This is the first update in a couple of months. I was sick for a couple of weeks at the beginning of October, then traveling for the rest of the month so just didn’t get around to sitting down and writing an update for October. So I apologize to anyone who was waiting for the update that never came.

Overall nothing out of the ordinary happening with any of the investment portfolios in September/October.

The Peer to Peer lending Portfolio income was down in October to £277 after a better than average month in September of over £1,100. This is due mainly to the property values with Assetz Exchange decreasing a bit after they announced a more permanent cap on prices, and income from a couple of platforms which have variable monthly incomes were also down a bit. I’m still not sure how to track the Assetz Exchange data as it’s the only P2P platform I use where property values can go up or down as well as rental income coming in every month and obviously it affects the overall portfolio significantly when property prices fluctuate. I’ll keep looking at it and see if I can change things to be more income reflective.

The Crypto Portfolio has screamed up over the last couple of months ending October with almost $40k in profit. That’s within 3 months from being down $15k+ in July. Crazy volatile but I’m not complaining 🙂

Growth Portfolios sold off a bit over September & the beginning of October but were almost back to their highs by October 31st. Everything within normal ranges though. 10% pullbacks in these portfolios are totally normal.

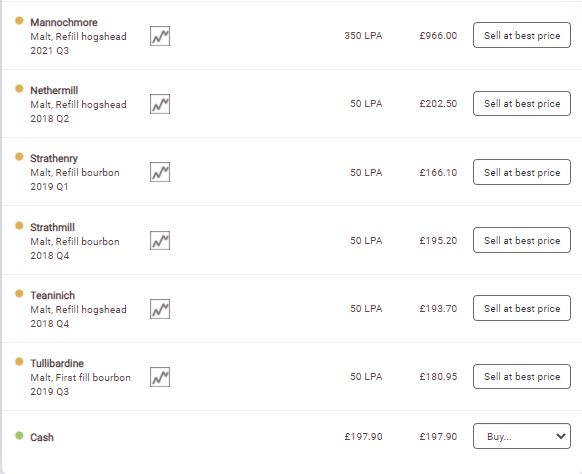

I’m still in the process of building the Whisky Portfolio so more on that below.

With that, we’ll move on to the individual portfolio updates.

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Peer to Peer Lending Platforms & Portfolio Update

Total Peer to Peer lending investment decreased a little from £196,912 in September to £190,857 at the end of October. This was due to me withdrawing some money from Assetz Capital and Loanpad to invest into the Whisky Portfolio, and I also pulled some out for some new deals that are coming in November from Asset Exchange. Overall XIRR is down just a bit to 5.41% due to the the lower income and also I think some of the platform rate decreases are affecting it. My strategy moving forward is to try and increase that by moving some funds to higher paying investments without compromising safety by a large amount. All lending figures are available on the Tracking sheet in the Peer to Peer Lending Portfolio.

In October I added just a little more capital to CrowdProperty to bring repaid capital to a round number for a new loan investment, and also added capital to Assetz Exchange which brought out a new charity loan, so I had to have some of that.

Apart from that, it was a very quiet couple of months in Peer to Peer lending, with everything else just about normal.

You can always see the live Peer to Peer Lending Portfolio data here >>

Individual Peer to Peer Platform Updates

Ablrate again brought a couple more nice loans in October. I’m definataley going to start moving some more capital over there if I can get time to do the due diligence. Probably about the highest paying platform out there right now for GBP investments.

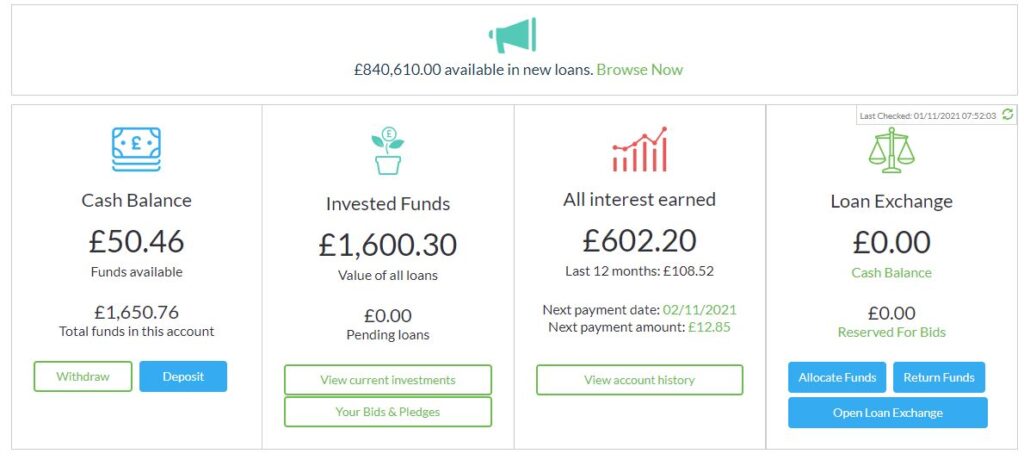

Here is a view of my Ablrate account as it stands at the end of October 2021.

The same 2 loans have been on hold for several months now due to the company assets being liquidated. Hopefully that will be done soon so we can get our capital back. It’s not much capital investment for me though so I’m not too worried about it.

There will always be defaults with higher risk loans like are available on Ablrate. The thing to watch is how they are dealt with by the platform. Ablrate have a very good track record of recovering funds upon default, although of course this can take a long time. I’m happy in this case that with both loans I had risked very little capital.

My Ablrate Strategy.

There are some great returns available through Ablrate if you’re willing to put the time in to do the research and buy the best loans. Up to 15% per annum. One of the best rates of all UK Peer to Peer lending sites.

For some it will be totally worth the effort. For me with my “Lazy Investor” attitude, the time commitment required exceeds my enthusiasm at the moment. That may change in the next few weeks, but for now I don’t have the time to diversify a significant amount of capital in the way I would like.

If you do have the time to spare, Ablrate are one of the best paying lenders out there as far as returns go. The fact that they are still around after the pandemic also has to say something about their business model and the saftey of the platform.

Ablrate Signup & Cashback Offers**

£50 Ablrate Cashback on £1000+ investment for New Investors

Use this link to qualify for Ablrate cashback or to signup >>>

See Full Assetz Capital Review

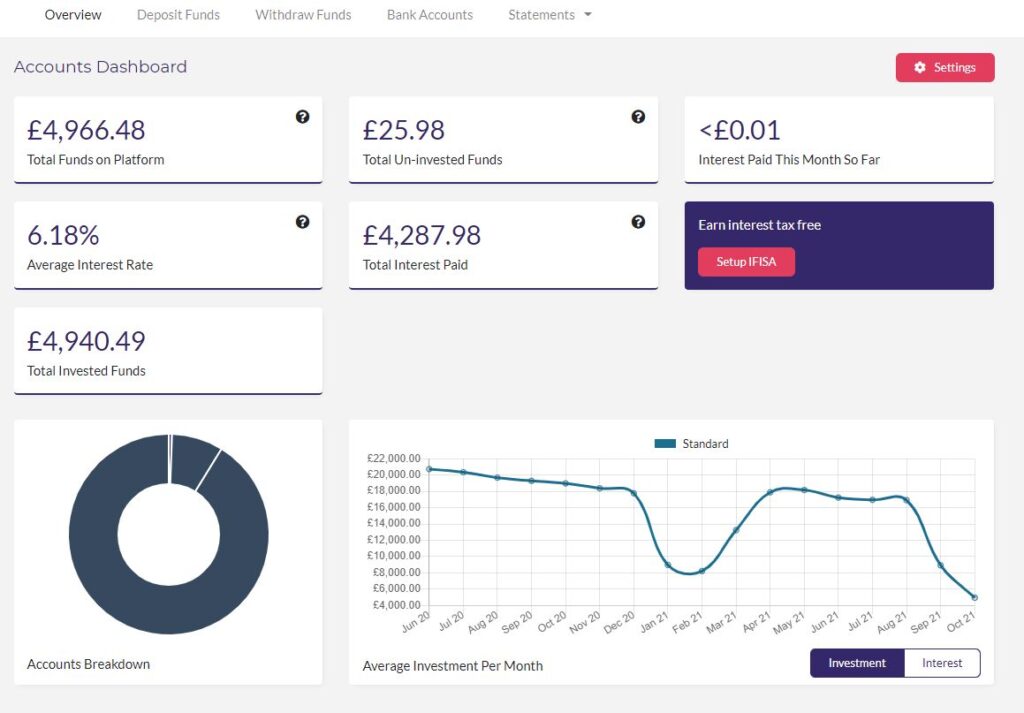

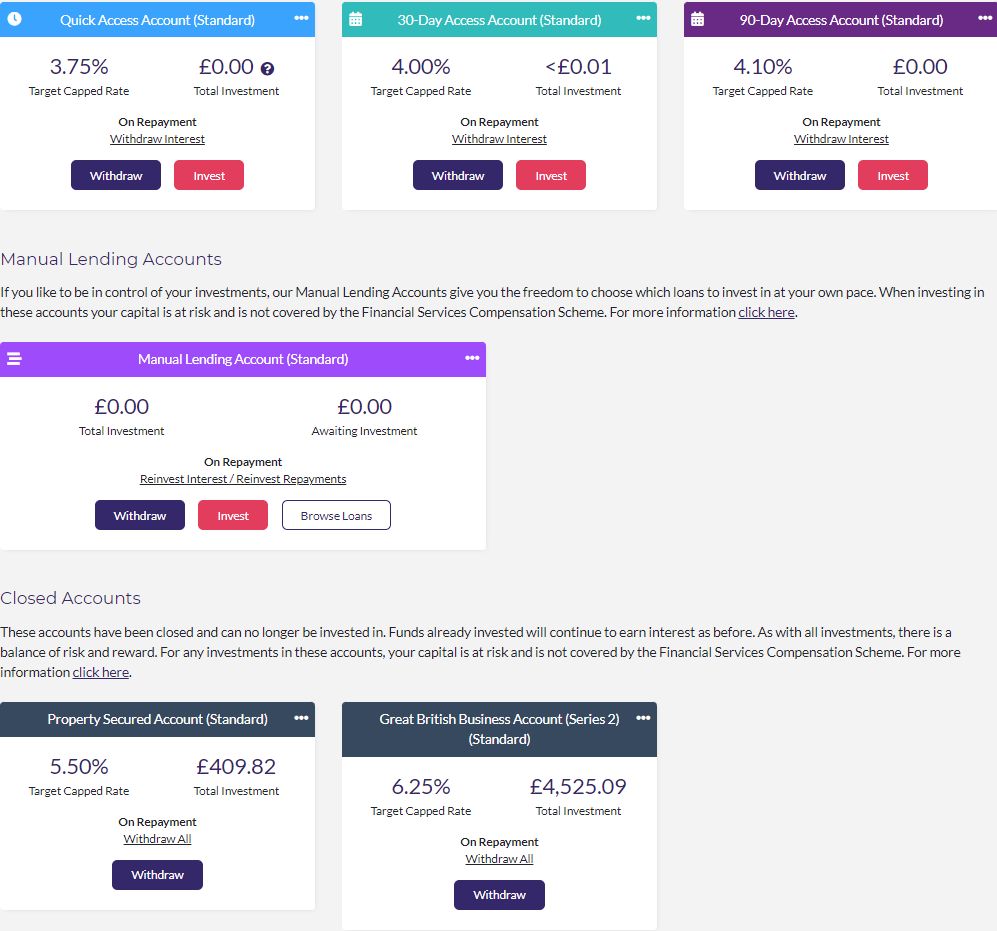

Visit WebsiteAssetz Capital still appear to have an excess of investment capital so they are working on getting new loans in. There is a wait to get invested even in the Access Accounts.

Due to this I decided to withdraw some capital from the ‘Access Accounts’ and use it for other investments. 4% is not a great return on it’s own, so to put it with a bunch of cash drag is just not an option for me.

I’ll reevaluate my investments with Assetz Capital once they clear out the backlog of funds and issue some new loans. They are a good company but they need to get some new loans on board quickly.

Here’s what my Assetz Capital account looks like now:

My Assetz Capital Strategy.

If Assetz Capital can get more loans available so they can keep capital invested and reduce cash drag, I will have no problems moving more money there. For now though, it’s pointless investing more as there would likely be cash drag while it’s waiting to be invested.

Assetz Capital Signup & Cashback Offers**

No current Cashback Offers

Use this link to check for new offers or to open account >>>

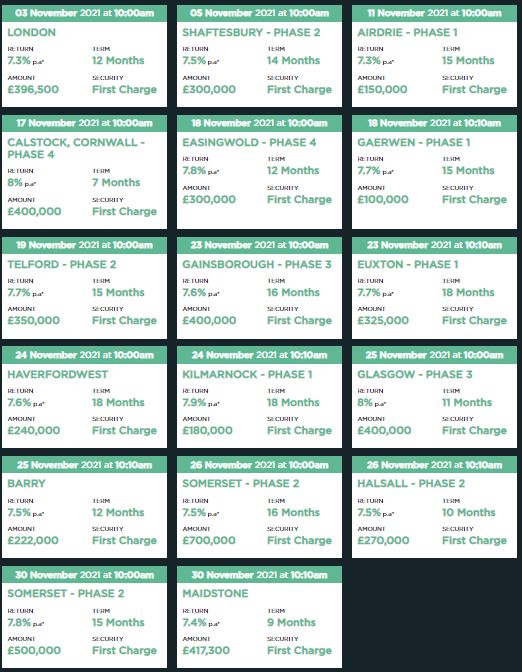

CrowdProperty are again showing 18 new loans due to be funded for November. Every month now it seems to be around this number get funded, all in under 1 minute (more like 3 seconds on most).

I sent over a little more capital to CrowdProperty but only to make up a reinvestment amount to a round number so I could invest it in a new loan.

The only thing I’m not liking about CrowdProperty right now is that they are still putting some of the smaller loans up for auto-invest only. This means they are not allowing us to self-select them. The trouble with that is their auto-invest will only invest a maximum of 20% of the value of our auto-invest accounts in to any single loan, and then there are usually so many investors waiting to get in that you mostly don’t even get that much invested. So what that means is; if you want to get a reasonable sized investment into any loan through auto-invest, you need to have a bunch of cash sat there not making anything while it’s waiting to be invested.

Apart from that though, CrowdProperty are the bees knees and I can still get invested the capital I need through select invest.

The XIRR jumps up and down with both CrowdProperty and Kuflink as returns only typically come back when loans are repaid, so it’s not a straight income line like Loanpad or easyMoney. Income is erattic as you can see from the lender spreadsheet in the Peer to Peer Lending Portfolio.

Here are loans that are coming in November (one is already up for funding so not shown on this screenshot):

Here’s a screenshot of my CrowdProperty account at the end of October 2021.

My CrowdProperty Strategy.

My strategy since the beginning with CrowdProperty is to invest £500 into almost every loan they have for good diversification. If the LTV is low, and it’s a tranche 1, I’ll invest £1000. I do a little due diligence on each loan before it goes live. Once in a while I see something I don’t like the look of and I don’t invest in that particular loan. I’ll often look closely at higher level (numbers) tranches and pass over some of them at times. Overall though, that happens very infrequently so it’s pretty much £500 or £1000 into each loan.

CrowdProperty Cashback & Signup Offers

No current CrowdProperty Cashback Offers

Use this link to go to CrowdProperty’s website and check for new offers, or to open an account >>>

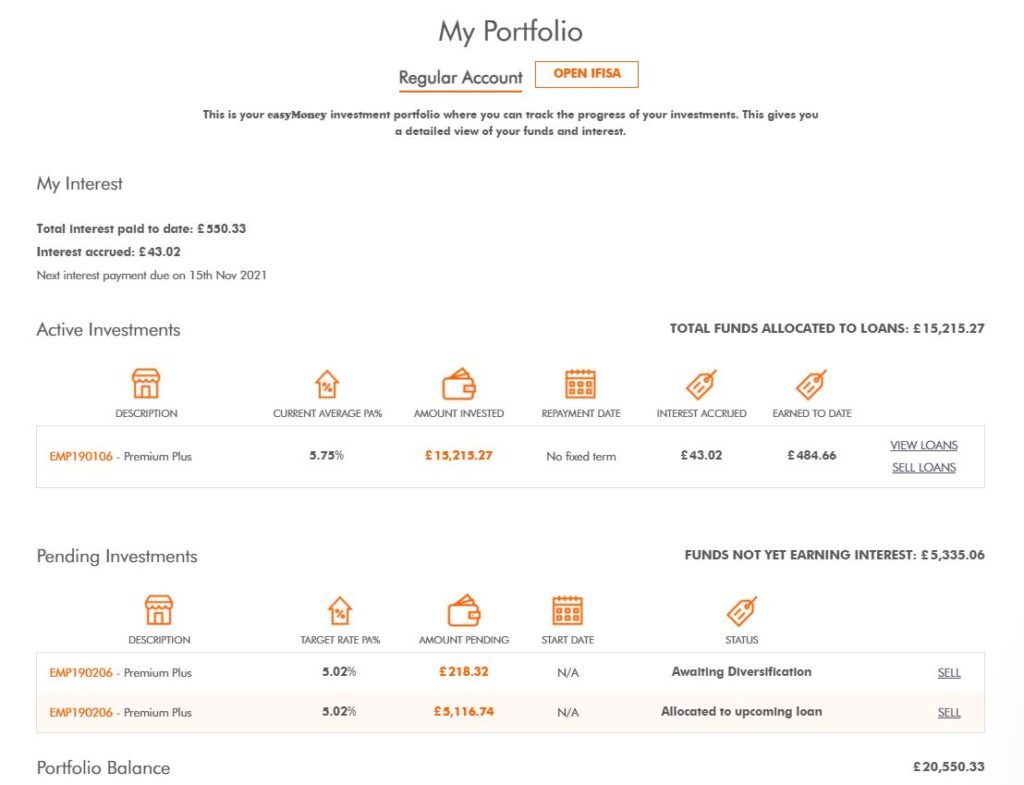

easyMoney was another new investment for me in April. I wrote more in detail about them in the May update.

One of the things I like about easyMoney is, like Loanpad, income payments are at a set rate each month so it doesn’t change much. Unlike other platforms which only see returns when a loan gets paid back in full. Each month you can typically bet on (within a few blips) of what the income will be with easyMoney.

The rate drop as of September 1st is starting to show now with the easyMoney account XIRR dropping a little to 5.53%. Still well above Loanpad though, with a track record just as good, so can’t really complain. Overall I’m still very happy with this investment.

Here’s my easyMoney account information for the end of October, 2021. You’ll note there is a significant amount waiting for reinvestment. Typically goes fairly quickly though but I’m keeping an eye on it.

For anyone waiting to invest, it looks like they’ve cleared out there backlog of investment capital (likely due to the rates dropping a bit), so investment should be much faster now. My reinvestments are only taking a few days. Still takes a bit longer for new investments but not like it was.

Here’s a screenshot of the easyMoney Dashboard

My easyMoney Strategy

There’s no real strategy required for easyMoney. Just deposit your capital and start earning interest. There’s really nothing else to do.

easyMoney Cashback Offers & Signup Links**

Click here to check for new easyMoney cashback offers >>

Signup for easyMoney ISA Account >>

See Full Funding Circle Review

Visit WebsiteNo change with Funding Circle this month. Just withdrawing capital as it’s repaid as there is no option to reinvest currently.

I withdrew £318 from monthly repayments in October.

Here is how my Funding Circle account looks as of October 31st. My current calculated XIRR is showing 3.43% return as opposed to their 4.1%

My Funding Circle Strategy.

I’ve been drawing down my Funding Circle account since July 1st 2019 – trying to sell out and get my capital back after events that unfolded in 2019. You can read more about it in the Funding Circle Review. There is also no option to invest in Funding Circle currently as they are not accepting investment from retail investors.

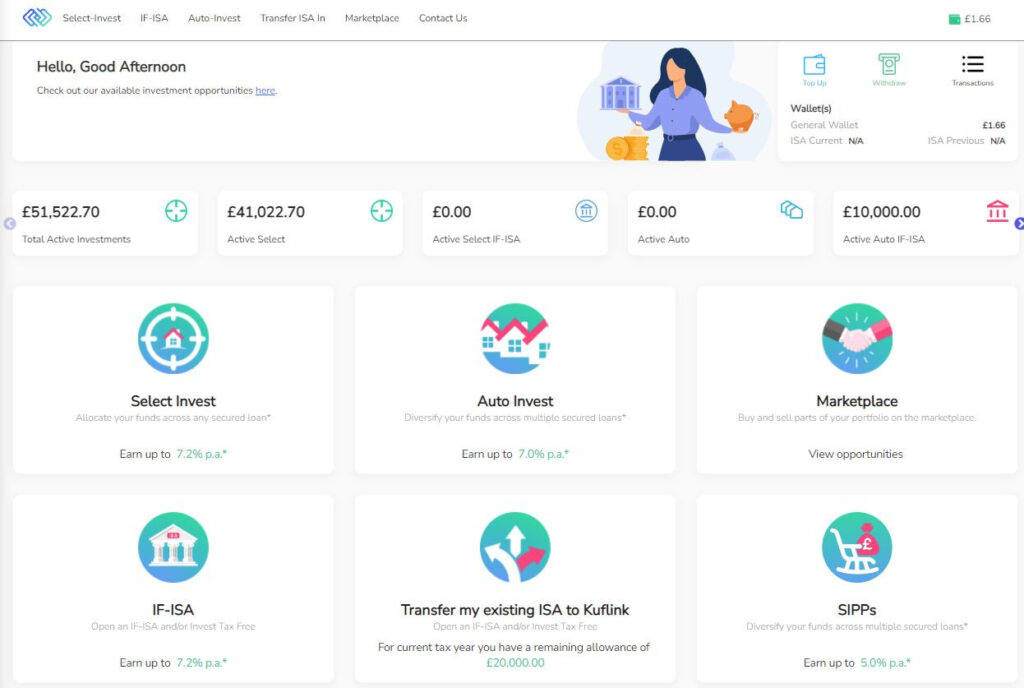

Reliable Kuflink again over £200 income for October. It was over £340 in September from a couple more than usual loans paying back. With over £51k invested in Kuflink now, that’s over 25% of my overall P2P lending portfolio. I have no worries at all that it’s safe with Kuflink as I have been investing with them for several years. I love the platform & feel that it’s one of the safer lenders, however things can change rapidly in the P2P asset class so I’ll keep it around 25% just to be safe.

Kuflink is the only platform now (that I can find) offering plenty of loans, liquidity if needed (loans sell very quickly on the secondary market) and still 6.50%+ real average returns. So I’ll take a little more risk with them than I usually would.

Kuflink XIRR at a solid 6.52%. Very good considering that many other other platforms are sub 5% with some at 4% now.

The other thing to point out here; my ISA also has £10k in it and the return on that won’t show until it is paid back in April as returns are paid annually, so I’ll bet it puts the overall XIRR closer to 7% because I’m including the £10k in the overall XIRR number now but not the return on the ISA .

This is how my Kuflink account looks at the end of October, 2021:

Out of a total of 78 loans I have with Kuflink, only 3 are delayed, and that’s because they are all awaiting delayed materials or finishing up the development late. We still earn interest for delayed loans, so I really don’t mind. All of the other loans are performing with on time payments & on target completions. Outstanding!

As mentioned earlier, another thing I like about Kuflink is that you don’t need to be near your computer at a certain time to get in to most loans. They bring so many to the table, there is always a way to get capital invested with good diversification.

Here are currently available loans (as of 2nd November):

My Kuflink Strategy.

As capital gets repaid, I continue to reinvest around £500 into almost every loan Kuflink brings with an LTV over 50% (providing I have capital available of course). For loans with LTV’s under 50% & first legal charge (& usually tranche 1), I often invest £1000. As with CrowdProperty I do a little due diligence and if I see something I don’t like, then I don’t invest. That does not happen often though as Kuflink do great due diligence themselves, so it’s pretty much £500 or £1000 into every loan.

Kuflink Cashback & Signup Offers**

New Kuflink customers receive the following Kuflink cashback on an investment of £1000 or more when they use signup links from obviousinvestor.com. Must invest into loans within 14 days of first investment to qualify for cashback.

| Investment amount | Cashback |

| £ 1,000.00 – £ 5,000.00 | 2.50% |

| £ 5,000.01 – £25,000.00 | 3.00% |

| £ 25,000.01 – £50,000.00 | 3.50% |

| £ 50,000.01 – £99,999.99 | 3.75% |

| £100,000.00 | 4.00%* |

*Cashback capped at £4,000.

Use this link to signup & qualify for the current Kuflink cashback offer >>>

No changes. Just withdrew a little capital which was paid back.

Recap:

I decided to retrieve capital (where possible) from lenders who have unsecured loans to reduce my overall exposure to Peer to Peer lending when the pandemic hit. Although LendingCrowd do have some secured loans, many just have directors personal guarantees. Historically, trying to recover from just these personal guarantees has been hit and miss. So, I made an early decision to withdraw my capital.

I was able to sell about 75% of the loans as I was early to start selling in March 2020.

Repayments have still been coming in slowly for the last year and LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors. Hopefully when things get back to some form of normality, LendingCrowd will open its doors to retail investors again.

Here is a screenshot of how my account looks currently

My LendingCrowd Strategy.

As mentioned previously; LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors.

As soon as they start accepting investments again, I’ll make a decision on if & when to increase my investment again with LendingCrowd.

Loanpad announced they became a profitable platform in June 2021 after tripling their loan book in the prior 12 months. This is no surprise as they’ve really been killing it since the pandemic exposed a lot of the other platforms weaknesses while Loanpad didn’t miss a beat as far as liquidity or defaults. Many investors took notice of this and feel safe with their capital invested in Loanpad (as I do).

I’ve started to use Loanpad almost like a bank (it’s not a bank though remember and has risk of loss obviously, as capital is not covered by FSCS insurance). I basically have most of my Loanpad invested funds (both standard & ISA) in the Premium Account at 4% which requires a 60 day notice period in order to get capital out. But then I’ve been moving some short term capital (that I use for day to day stuff & investments) back and fourth as I need it between my “real” bank account and Loanpad’s Classic Account which allows instant access (under normal market conditions). Why not make 3% on capital I’ll need soon, but not right now? Banks are not paying diddley. It only takes a day to move it from Loanpad to my bank so providing I plan things correctly I don’t see why this is not a good idea. Shows the trust I have in Loanpad.

Here is a screenshot of how my Loanpad accounts (standard & ISA) looked at the end of October 2021 (nothing in classic now as I just moved it)

My Loanpad Strategy.

There’s not really any strategy necessary with Loanpad. Just deposit your funds, choose your account & done. Nothing more you can do even if you wanted, it’s all taken care of for you behind the scenes. Of course 3% or 4% aren’t huge returns as far as some P2P platforms go, but I believe they are about the safest lender out there for the risk/return and that’s the reason they are one of my largest lending accounts by value.

Loanpad Cashback & Signup Offers**

£50 bonus if you invest into a lending account a minimum of £5,000 within 4 weeks post registration and keep it invested for 1 year

£100 bonus if you invest into a lending account a minimum of £10,000 within 4 weeks post registration and keep this invested for 1 year.

Use this link to visit the Loanpad website & qualify for Loanpad cashback offers >>>

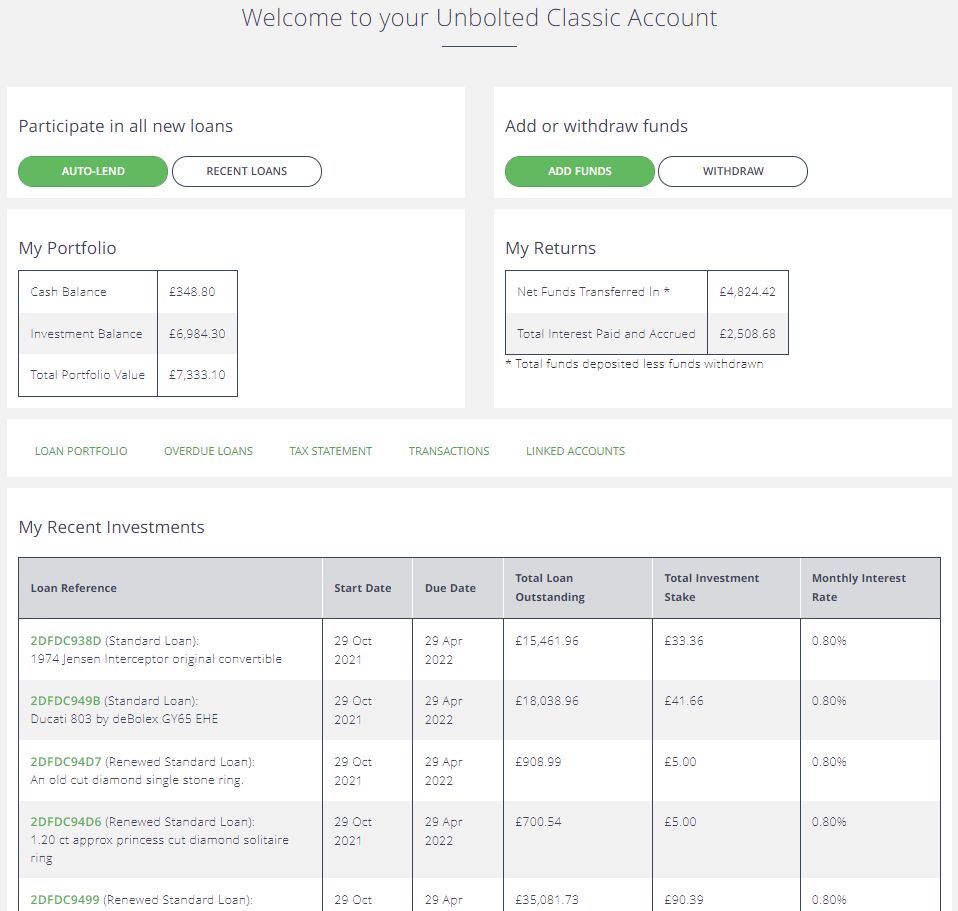

Cash drag got a little bit worse again in October. At the beginning of the month there was over £500 sat in cash, but by the end it was down to £348 so hopefully that’s a good sign.

Even with cash drag, Unbolted are still averaging almost 8.5% returns, so really can’t complain.

Unbolted are a great lender and I love the fact that they are not real estate property loans. Just something different to diversify into & they have a great track record.

In case you’re unfamiliar; Unbolted offer pawnshop style loans to the general public with very liquid assets. These types of assets can be sold very quickly upon default so the demand for Unbolted loans exceeds the available loans.

I have been lending with Unbolted for several years now, and although there have been many defaults, assets have always sold at more than the outstanding loan principle and I have always been paid back both principle and interest very quickly. Loans are short to medium term in nature so a complete exit can be had by turning off auto-invest within 3 to 12 months.

Unfortunately the only problem with Unbolted is it’s difficult to get capital invested because they have so few loans now, and too many investors with a lot of capital waiting to get in.

Here’s a screenshot of my Unbolted account as it stands at the end of October, 2021.

My Unbolted Strategy.

I’ve always just gone with auto-invest through Unbolted. Simply deposit funds, set up the auto-invest & that’s it.

I would happily invest more capital if I could get it invested without the cash drag and good diversification. I really love the platform and I’ve been lending with them for a long time now.

Unbolted Cashback & Signup Offers**

No current cashback offers.

Use this link to signup with Unbolted >>>

EURO Lenders Update

I have been drawing down my Euro investments slowly as because I live in Portugal some of the time, when I’m here I live on Euros. So I have been using the Euros that I have invested in Euro Lenders for living expenses.

Typically I would change US Dollars or GB Pounds for Euros, but the Euro has been rising rapidly recently against the USD, and the GBP has still not recovered fully from Brexit. So I decided to use the Euros I have before changing more at this high rate in the hope it comes back down soon.

If you have Euros to invest and are looking for ideas. There are a few Euro Lenders that have come through the pandemic and seem to have been largely unaffected, namely Swaper, Peerberry & Robocash have all done what they are supposed to do. I will invest in these all again once I am ready to invest Euros again. I believe they are all decent investable companies paying very good returns. Mintos is also worth investing in as long as you realize you’re not investing in Mintos, you’re investing in their LO’s, and as such you should pay more attention to them than to the platform. The new news is that Mintos just became a regulated lender in August 2021, and as such is getting more interesting as a possible investment platform. I’ll be watching to see if they start to allow UK investors again and if they have more GBP loans like they used to.

Securities, Bonds, Gold & Crypto Portfolios

USD Growth Portfolio

Small pullback of around 4% from August to the end of October but nothing out of the norm for this portfolio. I don’t even pay attention to drawdowns of less than 10% as they happen regularly.

By the end of October, my main personal portfolio was back to the previous highs. I’ve been investing in these asset classes for over 30 years and when they’re invested in correctly, they are very reliable. Just rebalance the portfolio once per year then leave it alone.

Permanent Portfolios (all currencies)

Again, everything performing as expected. Differences in returns are due to the multiple currencies and asset performance from the separate countries they are invested in. Overall they still perform relatively well. The USD assets always perform better because the US markets generally perform better. After all, it is still the biggest economy in the world.

The Permeant Portfolio assets have performed this way for the last 100 years, so I would be surprised if anything changes in my lifetime.

A couple of good books to read on these portfolios are “Fail-Safe Investing” and “The Permanent Portfolio” if you’re interested in how they’re constructed. Both oldies but goodies.

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking). And I use the Ledger Nano X & S for Crypto offline cold storage.

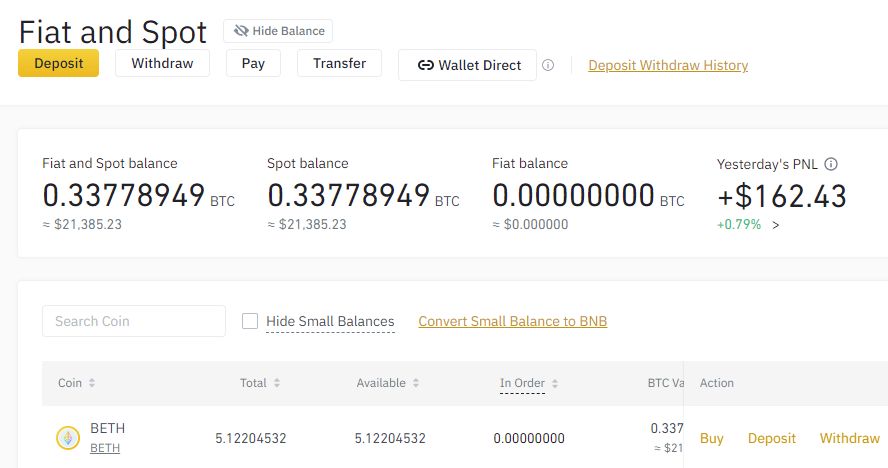

Visit Kraken Visit BinanceWell, the crypto portfolio has gone completely nuts over the last couple of months. In a good way!

My first crypto investment (PolkaDOT) has really been the winner, but almost all of the different coins & tokens have taken off. DOT starts its Parachain Auctions on November 11th, so the thing has gone nuts. At the end of day on October 31st, my Crypto Portfolio was at a value of $103,363. 2 days later, I’m looking at it now as I type this, and it’s at $114,509. Crazy volatility but fun to watch. I added the XIRR to the calculations just for fun 😀

Here’s a quick screenshot of the portfolio as of today (see the actual portfolio for latest updated figures):

Remember, some of that profit is from staking as well as the market moving up of course.

I stake ATOM & KAVA through Kraken (here is a screenshot of my Kraken staking account) 7% return on ATOM & 20% on KAVA:

I stake my Ethereum (ETH) through Binance.com (the ETH have actually been converted to BETH which is the way Binance hold them when staked there, until the next phase of Ethereum development is released, at which point they will be converted back to ETH). Currently making about 5% per annum on ETH.

Here is a screenshot of my Binance staked BETH.

The rest of my crypto is in cold storage, stored offline with my two Ledger wallets (I have an S and X).

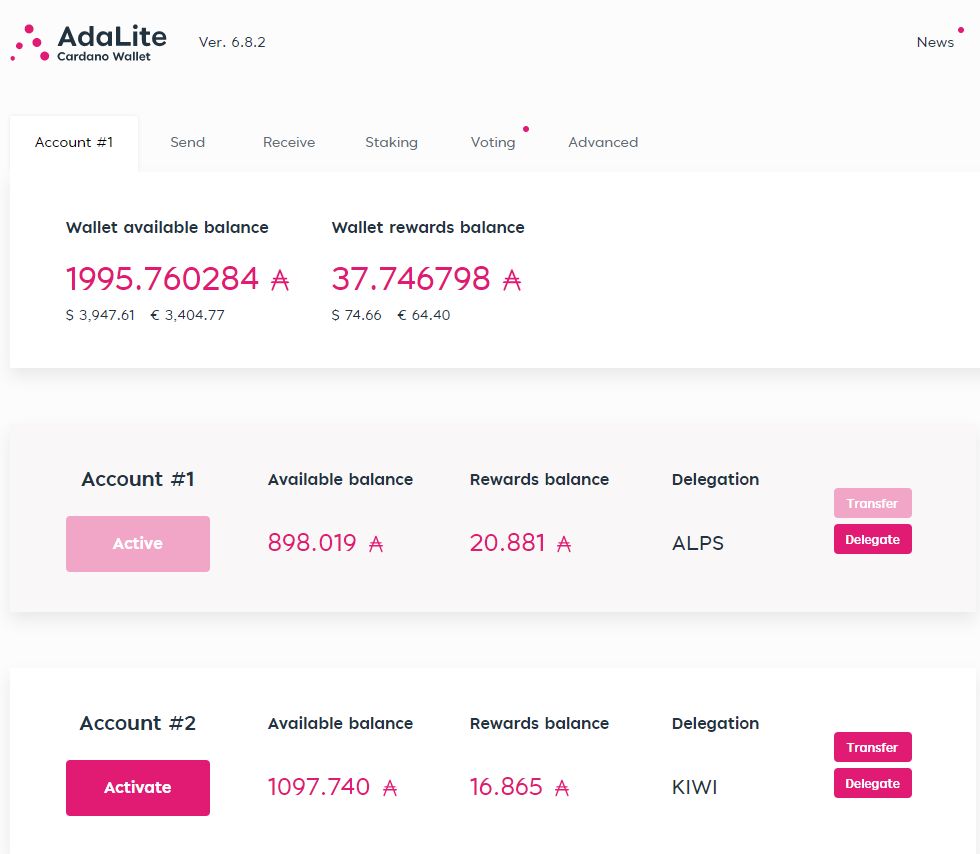

I stake PolkaDOT (DOT) through Ledger Live (currently making about 14%), Cardano (ADA) through the Ledger wallet (about 5% rewards per annum), but using AdALite for the staking, & just store the other crypto I have that is not staked offline for safe keeping.

Here is a screenshot of my DOT wallet in Ledger Live, you can see I’ve earned 70.814 DOT by staking since Feb 2021 (currently worth about $3,651 with DOT at $51.57).

Below you can see the DOT rewards coming in each day:

Here are all the crypto I store offline in cold storage (except Cardano (ADA) which requires a connection with AdAlite wallet to see it):

Here’s a screenshot of my Cardano (ADA) stored on Ledger Nano via Adalite. I have the staking split between 2 staking pools (Stake ALPS & KIWI).

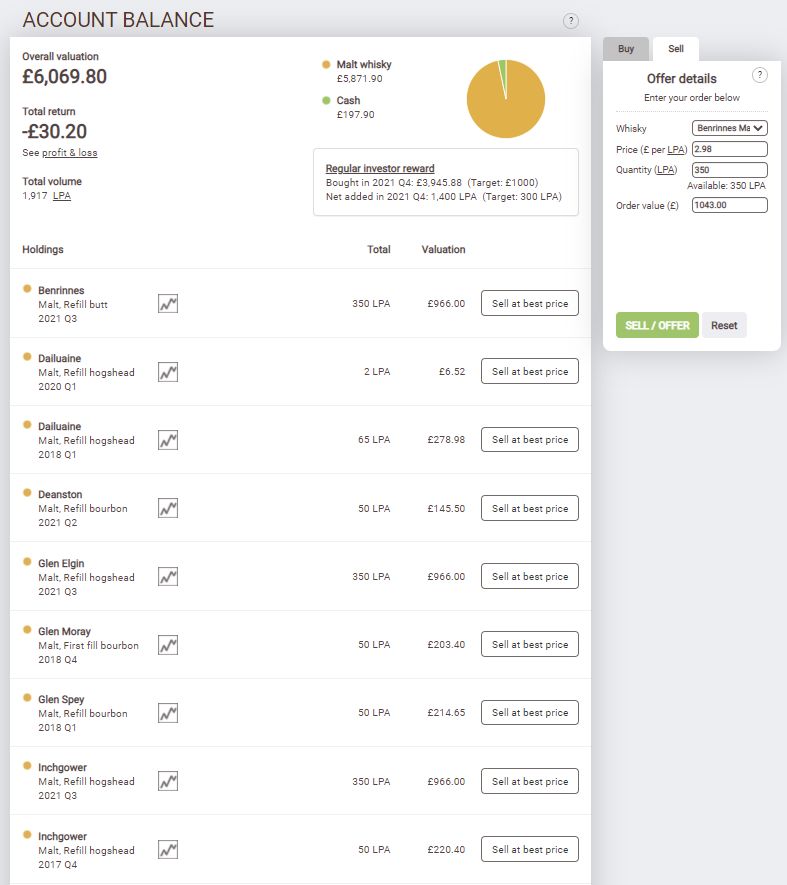

Whisky Portfolio

I am still in the process of building my whisky portfolio. This will be a steady process as I am only going to buy new, pre-order liquids from WhiskyInvestDirect.com from now on as I am in this for the long run and I think this is the best way to make a steady profit without too much work (Lazy Investor, remember?). That being said, I think there is a little more profit possible from buying specific whisky’s from the order board if you have the time to do the research on which ones historically have made more gain, sounds like too much work for me though so I’ll just diversify into everything that comes up new on the pre-order and plan to hold it for 5-10 years which should return between 7% & 9% per annum historically. I can always sell it on the order board if something changes and I need to retrieve my capital.

Here is my WhiskyInvestDirect.com account at the end of October, 2021. Note that there is a loss on the account, this is because as I have purchased most of the liquid in the last month, the 2% commission is still outweighing the appreciation. In the screenshot below (at the top), you can see that the fist 350 LPA’s (Liters of Pure Alcohol) could already be sold on the order board for more than I paid for it. This is just not reflected in the account balance yet as they don’t update the value of new liquids for a few months.

Summary

That’s all for this update. I’m happy with the way everything is going, although I’m always looking for new assets to invest in to increase diversification.

I’ll keep on tracking everything and we’ll see how I do with the various investments.

If you have any comments or suggestions, please feel free to comment on the post, or email me directly if you prefer.

Good luck with your investments in the coming months! Remember, it’s about patience & persistence, not perfection! If you start investing in various assets when you are young, just a small amount every month like I did, you’ll be amazed how quickly it becomes a significant portfolio. You’ll also be amazed at how quickly you get old 😀

My best to you and your families. Stay safe and I’ll post an investment update again soon.

฿ – Cryptocurrency Portfolio

£ – GBP Permanent Portfolio

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

£ – GBP Peer to Peer Lending Portfolio

$ – US Dollar Growth Portfolio

Maturing Whisky Portfolio

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

€ – Euro Permanent Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.