There were a few interesting changes in August; I started a Whisky Portfolio which you can read in the blog post My First Investment in Whisky. I’m still doing research on this but so far it’s looking really solid & I expect to have significant capital invested in whisky eventually.

The Peer to Peer lending Portfolio is back to normal with £749 of income for the month of August and getting close to that £200k invested level.

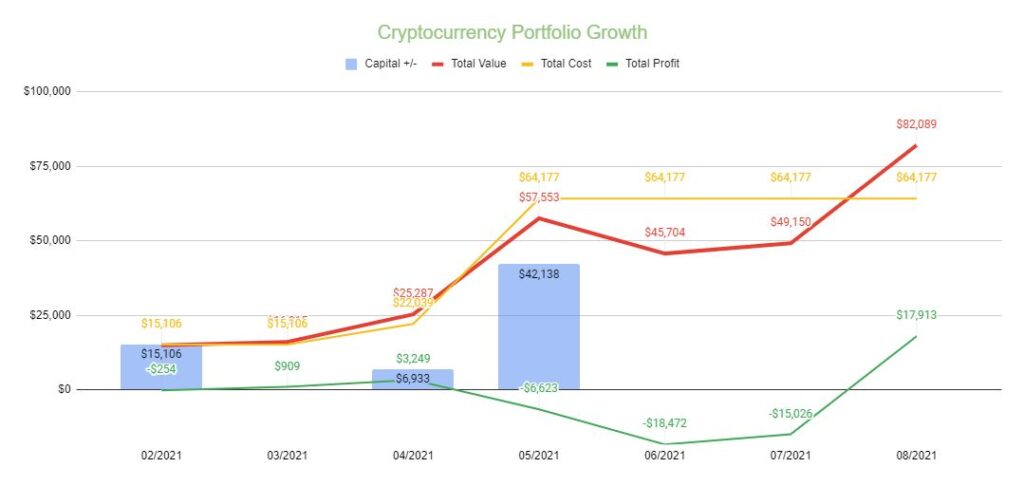

The Crypto Portfolio was the most interesting asset class going from being down over $18k at the end of June, to being up almost $18k at the end of August (and up $27k by the 6th of September). No complaints there, although I would have liked to have had the opportunity to invest more capital, but it just didn’t come down to levels I was comfortable with. It could still happen though.

Growth Portfolios continued to climb slowly. Gold had a massive selloff on August 9th when some whale fund decided to dump several billion $ worth into the futures markets all at once, like they were trying to sink the market on purpose. Gold quickly bounced back though, trading again above $1,800 by the end of the month. Some say it’s the US Government that keeps smacking gold down as it doesn’t like it getting close to $2,000/oz, something to do with controlling fiat currency & the economy. Not sure I’m even close to understanding how they manipulate the markets, not sure I want to be. Personally I think it will be way above the $2,000 level by the end of the year, but that’s just a guess of course, no one knows.

“And now for something completely different” as the old Monty Python sketches go (what I mean is something a little different to the normal Monthly Investment update blurb):

For readers just starting out on their investment journey to financial freedom; I was lucky enough to be privy to an early, pre-release version of a new book coming out at the end of September called “Invest Your Way to Financial Freedom” by Robin Powell of The Evidenced-Based Investor and Ben Carlson of the blog (and book of the same name) A Wealth of Common Sense.

I was a little skeptical at first as I’m pretty set in the way I’ve invested & pursued financial freedom throughout my life. I took the time and read the book though (didn’t take long as it’s a fairly easy, quick read), and I have to say, it has some really useful information if you’re just beginning on, or half way through your journey to financial freedom.

In fact, I had to look twice at it as I thought maybe I’d written it myself at some point (joke) as it mirrors my basic strategies over the years very closely. Of course there are some new investment ideas out there now, most of which I still agree with in the book, but the basic sense they make of things will really help “newbie’s” get a grip on where to start, and more importantly “how & why”. Take a look at it on Amazon.co.uk if you’re interested (it’s available pre-order for release on September 28th).

I have no involvement in the writing or publishing of the book, I simply got an early read, but thought it would be worth a mention for anyone not 100% sure of how to get started (or proceed) on their journey to financial freedom.

With that, we’ll move on to the individual portfolio updates.

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Peer to Peer Lending Platforms & Portfolio Update

Total Peer to Peer lending investment increased a little more in August 2021 to a total of £197,035 from £194,220 at the end of July. Current overall P2P portfolio XIRR is down just a pip at 5.48% from 5.49% last month. Many of the platforms I’m invested in don’t show a smooth return line as income is only recognized when individual loans pay back (along with interest income), so the XIRR jumps up and down a bit, but in general it is trending slowly upwards. All lending figures are available on the Tracking sheet in the Peer to Peer Lending Portfolio.

In August I added just a little more capital to Kuflink to catch a loan I really liked the look of, but I’m at $50k overall investment there now so I really don’t want to go any further at the moment (although I’d like to as I think Kuflink is one of the best investments out there currently). Assetz Exchange brought out a new charity loan so I had to have some of that. I also added another £1000 to CrowdProperty taking the overall investment there to just over £30k.

Apart from that, it was a very quiet month in Peer to Peer lending, with everything else just about normal.

You can always see the live Peer to Peer Lending Portfolio data here >>

Individual Peer to Peer Platform Updates

Ablrate wrote 2 more loans in August. They are starting to bring out more property backed loans now having established a relationship with P1 Investments. The last loan paid 9% which is not half bad.

I keep saying it but I really do need to get back into Ablrate with a larger investment. Just need to put aside time to do some research. They really are a good platform and are well liked by the “expert” lenders (whatever that means). They have a very large (what one might call) “cult” following and there are people out there who have been making close to 10% annual returns for several years now.

Here is a view of my Ablrate account as it stands at the end of August 2021.

The same 2 loans as last month still on hold. The portfolio loan is now in default, and the Air Freight company is being liquidated and they are selling off the aircraft. Last update was they had offers on the aircraft so hopefully some of this will be paid back soon.

There will always be defaults with higher risk loans like are available on Ablrate. The thing to watch is how they are dealt with by the platform. Ablrate have a very good track record of recovering funds upon default, although of course this can take a long time. I’m happy in this case that with both loans I had risked very little capital.

My Ablrate Strategy.

There are some great returns available through Ablrate if you’re willing to put the time in to do the research and buy the best loans. Up to 15% per annum. One of the best rates of all UK Peer to Peer lending sites.

For some it will be totally worth the effort. For me with my “Lazy Investor” attitude, the time commitment required exceeds my enthusiasm at the moment. That may change in the next few weeks, but for now I don’t have the time to diversify a significant amount of capital in the way I would like.

If you do have the time to spare, Ablrate are one of the best paying lenders out there as far as returns go. The fact that they are still around after the pandemic also has to say something about their business model and the saftey of the platform.

Ablrate Signup & Cashback Offers**

£50 Ablrate Cashback on £1000+ investment for New Investors

Use this link to qualify for Ablrate cashback or to signup >>>

See Full Assetz Capital Review

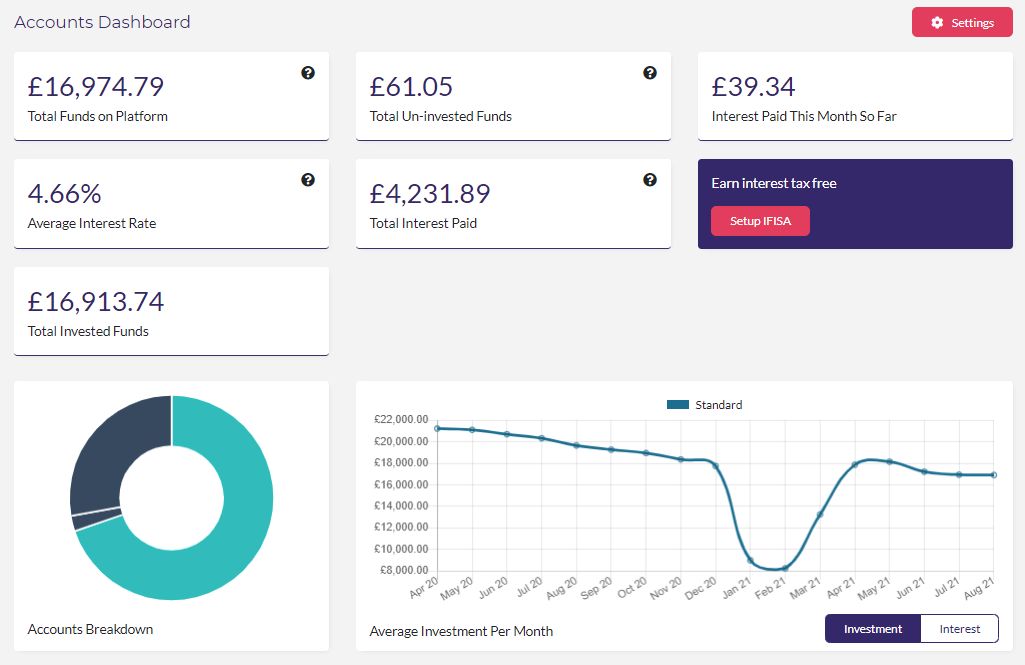

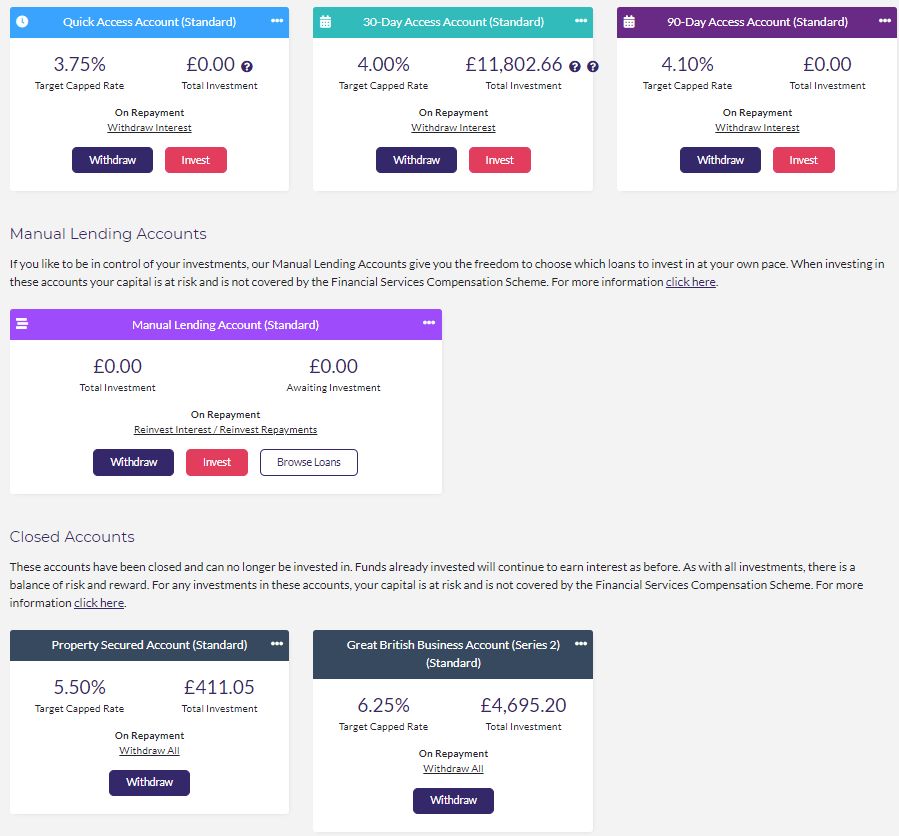

Visit WebsiteAssetz Capital still appear to have an excess of investment capital so they are working on getting new loans in. There is a wait to get invested even in the Access Accounts. Then the rates are not all that impressive once you get invested. Of course they are on par with Loanpad and are probably just as safe, but because of the rates Assetz Capital used to pay, I’m still not conditioned to the new, lower rates. The fact that there is a wait to get funds invested doesn’t help either.

I had to move another £185 out of Assetz Capital as it was sat there (in the 30 Day Access Account) still un-invested and making no return. If I keep getting funds returned unable to invest, I’ll keep moving them out. I’m actually tempted to move all of my funds from the Access Accounts & invest them in CrowdProperty & Maturing Whisky until they get enough loans in place so all investors capital can get lent out easily, but we’ll see.

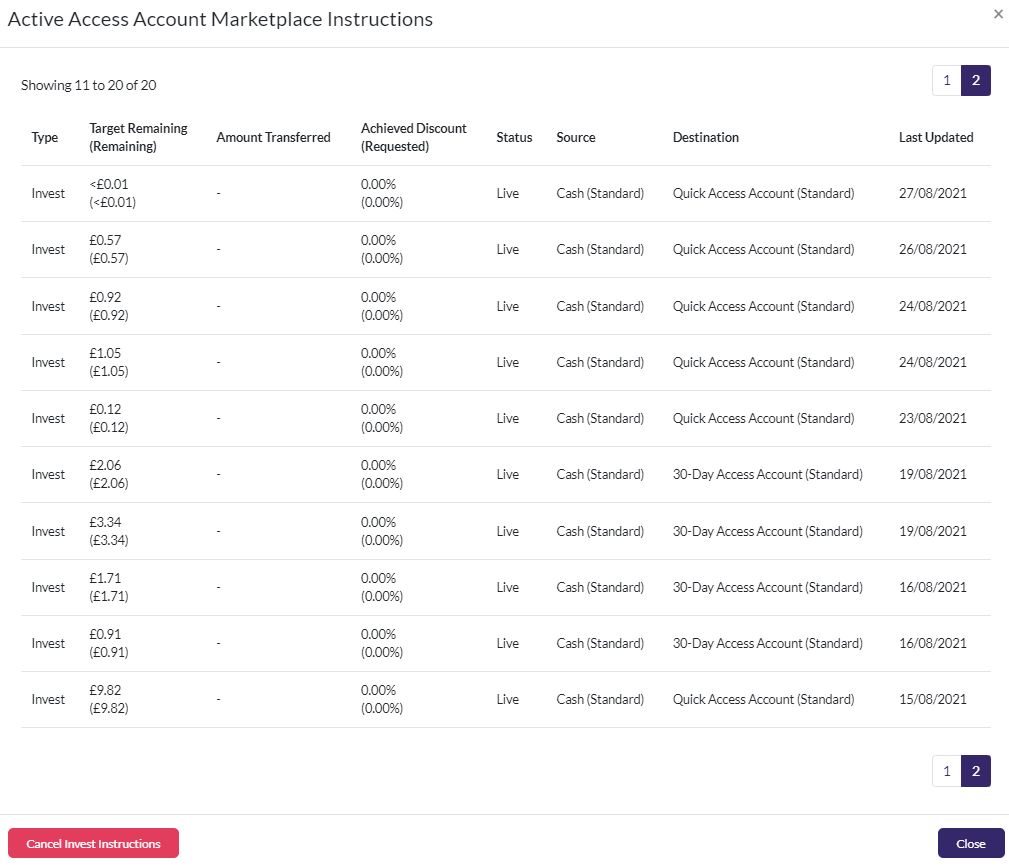

You can see in the screenshot below, capital gets paid back but is not getting re-invested.

Here’s what my Assetz Capital account looks like now:

My Assetz Capital Strategy.

I’m about £17k invested with Assetz Capital. If they get more loans available so they can keep capital invested, I will have no problems moving more money there. For now though, it’s pointless investing more as there would likely be cash drag while it’s waiting to be invested.

Assetz Capital Signup & Cashback Offers**

No current Cashback Offers

Use this link to check for new offers or to open account >>>

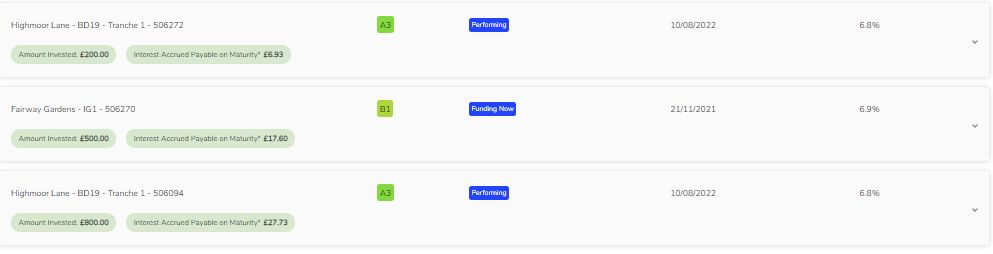

CrowdProperty are showing 18 loans due to be funded for September. Just under that number in August got funded, all in under 1 minute (more like 3 seconds on most).

In my opinion, CrowdProperty and Kuflink are leading the UK P2P property development market at the moment, with the only problem being getting into loans with CrowdProperty as I’ve harped on for the last few months.

I sent over a bit more capital & picked up a few loans in August, but I need to decide if I want to move capital over there from other platforms as I’m not ready to change more USD to GBP yet to increase my overall P2P investment until the exchange rate comes down a bit more. I’m a little over £30k invested now with CrowdProperty, but I would be OK with £50k (the same as Kuflink) as I think they are just as safe, and it would certainly give my overall XIRR a boost. I’ll have to think about it.

I’m still loving CrowdProperty. Great risk/reward and basically does what it says on the tin.

The XIRR jumps up and down with both CrowdProperty and Kuflink as returns only typically come back when loans are repaid, so it’s not a straight income line like Loanpad or easyMoney. Income is erattic as you can see from the lender spreadsheet in the Peer to Peer Lending Portfolio.

Here are loans that are coming in September (one is already up for funding so not shown on this screenshot):

Here’s a screenshot of my CrowdProperty account at the end of August 2021.

My CrowdProperty Strategy.

My strategy since the beginning with CrowdProperty is to invest £500 into almost every loan they have for good diversification. If the LTV is low, and it’s a tranche 1, I’ll invest £1000. I do a little due diligence on each loan before it goes live. Once in a while I see something I don’t like the look of and I don’t invest in that particular loan. I’ll often look closely at higher level (numbers) tranches and pass over some of them at times. Overall though, that happens very infrequently so it’s pretty much £500 or £1000 into each loan.

CrowdProperty Cashback & Signup Offers

No current CrowdProperty Cashback Offers

Use this link to go to CrowdProperty’s website and check for new offers, or to open an account >>>

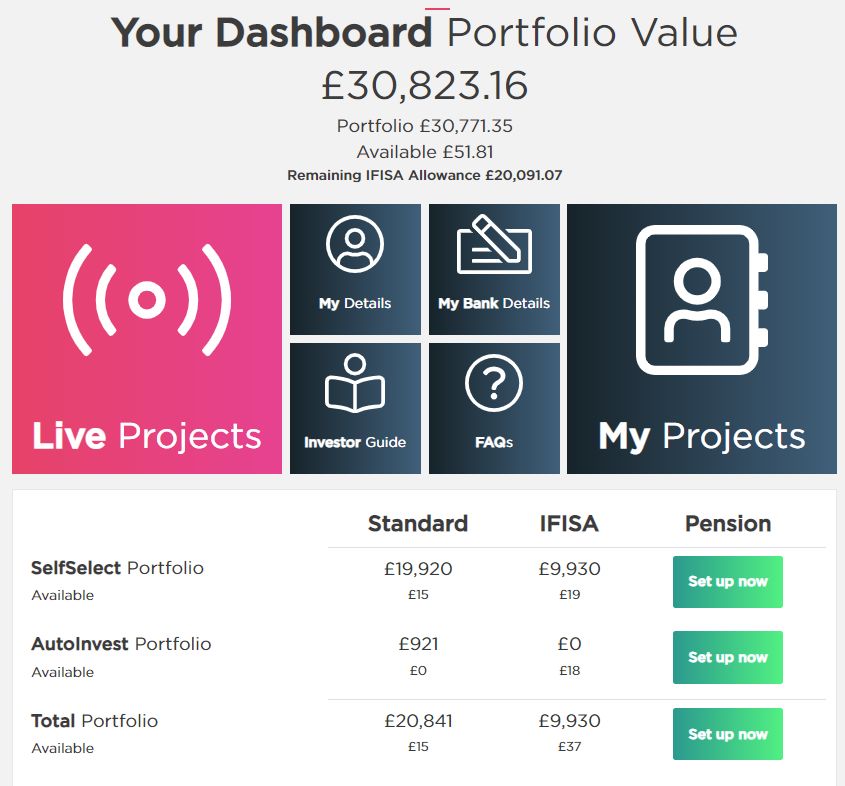

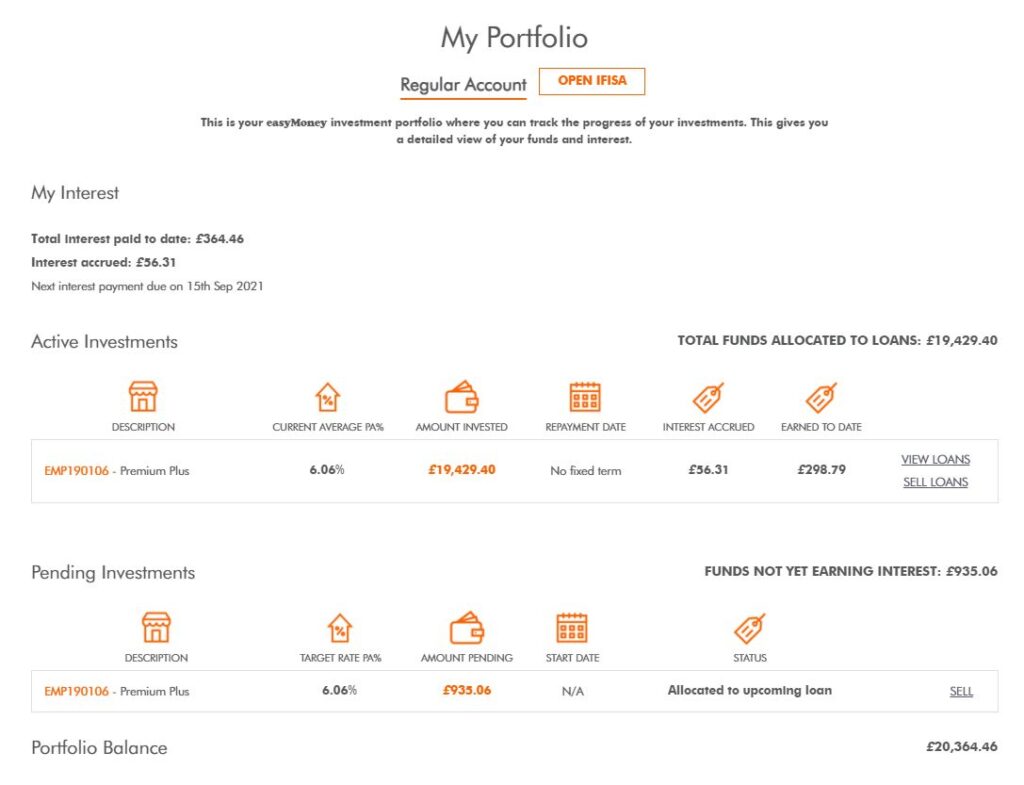

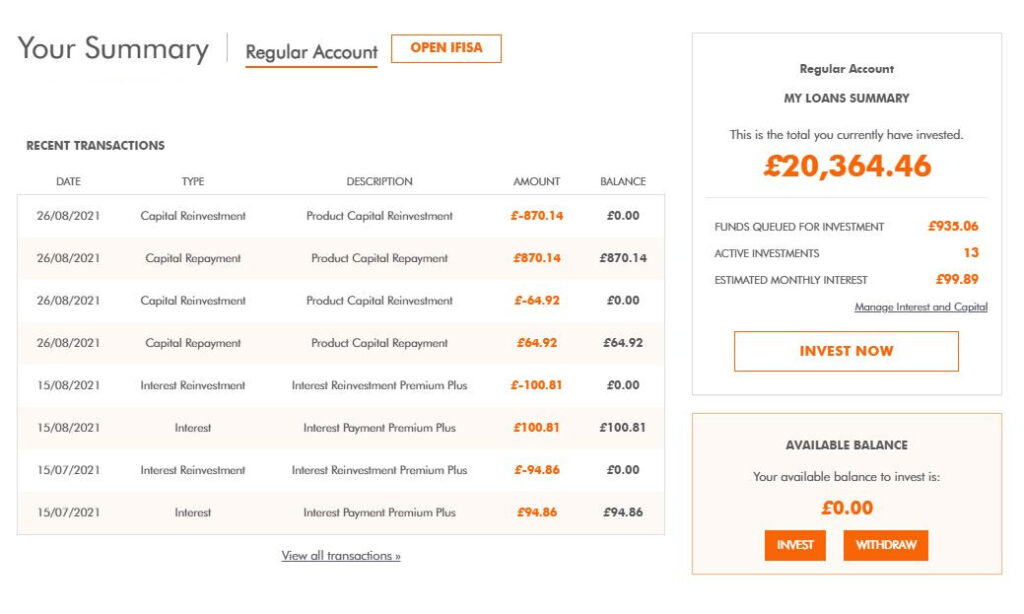

easyMoney was another new investment for me in April. I wrote more in detail about them in the May update.

For anyone waiting to invest, it looks like they’ve cleared out there backlog of investment capital (likely due to the rates dropping a bit), so investment should be much faster now. My reinvestments are only taking a couple of days. Still takes a bit longer for new investments but not like it was.

I’m disappointed that they are lowing rates as of September 1st (for new investment), but it’s still higher than some platforms (depending on your level of investment).

What I do like about easyMoney is, like Loanpad, income payments are at a set rate each month and don’t depend on when a loan gets paid back in full. To be fair though, this is also an option with Kuflink, but then you don’t get the compounding effect so it takes the return rate down a little. I just leave all of my loans to compound as I don’t need the monthly income from P2P investments so I’ll just leave it to grow.

Here’s my easyMoney account information for the end of August, 2021.

Here’s a screenshot of the easyMoney Dashboard

My easyMoney Strategy

There’s no real strategy required for easyMoney. Just deposit your capital and start earning interest. There’s really nothing else to do.

easyMoney Cashback Offers & Signup Links**

Click here to check for new easyMoney cashback offers >>

Signup for easyMoney ISA Account >>

See Full Funding Circle Review

Visit WebsiteNo change with Funding Circle this month. Just withdrawing capital as it’s repaid as there is no option to reinvest currently.

I withdrew £452 from monthly repayments in August. This went over to Kuflink where I’m averaging over 6.53% returns right now.

Here is how my Funding Circle account looks as of August 31st. My current calculated XIRR is showing 3.40% return as opposed to their 4.2%

My Funding Circle Strategy.

I’ve been drawing down my Funding Circle account since July 1st 2019 – trying to sell out and get my capital back after events that unfolded in 2019. You can read more about it in the Funding Circle Review. There is also no option to invest in Funding Circle currently as they are not accepting investment from retail investors.

£226 income from Kuflink this month. Normal range. I increased my investment just a little in August. Only £400 increase this month, but I’m getting to the high limit of my single lender comfort zone with over £50k invested now. That’s almost 25% of my overall P2P lending portfolio. I have no worries at all that it’s safe with Kuflink, however things can change rapidly in the P2P asset class so better safe than sorry. 25% is still way too much for the purpose of platform diversification, but unfortunately options to earn these sorts of returns from a P2P lender these days are limited.

Kuflink is the only platform now (that I can find) offering plenty of loans, liquidity if needed (loans sell very quickly on the secondary market) and still 6%+ real average returns. So I’ll take a little more risk with them than I usually would.

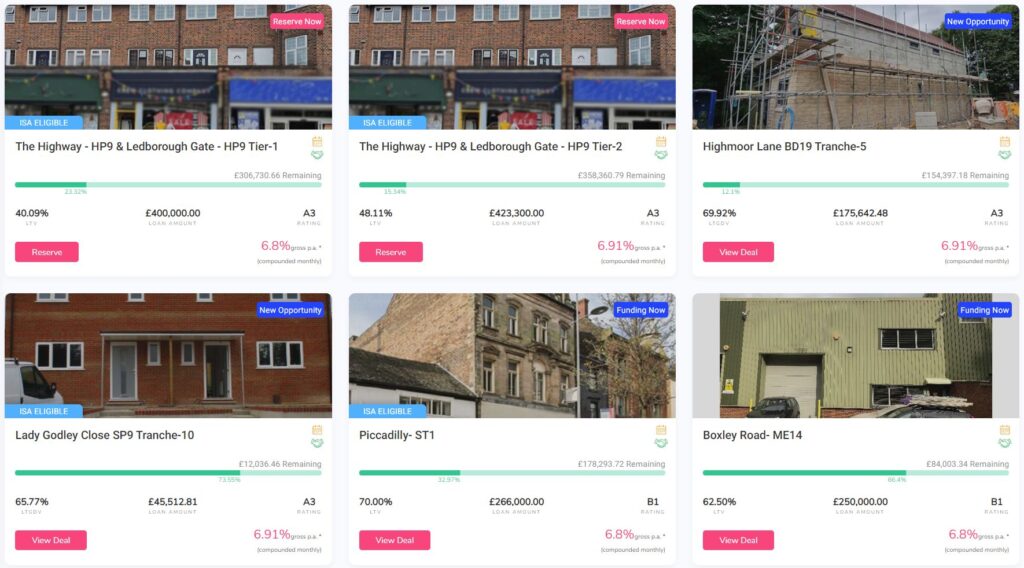

This is how my Kuflink account looks at the end of August, 2021:

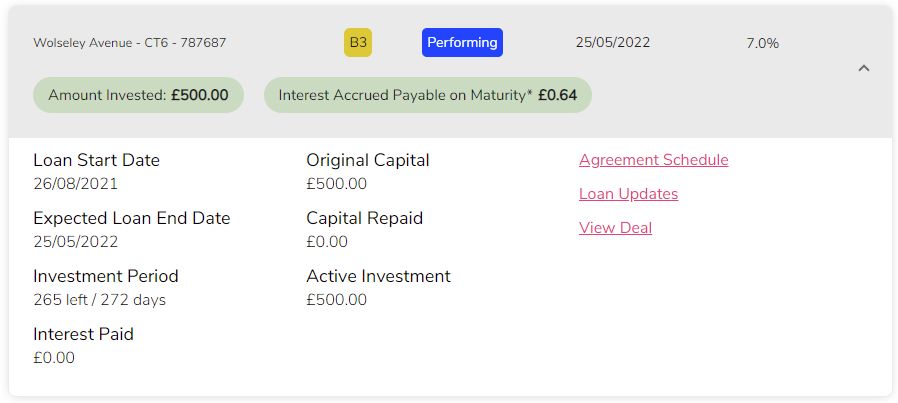

Kuflink have made of few changes on their website, most of which make sense. The change I like the most is the ability to dig down in to the detail of each individual loan right from the listing screen. You can expand to the loan detail with the down-chevron on the right of each loan. It’s much easier than having to switch screens like before.

Here’s a list of all my current Kuflink loans in the new listing format. Only 2 loans pending this month. One of the other 2 from last month was paid back, and the other extended for 3 months (still paying interest). The 2 below are also extending so nothing behind or in default.

I have no problems with loan extensions providing they continue to pay interest. It happens a lot with development loans.

You’ll note I’m in multiple tranches of some loans & I’m ok with that. Sometimes I look at a loan and decide I want more money in it at a higher rate (and a little more risk of course) so I take positions in later tranches.

Always plenty of loans to choose from with Kuflink, and you don’t need to be near your computer at a certain time or a speed-typist to get capital invested into them.

Here are currently available loans (as of 2nd September):

My Kuflink Strategy.

As capital gets repaid, I continue to reinvest around £500 into almost every loan Kuflink brings with an LTV over 50%. For loans with LTV’s under 50% & first legal charge (& usually tranche 1), I often invest £1000. As with CrowdProperty I do a little due diligence and if I see something I don’t like, then I don’t invest. That does not happen often though as Kuflink do great due diligence themselves, so it’s pretty much £500 or £1000 into every loan.

Kuflink Cashback & Signup Offers**

New Kuflink customers receive the following Kuflink cashback on an investment of £1000 or more when they use signup links from obviousinvestor.com. Must invest into loans within 14 days of first investment to qualify for cashback.

| Investment amount | Cashback |

| £ 1,000.00 – £ 5,000.00 | 2.50% |

| £ 5,000.01 – £25,000.00 | 3.00% |

| £ 25,000.01 – £50,000.00 | 3.50% |

| £ 50,000.01 – £99,999.99 | 3.75% |

| £100,000.00 | 4.00%* |

*Cashback capped at £4,000.

Use this link to signup & qualify for the current Kuflink cashback offer >>>

No changes. Just withdrew a little capital which was paid back.

Recap:

I decided to retrieve capital (where possible) from lenders who have unsecured loans to reduce my overall exposure to Peer to Peer lending when the pandemic hit. Although LendingCrowd do have some secured loans, many just have directors personal guarantees. Historically, trying to recover from just these personal guarantees has been hit and miss. So, I made an early decision to withdraw my capital.

I was able to sell about 75% of the loans as I was early to start selling in March 2020.

Repayments have still been coming in slowly for the last year and LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors. Hopefully when things get back to some form of normality, LendingCrowd will open its doors to retail investors again.

Here is a screenshot of how my account looks currently

My LendingCrowd Strategy.

As mentioned previously; LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors.

As soon as they start accepting investments again, I’ll make a decision on if & when to increase my investment again with LendingCrowd.

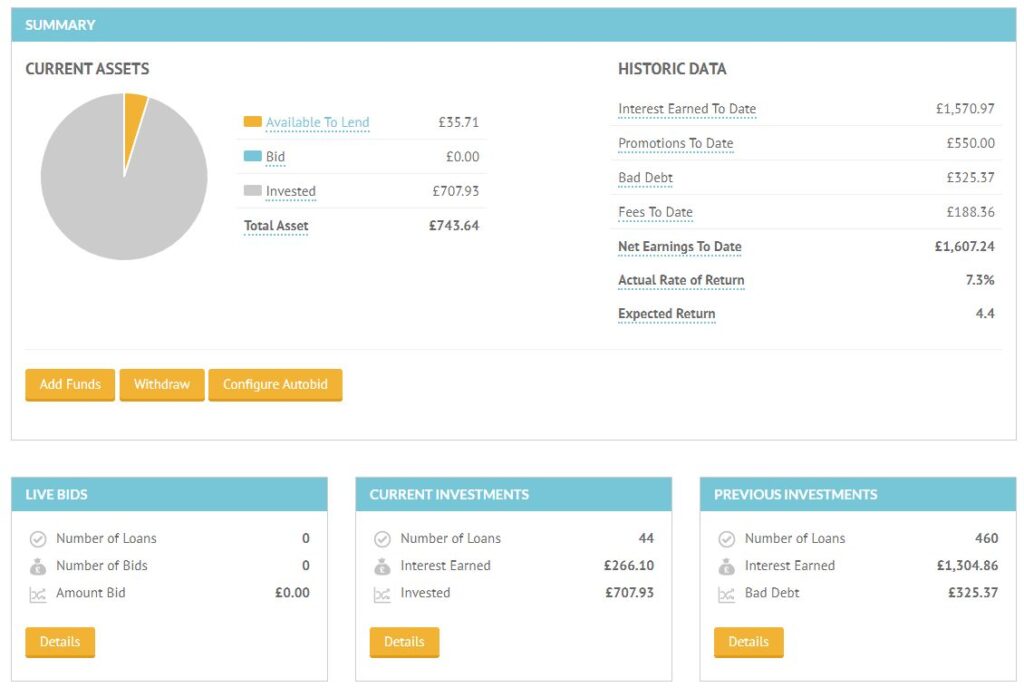

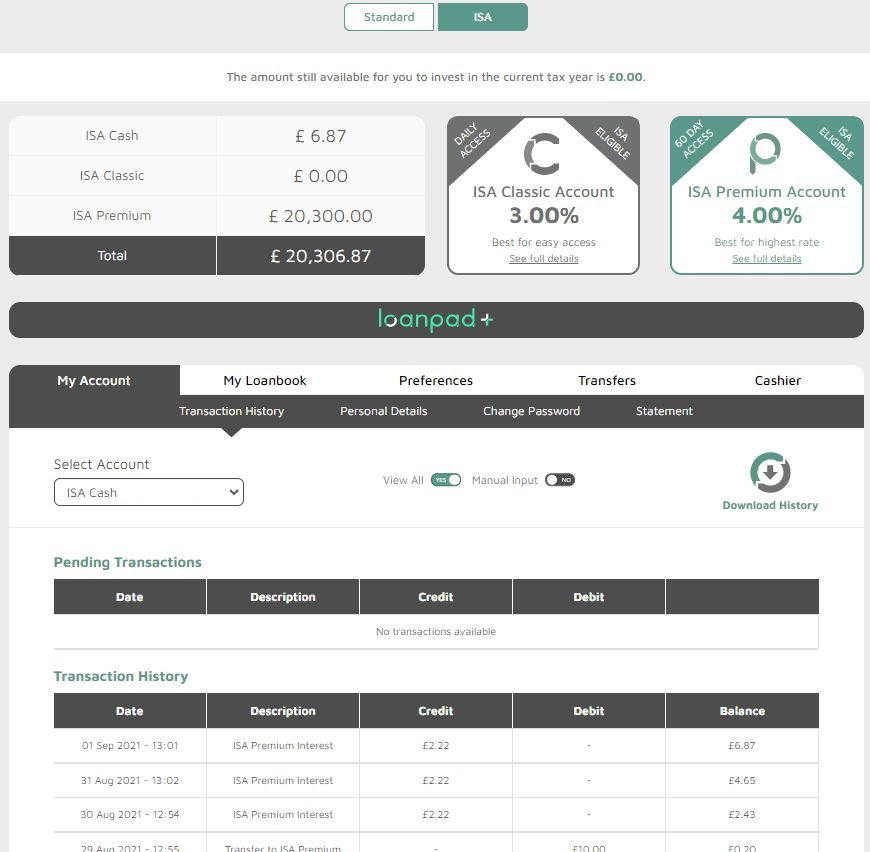

Loanpad are ticking along as normal. Never a problem, safe as houses. Still my second biggest lender (only after Kuflink) and will likely stay that way for the foreseeable future. Interest is paid daily, and automatically reinvested once it gets to £10.

Here is a screenshot of how my Loanpad accounts (standard & ISA) looked at the end of August 2021

My Loanpad Strategy.

There’s not really any strategy necessary with Loanpad. Just deposit your funds, choose your account & done. Nothing more you can do even if you wanted, it’s all taken care of for you behind the scenes. Of course 3% or 4% aren’t huge returns as far as some P2P platforms go, but I believe they are about the safest lender out there for the risk/return and that’s the reason they are one of my largest lending accounts by value.

Loanpad Cashback & Signup Offers**

£50 bonus if you invest into a lending account a minimum of £5,000 within 4 weeks post registration and keep it invested for 1 year

£100 bonus if you invest into a lending account a minimum of £10,000 within 4 weeks post registration and keep this invested for 1 year.

Use this link to visit the Loanpad website & qualify for Loanpad cashback offers >>>

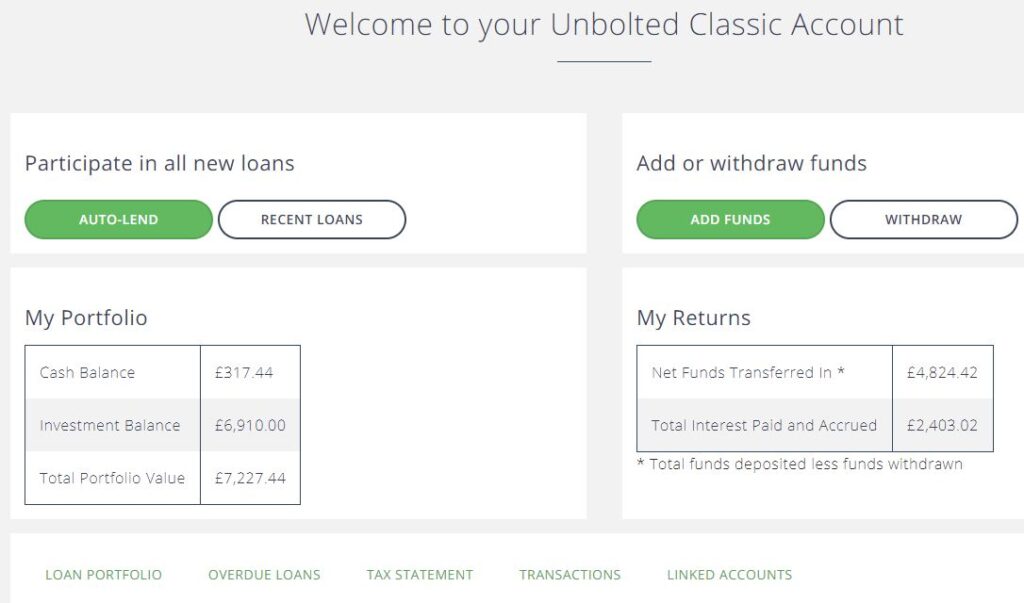

Cash drag is getting better every month now with Unbolted, although I’m not convinced I could get a big chuck of capital invested with them yet. I wish I could though, and I will once it becomes clear that I can.

Unbolted are a great lender and I love the fact that they are not real estate property loans. Just something different to diversify into & they have a great track record.

In case you’re unfamiliar; Unbolted offer pawnshop style loans to the general public with very liquid assets. These types of assets can be sold very quickly upon default so the demand for Unbolted loans exceeds the available loans.

I have been lending with Unbolted for a few years now, and although there have been many defaults, assets have always sold at more than the outstanding loan principle and I have always been paid back both principle and interest very quickly. Loans are short to medium term in nature so a complete exit can be had by turning off auto-invest within 3 to 12 months.

Unfortunately the only problem with Unbolted is getting capital invested because they have so few loans now, and too many investors with a lot of capital waiting to get in. Although it looks like that may be changing, so I’ll be keeping an eye on them and adding capital as needed.

Here’s a screenshot of my account as it stands at the end of August, 2021.

Here are some of the recent loans capital has been put into by auto-invest in August

My Unbolted Strategy.

I would happily invest more capital with Unbolted if I could get it invested without the cash drag and good diversification. I really love the platform and I’ve been lending with them for a long time now.

The fact that I was able to send over another £1000 in July hopefully means that things are looking up!

Unbolted Cashback & Signup Offers**

No current cashback offers.

Use this link to signup with Unbolted >>>

EURO Lenders Update

I have been drawing down my Euro investments slowly as because I live in Portugal some of the time, when I’m here I live on Euros. So I have been using the Euros that I have invested in Euro Lenders for living expenses.

Typically I would change US Dollars or GB Pounds for Euros, but the Euro has been rising rapidly recently against the USD, and the GBP has still not recovered fully from Brexit. So I decided to use the Euros I have before changing more at this high rate in the hope it comes back down soon.

If you have Euros to invest and are looking for ideas. There are a few Euro Lenders that have come through the pandemic and seem to have been largely unaffected, namely Crowdestor, Swaper, Peerberry & Robocash have all done what they are supposed to do. I will invest in these all again once I am ready to invest Euros again. I believe they are all decent investable companies paying very good returns. Mintos is also worth investing in as long as you realize you’re not investing in Mintos, you’re investing in their LO’s, and as such you should pay more attention to them than to the platform. The new news is that Mintos just became a regulated lender in August 2021, and as such is getting more interesting as a possible investment platform. I’ll be watching to see if they start to allow UK investors again and if they have more GBP loans like they used to.

Securities, Bonds, Gold & Crypto Portfolios

USD Growth Portfolio

As usual, everything performing as expected. 7.70% YTD growth, averaging 16% per annum over the last 16 years (longer actually, that’s just how long I have been tracking it for). That does not include a factor for inflation. If inflation is taken into consideration, it’s still well over 10% per annum which I’m more than happy with. This portfolio is where most of my personal assets are invested.

Permanent Portfolios (all currencies)

Again, everything performing as expected. Differences in returns are due to the multiple currencies and asset performance from the separate countries they are invested in. Overall they still perform relatively well. The USD assets always perform better because the US markets generally perform better. After all, it is still the biggest economy in the world.

The Permeant Portfolio assets have performed this way for the last 100 years, so I would be surprised if anything changes in my lifetime.

A couple of good books to read on these portfolios are “Fail-Safe Investing” and “The Permanent Portfolio” if you’re interested in how they’re constructed. Both oldies but goodies.

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking). And I use the Ledger Nano X & S for Crypto offline cold storage.

Visit Kraken Visit BinanceIt looks like I’ve missed my opportunity to invest more capital in the Crypto Portfolio for now. I was really expecting a greater pullback than we got & I wasn’t comfortable investing a lot more at the levels it pulled back to this time. Plenty of time though, I’ll wait for the next “crypto crash” & see what it looks like then.

There is no rush, I think the crypto market is really just getting started & I’m still making rewards through crypto staking with many assets.

I can’t complain that I missed the last down move, my current portfolio went from being down over $18k in June to being up almost $18k at the end of August, and by September 6th (as I’m completing this update), it is up over $27k 🙂

Here’s a quick screenshot to the end of August (see the actual portfolio for latest updated figures):

Remember, some of that profit is from staking as well as the market moving up of course.

I stake ATOM & KAVA through Kraken (here is a screenshot of my Kraken staking account) 7% return on ATOM & 20% on KAVA:

I stake my Ethereum (ETH) through Binance.com (the ETH have actually been converted to BETH which is the way Binance hold them when staked there, until the next phase of Ethereum development is released, at which point they will be converted back to ETH). Currently making about 5% per annum on ETH.

Here is a screenshot of my Binance staked BETH.

The rest of my crypto is in cold storage, stored offline with my two Ledger wallets (I have an S and X).

I stake PolkaDOT (DOT) through Ledger Live (currently making about 14%), Cardano (ADA) through the Ledger wallet (about 5% rewards per annum), but using AdALite for the staking, & just store the other crypto I have that is not staked offline for safe keeping.

Here is a shot of my DOT wallet in Ledger Live, you can see I’ve earned 10.835 DOT by staking just in August (currently worth about $346 with DOT at $32). Total since February I’ve made 45.57 DOT so around $1,500 staking just DOT (on a total $27k DOT investment).

Below you can see the DOT rewards coming in each day:

Here are all the crypto I store offline in cold storage (except Cardano (ADA) which requires a connection with AdAlite wallet to see it):

Here’s a screenshot of my Cardano (ADA) stored on Ledger Nano via Adalite. I have the staking split between 2 staking pools (Stake ALPS & KIWI). I just switched to ALPS because the other pool I was using (FISH) got saturated (too many ADA staked).

Summary

That’s all for this update in September. I’ll keep on tracking everything and we’ll see how I do with the various investments.

If you have any comments or suggestions, please feel free to comment on the post, or email me directly if you prefer.

Good luck with your investments in the coming months! Remember, it’s about patience & persistence, not perfection! If you start investing in various assets when you are young, just a small amount every month like I did, you’ll be amazed how quickly it becomes a significant portfolio. You’ll also be amazed at how quickly you get old 😀

My best to you and your families. Stay safe and I’ll post an investment update again soon.

£ – GBP Permanent Portfolio

Maturing Whisky Portfolio

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

$ – US Dollar Growth Portfolio

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

฿ – Cryptocurrency Portfolio

£ – GBP Peer to Peer Lending Portfolio

€ – Euro Permanent Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.