Assetz Exchange – Pros & Cons

PROs 👍

- Safety – Loaning to companies (SPV’s) which let out property to UK government supported charities is a relatively safe bet.

- Rate of Return (ROI) – risk/reward rates are very reasonable based on the current overall Peer to Peer lending market.

- Capital Growth –opportunity to capitalize on property price growth whilst maintaining investment liquidity.

- Ethical Lending – providing high quality homes for vulnerable people.

CONs 👎

- New(er) Lender – The Assetz Exchange platform only launched in 2019, although they are already a profitable outfit.

- Different Investment Structure – lending to SPV’s (companies specifically created to buy & let out properties) is a new way of doing things in the P2P market place, although it already appears to be proving itself as a positive change.

- Smaller Company – still a smaller organisation, however they have the backing of the well-know larger platform Assetz Capital.

Visit The Assetz Exchange Website

What is Assetz Exchange?

Assetz Exchange (AE) is a UK based P2P property investment platform. It is somewhat like a regular Peer to Peer lending platform, however it operates a little differently to usual P2P lending platforms as technically Assetz Exchange doesn’t lend to property developers. Instead investors lend capital to Special Purpose Vehicles (SPV – company specifically created by AE for investment) which then purchase properties and let them out to UK charities on a long term basis (typically 5 to 10 years).

These charity organisations don’t typically have periods when the property is untenanted and producing no income as they are directly funded by the UK government, so the chance of default or non-payment of rent is very small. Also maintenance costs and general upkeep is taken care of by the charities themselves, as opposed to investors as landlords paying for it, which keeps income at a very respectable level.

One of the things I really like about this platform is most of the properties they provide to charities are for vulnerable people. They provide high quality homes for people that are disabled, or have learning difficulties and require a caregiver. Some of the homes have been specially adapted so they are suitable for this type of tenant. It’s always good to know you’re doing some good for others as well as making some return for your efforts.

The company also works with national builders such as Avant Homes, where they purchase fully furnished show homes from areas around the UK. These are then leased back to the property developer for fixed periods of up to five years to be used to help sell other new builds. These types of investment are also lower risk as the developer is responsible for rent payments. In the future though, Assetz Exchange will be focusing on charity let properties as these have become the core part of the business.

Assetz Exchange have in the past also done some standard buy-to-let properties, however this business has also given way to the safer charity lets.

From letting to charities, investors benefit from a relatively safe investment paying between 5% & 6% monthly income, plus the opportunity to have their investment increase (or decrease) in value based on supply & demand for the properties and the UK property market in general.

As the name suggests; Assetz Exchange is a sister company to the well known Assetz Capital P2P lending platform, however it operates completely separately, so if you already have an account with Assetz Capital, you’ll need to sign-up again with Assetz Exchange. That being said, Assetz Capital are Assetz Exchanges’ “living will partner” meaning if AE were to go into administration, AC would take over day-to-day running of accounts. This just adds another level of security to the Assetz Exchange platform.

Since the platform was launched in 2019, it has gained a lot of attention from investors and the media alike. The Times did an article on Assetz Exchange (subscription required to read) which helped to propel the platform to success. Overall the platform has gone from a startup to a formidable leader in this part of the UK property buy-to-let market in a very short period of time.

Easy-Info Table© – Assetz Exchange Review

| Overall Rating*: |  (4.4 / 5) (4.4 / 5) |

| Who can invest: | Anyone from any country |

| Loan Currencies: | £ |

| Estimated Return: | 5% - 6% annual rental yield + 4% - 7% avg annual capital growth when properties parts are sold. |

| Target Annual Return (Platform Number): | 5.56% (rental yield only). |

| My Calculated XIRR: |  (rental yield only - does not include capital growth) |

| My Current Investment: (click to see amount in £) | See My Investment £ |

| Risk Rating*: | 2/10 - Low  |

| Early Exit: | Yes. Under normal market conditions. Investments can be sold to other investors on the exchange. |

| Min. Investment: | £1 |

| Deposit Funds: | Bank Transfer. Available 2-17 mins for deposits £10k or lower, one working day for larger deposits (for AML checks) |

| Auto-Invest: | No |

| Manual Invest: | Yes |

| Lending To: | Companies set up to purchase the properties that are controlled by the lenders by way of majority vote. These properties are then let to large (usually regulated) organisations |

| Loan Security: | Fractional ownership of SPV which owns property. |

| Default Rates: | N/A |

| Provision Fund: | No |

| Loans Amortize: | Not a loan. Rental income paid monthly per property. |

| Time to Invest: | Fast. Investors can bid for property parts on the Assetz Exchange and invest as fast as they like. |

| Time to Mange: | Almost none once invested. |

| Lender Fees: | No |

| Payments Received: | Payments are received throughout the month. |

| Amount Lent: | Purchased £17m + worth of properties. |

| Number of Investors: | 2000+ |

| Loan/Dflt Stats: | Not a loan so defaults not possible All rentals payments current to date |

| Regulated: | Yes: FCA |

| Location: | Manchester, UK. |

| Launched: | 2019 |

| Website: | https://www.assetzexchange.co.uk/ |

| Email: | info@assetzexchange.co.uk |

| Telephone: | 03330 119830 (UK) |

| IFISA/IRA: | Yes: IFISA Learn More >> |

| Cashback**: | Sometimes Check for Current Promotion >> |

| How to Sign Up**: | Signup Here! |

.Visit The Assetz Exchange Website

My Overall Experience with Assetz Exchange…

I have been investing with Assetz Exchange for a little over a year now. It has taken me that long to write this Assetz Exchange Review as I wanted to be sure I understood the platform and also to see how they performed before I put it out there for readers. Lending to an SPV which purchases and lets out properties is a new concept, so I really wanted to give it time before reviewing it.

I’m happy to report Assetz Exchange deliver all they promise. I like the steady rental income flow, and it’s also good to have exposure to the UK property market which is still one of the hottest in the world.

Lending on properties for letting through a SPV instead of lending directly to developers for short term bridging offers (in my opinion) good diversity and another layer of safety. The long-term rental contracts with UK based (regulated) charities provides an even safer investing environment (how many UK government supported charities do you hear of going bankrupt?).

My latest lending experiences can always be found in my Monthly Portfolio Updates.

Latest Update & Current State of Account

As it’s now possible to get around 5% from government insured bank accounts, I have decided to reduce my exposure to P2P lending and the UK property market and move some cash to banks. I have drawn down my Assetz Exchange account to just over 30k (as I have most of the other P2P accounts). It’s still good (in my opinion) to have some exposure to P2P as it does still pay slightly more than banks (at the moment), however the risk is obviously more, so limiting exposure accordingly is prudent. Assetz Exchange are a little less risky than platforms that offer development loans (in my opinion) however we still have up & downside exposure to the UK property market. With the BoE still raising rates into next year, we don’t know yet how this will effect the UK property market as variable interest mortgages get more expensive for households. This along with inflation and the energy crisis could have a significant impact on the economy and real estate prices across the board. Better to be safe than sorry (especially when we can get almost the same rates in banks).

.Visit The Assetz Exchange Website

Account Screenshots

Latest Screenshots from my personal Assetz Exchange account.

Assetz Exchange Investment Return Charts

(Click on Image for Interactive)

Please note: rental yield & capital growth are shown separately. below The capital growth charts are just informational until I decide to sell property parts, at which time capital growth will be added to overall income.

Detailed Overview – Assetz Exchange Review

When Did Assetz Exchange Launch? – History

The Assetz Exchange platform was established and ready for investment in 2019.

Although the company is the sister of the well known Assetz Capital P2P lending platform, Assetz Exchange operates as a separate entity.

How Assetz Exchange Came into Existence

Back in 2016, Peter Read (now Managing Director of AE) and his brother developed software for trading ‘partial shares’ of properties on an exchange. The same year they met Stuart Law (Managing Director of Assetz Capital) who identified the opportunity to extend Assetz Capital’s offerings into longer term investments.

As discussions progressed, it was decided to set up Assetz Exchange as a completely separate entity from Assetz Capital, specifically for longer term investments with a different (and lower) risk profile. It was also decided the best way to go about this was through the route of buying properties through a Special Purpose Vehicle (SPV) and enable investors to control this SPV through a voting system. As this was a completely new idea for a P2P platform, it took until 2019 (when the platform was launched) to gain approval from the FCA to begin trading.

How Does Assetz Exchange Work?

The way investments through AE work is a little different to traditional P2P lending platforms. Basically we are making a loan to a limited company that has been set up specifically to purchase the property (also called an Special Purpose Vehicle). There is no other debt or income in the company, and in the event of the property being sold, proceeds (less sale costs) will be distributed in full to investors. It’s as simple as that (at a very high level of course).

As the latter part of the name “Exchange” suggests, parts of properties are bought & sold on the platform though a bid & offer system which is very effective.

You can see at any time what other investors are bidding on property parts, or offering for sale a previously purchased part.

This exchange market system sets the overall price for properties, which means as well as receiving monthly rental income for a purchased property, we can also take advantage of rising (or falling) property prices based on the exchange supply & demand, and (over time) overall UK property prices which have averaged around an 8% annual increase over the last few decades. It’s important to remember of course that if prices fall, you are also subject to that eventuality. That will only matter when you want to sell your property piece.

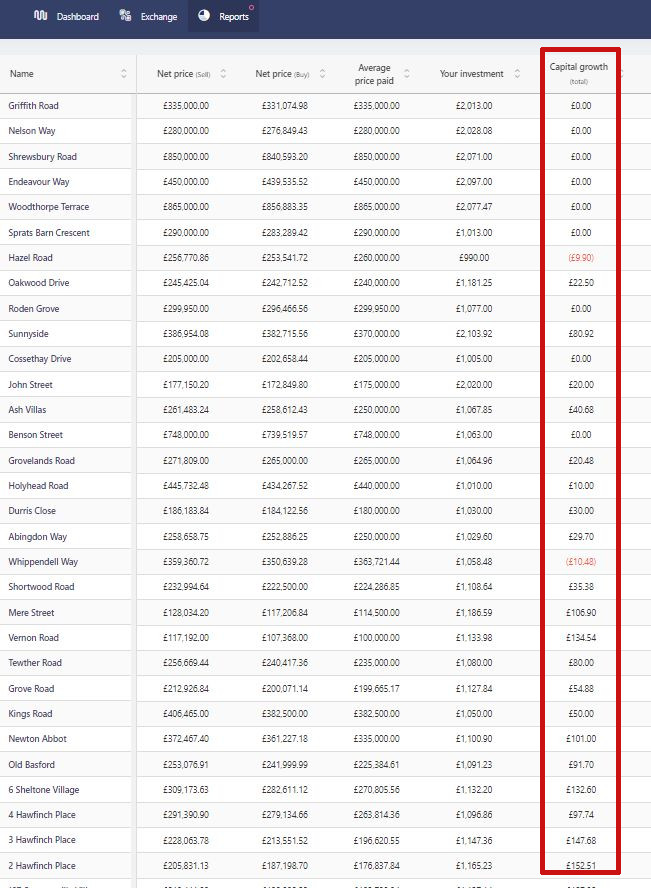

You can see below how we can monitor current property parts valuations & capital growth from the “Reports” menu.

Is Assetz Exchange Safe?

No Peer to Peer platform is 100% safe as they are not covered by FSCS protection, so in that respect they are not safe like a bank. As an investment platform however, I consider Assetz Exchange to be relatively safe and in the lower end of the risk spectrum. Lending on buy-to-let properties which are long-term lets mainly to UK Charites, is in my opinion about as safe as it can get with Peer to Peer lending.

Is Assetz Exchange Profitable?

Assetz Exchange have seen a very healthy growth path and they turned profitable for the first time in Q1 2021/2022 (financial year starts in October) which is quite a feat in less than 3 years. There are P2P platforms out there which have been running for 6 or 7 years and are still yet to see a profit. A profitable platform in my opinion offers just another addition to the overall safety of the investment.

Investment figures since platform launch are as follows:

2019 – £487,206

2020 – £4,391,820

2021 – £4,461,123

2022 £7,573,653 (YTD as of June 2022)

Assetz Exchange expect to continue with this phenomenal growth path moving forward as they add new properties to the platform.

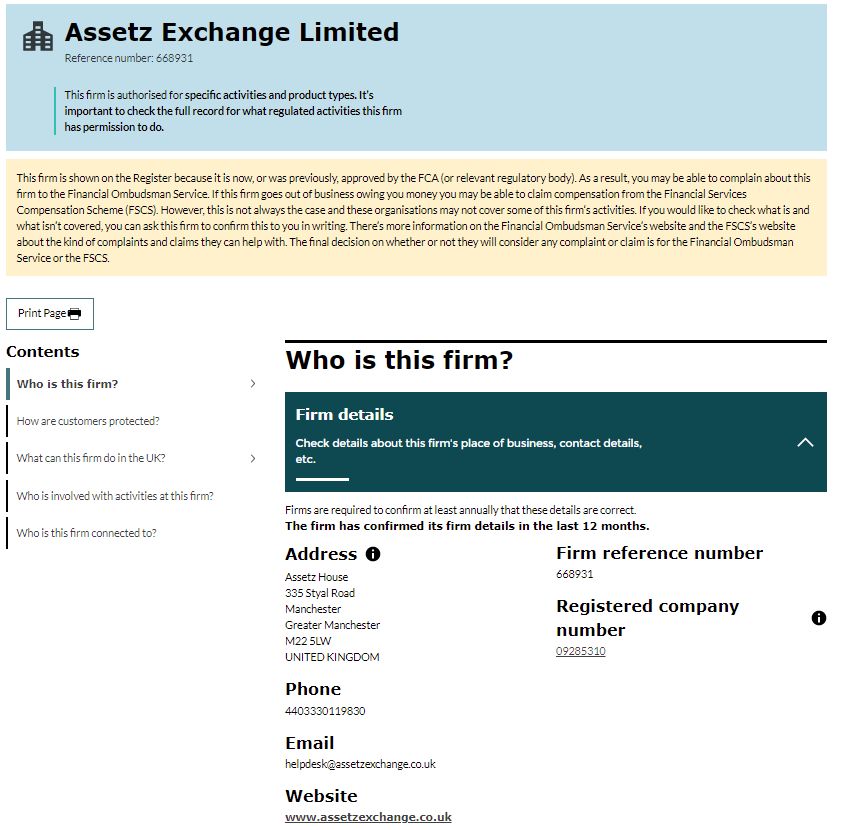

Is Assetz Exchange Regulated?

They are regulated by the UK’s Financial Conduct Authority (FCA) with full permissions under FCA number 09285310.

The company gained FCA permissions in July of 2017.

It’s important to note in this Assetz Exchange review that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

How Long Does it Take to Invest with Assetz Exchange?

As properties can be purchased on the exchange which is a type of bid & ask property marketplace, investment can be immediate if you are willing to pay the asking price and there are property parts for sale. Of course you can always put a bid in at a lower price and wait to see if it’s accepted.

There is also the option to wait until new properties are released and get a piece at the initial value. This can take longer to get invested depending on how many new properties are coming to market, and how much you want to invest into each property.

Who are we lending to and What Security Does Assetz Exchange Offer?

We are lending capital via the Assetz Exchange Investment Platform to individual companies (SPV’s created by Assetz Exchange) which own individual properties. These SPV’s are created specifically to purchase buy-to-let properties through and have no other purpose than property ownership and income distribution. SPV’s are used (as opposed to direct ownership of properties) as they are more tax efficient and require much less admin than having several hundred investors with ownership of a single property. It also allows for immediate selling and purchase of loan parts without having to deal with solicitors or the UK Land Registry every time a loan part is bought or sold.

You can see the organizations Assetz Exchange are dealing with and case studies of working with them by clicking here.

How Safe are Assetz Exchange SPV’s (Special Purpose Vehicles)

The only creditor the SPV’s have are the loans from the lenders. The SPV’s are stand alone legal entities that are structured so that lenders have control over key decisions (such as to sell a property, accept or reject an offer etc., etc.). This is defined in the SPV’s articles of association. Under no circumstances can any sort of distribution be made to anyone else from the SPV’s funds – doing so would be against the law.

Lenders are therefore protected by company law. Any money in the SPV can only be distributed to investors themselves, as the company’s only creditors. As with any business/company there is the always risk of fraud, that can never be completely mitigated, although with AE overseeing the day-to-day running of the SPV’s, I don’t see any more risk than any other P2P platform could see because of fraud. That’s why we have the FCA and Companies House to oversee this type of thing.

Should AE cease to trade, then it is written in their winddown plan that the sister company Assetz Capital would take over day-to-day running of the SPV’s and in fact all Assetz Exchange business.

If Assetz Capital themselves were to cease trading while in charge of AE SPV’s, then their living will partner would take over and handle the winddown and distribution of assets to investors as per FCA regulations of Peer to Peer lending platforms.

One thing to mention is that people often ask the Assetz Exchange team if loans are directly secured to property title. They say they have looked into registering a charge against the loans secured on the properties, however really it adds nothing to the safety because as outlined above, given there is only one creditor, they rank first for any distributions. Therefore adding a charge is of no practical benefit and would increase administration & associated costs significantly.

Has Assetz Exchange had any Defaults?

Because we aren’t lending money to other business, defaults don’t really apply here. No money is lent to the charities, so they can’t default. All they can do is stop paying rent (which has never happened to date) and even if they did, investors still own the asset, so AE could sue the charity for breach of contract. So rent payments could stop, however I would be confident AE could recover the owed rent (unless a charity actually went bust, again very unlikely when they are government supported) and AE would try and re-let the property anyway. Worst case, AE could sell the property and repay investors.

How Can I Sell Loans and Withdraw Capital from Assetz Exchange?

You can get almost instant access to your money under normal market conditions depending on what price you would like to get for your loan part. Selling loans is typically fast if there are offers on the property, and capital is returned to your bank within a couple of days. Obviously there needs to be buyers for your loans in order to sell them, which is not typically a problem.

How is Capital Diversified?

Diversifying capital into loans is something we do manually when we invest. For example, you’ll note from the image below that I typically invest between £1,000 & £2,000 per property. This is based mostly on what investment capital I have available at the time, amongst other factors such as risk/return/income profiles etc.

Does Assetz Exchange have a Provision Fund?

No, there is no provision fund to cover missed rental payments. As we are mostly lending to UK charities (which are supported by the UK government) this is not something that concerns me. Charities typically pay rental payments in full and on time.

Is there a Tax Efficient Assetz Exchange ISA Account?

Yes, as of the time of writing this Assetz Exchange review, they offer an Innovative Finance ISA (Assetz Exchange ISA) offering the same benefits & return as their standard account.

The Assetz Exchange ISA is for UK residents only.

.Visit The Assetz Exchange Website

What Type of Investment Accounts Does Assetz Exchange Offer?

There are just the two types of account, the Standard Manual Lending Account and the ISA Account which keeps things nice and simple.

What Rate of Return (Return on Investment – ROI) Should I Expect from Assetz Exchange?

Most of the long term charity rental properties have a return rate of between 5% & 6%. My current average rate as I write this Asset Exchange Review is 5.56% as you can see below (although my self-calculated XIRR is actually a little higher).

The Average AER Yield above does not include capital growth on investment properties which can also be seen from the reports menu. It’s difficult in my case to work out the exact percentage growth over the past year as the figure below includes investments I’ve had for a full year and also investments I’ve added throughout the year.

A Word on Capital Growth with Assetz Exchange

Capital growth as far as this Assetz Exchange review is concerned is based on the supply and demand of their exchange. The values go up and down based on a variety of factors. I’ve noticed when a lot of new properties are released, capital growth on current properties goes down a bit (as there are more opportunities for investors to buy properties at a lower cost). As more investors (and capital) comes to the platform, prices go up, and so does capital growth. I expect over time the prices of all properties will follow UK property prices as when a property is finally sold (by AE) it would go for the current market price or thereabouts (less costs of course). There is one thing to mention, because of FCA regulations, when Assetz Exchange physically sell a property, they have a NET CAP (after costs, taxes, stamp etc.) of 3% annual profit. So bear that in mind if you’re in it for the long term and looking at capital growth.

When I mention capital growth in this Assetz Exchange review, you’ll note it’s just informational, I don’t and won’t include that in my return figures until properties parts are sold and I actually realize the return.

What is the Assetz Exchange Website Like to Use?

Investing on the Assetz Exchange Website is straight forward. It’s very well designed and self-explanatory.

The Account Dashboard gives you a good snapshot of your account. You can see at a glance how your investments are performing and income is received. At the bottom you’ll see the rental income (note that I’m writing this Assetz Exchange review half way through June, so the full income for June is not showing yet).

Similarly the Exchange View clearly shows live investments as well as my current investments, past investments and upcoming pipeline investments.

Everything is quite detailed but still fairly self explanatory as you can see in the screenshot below.

Really couldn’t be easier to use the website. The learning curve here is about 5 minutes & you’re ready to get started investing.

How Can I Signup with Assetz Exchange? – Signup Process

Opening an account is a simple process. Just the usual ID & anti money-laundering checks.

If they can verify you though one of the UK’s credit agencies, you will be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a bank statement to prove the account belongs to you for AML purposes.

As of the time of writing this Assetz Exchange review, just about anyone from any country can signup with the platform. Contact Assetz Exchange for further information.

How Can I Make Deposits & Withdrawals from Assetz Exchange?

Deposits and Withdrawals are made by bank transfer from a UK bank. Deposits are typically available in 2-17 mins for deposits of £10k or lower, one working day for larger deposits (for completions of AML checks)

Withdrawals are only to a verified bank account and typically take 1 – 3- business days.

.Visit The Assetz Exchange Website

Summary – Assetz Exchange Review

Assetz Exchange offers an interesting cross between Peer to Peer lending and buy-to-let investing where investors can benefit from a regular rental income and also price fluctuations in the property market over time.

The fact that most tenants of properties are UK charities supported and funded by the UK government make this a safer long term investment, at the same time being more liquid than a regular buy-to-let investment because of the property exchange that Assetz Exchange offers allowing investors to instantly trade property slices with other investors.

The 5% to 6% annual return along with the opportunity to capitalize on the popularity of investment properties on the property exchange, and UK property price growth over time makes the Assetz Exchange platform an interesting proposition for investors.

Points to Consider when Investing with Assetz Exchange

Thumbs Up Points

- Safety – Loaning to companies (SPV’s) which let out property to UK government supported charities is a relatively safe bet.

- Ethical Lending – providing high quality homes for vulnerable people.

- Rate of Return (ROI) – risk/reward rates are very reasonable based on the current overall Peer to Peer lending market.

- Capital Growth –opportunity to capitalize on property price growth whilst maintaining investment liquidity.

- Website – very easy to use and understand.

- Instant, no cost exit – providing liquidity, selling loans is generally free and fast.

- Financial Conduct Authority – (FCA) Regulated.

- Innovative Finance ISA (IFISA) available – Assetz Exchange ISA for tax efficient investing for UK investors.

Thumbs Down Points

- New(er) Lender – The Assetz Exchange platform only launched in 2019, although they are already a profitable outfit.

- Different Investment Structure – lending to SPV’s (companies specifically created to buy & let out properties) is a new way of doing things in the P2P market place. Already it appears to be proving itself as a positive change.

- Smaller Company – still a smaller organisation, however they have the backing of the well-know larger platform Assetz Capital.

.Visit The Assetz Exchange Website

Obvious Investor Risk Rating*

– 2/10 – Low

– 2/10 – Low

Is Assetz Exchange safe? I consider them to be in the lower end of the risk scale. Letting properties to UK government supported charities offers a higher level of safety than lending to general businesses or consumers.

Who Can Invest with Assetz Exchange?

Investors from most countries who can pass the ID checks can invest with Assetz Exchange. Contact them for further information.

Assetz Exchange Cashback Offers & Signup Links**

Cashback offers change frequently with this platform

Click here to check for new Assetz Exchange cashback offers>>

Open Assetz Exchange Standard Account >>

Signup for Assetz Exchange ISA Account >>

Similar Lenders to Assetz Exchange

Other Investment Platform Reviews

Proplend Review

London House Exchange Review

Find UK Property Review

Loanpad Review

easyMoney Review

Unbolted Review

Kuflink Review

LendingCrowd Review

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.