I decided it’s time to do an update as I haven’t in a few weeks. As usual, just had a lot of stuff going on at home that seemed more important, and of course this silliness going on in Ukraine.

As you’ve no doubt noticed, the uncertainty because of the invasion, and also inflation and fuel prices sky rocketing has markets on edge. Add to this the US Federal Reserve deciding to hike interest rates (in an effort to curb inflation) and also reducing their QE & bond purchases, all leads to what seems like the perfect storm for stocks, bonds & cash.

Crypto has also taken a hit and appears to be acting more like the regular stock market than an alternative asset. I’ve read that some people think this is because of (in part) the new Bitcoin futures contracts which allow hedge funds to take larger positions in the cryptocurrency and somewhat control the market in a way they couldn’t when it was just Bitcoin trading on its own on the blockchain. I’m not sure about all that as I’m not that clever, but I believe from chart patterns I’m seeing, there is potentially more downside to the Crypto space if they play out like these patterns typically would.

Gold on the other hand (part of all of the Growth Portfolios) is doing exactly what it’s there for and rallying as capital moves over to it for safe haven. Unlike most people, I don’t believe gold is a hedge against inflation. If you look at charts historically that idea just doesn’t play out. Personally I believe gold is a safe haven when there is panic in the markets, and uncertainty in the world. It also seems to rally when trust in government gets low. Gold is something normal people can move and hide away from the prying eyes of governments, banks and any other entity which can dip in to a bank or investment account and commandeer your funds. Gold is good, & no one will convince me otherwise!

Peer to Peer lending seems to be mostly unaffected by all of these goings on, and ticks on as usual. So far I’m not seeing any increase in defaults, late payments or anything else that would make me think investors are panicking. I always look at the secondary markets when something big happens to see if there is an increase in loan parts up for sale which would suggest people are panicking, but so far I have seen nothing that would suggest that.

Whisky for some reason has gone nuts! Prices just keep increasing in huge increments. I have no idea why this is. Some say it’s part of the inflationary environment, and then some say whisky is just having its day as the “in thing” for the masses to drink & collect. Who knows. I’m ok with it though as long as it keeps going up. Of course the big problem now is trying to get capital invested into whisky so we can benefit from these huge moves. More on that below.

With that, we’ll move on to the individual portfolio updates & get a little more into detail..

Disclaimers

The information below is comprised of my opinions on current investment market conditions and my personal actions with my investments. It should not in any way be construed as financial advice. Please do your own research before making investment decisions and do not base them solely on what you read on this website. Please read my full disclaimer of more information.

Some of the links on this website are affiliate referral links. For cashback offers, you’ll generally need to use these links to qualify for the cashback. If you use these links I can sometimes receive a commission, at absolutely no cost to you. This helps me to run the website, write new platform reviews, publish monthly portfolio updates & generally keep me interested in taking the time to share the information you are currently reading. I don’t receive commissions from all links, and it has no effect on my ongoing opinions on investments, which are entirely focused on generating Income and preserving capital.

Peer to Peer Lending Portfolio Update

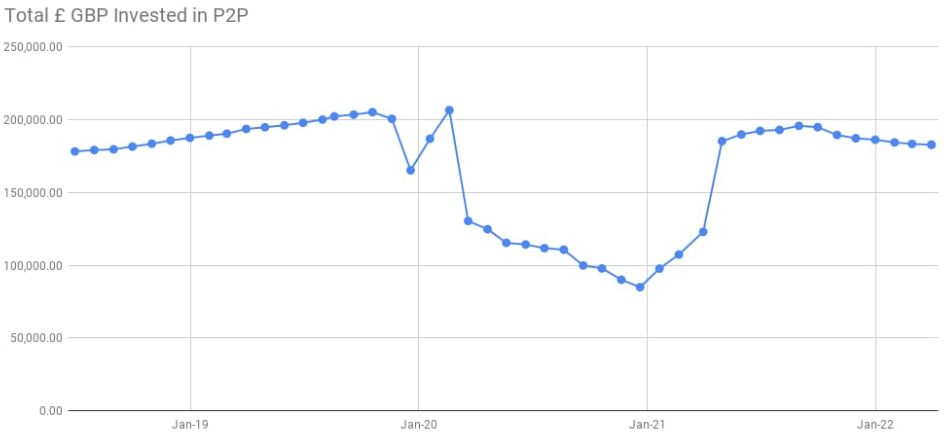

Peer to Peer Lending total investment keeps coming down a little. This is due to me pulling capital out and using it for other things, mostly putting it into the Whisky Portfolio.

Overall P2P Lending Portfolio XIRR moved up a couple of blips to 5.04% in March. Not great but going in the right direction. Monthly income for both February & March were in the normal range of just above £800.

I pulled most of the withdrawn capital out of Loanpad as I’ve been using their Classic Account as kind of a bank account paying 3% as I’ve mentioned previously. I do still have 21k there in an ISA in their Premium Account paying 4%. The only reason I’m pulling money out of Loanpad and moving it to the Whisky portfolio is because the return is so low. Loanpad is still about the safest lender out there, but when inflation is running 6%+, personally I feel the need to at least try and get close to that. 3 or 4% just doesn’t cut it unfortunately. If I were nervous about P2P investments though, Loanpad is where my money would be for safety.

I also moved a bit of capital over to Ablrate. They have started to bring in several new loans and overall most of the loans seem to be performing well. The returns they pay are about the best in the business, so I decided it was time to start increasing my investment there again.

Of course a couple of weeks after I made the new investment, I received an email from Ablrate saying that they had suspended their loan exchange because of a disagreement with the FCA (regulator). This situation is still ongoing as I write this update, but hopefully they have it sorted out soon. I don’t think it’s an end of the world situation. More of just some updating that needs doing to meet FCA rules.

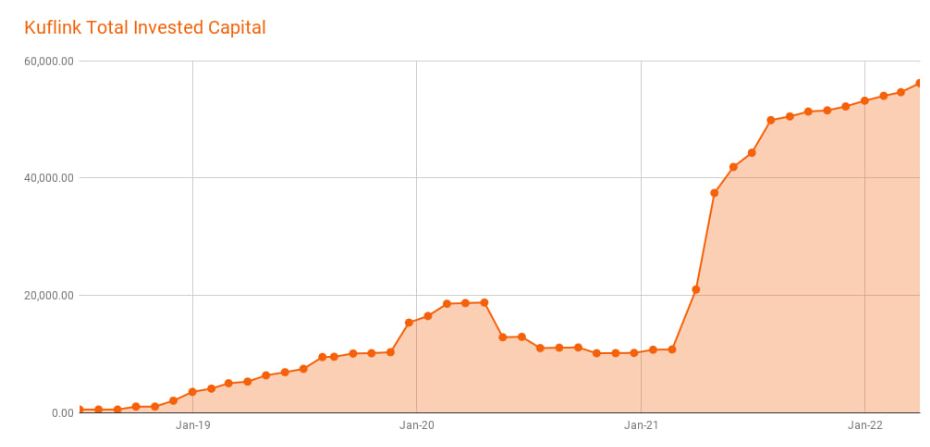

One of my favorite platforms Kuflink continues to perform, & I keep adding more & more capital to pick up deals that come up I just can’t resist. I’m over £56k in the account now which is a much larger portion of my overall portfolio than I should have in a single lender, but I’m just so comfortable with Kuflink and the way they operate.

And of course the (almost) 6% annual return doesn’t hurt. I do watch everything very closely, but so far they haven’t missed a beat. Investors are pouring into the platform with large amounts of investment capital, evidenced by the fact deals are getting gobbled up quite quickly now as soon as they are released. Not quite as fast as CrowdProperty, but it’s getting there. I often look on the secondary market to see if there is anything worth picking up. Unfortunately there is usually nothing listed at all for sale, suggesting that investors don’t want to sell their investments. I get it, because I don’t want to sell either. The downside of this success for Kuflink of course is that we as investors don’t have so much opportunity to get capital lent out because there are so many of us trying to do it at the same time.

easyMoney is still ticking along quite nicely. Capital seems to get reinvested quickly which is positive. I’m still enjoying my investment with this platform. Very hands-off and (I believe) relatively safe, with a reasonable return for the risk at 5.6% as of the end of March. I’ll likely start increasing my investment with easyMoney now I have almost a years worth of experience with them. So far, so good.

CrowdProperty of course also deserve a mention. They are going great guns, but I’m still having trouble getting invested. Many of their deals are still auto-invest only. Unless you have a bunch of cash sat there earning nothing in your auto-invest account, you’re not going to get much into each loan. In fact, (you can’t see it on the charts yet as they are only updated at the end of each month) at the beginning of April I had to pull some cash out of CrowdProperty as I had a bunch of loans pay back and couldn’t get the capital reinvested fast enough.

I still haven’t been able to add any more capital to Unbolted as the cash drag is still every present. Not enough loans and too much investment capital sat waiting makes it very difficult to get fully invested. Shame really as Unbolted are a super-solid platform.

All lending figures are available on the Tracking sheet in the Peer to Peer Lending Portfolio.

Latest Detailed Individual Peer to Peer Platform Updates

(Click link to go to latest update in review)

You can always see the live Peer to Peer Lending Portfolio data here >>

Securities, Bonds, Gold & Crypto Portfolios

USD Growth Portfolio

All of the Growth Portfolios are down a bit at the moment. My main USD Growth Portfolio has pulled back around 5% by the end of March. Totally normal, in fact 10% pullbacks happen often in these types of portfolios which is nothing terrible. I don’t pay attention unless it gets to around 15% which is the biggest drawdown the portfolio has ever seen. The overall annual CAGR for this portfolio is 9.52% since 2005. It always has ups & downs but is generally very reliable.

Watching these portfolios can be boring most of the time, but boring is generally good with long term investments.

Permanent Portfolios (all currencies)

Both the EURO based portfolio and the GBP based portfolio pulled back just a bit in February, however they saw a slight uptick in March. Nothing out of the ordinary here. Gold was the saving asset in both portfolios, and it’s doing exactly as it is intended. Gold is a completely useless asset, until it isn’t.

People tell me all of the time “I’m not putting gold in my portfolio, it doesn’t pay dividends, or interest, and it’s so volatile it’s hard to deal with”. Of course when the proverbial “you know what” hits the fan, things are different. This is why I have gold in my portfolios. Gold has been a safe haven and store of value for over 10,000 years. That probably won’t change in our lifetimes.

All of the assets these portfolios are based on have performed this way for the last 100 years or more, so I would be surprised if anything changes in my lifetime. You can see a 50+ year asset class backtest of these assets on the Portfolio Visualizer site by clicking here.

A couple of good books to read on these portfolios are “Fail-Safe Investing” and “The Permanent Portfolio” if you’re interested in how they’re constructed. Both oldies but goodies.

Crypto Currency Portfolio

I use Kraken & Binance for my Crypto Portfolio (buying/selling/staking). And I use the Ledger Nano X & S for Crypto offline cold storage.

Visit Kraken Visit BinanceThe Crypto portfolio had pulled back from its high of $103k at the end of October 2021 down to $59k by January 2022. By the end of March it was back up to $70k and showing a small profit. So volatile are these assets, but they make for interesting opportunities.

I am still staked with many of the assets so still making money while the prices are low.

So when am I going to buy more Crypto? Readers send me emails and ask this question a lot?

Well, take a look at the 200 week Moving Average Bitcoin chart below:

I know that I’ve pointed this out in the past, but do you see how Bitcoin keeps coming back to the 200 week moving average? Then it bounces off and makes new highs sometime in the future. Well, I’m waiting for it to do that again. When it does, I’ll likely buy some (and probably some more Ethereum too). That line is currently at about $21k but it rises every day. With Bitcoin at $42k as I write this post, that means it would need to lose 50% from where it’s at now in order to hit that line. Could happen, it’s happened several times before. Bearing in mind of course that it’s already lost almost 50% from it’s high at this level. Or it could just keep going up for the next 2 years without returning to that line, who knows. I’m just not comfortable putting a significant amount of capital into it until it pulls back more.

Long term I’m still bullish on Crypto. I think it’s the future of finance and freedom, but right now it’s still fairly volatile and risky, so don’t put anything into Crypto that you can’t afford to lose, because who knows.

Whisky Portfolio

I buy & store my whisky through WhiskyInvestDirect.com

Visit WebsiteI picked up a few more pre-order liquids from WhiskyInvestDirect.com over the last couple of months. As I mentioned at the beginning of the post, the problem is now that the word is out, so new pre-orders of whisky (both grain & malt) are way over subscribed so it’s really difficult to get any kind of meaningful capital into an order. There was one last week (2nd week in April). I had £11k in pre-ordered liquids in. Once the distribution was finished, I actually got a total of £1.5k in orders. Not great!

I wonder if I should be blaming myself for publishing these ideas here on the website. You lot see what I’m doing, then go off and do the same thing it appears. Then I can’t get any of my own capital in! 😀

Just joking of course. I know many of you did invest with WhiskyInvestDirect.com and I hope you’re all happy with the results so far. I know I am.

There have actually been a couple of bulk trade bids on the platform over the past couple of months. I’ve accepted all but 1 of them and made a tidy profit. I’m just waiting for one to close for Cameronbridge Grain, Refill hogshead 2021 Q4. This deal made about 30% profit in just a couple of months. Can’t be bad!

So far the portfolio has shown a 14% total profit since August of 2021. Very respectable indeed. Just need to get more capital invested now somehow.

I have looked a couple of times at cask whisky providers who sell whisky by the cask. So far unfortunately, from everyone I’ve looked at, WhiskyInvestDirect still offer the best deal by far. If you have a cask provider you use that you are happy with, please let me know.

Summary

So as we come to the end of another update, it can sometimes be hard to see the light at the end of the tunnel when investments (and the world) are as volatile as they are now.

I always try to remember that (even in my short lifetime) there has been inflation, wars, starvation, interest rate hikes, and just about everything I can think of many times before. It’s always happened before and things have always come back to some semblance of normality eventually. I try not to get too tied up in the day-to-day mechanics of my investments, opting instead for the long term outlook, which fits with my investment strategy.

If you have any questions, comments or suggestions, please feel free to comment on the post, or email me directly if you prefer.

Good luck with your investments in the coming months! Remember, it’s about patience & persistence, not perfection! If you start investing in various assets when you are young, just a small amount every month like I did, you’ll be amazed how quickly it becomes a significant portfolio. You’ll also be amazed at how quickly you get old 😀

My best to you and your families. Stay safe and I’ll post an investment update again soon.

£ – GBP Peer to Peer Lending Portfolio

Maturing Whisky Portfolio

£ – GBP Permanent Portfolio

$ – US Dollar Growth Portfolio

$ – Recovery Portfolio

Short term stock portfolio for The Obvious Investor website. UPDATE: May 31st, 2021: The Recovery…

$ – US Dollar Permanent Portfolio

Below are the results of my personal USD Permanent Portfolio of mixed assets in US…

฿ – Cryptocurrency Portfolio

€ – Euro Permanent Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.