In the June update; Crypto-crashes, Peer to Peer lending delivers, and the closed out Recovery Portfolio nets a nice 27.09% total profit!

May 2021 was an interesting month overall. The Cryptocurrency market had it’s biggest crash ever, just as I decided to get in (always seems to happen when entering new investments for some reason). I added a significant amount of capital to the portfolio, and I intend to add more if we get another test of the bottom.

Peer to Peer lending income was the most since before I started to draw down the portfolio for the COVID crash with a little under £1000. for the month of May.

I decided to close out the Recovery Portfolio as I had suggested I might do in last months update. Return was a nice 27.09% (in numbers a tad over $102,000 USD) in just under 5 months, which is not half bad if I do say so myself.

My Growth Portfolio and the multi-currency Permanent Portfolios are performing well and rebounding from a short pullback.

So with that in mind, let’s get right into it with the detailed Peer to Peer lending update first.

Peer to Peer Lending Sites & Portfolio Update

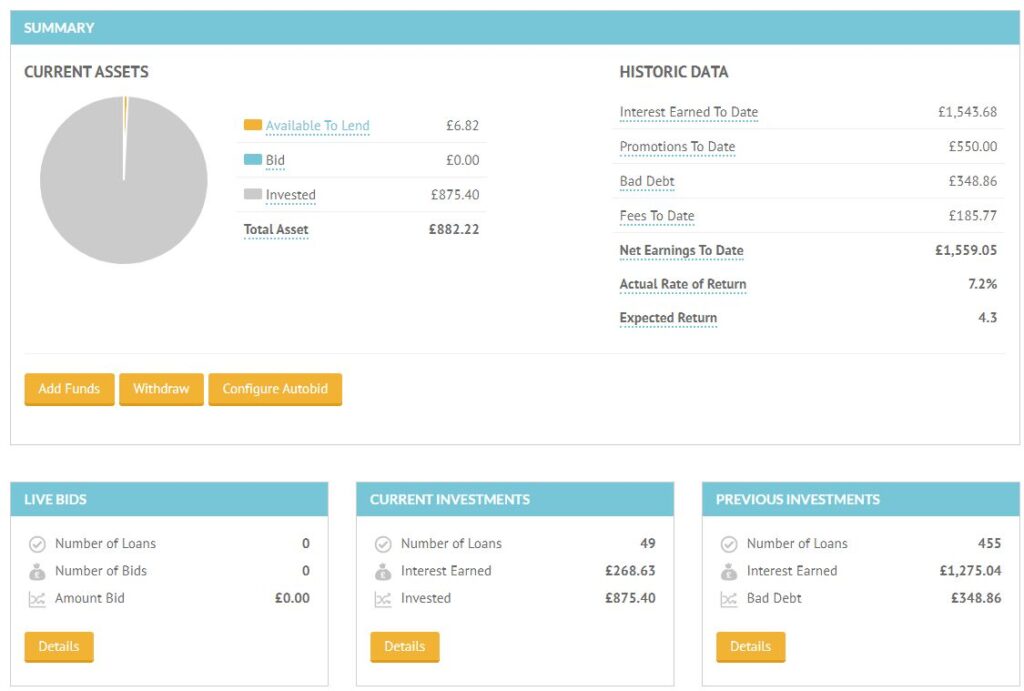

Peer to Peer lending investment increased only slightly from £185,054 in April to £189,751 in May. I’ve managed to bring down the cash drag by moving capital around, so the total XIRR has moved up from 5.01% to 5.06% overall. I expect that to continue increasing as I invest more capital with Kuflink, CrowdProperty & Assetz Exchange as these platforms are paying well right now and I consider them to be relatively safe. Good risk/reward ratio.

The two new lenders I added in April (easyMoney & Assetz Exchange) seem to be doing what is written on the tin, which I’ll discuss below.

You can always see the live Peer to Peer Lending Portfolio data here >>

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Individual Peer to Peer Platform Updates

No change in my Ablrate investments this month. Ablrate brought a couple of new loans online in May which is promising. The loan flow seems to be getting back to normal now although they do still have many loans delayed.

I’m still on the sidelines with Ablrate until I get some time and inclination to invest more with them.

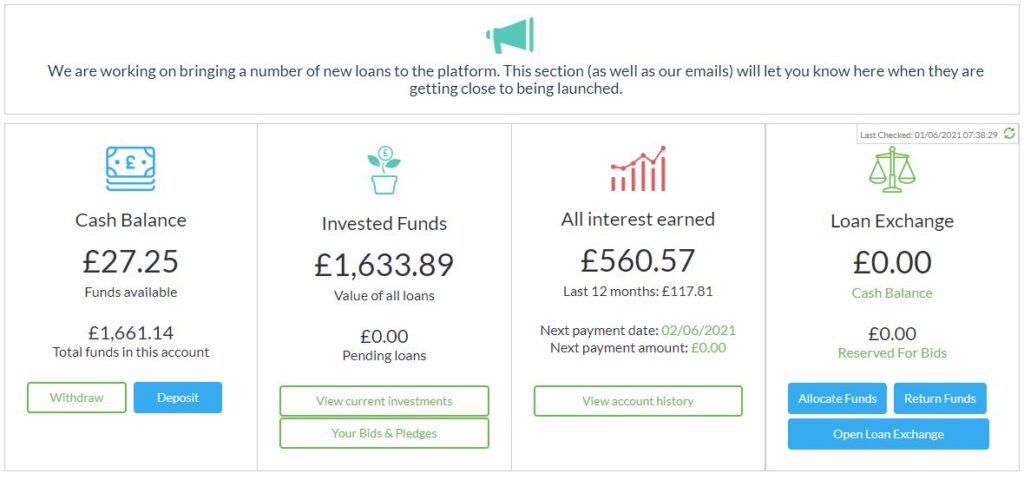

Here is a view of my Ablrate account as it stands at the end of May 2021.

My current Ablrate Investments (as you can see, still only 1 late currently)

My Ablrate Strategy.

There are some great returns available through Ablrate if you’re willing to put the time in to do the research and buy the best loans. Up to 15% per annum. One of the best rates of all UK Peer to Peer lending sites.

For some it will be totally worth the effort. For me with my “Lazy Investor” attitude, the time commitment required exceeds my enthusiasm at the moment. That may change in the next few weeks, but for now I don’t have the time to diversify a significant amount of capital in the way I would like.

If you do have the time to spare, Ablrate are one of the best paying lenders out there as far as returns go. The fact that they are still around after the pandemic also has to say something about their business model and the saftey of the platform.

Ablrate Signup & Cashback Offers

£50 Ablrate Cashback on £1000+ investment for New Investors

Use this link to qualify for Ablrate cashback or to signup >>>

See Full Assetz Capital Review

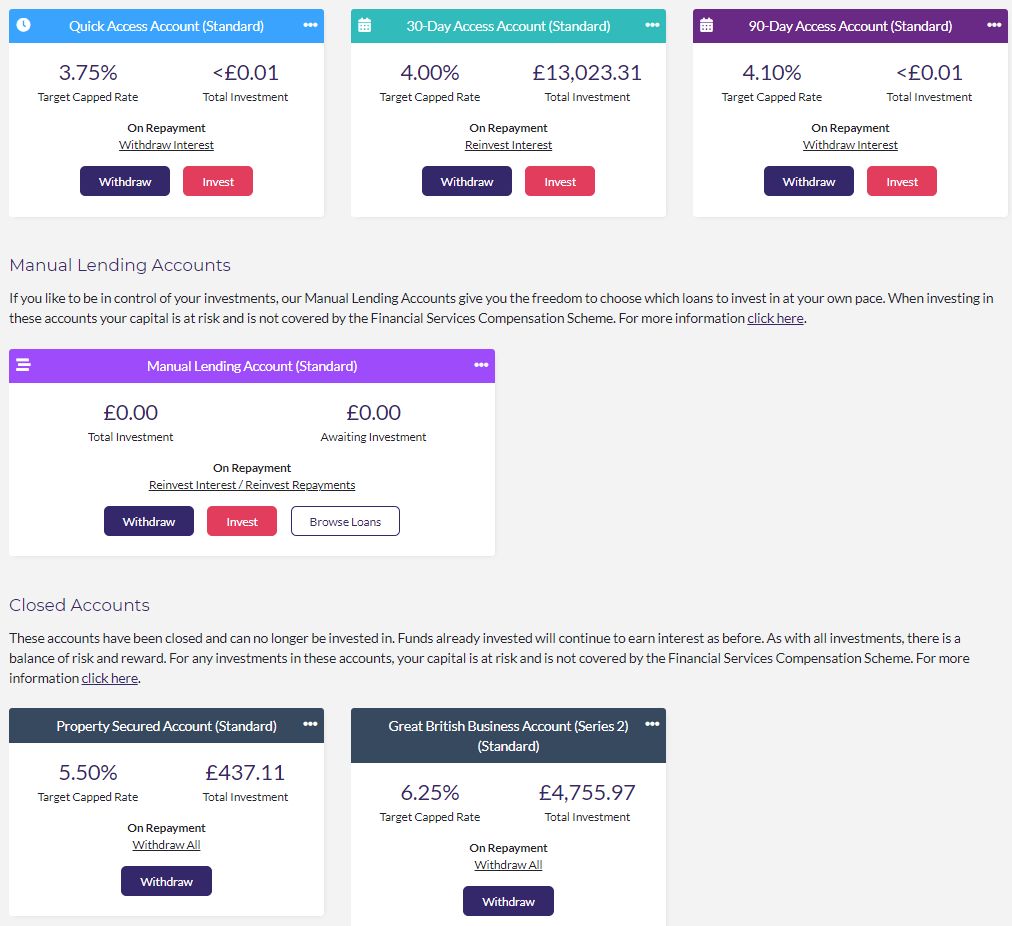

Visit WebsiteAssetz Capital have been relatively quiet. I’m mostly invested in the 30 Day Access Account right now at 4% as I don’t feel like the 90 Day Access Account is worth it for the extra 0.10% (total 4.10%) for an extra 60 days lockup on the cash. I may start and look at some of the Manual Lending Account loans if I get some time. There are much better rates available on the MLA, however there is work needed in finding the good ones and of course there is no provision fund. Managing them takes work too so I’ll have to see if I get motivated enough. The extra 3% or 4% available on loans in the MLA is likely only worth it if I make a more significant capital investment.

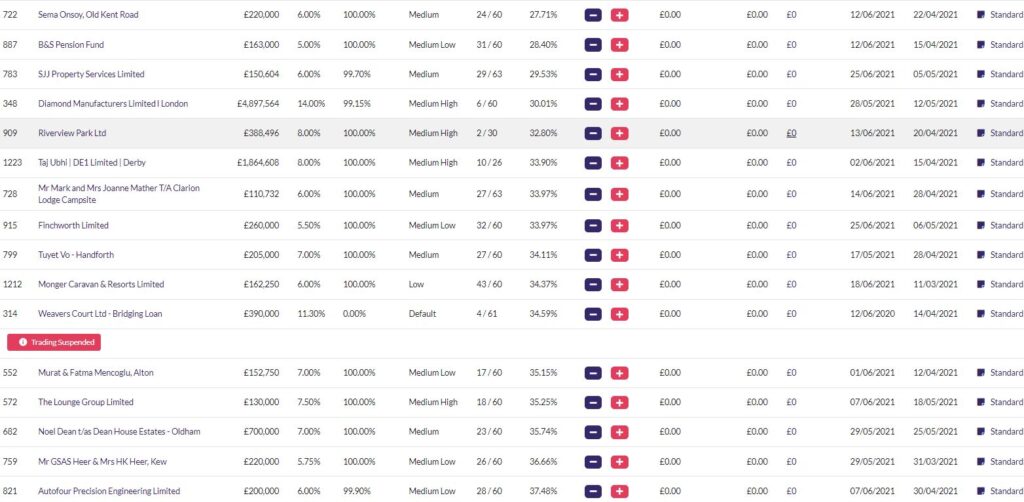

Here’s a screenshot of some of the MLA loans. As you can see there are some decent rates available with low LTV’s if you have the time to look at them.

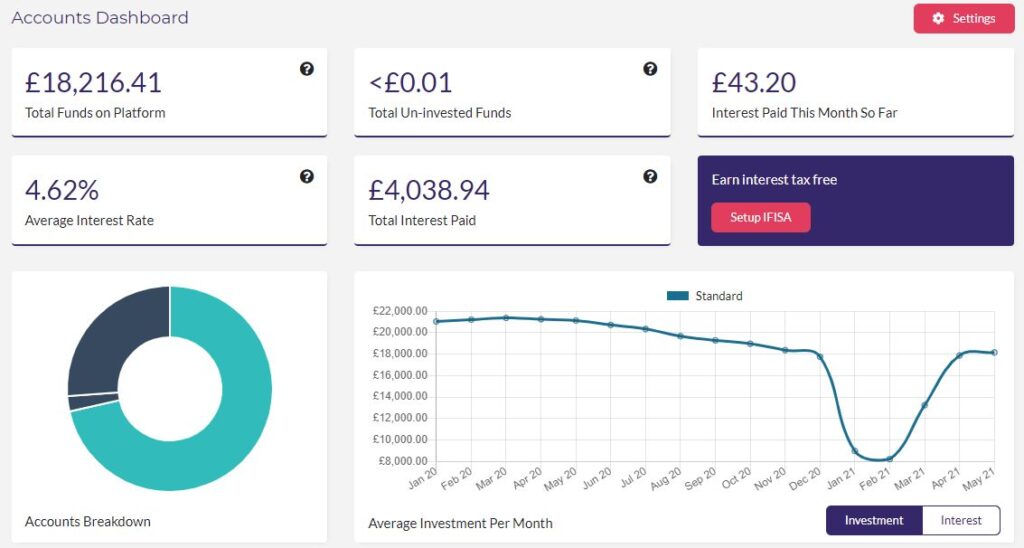

Here’s what my Assetz Capital account looks like now:

My Assetz Capital Strategy.

I started to increase my investment in Assetz Capital once things started to look like they were getting back to normality. Right now I’m a little over £18k invested with them and I’ll probably increase more as things get back to baseline normal, especially if I decide to invest in the MLA.

I like Assetz, they were my biggest P2P investment account at one point, but when the pandemic hit and the liquidity squeeze came on, I think it surprised everyone (including me). Assetz Capital are still here after the pandemic, and I can see they are much stronger for the experience.

Assetz Capital Signup & Cashback Offers

No current Cashback Offers

Use this link to check for new offers or to open account >>>

CrowdProperty just keep banging out 2 or 3 new loans per week. They go so quickly. Even the big ones over £1m get gobbled up in seconds.

It’s still possible to get into them if you are sat in front of your computer when they are released. I don’t think I’ve ever missed one when I’ve been ready for it. Be a couple of seconds late though and you’re S.O.L. The CrowdProperty platform has so much money on it looking for investment right now, you have to be fast.

I’m really liking CrowdProperty at the moment. Great risk/reward and basically does what it says on the tin. I’m going to move more money here once I use up my free cash. I just had a couple of deals from last year pay back so there is more free cash to invest at the moment.

The XIRR jumps up and down with both CrowdProperty and Kuflink as returns only typically come back when loans are repaid, so it’s not a straight income line like Loanpad or easyMoney.

Here’s some of the loans I got into in May:

Here’s a screenshot of my CrowdProperty account at the end of May 2021.

Here are the upcoming loans for the first half of June 2021

My CrowdProperty Strategy.

My strategy since the beginning with CrowdProperty is to invest £500 into almost every loan they have. If the LTV is low, and it’s a tranche 1, I’ll invest £1000. I do a little due diligence on each loan before it goes live. Once in a while I see something I don’t like the look of and I don’t invest in that particular loan. I’ll often look closely at higher level (numbers) tranches and pass over some of them at times. Overall though, that happens very infrequently so it’s pretty much £500 or £1000 into each loan.

CrowdProperty Signup & Cashback Offers

No current cashback offers from CrowdProperty.

Use this link to go to CrowdProperty’s website and check for new offers, or to open an account >>>

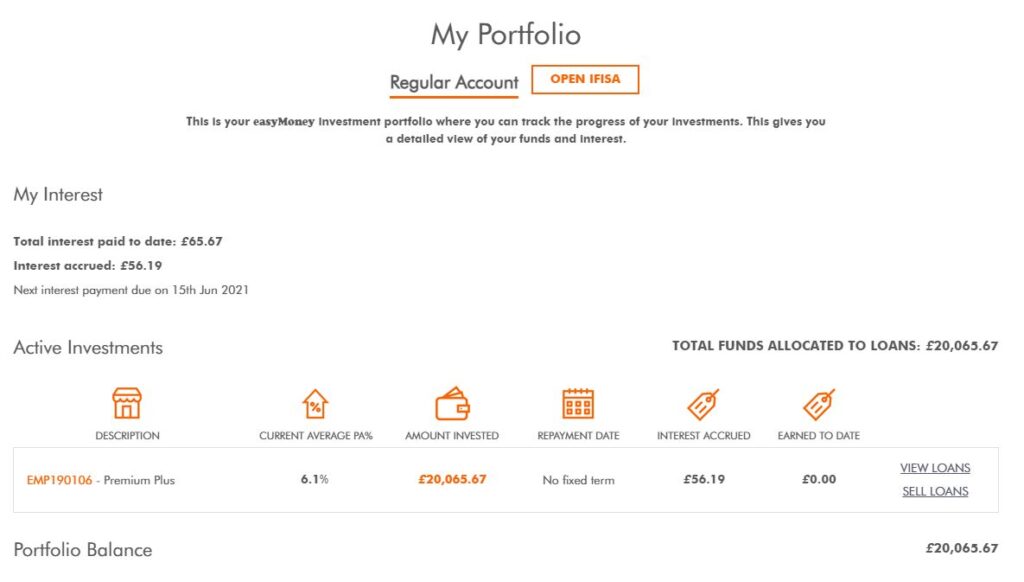

easyMoney was another new investment for me in April. I wrote more in detail about them in last months update.

I was a little worried last month about how long it took to get the last £5k invested, but it actually happened exactly as one of the team I spoke with told me, and got processed on the 15th of the month. Just a quick shoutout to whoever that was (sorry, forgot your name). I put in a support ticket to ask a few questions and they actually called me on my phone to help within a few minutes. Good service!

I’m getting good vibes from easyMoney. It feels kind of like Loanpad but with 6.10% return. Hopefully it’s as safe as Loanpad. Time will tell but I don’t see why not. The loans seems to be very well vetted and none have defaulted to date. That says a lot after the whole COVID situation.

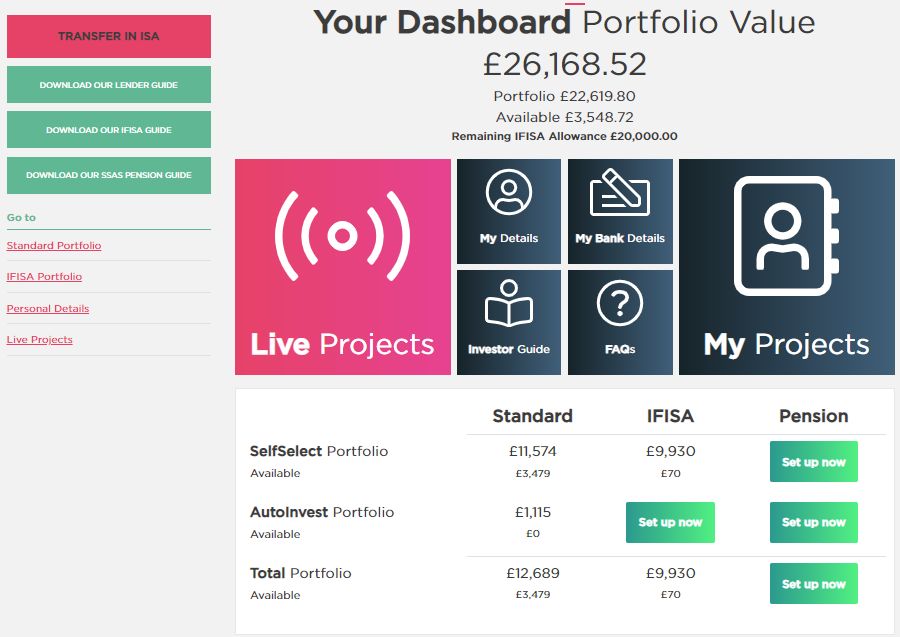

Here’s my easyMoney account information for the end of May, 2021.

Here’s a screenshot of the easyMoney Dashboard

My easyMoney Strategy

There’s no real strategy required for easyMoney. Just deposit your capital and start earning interest. There’s really nothing else to do.

easyMoney Signup & Cashback Offers

£50 bonus if you invest at least £1,000 for 12 months. Must use referral link to qualify

Click here to qualify for easyMoney cashback >>

See Full Funding Circle Review

Visit WebsiteNothing new with Funding Circle in May. I withdrew £440 which had been paid back.

Here is how my Funding Circle account looks now (the 3.2% returns indicated is misleading, that’s assuming no more defaults & reinvestment of capital. Neither of which is going to happen).

My Funding Circle Strategy.

I’ve been drawing down my Funding Circle account since July 1st 2019 – trying to sell out and get my capital back after events that unfolded in 2019. You can read more about it in the Funding Circle Review Funding Circle still have no liquidity, and all I’m doing is receiving monthly loan repayments as loans are paid back. I will not be investing new capital with Funding Circle for the foreseeable future. Never say never though. Maybe they’ll get back to lending as they used to one day.

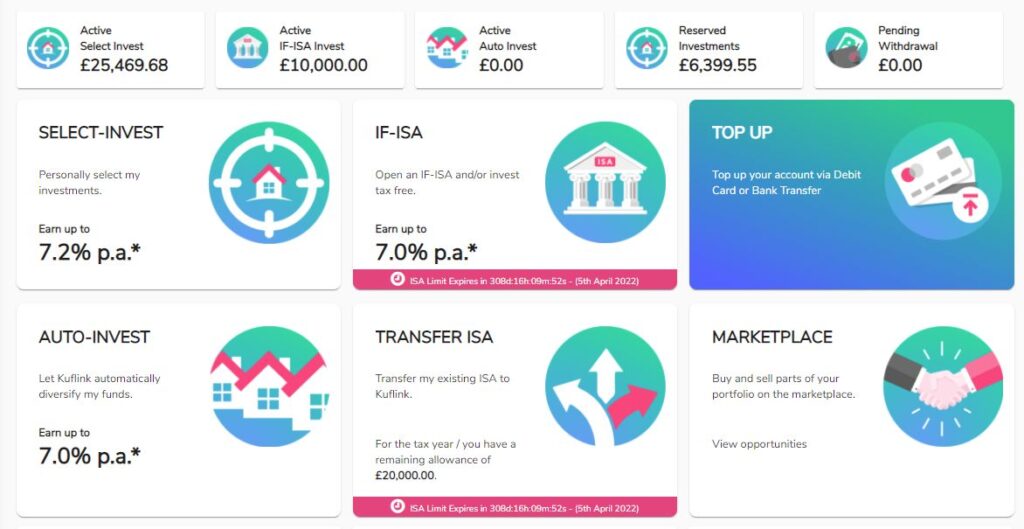

I increased my investment with Kuflink again just a little in May. I still had some capital left in my Kuflink Self Select account from loans that repaid in May to invest, so I just sent over a bit more to catch a few of the loans once I used up the free cash.

Kuflink are still bringing lots of great low LTV loans out, and paybacks all seem to be on time and on value. One of the best all the way through the pandemic, no problems.

Here’s my account as it stands at the end of May 2021.

£25.5k active Select Invest investments, over £6k in reserved loans, and £10k IFISA in Auto-invest.

Here are the self select loans I have invested into in May (click to enlarge).

You’ll note I’m in multiple tranches of some loans & I’m ok with that. Sometimes I look at a loan and decide I want more money in it at a higher rate (and a little more risk of course) so I take positions in later tranches.

My Kuflink Strategy.

I continue to invest £500 in to almost every loan Kuflink brings with an LTV over 50%. For loans with LTV’s under 50% & first legal charge (& usually tranche 1), I invest £1000. As with CrowdProperty I do a little due diligence and if I see something I don’t like, then I don’t invest. That does not happen often though as Kuflink do great due diligence themselves, so it’s pretty much £500 or £1000 into every loan.

Kuflink Signup & Cashback Offers

New Kuflink customers receive the following Kuflink cashback on an investment of £1000 or more when they use signup links from obviousinvestor.com. Must invest into loans within 14 days of first investment to qualify for cashback.

| Investment amount | Cashback |

| £ 1,000.00 – £ 5,000.00 | 2.50% |

| £ 5,000.01 – £25,000.00 | 3.00% |

| £ 25,000.01 – £50,000.00 | 3.50% |

| £ 50,000.01 – £99,999.99 | 3.75% |

| £100,000.00 | 4.00%* |

*Cashback capped at £4,000.

Use this link to signup & qualify for the current Kuflink cashback offer >>>

No changes. Just withdrew a little capital which was paid back.

Recap:

I decided to retrieve capital (where possible) from lenders who have unsecured loans to reduce my overall exposure to Peer to Peer lending when the pandemic hit. Although LendingCrowd do have some secured loans, many just have directors personal guarantees. Historically, trying to recover from just these personal guarantees has been hit and miss. So, I made an early decision to withdraw my capital.

I was able to sell about 75% of the loans as I was early to start selling in March 2020.

Repayments have still been coming in slowly for the last year and LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors. Hopefully when things get back to some form of normality, LendingCrowd will open its doors to retail investors again.

Here is a screenshot of how my account looks currently

My LendingCrowd Strategy.

As mentioned previously; LendingCrowd are currently lending only through the UK government backed CBILS scheme and as such are not accepting new capital from retail investors.

As soon as they start accepting investments again, I’ll make a decision on if & when to increase my investment again with LendingCrowd.

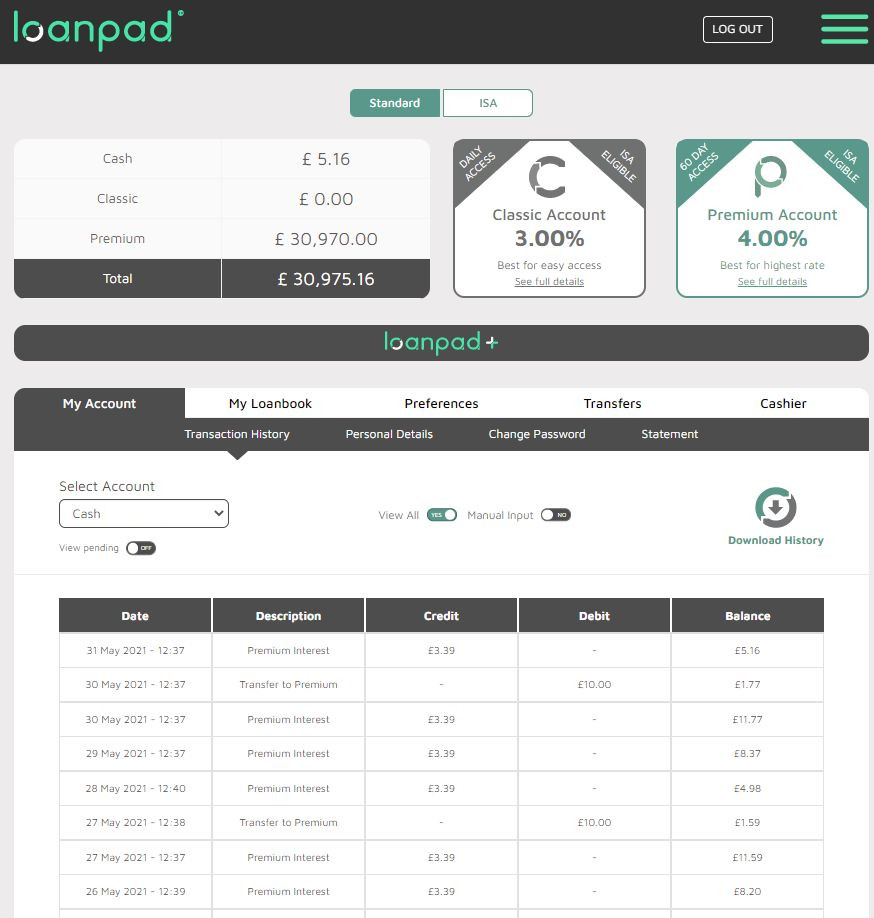

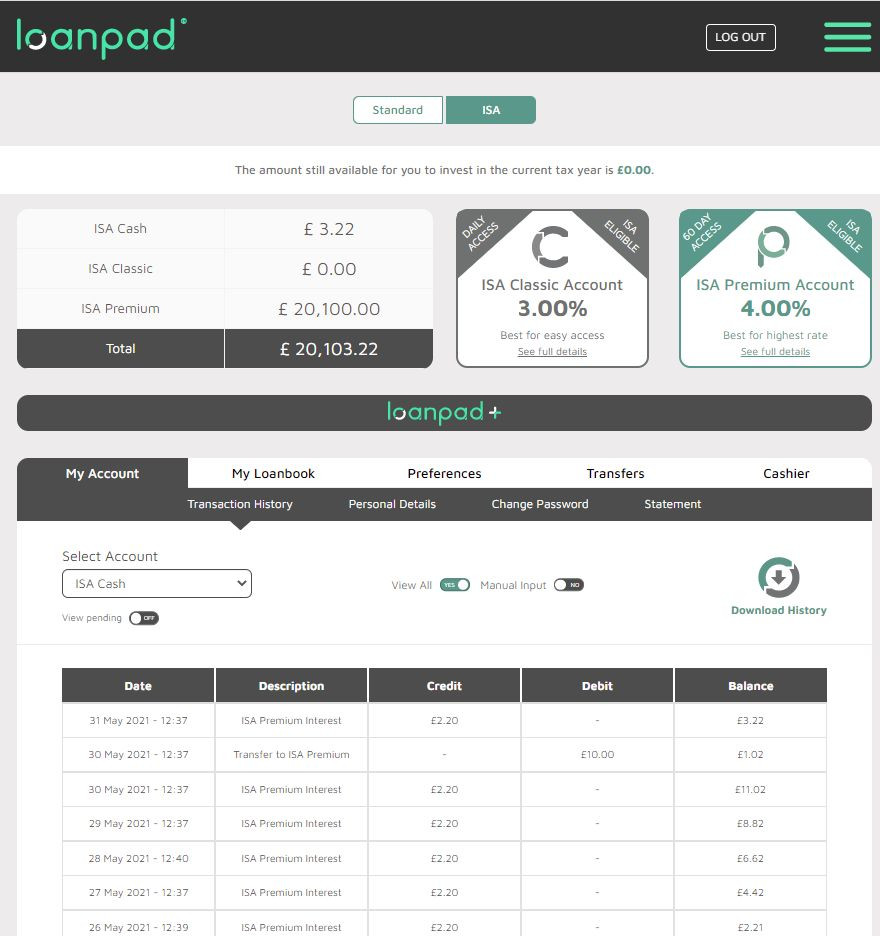

Same as always with Loanpad. Returns just come in every day and then get automatically reinvested once the cash account reaches a value of £10. Easy as pie. Safe as houses (literally) with the lowest LTV loans in the business. Closest platform to a bank you’ll get (NOT a bank though by any means, no FSCS insurance and capital at risk).

Here is a screenshot of how my accounts (standard & ISA) looked at the end of May 2021

My Loanpad Strategy.

There’s not really any strategy necessary with Loanpad. Just deposit your funds, choose your account & done. Nothing more you can do even if you wanted, it’s all taken care of for you behind the scenes. Of course 3% or 4% isn’t huge returns, but I believe they are about the safest lender out there and risk/returns.

Loanpad Cashback Offers

£50 bonus if you invest into a lending account a minimum of £5,000 within 4 weeks post registration and keep it invested for 1 year

£100 bonus if you invest into a lending account a minimum of £10,000 within 4 weeks post registration and keep this invested for 1 year.

Use this link to visit the Loanpad website or to signup & qualify for Loanpad cashback offers >>>

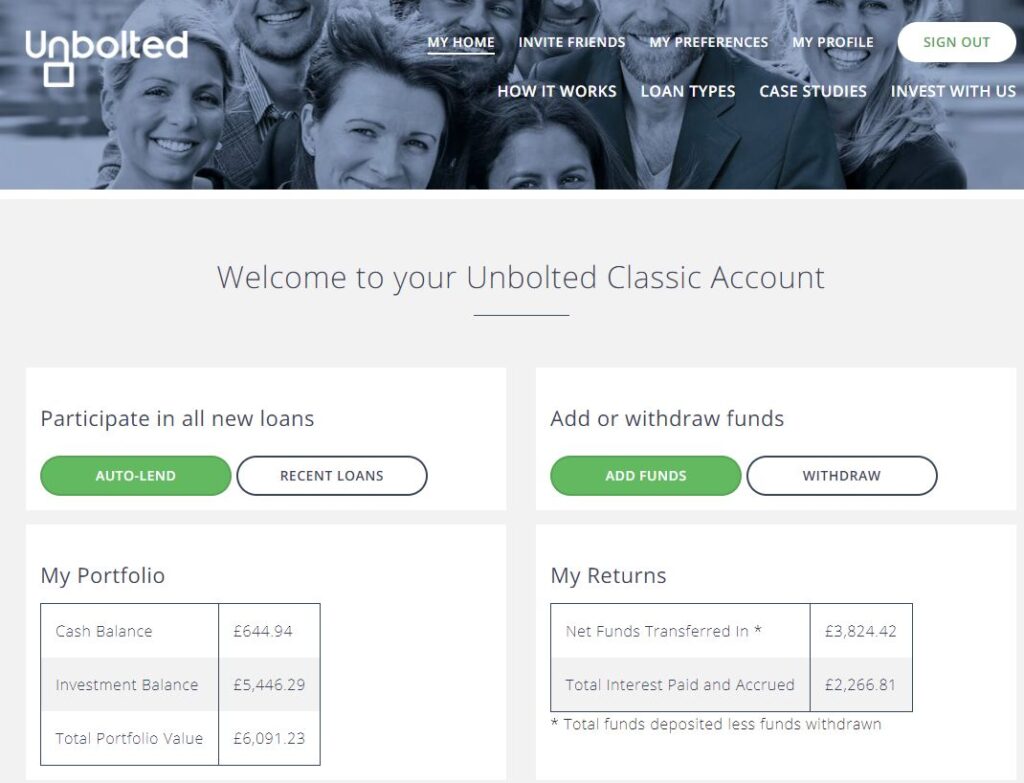

It’s so unfortunate that I can’t get more capital invested with Unbolted. I had to withdraw £5k from Unbolted in April as you may remember, and it wasn’t any better in May. I didn’t withdraw any but I once again have un-invested capital starting to stack up. Just can’t get any good amount of money into loans.

Unbolted are a great lender and I love the fact that they are not real estate property loans. Just something different to diversify in to & they have a great track record.

In case you’re unfamiliar; Unbolted offer pawnshop style loans to the general public with very liquid assets. These types of assets can be sold very quickly upon default so the demand for Unbolted loans exceeds the available loans.

I have been lending with Unbolted for a few years now, and although there have been many defaults, assets have always sold at more than the outstanding loan principle and I have always been paid back both principle and interest very quickly. Loans are short to medium term in nature so a complete exit can be had by turning off auto-invest within 3 to 12 months.

Unfortunately getting capital invested has become difficult because they have so few loans now, and too many investors with a lot of capital waiting to get in.

Here’s a screenshot of my account as it stands at the end of May, 2021.

Here are some of the recent loans capital has been put into by auto-invest in May. You’ll notice still only small amounts being invested. Loans are being repaid, but the newer available loans can’t keep up. I did get £121.90 in to a standard loan, that’s because they are the most risky so people don’t like to invest so much in them.

My Unbolted Strategy.

I would happily invest more capital with Unbolted if I could get it invested without the cash drag. I really love the platform and I’ve been lending with them for a long time now.

I’ll keep an eye on them and as soon as capital starts to get invested quicker, I will increase investment in Unbolted by a significant number. The question is; when will this happen of course.

Unbolted Signup & Cashback Offers

No current offers.

Use this link to signup with Unbolted >>>

EURO Lenders Update

I have been drawing down my Euro investments slowly as because I live in Portugal some of the time, when I’m here I live on Euros. So I have been using the Euros that I have invested in Euro Lenders for living expenses.

Typically I would change US Dollars or GB Pounds for Euros, but the Euro has been rising rapidly recently against the USD, and the GBP has still not recovered fully from Brexit. So I decided to use the Euros I have before changing more at this high rate in the hope it comes back down soon.

If you have Euros to invest and are looking for ideas. There are a few Euro Lenders that have come through the pandemic and seem to have been largely unaffected, namely Crowdestor, Swaper, Peerberry & Robocash have all done what they are supposed to do. I will invest in these all again once I am ready to invest Euros again. I believe they are all decent investable companies paying very good returns. Mintos is also worth investing in as long as you realize you’re not investing in Mintos, you’re investing in their LO’s, and as such you should pay more attention to them than to the platform.

Securities, Bonds, Gold & Crypto Portfolios

USD Growth Portfolio

No changes from last month. Everything performing as expected. This portfolio never disappoints. That’s why most of my personal wealth is invested in these assets.

Recap:

My main Growth Portfolio is doing as expected. REITs took a tumble at the beginning of the pandemic. Actually all assets got hit initially as panic set in, but REITs got hit the hardest losing around 50% of their value in a few weeks. Crazy stuff! That’s what panic does for us.

As always happens, the “safe haven” assets (Bonds & Gold) picked up the slack and started to rally just as they always do when the “big money” (funds) start to move capital into those assets as a safety hedge. The portfolio performed admirably throughout the pandemic after the initial “shock drawdown”.

If you look at the other portfolios based on Harry Browne’s Permeant Portfolio, you’ll see that this Growth Portfolio beats them hands down with just the addition of the REITs. Although all of the Permanent Portfolio assets did as expected.

You may have noticed that the returns numbers have increased significantly for this portfolio. That’s because before I was using inflation adjusted data. I decided to stop that as the data is difficult to correlate so now it just the raw numbers. If you need to know how that looks historically against inflation, you’ll need to do some number crunching yourself 🙂

Permanent Portfolios (all currencies)

No changes from last month. Everything performing as expected.

Recap:

Portfolios based on Harry Browne’s Permanent Portfolio strategy are all still doing well and as expected. They all experienced some drawdown when the pandemic first hit, but nothing out of the ordinary. 7% – 12% drawdowns with these portfolios are a regular occurrence.

None of them perform as well as the USD Growth Portfolio because the portfolios that are not in USD currency are not based on the US markets (historically some of the worlds top performing markets), plus they don’t have the added exposure to REITs and the high dividends they bring. The only difference between the USD Growth Portfolio & the USD Permanent Portfolio are the REITs, so you can see by looking at that the difference they make over time.

The Recovery Portfolio

At the end of May, I decided to close out the Recovery Portfolio. You may remember in last months update I was considering if I should try to sure-up this portfolio with gold & bonds, or exit at the top. I decided to exit and take a nice profit. 27.09% ($102k) in just under 5 months is a very nice parting gift from the COVID pandemic. Now the portfolio assets are back to their highs, the risk goes up significantly as this portfolio has no uncorrelated assets in it, so I decided it was time.

You can see below where we were in January (this image from the original post)

And this is where we were when I exited (end of May 2021)

So now I can take that capital and play with it elsewhere, like the Cryptocurrency portfolio next 🙂

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking).

Visit Kraken Visit BinanceEver since I made my first small investment in Cryptocurrency back in February 2021, I’ve kind of been infactuated with them. The more I learn, the more I want to know. It’s so different to other assets and very interesting to learn about.

I’m starting to believe this is going to turn out to be a major asset class eventually and not just a “fad”. I recently updated the commentary around the Cryptocurrency Portfolio if you’re interested to read some of the information I’ve learned. There is more to cryptocurrency than is obvious when you first look at it. To me, in the past, it never really made a lot of sense. However now I’m learning more about it, it’s starting to get very interesting.

I was always under the impression that crypto-assets had no real use whatsoever, but I’m becoming convinced now that this is not necessarily the case. Sure Bitcoin is fairly useless for anything else than a speculative vehicle, but some of the altcoins, Ehererium for example, actually makes a lot of sense. It has many uses to businesses, and to other types of coins, tokens & applications which are built on it. This is a good writeup describing what I’m talking about which is worth a read if you have the time.

Another thing I like about Cryptos is the ease of moving them around and storing them. Since I increased my investment in Cryptocurrency, I still use Kraken for buying and selling, and for some asset staking for which I also use Binance, but most of them are now stored & staked offline in what’s called “cold storage”. Basically the keys required to access them have been taken offline and are kept in an electronic wallet (similar to a USB thumb drive) where they are safe (meaning they are not accessible to hackers, or at risk if an exchange goes broke). When I want to sell, I can move them back to Kraken or Binance very quickly (5 minutes) & make the trade.

Anyway, I may write a separate post about what I’ve come to understand about Crypto if anyone’s interested, but for now, we can move on to the portfolio.

Back in April I had continued to buy the dips on Polkadot (DOT) and Cardano (ADA). When the Crypto market pulled back a bit towards the end of April, I bought some more DOT and also some others (DOGE, ATOM, ETH, BCH, XRP & KAVA). I had limit orders in expecting another pullback, but I did not expect the 50%+ crash that happened on May 19th which blew through all of the limit orders and continued down. So now I’m underwater and I’m expecting at least a test of the bottom again (if not another significant down-move) before things start to move back up. I’m thinking this could be an opportunity to buy some really cheap Crypto assets if we get a bit of a panic going again. We’ll see but I fully intend to invest more if we test the lows again.

If you’ve been following the ObviousInvestor.com for a couple of years, you’ll know there’s a methodology which I’ve been a big fan of for many years called “Wolfe Waves”. They were identified about 30 years ago by a fellow called Bill Wolfe and they have a uncanny way of showing how markets move. Similar to Elliott Waves if you’ve heard of those?

In the chart below (June 2nd as I write this update), you’ll see the individual waves mapped out. If the current price continues up over the red line towards the small “5?” and turns back down somewhere before the green “4?” line, then proceeds back down hart to the green “5?” at the bottom, and ideally we see a volume spike right there at the green “5”. I would look at buying a few different currencies around that level. This wave is showing in many of the other Cryptocurrencies too. I’m just monitoring ETH as it’s got the most volume of altcoins so is more reliable than those that are more lightly traded.

Of course the price could blow right through that level and continue down to who knows where. Or it could just blow up through the green line and head up. There is a good chance (better than 70%) that if the setup mentioned above occurs exactly, we should see at least a move back up to the greet #4 line at minimum. There’s too much to Wolfe Waves for me to explain it all here, but if you would like to know more about Wolfe Waves, you can learn about them on Bill’s website. To learn about them in enough detail to trade them, it costs quite a bit for the course, but you’ll get the idea from his website or Googling it. Lot’s of information out there.

So we’ll see what happens.

It goes without saying, please don’t just follow investments that I make. And when you do decide to invest, based on our own research, don’t invest in Crypto what you can’t afford to lose or at least hold on to for a long time, because it is still the wild west of investing and very volatile as the last few weeks have shown.

Summary

That’s all for this update. It will be interesting to see what happens with all investments over the coming weeks. It seems like everything is finally getting back to normal after the pandemic, but there is still a very large bubble in many assets so a crash in just about everything over the next months would not surprise me. I’ve been saying that for about 10 years though so take it with a grain of salt 🙂

Good luck with your investments in the coming months! Remember, it’s about patience & persistence, not perfection! If you start investing when you are young, just a small amount every month like I did, you’ll be amazed how quickly it becomes a significant portfolio.

My best to you and your families. Stay safe and I’ll post an investment update again soon.

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

€ – Euro Permanent Portfolio

Maturing Whisky Portfolio

$ – US Dollar Growth Portfolio

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

£ – GBP Permanent Portfolio

฿ – Cryptocurrency Portfolio

£ – GBP Peer to Peer Lending Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Fantastic reading, so thank you for your effort publishing “The Obvious Investor”

Question: Why has there been no write up about P2P platform “Proplend”

Am I missing something?

Thanks for the kind words David.

As I only review & discuss platforms I invest my own money with (either currently or in the past), I’m not really qualified to review Proplend as I have never invested with them (up to now at least).

If I ever do invest with them, I’ll do a review for sure.

Mark

Hi it’s Paul going back to Assetz Exchange how do you purchase a part of a property at a discount.

Hi Paul,

There is a bidding system on the Assetz Exchange platform (when you look at >>>Property Detail on the Exchange, >>>Buy >>>Order Book). You just bid below what the current asking price is. You’ll see all of the offers & bids listed there. Very similar to Ablrate.

Hope that helps.

Cheers,

Mark

Where is the like button?

It´s always a great pleasure to read your updates! Congrats on the Recover Portfolio! It’s nice to see that our opinions on crypto go exactly the same way!

Hug for you my friend!

Thanks Sergio. I’m happy with the return from that portfolio. Crypto will be a great investment long term I think.

Long time no talk to. Hope you guys are doing well?

Hug back for you and Susi.

Bitcoin, as a digital gold, is in a sense a pet rock so not under threat from newcomers, as it has already achieved the network effect. So has Ethereum but ETH is under threat from new smart contract currencies which do a better job.

So short term perhaps ETH will do well, but longer term BTC is safe. Just my thoughts.

Hi Dave,

I somewhat agree. I don’t think Bitcoin is going anywhere for sure. Even though I’m not big on it as an investment short term, I think the fact that it is widely accepted as the main investment vehicle for crypto will keep it around forever or certainly a very long time. In fact, I’m warming to the idea of picking some up as part of my portfolio if this current down leg continues to somewhere between 24k & 20k $. I still think there is more short term opportunity in some of the altcoins, but long term, BTC is certainly showing as an investment to hold. It just won’t be all of my portfolio.