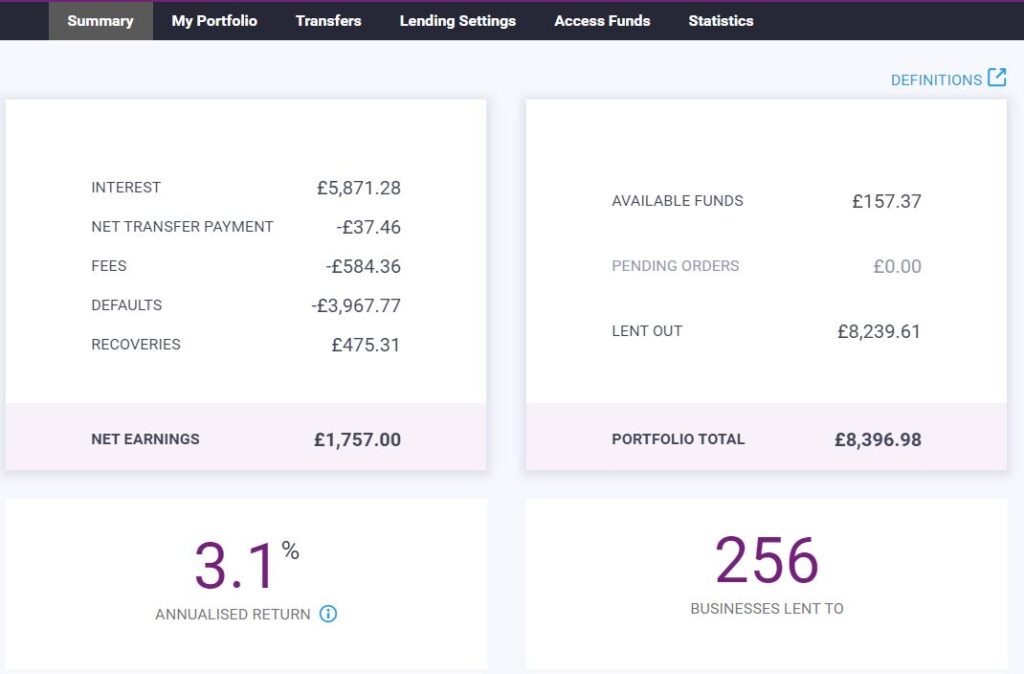

Visit WebsiteFunding Circle were not so bad when I first invested with them several years ago. Returns were good and there was a reason they got to be one of the biggest lenders out there.

Unfortunately when they went public on the open stock market in 2019, instead of focusing on what had made them successful, they relaxed their lending criteria in order to try and make their bottom line look better. They wrote a bunch of bad loans with relaxed lending criteria. Investors got to pay for these mistakes (I’m one of them).

When investors (lenders) realized what had happened, they started to pull out their capital fast by selling loans. This caused a liquidity problem so now it’s difficult for any investor to get their money out faster than waiting until all of the loans pay back or go into default.

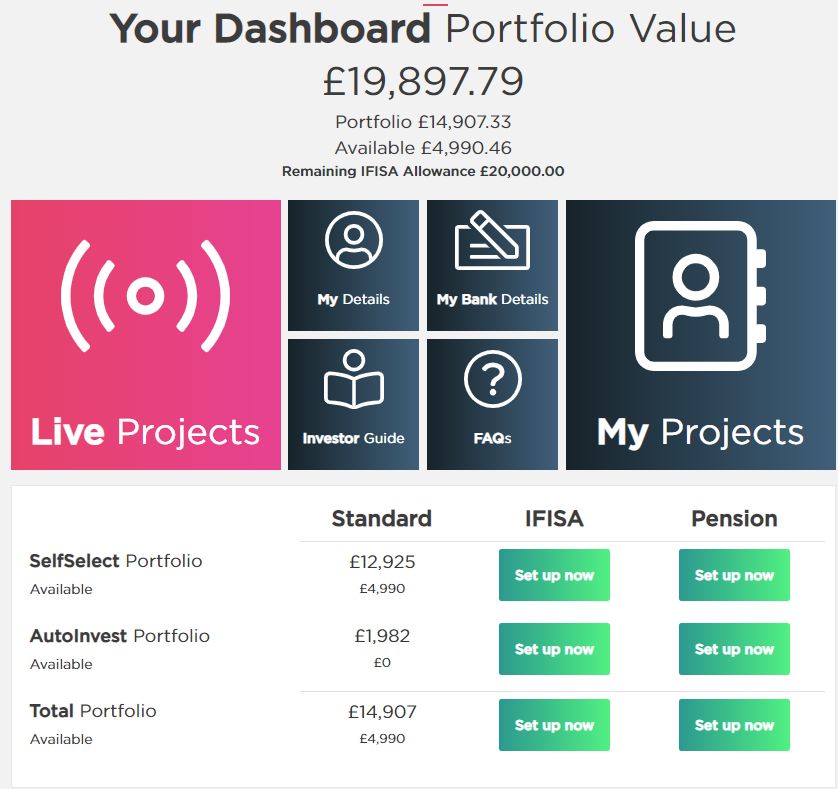

Here is how my Funding Circle account looks now (the 3.1% returns indicated is misleading).

My Funding Circle Strategy.

I’ve been drawing down my Funding Circle account since July 1st 2019 – trying to sell out and get my capital back after the events outlined above. Funding Circle still have no liquidity, and all I’m doing is receiving monthly loan repayments as loans are paid back. I will not be investing new capital with Funding Circle for the forseeable future. Never say never though. Maybe they’ll get back to lending as they used to one day.

See Historical Growth Street Review

Growth Street got killed by the COVID pandemic. Just to give you an overview (then this section will be gone in the next update)

Growth Street had to declare a “Liquidity Event”, which then became a “Resolution Event”, which then became an orderly wind-down of the company. To be fair though, credit where credit is due, the Growth Street team stuck with the wind down and got ALL of investors capital returned PLUS INTEREST!

I’m really disappointed Growth Street have gone. I really liked them before the crisis. I was not happy with they way they changed T&C’s at last minute when the pandemic hit though, so credibility was already tarnished with many investors.

Kuflink seem to go from strength to strength. They came through the pandemic largely unaffected. Few delayed loans but nothing more serious.

They are still bringing new loans to the platform en-mass, and the loans are still being filled quickly. I speak with Kuflink staff quite regularly and they are a great team. They all seem very excited about how well Kuflink is doing and they see a bright future for the company.

I’m happy Kuflink are doing well. They deserve it. Kuflink offers a very fair return for the associated risk.

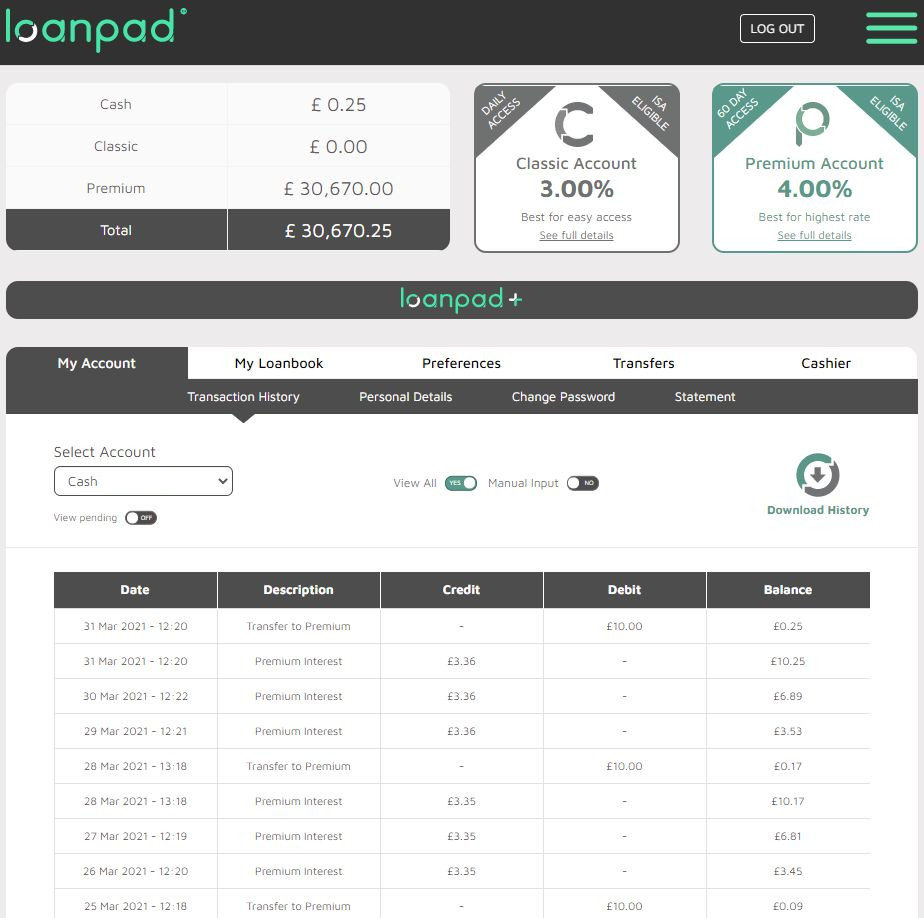

Here is a snapshot of my Kuflink account

Here are a few of the loans I have invested in recently (click to enlarge)

My Kuflink Strategy.

I continue to invest £500 in to almost every loan Kuflink brings with a LTV over 50%. For loans with LTV’s under 50%, I invest £1000. As with CrowdProperty I do a little due diligence and if I see something I don’t like, then I don’t invest. That does not happen often though as Kuflink do great due diligence themselves, so it’s pretty much £500 or £1000 into every loan.

Just as a side note, in April I’m already £10k more in to Kuflink with an account balance of around £30k.

Kuflink Signup & Cashback Offers

New Kuflink customers receive the following Kuflink cashback on an investment of £1000 or more when they use signup links from obviousinvestor.com. Must invest into loans within 14 days of first investment to qualify for cashback.

| Investment amount | Cashback |

| £ 1,000.00 – £ 5,000.00 | 2.50% |

| £ 5,000.01 – £25,000.00 | 3.00% |

| £ 25,000.01 – £50,000.00 | 3.50% |

| £ 50,000.01 – £99,999.99 | 3.75% |

| £100,000.00 | 4.00%* |

*Cashback capped at £4,000.

Use this link to signup & qualify for the current Kuflink cashback offer >>>

I decided to retrieve capital (where possible) from lenders who have unsecured loans to reduce my overall exposure to Peer to Peer lending when the pandemic hit. Although LendingCrowd do have some secured loans, many just have directors personal guarantees. Historically, trying to recover from just these personal guarantees has been hit and miss. So, I made an early decision to withdraw my capital.

I was able to sell about 75% of the loans as I was early to start selling in March 2020.

Repayments have still been coming in slowly for the last year and LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors. Hopefully when things get back to some form of normality, LendingCrowd will open its doors to retail investors again.

Here is a screenshot of how my account looks currently

My LendingCrowd Strategy.

As mentioned previously; LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors.

As soon as they start accepting investments again, I’ll make a decision on if & when to increase my investment again with LendingCrowd.

When COVID first hit, I was able to sell almost all of my Lending Works loans and get out right before the liquidity run came and everyone was trying to withdraw. I made the decision to do this at the time because I knew that Lending Works were an unsecured lender and therefore a much riskier proposition in the event of a serious recession.

As expected, Lending Works struggled with liquidity throughout 2020. They upset a lot of investors because of the extra charges they were implementing against investors in order to try and stay afloat, me included. When I withdrew my funds, I was hit with extra charges because of the shortfall in loan rates.

Jump one year ahead, and Lending Works now think they have a handle on things. I read their emails, and spoke to a few of their team and they seem to be doing better. Time will tell.

I decided to give Lending Works another try in February when I deposited £10k with them to see how they do.

Here is a screenshot of my account

My Lending Works Strategy.

Unfortunatley since depositing the £10k mentioned above in Febuary, it has still not been lent out and is therefore not making any returns. I’m seriously considering pulling it out of Lending Works and placing it with another platform until they get there stuff together.

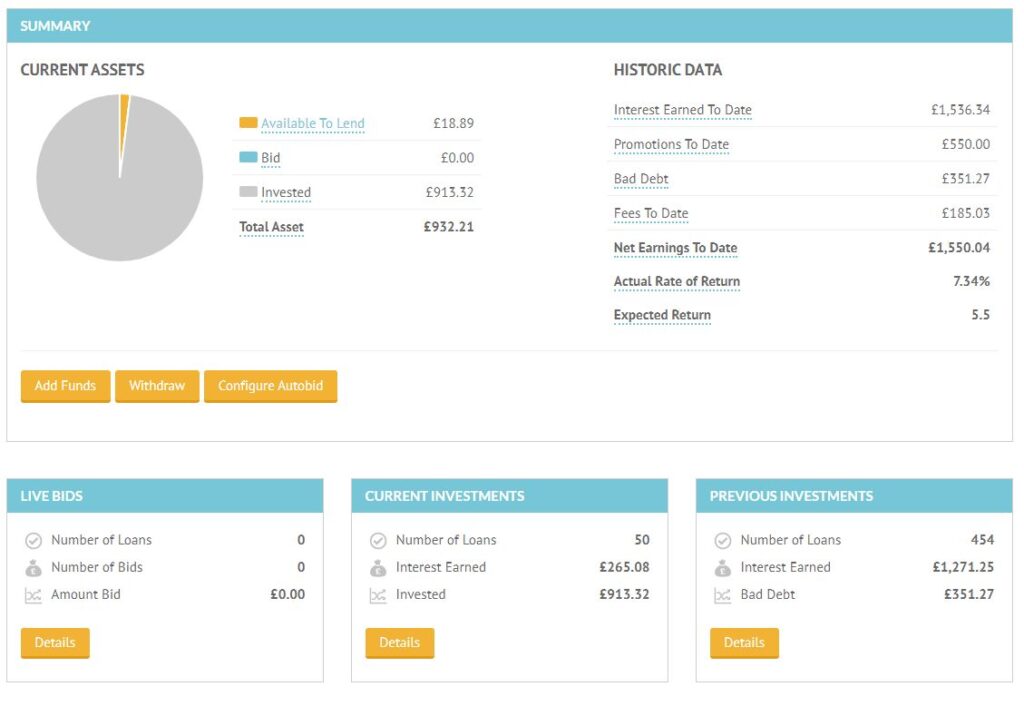

Loanpad are one of the only lenders with “Quick Access” accounts (Loanpad call their account the “Classic” account) who did not run in to liquidity issues throughout the pandemic. I was able to withdraw or invest capital at any time over the last year without issue.

They did lower the returns for their accounts a bit (as did almost all other platforms) but I am still getting 4% (which is almost 5% with reinvestment, see my Loanpad Review to understand how that works with Loanpad).

So, because of my experience with Loanpad, and the security their accounts offer, they are now my largest lending account (by far). At the end of March the account balance was at £30k, and I’ll give you a little heads up that in April it’s already at £50k.

Here is a screenshot of how my account looked at the end of March

My Loanpad Strategy.

As mentioned above, I’ve continued to increase my investment with Loanpad substantially. Already in April I’m at £50k and (for now at least) that’s enough for a single lender. The great thing about Loanpad is; it’s a completely hands-off investment. Set up the auto-invest and everything just works like clockwork. No need to do anything after that.

I realize the amount I have invested with Loanpad is higher than I would normally allow with my diversification rules. However because of their low LTV loans, and the fact that they came through the pandemic unscathed. I’m perfectly comfortable with my investment in this case. Now, as I find new lenders that perhaps pay a little more income for a reasonable risk, I may diversify some of this capital into other platforms.

Loanpad Cashback Offers

£50 bonus if you invest into a lending account a minimum of £5,000 within 4 weeks post registration and keep it invested for 1 year

£100 bonus if you invest into a lending account a minimum of £10,000 within 4 weeks post registration and keep this invested for 1 year.

Use this link to signup & qualify for Loanpad cashback offers >>>

Mintos had several loan originators go into default or liquidation over the past year. I was able to draw out about 50% of my Euro investments over time, but Varks Armenia (part of the Finko Group) lost it’s lending license in March, and guess who most of my short term loans were with 🙄

Mintos looked at Varks and the Finko group guarantee (where larger corporations are responsible for buyback guarantees of their subsidiaries), however they determined that to enforce the guarantee could potentially take the whole Finko group down. So now we have a “promise” by Finko that all loans will be paid back by 2022. Not great news but there you go.

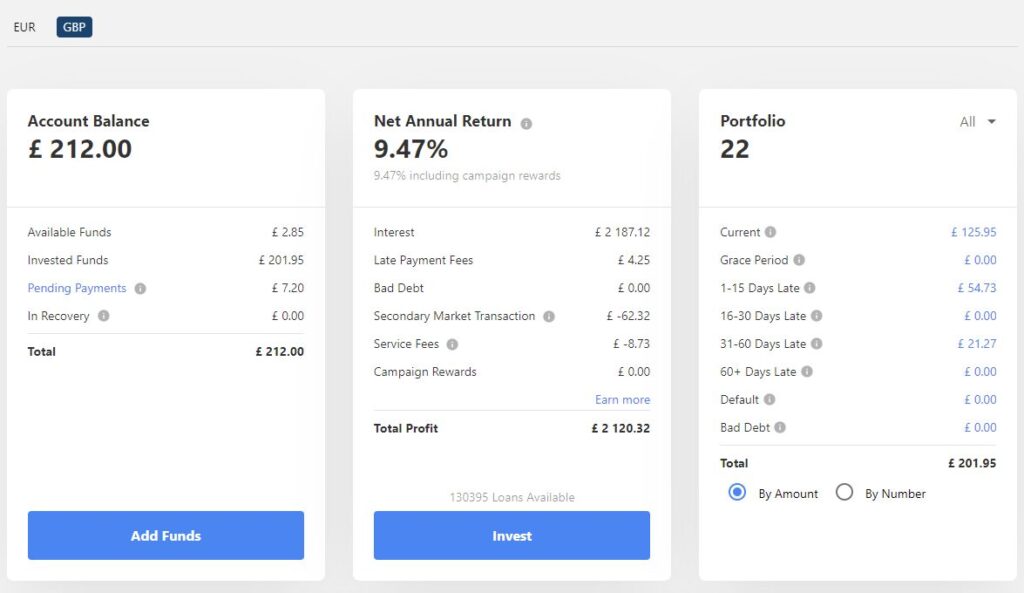

I sold down many of the Mogo GBP car loans just because they are finished anyway (no new GBP car loans on Mintos now), and I thought better to reduce exposure to Mintos as a whole. I still have about £200 in Mogo loans which have been paying back slowly.

My Mintos Account Summary (click to enlarge).

My Mintos Strategy.

Unfortunately Mintos no longer allows investments from UK residents in GBP so there is not much choice there as far as investing in Mintos for most folks.

I still have a bunch of money stuck in Euros as you can see from the screenshot above, so until I get that back, I’m not investing any more in Mintos.

Mintos are also trying to become a regulated platform which would be great and would instill a lot of confidence from investors.

I like Mintos and their general business model. If you’re investing with them in Euros, make sure you keep an eye on the LO’s (Loan Originators) and make sure you have good diversification.

See Historical Octopus Choice Review

I exited Octopus Choice in March 2020 when the pandemic first hit.

Since then Octopus Choice had to close the platform because of the lack of liquidity throughout the pandemic. As far as I know, all investors capital was returned and I retrieved every penny of my capital & interest. So good luck to the staff from Octopus Choice for the future & RIP the OC platform.

Another platform killed by the COVID pandemic.

I’ll remove this section from the update as it serves no purpose moving forward.

See Historical RateSetter Review

RateSetter was acquired by Metro Bank at the beginning of August 2020. Here is the announcement

I exited RateSetter March 2020 and I was lucky to get out before the liquidity problems set in.

RateSetter really struggled throughout the pandemic (unsecured lending, go figure). They were eventually purchased by Metro Bank and have now returned all investors capital and are not accepting retail lenders anymore. I guess Metro Bank will be funding all the loans.

I’ll remove this section from the update as it serves no purpose moving forward.

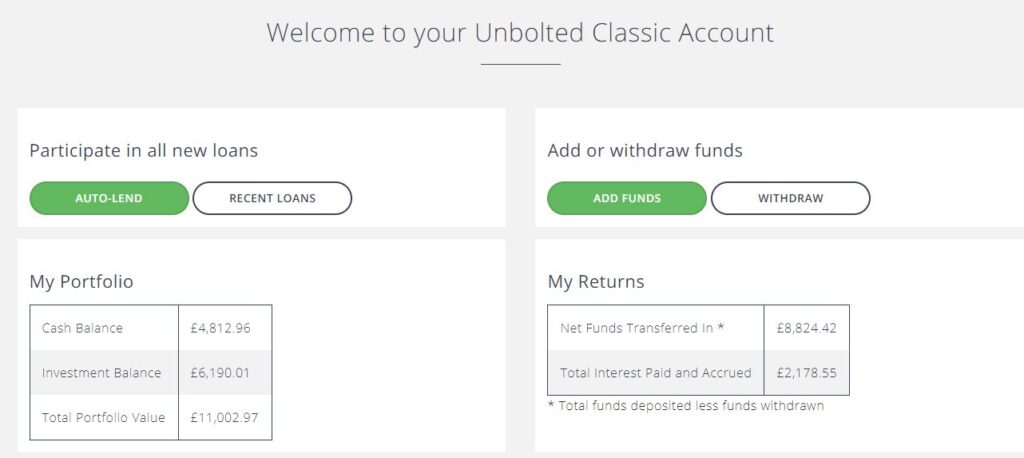

Unbolted were largely unaffected from the COVID 19 situation. I think the only problem they had were new loan volumes reduced a bit so it was difficult for investors to get capital distributed. I myself had a lot of cash drag (and still do).

In case you’re unfamiliar; Unbolted offer pawnshop style loans to the general public with very liquid assets. These types of assets can be sold very quickly upon default so the demand for Unbolted loans exceeds the available loans.

I have been lending with Unbolted for a few years now, and although there have been many defaults, assets have always sold at more than the outstanding loan principle and I have always been paid back both principle and interest very quickly. Loans are short to medium term in nature so a complete exit can be had by turning off auto-invest within 3 to 12 months.

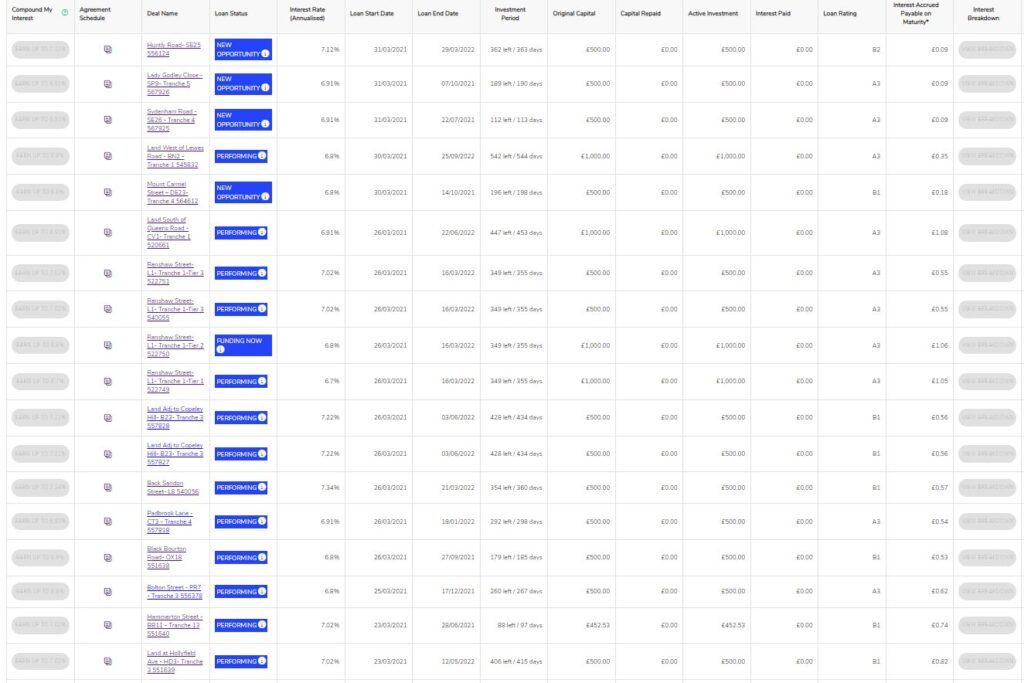

Here’s a screenshot of my account as it stands March 31st, 2021.

My Unbolted Strategy.

I would happily invest more capital in Unbolted if I could get it invested without the cash drag (you can see how much cash balance I have from the screenshot).

As capital gets invested I will increase investment in Unbolted by a significant number. The question is; when will this happen of course.

Unbolted Signup & Cashback Offers

No current offers.

Use this link to signup with Unbolted >>>

UOWN have decided to pull out of FCA regulated lending and cater only to HNW (High Net Worth) individuals & institutional investors. Although I qualify for this type of investment, I like the fact that UK Peer to Peer platforms are regulated and therefore have certain controls that unregulated businesses don’t have. I think it saved many investors throughout the last year of the pandemic. So I decided to draw down my UOWN investments.

My UOWN Strategy

I sold down my rental investment shares and will withdraw capital from my other investments as soon as they are repaid.

EURO Lenders Update

I have been drawing down my Euro investments slowly as because I live in Portugal much of the time, when I’m here I live on Euros. So I have been using the Euros that I have invested in Euro Lenders for living expenses.

Typically I would change US Dollars or GB Pounds for Euros, but the Euro has been rising rapidly recently against the USD, and the GBP has still not recovered fully from Brexit. So I decided to use the Euros I have before changing more at this high rate in the hope it comes back down soon.

If you have Euros to invest and are looking for ideas. There are a few Euro Lenders that have come through the pandemic and seem to have been largely unaffected, namely Crowdestor, Swaper, Peerberry & Robocash have all done what they are supposed to do. I will invest in these all again once I am ready to invest Euros again. I believe they are all decent investable companies paying very good returns. Mintos is also worth investing in as long as you realize you’re not investing in Mintos, you’re investing in their LO’s, and as such you should pay more attention to them than to the platform.

Securities, Bonds, Gold & Crypto Portfolios

USD Growth Portfolio

My main Growth Portfolio is doing as expected. REITs took a tumble at the beginning of the pandemic. Actually all assets got hit initially as panic set in, but REITs got hit the hardest losing around 50% of their value in a few weeks. Crazy stuff! That’s what panic does for us.

As always happens, the “safe haven” assets (Bonds & Gold) picked up the slack and started to rally just as they always do when the “big money” (funds) start to move capital into those assets as a safety hedge. The portfolio performed admirably throughout the pandemic after the initial “shock drawdown”.

If you look at the other portfolios based on Harry Browne’s Permeant Portfolio, you’ll see that this Growth Portfolio beats them hands down with just the addition of the REITs. Although all of the Permanent Portfolio assets did as expected.

You may have noticed that the returns numbers have increased significantly for this portfolio. That’s because before I was using inflation adjusted data. I decided to stop that as the data is difficult to correlate so now it just the raw numbers. If you need to know how that looks historically against inflation, you’ll need to do some number crunching yourself 🙂

Permanent Portfolios (all currencies)

Portfolios based on Harry Browne’s Permanent Portfolio strategy are all still doing well and as expected. They all experienced some drawdown when the pandemic first hit, but nothing out of the ordinary. 7% – 12% drawdowns with these portfolios are a regular occurrence.

None of them perform as well as the USD Growth Portfolio because the portfolios that are not in USD currency are not based on the US markets (historically some of the worlds top performing markets), plus they don’t have the added exposure to REITs and the high dividends they bring. The only difference between the USD Growth Portfolio & the USD Permanent Portfolio are the REITs, so you can see by looking at that the difference they make over time.

The Recovery Portfolio

Our newest portfolio is doing exactly as expected. I haven’t had chance to put together a tracking spreadsheet yet, but we can see using Portfolio Visualizer pretty much how we’re doing. If you Click here you can see the live test for yourself. Just to give you a quick overview though;

You can see below where we were in January (this image from the original post)

And this is where we are currently

As you can see from the charts, all sectors are returning to their average growth lines as expected.

The question will be of course when it gets there, will I balance the portfolio out with bonds and other assets, keep it as is, or sell it and take a profit? 🤔 This portfolio under normal circumstances is very aggressive and could be subject to large drawdowns so I’ll need to make a decision when the target is hit.

Crypto Currency Portfolio

I use Kraken for my Crypto Portfolio

Visit KrakenThis really is a volatile one (again, as expected). As I write this, I’m up about £2k, having been up almost £4k at one point last week (that’s on a £11k investment remember, in 2 months).

The thing I have to remind myself with this portfolio is that it wasn’t made as a growth portfolio as such, but a “punt portfolio” as outlined in the original blog post. It’s always nice to be up a bit though 🙂

Here is a screenshot of my Kraken App

I have also been learning over the last few weeks about “Crypto Staking”. Have you guys heard of that? Because I’m such a newbie to Crypto I hadn’t, and it seems too good to be true. Basically you “Stake” your Crypto assets to the network, and they pay you a percentage every couple of weeks (PolkaDOT pays 12% per annum). It seems like there is very little downside except for possible tax implications for some folks. It is also possible that you couldn’t get the Crypto out of staking right away if you needed it, but that’s not a major bother for me as I’m in it for the long term. Also this is a rare occurrence apparently.

I’ll let you know how it goes as I’m going to try by staking some of my DOT and see what gives.

Summary

That’s all for this update. Now things are settling down a bit with the new baby (he’s walking already), I hope to be able to do more frequent updates on my portfolios for you.

I need to get more capital distributed into Peer to Peer lending, so I’ll be looking for some new platforms in the coming months. I’ll post back what I find in my updates.

Good luck with your investments in the coming months!

My best to you and your families. Stay safe and I’ll post an investment update again soon.

Maturing Whisky Portfolio

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

฿ – Cryptocurrency Portfolio

£ – GBP Peer to Peer Lending Portfolio

£ – GBP Permanent Portfolio

€ – Euro Permanent Portfolio

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

$ – US Dollar Growth Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Lending Works post: *their

And for those who don’t know, the Irish currency used to be called the Punt. And the Irish are known for saying “it’s worth a punt” which means “worth a gamble” or a bet.

Funny that.