Overview

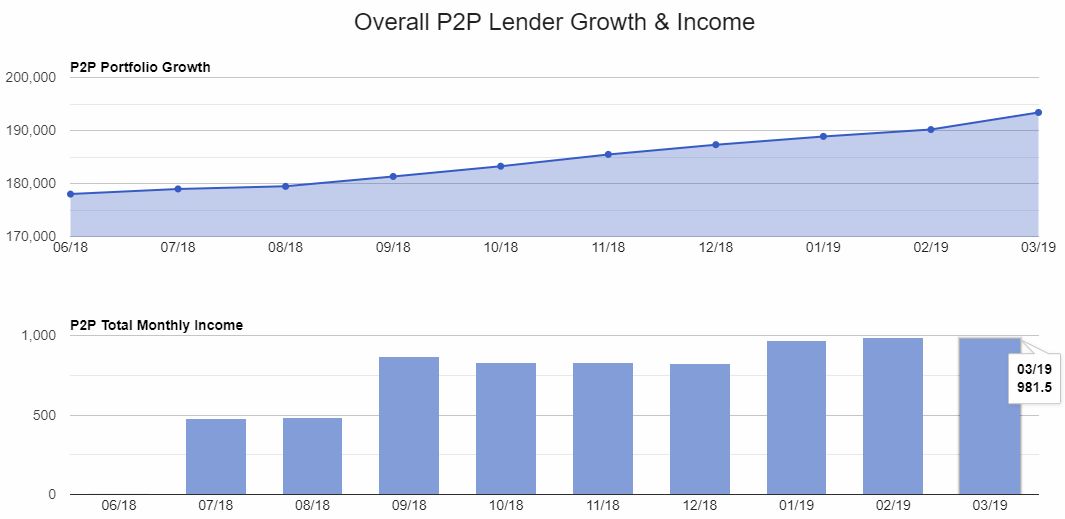

March 2019 turned out to be another good month for my Peer to Peer Lending Portfolio with a total income of £981.50. The second best month so far with only £4.28 less than February. It could however have been a stellar month if not for a couple of hefty defaults from Funding Circle. More on that later. I added more capital to Ablrate this month and also opened a new account with a brand new lender Loanpad. Unfortunately I had to withdraw more money from Mintos because there are just no new GBP loans coming out 🙁

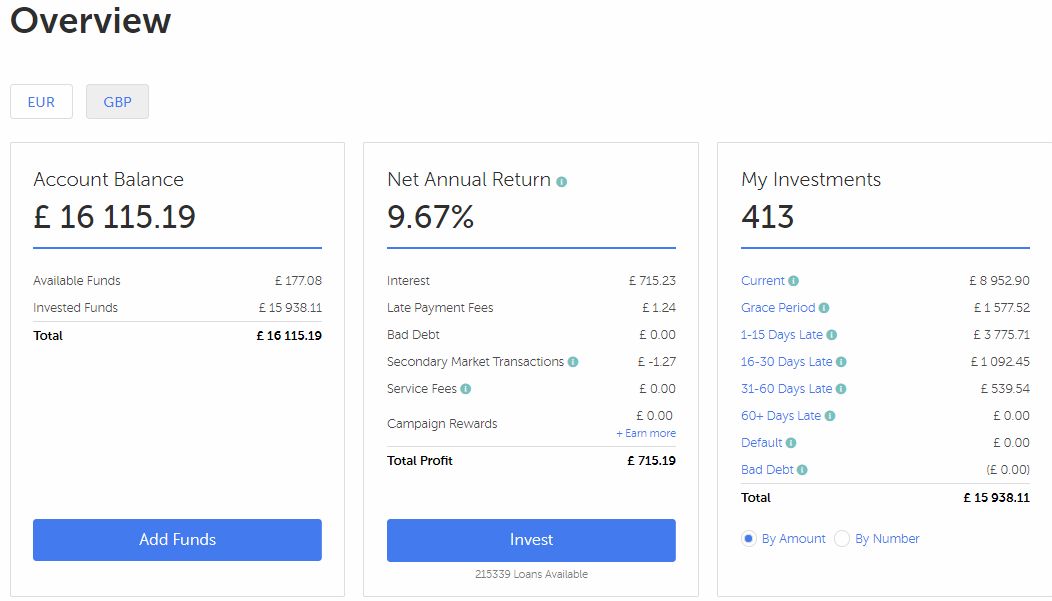

P2P XIRR is still growing slowly going from 5.26% last month to 5.38% this month. I’m still expecting overall performance to be above 6% once we have about 12-14 months of data. Funding Circle is the only XIRR which decreased slightly this month due to the defaults mentioned earlier.

There are some great cashback incentives for new investors right now. I have listed them at the end of each lender update below. If you are considering investing in any of the lenders below, and you think my website is helpful in your research, please consider using my links below as I can sometimes get a small commission from the lenders which costs you absolutely nothing and helps me continue to run the website.

Charts and spreadsheet updates are below. You can see live versions of these anytime here

Individual Lender Updates

ABLRATE

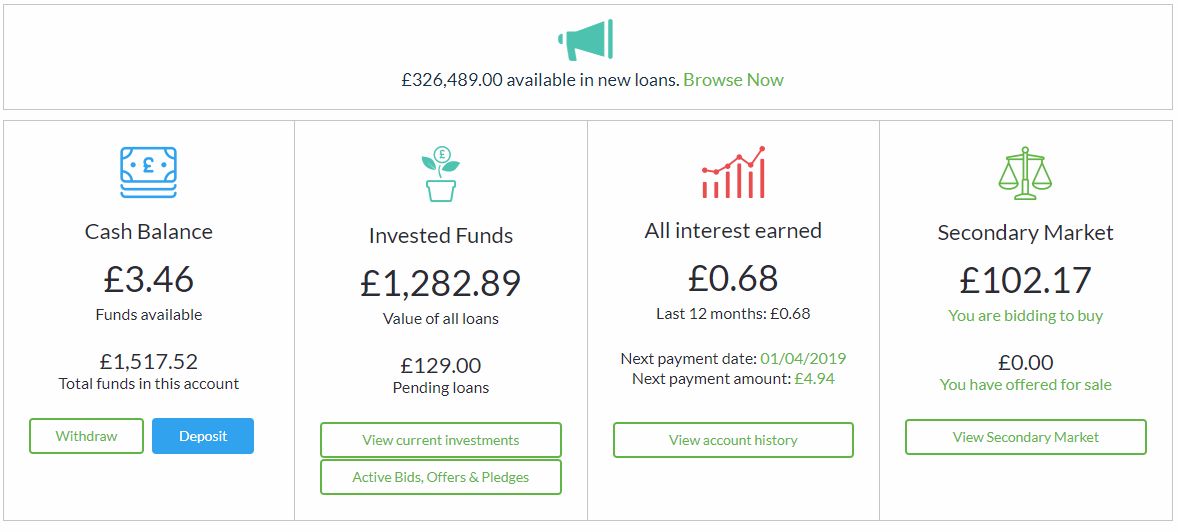

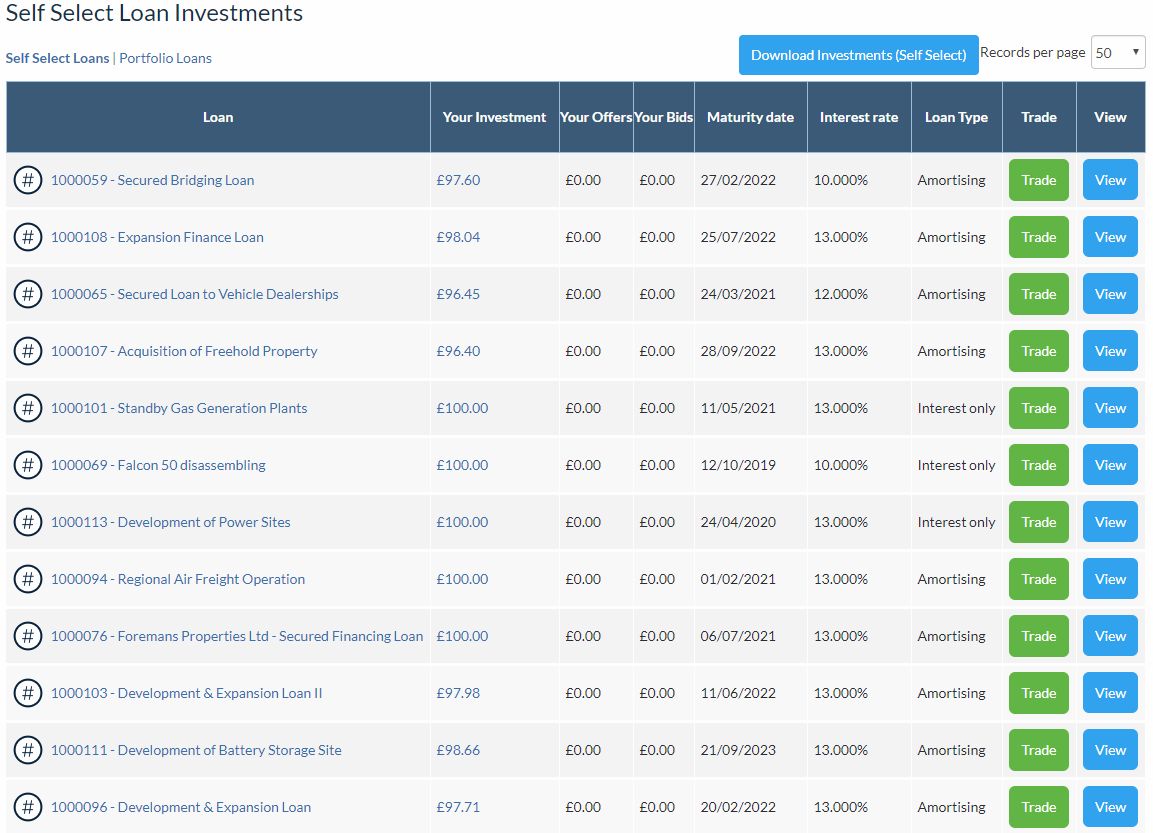

I increased my investment in Ablrate to £1500 in March. The interest rates are great, however there are not so many loans (I think only 2 new loans in March) so diversification is difficult. I picked up a few on the secondary market but I’m still only into a total of 12 loans so far. One new loan is pending so that makes 13 and I have one bid in the secondary market.

There are many more loans available on Ablrate (I count a total of 49 available for sale on the secondary market), however many of them are with the same company. I only want to be in 1 loan with 1 company at the moment. Maybe I’ll change my mind more later but for now, I figure if a company goes out of business, ALL the loans would likely go with it. Even though they might be asset secured, it could take ages to get them all sorted out.

ASSETZ CAPITAL

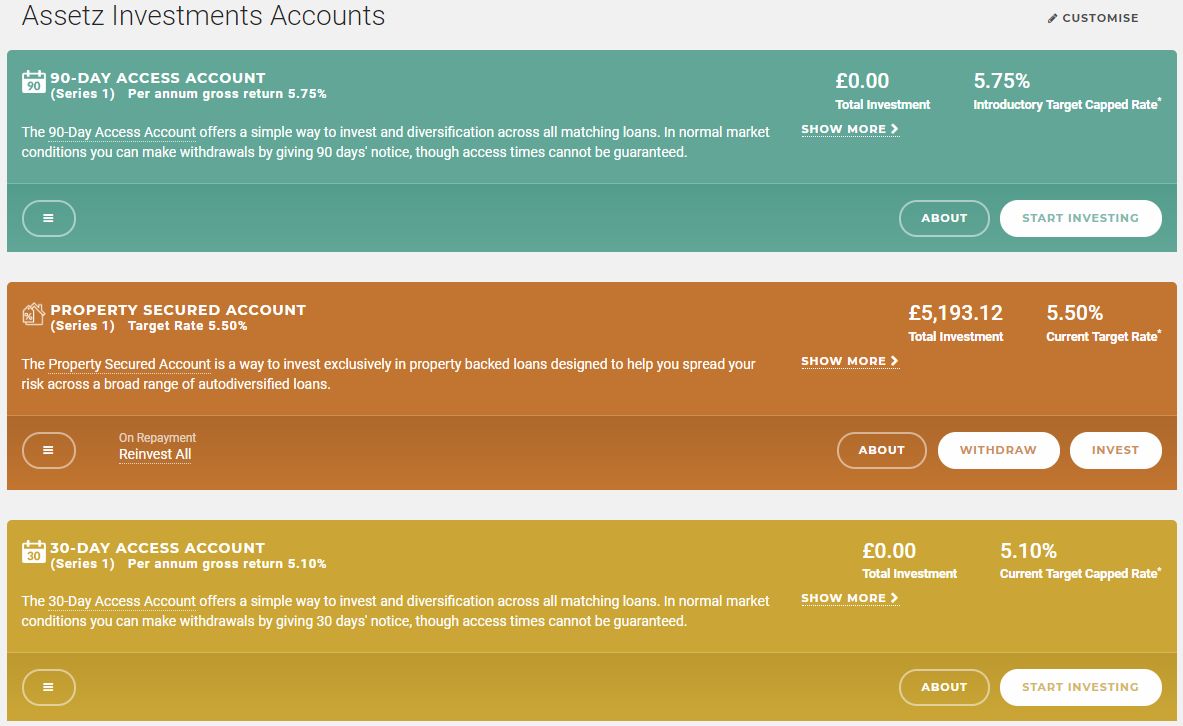

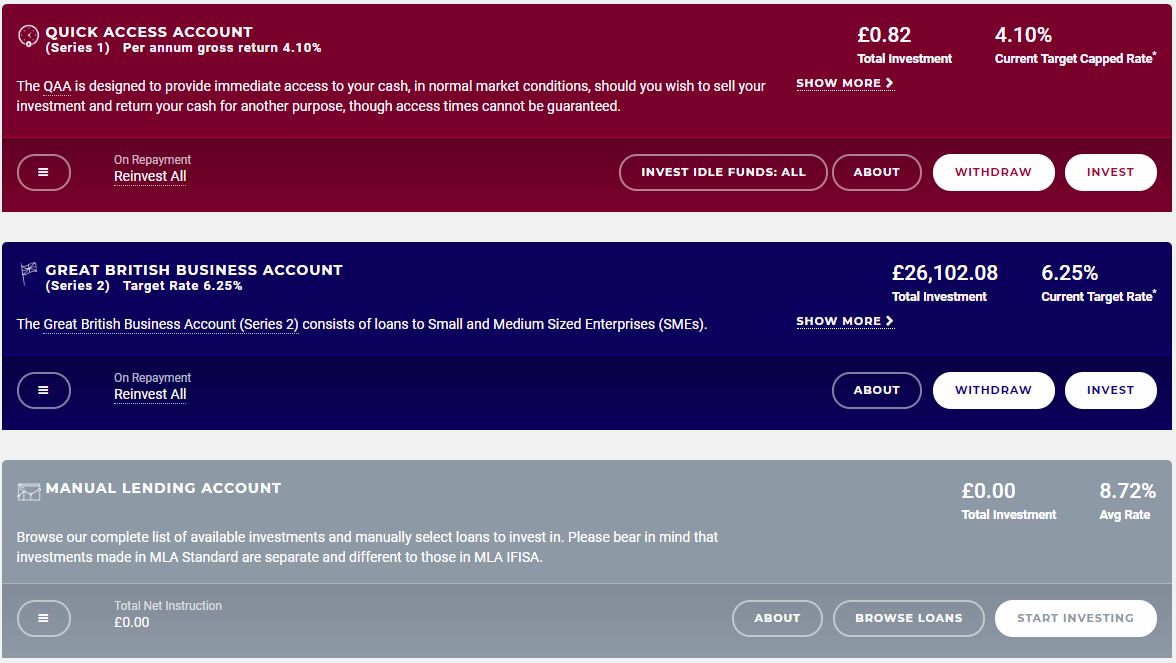

£164.65 in income from Assetz Capital this month with XIRR increasing to 5.58%. More than last month but not as good as January with £185.08. Assetz are really killing it right now with all their new loans and also their growth figures as a company. They basically do what they say they’re going to do on the tin. Returns are very good for (mostly) asset secured loans. I hope that rates don’t come down with Assetz in the future as they become more successful. It seems to be that the more a platform gains size and stability, the lower the rates go.

So, if you’ve been thinking about getting in to Assetz Capital, now is a good as time as any to lock in their best rates! See below for link to the cashback offer. If you’re already in Assetz and looking to diversify further, take a look at the new lender Loanpad further down the post which also offers some short term, secured investments.

See the Assetz Capital Review for information on their latest 2% cashback offer!

FUNDING CIRCLE

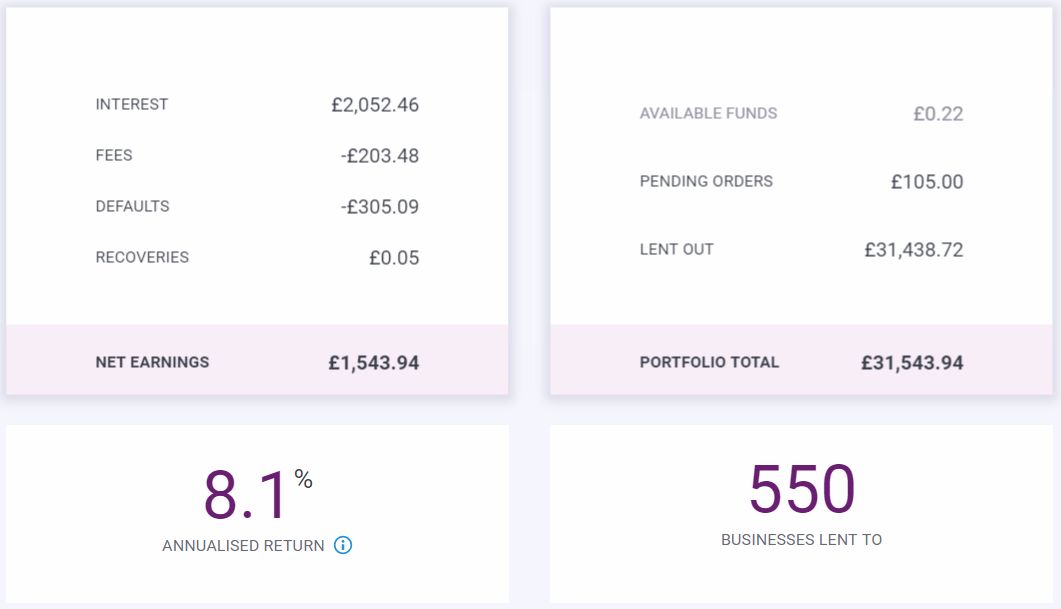

It kind of feels like Funding Circle did me wrong this month for some reason. As I said in last months update, Funding Circle have been getting some bad press recently about loans defaulting. Well, I caught some of that this month. My defaults went from around £148 total for the previous 6 months, to £305.09. They doubled in just one month! Without that happening, I would have broken the £1000 monthly income mark.

Can’t really complain though as lender stated actual income rate is still high at 8.1% (down from 8.6% last month). XIRR dropped from 7.14% last month to 6.91% this month. Still a very respectable return rate by any measure.

When looking at my loan holdings with Funding Circle, I can see there are still another 10 loans late in paying. That sounds bad, but when you consider I’m diversified between 550 different companies, I guess it’s really not that bad. From the beginning Funding Circle have said my expected overall expected rate of return would be around 7.2%, so I think that the defaults we are seeing here have already been factored in to the end number. Funding Circle are a huge company with £ billions lent out already so I’m not too worried about my capital. They’ll adjust their lending criteria and the defaults will die down in the future I’m sure. If I wasn’t, I would be withdrawing capital 😀

If you’re looking to start investing with Funding Circle, they currently have a cashback offer: Invest £2000 and receive £50 Amazon Gift Certificate. Click here for more info.

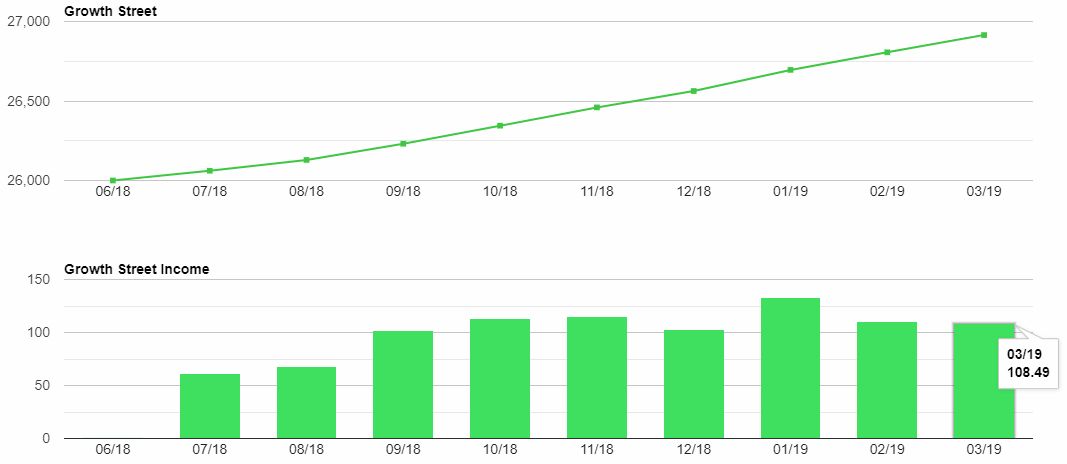

GROWTH STREET

Growth Street is where I keep my “almost an emergency” capital in GBP. The “almost” part is because it takes 30 days to get my money out, but with a return rate of 5.3% it’s a very good option. Income is steady and loan parts are broken up each month as new 30 day loans are established. Don’t forget Assetz Capital’s 30 day access account paying 5.1% too. I also added a new lender, Loanpad which has a similar account, read on for more information on Loanpad further down the post.

For new investors, Growth Street have a good cashback offer: Invest £5000 or more for 1 year for £200 cashback. Click here for more info.

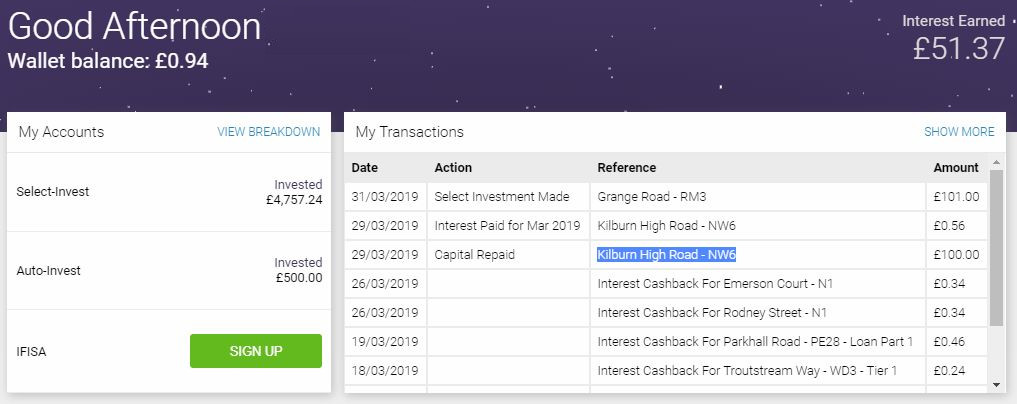

KUFLINK

I sent over just a little more money to Kuflink in March as I already had some there waiting for new loans. Right after I did, I got an email from them saying they had an excellent opportunity with 6.5% return for a low 30% LTV, so I snatched up all I could get (£350 at the time). If you’re not familiar with Kuflink loans, they are very well secured indeed. When a loan has an asset secured LTV (Loan to Value) of 30%, it means that literally the asset would have to lose 70% of it’s value before investors would lose money.

On top of that, Kuflink have “skin in the game”. This means they have 5% of their own money in the loan and will take the first 5% loss on any loan that goes bad. So that means the asset would have to lose 75% of it’s value before investors lost money. I’m not sure that has ever happened on property, and if it did, it’s not something that happens often, so I’m willing to risk a lot more capital per loan on this type of investment.

Note on Kuflink XIRR

One thing I sometimes forget to point out is that some Kuflink loans pay interest at the end of the loan, or annually, so XIRR for Kuflink looks low now, but when the payments from some of the delayed loans come in (mainly in the auto-invest portfolio, overall XIRR should jump up significantly, probably to around 6% – 7%.

Kuflink really are a very good option for lower risk – higher return investments in my opinion and I’ll be shooting more money over to them as more loans come out.

I also picked up a few other loans. Not such low LTV’s as the last but still fairly decent at around 70%.

If you’re looking to invest with Kuflink, now is a great time as they have a great cashback going on from £50 to £250 for a £500 to £5000 investment. Click here for more information. You can see my latest Kuflink Review here.

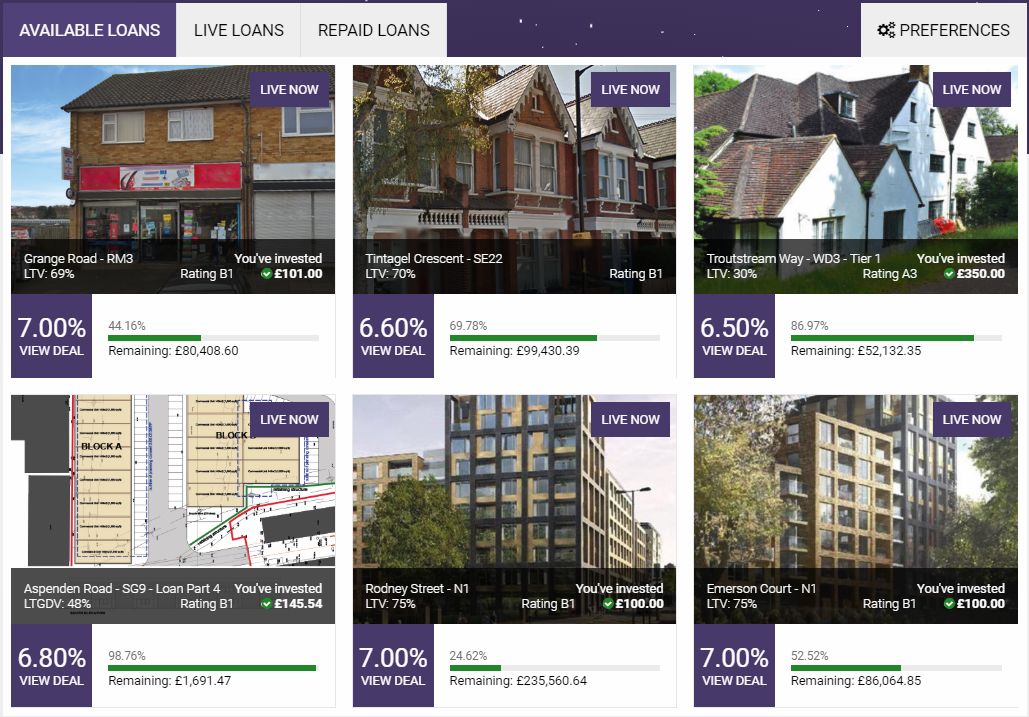

LANDBAY

As usual, not much to say about Landbay. I don’t even look at the account most of the time as it really is a “worry free” investment (for me at least). That does not mean there is no risk involved, it is just that the perceived risk is relativity small, along with the returns. Even though it’s more risky (in theory), I prefer the higher paying secured lenders like Assetz Capital or Kuflink. I guess if you were really risk averse though, Landbay is a good option. Or if like me, you just want to diversify some more of your capital so all of your eggs are not in too few baskets.

For the said-to-be-safer option for your money, or just for some diversification, Landbay currently have an incentive for new investors: £50 cashback when investing £5000 or more. Click here for more information. Taking this cashback offer increases your income on this investment by 1% for the first year which helps.

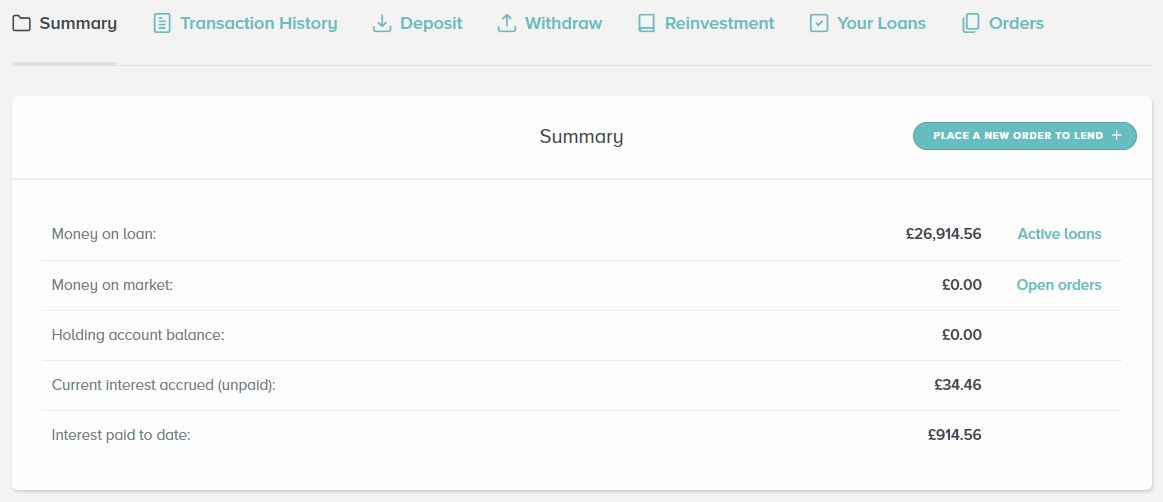

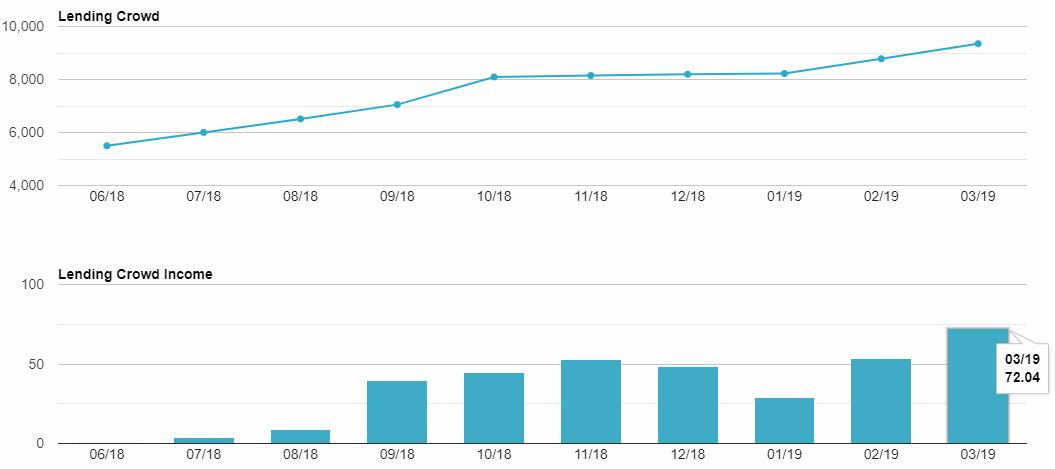

LENDING CROWD

Ok, so it’s official, I have some kind of addiction to Lending Crowd. I literally cannot stop sending money over there! Every month their loans gobble up the money I send over, then I start getting emails about new loans coming out when my money runs out, so I have to send over more so I don’t miss the loans! Lending Crowd really do have a great loan supply and their rates are very good. Currently Lending Crowd are saying that I’m getting an actual return of 8.42% with an estimated 7.98% over time.

That being said though, XIRR is running at 6.53% which is much less than Lending Crowd are saying. I think this is probably because of the couple of defaults recently and also maybe a bit of cash drag. I guess we’ll see as time goes on.

They certainly are managing to clear down the late loans every month. Out of 360 loans that I am in now, only 6 are in arrears (technically 3 in arrears and 3 late). These numbers are really not bad at all.

Take a look at one of the last P2P lenders that still allow bidding on loans! Lending Crowd have Up to £400 cashback for £10,000 investment. Click here for more info. See my Lending Crowd Review if you would like to read about bidding on loans.

LENDING WORKS

March was the second best month so far for Lending Works. The safety of the Lending Works Shield along with 6.5% – 5 year returns is certainly worth a look and can easily be considered for part of an overall Peer to Peer investment portfolio. I think if I only wanted to spread my capital between 2 or 3 lenders (instead of 13 like now), Lending Works would be on the short-list.

Should you be looking for a safer place to put some of your capital with very good returns, then Lending Works have a great cashback offer of £50 for investing just £1000 with them for new investors. Click here for more information on the offer.

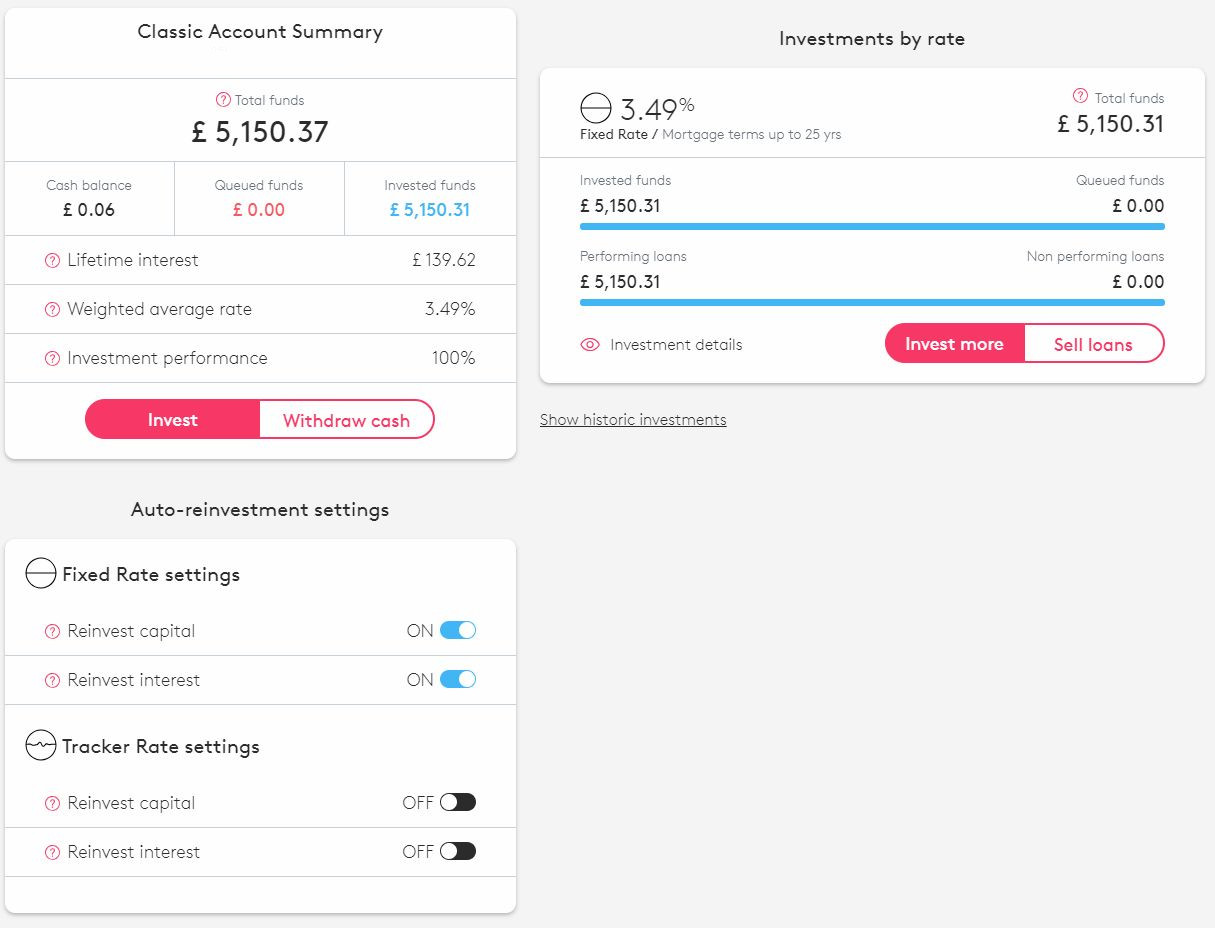

LOANPAD

New to the lineup this month is Loanpad!

Loanpad are a new lender who are trying to enter the short-to-medium term Peer to Peer investment markets. They offer property development loans and they source their loans through a very experienced third party lender. Loanpad holds the senior position on all of its loans so if a loan goes bad, Loanpad gets first rights. One of the the things that attracted me to them are the low loan-to-value ratios they have on most of their loans. So similar to Kuflink, it would take a real disaster to lose all of my capital. Loanpad pays daily interest which is good if you’re looking for income to live on. Of course if you want to reinvest it, that is always an option too. I decided to invest with them as they are similar to Growth Street as far as short-term offerings.

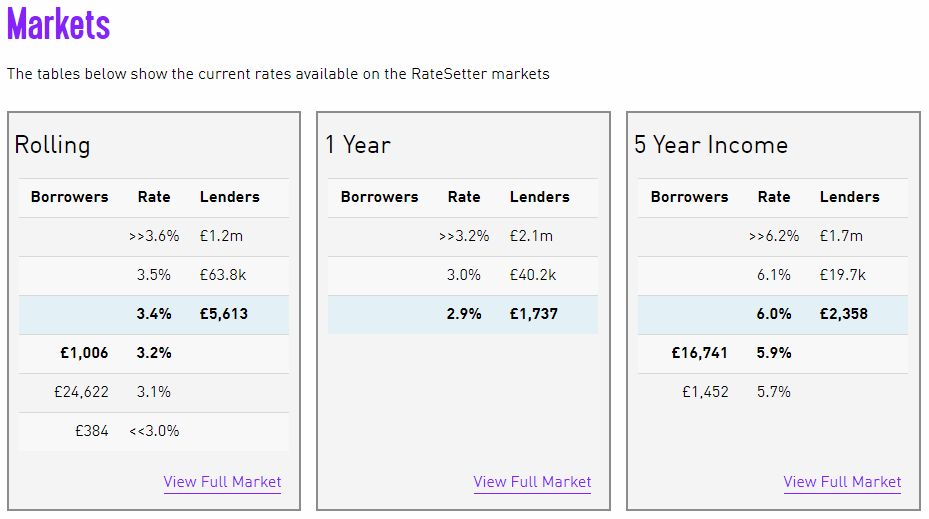

You can get instant access to your money with a 4% return from Loanpad, which rivals Assetz Capital’s QAA account currently at 4.1%, as well as RateSetter’s Rolling Rate account sitting at around 3.4%. Then the Loanpad 60 day account offers 5% with a 60 day notice to withdraw your money at no cost. You can get it faster in an emergency under normal market conditions for a fee of 0.5%. Just to point out here, the rates they advertise (4% & 5%) are actual rates and do not take in to consideration compounding effects like most lenders advertise, so in theory the rates should be up there with Growth Street on the 60 day account if you reinvest all of your interest and repaid capital for the effect of compounding.

Loanpad Review

I’ll write a full review on Loanpad once I get a bit more experience with them and start to see what their returns actually look like. I believe upon initial investigation Loanpad will be a good, safer diversification option for investors wanting short-to-medium term access to their capital with a very reasonable return.

Should you decide to invest with Loanpad, please use this link for their standard investment account so they know I sent you. Loanpad also enable tax free investing through an ISA so click here if you are interested in reading more about the ISA.

There are no cashback offers at present as the investor interest since they launched has been very good. I’ll let you know if & when any cashback offers some about.

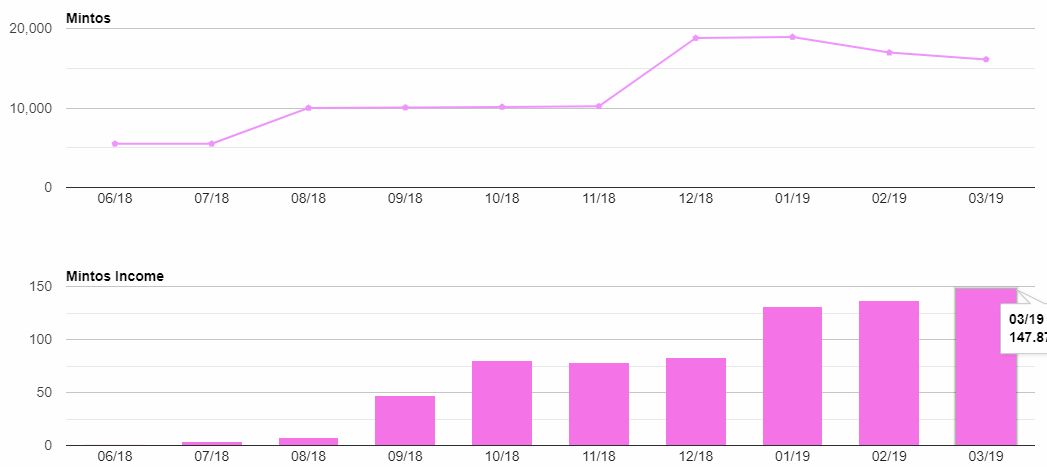

MINTOS

Once again I had to move some capital out of Mintos this month. “Boooo” I hear you say! And I agree! The XIRR for Mintos jumped from 7.95% last month to 8.40% this month which still puts Mintos out there as my top lender by return percentage. Unfortunately it doesn’t look like they are going to be having any more GBP car loans any time soon. I read that the UK FCA refused to give Mintos a license to trade in the UK a while back so I can’t see why they would offer any further loans in GBP. I hope I’m wrong but as the old adage goes “hope for the best and plan for the worst”. I’ll hopefully have some euros to invest in the coming months and you can bet a lot of them will go to Mintos 🙂

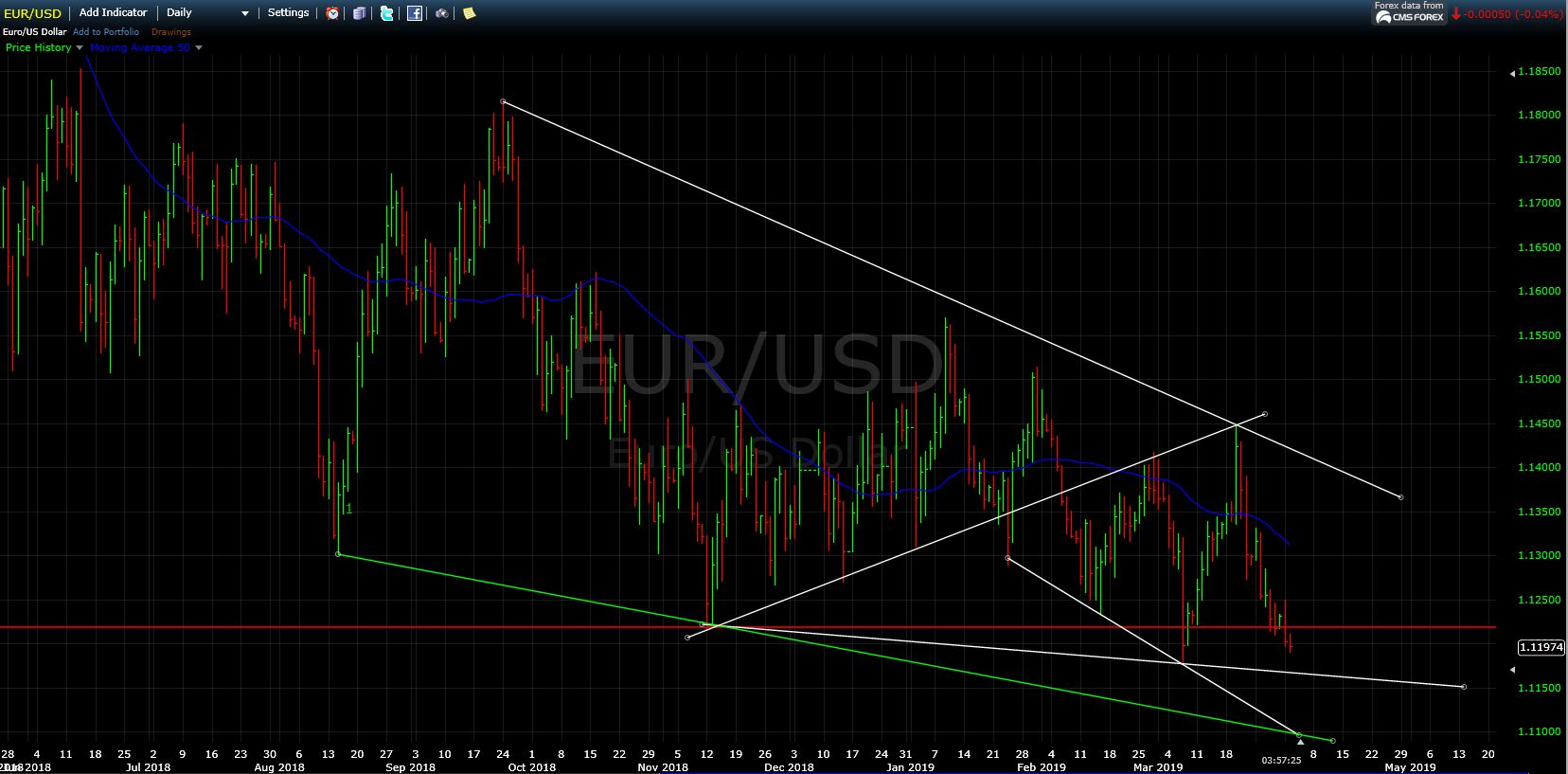

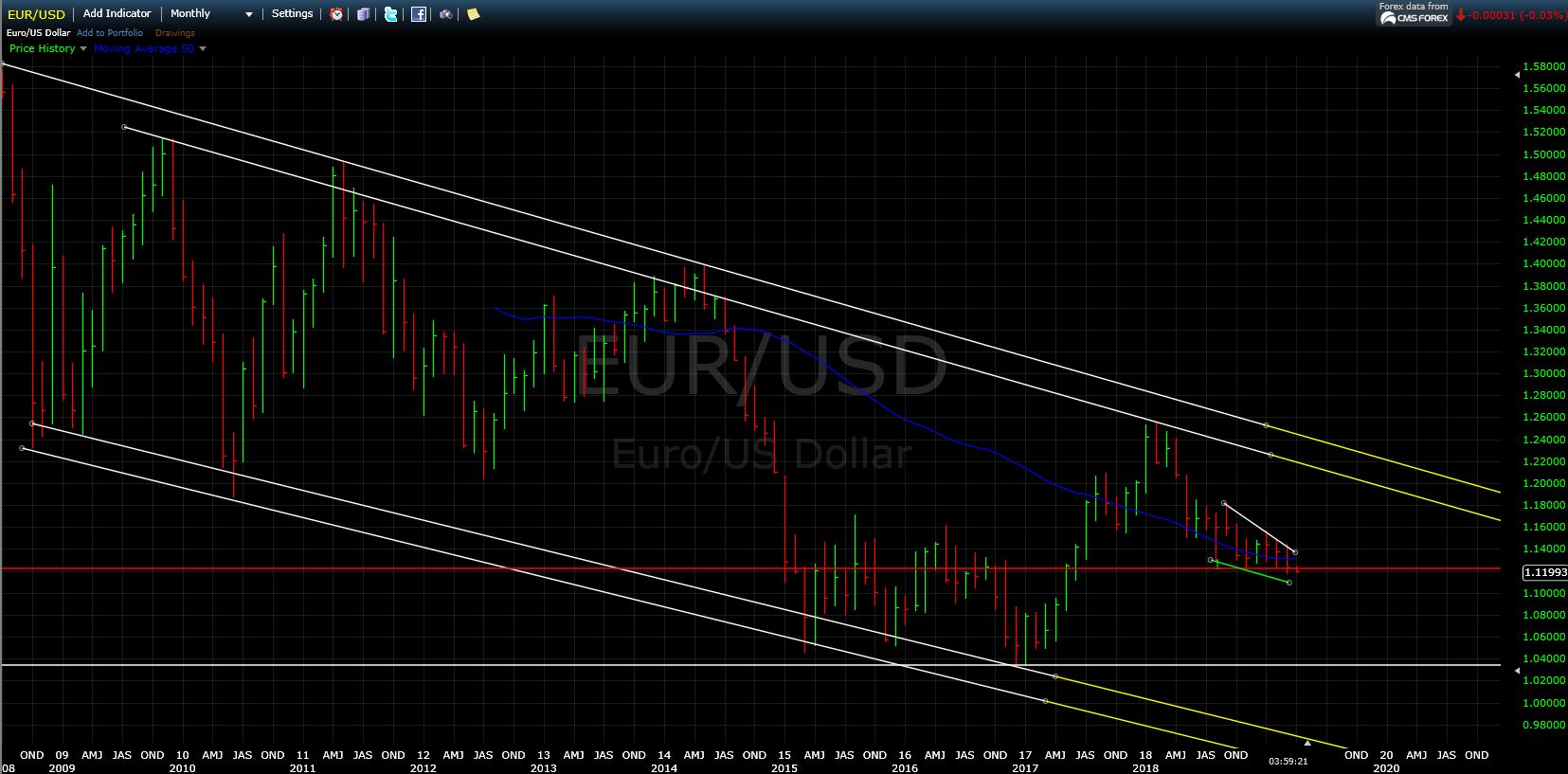

As I wrote last month, I’m still watching the euro against the GBP and the USD for the opportunity to exchange some and make some euro based P2P investments. It’s still slowly coming down and I expect it to be 1:1 to the USD in the coming months, maybe a year maximum. If I’m right, then it’s worth waiting for as that’s about the same percentage drop as I could potentially make with euro P2P lending. If I’m wrong of course then I’ll lose out. Investing in anything is risk, even in currency fluctuations, so I’ll see if the wait was worth it!

Daily Euro/USD

Monthly Euro/USD

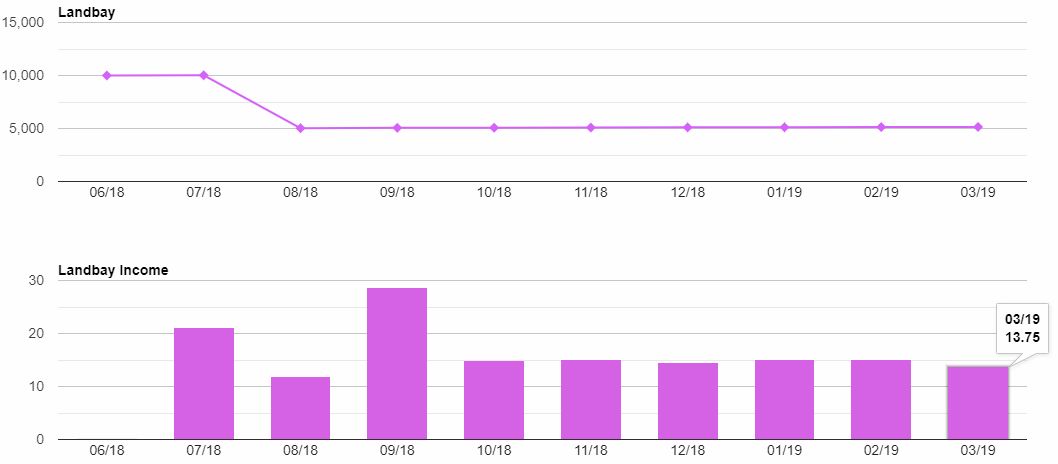

RATESETTER

Income from RateSetter this month was £128.11. A little less than the previous couple of months but still very respectable. I have no idea why some months are more or less with RateSetter as they have their provision fund so there is very little exposure to defaults. I’m guessing though it’s to do with when payments are made from borrowers and also when repaid funds get reinvested at my preset rate. I know this can cause a bit of cash drag but I like to wait for the rates to come up to me instead of just taking the market rate.

RateSetter have also done a total revamp of their website and marketing materials. Not sure if it’s better or worse, but it certainly is purple 😀

Not sure what happened over the last few days but it looks like RateSetters rates have leveled out. Maybe it’s just due to the website update they did?

Either way they are still matching rates at above 6% so it’s still certainly not a bad time to get in if that’s what you’re looking to do. Use this link to take advantage of a very decent cashback offer. RateSetter is offering £100 cashback for investing £1000 for a year (10% ON TOP OF standard returns), it is definitely worth considering. Click here for more information on the cashback offer.

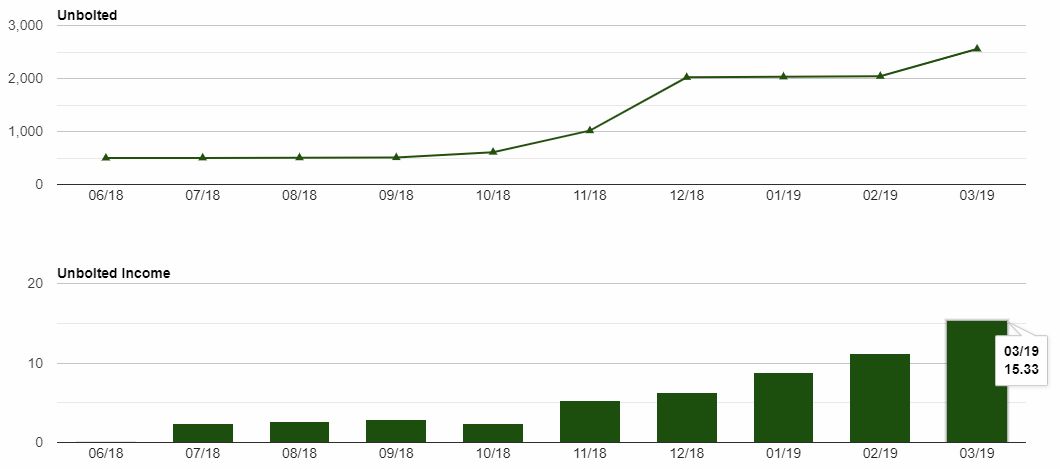

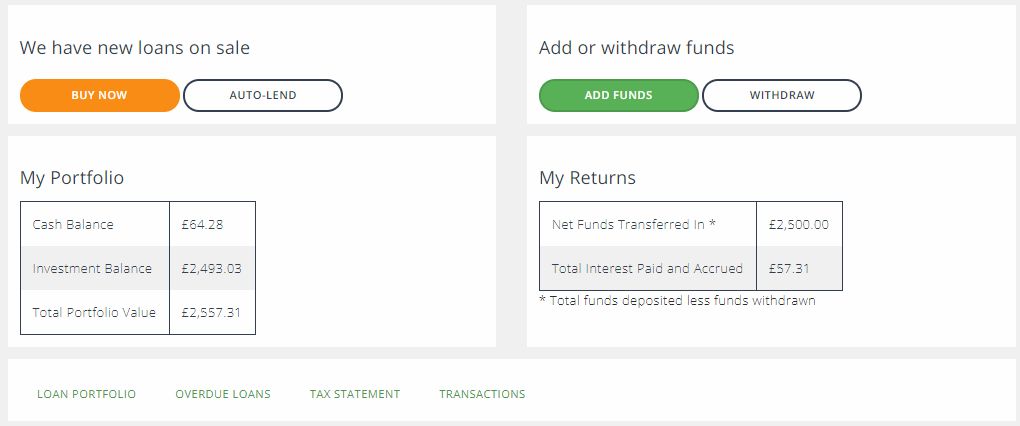

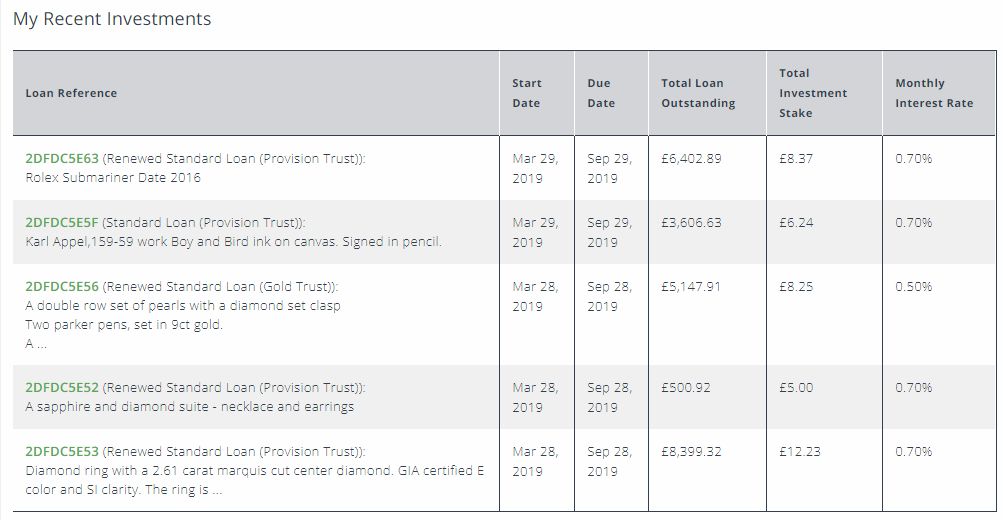

UNBOLTED

I sent another £500 over to Unbolted in March and once again most of it has been lent out! I think the investment settings highlighted last month are working quite well 🙂

Although I don’t have a lot of capital with Unbolted, the return rates are still some of the best in the business. For (mostly) easily salable asset secured pawn shop style loans. XIRR once again increased from 6.83% last month to 7.33% in March.

Summary

Overall my P2P investments are still doing well. Compared to keeping my capital in a bank, well, there is no comparison. Almost £1000 monthly income from less than £200k is very respectable. As I said in last months update, for you FiRE folks out there, you could retire and live very nicely on that amount in Portugal (non-materialistically of course). Talking about Portugal, I’ve had a few people ask me questions about it, quite a bit of interest in fact. I may write a post on Portugal at some point in the future. If that’s something you would be interested in, please let me know in the comments section of this post.

I’m going to keep looking for some new GBP lenders to add to my Peer to Peer Lending Portfolio like Loanpad in the near future. As well as some euro lenders. As soon as I feel the time is right to buy some euros to invest. I just wish it would hurry up!! I’m excited about the prospect of euro P2P lending as returns are generally much higher than UK lenders. Although there are reasons for that. Risk is relative to reward with pretty much any investment. With the lack of regulation with most euro P2P lenders, we just have to make sure we pay attention to the risk and do our research. I do believe there is a lot of opportunity to safely make excellent returns from some euro lenders right now.

Finally I hope April goes well for everyone and I wish you the best of luck with your lending. I will update you on my P2P Portfolio around the same time next month.

Thanks for reading my blog! Please feel free to comment below or email me if you have comments, criticisms or suggestions.

Please note that most of the cashback offers on this site are for new lenders to a company. I suggest you do your own research before investing as cashback offers change daily.

If you’re new to Peer to Peer Lending, you can learn more about it on my page About Peer to Peer Lending. Also take a look at my Peer to Peer Lending Guide, Where to Start if you’re just thinking about getting your feet wet. Individual lender reviews are all here.

Disclaimers: This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website. * My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective. ** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations. Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences. Please read my full website Disclaimer before making investment decisions.

Thanks for the update Mark. You have my up-vote for a post about Portugal!