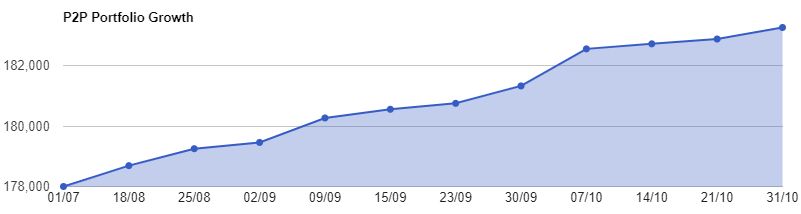

Peer to Peer Lending Portfolio Update for October 2018.

Live versions of these charts are always available here.

Overview

Portfolio growth is plodding along as expected. A little over £833 income for the month which really isn’t bad. I get emails from banks regularly touting 1.3% interest on their super-duper accounts, which would mean less than £200 per month on the capital I have invested in Peer to Peer. A little safer, maybe, however they are still lending the money out at the same rates as the Peer to Peer lenders, and just pocketing a big chunk of the income instead of passing it on to investors as Peer to Peer companies do. Actually, technically the lending platforms are not passing anything on as we as investors are lending directly to the borrowers in most cases. The lending platforms just take a cut, mostly from the borrower, but in some cases they also charge us, the investor a fee.

I increased investment in October with Lending Crowd (again) and also with Unbolted. I wrote a review on Unbolted earlier in the month, afterwards I thought I would send over a little more capital just to see how well it gets lent out. It seems to be a little faster than when I initially deposited capital with them. I’ll watch and maybe even send over a little more in November as I would like to get some more capital diversified in to these pawn types of loans.

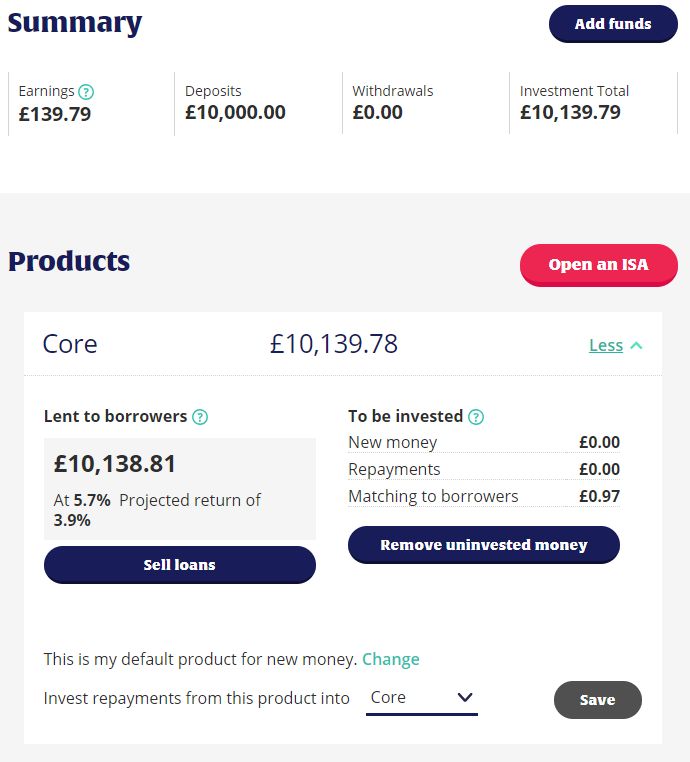

Below is an overview of each account along with screenshots so you can see what is happening with each lender.

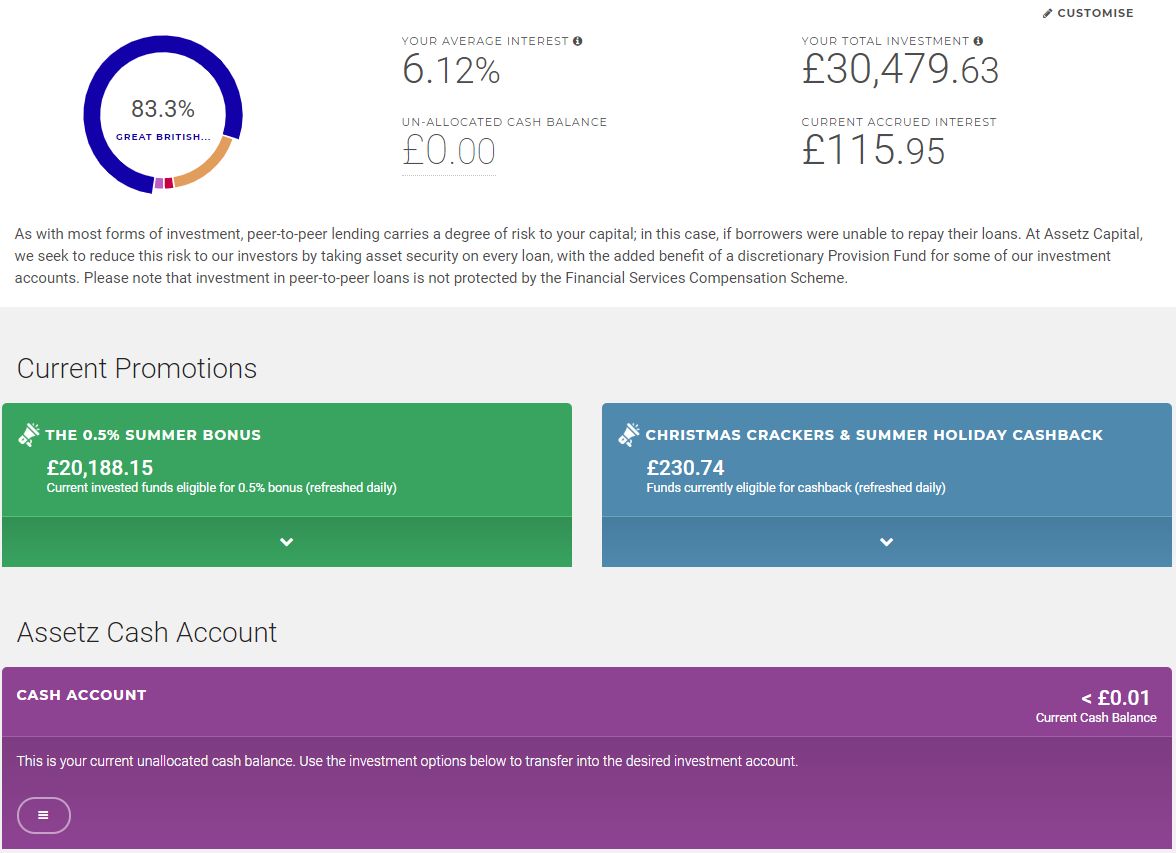

Assetz Capital

Assetz Capital continues to do well, second highest return (amount) overall so far only after Funding Circle. The only single thing I don’t like about Assetz is the diversification in their auto-invest accounts. As you can see from the screenshot above, they have over £1011 in just one account which is almost 4% of the overall account balance. Even with their provision fund (which remember is discretionary) and their asset security, it still makes me a bit uncomfortable. Not much I can do about it if I want to use auto-investing though, Assetz platform decides on the diversification. I’ve actually been thinking about removing some money from the 2 accounts I’m in with Assetz and giving their manual investing a try. The target rate over all loans in their manual invest is a little over 9%, and there are over 400 loans right now so it would be quite easy to get invested and diversified. Only thing is there is no provision fund in the manual-invest account, so I would need to spend more time watching the loans so I can sell them if they go bad before they get frozen. I’ll watch and think on it some more.

Funding Circle

Funding Circle continues to out-perform the rest of the lenders as far as actual returns go. My target rate is 7.2% however my actual is running at 9.0%.

I did have my first loan go bad since the portfolio was restarted in June, so there is a £48 loss which has been taken from the profit. Defaults are expected and accounted for in the target 7.2% return rate quoted, so they are just something you have to expect with P2P lending. Payments on all of the other loans look to be up-to-date though, so hopefully no more defaults in the immediate future.

I’ve said it before but one thing I do really love about Funding Circle is the way they diversify. My money is lent between 462 business as of today, with no more than .05% of my account value in any single business.

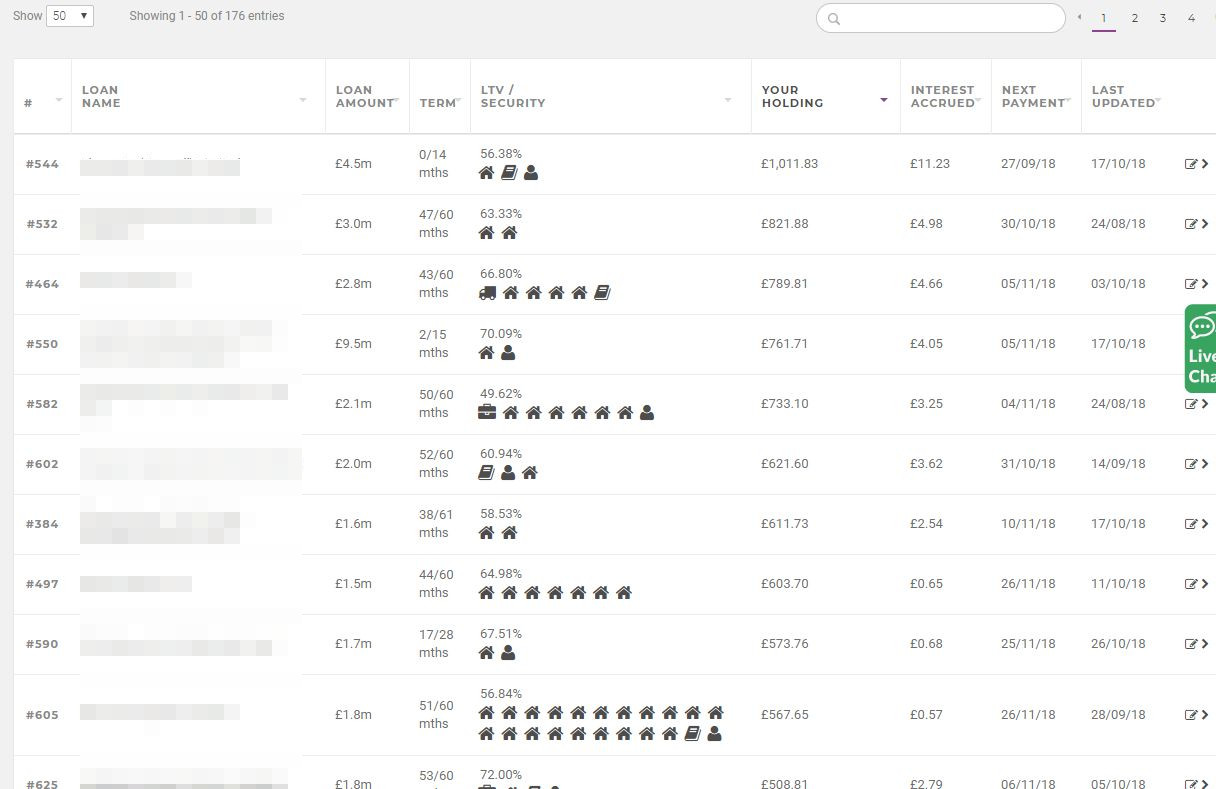

Growth Street

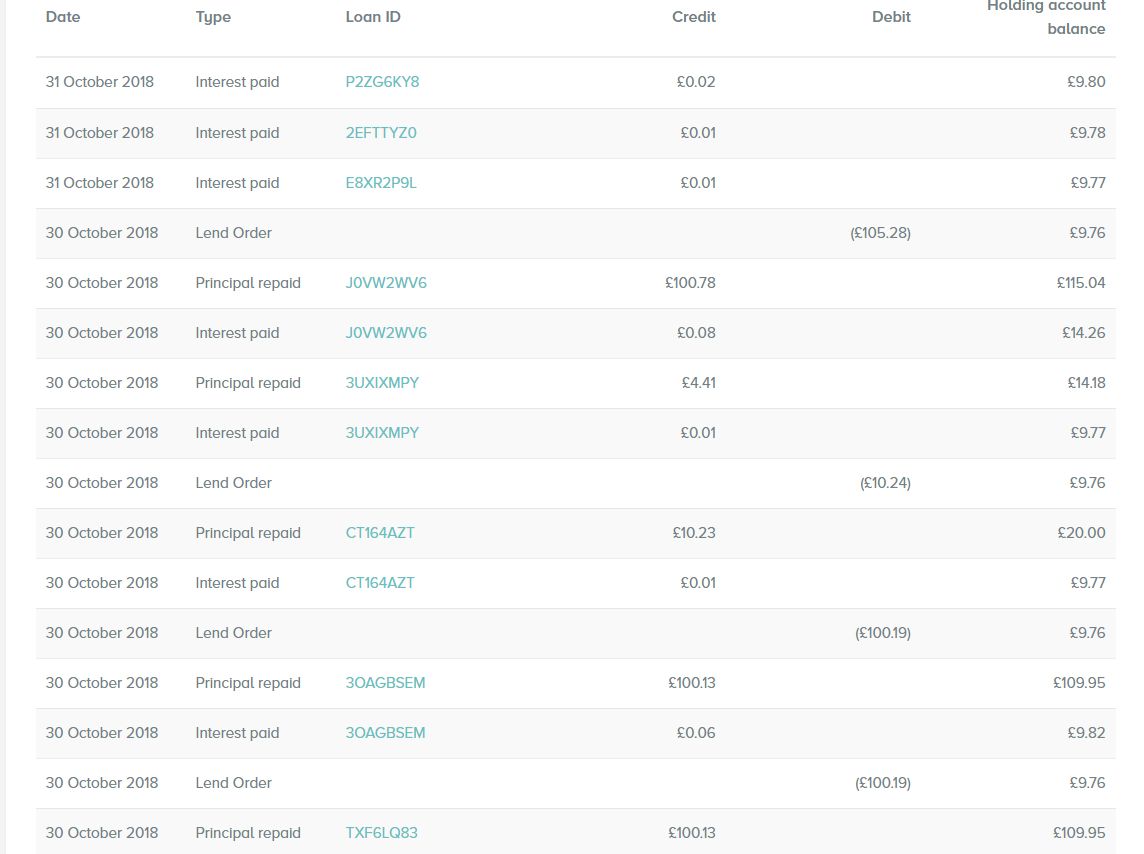

Growth Street always seems to be very quiet when I log in to my account. The cash drag I was seeing a little bit seems now to be gone. Capital seems to be loaned out the same day, as soon as it is repaid, or if not the following day. It’s interesting when you dig down in to the transactions screen though, to see that there are many small transactions going off in the background automatically.

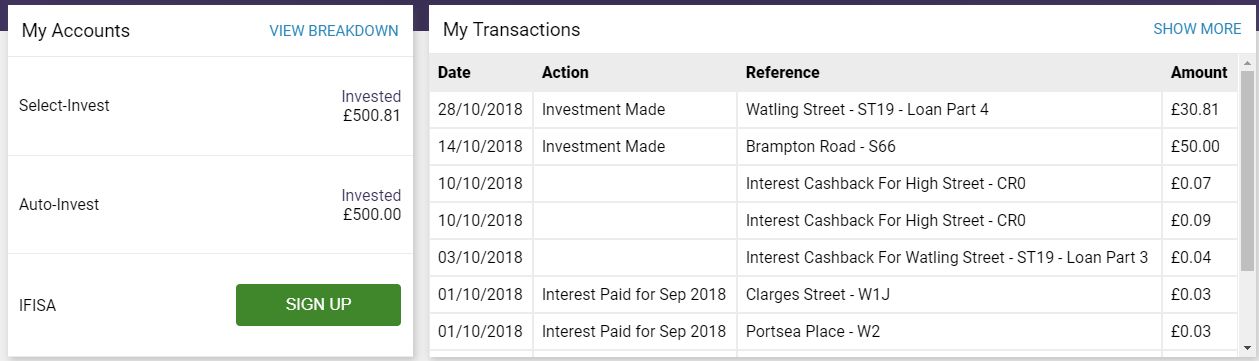

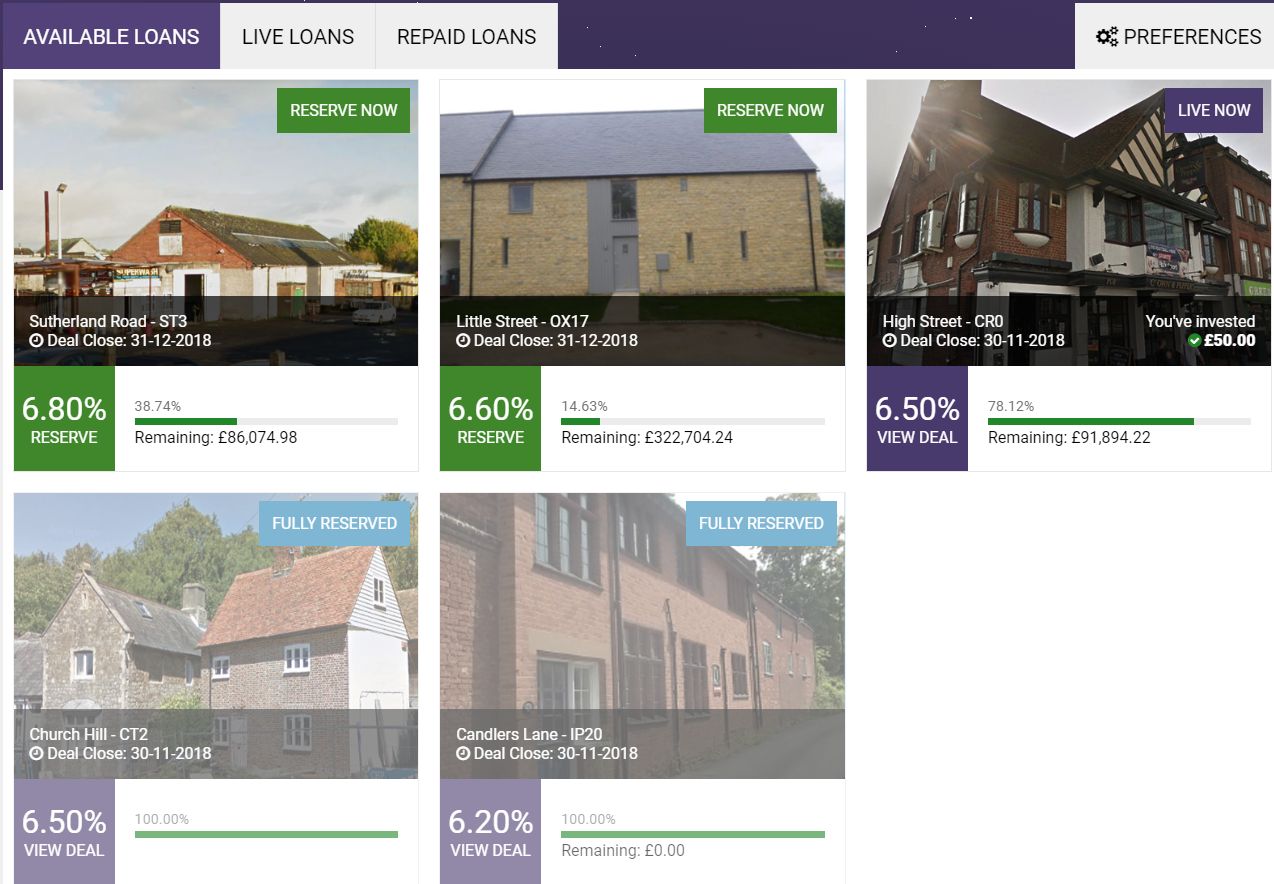

Kuflink

I finally used up my un-lent capital with Kuflink last week so I will send a little more over. Their loan supply is quite slow, but the loans they have are very good and well vetted, and the asset security seems to be very reasonable along with their “skin in the game” (read the review for info). Still, I’m trying to diversify as much as possible. I’ve been putting £50 in per loan but I may increase that moving forward. Kuflink’s auto-invest accounts pay interest annually so I’ll need to wait to see my account grow from actual profit there.

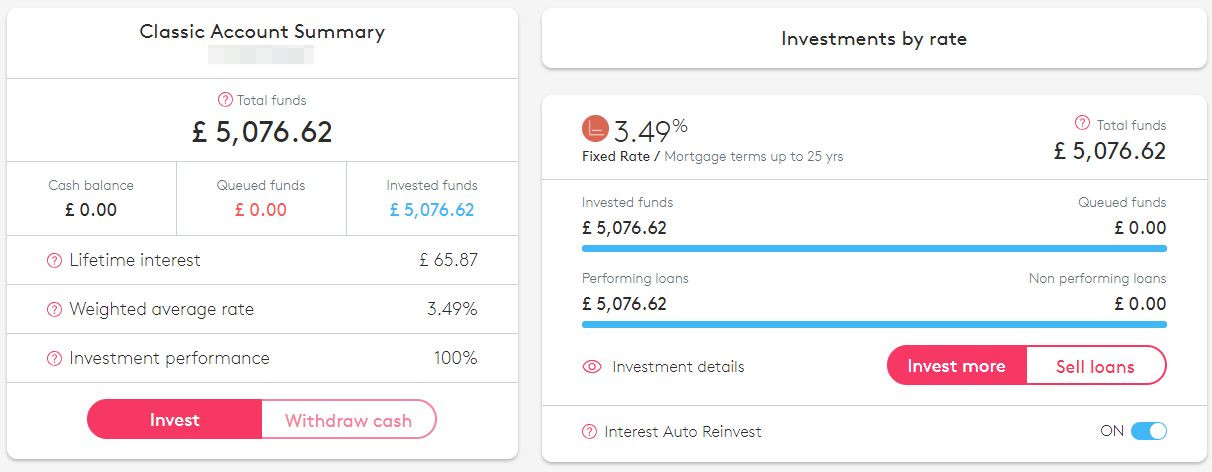

Landbay

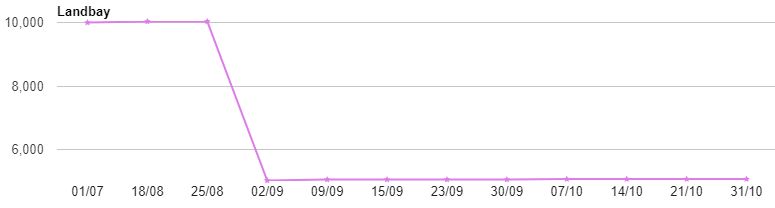

Landbay continues to be the most boring (boring is good where investments are concerned) but also (apparently) the safest lender. When I started P2P lending about 5 years ago, I would have thought that 3.49% with any low risk investment was very, very good. Considering banks were paying less than 1% at the time. These days though, I look at Landbay and think “why do I keep this money there”. I could put this with Mintos and be making 9%+! Risk = reward though, so there is some sanity to keeping little capital here with Landbay.

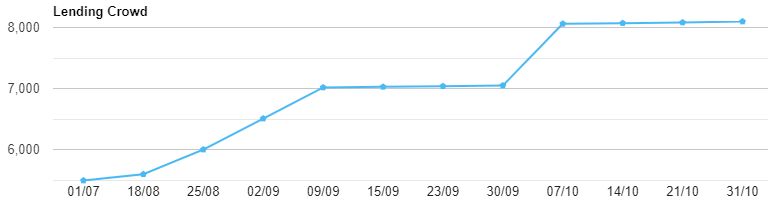

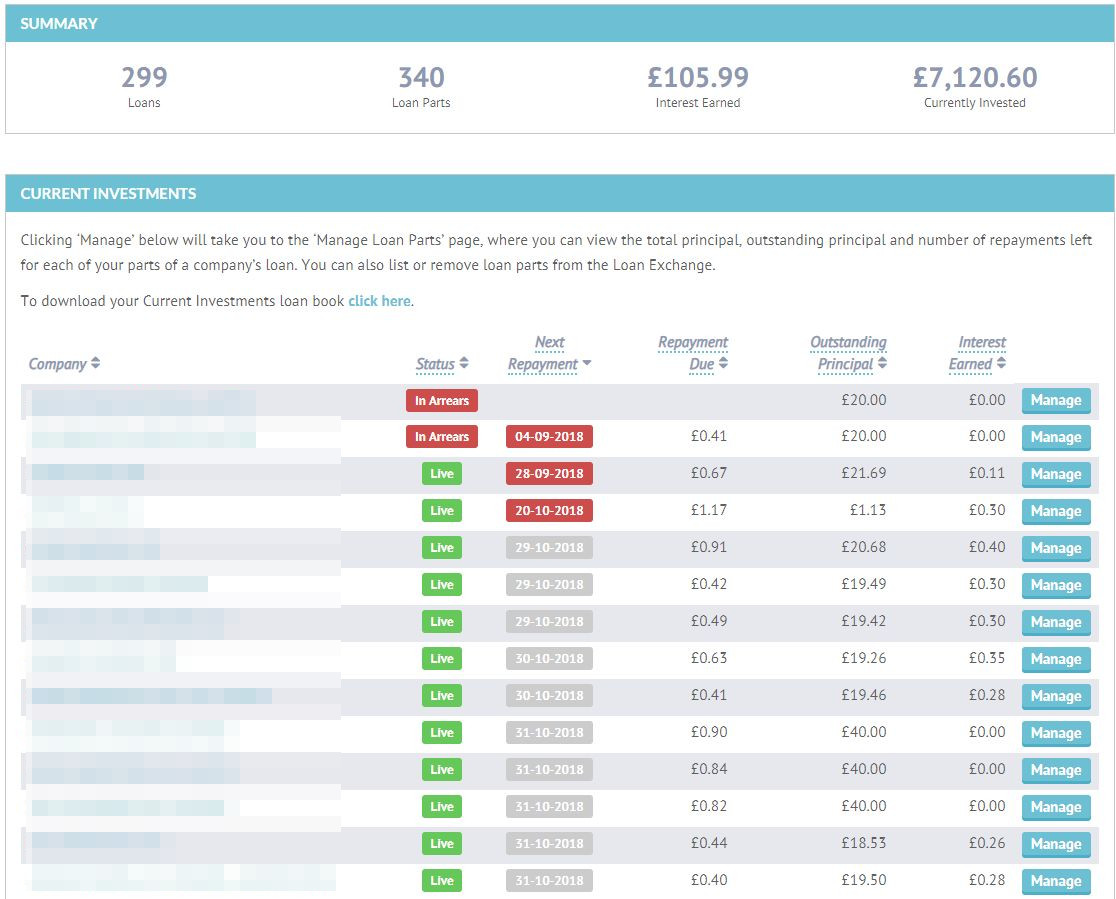

Lending Crowd

I increased my investment with Lending Crowd by £1000 in October so I can continue to bid on loans. Lending Crowd continue to be a hobby for me as well as an investment. I still bid on loans almost every day, as they have had a really good new loan flow recently. In the last month I have increased my loan number from 274 to 299. All of these loans were through bids. With every new loan I’m at around 1% higher return than the overall rate on each loan. This not only means better return rates, but it also makes the loans easier to sell if I ever need to exit early, as investors seem to buy loans more quickly when they are above the average return. You can see from the screenshot below what I mean about the average rate and my rate. This loan hasn’t fully funded yet so chances are the average rate will drop quite a bit before it goes live.

I have a couple of loans that are in arrears, and a couple that are just late in the screenshot below (although while writing this post, I just received an email from Lending Crowd that said one of the loans is now up to date). I have learned that loans are marked as late 5 days after the payment was supposed to be made. So what I have started to do is to try to sell loans on the secondary market on the 4th day they are late and let someone else take the risk of default if they want to. I managed to sell 2 loans last week that then went in to arrears. Hopefully if I can keep on top of this method, it should help keep my returns on the higher side.

You can see in the screenshot below how to sell loans. Simply move the “Loan Exchange Status” slider to “Listed for Sale” and then the loan becomes available on the secondary market. After a loan is marked by Lending Crowd as “In Arrears” though, after being 5 days late, the “Loan Exchange Status” slider then becomes unavailable

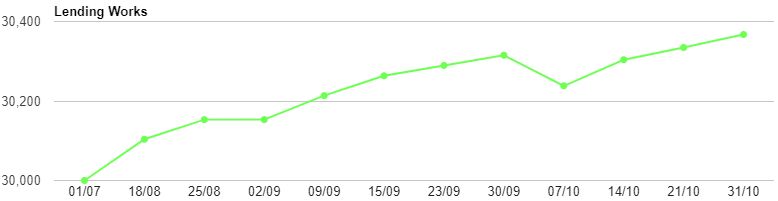

Lending Works

Lending Works continues to be an easy hands-off investment. Just set everything up, then leave it alone and the interest rolls in. There was a little bit of a bump this month (see growth chart above). I logged in and noticed that my account value had gone down. This shouldn’t happen with Lending Works as any defaults are taken care of by their Provision Fund (Lending Works Shield). I sent them an email basically saying WTF (in a nice way) and received an email back explaining that they had changed the way they display balances on lender accounts (see email below). So no big deal. Just a change in the way they display things. I’m happy they did this as I didn’t realize they were displaying a balance with accrued but not yet received interest in there.

Mintos

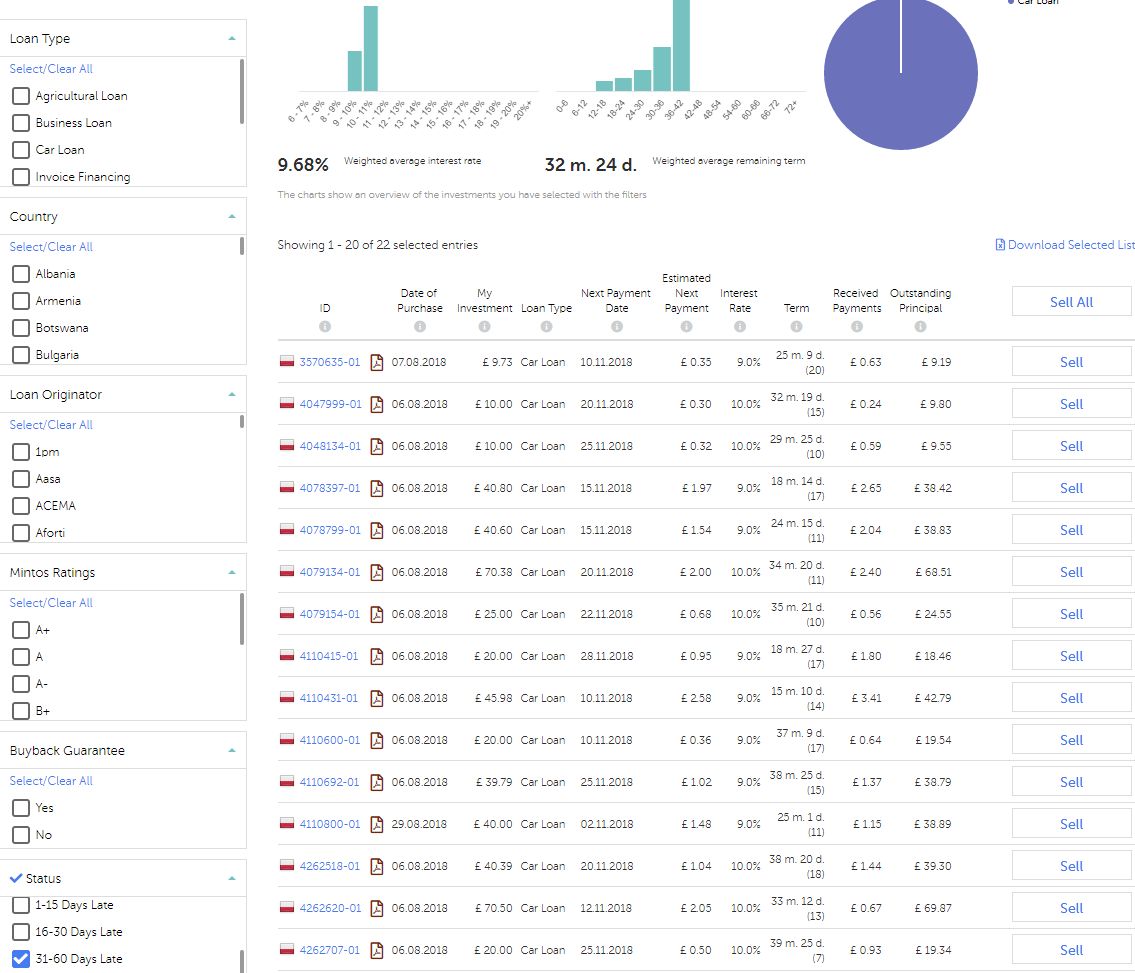

There has started to be some cash drag with Mintos due to lack of loan availability in GBP. When loans are repaid, or they go over 60 days in arrears, and the Mintos originator buys them back (in my case Mogo), the cash goes back in to my lender account and sits there. It’s a little frustrating when they have 140,000 loans available in Euros, however I guess I shouldn’t complain. The fact that a Latvian lender has loans available in GBP at all is quite amazing if you ask me.

You can see above that there are quite a few loans going in to the 31-60 day late range. Once they get over 60 days late, MoGo will buy them back and the money will be deposited back in to my lender account and wait there until there are loans available to buy again.

Here you can see this is the only GPB loan available for sale as of October 31st. This loan is a business loan with no buyback guarantee, so I’m not really interested in it. I’m amazed that anyone buys these unsecured business loans with no provision fund, or buyback guarantee. 10% return for that kind of risk is just not worth it to me.

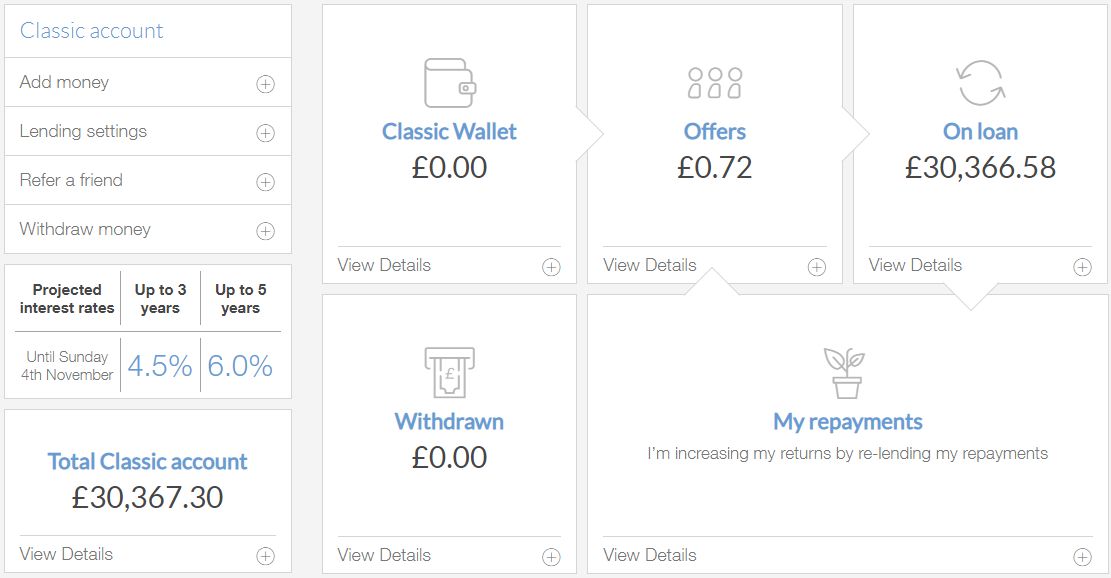

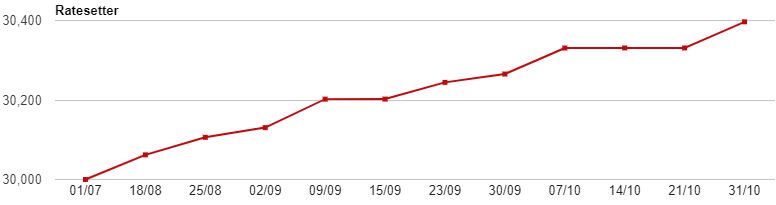

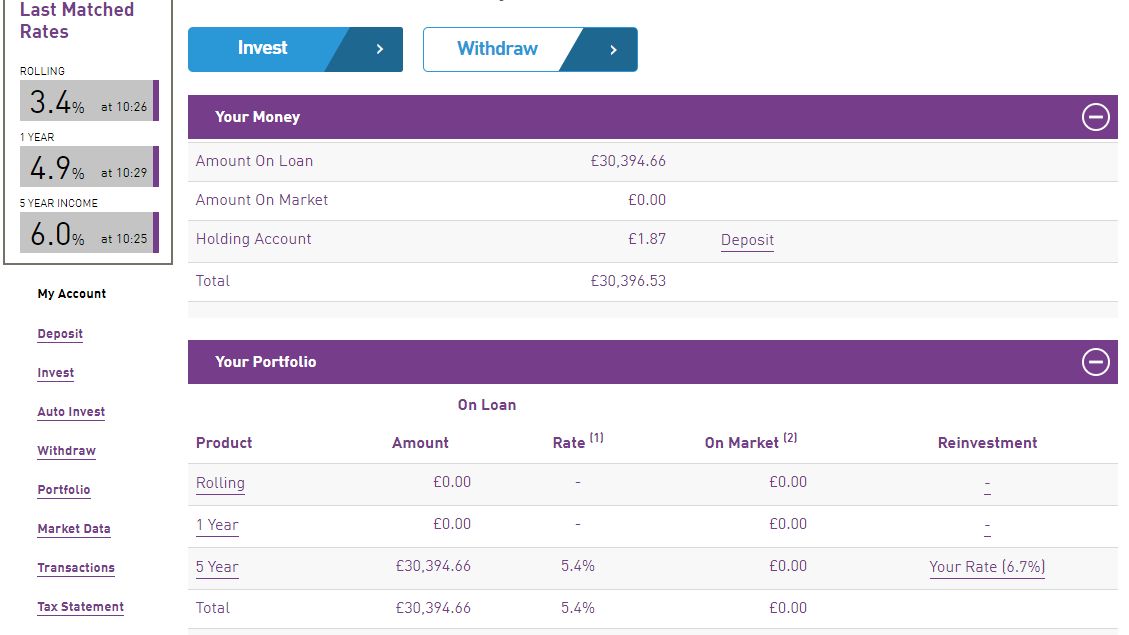

Ratesetter

Ratesetter’s rates continue to rise. I got in at 5.4% back in June when I reset my portfolio. Over this last weekend I saw rates of 6.7% which is very good for a large lender like Ratesetter. I set my reinvest rate to 6.7% to see if I can get that rate on funds repaid from other loans and reinvested. I’ll keep my eye on it and move the rate as needed.

Here is a screenshot of Ratesetters rate table for the last few days.

As you can see, there was a possibility of getting around 5.3% on a 1 year loan last weekend. Kind of annoying when I got 5.4% locked in for 5 years, but that’s the way lending goes.

Unbolted

After finishing up a review on Unbolted a few days ago, I decided to send over another £100 to see how long it took them to lend it out. This screenshot is from the day after I sent it, so they already lent about 40% of it out, which is not too bad. However lending out small amounts is one thing, not sure how they would do if I upped the investment by 10 or 20 times. I’m guessing not so well, but I’ll continue to send bits of capital over there and see how they do. I like being able to get in to these loans as they pay well, and when there is default, items are easier to sell than property in order to recoup capital.

Here is a list of where the recent capital deposit went. Rolex watches and diamond earrings were a couple of items 🙂

Zopa

Zopa always gives good information on where your money is and when payments are coming in. It’s all quite useless though as their auto-invest (only) accounts distribute the capital between loans for you and don’t offer any way to exit bad loans. If you try to sell your loans so you can withdraw capital, Zopa will tell you how much you have in loans that are in arrears. It won’t let you withdraw the capital which is part of loans that have gone bad though, and won’t even let you see the loans that are actually in arrears, which never seems to make any sense to me. Zopa is the oldest lender in the UK, but I’m not sure some of their latest changes to the way they do business are the best.

Summary

That’s all for this month. Once you get invested in the P2P market, unless you do the self-bid stuff as I do with Lending Crowd, there is really nothing more to do. You can be as “hands on” or as “hands off” as you want with Peer to Peer Lending. In my “Top Lenders List” I make suggestions for accounts I would use for different strategies like “Low Risk/Returns, Hands-off” and “High Returns – involved investing”. You’ll need to subscribe with your email if you want access to the list though.

Feel free to email me if you have questions.

This P2P stuff looks interesting. I have never heard much about it before.

Thanks for posting your figures! It makes it more real to see the results.

Tom

Hi Tom,

You’re welcome!

Let me know if you have any questions or if there is anything I can help with.

Cheers,

Mark

Just started investing with Unbolted – put £500 in which has been allocated in about a week – I like the fact that each investment is small and diversified over a large number of loans. Also using Welendus which has a buy back guarantee and is working well with loans allocated very quickly.

Hi Ian,

I upped my stake in Unbolted by another £500 myself this month. They are allocating a little more quickly now which is great!

Been looking at Welendus myself but haven’t taken the plunge yet. I’ll take another look at them, thanks for the tip!

Cheers,

Mark