Overview

January has been the best month so far for my new P2P Lending Portfolio! £966.43 in monthly income. That Peer to Peer lending number doesn’t include a couple of peer to peer cashback bonuses I got from a couple of lenders that would have totaled another £98. I don’t include cashback bonuses in my income and peer to peer returns calculations as I feel it skews the figures unfairly. Plus it’s not income which I can rely on going forward, so better to keep a log of the actual interest ROI as that can be pretty much relied upon to an extent. Overall Peer to Peer XIRR continues to grow as expected and in fact just surpassed the 5% mark now running at 5.03%.

Remember that Peer to Peer XIRR doesn’t take in to account future compounding effects, so I am still expecting it to continue to grow to over 6% in the coming months as we get more stable data.

Charts and spreadsheet updates are below. You can see live versions of these anytime here

Individual Lender Updates

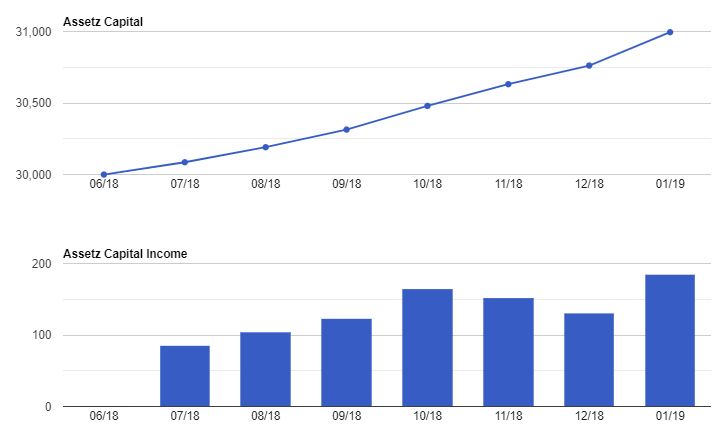

ASSETZ CAPITAL

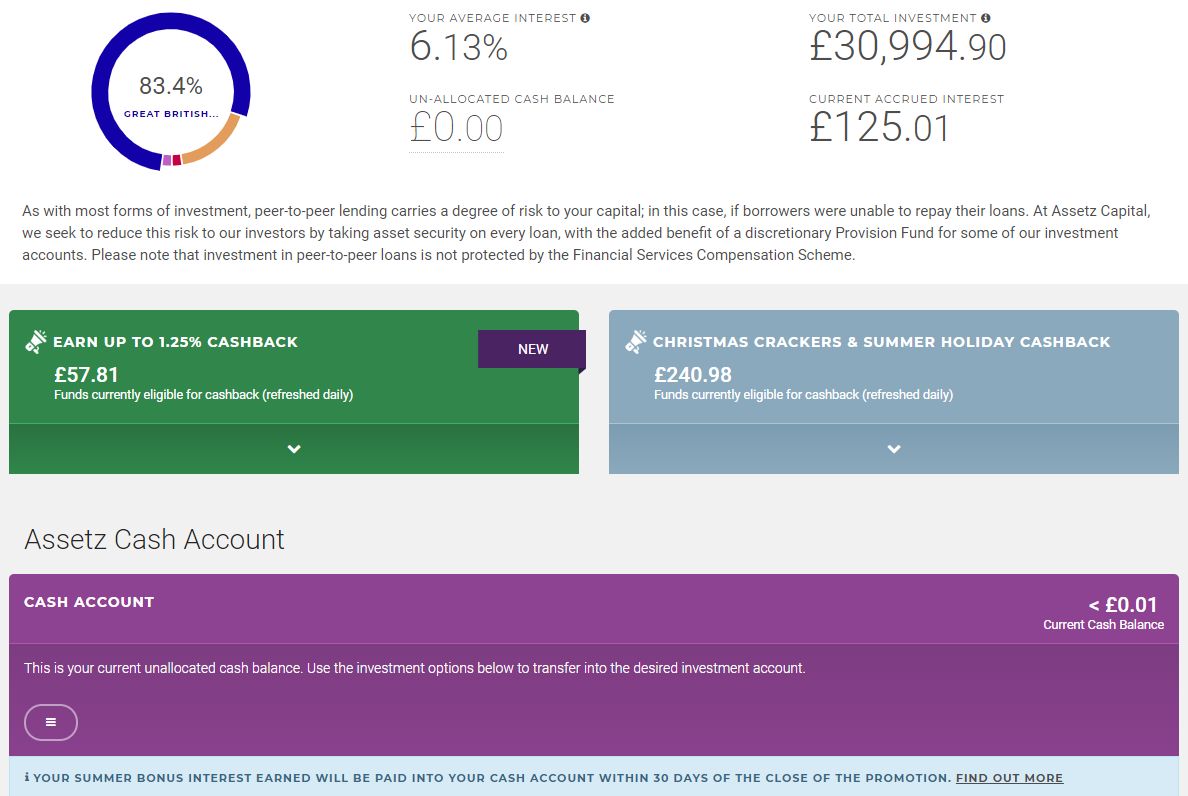

Assetz Capital continues to impress with (mostly) secured business and property loans. Income this month was highest so far at £185.08 and that DOES NOT include the £48.36 Peer to Peer cashback which was paid in to my account for the summer bonus offer of .5% which Assetz had. My Assetz Capital account balance has almost increased by £1000 in the last 7 months!

Returns (per Assetz calculations) rose a little to 6.13% and so did Peer to Peer XIRR which rose to 5.42% from 5.10% last month which would still put it in line with Assetz calculations when compounding is taken in to consideration. Assetz Capital is pretty much hands-off investing. The only thing I had to do this month was move the cashback bonus from the cash account to an investment account which took about 2 seconds. See my Assetz Capital Review for more information on how their accounts work.

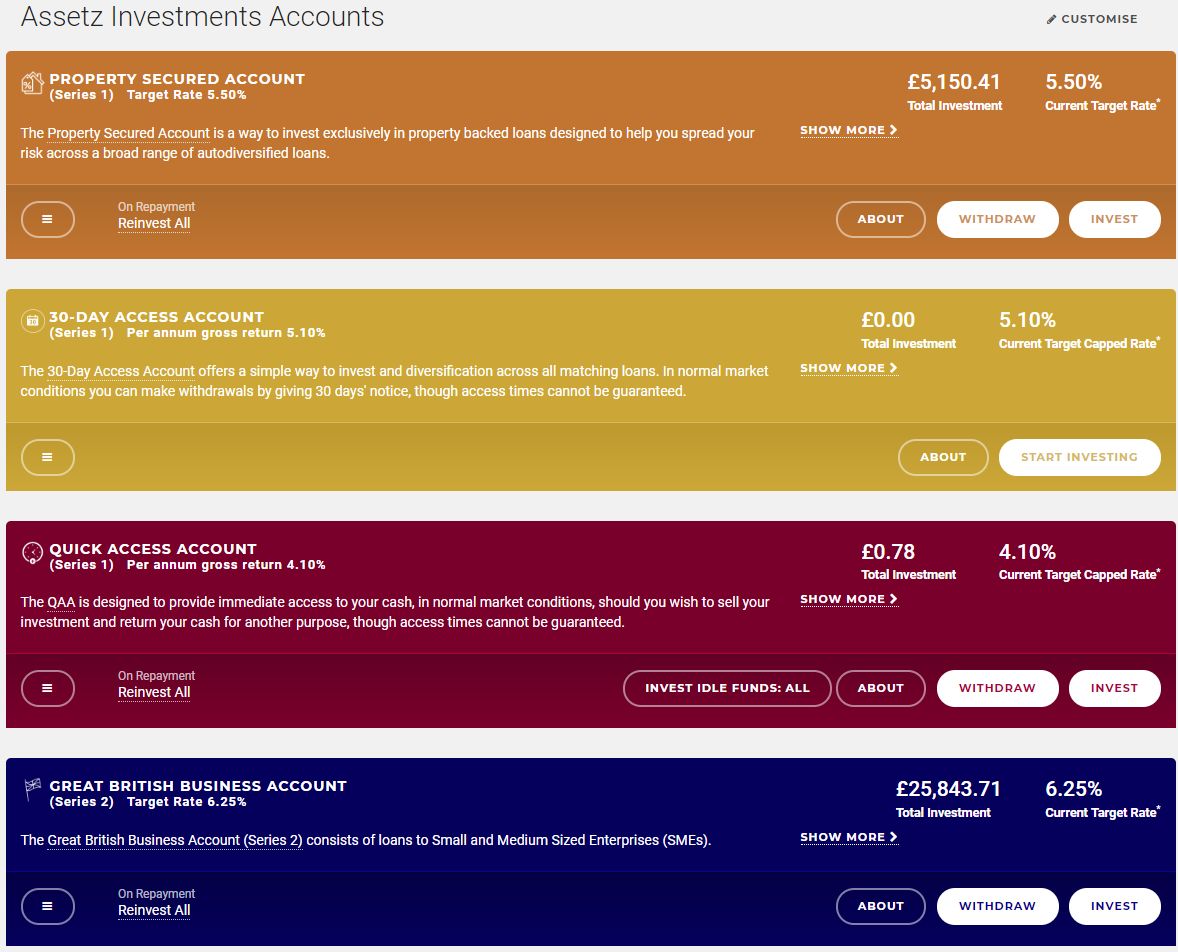

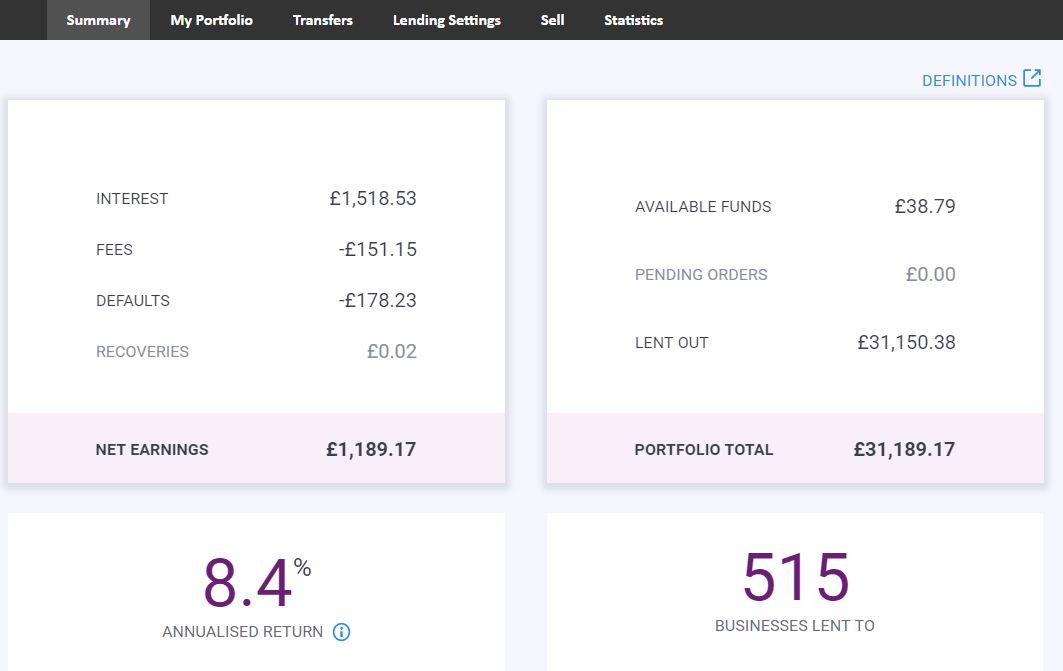

FUNDING CIRCLE

Funding Circle is still the overall highest grossing lender with a total income of £168.59 for January. Down a little from the previous month due to a couple of small default losses which were taken. Funding Circle’s Return on Investment calculations still put my account at 8.4% though. Which is still a good bit above their suggested annual income of 7.2%. XIRR has decreased a little to 6.82% (from 6.86 last month) due to the loss, however it is still the second highest Peer to Peer XIRR only to Mintos, which is running at 7.51%.

Funding Circle changed their Account Summary screen this month per below. Not sure if it’s any better but it’s still easy to see all of the figures, and that’s what really matters. You can see how it used to look in my Funding Circle Review.

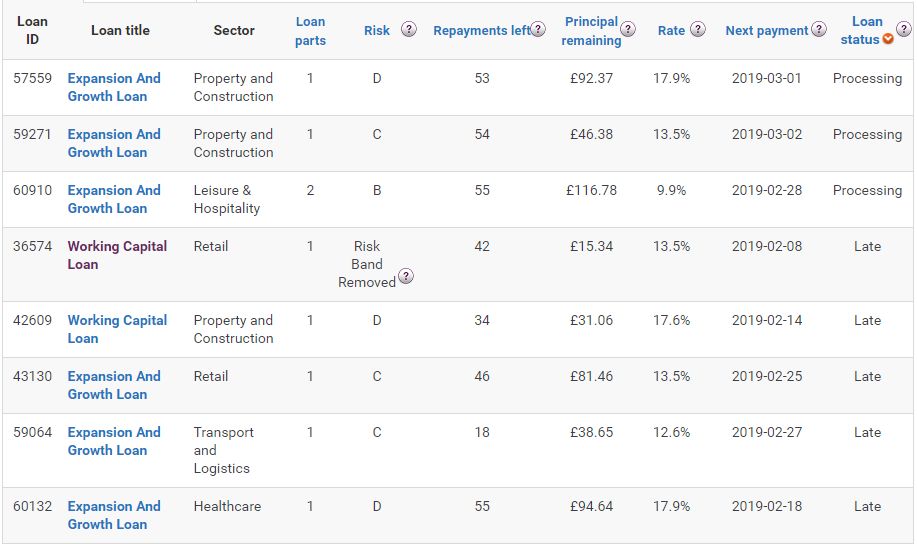

These are the loans that are currently late with Funding Circle. Not too bad at all. “Processing” typically means that they are new loans just being made, or payments have been made and not been added to the account yet.

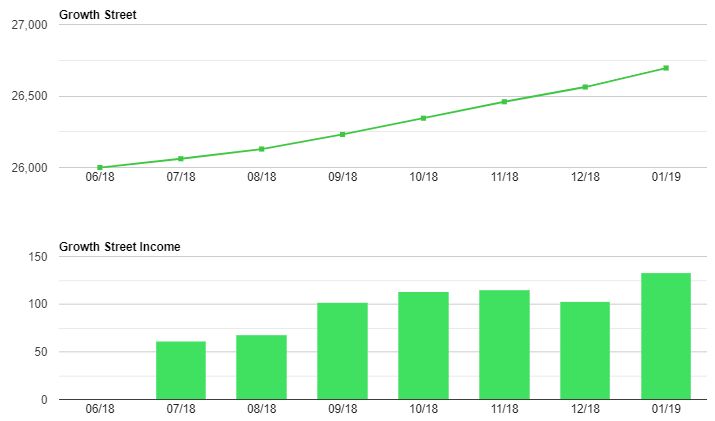

GROWTH STREET

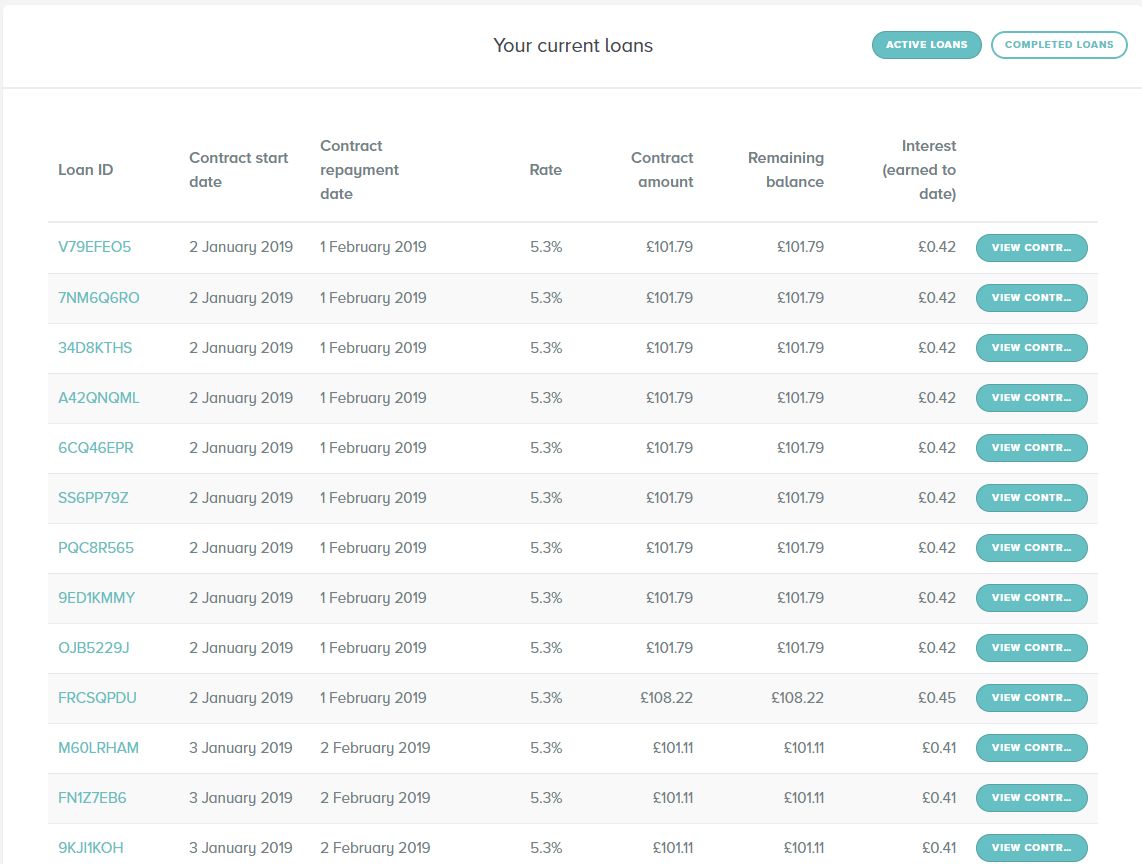

Growth Street is still my favorite (relativity) short term investment. At 5.3% return for 30 day loans I like knowing that at any time I can turn off auto-invest and have my capital back within 30 days. Other P2P Lenders have “Tracker” or “Easy Access” accounts which enable instant access to capital (under normal market conditions) but they don’t pay 5.3%. Assetz Capital’s Quick Access Account (QAA) is the closest but still only runs at 4.1%.

Growth Street were seeing a little bit of cash drag (funds waiting to be invested) but that has totally gone away now as their loan flow has increased a lot. So much in fact they are looking for new investors, and as such are offering a £200 cashback bonus for a £5000 investment at the moment, which is very good considering the rates they regularly pay. You can read more about it here.

I also added a screenshot below of transactions that go on automatically in the background. You can read more about how Growth Street works in my Growth Street Review.

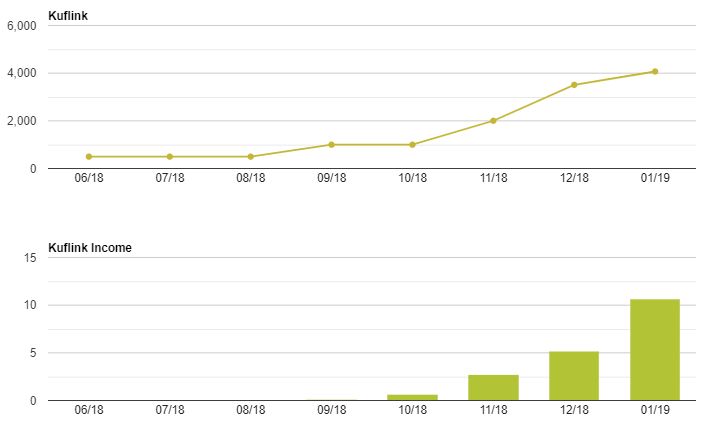

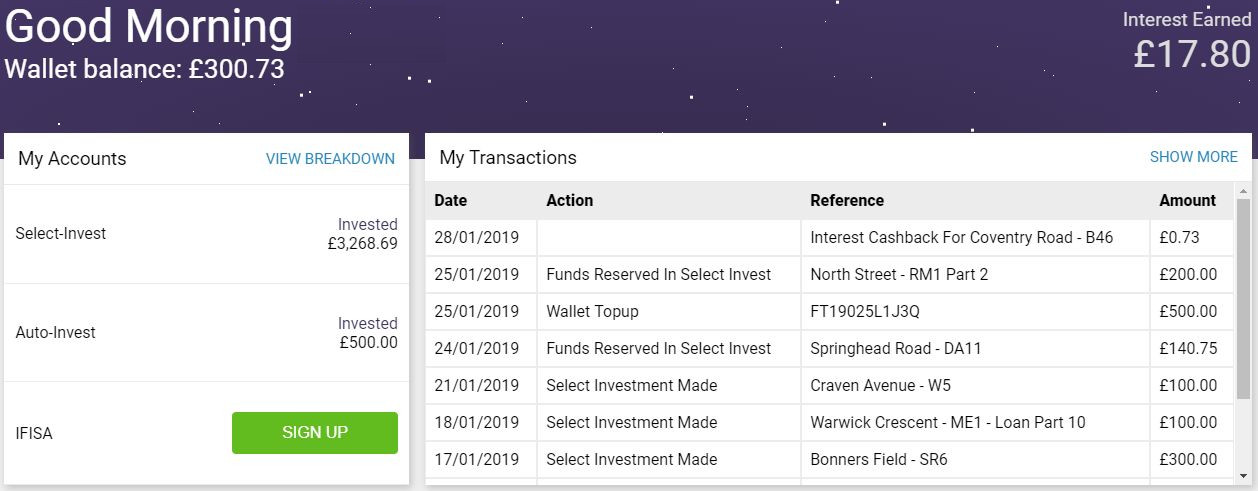

KUFLINK

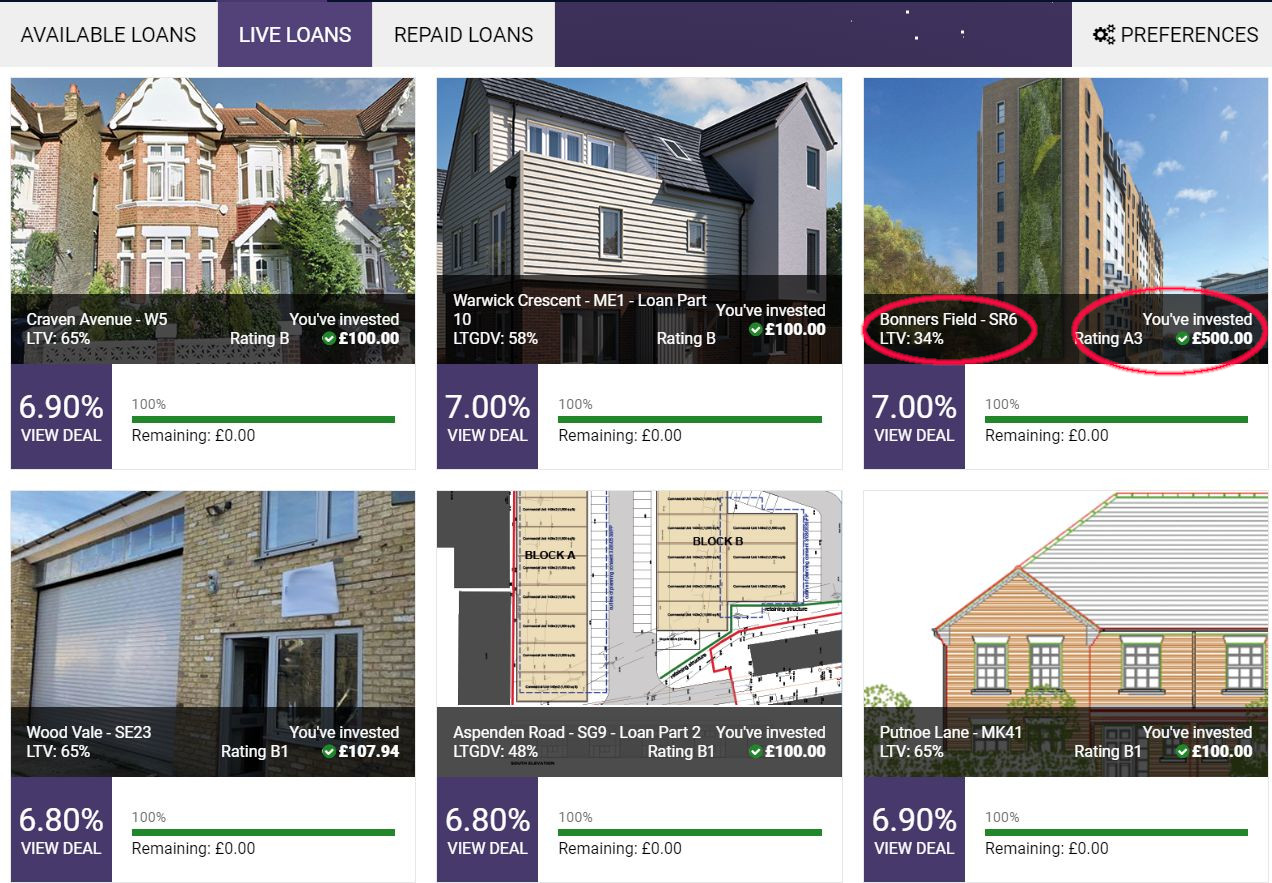

I continue to invest in Kuflink loans. They are all secured by property and typically at low Loan to Values (LTV). If you read some of my previous updates, you’ll remember I said I was considering putting more money in to Kuflink loans as I believe they are some of the best quality loans available, plus their LTV’s on some of their deals are not seen elsewhere. You’ll notice in the screenshot below that one of the loans had a LTV of just 34% (red circles).

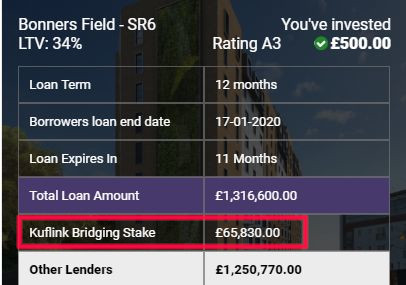

I decided on this loan to take a leap of faith and do a big £500 chunk at 7% return. Although this doesn’t bode too well with my diversification rules per account, I feel this loan is relativity safe as it is only a 12 month bridging loan. If it were to go bad, the property would need to lose 66% of it’s value before I lost money. Added to that is Kuflinks “Skin in the Game” per the screenshot below (red box), where they take first loss before any other investor loses anything. So, overall about as safe as it gets in Peer to Peer lending.

Kuflink income doesn’t look great on the charts yet at an XIRR of 2.58% because some of the loans I’m invested in pay the interest annually so that will show up in a few months which will give a big jump in XIRR.

I really feel that Kuflink offer some great, safer loans at good return rates. If you’re looking to invest with Kuflink, now is a great time as they have a great cashback going on from £50 to £250 for a £500 to £5000 investment. Click here for more information. You can see my latest Kuflink Review here.

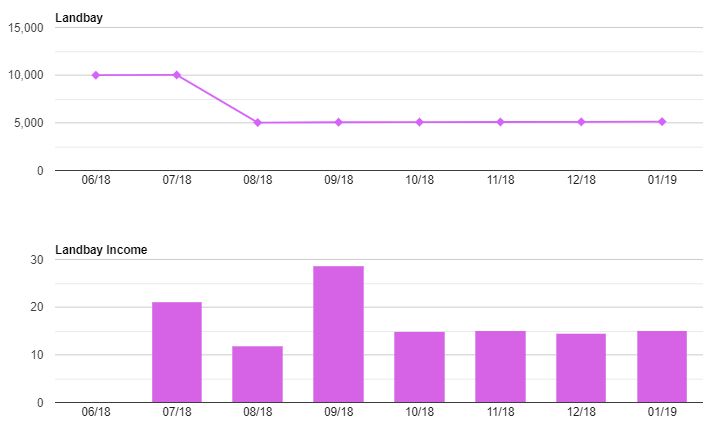

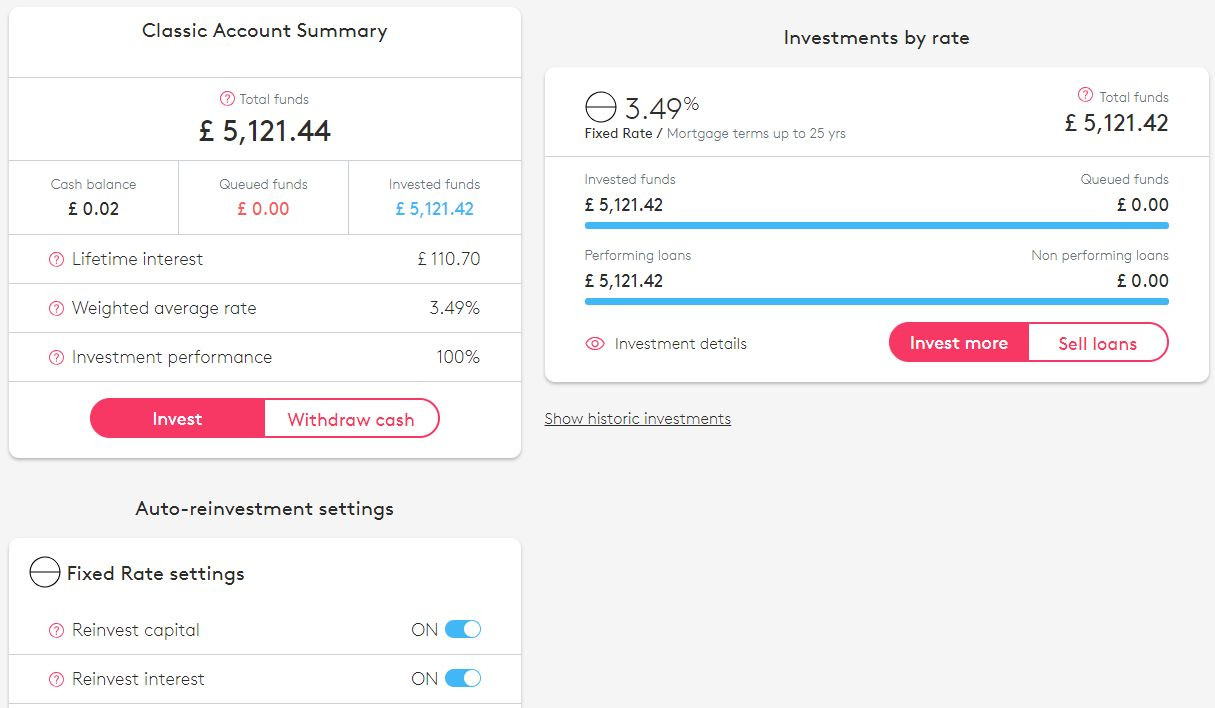

LANDBAY

Old Faithful lender account Landbay just keeps plodding along at its lender suggested rate if 3.49% with an actual XIRR of 3.22% (increased from 3.18% last month). Not an impressive return, however if you’re not very risk-adverse, then it’s supposedly as safe as houses (literally) as all loans are secured on rent-to-own mortgages.

No Landbay investors have lost any money to date and that is reflected in the returns. Remember though this is still P2P lending and as such your capital is at risk. See my Landbay Review for more information.

LENDING CROWD

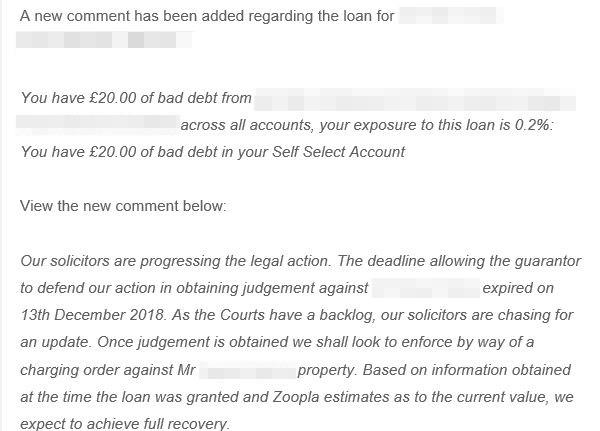

I’m a lot more comfortable with Lending Crowd in January than I have been for a while. You’ll remember last month and the month before there were 11 loans either in default or in arrears which was annoying me a little. Well, I’m happy to report that Lending Crowd have taken that number down a bit. As of today (Jan 31st 2019) there are only 6 loans in arrears, and one that looks like it could go in to arrears (red circle) on the image below.

They did default and take a loss of 2 loans as bad debt but according to an email I received the other day, they are still chasing the bad debt and think they have a good chance of recovery based on directors guarantees and asset security (see below).

Email from Lending Crowd regarding one of the companies that was written off as bad debt.

Lending Crowd’s suggested Return on Investment seems to be right on target by their calculations, but income and Peer to Peer XIRR this month is a little less at 5.58% because of the bad debt hit.

Lending Crowd are another company who are having a good cashback offer right now from £100 – £400 for lending out £2,500 to £10,000. Click here for more information on the cashback offer.

Read my Lending Crowd Review for more information on how they work.

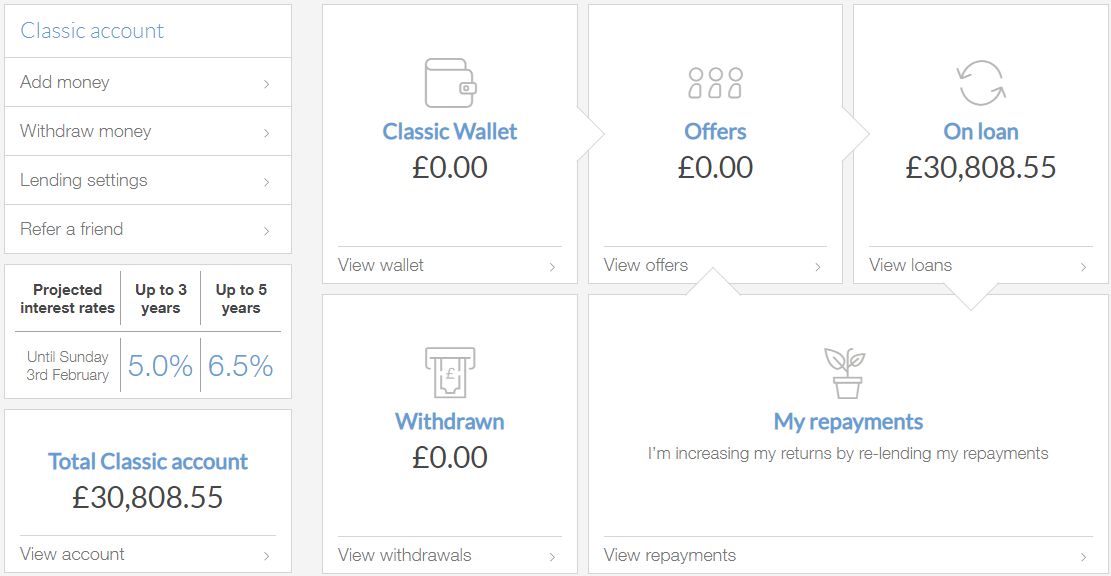

LENDING WORKS

Lending Works is really a pleasure to invest with. They are now paying an amazing 6.5% for a 5 year, hands off investment. This is covered by their excellent “Lending Works Shield” provision fund and diversification methodology. This makes them (in my mind) getting towards being almost as safe as Landbay, but with almost double the returns. Of course the real difference is that Landbay investments are all secured with property. So if the company went broke, we would still have asset security, not so with Lending Works as many of their loans are unsecured.

You can read more about how they work in my Lending Works Review. Under normal market conditions though, I consider Lending Works to be one of the safest lenders out there. On top of that, Lending Works have a great cashback offer of £50 for investing just £1000 with them for new investors. Click here for more information on the offer.

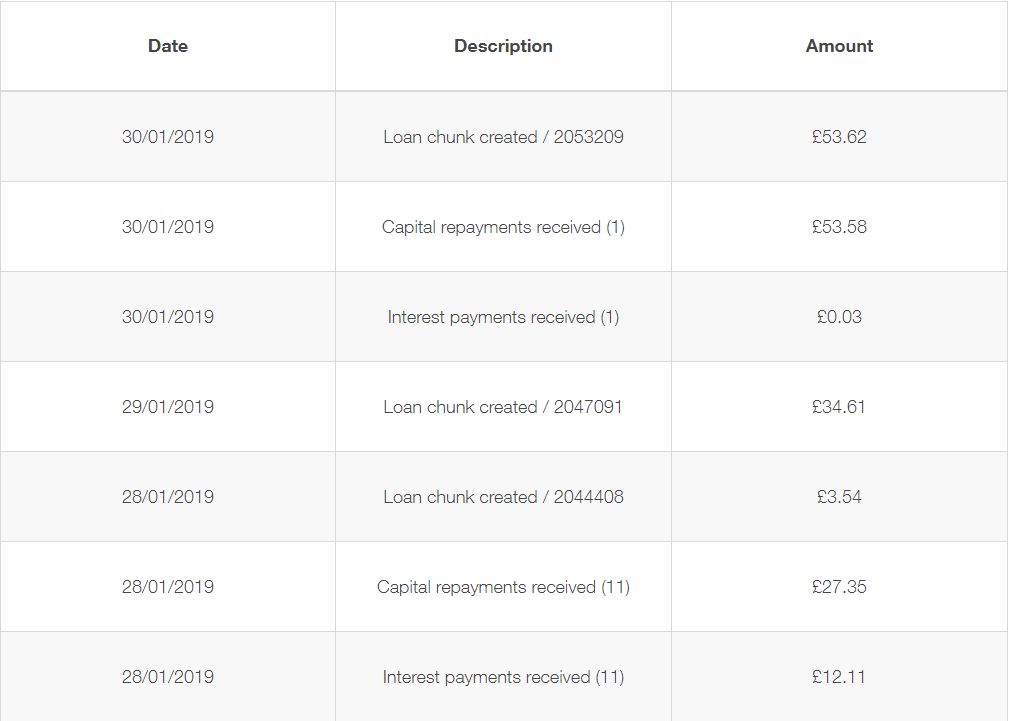

As well as the usual account screenshot below, I also posted a list of recent transactions so you can see what goes on automatically in the background.

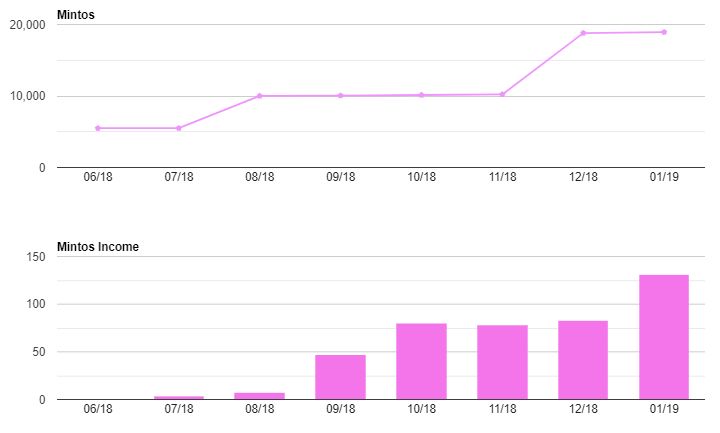

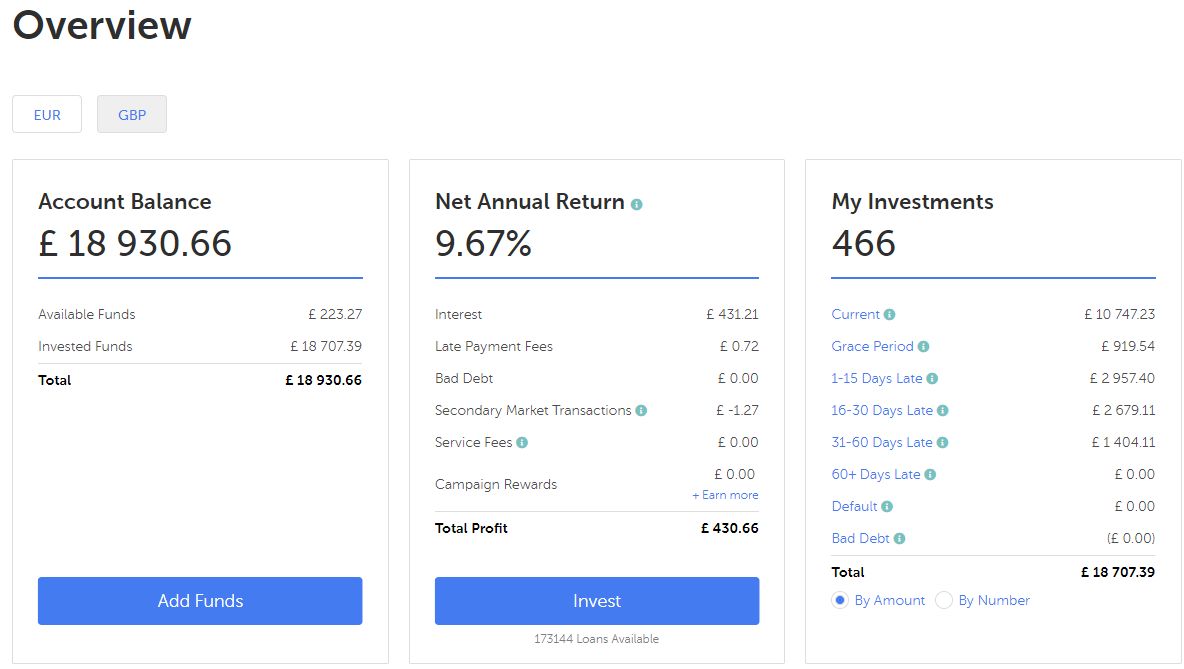

MINTOS

One of my favorite platforms, Mintos, is still the leader of the income and XIRR pack with an actual Peer to Peer XIRR of 7.51% which is really great. If you remember last month I decided to increase my investment significantly because Mintos had an influx of MoGo car loans in GBP. Well, unfortunately this month they seem to have dried up 🙁 I did get most of my capital into the loans last month though, which shows in January with the increased Mintos income.

Hopefully we’ll see some more MoGo car loans come through in GBP in February. If not, I’ll be seeing some cash drag as when the MoGo buybacks kick in on loans that are overdue, and the money is paid back into my account. If there are no loans for the money to go into, then it will just sit there not earning interest.

I am seriously considering investing in Euros with Mintos as they have over 150,000 loans available at any one time, meaning zero cash drag. I’ve just been putting off changing money to Euros as I really believe the Euro will crash against other currencies in the near future. I also believe the GBP will rise substantially shortly after Brexit.

You can read about why I love Mintos so much in my Mintos Review.

Mintos are another lender to have a wonderful cashback bonus, one of the best in fact. Mintos offer 1% of the value of your investments cashback for the first 90 days you are investing with them! Click here for more info on this fabulous offer!

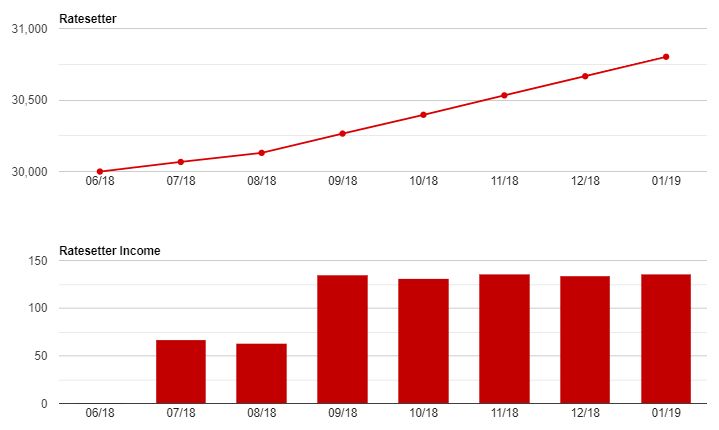

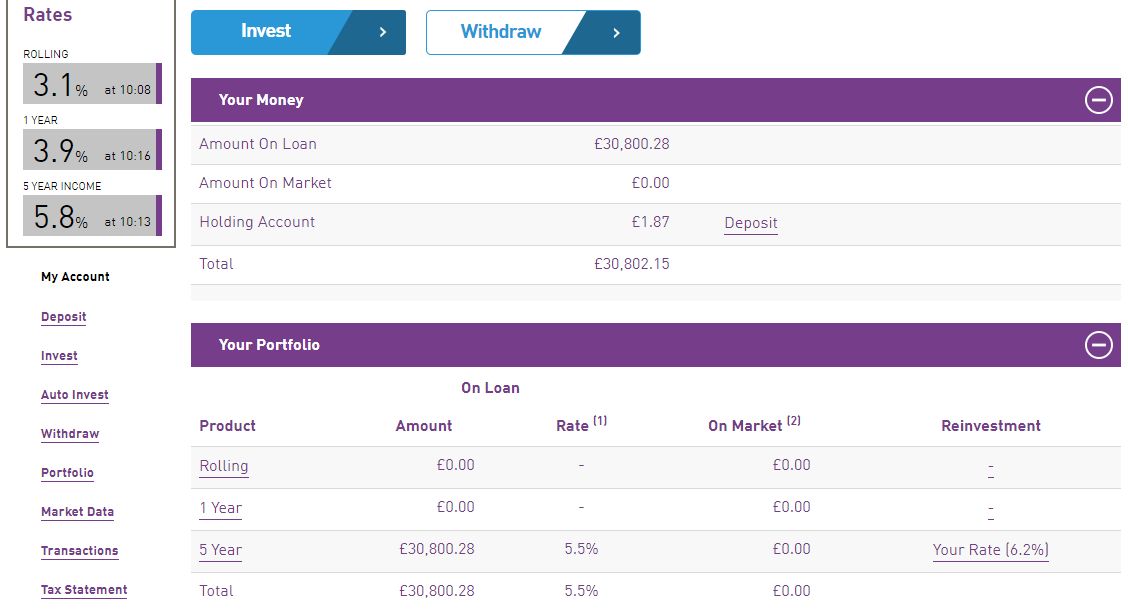

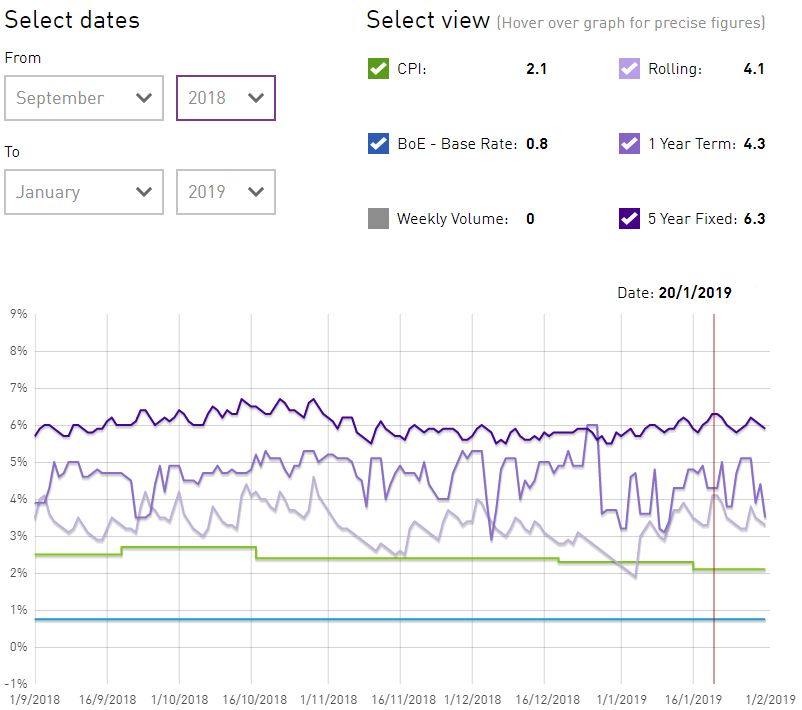

RATESETTER

RateSetter is one of the lenders I would use if I were only going to use two or three lenders for safe investments. They are a safe, fair, profitable lender offering very reasonable returns for a relativity safe investment. RateSetter rates have been climbing higher recently.

And if you’re looking to start investing with RateSetter, now is a great time to do so! Rates in January hit 6.3% (I actually saw 6.5% for a little while), so getting in now certainly wouldn’t be a terrible idea. That coupled with the awesome cashback offer RateSetter is having right now of £100 cashback for investing £1000 for a year, it seems to me you can’t go wrong! Click here for more information on the cashback offer.

When I originally invested with RateSetter with this portfolio in June 2018, I only manged to get a rate of 5.4% which in hindsight now was not great. Although my rate has since climbed to 5.5% because of reinvesting repayments at a higher rate, I still wish I could have got the 6.3% – 6.5% we are seeing now. See my RateSetter Review for more information on why I like them so much.

UNBOLTED

Unbolted continue on with the returns on pawnshop type loans currently running at an XIRR of 6.63% which is down quite a bit from last month’s 7.37% XIRR. This is mainly because of the cash drag. You may remember I sent over another £1000 to invest with Unbolted to see how long it would take to get invested. Unfortunately as of today (Jan 31st 2019) there is still £491 not yet invested from that £1000.

There en-lies the problem with Unbolted. Honestly if I thought I could get invested substantially with them, I would send over a lot more capital as I feel very comfortable being in these types of loans. Mainly because they have a provision fund, but more importantly because the items the loans are secured against are typically very easy to sell and recoup capital from in the event of default. It does not seem at this time that it is a viable large investment solution, so I’ll just leave what I have there for now and keep an eye on them for the future. You can read more in my Unbolted Review about how they operate.

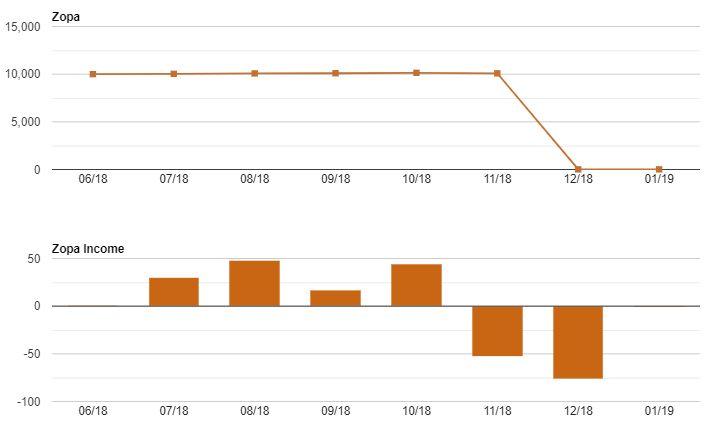

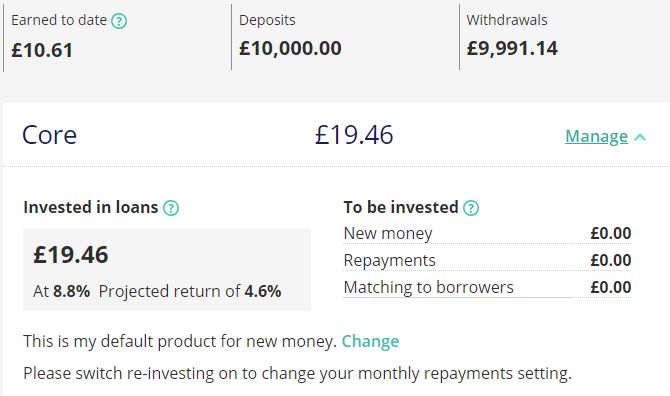

ZOPA

I’m not going to waste your time here talking too much about Zopa. If you read my update last month you’ll remember that I decided to exit Zopa effectively. Not because Zopa is bad, but because I feel there are better rewards for similar risks, and I am willing to take those risks. Zopa is still a good investment if you’re just looking for easy, safe (ish) returns (unsecured debt with no provision fund remember). As you can see in the screenshots below, I still have a very small amount in my Zopa account. That is capital that is late in repayments so I can’t sell it.

Summary

That’s all again for this month. I’m very happy with the way my Peer to Peer investments are going. I’m going to start and look at some new lenders in the next few weeks as I would like to get some more capital into P2P eventually. It’s a small part of my overall portfolio right now so I would like to expand it a little. Not too much though as it is still classed as risk capital to me.

Have a happy and prosperous month! I will update you on my P2P Portfolio about this time next month. If you are waiting for an update to my Growth Portfolio, that will be out in the next couple of days.

Thanks for reading my blog! Please feel free to comment below or email me if you have comments, criticisms or suggestions.

Please note that most of the cashback offers on this site are for new lenders to a company. Please do your own research before investing as cashback offers changes daily.

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Impressive update Mark! You must put lots and lots of hours into creating such extensive work. Thanks for sharing your journey with us, it’s great to see how you’re investing in the UK.

Thanks Jorgen! Appreciate your comments. It takes about a day to get everything together as I’m sure you know 🙂

Hi, i also invest with a few of these. As for funding circle my portfolio is smaller than yours however i have seen a disparity between the amount of interest earned, defaults and the amount i can actually sell, when you try to sell out on funding circle i assume that its not 31k but it will be a lot less?

Hi Asif,

Thanks for the comment!

I just looked at my Funding Circle Lender account and there are currently only 5 loans late (out of 500+) totaling less than £200. They are all less than 1 month late so this is normal and some could still repay. I guess if I needed to get my money out now then these loans would be locked in until they pay. However I don’t need it out and losses/bad debt are just part of lending as I’m sure you know 🙂

I added the screenshot to the update.

Hi Mark 🙂

Thank you for all the hard work and explanations and congrats about the p2p evolution.

Nice move with the 500£ at 7% and 34% LTV! Probably i will do something similar 😉

Take a look at BrickOwner when you analise the new lenders please.

Cheers,

Sérgio Costa

Hi Sergio!

Hope you are well my friend?

Thanks for the comments on Kuflink. They really do have some great loans. If you remember last month I missed one at 17% LTV 🙁 I was away for a couple of hours and it was gone. If I see something like that again I’ll be putting even more in to it 🙂

I will indeed take a look at BrickOwner, thanks for the heads up!

Did you get in to the Growth Portfolio last month? Huge up this month! I just updated the site.

Cheers,

Mark

Everything just fine! Thanks 🙂

I changed the plan and will start after May, i allready have the money free to start it but i made a business with my mother, she will pay my house credit and i will pay the bank interest to her (about 3%)! She only have the money after may so i will use my own money to pay it right now. Is this explanation perceptible? lol

Waiting for that update!

Hi Sergio,

Just posted the update on the Growth Portfolio. It’s just a short one this month 🙂

Mark