Initial Research & Proplend Review; UK Peer to Peer Platform

Although I have not invested with Proplend (yet), I have done considerable research so I am posting it here in the hope it might save you some time instead of just leaving it in a draw somewhere. I hope you find it useful.

Introduction- Proplend Review

Proplend is a UK-based peer-to-peer (P2P) lending platform that specializes in property-backed loans, connecting borrowers seeking commercial property loans with investors looking for attractive returns. This Proplend review will provide an in-depth analysis of Proplend, its features, benefits, risks, and overall performance, to enable potential investors to make informed decisions.

Company Background and History

Established in 2014, Proplend has positioned itself as a prominent player in the UK P2P lending market, focusing on commercial property loans. With its innovative approach and commitment to transparency, Proplend has garnered a loyal following of investors and borrowers, facilitating millions of pounds in loans since its inception.

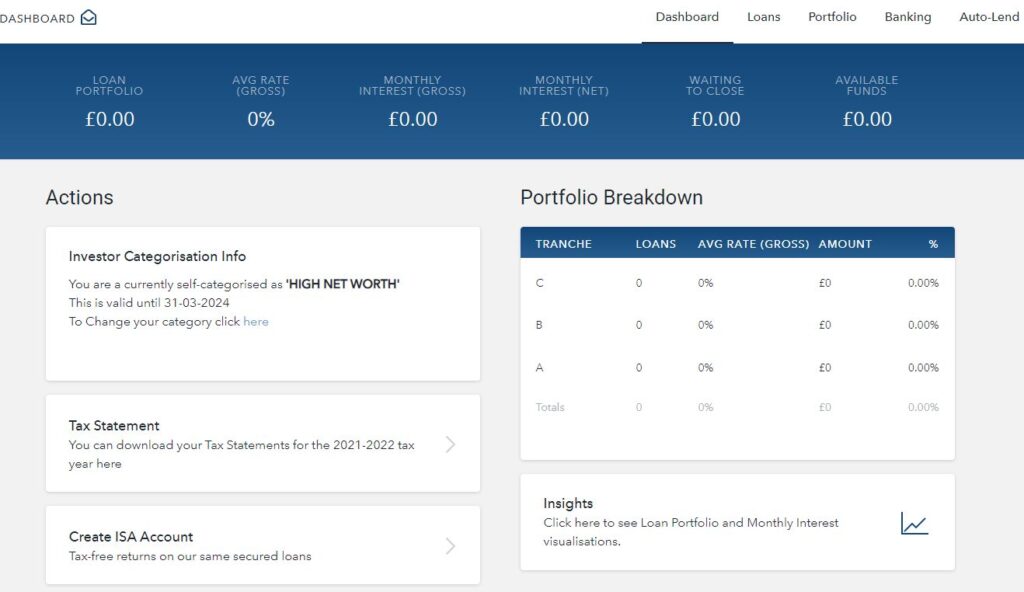

Platform Overview

Proplend offers a user-friendly platform that enables investors to diversify their portfolios with property-backed loans and borrowers to access competitive financing options for commercial property ventures. The platform is designed to provide a seamless experience for both investors and borrowers, with a simple registration process, comprehensive loan information, and a range of investment options.

Registration and Account Setup

While writing this Proplend review, we discovered that opening an account with Proplend is straightforward. Both investors and borrowers need to provide basic personal information and verify their identity to meet the platform’s Know Your Customer (KYC) requirements. Once the account is verified, users can access the platform’s features and start investing or apply for a loan.

Investor Features and Benefits

a. Loan-to-Value (LTV) Tiers: Proplend’s unique LTV tier system allows investors to choose the level of risk and potential return that best suits their investment objectives. The platform offers three LTV tiers (A, B, and C), each with different interest rates and risk profiles.

b. Diversification Opportunities: Investors can diversify their investments across various property types, locations, LTV tiers, and borrowers, reducing the overall risk associated with their portfolio.

c. Auto-lend Feature: The platform’s auto-lend feature enables investors to automatically invest in new loans that match their chosen criteria, saving time and ensuring diversification across multiple loans.

d. Secondary Market: Proplend offers a secondary market where investors can buy and sell loan parts, providing a degree of liquidity for those who need to access their funds before the end of the loan term.

e. Interest Rates and Returns: Proplend’s loans typically offer higher returns than traditional fixed-income investments, making it an appealing option for investors seeking higher yields.

f. Risk Management and Security Measures: The platform employs strict underwriting and credit assessment processes to minimize risk, and all loans are secured by a legal charge over the property.

Borrower Features and Benefits

Although this Proplend Review is mainly for investors, I felt it important to highlight why borrowers would use Proplend as without them there would obviously be no business.

a. Loan Types and Amounts: Proplend offers commercial property loans ranging from £250,000 to £5 million, catering to various property types, including office, retail, industrial, and mixed-use properties.

b. Loan Application Process: Borrowers can access a simple and efficient loan application process, with a dedicated account manager to assist them throughout.

c. Interest Rates and Terms: The platform offers competitive interest rates on commercial property loans, often lower than those offered by traditional banks and lending institutions.

d. Property Valuation and Assessment: An independent surveyor conducts a property valuation to ensure that the property’s value is accurately assessed, providing a reliable basis for the loan-to-value calculation.

e. Repayment Options: Borrowers can choose between interest-only or amortizing repayment structures, depending on their cash flow requirements and financial objectives.

Loan Underwriting and Credit Assessment Process

Proplend employs a rigorous underwriting and credit assessment process to evaluate borrowers and the associated risks. The platform reviews each borrower’s credit history, financial standing, and property’s condition, location, and valuation to make informed lending decisions. This thorough process helps mitigate risk for investors and ensures that the platform only offers high-quality loans.

Property Types and Sectors Supported

Proplend supports a variety of commercial property types, including office buildings, retail spaces, industrial properties, and mixed-use developments. This broad range of property sectors enables investors to diversify their portfolios across various industries and markets.

Financial Conduct Authority (FCA) Authorization and Regulation

For this Proplend review, we checked the FCA website and found Proplend is authorized and regulated by the Financial Conduct Authority (FCA) under number 726646, ensuring that the platform complies with stringent regulatory requirements and industry best practices. This FCA authorization adds an extra layer of security and trust for both investors and borrowers.

Platform Security and Data Protection

Proplend takes the security of its users’ data seriously, employing advanced encryption technologies and robust data protection measures to safeguard personal and financial information. The platform also has robust cybersecurity measures in place to protect against unauthorized access and data breaches.

Customer Support and User Experience

Proplend offers excellent customer support, with a dedicated team available to assist users with any queries or concerns. While researching this Proplend review, I found that the platform’s user interface is intuitive and user-friendly, making it easy for both investors and borrowers to navigate and access the various features.

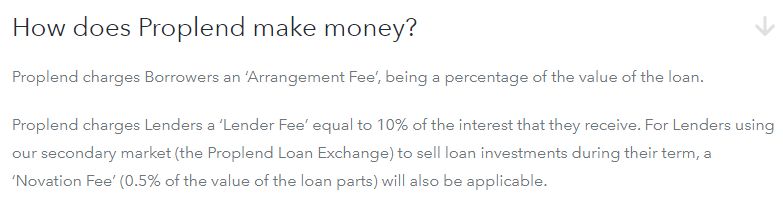

Fee Structure for Investors and Borrowers

Proplend’s fee structure is transparent and straightforward, with fees clearly outlined for both investors and borrowers:

For Investors:

- Lender fee: A 10% fee on the gross interest earned by the investor is deducted before the net interest is paid out.

- Secondary market fee: A 0.5% fee is charged when investors sell loan parts on the secondary market.

For Borrowers:

- Arrangement fee: A one-time fee, typically calculated as a percentage of the loan amount, covers the administrative costs associated with setting up the loan.

- Valuation fee: Borrowers pay for the property valuation conducted by an independent surveyor.

- Legal fees: Borrowers are responsible for covering the legal fees associated with the loan.

- Performance Metrics and Loan Portfolio Analysis

Proplend has a strong track record of successful loan repayments and attractive returns for investors. Detailed performance metrics and loan portfolio analyses are available on the platform, allowing investors to make informed decisions based on historical performance and current market trends.

Success Stories and Case Studies – Proplend Review

Proplend has facilitated numerous successful loans for various commercial property projects, with many borrowers and investors sharing their positive experiences on the platform. These success stories and case studies can provide valuable insights into the platform’s efficacy and the potential returns for investors and borrowers.

User Reviews and Testimonials

User reviews and testimonials are a valuable source of information, offering insights into the experiences of real users. Overall, Proplend has received positive feedback from both investors and borrowers on TrustPilot, with many praising the platform’s transparency, user-friendly interface, and excellent customer support.

Proplend’s Unique Selling Points

Proplend sets itself apart from other P2P lending platforms with its focus on commercial property-backed loans, unique LTV tier system, and commitment to transparency and security. These unique features make Proplend an attractive option for investors and borrowers in the commercial property sector.

Risks and Challenges Associated with Investing in Proplend

As with any investment, there are risks and challenges associated with investing in Proplend. These may include illiquidity,

default risk, and economic factors that can impact the property market. However, Proplend’s strict underwriting processes, LTV tier system, and diversification opportunities can help mitigate these risks. You can always read more about general P2P lending risks in my Peer to Peer lending 101 document.

Future Outlook and Growth Prospects

Given the growing demand for alternative financing options and the popularity of P2P lending, Proplend is well-positioned for continued growth and success. The platform’s focus on commercial property loans and innovative features, combined with its commitment to transparency and security, makes it an attractive option for investors and borrowers alike.

Conclusion – Proplend Review

Proplend offers a unique and innovative platform for investors seeking attractive returns through property-backed loans and borrowers in need of competitive financing options for commercial property projects. With its LTV tier system, risk management measures, and user-friendly interface, Proplend is an appealing choice for those looking to invest in or borrow against commercial properties.

However, potential investors and borrowers should carefully consider the risks associated with P2P lending and thoroughly research other platforms before making a decision. Overall, Proplend’s track record of success, commitment to transparency, and FCA authorization make it a strong contender in the UK P2P lending market.

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.