Back in 2015 I received an email from the platform I use to buy & store most of the physical gold for my Growth Portfolios called BullionVault. They were “Touting” a new platform they had just started called WhiskyInvestDirect which enables individual investors to invest in whisky. At the time I thought “yeah, right” it’s probably some kind of gimmick they are pitching to get more investment in gold, or some other marketing ploy.

I followed http://whiskyinvestdirect.com for a couple of years, just to make sure I wasn’t missing anything, then for one reason or another I lost track of them.

Enter COVID19 and the downfall of many of the Peer to Peer lending platforms I was invested in, leaving me with less diversification of capital than I ideally would like.

So, at the beginning of 2021, I started to look for new platforms & investment opportunities. As you’ll know if you follow my blog, I found easyMoney, Assetz Exchange and also started investing in Cryptocurrency. At that time, WhiskyInvestDirect kept popping into my sights again, and again, and again, so I eventually gave in and started to look at them.

At first, I just didn’t “get it”. A couple of issues which really bothered me were:

1. It looked kind of complicated to invest in whisky (knowing absolutely nothing about whisky, apart from the fact that it gives me a headache if I drink enough), and I’m not sure I wanted to spend the next few years becoming a whisky connoisseur in order to learn to invest in whisky. Or another way to put it: my “Lazy Investor” rule kicked in.

2. The fees associated with buying and storing it, if I ever did decide to invest in whisky, always seemed extortionate.

On further investigation and many emails exchanged with the WhiskyInvestDirect team (probably quite irritating to them), I slowly started to get interested. Then, when I really started to look at the overall numbers when starting to invest in whisky, a lightbulb came on & I began to become much more interested.

Rather that try to explain ALL of the research I did to invest in whisky, I’ve listed below a few items I think are important to understand:

Invest in Whisky? Really?

Just about ALL Scotch Whisky increases in value with age. That’s probably not new news to anyone, but the process is interesting, and the implication of that fact as far as someone who is looking to invest in whisky, is even more interesting.

After the whisky’s are distilled, they are placed into a cask to mature, and stored in a large, secure, climate controlled area (warehouse typically) while they mature.

At some point, usually when the whisky is between 3 and 12 years matured, they are bottled and sold. Depending on the type of whisky (malt, grain), distillery, date of distillation, type of casks etc., they are either mixed together to make a “blend” (about 90% of all Scotch Whisky is blended), or they are sold as a “single” if they are good enough. Between the distillation and bottling phase, (the “maturing” phase), these whisky’s increase in value significantly. It is that maturing phase which is the best to invest in whisky in order to take advantage of a lower-risk investment with very reasonable returns.

How Scotch Whisky Gets to Market

Distilleries generally make more whisky than they can store (or they only distill it, and don’t store any). Storing this whisky is extra cost to distilleries which ties up capital which could be used to make more whisky, so they sell off whatever they can’t (or don’t want to) store to investors as kind of a “hedge”.

Many of these investors are large companies with warehouses who buy thousands of LPA’s (Liters of Pure Alcohol) and store it in casks (usually around 200 liters per cask, which makes around 380 bottles of whisky when matured) in order to make a profit when the whisky is finally sold for bottling. Or they are large investors who buy casks and pay for it to be stored in warehouses which specialize in this kind of storage.

The distilleries sometimes buy back the whisky at the going price (or make a “bulk bid” at a price they want to pay) when it is somewhere between 3 and 12 years matured, and then bottle it and sell it as an end product.

Often independent bottling companies and whisky brands buy the whisky in bulk bid in order to fulfill their requirements as well.

Before it is purchased by the bottlers/brands/distilleries, whisky can be bought and sold several times. There is an active market which works like (and essentially is) a commodities market where whisky can be traded.

Scotch Whisky Value Increases as it’s Maturing

I think the main point that finally struck home with me that didn’t really sink in before and helped me decide to invest in whisky is the first one . “Just about ALL Scotch Whisky increases in value while it’s maturing”. I knew this of course, but the implications never really hit home.

Once I opened an account with WhiskyInvestDirect, I started to do some research into this first point.

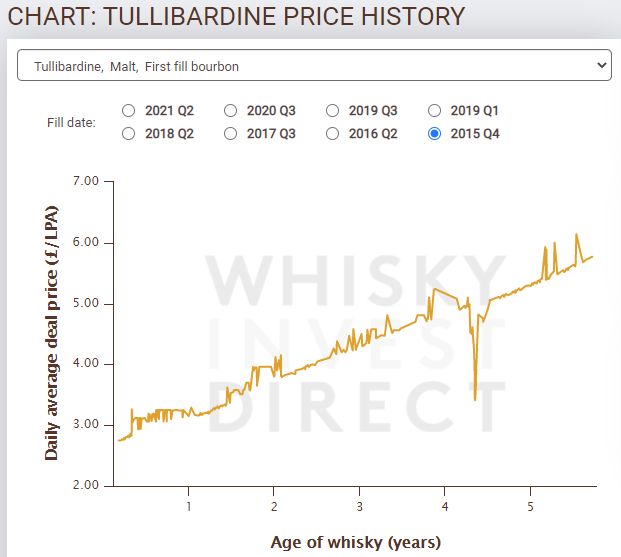

Rather than explain more here, let me show you a couple of screenshots:

The above charts are of different malt whisky prices from distillation to today. You’ll notice there are “blips” (typically when a large investor decides to invest in whisky or sells, or a bottler/brand/distillery does a bulk buy order) but generally the lines all go up diagonally in a straight line. In all of the above charts, the price has doubled as the whisky aged. Some in as little as 4 years, some in 8 years, but the fact remains, the prices increased significantly.

This is due to the maturing of the whisky, and this is the “sweet spot” where bulk whisky investment is concerned. I say “bulk investment” because there is a large market for vintage bottled whisky of course, but you really need to be an expert in order to do well in that market.

As a side-note; you’ve probably noticed the big downward “blip” in the above charts? That was for a couple of weeks in March 2020 when COVID hit. Investors were “fire selling” everything for any price at the time, which took prices way down. Unlike other asset types though, look how quickly they went back exactly to the same diagonal growth line once the “panic’ers” were weeded out. Some lucky investors who kept their heads managed to invest in whisky at some very attractive prices before they snapped back to the “normal” line.

There are hundreds of these charts available on the WhiskyInvestDirect platform which help investors invest in whisky. Me being me of course, I’ve spent days looking at just about all of them, and I am yet to find any that don’t go up like this. Some by a lot, and some by not as much, but they all go up over time as whisky ages. If you’d like to see for yourself, go to http://whiskyinvestdirect.com and look at the charts (you don’t need to register for an account or give any information, the charts are public).

Return on Investment from Scotch Whisky

The charts above show generally large returns on a physical asset investment, but then remember my second “issue” mentioned above: Fees. There are costs to initially buy the whisky (1.75%), sell the whisky (1.75%), and of course to store the whisky (£0.17p per LPA per annum, which also includes insurance). However after all these costs are taken into consideration, there is still a firm history of solid profit of around 9% per annum on malt whisky, and 4.8% per annum on grain whisky. Also remember the less you “trade”, and instead invest in whisky & hold it, the less buy/sell commission there is to pay.

A sensible portfolio of both malt & grain averages out (net, after associated costs) at about 7.3% which in my opinion is very reasonable for an asset secured investment. If you go to http://whiskyinvestdirect.com and click on “About Whisky” from the menu, then “Whisky Investor Account Examples” you’ll see examples of real-life account returns which echo these numbers.

There are a few reasons why grain whisky annual returns are much less than malt in the example above. The first being that grain whisky is typically valued at much less than malt (roughly half). Storage & insurance costs are however the same for each, so it basically costs half as much to store malt whisky than it does grain.

The second reason is that grain whisky prices have been falling for the last few years:

Yet even with grain whisky prices falling over 20% over the past few years, overall it still returned almost 5% per annum. There are not too many investments which still turn a decent profit for investors even though prices are falling.

Malt whisky price of course has been relatively stable and has returned around 9% per annum, which gives a better idea of the real return of the maturing process as opposed to market price fluctuation.

Taking the above into consideration, it’s probably best to invest in a mixed portfolio of malts & grains, looking at a realistic solid 7% to 8% per annum for long term returns, because if/when grain prices start up again, and should malt prices start down, it would be good to own both. If grain on the other hand flattens out, and malt continues flat as it has for the last several years, the overall portfolio return would increase accordingly.

Also if inflation takes off as it appears to be doing recently, whisky in general could be a very interesting investment. Almost all commodities do well in a high inflation environment.

The other interesting point (which was also a big part of why I decided to invest in whisky) is that there is generally no UK Capital Gains Tax (CGT) on maturing cask whisky as it is classed by HMRC as a “Wasting Asset” so this helps to add to the overall profits. Of course speak to your accountant, do your own research, and don’t just take my word for it as with anything on this site.

Risks of Investing in Whisky

With just about every investment, there has to be risk. Even in an assumed “safe bank account” protected by government, there is a slight risk. For example, if a big enough slew of banks were to fail, potentially the government bank insurance could falter (there is not enough capital in ANY government insurance to protect every customers account in that event). Or, the government them self could run into trouble and default. These risks are small compared to other investments, but that’s why banks pay less than 1% on general savings these days. Low risk/reward.

Here are some of the risks I’ve identified related to investing in whisky:

- The market price for the whisky you invested in could fall. It’s unlikely you would make a big loss, but you might not make as much (so remember the golden rule: DIVERSIFY and spread the risk across many types of whisky, the same as we do with Peer to Peer loans).

- Whisky could become hard to sell if it becomes too old, or too scarce to be used in a blend, while not being thought good enough to be bottled as a single malt (so as your whisky matures, make sure you either sell it on the open market, or accept all bids from bottlers/brands/distilleries when they come to bulk buy it for bottling under a bulk bid. You’ll be notified as an owner when this happens).

- Your whisky could be destroyed or stolen (although this is where insurance which is included the storage costs would kick in, so with the WhiskyInvestDirect platform, it shouldn’t be an issue).

- If we buy through fractional ownership with a platform such as WhiskyInvestDirect, it could go bankrupt (however remember you still own the whisky, which can still be sold. It may be an awkward and lengthy process, but you still own an asset). There is more on the WhiskyInvestDirect website about their specific wind down process if this should occur. Similar to a Peer to Peer lending platforms wind down processes.

I’m sure there are other risks, but these are the main ones I can find.

WhiskyInvestDirect Platform

The WhiskyInvestDirect platform was established in 2015 to enable smaller investors to have access to this lucrative P2P/P2B investment asset, where investors can invest in whisky by the Liter of Pure Alcohol (LPA) without the need to have a large warehouse, or buy hundreds of LPA’s of a single type of whisky in a cask. You might even refer to it as “Scotch Whisky Crowdsourcing” where investors can buy just part of a cask of whisky and share storage costs with other, smaller investors.

This is very similar to their sister company BullionVault (founded in 2005), where investors can buy gold & silver by the Oz/Kg (or part thereof), and they store it for us in a safe, insured location. We still own the whisky directly, it is a physical asset, and we have a legal contract for our whisky. We can actually ask for it to be bottled and delivered to our door at any time if we like (of course there are costs associated with that process). The point is, we as investors have legal ownership of the physical asset, and can get it whenever we want, and it’s insured in case of mishap.

There are lots of other companies out there which can help investors to invest in whisky by the cask, for me though I like the opportunity to buy small parts of many whisky’s & diversify across the market for the first time I invest in whisky. I am actively looking at other platforms (including cask only platforms) for the future though, in order to diversify across platforms. WhiskyInvestDirect is a great place to get my feet wet though and I feel it is safe enough for a substantial investment.

My Scotch Whisky Investment Strategy

With the above information in mind, and speaking with other whisky investors I’ve made contact with, as well as detailed discussions with the WhiskyInvestDirect team, I devised a strategy that I decided to use to make my first investment in whiskey.

As I’m not (and don’t particularly want to be) a whisky expert, I use the “first directive” and diversify. I’m going with a 70/30% malt/grain portfolio made up of more recent-term and mid-term whisky. That way I can spread the risk over many products, and also have the opportunity to hold them for a long time before bottlers/brands/distilleries come in to buy them back for retail sale. Of course I can still sell them on the open market before then if I want to, or if there is an opportunity to make a quick, large profit.

There is some information below (provided by the helpful team at WhiskyInvestDirect) which anyone who wants to put a lot of time into choices when they decide to invest in whisky, to squeeze every last penny of return can use. Personally I decided to buy a few of the whisky’s offered directly by the platform, and then some other products from the secondary market (sold by other investors similar to P2P lending secondary markets) using some of the information below. I’ll keep adding more so I can build up a good portfolio over time as I invest in whisky and become more experienced.

There is an option to purchase “WhiskyInvestDirect Quick Buy Packages” but I decided for the amount of investment I intend to make over time, I’d like to have even more diversification. They are a good option for investors wanting to just get in and be done with it though, or for investors with smaller amounts of capital to invest in whisky (the minimum investment in a package is just £100).

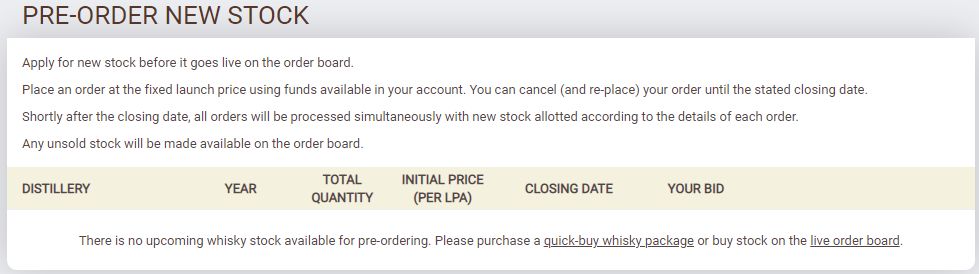

There is also the opportunity to “pre-order” new stock before it arrives:

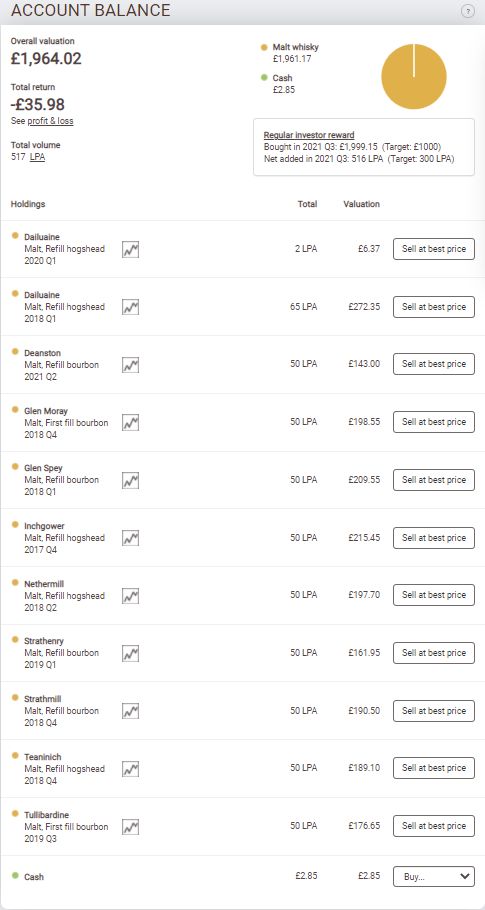

One thing to mention; WhiskyInvestDirect offer a “Regular Investor Reward” which takes off £0.02p from storage costs per LPA per annum, taking it down to £0.15p per LPA (doesn’t sound a lot, however it is significant if an investor holds a good quantity of whisky). To qualify an investor needs to invest at least £1,000 per quarter and increase their holding by at least 300 LPA per quarter over the year. So worth taking into consideration when someone decides to invest in whisky.

Which Whisky is the Best to Buy?

Here is some useful information from the team at WhiskyInvestDirect for serious whisky buyers who have the time and want to try and pick the perfect whisky investments.

In value terms it’s difficult to differentiate between the available whiskies. Some distilleries are better known than others and they may trade at a premium. But this is not necessarily a good indicator of ultimate financial returns, and as with stocks and shares it is never obvious which will be the winners. Again, just as most investors select a variety of stocks and shares, most of our users choose a sensible and conservative variety of whiskies.

The following are some issues an investor should bear in mind if they decide to invest in whisky:

Single malt whisky is generally considered more valuable than single grain whisky.

Whisky appreciates in the cask. So older whisky is generally considered more valuable than younger whisky.

Different casks/barrels mature whiskies with different results. Sherry and port barrels are harder to source and impart particular flavours, so whisky matured in these barrels are generally considered more valuable than whisky matured in more standard bourbon barrels.

First fill barrels usually mature better than refill barrels, so they are usually considered more valuable.

In percentage terms, because storage is charged according to physical volume, the carrying cost of cheaper whiskies is higher in percentage terms than the carrying cost of more expensive ones.

My Scotch Whisky Portfolio

As you can see with the screenshot of my account, I only just started building my Scotch Whisky Portfolio. So far I have purchased a few different malts of recent maturity (the losses posted are just the purchase commissions).

I’m currently waiting on funds to be deposited to continue the process, but I decided to post my intentions here as lately it seems that when I decide to get into an investment, coincidently so does everyone else. So prices start to rise rapidly & significantly as they did with my investments in Assetz Exchange & the Recovery Portfolio, or it becomes difficult to get capital invested as it did with easyMoney because everyone is trying to buy at the same time.

I had a couple of pieces of “hate email” asking why I waited so long to post my investment ideas, so this time, here it is, no more hate emails please 🙂

Remember though, these are just my thoughts & opinions, do your own research and make your own investment decisions, please don’t just invest based on the information posted here.

Once I get a significant amount of capital invested, and a few months of data under my belt, I’ll publish a “Whisky Portfolio” in the Portfolio Area of the website so we can all follow along and see how good of an investment it really is.

Summary – Invest in Whisky

After the research I’ve done on how to invest in Whisky, I’m convinced this is a viable investment for diversification of my overall investment portfolio.

I intend to build a healthy portfolio over time, and I would eventually like to have the value of the Whisky Portfolio to be around the same value as my total Peer to Peer Lending Portfolio or more, if everything goes as planned.

The opportunity to invest in whisky, a physical asset which increases in intrinsic value over time, and which is much less volatile and less susceptible to open market fluctuations than some of the other assets in my overall investment portfolio, is attractive for portfolio diversification.

I also like that it appears to have almost zero correlation to any to my other individual portfolios.

The only platform I’ve found which enables smaller investors to invest in whisky is WhiskyDirectInvest, so that’s where I’m buying everything right now. I have invested with their sister company BullionVault for many years, & I find the team always transparent, professional & courteous. As stated earlier, I’m also looking at cask only platforms for future diversification.

If you are interested in investing in whisky, head over the WhiskyInvestDirect website and take a look for yourself. You can open an account without the need to deposit anything or provide any documentation initially if you just want to look around and get a feel for it.

Maturing Whisky Portfolio

฿ – Cryptocurrency Portfolio

£ – GBP Peer to Peer Lending Portfolio

$ – Recovery Portfolio

$ – US Dollar Permanent Portfolio

€ – Euro Permanent Portfolio

£ – GBP Permanent Portfolio

$ – US Dollar Growth Portfolio

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

I’ve also come from Bullionvault to WhiskyInvestDirect and been investing there since early 2016, and I can confirm everything written here. My Whisky portfolio there has steadily grown – and no, I still know next to nothing about whisky – to currently ~5000 LPA, and the return is around 7,5% per year. So unless some unpleasant and unexpected issues come up (Brexit?) this indeed is a very interesting way to diversify your portfolio into some tangible asset class.

Hello. Stupid question on it’s way, but someone’s gotta ask it ;). Having been fortunate enough to be on the odd Whisky tour, I’m interested to hear how “the angels share” is managed, and accounted for in investment returns. For those of you not so fortunate, “the angels share” is the proportion of whisky that evaporates out of the cask (the casks are not sealed) over time, so literally there is less liquid as time goes by; on the upside, this improves what’s left 🙂 Bottom line, you’ll never get the same amount of whisky (LPAs?) back as you buy, and the longer you hold, the less you’ll get back. But, the value of what’s left, after all costs have been deducted, should hopefully be worth more than initially invested.

And whilst I think of it, shouldn’t you be invested in Portuguese Port instead 😀

HI Felice,

Thanks for the comment. I had asked this question to WhiskyInvestDirect and this was the reply.

“Angels Share

I am attaching the link to the right page on our website, but effectively it is an industry standard that barrels are going to lose on average 2-3% per year (average %: so some barrels less and some more than 2-3%).

Also the number of litres you buy is exactly how many you will sell and be paid for irrelevant of angels share, it is up to the buyer (distillers & bottlers) to approximate how much they will get, and they all know this is just part of the industry. https://www.whiskyinvestdirect.com/help/FAQs/FAQs-storage.html#What-about-evaporation

Because we believe that all our whisky is going to end up back in the distilling industry the only time the evaporation would be a factor is if an investor decided to take some barrels and bottle or sell them directly (which is not an easy or cheap exercise and our business model is not conducive to such small increments), more like the cask investment companies. The client may want to bottle a bourbon barrel after 10-15 years and they think they are getting 200 litres…..and they have lost 2-3% per annum.

Sorry, a longwinded way of saying that it is not relevant to our business or model.”

So in short, doesn’t affect our investment.

BTW: I haven’t found a platform which lets me invest in Port yet. You can be sure I will if I find one that makes sense though 🙂

I opened an account when I read your article and so far got about £2800 invested. Initially I spread across malt and grain whiskies and across a range of years, mostly buying from the live order board with ‘sold out stock lines’ and concentrating on those with smaller buy/sell spreads. More recently I’ve used the ‘pre-order new stock’ facility. I’ve sold a couple of lines when the price rose significantly and I decided to take the profit, I’ve also sold my first batch through the Bulk Trade Buy facility.

Experience so far has been good. I like the website, although it can take some time navigating backwards and forwards if you have a large number of lines (I’ve got 15+ individual lines at the moment).

I am intrigued as to how the price is set. On the face of it this is a straight trade using offers from buyers or sellers at the price they want. This week however pretty much every price went up by 3-4% in one day, very unlikely to be an across-the-board increase in prices offered by sellers. When I asked WID the reason they said it was in response to greater retail demand and more offers coming through the Bulk Trade Buy route – so suggests to me that WID themselves place buy offers at a price they want to encourage as a ‘market value’; further evidence of this is that many whiskies from different distilleries but the same type (malt / grain, cask type) and the same age have the same price, unlikely if the sell offers come from individual investors. This type of market fixing suggests that the number of trades between investors is not sufficient for an ‘efficient’ market.

Hi Peter,

I know they do release certain liquids that they hold themselves sometimes. Not sure that is price fixing as why wouldn’t they want to profit as well as their investors?

3% – 4% in a day I don’t think is so out of the ordinary. I’ve seen the whole US stock (and bond) market do that once or twice (long term bonds were off almost as much as that this Monday just gone), and some crypto moves that much almost every day.

That’s just my opinion of course. Who knows? As long as it goes up 3% or 4% I’m happy.

I have a lot of trust in these guys from the conversations we’ve had and research I’ve done. Plus being associated with BullionVault gives them a good bit of credibility with me.