It’s time for an investment update again. For the last few months I’ve been working on an exiting new long-term investment opportunity, which I’ll tell you about in the next few weeks. I want to be 100% sure it’s as good as it looks before I put it out there for readers to review.

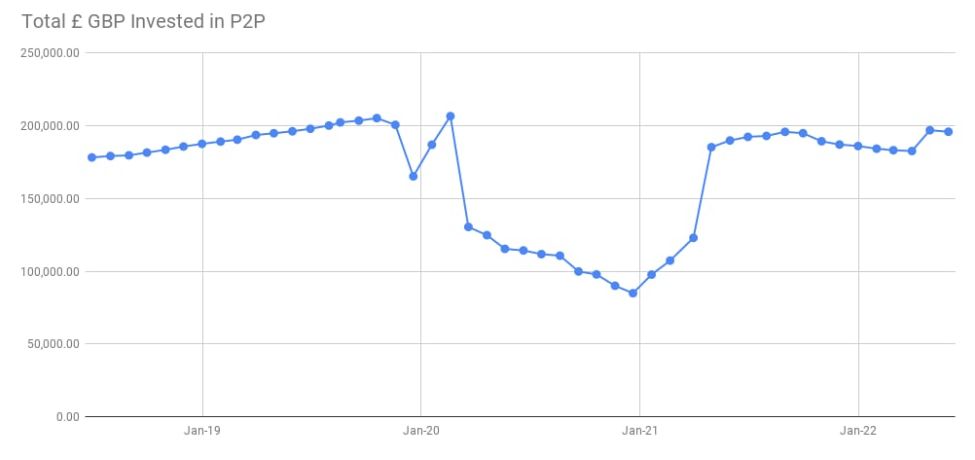

To that end, if you’re a regular reader of The Obvious Investor, you’ll likely have noticed money moving about between P2P investments and also capital being reduced in some lenders and sitting in cash. This was used for the new opportunity I’m working on, plus trying to shuffle the higher paying platform money into ISA’s for obvious reasons. I also changed some capital from USD to GBP as the rate came down a bit so that money was also used for the new investment.

Volatile markets still abound as the US equities markets enter a bear trend. In fact the Nasdaq is in the middle of its worst drawdown since the Lehman crisis, and the Dow just suffered its longest losing streak in many years. Uncertainty because of the Ukraine invasion, inflation, fuel prices and now a likely global food shortage is adding to the world-wide narrative. It appears that the US Federal Reserve deciding to hike interest rates (in an effort to curb inflation) and also reducing their QE & bond purchases, is pushing the markets lower.

Other central banks (notably the UK, China etc.) are also increasing rates to try and slow down runaway inflation which is having an undesirable effect on their individual economies, however the world still seems (at a high level) to follow the largest economy in the world (USA, still “just” the largest) for what’s going to happen next.

My personal opinion on what’s next (which along with a couple of pence and a stick of gum might get you a coffee) is that most first world countries will “officially” dip into recession for a period as inflation slows and prices curb (most are already in a recession, the data is just taking a while to catch up). Economies almost have to go into recession to start to slow inflation, it’s almost impossible to do without that.

Eventually the US Federal Reserve (and other central banks) will start to pull back interest rates again, for effect. Unfortunately though they have to raise them first even without inflation as they have nowhere to go when they’re at almost zero anyway, apart from negative of course and no-one likes that. They’ll also likely have to start QE into the bond and equites markets again to buy them higher. At which point everything will take off again. When will this happen? Who knows, however remember that 2024 is an election year in both the USA and the UK, so I’ll bet the “supposedly” independent central banks will coincidently be looking to boost the economies of both countries sometime before the elections.

I’ve always noticed that markets won’t change long term direction until something big changes. Could be the central banks (as above), could be the war ending, could be inflation crashes into deflation. They rarely just turn around for no apparent reason and start to head upwards. Same as when they start down. Something always happens big it seems.

Crypto is basically following equities markets as I mentioned in the last update, which is unfortunate. Many investors were hoping this new asset class was going to be less correlated to the general equity markets and offer something completely different to diversify in to. Unfortunately Wall Street got it’s claws into Bitcoin (with futures contracts), so now the big money is controlling it through that avenue it appears.

Gold is still holding it’s ground, but every time it gets near the $2,000 mark it gets clobbered by the powers that be who can’t have it rallying above that level because they know full well that they’ll lose control of their fiat currencies and many of the equities markets as frightened money starts to pile in. There will come a time where shorting billions of dollars worth of gold futures contracts & dumping millions into the metal markets all at once won’t keep the shiny metal down any longer, and at that time, we could see gold doubling in price many times over. That’s just speculation of course, but see throughout history (10,000 years, not just the last couple of hundred). When things get really bad, the old, big money goes into gold. I’m certainly not selling any of my gold anytime soon, that’s for sure.

Peer to Peer lending still seems wholly unaffected by all of these goings on. I’m not seeing any increase in defaults, late payments or anything else that would make me start to look at pulling capital out for safety (I drew P2P investments down a bit in 2020 for the beginning of the pandemic just in case. In the long run I don’t think I would have lost anything anyway, but it felt like the right thing to do at the time). I continue to look at the secondary markets when something big happens to see if there is an increase in loan parts up for sale, which would suggest people are panicking, but so far I have seen nothing that would suggest that. So I continue to reinvest capital as it is paid back.

Whisky is still holding it’s gains and growing. A wise man once said to me: alcohol in general is not a terrible investment. When times are good, people like to celebrate, when times are bad, they like to drown their sorrows. Either way, they tend to do it with some form of alcohol.

I try to buy as much as I can every time new liquid is released. Unfortunately there are many people who have the same idea so it’s difficult to get much capital invested these days through WhiskyInvestDirect.com. Once I get the new passive investment I’m currently working on sorted out, I intend to start and look at other ways to invest in whisky, or perhaps other types of alcohol, wine maybe. The problem as is I know very little about it, so much research is required.

And so on to the individual portfolio updates & a little more detail.

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Peer to Peer Lending Portfolio Update

Total capital invested in P2P dropped just a little bit in May as I started to move it about and get investments into ISA cover and also take out a little bit for the new investment opportunity I’m working on.

Overall P2P Lending Portfolio XIRR moved up a couple of blips to 5.22% in May. Not too bad and going in the right direction. Monthly income for May was high again mainly due to moving things around with Kuflink.

I did sell some loans and pull some capital out of one of my favorite platforms Kuflink in May. There are two reasons for this; 1. the account was getting close to £60k, over 30% of my overall P2P portfolio, which is just too much no matter how safe I think they are. So a rebalance between platforms was in order. And 2. I hold my 2022-2023 ISA with Kuflink so I sold most of the loans that had an end date in 2023 in the regular, non ISA wallet, and started to move capital into the ISA wallet and bought more loans there. That way I can take full advantage of the tax efficient wrapper for the 2022-2023 tax period. I have 2 ISA wrappers there with Kuflink now totaling £30k.

This year looks like it’s going to be a relatively low income year for me on a whole (with the markets and economy the way they are I’m not going to sell anything at a loss), so I may as well take the taxable gains here in 2022-2023 and move to the ISA’s for the following year. The reason for the spike in income again in May with Kuflink is because when I sold the 2023 loans, the accrued interest was paid now, all at once instead of when the loans would have originally come to fruition.

As capital is paid back, I’ve also decided to draw down my CrowdProperty regular account a bit. I’m actually a little disappointed in the XIRR the platform shows after almost 3 years of investment with them. A touch over 5% is not that good when they promise 7%-8% on most of their deals. On top of that, investing with them has become frustrating recently because many of their deals now go directly to auto-invest, and their auto-invest is not the best. You can read more about it in detail in the latest update if you didn’t know already. The other thing that’s a small disadvantage with CrowdProperty is that they don’t have a secondary market. So once you’re in a deal, there is no exit until the loan is paid in full. Not typically a problem for me, however Selling loans in Kuflink last month showed me just how nice it is to have that option if you need to withdraw capital. And as Kuflink delivers on their return promises, it just seems like a better model to me. I do have an ISA with CrowdProperty so I’ll only be drawing down so far.

The above might sound negative for CrowdProperty, but just to be clear, I still think they are a good platform, I just wish I could get more money invested there and also figure out why my XIRR is so low when it should be 2 or 3 points higher.

CrowdProperty launched another platform recently call CP Capital. This platform is higher risk with loans that take second charge on assets. For higher risk comes higher return though. The first loan financed on the platform paid 16.5% interest! I didn’t get a part of this one as the minimum investment in a single loan is £1,000, so I would want to do a bit more research before investing, and I didn’t have time.

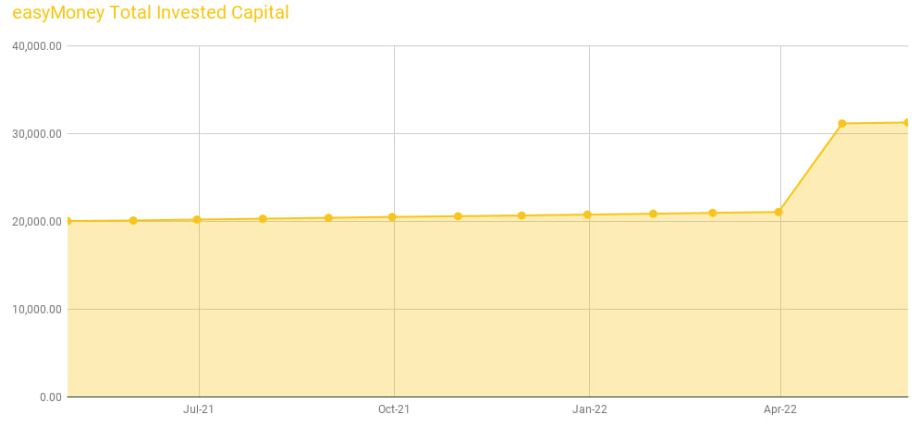

easyMoney is actually showing a better XIRR than CrowdProperty at the moment. As I have about a years experience with them now, I decided to up the investment there some. I believe they are safe enough (when you look at their loan & history, no defaults), so I have no problem bringing this account up to similar values as my other main accounts now.

I increased my investment in easyMoney by another £10k.

There is already a bit of an increase showing in monthly income. We should see a bit more of an increase in June

I still haven’t been able to add any more capital to Unbolted as the cash drag is still ever present. Not enough loans and too much investment capital sat waiting makes it very difficult to get fully invested. Shame really as Unbolted are a super-solid platform and its just something different.

All lending figures are available on the Tracking sheet in the Peer to Peer Lending Portfolio.

Latest Detailed Individual Peer to Peer Platform Updates

(Click link to go to latest update in review)

You can always see the live Peer to Peer Lending Portfolio data here >>

Securities, Bonds, Gold, Crypto & Whisky Portfolios

USD Growth Portfolio

Growth portfolios (stocks, bonds, REITs, gold etc.) continue to pull back as mentioned earlier. Nothing out of the ordinary yet though. My main portfolio has a lifetime drawdown of 14.75% (back in 2008) and it’s currently down 11.25% so we’re still in the “normal range”.

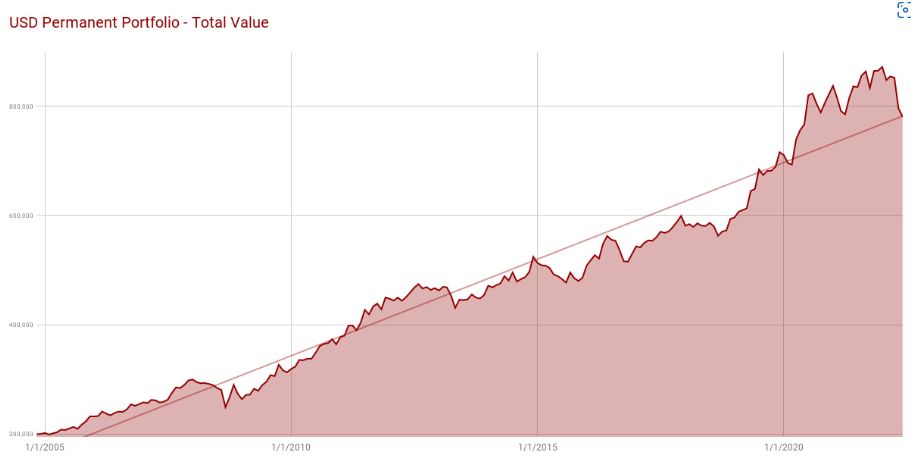

Permanent Portfolios (all currencies)

Both the EURO based portfolio and the GBP based portfolio also pulled back some more but less so than the US Dollar based portfolios which tend to be more volatile in general. Still nothing out of the norm though.

The key to using these portfolios is to make sure you always have access to cash should you need it, whether that comes from gainful employment or fixed income investments, or just cash in the bank. The last thing you want to do is have to sell anything from these portfolios when they are down and take a loss because you need the money to live on. They are a long term investment, so best to leave them alone until you’re ready to retire, or you need to make a large fixed investment like a house, and then time your exit when they are not on a pullback. Don’t put yourself in a position where you HAVE to sell.

All of the assets these portfolios are based on have performed the same way for the last 100 years or more, so I would be surprised if anything changes in my lifetime. You can see a 40+ year asset class backtest of these assets on the Portfolio Visualizer site by clicking here.

A couple of good books to read on these portfolios are “Fail-Safe Investing” and “The Permanent Portfolio” if you’re interested in how they’re constructed. Both oldies but goodies.

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking). And I use the Ledger Nano X & S for Crypto offline cold storage.

Visit Kraken Visit BinanceThe Crypto portfolio has turned out to be a somewhat correlated asset to the securities markets, and much more volatile. To say it was up over 39k at one point and now down over 31k makes this an interesting investment 🙂 I would think once the other markets turn around crypto will start to rally again along with them. You never know though. This is the wild west of investing so anything could happen. Governments generally don’t like the crypto market as they can’t control it, so they are always trying to get a handle on it somehow.

For now I’ll just sit tight and keep saving my staking rewards.

I am still staked with many of the assets so still making money while the prices are low.

Bitcoin is getting closer to that 200 week Moving Average all of the time. I still think if it hits it, there could be a good buying opportunity as I’ve been saying for a few months. It’s bounced off it several times before in it’s history.

Long term I’m still bullish on Crypto. I think it’s the future of finance and freedom, but right now it’s still fairly volatile and risky, so I suggest not putting anything into Crypto that you can’t afford to lose, because who knows.

Whisky Portfolio

I buy & store my whisky through WhiskyInvestDirect.com

Visit WebsiteOnce again I got a little more capital invested through pre-order with WhiskyInvestDirect.com in April & May. It’s still really difficult to get capital invested in whisky as it has been doing so well, and the word is out to investors now. Lots of money waiting around and trying to buy maturing whisky.

The bulk trade bid for Cameronbridge Grain, Refill hogshead 2021 Q4 came out ok. This deal made about 30% profit in just a couple of months. Can’t complain at that. Now of course I need to get that capital reinvested again.

So far the portfolio has shown a 14.64% total profit since August of 2021. The XIRR is showing 42.01%, that’s probably a bit deceptive though as we just don’t have enough data yet.

I keep looking at cask whisky providers who sell whisky by the cask to see if there’s a way I can get more capital invested in whisky. Unfortunately so far they seem more like companies that promise a lot but don’t have much of a track record. Some come over like double glazing salesmen or timeshare for some reason. I’m probably being a bit over the top there but I didn’t find any that I would be comfortable putting capital into yet.

Summary

It looks like some of the alternative passive income investments (p2p, whisky) are holding ground so far with this market turmoil. I knew crypto was volatile when I got in, that’s why I didn’t have a lot of money in that portfolio.

Growth Portfolios are generally reliable. Somewhat volatile but with a long history so we (kind of) know what to expect. They are pulled back at the moment but nothing out for the ordinary.

These are interesting times with everything going on at the moment. I’m not sure when things will start getting better, but let’s hope first of all that they don’t get much worse. As mentioned earlier, we have general elections for two of the largest western economies coming up in 2024, so you can bet current governments will be doing anything they can to try and show how they “rescued” us all from the recession.

Until next time; good luck with your investments and stay safe. My best to you and your families.

฿ – Cryptocurrency Portfolio

£ – GBP Permanent Portfolio

$ – US Dollar Growth Portfolio

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

£ – GBP Peer to Peer Lending Portfolio

€ – Euro Permanent Portfolio

Maturing Whisky Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Hi Mark

Thanks for the update, I found your comments about Crowdproperty Interesting. Dispite investing with them for several years I started to pull out around 3 months ago due to the following. Cash left on Balance to long. Interest rates not as high as I had hoped over the year. To many projects on long delays. I know of a least one Project that has already been delayed and will most likely go into default. Although Crowdproperty has not yet confirmed this to investors. When I emailed them about it they were very cautious in reply, It is due for repayment this month. I feel happier with Kufflink and Easymoney at present.

Hi Stephen,

I totally agree. I’m not concerned about CrowdProperty because they have a lot of experienced staff. If the project in question doesn’t pay, they are in a position to take it over and bring it to fruition as opposed to many other platforms which can only sell it through a default sale and we all know the costs involved in that route. So, I hope there will be little loss for investors if any.

I’m with you on easyMoney and Kuflink as well. Can’t fault either of them right now. Kuflink I’ve been with for a long time and they’ve never missed a beat.

Thanks for the note.

Mark

As ever Mark, thanks for the excellent blog update.

In light of the UK and world economies’ projected performances, and the unpredictable effects of the Ukraine/ Russian war, I have reassessed the risk vs reward of my Big-Four P2P investments:

> I’m keeping my Kuflink & CrowdProperty investment exposure fairly level.

> However, I have completely cashed out of Loanpad and put the money into my Marcus easy access account at 1.4% (incl bonuses) as I feel the low LP rates simply aren’t worth the risk at the moment.

> I am slowly reducing Unbolted from a high level, and note they have just announced some of their interest rates will drop from June.

> I had already reduced virtually all my other P2Ps to zero, though I still have about 1% of my P2P portfolio stuck in The House Crowd.

Your comment “I increased my investment in easyMoney by another £10k” looks like it was done over one month. I’d be interested to know how many different investments that £10k was spread over, and how much the larger single investments were. My concern with EM is the lack of diversification when investing larger amounts.

Good luck with everything!

Thanks again, Richard of Sussex

Hi Richard,

I’m staying with Loanpad. Their rates are lower but I still believe they are the safest platform out there having been with them since the start, through the pandemic etc. Everyone has to do what they are comfortable with so totally understand your perspective.

The easyMoney capital was distributed to just 4 loans. I agree with you about the diversification. However these loans are few because they are very well researched and have very low LTV’s. Of the 4 loans the recent 10k was distributed to, the highest LTV was 34% and the lowest was 14% LTV. This is another account (like Loanpad) where personal risk aversion comes in to it. easyMoney again never missed a beat through the pandemic and have never had a loan default (or even a seriously late one as far as I can tell). Again because of the due-diligence they do on their loans, they only accept the top 1% of applicants, the possibility of default is fairly low, and if they did default, the very low LTV’s should help get most capital back. They go for quality instead of quantity. Nothing’s for certain though so again, everyone to their own comfort level.