It’s about that time again. Here’s a quick update on my investments and also an introduction to a couple of new reviews including new investment opportunity I’ve been working on.

The first review is of Assetz Exchange whom I have been investing with now for over a year. I like this platform because it’s different from P2P lending. Although it “feels” similar, we are not lending money at all, we are purchasing part of a property (through an SPV) which is long term leased out to UK charities. This gives us a monthly rental income, and also exposure to the UK property market. If you not familiar with the platform, definitely worth taking a look at the Assetz Exchange Review.

The other completely new opportunity I’ve been working with for the last few months is “Find UK Property“. As opposed to a P2P platform, this is a true buy-to-let opportunity, with a twist. Anyone who’s been involved with buy-to-let knows it’s a decent long term investment, the problem is always the “hassle” of being a landlord, or even dealing with management companies. Find UK Property offers a hands-off turnkey solution for investors who like to own property outright but don’t want the hassle of dealing with it (the epitome of “me”). It offers a guaranteed 6% return with zero hassle plus exposure to the UK housing market which has averaged around 7% growth per annum for the last 50 years. Check out my full Find UK Property Review if this is something that might be of interest to you.

On to the investment updates.

Equities & bond markets are still extremely volatile. As well as the Russia-Ukraine situation, we also now have a China-Taiwan issue which is making everyone nervous. Add that to serious inflation and the fuel crisis, and we have the perfect storm! The US Federal Reserve hiked again as expected, as did the BofE and the ECB trying to curb inflation, however traders are now starting to expect the central banks to “pivot” in the next few months, meaning they will stop hiking and even perhaps start reducing rates if the economy gets bad enough and inflation starts to show signs of slowing down. Because of this, we’ve seen a “hope rally” in stocks and bonds in recent weeks. Although that seems to have faded now.

Personally I’m not convinced in any “hope rally” as I think we have more downside because nothing significant has really changed yet. And now with the added possibility of more wars, things are still going to be very sensitive.

Crypto has been dead in the water for the last couple of months. I actually don’t even look at it now except for updating the numbers on the website at the end of each month.

Crypto is the epitome of speculation so I really don’t expect anything big to move in a bullish direction here until general public sentiment picks up. Then who knows what will happen?

Gold against the GBP is still in a trading range, however it appears to be testing the top of that large triangle again. If it breaks out of there properly to the upside, it would give a price target of about £1720 based on age-old technical analysis. I hope it does as that would help the Permanent Portfolio investments as well as my personal Growth Portfolio.

Peer to Peer lending is still plodding along as usual. I have noticed there seems to be more loans available with some of the platforms now so I guess there are not quite as many people investing as before. This is actually a good thing for the rest of us as (hopefully) it will drive return rates up a bit. We are already seeing that with Loanpad who have made a couple of small hikes already with the latest to come into effect September 1st paying 4.30% on their Premium Account and 3.10% on the Classic, then from October 1st it will move to 4.40% on the Premium and 3.20% on the Classic.

I’ve had a few people write and ask me why P2P rates in general aren’t rising as they are with high street banks. As far as I understand it, P2P lenders are not driven by the central bank rates as banks are. We see bank savings rates go up because the central bank is increasing its rates. P2P rates go up for a couple of reasons; 1. Because there are less funds coming into the platform so they need to make returns more attractive to bring in more capital (like Loanpad is doing now). Or 2. The risk level rises or falls on the investment. As bank rates rise, it may have an influence on P2P platforms if they want to stay competitive in order to attract funds (this basically fits in to item #1 above).

So, I’m not sure we’re going to see rates rising to double digits without a rise in risk unless capital inflows get substantially less into P2P platforms. That could happen if bank savings rates get to say 7% or 8% because if a savings account was paying that with government insurance, why would anyone want to put money in Loanpad currently at 4.30%? Or even Kuflink paying 7% when there is virtually no risk at keeping capital in the bank at the same rate? I’ll tell you this much, if I can get 8% on my capital from a government insured bank account, I’ll have a lot of them, all with the covered £80k in there. What would it take to keep me in a P2P platform at that point? Who knows, but it would at least be double digit returns.

Whisky has really surprised me as far as returns to date. I was expecting 7%-8% per annum but it’s way above that currently running at 21.31% in the last 12 months. The problem of course now is buying it. Just can’t get invested as there is too much money trying to get in and too little liquid coming available unfortunately.

Whenever WhiskyInvestDirect.com launch new product I try to buy as much as I can, but that’s just not a lot at the moment.

And so on to the individual portfolio updates & a little more detail.

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Peer to Peer Lending Portfolio Update

I’m still increasing my investment in P2P each month by a small amount when I see the right opportunities as you can see below;

The P2P Lending Portfolio XIRR currently running at 5.19% in August.

My biggest platforms as far as monetary value now are Kuflink and Assetz Exchange each with well over £50k, and then easyMoney.com coming in second at a little over £31k. CrowdProperty & Loanpad are the other two significant platforms, but as I mentioned in the last update, I’m going to slowly sell out of CrowdProperty.

Depending on how things pan out, I’ll either reinvest the money in Loanpad if we get close to 5% again, or I might just buy another house through Find UK Property. The only thing that’s stopping me from doing that right now is that the growth portfolios are drawn down quite a lot and I don’t want to tie up more cash in a long term, relatively illiquid investment in case I need it for something unexpected. Don’t want to ever have to sell securities from the growth portfolios at a loss to raise cash, and we don’t know how long this drawdown is going to last.

I had to withdraw more money out of Unbolted over the last couple of months as the cash drag is still ever present. Not enough loans and too much investment capital sat waiting makes it very difficult to get fully invested.

At least unbolted is still paying well though so I’ll keep money in there as long as I can.

All lending figures are available on the Tracking sheet in the Peer to Peer Lending Portfolio.

Latest Detailed Individual Peer to Peer Platform Updates

(Click link to go to latest update in review)

You can always see the live Peer to Peer Lending Portfolio data here >>

Securities, Bonds, Gold, Crypto & Whisky Portfolios

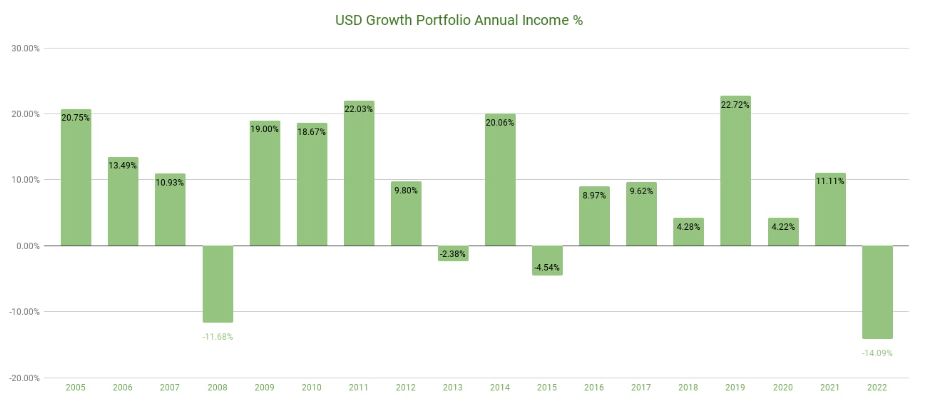

USD Growth Portfolio

Growth portfolios (stocks, bonds, REITs, gold etc.) continue to pull back as mentioned earlier. My main portfolio had a lifetime drawdown of 14.75% (back in 2008) before now, and it actually exceeded that in August 2022 with a drawdown at 15.21%. It’s always scary when things like this happen but the worst thing I could do now is get scared out of it and sell everything accepting a large loss. I remember in 2008 when the world seemed like it was ending (not dissimilar to now), and the portfolio made new drawdown lows at that time, I was very tempted to cut my losses and sell out. Happy I didn’t though as it came back very quickly and once out, I would have probably missed the rally as it would have been quite difficult to recommit after mentally taking a big loss like that. I prefer to just ride it out. Each to their own.

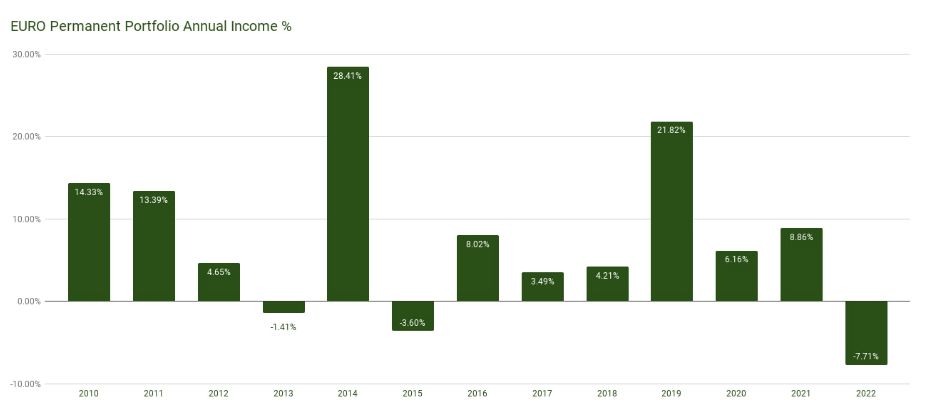

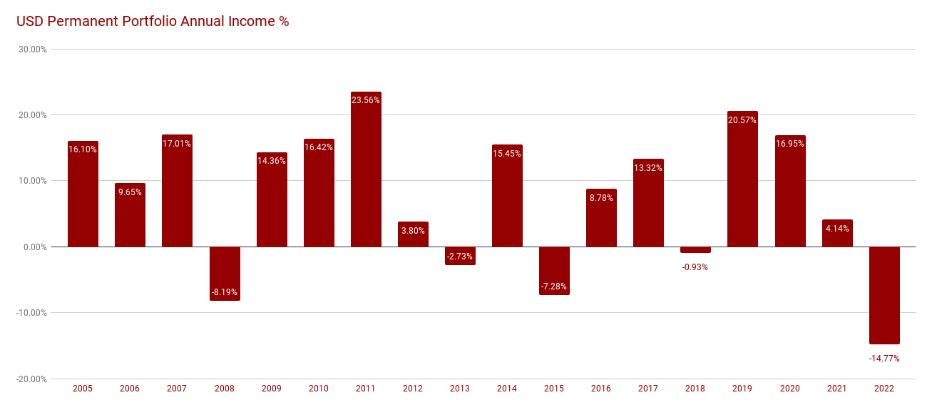

Permanent Portfolios (all currencies)

Both the EURO based portfolio and the GBP based portfolio also pulled back some, but less so than the US Dollar based portfolios which tend to be more volatile in general. The fact that both currencies against the US Dollar are falling seems to mean that the portfolio assets don’t take such a big hit. Or perhaps Europeans aren’t as “panicky” as U.S. traders 🙂 The fact still remains that both portfolios are still drawn down beyond their historical lows. Again, what are we going to do? Personally I’ll just ride it out. Historically things have always come back, and panic selling is not a good long term investment strategy.

All of the assets these portfolios are based on have performed the same way for the last 100 years or more, so I would be surprised if things didn’t come back in the next year or so. Might be longer but I would be surprised if we weren’t back to all time highs by the end of 2024. All it’s going to take (I think) is the central banks to start slowing down the rate hikes (which will mean that that inflation is starting to slow) and we’ll see things take off again. Obviously having the world NOT on the brink of world war III on two continents wouldn’t hurt anything either.

You can see a 40+ year asset class backtest of these assets on the Portfolio Visualizer site by clicking here.

A couple of good books to read on these portfolios are “Fail-Safe Investing” and “The Permanent Portfolio” if you’re interested in how they’re constructed. Both oldies but goodies.

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking). And I use the Ledger Nano X & S for Crypto offline cold storage.

Visit Kraken Visit BinanceCrypto has just been killed as you probably already know. We did get a bit of an upturn in July & August but nothing significant.

For now I’ll just sit tight and keep saving my staking rewards.

I am still staked with many of the assets so still making money while the prices are low.

It is interesting that once again Bitcoin did hit that 200 week Moving Average. I did say in previous posts that I would buy it when BTC hit that 200 WMA, however things have changed (as they do) and I used the money I was going to buy that with to buy a house with Find UK Property instead. I think at the moment that’s a safer bet. Plus being down over $35k on crypto makes it kind of difficult to pull the trigger on another $100k or so of Bitcoin (which was my previous intention when it hit the 200 WMA).

It is interesting in the past though how it’s always bounced off that 200 week MA and gone on to make new highs. Let’s see what happens this time.

Whisky Portfolio

I buy & store my whisky through WhiskyInvestDirect.com

Visit WebsiteOnce again I got a little more capital (emphasis on little) invested through pre-order with WhiskyInvestDirect.com in August. It’s becoming kind of a joke now unfortunately. There is so much capital trying to get in, and they distribute the new liquid equally between all investors . So if you’re waiting on the sidelines with £50k trying to get invested, you’re going to get exactly the same amount as a person with £500 waiting. This last time I got £150 invested (from a request of several thousand). Not going to get rich anytime soon on that level of investment.

There were two more bulk trade bids come in from bottlers, so I accepted them both. Nice profit on each but getting that capital invested again might be difficult.

Summary

Overall things look pretty bleak in the bonds/stock markets. However that can change quickly as we’ve seen in the past. My strategy is to just sit tight for now. I reinvest all of the dividends I get on my holdings, so on a positive point, I’m buying new units of most items at a big discount.

Who knows what will happen with Crypto? I have a feeling it will rip back at some point making us all wish we would have dumped everything into Bitcoin, Ethereum & DOT. For now I’ll leave everything staked so when it does come back, I’ll be looking even better than before, perhaps.

P2P, Whisky & the new buy-to-let opportunity with Find UK Property looks very promising. I have a couple of other investments coming to fruition in the next few months so I’ll look at purchasing another house at that time if I don’t decide to invest it back into the current investments.

Until next time; good luck with your investments and stay safe. My best to you and your families.

€ – Euro Permanent Portfolio

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

£ – GBP Peer to Peer Lending Portfolio

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

£ – GBP Permanent Portfolio

$ – US Dollar Growth Portfolio

฿ – Cryptocurrency Portfolio

Maturing Whisky Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Interested that you’re still happy with peer to peer given you can get very similar returns with a fixed rate bank account now ?

4.3% to 4.5% for a years fix with monthly payouts of income

I’m still happy with it, however if I can get more or the same return in a government insured bank account, of course I’m going to reduce risk in the P2P and start to move some capital over. The better diversified any portfolio is, the safer it is (in my humble opinion).

Hi Mark, when will we have new update? 🙂

There is a new one now Sergio. Sorry it took so long.