June was the best month ever for my Peer to Peer lending Portfolio, not so much for the Crypto Portfolio, but that in itself may be an opportunity. More on that later.

Growth Portfolios continued in the right direction, although I feel like we may be due for a pullback in the not too distant future.

Just as an FYI; I implemented a couple of newsfeeds on my site. One for Peer to Peer Lending News, and the other for Cryptocurrency News. To be perfectly open, I did this for me personally as they just pull together different sources that I usually read without having to go to each individual site, but I thought I would make them public in case any of you folks find them useful.

Short intro this month so let’s get right into it with the detailed Peer to Peer lending update first.

Peer to Peer Lending Sites & Portfolio Update

The Peer to Peer lending portfolio investment increased only slightly from £189,751 in May, to £194,318 in June.

Overall, it was the best month the portfolio has ever had with a total income for the month of £3,288.67, due mainly to the new lender Assetz Exchange, and also for once, Funding Circle came up trumps. Great months from Kuflink and CrowdProperty also didn’t hurt anything. I’ll explain in more detail below in the individual updates.

You can always see the live Peer to Peer Lending Portfolio data here >>

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Individual Peer to Peer Platform Updates

Ablrate had a couple of new loans in June, but I didn’t invest in any. Not much new to report here. Alblrate still seem to be doing ok but I’m still not motivated enough to invest more capital with them as the work involved to find good loans with a small amount of capital is not worth it (for me at least). I’m still on the sidelines with Ablrate until I get some time and inclination to invest more money with them.

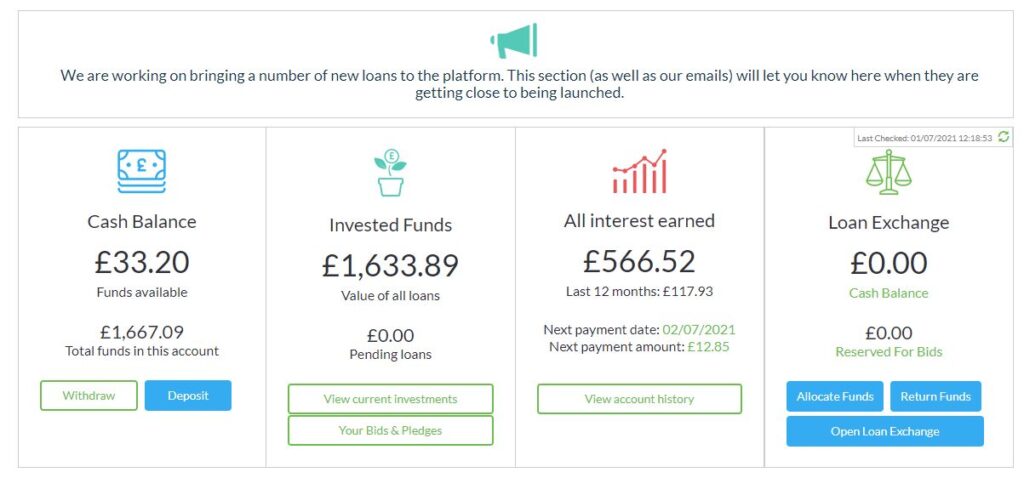

Here is a view of my Ablrate account as it stands at the end of June 2021.

My current Ablrate Investments. You may have noticed that there are now 2 loans on hold (last month only 1). This can happen though for just late payments so I’m not worries about it.

My Ablrate Strategy.

There are some great returns available through Ablrate if you’re willing to put the time in to do the research and buy the best loans. Up to 15% per annum. One of the best rates of all UK Peer to Peer lending sites.

For some it will be totally worth the effort. For me with my “Lazy Investor” attitude, the time commitment required exceeds my enthusiasm at the moment. That may change in the next few weeks, but for now I don’t have the time to diversify a significant amount of capital in the way I would like.

If you do have the time to spare, Ablrate are one of the best paying lenders out there as far as returns go. The fact that they are still around after the pandemic also has to say something about their business model and the saftey of the platform.

Ablrate Signup & Cashback Offers

£50 Ablrate Cashback on £1000+ investment for New Investors

Use this link to qualify for Ablrate cashback or to signup >>>

See Full Assetz Capital Review

Visit WebsiteAssetz Capital surprised investors at the beginning of June with an email saying that they now have more investment in their Access Accounts than they have loans to put the capital into, so they were returning some of investors capital.

I had around 10% of my capital returned, so I withdrew it and sent it over to Kuflink where returns are better anyway frankly.

I still like Assetz Capital, but they are going through some fallout from the COVID19 situation (having too much capital is not necessarily a bad thing, it just requires more loans which they will need to work on).

I still believe in Assetz Capital and think they still are a relatively safe bet. As soon as they figure things out, I’ll have no qualms about investing more capital with them.

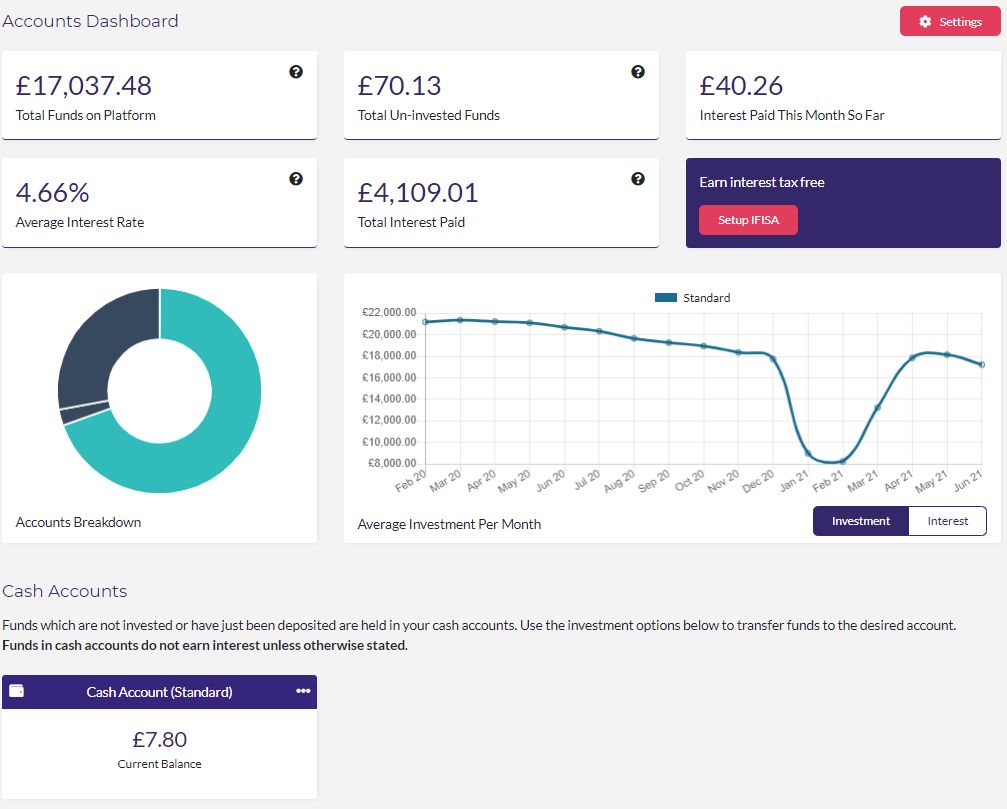

Currently I’m mostly invested in the 30 Day Access Account at 4% as I don’t feel like the 90 Day Access Account is worth it for the extra 0.10% (total 4.10%) for an extra 60 days lockup on the cash. I may start and look at some of the Manual Lending Account loans if I get some time. There are much better rates available on the MLA, however there is work needed in finding the good ones and of course there is no provision fund. Managing them takes work too so I’ll have to see if I get motivated enough. The extra 3% or 4% available on loans in the MLA is likely only worth it if I make a more significant capital investment.

Here’s what my Assetz Capital account looks like now:

My Assetz Capital Strategy.

I’m a little over £17k invested with Assetz Capital. Once they get more loans available so they can accept larger investments, I’ll likely be moving more money over there.

Assetz Capital Signup & Cashback Offers

No current Cashback Offers

Use this link to check for new offers or to open account >>>

CrowdProperty are keeping up the good work. Still putting out 8-12 loans per month it seems, I’m getting capital into every one I can.

June was the best month yet for returns from CrowdProperty with several loans paying back this month there was a total profit of £256.37

The only single problem (if you can call it that) with CrowdProperty just now is how fast the loans fund. Literally 2.7 seconds the last one I invested into. It’s become like a game where I sit at the computer when the loans are released (typically at 10:00am and in 10 minute intervals after that if there are more than one loan in a day) and as soon as the loan gets released, it’s a typing and clicking frenzy 🙂 so far I’ve managed to get into every loan I’ve tried for, so it is possible, you just have to be proactive about it. Auto-invest is basically a waste of time if you want to get any significant capital invested into a loan. If you can’t be at the computer when they’re released though, it’s the only option.

I’m really enjoying CrowdProperty at the moment. Great risk/reward and basically does what it says on the tin.

The XIRR jumps up and down with both CrowdProperty and Kuflink as returns only typically come back when loans are repaid, so it’s not a straight income line like Loanpad or easyMoney.

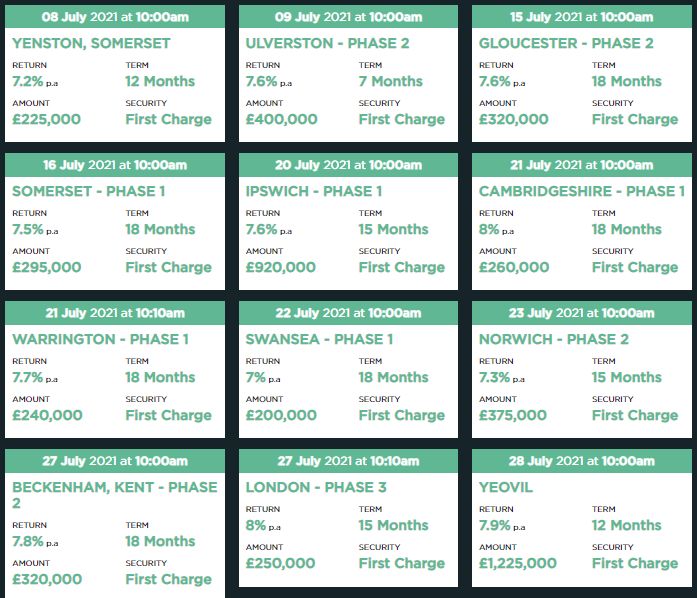

Here’s some of the loans I got into in June:

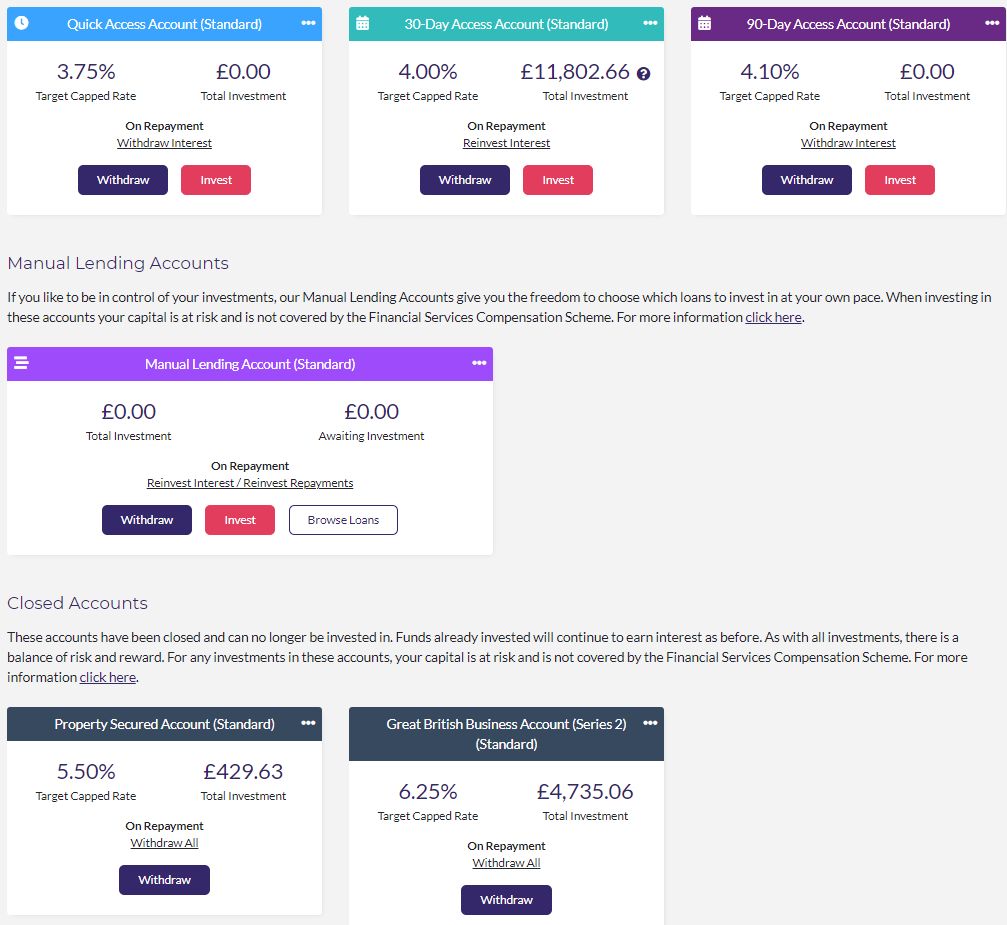

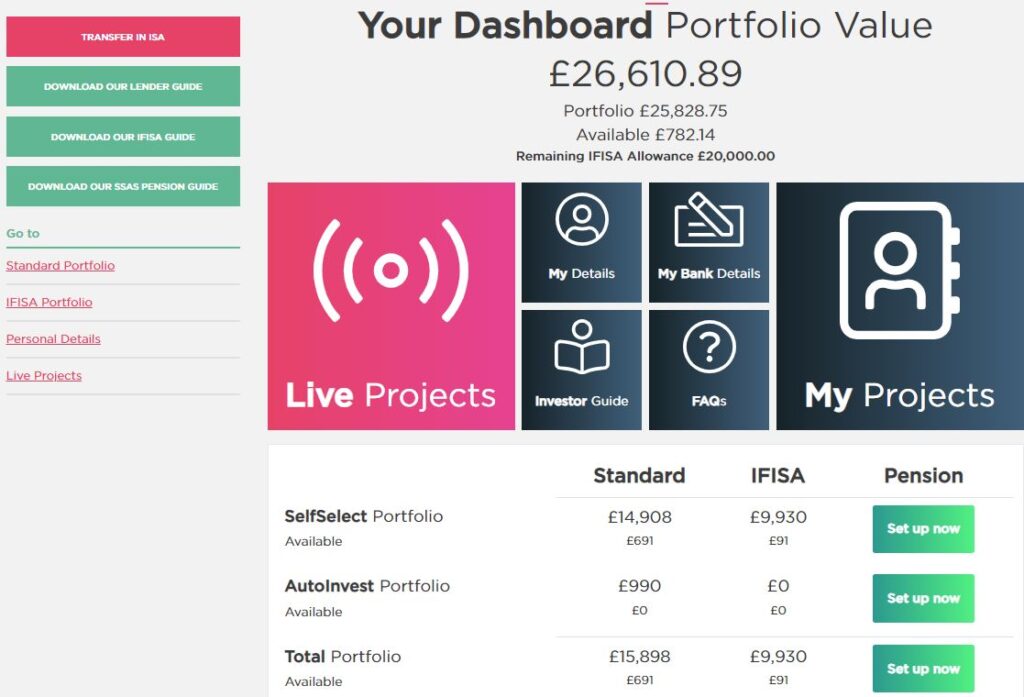

Here’s a screenshot of my CrowdProperty account at the end of June 2021.

Here are the upcoming loans for July 2021

My CrowdProperty Strategy.

My strategy since the beginning with CrowdProperty is to invest £500 into almost every loan they have for good diversification. If the LTV is low, and it’s a tranche 1, I’ll invest £1000. I do a little due diligence on each loan before it goes live. Once in a while I see something I don’t like the look of and I don’t invest in that particular loan. I’ll often look closely at higher level (numbers) tranches and pass over some of them at times. Overall though, that happens very infrequently so it’s pretty much £500 or £1000 into each loan.

CrowdProperty Signup & Cashback Offers

No current cashback offers from CrowdProperty.

Use this link to go to CrowdProperty’s website and check for new offers, or to open an account >>>

easyMoney was another new investment for me in April. I wrote more in detail about them in the May update.

I’m getting more and more confident about easyMoney. They seem very much like Loanpad but with 6%+ return. The loans seem to be very well vetted and none have defaulted to date. That says a lot after the whole COVID situation.

I will likely at some point move more money over there, but for now I’m just watching the interest come in every month.

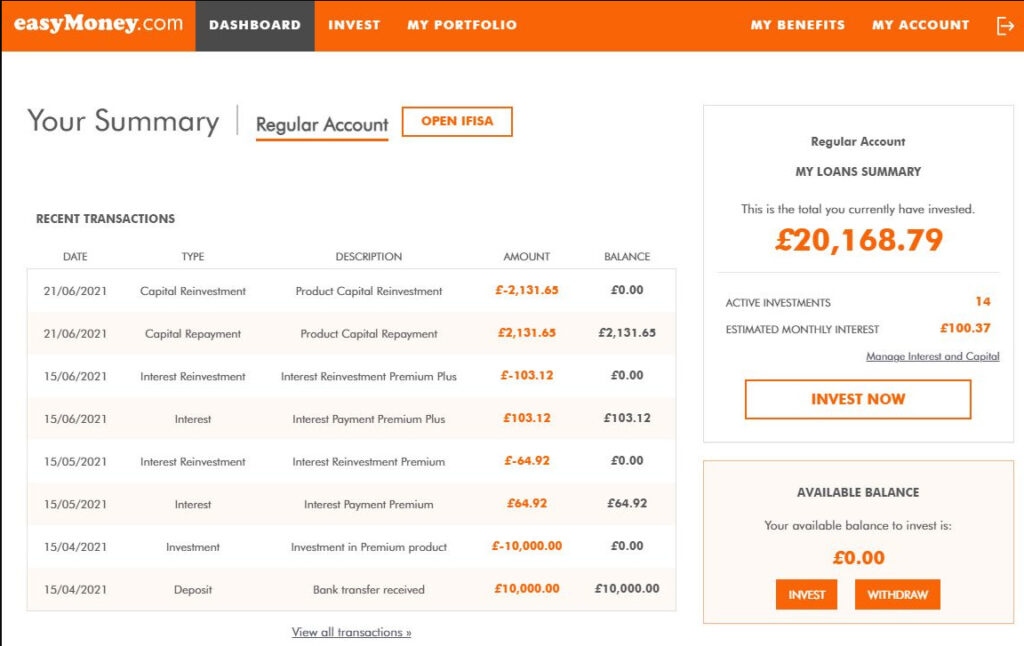

Here’s my easyMoney account information for the end of June, 2021.

Here’s a screenshot of the easyMoney Dashboard

My easyMoney Strategy

There’s no real strategy required for easyMoney. Just deposit your capital and start earning interest. There’s really nothing else to do.

easyMoney Cashback Offers & Signup Links**

Click here to check for new easyMoney cashback offers >>

Signup for easyMoney ISA Account >>

See Full Funding Circle Review

Visit WebsiteFunding Circle gave me a little surprise in June which contributed to the over all best month for P2P ever. They sold some defaulted loans to another company, so some of the capital I had written off as lost over the past few years came back! Not a lot but I’m not going to complain. All in all £673.77 returned so not a bad little surprise.

I withdrew £1,063 from the sold loans plus monthly repayments. It’s not possible to reinvest with Funding Circle anyway at this time as they are not accepting investment from retail investors.

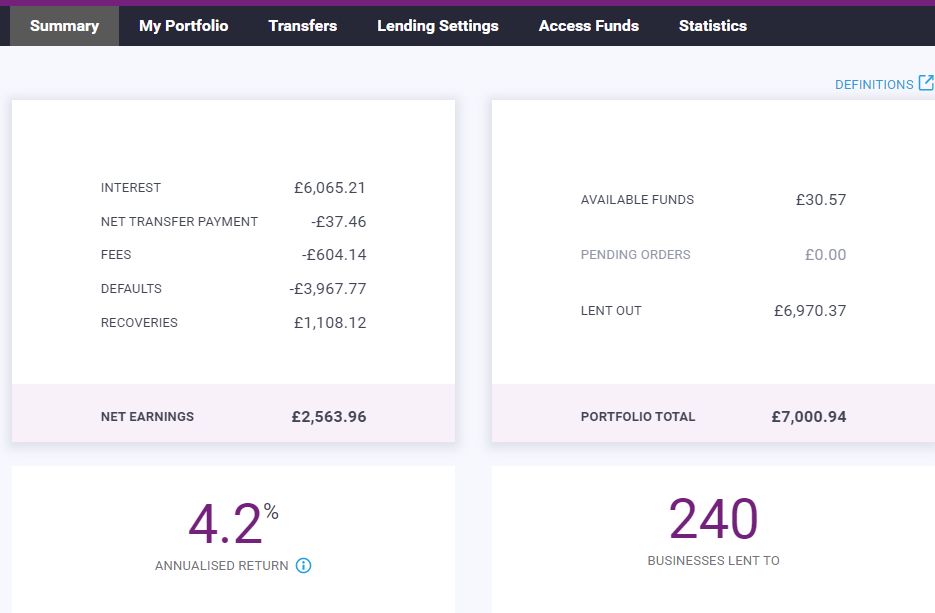

Here is how my Funding Circle account looks now. You’ll note that Funding Circle’s calculation of XIRR has gone up from 3.2% tp 4.2% (my own calculation puts it at 3.48%). Not a great risk/reward ratio in my estimation.

My Funding Circle Strategy.

I’ve been drawing down my Funding Circle account since July 1st 2019 – trying to sell out and get my capital back after events that unfolded in 2019. You can read more about it in the Funding Circle Review. There is also no option to invest in Funding Circle currently as they are not accepting investment from retail investors.

I increased my investment with Kuflink again just a little in June. I’ll still keep filtering small amounts of capital there as I balance out my portfolio, but I’m getting to the point where Kuflink is a large part of my whole portfolio, so I need to keep it real to ensure diversification. I have absolutely zero worries about Kuflink. Definitely one of the best lenders out there who do what they say. And one of the best things: you can still get into their loans! Loans typically stay around for a few days before they’re fully funded (or at least a few hours).

Great returns from Kuflink in June of £289.20 because of several loans being repaid. That’s how it works with platforms like Kuflink and CrowdProperty. Income is not one consistent level like it is with Loanpad or easyMoney as income is only received when the loans repay (unless you choose to receive income monthly, which reduces the ROI), but over the years an overall XIRR return of 6.73% for Kuflink is one of the best out there considering the loan security and their track record to date.

They are still bringing lots of great low LTV loans out, and paybacks all seem to be on time and on value. One of the best all the way through the pandemic, no problems.

Here’s my account as it stands at the end of June 2021.

Here’s a list of all my current Kuflink loans. Nothing in default, just a couple awaiting status updates (typically means they might be a couple of days late or the loan is about to repay).

You’ll note I’m in multiple tranches of some loans & I’m ok with that. Sometimes I look at a loan and decide I want more money in it at a higher rate (and a little more risk of course) so I take positions in later tranches.

As another note, Kuflink have now started allowing Select Invest deals to be invested into through ISA’s. Previously Kuflink ISA investment was only available through Auto-invest.

Not all deals are ISA eligible, but you can easily see the ones that are:

My Kuflink Strategy.

I continue to invest around £500 into almost every loan Kuflink brings with an LTV over 50%. For loans with LTV’s under 50% & first legal charge (& usually tranche 1), I invest £1000. As with CrowdProperty I do a little due diligence and if I see something I don’t like, then I don’t invest. That does not happen often though as Kuflink do great due diligence themselves, so it’s pretty much £500 or £1000 into every loan.

Kuflink Signup & Cashback Offers

New Kuflink customers receive the following Kuflink cashback on an investment of £1000 or more when they use signup links from obviousinvestor.com. Must invest into loans within 14 days of first investment to qualify for cashback.

| Investment amount | Cashback |

| £ 1,000.00 – £ 5,000.00 | 2.50% |

| £ 5,000.01 – £25,000.00 | 3.00% |

| £ 25,000.01 – £50,000.00 | 3.50% |

| £ 50,000.01 – £99,999.99 | 3.75% |

| £100,000.00 | 4.00%* |

*Cashback capped at £4,000.

Use this link to signup & qualify for the current Kuflink cashback offer >>>

No changes. Just withdrew a little capital which was paid back.

Recap:

I decided to retrieve capital (where possible) from lenders who have unsecured loans to reduce my overall exposure to Peer to Peer lending when the pandemic hit. Although LendingCrowd do have some secured loans, many just have directors personal guarantees. Historically, trying to recover from just these personal guarantees has been hit and miss. So, I made an early decision to withdraw my capital.

I was able to sell about 75% of the loans as I was early to start selling in March 2020.

Repayments have still been coming in slowly for the last year and LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors. Hopefully when things get back to some form of normality, LendingCrowd will open its doors to retail investors again.

Here is a screenshot of how my account looks currently

My LendingCrowd Strategy.

As mentioned previously; LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors.

As soon as they start accepting investments again, I’ll make a decision on if & when to increase my investment again with LendingCrowd.

Loanpad is same as usual, easy-peasy. Returns just come in every day and then get automatically reinvested once the cash account reaches a value of £10. Easy as pie. Safe as houses (literally) with the lowest LTV loans in the business. Closest platform to a bank you’ll get (NOT a bank though by any means, no FSCS insurance and you capital is at risk).

There were a few gripes on some of the P2P lending forums about LTV’s starting to creep up with Loanpad. And it’s true, but they are generally still under 50%. The problem is many of their loan LTV’s have consistently been from 5% to 25%, and investors have come to expect that. However as Loanpad have become more successful and are growing at a very high rate, they are going to need to bring in more loans to meet the increased capital requirements. Loans with 5% LTV’s are not the norm so they are going to creep up as loan flow increases.

As long as they stay under 50% (which is what Loanpad have always promised from the get go), and their due diligence remains good, I’m comfortable. Heck they have over £50k of my capital right now so I’d better be comfortable 🙂

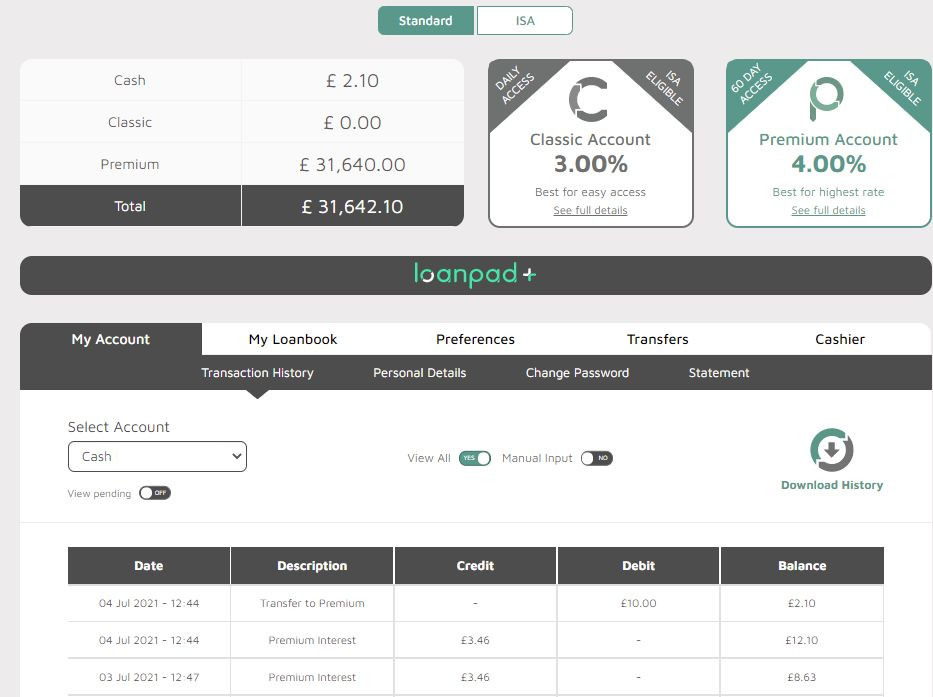

Here is a screenshot of how my accounts (standard & ISA) looked at the end of June 2021

My Loanpad Strategy.

There’s not really any strategy necessary with Loanpad. Just deposit your funds, choose your account & done. Nothing more you can do even if you wanted, it’s all taken care of for you behind the scenes. Of course 3% or 4% aren’t huge returns as far as some P2P platforms go, but I believe they are about the safest lender out there for the risk/return and that’s the reason they are my largest lending account by value.

Loanpad Cashback Offers

£50 bonus if you invest into a lending account a minimum of £5,000 within 4 weeks post registration and keep it invested for 1 year

£100 bonus if you invest into a lending account a minimum of £10,000 within 4 weeks post registration and keep this invested for 1 year.

Use this link to visit the Loanpad website & qualify for Loanpad cashback offers >>>

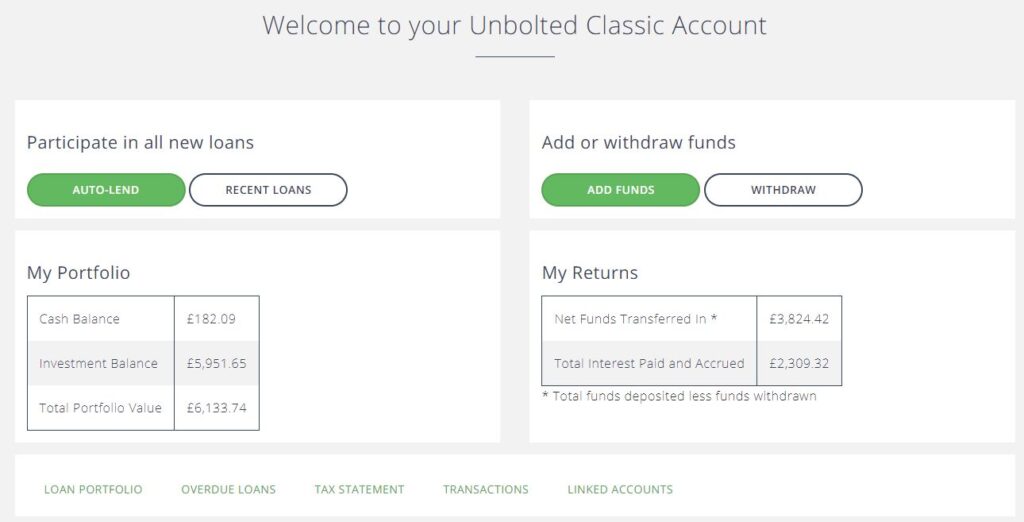

Unbolted appear to be getting a few more loans in as my cash balance as actually gone down in June. I’ll keep an eye on them and will probably send over some more investment capital if it continues.

Unbolted are a great lender and I love the fact that they are not real estate property loans. Just something different to diversify into & they have a great track record.

In case you’re unfamiliar; Unbolted offer pawnshop style loans to the general public with very liquid assets. These types of assets can be sold very quickly upon default so the demand for Unbolted loans exceeds the available loans.

I have been lending with Unbolted for a few years now, and although there have been many defaults, assets have always sold at more than the outstanding loan principle and I have always been paid back both principle and interest very quickly. Loans are short to medium term in nature so a complete exit can be had by turning off auto-invest within 3 to 12 months.

Unfortunately the only problem with Unbolted is getting capital invested because they have so few loans now, and too many investors with a lot of capital waiting to get in. Although it looks like that may be changing, so I’ll be keeping an eye on them and adding capital as needed.

Here’s a screenshot of my account as it stands at the end of June, 2021.

Here are some of the recent loans capital has been put into by auto-invest in May. You’ll notice still only small amounts being invested. Loans are being repaid, but the newer available loans can’t keep up. I did get £259.48 in to a standard loan, that’s because they are the most risky so people don’t like to invest so much in them. I don’t mind as they still have good asset security.

My Unbolted Strategy.

I would happily invest more capital with Unbolted if I could get it invested without the cash drag and good diversification. I really love the platform and I’ve been lending with them for a long time now.

I’ll keep an eye on them and as soon as capital starts to get invested quicker, I will increase investment in Unbolted by a significant number. The question is; when will this happen of course.

Unbolted Signup & Cashback Offers

No current offers.

Use this link to signup with Unbolted >>>

EURO Lenders Update

I have been drawing down my Euro investments slowly as because I live in Portugal some of the time, when I’m here I live on Euros. So I have been using the Euros that I have invested in Euro Lenders for living expenses.

Typically I would change US Dollars or GB Pounds for Euros, but the Euro has been rising rapidly recently against the USD, and the GBP has still not recovered fully from Brexit. So I decided to use the Euros I have before changing more at this high rate in the hope it comes back down soon.

If you have Euros to invest and are looking for ideas. There are a few Euro Lenders that have come through the pandemic and seem to have been largely unaffected, namely Crowdestor, Swaper, Peerberry & Robocash have all done what they are supposed to do. I will invest in these all again once I am ready to invest Euros again. I believe they are all decent investable companies paying very good returns. Mintos is also worth investing in as long as you realize you’re not investing in Mintos, you’re investing in their LO’s, and as such you should pay more attention to them than to the platform.

Securities, Bonds, Gold & Crypto Portfolios

USD Growth Portfolio

No changes from last month. Everything performing as expected. This portfolio never disappoints. That’s why most of my personal wealth is invested in these assets.

I’m actually not sure why I keep this section in the monthly update, this portfolio is so reliable it has been doing the same thing for many years. I guess it’s useful for when we get something different happen in the markets like when the COVID19 situation happened. Still didn’t change the overall maximum drawdown of the portfolio though and it actually performed very well through 2020.

Recap:

My main Growth Portfolio is doing as expected. REITs took a tumble at the beginning of the pandemic. Actually all assets got hit initially as panic set in, but REITs got hit the hardest losing around 50% of their value in a few weeks. Crazy stuff! That’s what panic does for us.

As always happens, the “safe haven” assets (Bonds & Gold) picked up the slack and started to rally just as they always do when the “big money” (funds) start to move capital into those assets as a safety hedge. The portfolio performed admirably throughout the pandemic after the initial “shock drawdown”.

If you look at the other portfolios based on Harry Browne’s Permeant Portfolio, you’ll see that this Growth Portfolio beats them hands down with just the addition of the REITs. Although all of the Permanent Portfolio assets did as expected.

You may have noticed that the returns numbers have increased significantly for this portfolio. That’s because before I was using inflation adjusted data. I decided to stop that as the data is difficult to correlate so now it just the raw numbers. If you need to know how that looks historically against inflation, you’ll need to do some number crunching yourself 🙂

Permanent Portfolios (all currencies)

No changes from last month. Everything performing as expected.

Recap:

Portfolios based on Harry Browne’s Permanent Portfolio strategy are all still doing well and as expected. They all experienced some drawdown when the pandemic first hit, but nothing out of the ordinary. 7% – 12% drawdowns with these portfolios are a regular occurrence.

None of them perform as well as the USD Growth Portfolio because the portfolios that are not in USD currency are not based on the US markets (historically some of the worlds top performing markets), plus they don’t have the added exposure to REITs and the high dividends they bring. The only difference between the USD Growth Portfolio & the USD Permanent Portfolio are the REITs, so you can see by looking at that the difference they make over time.

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking). And I use the Ledger Nano X & S for Crypto offline cold storage.

Visit Kraken Visit BinanceOver the last few months, ever since I made my first small investment in Cryptocurrency back in February 2021, I’ve been studying and learning about them.

I can say that I’m convinced they are going to be a big part of the future of investment, and also finance in general. I realize that was a bold couple of statements, but that’s where I’m at now. So much so that I’ve decided I’d like to eventually have around 5% of my overall investment capital in various crypto assets when I can buy them at (what I consider to be) reasonable levels.

Even though my Cryptocurrency Portfolio is severely in the red for June as I tried to “buy the dip” with many assets, and the market proceeded to crash right through that dip. I think there is a big opportunity in the making. Plus most of my assets are staked so I’m still making returns even though they are in the red.

If you’re interested in Crypto investing, I did a writeup on the Cryptocurrency Portfolio page on my reasoning for purchasing many of the assets. The only thing that’s really changed this month is that I’ve decided that if I’m going to invest substantial capital into Cryptocurrencies, some of that is going to have to be Bitcoin. All of my previous thoughts still stand about the overall potential for Bitcoin, but there is no denying that Bitcoin still has (by far) the largest market cap, and therefore still leads the overall Crypto market up or down. I’ll show you what I mean later.

So, with the above in mind, the question is: “when & how do I enter the market with significant capital?”. I already have a reasonable investment in a few of the altcoins (altcoin meaning anything that’s not Bitcoin) and there are a few that I would like to buy more of, namely Ethereum (ETH), Cardano (ADA), and Ripple (XRP). You can read in the Cryptocurrency Portfolio why I purchased these assets already. My reason for buying more of just these 3 is this;

Ethereum (ETH) is the second largest crypto asset after Bitcoin, so it’s good diversification away from Bitcoin and it also has a lot going for it as something other than a purely “speculative investment”, which is all Bitcoin really is.

Cardano (ADA) is a direct competitor to ETH, so with buying more of this, I’m hedging my investment against ADA actually overtaking ETH in the future, which I think is an outside possibility. ADA is very cheap right now compared to ETH, so I can buy a lot of it at lower levels.

Ripple (XRP) is a very different proposition. It was specifically developed for moving currencies around the globe and it just seems to make a lot of sense to me. It’s many times faster than the Visa or Mastercard systems as far as transactions it can process in a second, and the fact that it was developed specifically for moving assets internationally makes it interesting as anyone who has had to move large amounts of capital across international borders might tell you, and what an arduous process that can be.

PolkaDOT (DOT) is the other one that I like a lot, but I have enough of that for now.

All of the other altcoins I’m invested in, I think I have enough of for now. They were (and still are) “punts”, and perhaps one of them will pay off for that golden investment in the future, we’ll see.

The rest of my Crypto capital (about half of the total) will go into Bitcoin (BTC) as a long term investment. But ONLY at the right price, which I think may be coming, and is definitely NOT $50 or $60k in my opinion.

Let me explain what I’m thinking. Take a look at this chart of BTC & it’s 200 Week Moving Average below since it started back in 2012.

Something that occurred to me when I first saw it was; not once since it’s inception has it pulled back from the latest ATH (all time high) more than 60% and not returned to the 200 week moving average before setting off to make a new ATH. It pulled back in 2013 before taking off to a ATH, but that was only about a 30% pullback from the last low before it took off and made a new ATH.

Bitcoin typically makes a new ATH then pulls back to the 200 week MA before taking off again. So, a good place to try and buy it might be the next time it pulls back to that 200 week MA, wouldn’t you think?

Currently we are at a .618 Fibonacci pullback (61.8%) since the last time BTC touched the 200 week MA which was back in March 2020. This “Fib number” some of you will know is significant as to whether a pullback is indeed just a pullback, or if it’s a significant downturn. So if we start going up again now from that level (specifically set on the 22nd of June), we could be potentially looking at new highs based on Fib numbers, and BTC would be doing something it’s never done before, namely making a new ATH without touching the 200 week MA after a 60%+ pullback.

On the other hand, if we come down again and exceed that number, I think there might be a good chance we will meet the 200 week moving average before we head off up again to the new ATH.

Now, remember moving averages are (by their nature) moving! So every day this average is not hit, it moves up a bit. But that line is where I will likely buy Bitcoin if/when it touches it again, whatever the price may be at that point.

As the 200 week MA moves up, so will my buy level. The other thing to remember is that the MA is a LONG way down from where price currently is. For price to come down that far now (today) it would need to retrace about another 60% from where it is as I write this. That’s a big move, but in crypto, it happens, and it happens often. The Bitcoin price could also just stay in the trading range it’s been at for a few weeks, and the 200 MA would come up to meet it eventually.

Nothing is guaranteed obviously, but all we have to go on with investing is the past, so we can only hope it will continue to emulate it in the future. After all, markets are just a reflection of human greed and fear, and that hasn’t changed much since the beginning of time.

Why am I only discussing charts of Bitcoin? Because the whole market basically follows Bitcoin. Not exactly, but Bitcoin by it’s self is a huge part of the total Crypto market cap, so the other assets basically rotate around it, but on a whole follow it. Plus it’s easier to watch one major asset for a gauge to all the rest.

Just as a caveat, I’m still not saying Bitcoin will be the all time winner of the crypto race (if you’ve been reading my posts previously, you’ll know I don’t think that at all), but I’ve realized that we have to respect its size compared to the total crypto market currently. Out of all the crypto assets right now, I think it’s the most stable (kind of an oxymoron using “crypto” and “stable” in the same sentence I know) but for large amounts of investment, I need some of it to be in Bitcoin.

This is a chart of the total Crypto Asset class vs. USD:

Here’s a chart of Bitcoin/USD (these charts are from the free version of TradingView just in case you’re wondering)

Obviously the patterns are not exactly the same, but the levels & percentage pullbacks overall are very similar.

You’ll also notice several other lines & levels on the Bitcoin chart. The numbers are various waves I’m tracking (Elliott & Wolfe) and then the 200 week MA is the thick green line.

There are a lot of things happening around that green 200 week MA line. The 2019 high, and the 5th wave for some of the counts (although it’s quite a bit lower for a couple of them) are all in that vicinity all adding to the probability of a turn should the BTC price pull back to that level. Of course there is nothing saying that the 200 week MA will still be at those levels if/when the price gets there.

The Crypto market could take off back up and make another ATH, it could do nothing as it has been doing for the last few weeks, or it could come down some more, or a lot more (personally I think the latter, but no one knows obviously).

Either way, I’m happy. If it heads off up, then I’m already in the market with the assets I bought earlier in the year, and if it comes down to the 200 week MA, then I’ll buy in. I’ll buy Bitcoin and also the other assets mentioned earlier at the same time.

Of course then at that point, there is the possibility for it to crash through the 200 week MA, continue lower, and never make another ATH, but that’s the risk we take with any investment.

Historically BTC has always retraced to, then turned back up at or around that 200 week MA. I tend to believe that Crypto will continue this pullback, then resume its upward momentum to very high levels in the future as governments keep printing more and more fiat money, and also governments & banks tighten their control on capital movements for “money laundering” (AKA tax harvesting) reasons.

It could be a significant wait for anything to happen, but I’m in no hurry as most of my current assets are Staked and making returns anyway.

So we’ll see what happens 🙂

It goes without saying, please don’t just follow investments that I make. And if you do decide to invest, based on your own research, don’t invest in Crypto what you can’t afford to lose, or at least hold on to for a long time, because it is still the wild west of investing and very volatile as the last few weeks have shown.

Summary

That’s all for this update. I’ll keep on tracking everything and we’ll see how I do with the various investments.

If you have any comments or suggestions, please feel free to comment on the post, or email me directly if you prefer.

Good luck with your investments in the coming months! Remember, it’s about patience & persistence, not perfection! If you start investing in various assets when you are young, just a small amount every month like I did, you’ll be amazed how quickly it becomes a significant portfolio. You’ll also be amazed at how quickly you get old 😀

My best to you and your families. Stay safe and I’ll post an investment update again soon.

Maturing Whisky Portfolio

£ – GBP Permanent Portfolio

฿ – Cryptocurrency Portfolio

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

$ – US Dollar Growth Portfolio

£ – GBP Peer to Peer Lending Portfolio

€ – Euro Permanent Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.