Kuflink – Pros & Cons

PROs 👍

- Safety – Skin in the Game – Kuflink invest 5% of their own capital into loans on a “first loss” basis giving extra protection to investors.

- Low LTV’s – loan-to-value numbers are great, easier to recover investment should defaults occur.

- Great Rates – Up to 7.2% ROI, best risk/reward currently available in P2P sector.

CONs 👎

- No Provision Fund – but “skin in the game” makes up for this.

- Interest Paid Annually – on auto-invest accounts, you’ll need to wait for interest payments.

- Early Exit Fee – there is a small fee to sell loans early & retrieve capital on the secondary market.

What is Kuflink?

Kuflink is a medium size Peer to Peer lender. Providing property secured bridging and development loans to businesses around the UK, they have a unique offering.

They were also the first platform in the UK to offer “skin in the game“, meaning they invest 5% of their own capital into every select-invest loan they offer, taking the first loss on any defaulted loans.

Kuflink provides property secured bridging loans with return rates from 5% up to 7.2%. Loan terms are typically from 3 to 18 months on Select-Invest, and from 1 to 5 years on Auto-Invest accounts.

They are growing fast, becoming profitable for the first time in 2021. With great customer service and a growing loan book, they have a unique offering. The Kuflink ISA also offers a secured loans for possible tax free investing.

Easy-Info Table© Kuflink Review

| Overall Rating*: |  (4.6 / 5) (4.6 / 5) |

| Who can invest: | |

| Loan Currencies: | £ |

| Estimated Return: | 5.0% to 7.2% |

| Target Annual Return (Platform Number): | 5.87% |

| My Calculated XIRR: |  |

| My Current Investment:(click to see amount in £) | See My Investment £ |

| Risk Rating*: | 3/10 - Low  |

| Early Exit: | Yes. Secondary market. |

| Min. Investment: | £100 |

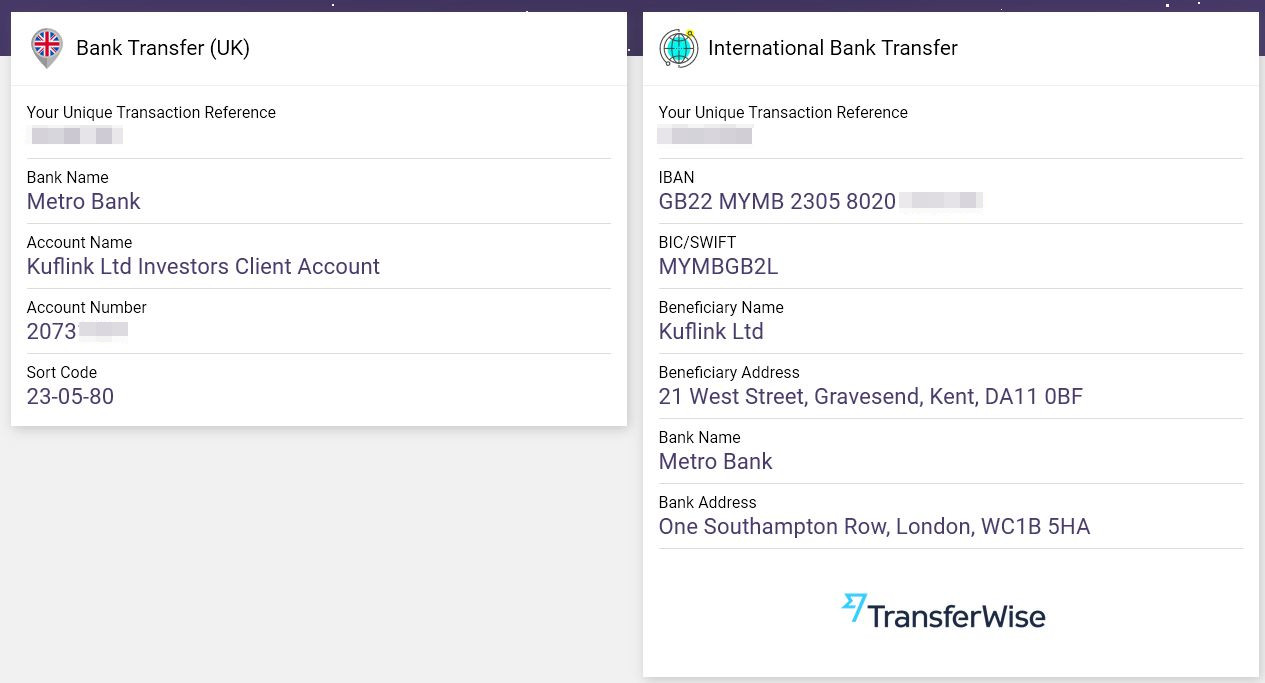

| Deposit Funds: | By bank transfer or debit card. Usually takes 24 - 48 hours for BACS. Can be same day for Faster payments. International payments can be made through Wise. |

| Auto-Invest: | Yes |

| Manual Invest: | Yes |

| Lending To: | Agreements directly with borrowers |

| Loan Types: | Bridging Loans. |

| Default Rates: | Actual 1.1%. No lender has lost capital. |

| Loans Amortize: | Some |

| Loan Security: | Yes. Property with good LTV's. Typically below 75% |

| Provision Fund: | No. However offer "skin-in-the-game". See review. |

| Time to Invest: | Auto-Invest - almost instantly. Select-Invest - varies, dependent on available loans. |

| Time to Mange: | None (Auto-Invest). Medium (Select-Invest) |

| Lender Fees: | No. |

| Payments Received: | Interest payment received annually on Auto-Invest loans, monthly on Select-Invest loans. |

| Amount Lent: | £135 million+ |

| Number of Investors: | 10,000+ |

| Loan/Dflt Stats: | Click to See Stats >> |

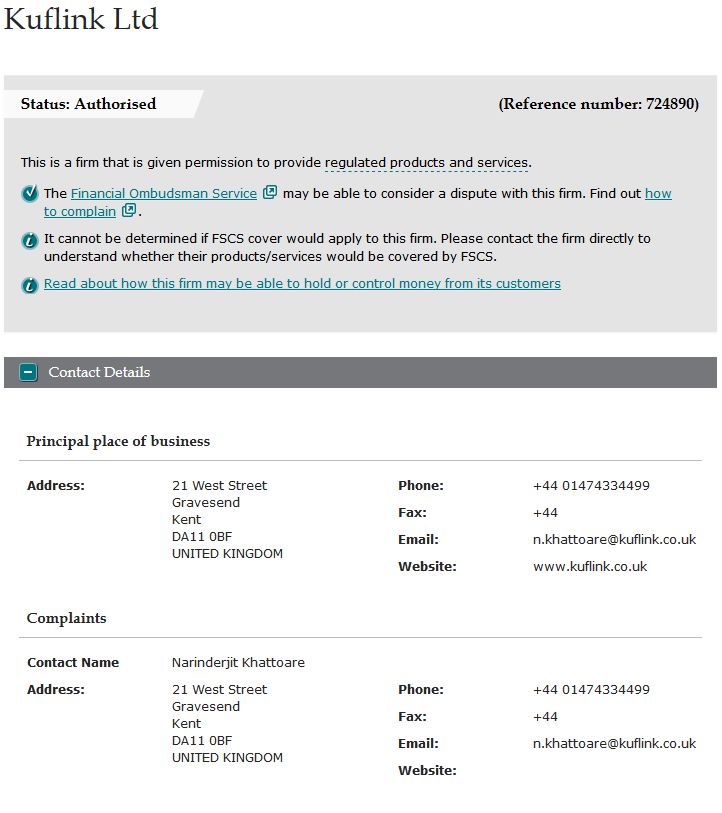

| Regulated: | Yes: FCA |

| Location: | Gravesend, UK |

| Launched: | 2016 |

| Website: | www.kuflink.co.uk |

| Email: | hello@kuflink.com |

| Telephone: | 01474 334499 (UK) |

| IFISA/IRA: | Yes: IFISA (Auto-Invest loans only) |

| Cashback**: | Sometimes: Check for current Cashback Learn More >> |

| How to Sign Up**: | Sign Up Here! |

My Overall Investing Experiences…

Kuflink benefited from the COVID19 situation in a big way. They are still bringing new loans to the platform en-mass, and they are still being filled relatively quickly. This shows that investors still trust the platform enough to invest with them. They picked up a lot of investment from other platforms throughout 2020 – 2021 because of this.

I have been investing with the platform for over 4 years as of writing this Kuflink review. So far my investing experience has been very positive in every way. Even with the COVID pandemic, most loans have been paid back on time. Some were delayed of course but generally they handled everything well and came through the situation even stronger than they were before.

Kuflink are going from strength to strength. It’s nice to see them doing well. They offer a fair return for the associated risk.

Finding loans with the kind of LTV’s available, associated returns and liquidity can be difficult to find elsewhere.

My latest lending experiences can always be found in my Monthly Portfolio Updates.

Latest Update & Current State of Account

As I am moving some of my capital from P2P in to UK banks, I decided to par down my Kuflink account a little and leave just what’s in my Kuflink ISA with them (still way above 30k). There are two reasons for this; 1. the investment was getting close to £50k again, around 25% of my overall P2P portfolio, which is just too much no matter how safe I think they are. So moving some capital from Kuflink to a bank was in order. And 2. I hold my 2022-2023 ISA with Kuflink, so all I did was sell down my non ISA wallet meaning now all income from Kuflink is tax free!

At some point I will sell out a bunch of stocks and bonds from one of my Growth Portfolios and move more money back to Kuflink, however right now that portfolio is drawn down so I won’t be selling any of that until it comes back.

If you’re not already in Kuflink you can do a lot worse. An investor can still get 7.00%+ XIRR real average returns. Very good considering that many other other platforms are still sub 5% with some at 4%. The large spike in income in October was because I realized gains from a lot of loans that I sold all in one month.

Taking everything into consideration, I still think Kuflink is about the best lender out there for overall risk/reward/liquidity.

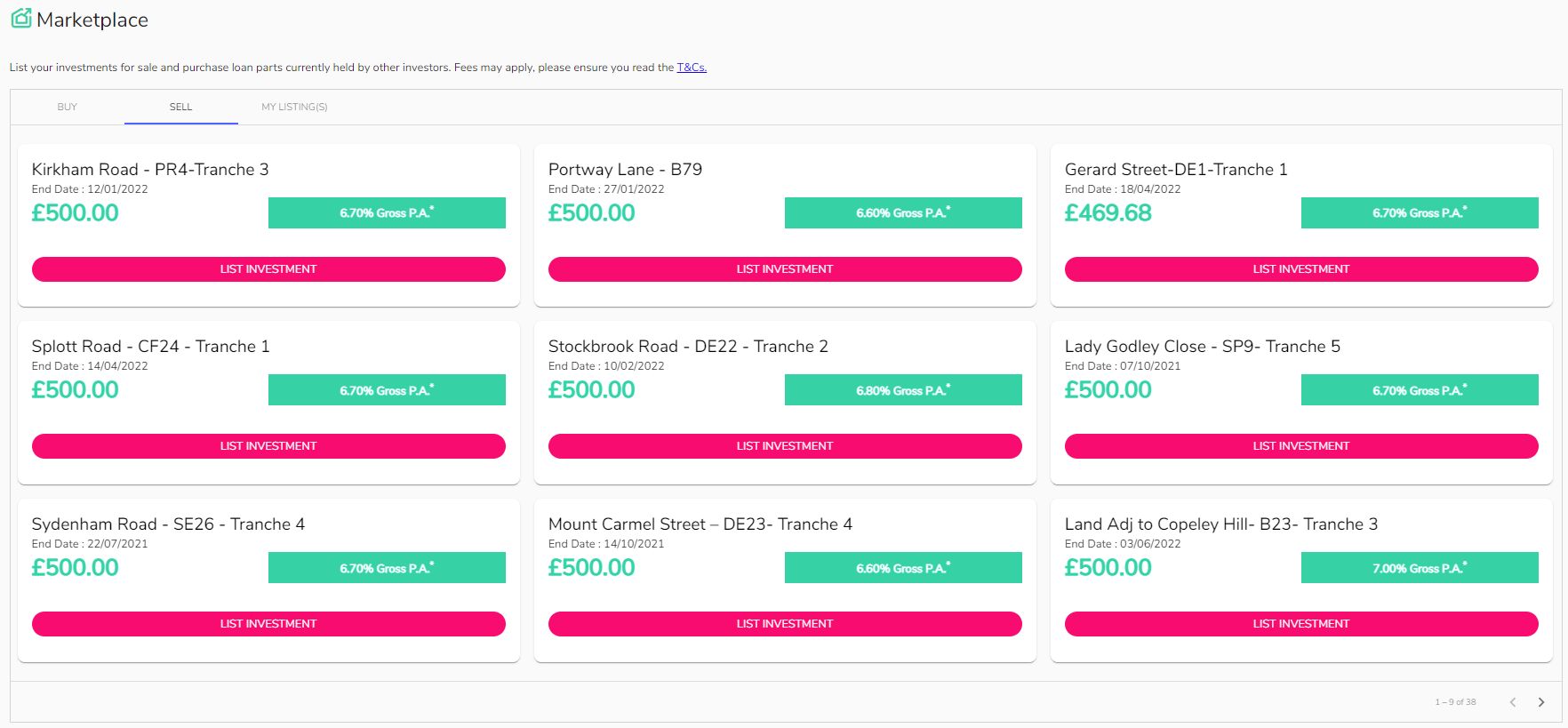

Account Screenshots

Latest Screenshots from my personal account.

What Annual Returns Can I Get From Kuflink?

See the charts below for my detailed average return from the last several years. In summary; I’ve consistently averaged around 6% XIRR, which is very good considering the risk taken with Kuflink loans.

Kuflink Investment Return Charts

(Click on chart image for interactive)

Detailed Overview – Kuflink Review

When Did Kuflink Launch? – History

The Peer to Peer business was launched in May 2016 in Gravesend, Kent UK.

Their property bridging division has operated for many years before launching their Peer to Peer platform, so the team has a lot of experience beyond the time the platform has been in business.

In the time they have been offering Peer to Peer loans, Kuflink have lent over £135 million on over 650,000 investments. From over 10,000 investors with over £85 million already having been repaid. Current default statistics available here.

The other impressive fact to note in my Kuflink review is that to date, no investor has lost money. Even through the pandemic, loans were repaid, mostly on time and liquidity was generally unaffected.

Who Owns Kuflink?

Narinder Khattoare is the CEO of Kuflink. Other information on company ownership & directors can be found at Companies House.

Is Kuflink Regulated?

They are regulated by the UK’s Financial Conduct Authority (FCA) with full permissions under FCA number 724890. They gained FCA permissions in April, 2017.

It’s important to note in this Kuflink review that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

Is Kuflink Profitable?

Yes, Kuflink became profitable in 2021. According to their accounts filed for 2020 – 2021 they had a profit of around £400,000.

Who are we lending to with Kuflink?

Kuflink is a true Peer to Peer platform. Lenders are lending directly to borrowers who are typically small to medium size British businesses.

Loan agreements are directly between the lender and the borrower. The platform just acts as a middle man, managing loans, payments and debt collection etc.

Do Kuflink Loans Amortize?

Loans do not amortize, so only interest payments are received until the principle is paid back in a lump sum at the end of the loan period.

On Auto-Invest loans, interest is paid annually. With manual Select-Invest loans, interest is paid at the beginning of each month, or you can choose to compound interest for a higher rate and have it all paid back when the loan pays back instead of monthly..

How Safe is Kuflink? – Loan Security

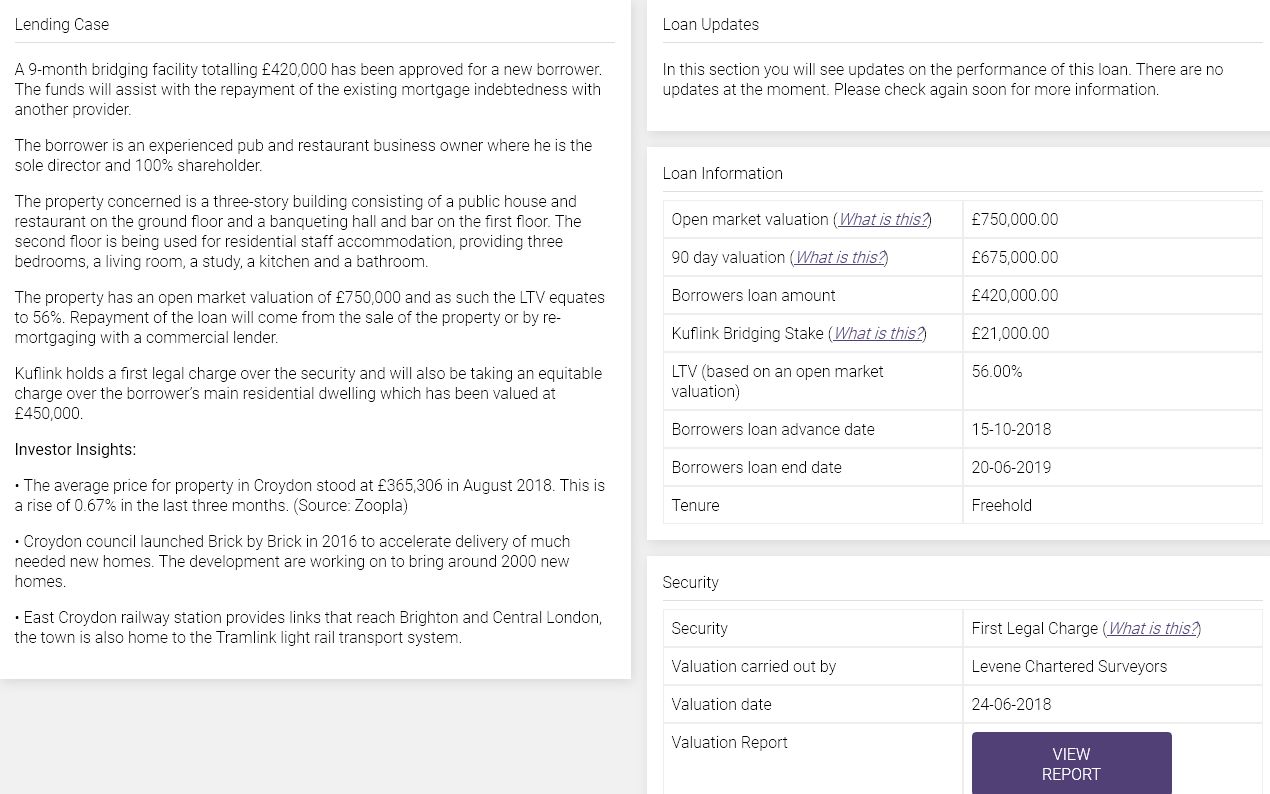

Kuflink only provide loans secured by property. The Loan to Value (LTV) ratios are typically very good, below 75%, I’ve invested in some at less than 30% LTV.

Loans are first or second legal charge on the properties the loan is against.

With an LTV of 30%, a property would need to lose more than 70% of it’s value before an investor would lose money. Then on top of that, their “skin-in-the-game” would take care of another 5%.

It’s easy to see why no investor has lost money through defaults to date. I consider them to be in the lower risk category.

Kuflink’s website provides good information on the security of each property.

It is even possible to drill down and see the full valuation report, in the case of the property in this screenshot, the full report was 45 pages!

Does Kuflink have a Provision Fund?

There is no Kuflink provision fund as such, however as mentioned previously, they invest 5% of their own money on a first loss basis into each loan. And with the low LTV’s, capital should always be recoverable. This seems to be the case as to date, they state that no lender has lost any capital.

They have had defaults though, (the rate they quote for the last 12 months is a little over 4%). Defaults don’t matter so much if funds can be recovered efficiently, and are to be expected with any type of lending.

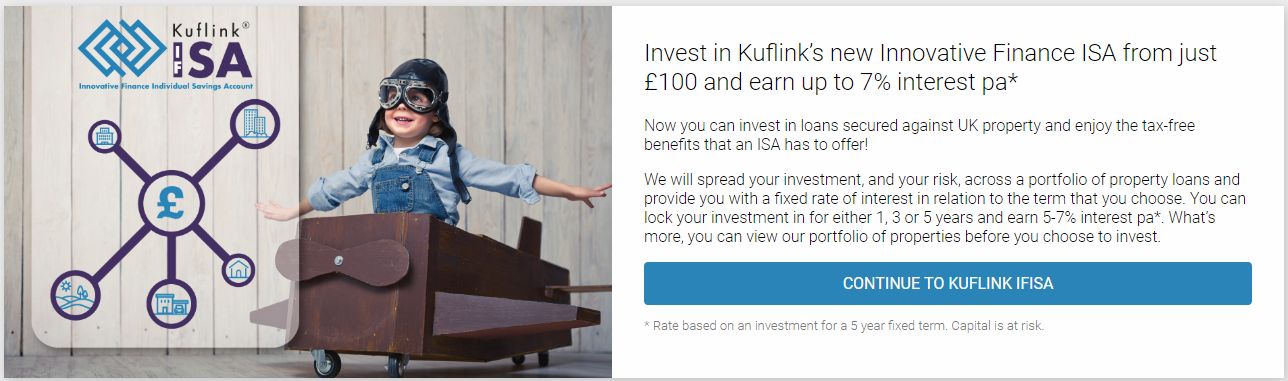

Is there a Tax Efficient Kuflink ISA Account?

They offer an Innovative Finance ISA (Kuflink ISA) which was launched in July 2017 for UK residents.

How Does Kuflink Work?

How Can I Signup with Kuflink? – Signup Process

Before you open an account with any Peer to Peer lender, it’s wise to use a cashback referral link to take advantage of any bonuses they are paying. This can increase your return on investment in the first year of investing substantially. Kuflink are usually paying one of the best cashback incentives in the business, so definitely worth taking note of if you’re considering investing with them.

Opening an account is fairly easy. Just the usual ID and anti-money laundering checks.

If they can verify you though one of the UK’s credit agencies, you may be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

Residents of most countries can sign up if they can pass the ID checks. The company says they accept investors worldwide.

A UK bank account is required to signup. If you don’t have a UK bank account, see my Wise Borderless Account review for more information on how it may be possible to get UK banking details even if you’re not a UK resident.

How Can I Make Deposits & Withdrawals with Kuflink?

Deposits can be made though a UK bank or an international bank account via Wise. Or from a UK issued debit card . Withdrawals are made by bank transfer from a UK bank or an international bank account.

Deposits usually show up in your account the same or next working day. Withdrawals typically take 2 – 3- business days.

How Long Does it Take to Invest?

When investing in their auto-invest accounts, investment is typically very quick, it took my first investment a few minutes to get the funds distributed between loans.

With manual Select-Invest loans, the time is dependent on how much research you need to do on the individual loans, and how many loans are available.

How Can I Sell Loans and Withdraw Capital?

The Kuflink secondary market was introduced in 2019, so it is possible to sell loans to other investors if you would like to exit a loan early.

There is a 0.25% fee for selling loans which is really not bad if you need your capital quickly.

Remember though, Loans are typically only 3 to 12 months on manual Select-Invest loans, and 12, 36 or 60 months terms on the Auto-Invest loans. So it’s not too long to wait if you don’t want to pay the exit fee.

How are Kuflink Loans Diversified?

Auto-Invest loans are diversified automatically when you initially invest. Capital is spread between available loans in each loan portfolio.

In the screenshot below, you can see that I deposited £500 initially to test auto-invest back in 2018 and this was split equally between available loans. I mostly do Select Invest loans these days but the Auto-Invest is a good option if you just want a “fire & forget” investment.

Diversification on loans is typically fairly good with Auto-Invest. Also because loans have good security, and they invest 5% of their money into Auto-Invest loans on a first-loss basis, I’m comfortable with even less diversification with their Auto-Invest.

With manual Select-Invest loans, you obviously diversify your capital into loans manually so you can choose your own diversification strategy.

How Easy is Kuflink’s Website to Use?

While writing this Kuflink review, I found their website very easy to use, and provides good information for both auto-invest and select-invest accounts (including the Kuflink ISA).

The Dashboard with your accounts and balances is displayed when you log in to the website.

Auto-Invest

On the auto-invest page, you can see rates available for the 12, 36 and 60 month loans, 5%, 6.1% and 7% respectively .

Simply choose your investment, and the amount you want to invest. The platform will then place the money on loan for your almost immediately. That’s it! If you don’t have the time to do the due diligence on manual select-invest loans, Auto-Invest is a good option, although the rates of return are a little lower.

As mentioned previously, something that is a little different with Kuflink to many other P2P lenders is that they pay interest annually on the auto-invest accounts, so you won’t see your account grow month by month. You’ll need to wait, then interest is added in a lump sum.

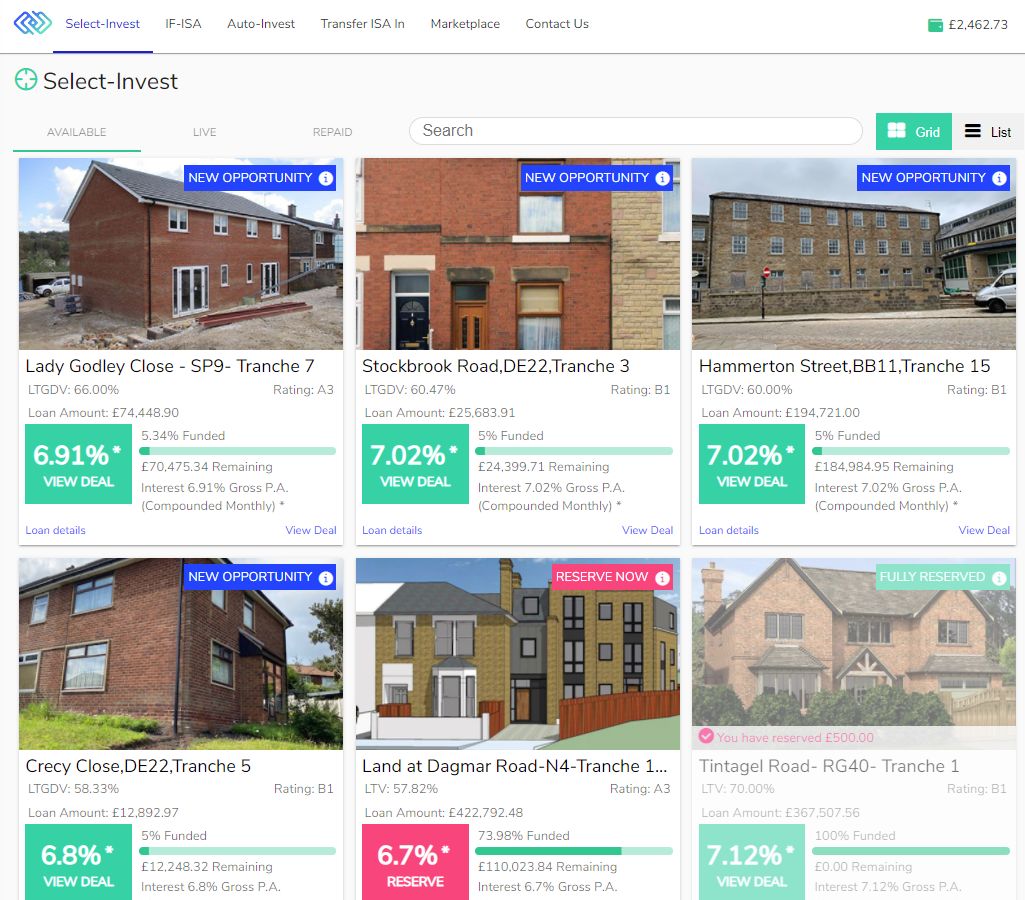

Select-Invest

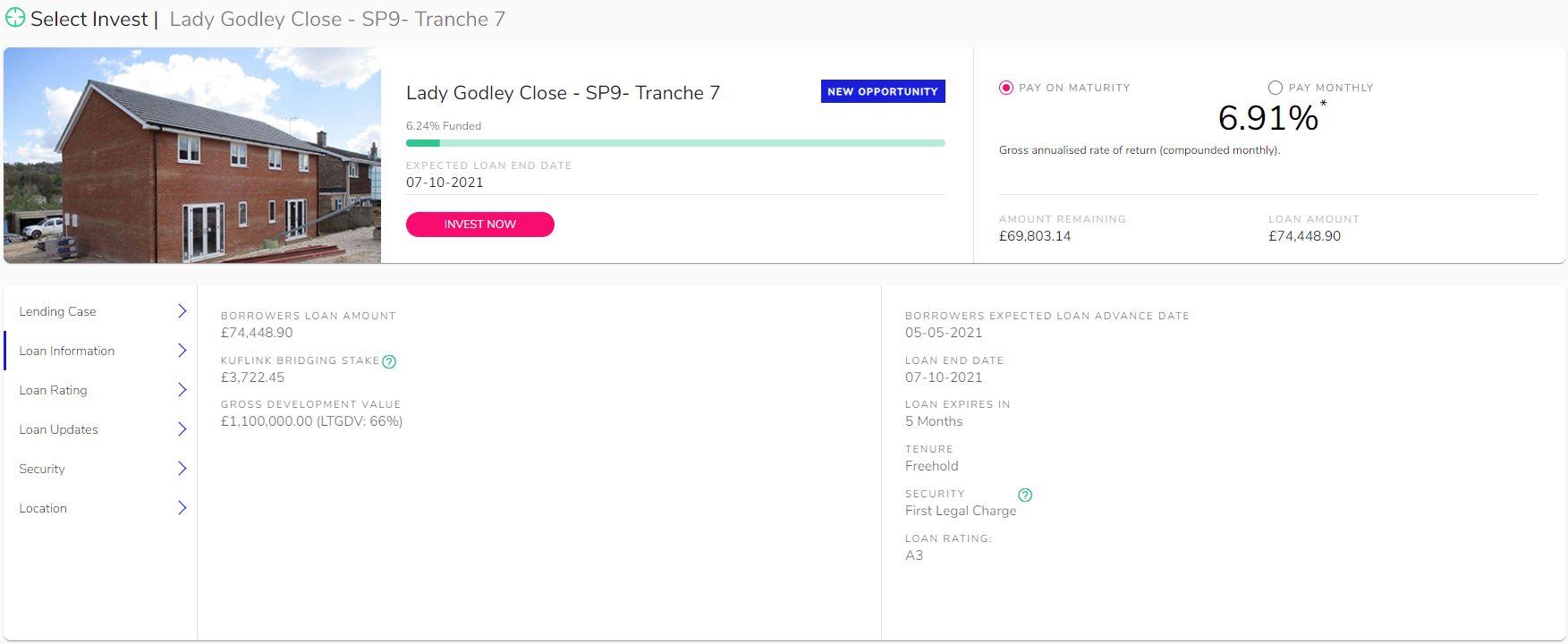

On select-invest loans there is a wealth of information available on Kuflink’s website.

The individual loans, terms and valuations are all available to help you make your decision on where to invest.

When you click on the “Available” loans page, you will see overview boxes giving you high-level information on loans.

Once you find a loan you are interested in, click on it to get in-depth detail on the loan.

You can also decide here if you would prefer to earn a little more by compounding the interest and receiving it all back at loan maturity. Or you can choose to receive interest payments monthly. The monthly option pays a little less as there is no compounding effect.

If you click on the side menu, you can page through all of the different detail for each loan.

If you decide to invest in a particular loan, just click on the “Invest Now” button & input the amount you would like to invest.

After that you will need to accept the terms & conditions and then finally hit the “Invest” button to confirm the investment.

Summary – Kuflink Review

My experience so far with Kuflink has been excellent. Their low LTV’s are attractive, and because they invest into each loan themselves (skin-in-the-game), it means they will be extra careful about who they loan our hard earned money to. Evidenced by the fact that no investor has lost money to date out of the thousands of investments they have processed already. Even through the COVID pandemic, there were no serious delays in loans or liquidity.

I like the platform a lot evidenced by the fact Kuflink is my largest lending account. I have increased my investment with them almost every month and will continue to do so moving forward. The safety they offer with better-than-average return rates are difficult to pass by. Plus the chance to use the Kuflink ISA for tax efficient investing is an added bonus.

Points to Consider Before Investing with Kuflink

Thumbs Up Points

- Safety – Skin in the Game – Kuflink invest 5% of their own capital into select-invest loans on a “first in, last out” basis which gives an extra layer of protection to investors.

- Property Secured with Good LTV’s – loan-to-value numbers seem very resalable, which means that in the event of a default investors should be able to recover most of their investment.

- Auto-Invest –there are three auto-invest accounts if you don’t want to self select making investing hands off requiring very little time to maintain. These account pay very reasonable rates too!

- Detailed Loan Information – for select-invest loans there is very detailed information to help investors make an informed decision.

- Website – very easy to use and understand.

- Diversification – with the auto-invest accounts, your investment is spread over as many loans as possible helping you adhere to the “Prime Directive” and diversify your investment.

- Low minimum investment – £100 to start. Minium investment per loan is “enough to earn 1p of interest”. If your portfolio is still small, it’s still easy to invest and still diversify over many loans.

- Kuflink Cashback – If you’re a new investor, they typically have some of the best cashback bonuses. See below for current offers.

- Financial Conduct Authority (FCA) – Regulated.

- Innovative Finance ISA – Kuflink ISA available for tax free investing.

Thumbs Down Points

- No Provision Fund – However their “skin in the game” and their low loan LTV’s go a long way to cover any possible defaults.

- Medium Size Company – with shorter track record, however they are growing fast and quickly becoming the de facto-standard for safer bridging and development loans in the UK.

- Interest Paid Annually – on auto-invest accounts, you won’t see your account grow until you’ve been invested for at least a year. On the select-invest account, you can choose to have interest paid monthly or at the end of the loan term.

- Early Exit Fee – there is a small fee to sell loans early & retrieve capital on the secondary market.

Obvious Investor Risk Rating*

– 3/10 – Low

– 3/10 – Low

Is Kuflink Safe? I consider them to be in the lower area of the risk scale.

Even taking in to consideration that loans are secured, and they have “skin in the game”, they are still a young but fast growing company.

I have enjoyed investing through through the platrofm, and based on my experience thus far, I think they’ll go on to do great things. Their low LTV’s make them an enticing investment. TrustPilot reviews give them a great rating too which they certainly deserve.

Who Can Invest with Kuflink?

Residents of most countries can invest with Kuflink if they have a U.K. bank account. Contact them for further information.

Kuflink Cashback Offers & Signup Links**

Click here to check for latest Kuflink cashback offers>>

Signup for standard investment account >>

Similar Lenders to Kuflink

Other UK Peer to Peer Lender Reviews

Proplend Review

London House Exchange Review

Assetz Exchange Review

Find UK Property Review

Loanpad Review

easyMoney Review

Unbolted Review

Kuflink Review

LendingCrowd Review

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.