Landbay is no longer accepting investment from retail clients (please see statement from Landbay below).

Review maintained for historical information purposes.

On December 5th 2019, all retail investors received the following email from Landbay.

All capital was returned to my account along with all interest owed.

What is Landbay?

Landbay is a medium size Peer to Peer lender providing loans to experienced buy-to-let landlords with properties which have low loan to values (LTV less than 73% ).

Rental incomes typically cover a minimum of 125% of the mortgage payment.

Landbay offers lower returns (3.10% – 3.54%) compared to some other lenders. However with the safety of secured income property, and a provision fund that provides another layer or protection to lenders. Landbay mortgages are probably one of the safest places in Peer to Peer lending to put your Landbay ISA.

Landbay is about as close to a bank as you can get. Although they are not a bank, and as with any investment, remember your capital is at risk.

My Experience with Landbay

Landbay are probably the easiest, and one of the safest lenders out there. They are not my largest Peer to Peer lending account by any means, just because of the low returns they offer. Lower risk = lower returns. However if you’re just looking for somewhere safe to park your cash and beat inflation, you could do a lot worse than Landbay.

My experience with Landbay has been nothing but good. Deposit your capital, put in a lend order and forget about it. In fact the only time I log on to my Landbay account is to update my Peer to Peer Tracking Spreadsheet and for getting figures for my monthly updates.

Click here to see account screenshots and the latest monthly update.

December 5th, 2019

Landbay is no longer accepting investment from retail clients (please see statement from Landbay above).

I don’t really have an opinion on this. Landbay made a decision (probably in light of the new FCA regulations due out on December 9th) that retail clients were not profitable or substantial enough for it to continue servicing them and as such decided to stop accepting investments from them. It’s all fairly self explanatory.

View Consolidated Monthly Investment Returns from All Lenders

See Screenshots & Detailed Monthly Updates From My Personal Landbay Account

The Obvious Investor – Easy-Info Table© – Landbay Review

The Obvious Investor – Easy-Info Table© – Landbay Review

Overall Rating*:  (4 / 5)

(4 / 5)

Who can invest: ![]()

Loan Currencies: £

![]()

Estimated Return: 3.10% to 3.54% depending on account.

My Annual Return

(Per Lender): 3.49%

My Calculated XIRR: 3.46%

My Current Investment:(click to see amount in £) See My Investment £

Risk Rating*: 2/10 - Low

Early Exit: Yes. Under normal market conditions.

0.20% fee plus difference on fixed rate account.

No fee on tracker account.

Min. Investment: £100 first deposit on standard accounts.

£5000 for ISA account.

Deposit Funds: By bank transfer or Visa debit card. Usually takes 24 - 48

hours for BACS bank transfer.

Can be same day for Faster payments.

Debit cards can take up to 3 days to clear.

Auto-Invest: Yes

Manual Invest: No

Lending To: Borrowers

Loan Security: Yes: on property.

Default Rates: Landbay expect a 0.10% default rate.

However there have been no defaults to date.

Provision Fund: Yes

Loans Amortize: Some yes. 25 year mortgages.

Some loans interest only.

Time to Invest: Medium.

Can take a few days depending on loan availability

Time to Mange: None (auto-invest)

Lender Fees: No

When are Payments Received: Monthly.

Amount Lent: £300m +

Number of Investors: Not published

Loan/Dflt Stats: Click Here!

Regulated: Yes: FCA

Location: HQ - London, UK.

![]()

Launched: April 2014

Website: https://landbay.co.uk/

Email: enquiries@landbay.co.uk

Telephone: (0)207 096 2700 (UK)

IFISA/IRA: Yes: IFISA

Cashback**: Yes! £50 Cashback! Click here for further information.

How to Sign Up**: Sign Up Here!

Landbay Review – Overview

History

Landbay were launched in 2014 in the UK. In the 5 or so years they have been in business, they have built a portfolio of over £300 million capital lent on properties with a value of over £430 million.

Landbay are proud to declare that they have had zero defaults, and no investor has lost money since they have been in business, which is a great track record however you look at with Landbay mortgages.

Even if there were to be defaults in the future, I would not personally worry about it based on the security all of their loans have, and the provision fund on top of that, it is unlikely I would lose much capital if any at all.

Personally I have some capital in Landbay but not as much as in some of the other Peer to Peer lenders as I don’t mind taking a little extra risk for the higher returns.

If you are very risk averse, Landbay could be a very good option for you.

Regulation

Landbay is a Peer to Peer lender regulated by the UK’s Financial Conduct Authority (FCA) with full permissions under FCA number 719626. They gained FCA permissions in December, 2016.

It’s important to note that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

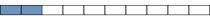

Signup Process

Opening an account with Landbay is easy. Just the usual ID & anti money-laundering checks. Same for the Landbay ISA, although if you wanted to move one from another investment firm, you’ll need to fill in some extra forms.

If they can verify you though one of the UK’s credit agencies, you will be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

Only residents of the UK, with a UK bank account can signup with Landbay (as of the time of this Landbay review).

Deposits & Withdrawals

Deposits and Withdrawals are made by bank transfer from a UK bank, or a UK Visa debit card (visa only).

From a bank account, deposits usually show up in your account the same or next working day. Debit card deposits take a little longer to clear, 2-3 days typically.

Withdrawals are only to a verified bank account and typically take 2 – 3- business days.

Time to Become Invested – Landbay Review

It can take a few days to get funds completely invested in to Landbay loans, however it doesn’t matter as Landbay is one of the only lenders to pay interest on funds, even while they are waiting to become invested.

So as soon as your money is deposited and in the queue to be invested, it is earning interest.

Who are we lending to?

Landbay is a true Peer to Peer Platform. Lenders are lending directly to borrowers who are typically experienced buy-to-let property owners.

Landbay just acts as a middle man, managing loans, payments and debt collection etc.

Loan Security – Landbay Review

Landbay loans are all secured with tenanted buy-to-let properties with LTV’s (Loan to Values) typically below 73%.

Also it’s important to note that rental incomes on properties typically cover a minimum of 125% of the payments on the Landbay mortgages when they are purchased, which provides an extra layer of comfort for lenders.

Default Rates

Landbay state that to date they have had zero defaults, and no investor has lost money.

This is one of the reasons return rates are lower than other Peer to Peer Lenders, lower risk = lower returns. As rates on mortgages to borrowers are so low currently, it would be difficult for Landbay to pay more return on it’s mortgages

Amortization – Landbay Review

Some Landbay mortgages amortize over a 25 year period, meaning you receive capital and interest payments every month.

Some loans are interest only loans, where only interest is paid monthly and the capital is repaid at the end of the loan period.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over time. It is an accounting technique used to lower the cost value of a finite life or intangible asset incrementally through scheduled charges to income.

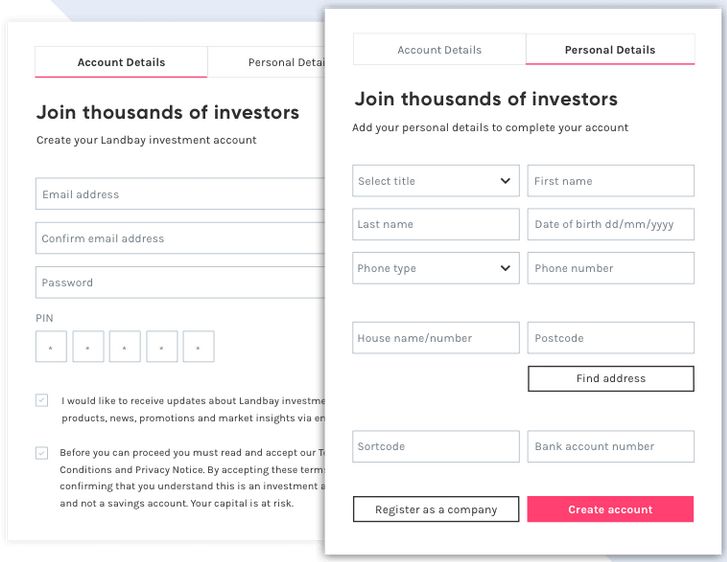

Selling Loans and Withdrawing Capital

There is no fee to exit the Tracker Account.

However there is a 0.2% exit fee for loans in the Fixed Rate Portfolio. If interest rates have risen since you made the original investment, there can also be a spread fee between the rate you received and the rate when you withdraw.

You can exit for free by setting auto reinvest to off in the Fixed Rate Portfolio, but it could take close to 25 years to become totally un-invested.

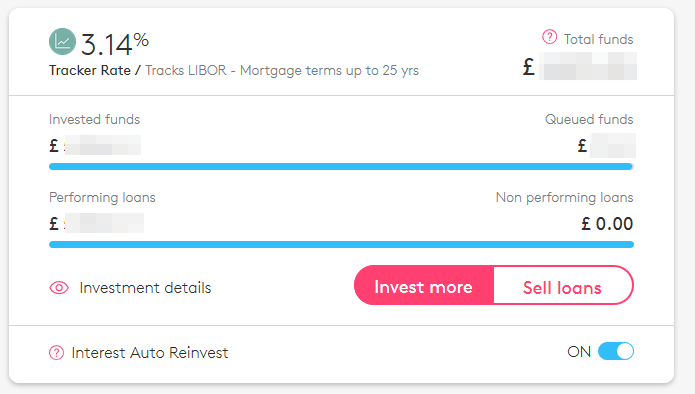

Here you can see the screen for selling loans and withdrawing capital.

Diversification

Diversifying loans is something Landbay does automatically. Because of the way their platform works, diversification is all done in the background.

It is not even possible to list the loans you are invested in as it doesn’t really make any difference.

Landbay’s provision fund would in theory take care of any defaults if any of Landbay’s mortgages were to go bad. However to date there have been none.

Provision Fund – Landbay Review

The Landbay provision fund is currently stated as covering between 0.5% to 0.6% of all outstanding loans.

This is useful for keeping payments to lenders on time in the event of a default.

Landbay mortgages are all very well covered with property assets and their lending criteria is so strict, it is a very rare occurrence that the provision fund would need to be used.

Retirement Account

Landbay offers an Innovative Finance ISA (Landbay ISA) which was launched in February 2017 for UK residents.

The minimum investment for their Landbay ISA is £5000 with a return of around 3.5% (varies).

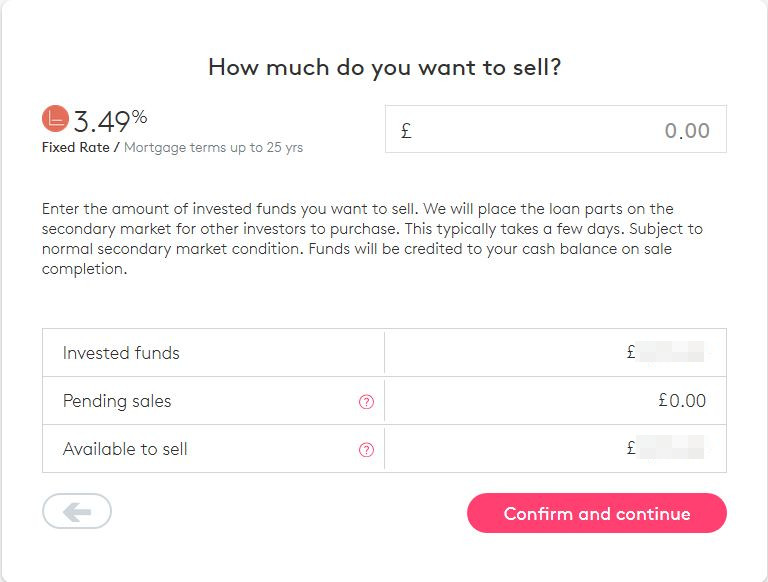

Accounts – Landbay Review

Landbay offer two classic (non Landbay ISA) investment accounts:

They have a “Fixed Rate” account currently offering returns of 3.49% on loan terms of up to 25 years. This has an early exit fee of 0.20% plus any difference in interest rates if they have increased since you bought your loans.

I like the “Tracker” account which tracks the “London Interbank Offered Rate” (LIBOR) which has a slightly lower return rate. However this has zero fees for exiting the account, so it is basically a quick access account that you can instantly pull your funds out of any time under normal market conditions.

Website – Landbay Review

Investing on Landbay’s website is easy. You just choose your portfolio and the return you want:

Then add money by either bank transfer or debit card (bank transfer is actually faster with Landbay which is not the norm. I typically find debit card transfers with most lenders are instant if they accept them).

And then sit back and watch your interest roll in.

Don’t forget to set your “reinvest” switch to on if you want a completely hands off investment experience.

That’s it! Very much like a regular bank savings account. Remember there is no FSCS insurance like a bank though and your capital is at risk.

Summary – Landbay Review

Landbay is one of the safest Peer to Peer lenders in the UK. Their website is built to be easy to use so just about anyone can deposit capital and receive bank beating rates.

The low risk comes with a price though, low risk = low returns.

If you’re new to Peer to Peer lending and a little nervous about giving it a try. Landbay are a good option for starting out and getting your feet wet in relative safety.

Thumbs Up Points for Landbay

-

Safety – Landbay is one of the safer Peer to Peer lenders. A medium size company with good history of providing secured loans to professional property investors with good LTV’s and a history of zero defaults.

-

Provision Fund – another layer of protection covers a portion of lenders investments should a default occur.

-

Auto-Invest –very easy to invest, and hands off investing once set up

-

Website – very easy to use and understand.

-

Low minimum investment– £100 to start – if your portfolio is still small, it’s still easy to invest with Landbay with a £100 minimum investment to start in regular account (£5000 in IFISA).

-

Instant, no cost exit – in “tracker” portfolio in normal market conditions.

-

Financial Conduct Authority (FCA) Regulated.

-

Landbay ISA – Landbay ISA available for UK investors.

Thumbs Down Points for Landbay

-

Investment Time – it can take a while to put money in the market initially, even if the amounts are small. Landbay pays interest from day one though so even if it does take time, you are still earning interest on your deposit.

-

Lower Returns – lower risk investments means lower returns. As Landbay are providing long term mortgages, it would be difficult for them to pay higher rates with current borrower rates being so low.

-

Early Exit Fees – for the fixed rate account it’s going to cost 0.2% plus any difference between your loan rate and current rates.

Risk Factor – 2/10 – Low

Is Landbay safe? I consider Landbay to be at the lower end of the risk scale.

Taking in to consideration that all loans are secured with a low LTV, and the Provision Fund, it’s hard not to give it a perfect number 1, but this is still an investment with no FSCS government backed insurance, and as such, capital is still at risk.

Although I could not find a TrustPilot rating for Landbay, their Feefo rating is very good.

Who Can Invest with Landbay

![]()

U.K. resident investors with a U.K. bank account and a U.K. address and phone number who can pass the ID checks can invest with Landbay. Contact Landbay for further information.

Offers & Signup Links**

Landbay is no longer accepting retail clients. See information at the beginning of the review.

Similar Lenders to Landbay

Landbay Promo Video – How It Works

Disclaimers: This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website. * My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective. ** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations. Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences. Please read my full website Disclaimer before making investment decisions.