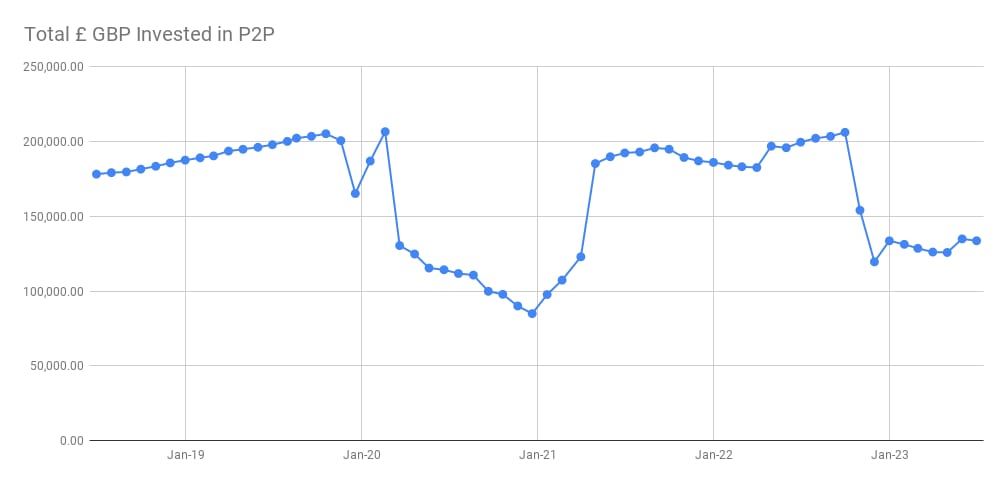

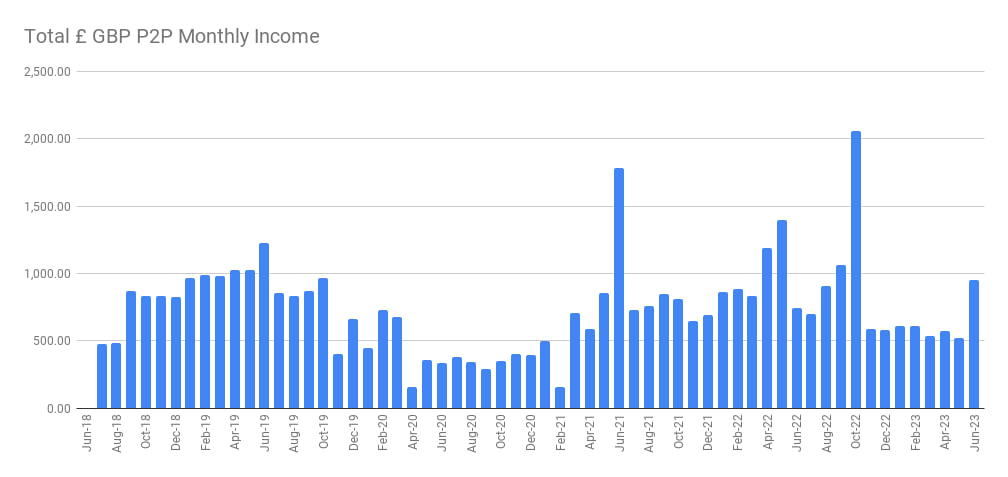

Below are the results of my British Pound based Peer to Peer Lending portfolio. This is income from UK Peer to Peer Lenders, many of whom I have been investing with since 2015. I started to publish returns information on my website in 2018. As you can see below, in 2020 because of the COVID pandemic, I drew down my P2P investments significantly, as many investors did. We did not know at the time how bad the pandemic would get, and which (if any) of the P2P lenders would survive.

Sure enough, many have closed down or been bought by banks & other concerns. Other platforms went to lending with government backed business loans, which do not allow retail investors to invest into.

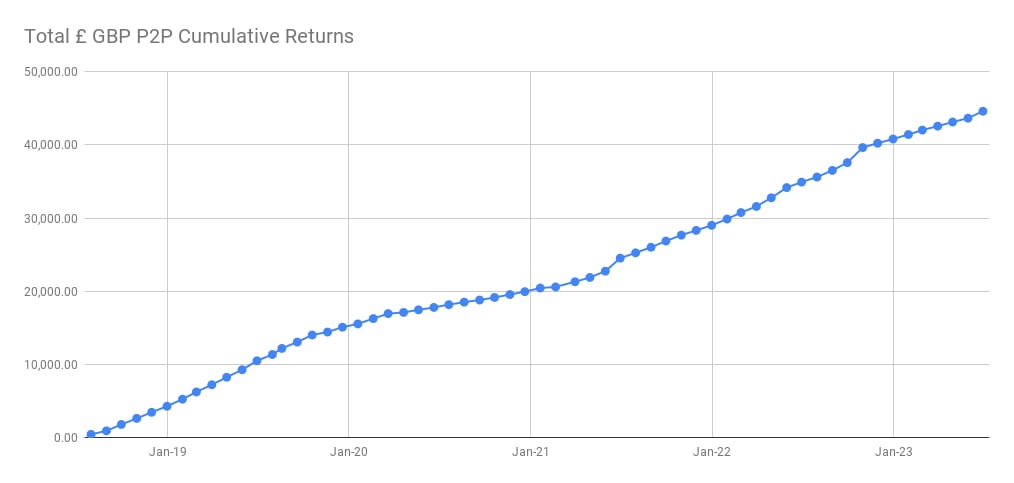

On the positive side, I didn’t lose a penny because of the pandemic through any GBP lending platform, which says a lot about the general strength of the industry in the UK in my opinion.

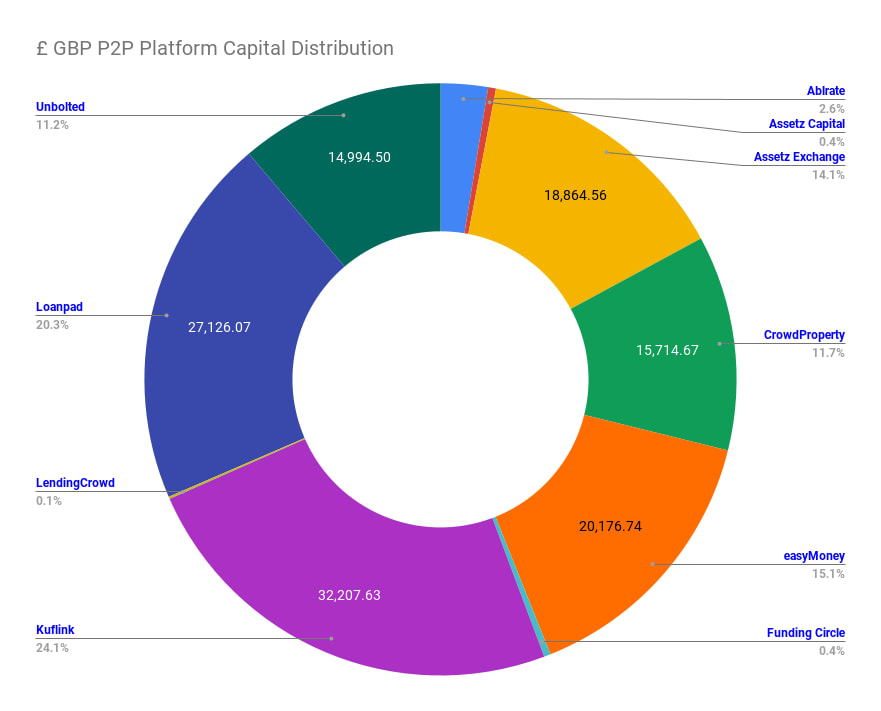

In January 2021 I started to increase my investment in Peer to Peer Lending again, becoming almost fully invested by the end of May 2021. Since then my overall average return (XIRR) from this portfolio has been around 5% (down from pre-pandemic levels) which I am currently trying to increase by moving capital from safer lower paying lenders to lenders with better returns. More recently I have also been moving some of my Peer to Peer Lending capital to my Whisky Portfolio so that is why you can see on the chart below total investment heading down slightly.

Tracking spreadsheet & income charts updated monthly.

£ – GBP Peer to Peer Lending Portfolio Return Charts.

(Click on Chart for Interactive)

Peer to Peer Lending Portfolio Tracking Sheet (live Google Sheet)

Some versions of Safari Browser have difficulties displaying the Google Sheet below for some reason, so if you can’t see it, please try another browser (Chrome & FireFox work well). Alternatively Click Here to see it on Google Sheets.

Euro Peer to Peer Lending Portfolio

For anyone looking for the Euro Portfolio, I have been drawing it down slowly as because I live in Portugal much of the time, I live on Euros, so I have been using the Euros that I have invested in Euro Lenders for living expenses. Typically I would change US Dollars or GB Pounds for Euros, but the Euro has been rising rapidly recently, so I decided to use the Euros I have before changing more at this high rate in the hope it comes back down soon.

If you have Euros to invest and are looking for ideas. There are a few Euro Lenders that have come through the pandemic and seem to have been largely unaffected, namely Crowdestor, Mintos, Swaper, Peerberry & Robocash have all done what they are supposed to do. I will invest in these all again once I am ready to invest Euros again. I believe they are all decent investable companies paying very good returns.

Peer to Peer Lender Reviews

Proplend Review

LendingCrowd Review

Find UK Property Review

easyMoney Review

Unbolted Review

Kuflink Review

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.