Mintos – Pros & Cons

PROs 👍

- Unique Diversification – focusing on consumers and businesses in many different countries.

- Great Returns – 19%+ in Euro investments, is nothing to sniff at.

- Huge Loan Book – there should never be any cash drag with Mintos loans.

CONs 👎

- No Regulation – may make Mintos Marketplace a riskier proposition.

- UK residents no longer allowed to invest.

- Loan Originator Buyback Guarantees not always enforced by platform.

Up to19% Returns Available Investing Euros With Europe’s Largest Peer to Peer Lender– Mintos Review. Is Mintos Safe? Find Out! New Mintos Marketplace iPhone App.

What is Mintos?

Mintos Marketplace – is the leading, and largest European Peer to Peer (P2P) Lender, providing loans to consumers & businesses around Europe.

Offering higher returns (up to 19%), and a huge loan book in multiple currencies, Mintos makes investment fast and easy wherever you reside. All coupled with the added safety of the “Mintos buyback guarantee” & “skin in the game“. Mintos Marketplace takes some beating.

My Experience with Mintos Marketplace

Mintos is one of my most favorite European Peer to Peer lenders, although with recent Loan Operator failures, I have decided to sit on the sidelines until things stabilize.

Latest Update

Mintos has had several loan originators go into default or liquidation throughout the pandemic. I was able to draw out about 50% of my Euro investments over time, but Varks Armenia (part of the Finko Group) lost it’s lending license in March, and guess who most of my short term loans were with 🙄

Mintos looked at Varks and the Finko group guarantee (where larger corporations are responsible for buyback guarantees of their subsidiaries), however they determined that to enforce the guarantee could potentially take the whole Finko group down. So now we have a “promise” by Finko that all loans will be paid back by 2022. Not great news but there you go.

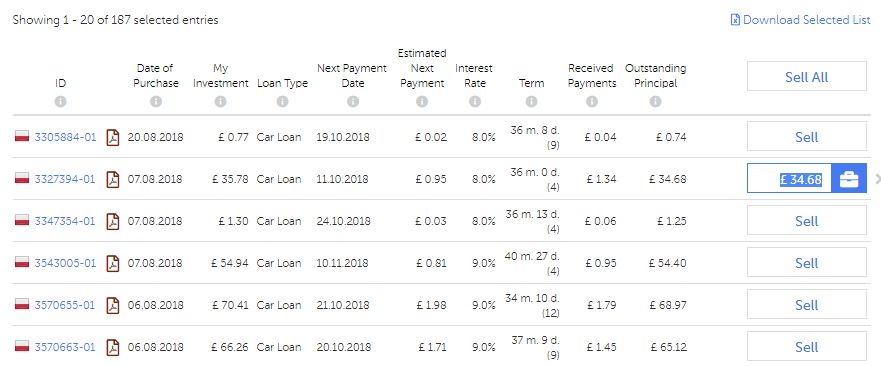

I sold down many of the Mogo GBP car loans just because they are finished anyway (no new GBP car loans on Mintos now), and I thought better to reduce exposure to Mintos as a whole. I still have about £800 in Mogo loans which are paying back slowly.

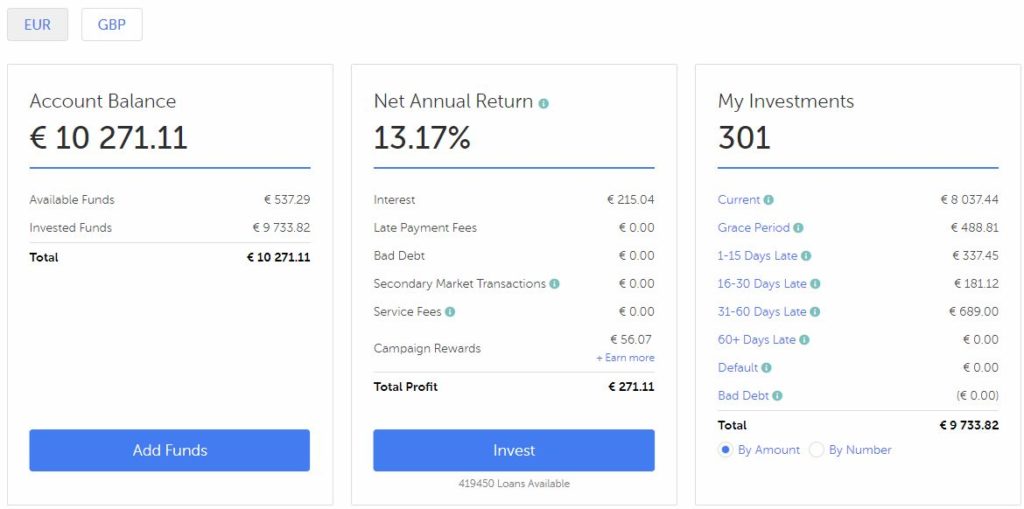

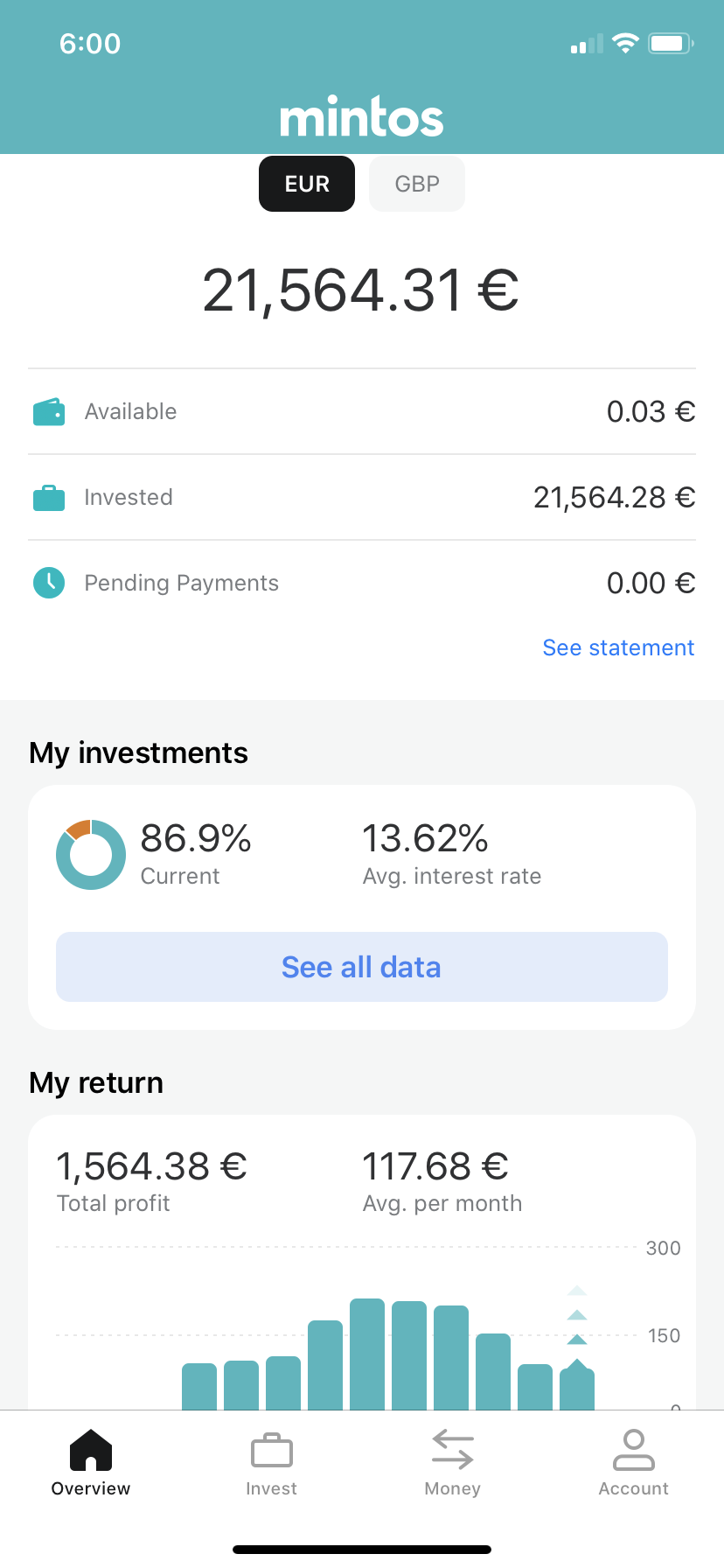

My Mintos Euro Account Summary (click to enlarge).

Mintos, some of the “not so good” stuff & why I don’t invest with them anymore;

In this section, I will explore some of the most common negative issues raised by users of the platform.

-

Default rates and late payments One of the biggest concerns for investors on Mintos is the risk of defaults and late payments. While Mintos offers a buyback guarantee for some loans, this is not a guarantee against loss, and many investors have reported significant losses on loans that were not covered by the guarantee. Even with the buyback guarantee, there have been reports of delayed payments or delays in the buyback process, leaving investors waiting for weeks or months for their money to be returned.

-

Lack of transparency Another major issue with Mintos is the lack of transparency in the loan originators’ performance and creditworthiness. While Mintos provides some information about each loan originator, including their historical performance and credit rating, this information is not always comprehensive or up-to-date. Some users have reported that loan originators have defaulted on loans or have had their credit rating downgraded, without any notification or action from Mintos. This lack of transparency can leave investors vulnerable to significant losses, particularly if they have invested heavily in loans from a single originator.

-

Technical issues Another common complaint from users of Mintos is the technical issues that can affect the platform. These issues can include slow loading times, errors when trying to invest or withdraw funds, and problems with the Auto Invest feature. These issues can be frustrating for users and can affect the performance of their investments. While Mintos has made efforts to address these issues, they remain a concern for many users.

-

Lack of regulation Another concern for some users of Mintos is the lack of regulation in the peer-to-peer lending industry. While Mintos is based in Latvia and is regulated by the Financial and Capital Market Commission, the loan originators on the platform are not subject to the same level of regulation as traditional banks or financial institutions. This can leave investors vulnerable to fraud, default, and other risks that are not present in regulated financial markets.

-

Limited secondary market options Another issue with Mintos is the limited options available for buying and selling loans on the secondary market. While Mintos does offer a secondary market where investors can buy and sell loans, the options are limited and the process can be slow and cumbersome. Some investors have reported difficulty finding buyers for their loans, leaving them with no option but to wait for the loan to be repaid or to sell at a significant discount.

-

Poor customer support Another common complaint from users of Mintos is the poor customer support provided by the platform. Many users have reported long wait times for responses to support tickets, unhelpful or generic responses to their inquiries, and a lack of follow-up or resolution to their issues. This can leave users feeling frustrated and unsupported, particularly when they are dealing with significant losses or issues with the platform.

In conclusion, while Mintos offers some advantages as a peer-to-peer lending platform, there are also some significant concerns and drawbacks that investors should be aware of. These include the risk of default and late payments, lack of transparency, technical issues, lack of regulation, limited secondary market options, and poor customer support. As with any

The Obvious Investor – Easy-Info Table© – Mintos Marketplace Review

The Obvious Investor – Easy-Info Table© – Mintos Marketplace Review

Overall Rating*:  (2.9 / 5)

(2.9 / 5)

Who can invest: ![]()

NOT currently accepting UK residents.

Loan Currencies: £

![]() €

€ ![]() + 10 Others

+ 10 Others

Estimated Return: Up to 19%+ depending on loans & currencies.

Target Annual Return

(Platform Number): GBP 9.66%

My Calculated XIRR: N/A

My Current Investment:(click to see amount in £) See My Investment £

Risk Rating*: 7/10 - Medium-High

Early Exit: Yes.

Loans can be sold on secondary market.

No Mintos fees.

Min. Investment: €10

Deposit Funds: Bank account. Multiple currencies.

Typically 1 -2 days.

Auto-Invest: Yes

Manual Invest: Yes

Lending To: Borrowers (through originators)

Loan Types: Personal loans, debt consolidation,

car finance, home improvement,

wedding loans, holiday loans, pawn shop loans.

Just about any type of loan you can imagine.

Also provide secured and unsecured business loans.

Loan Security: Yes, with some loans.

Provision Fund: No provision fund.

See review for "Buy Back Guarantee"

and "Skin in the Game".

Loans Amortize: Some fully amortize.

Some partial.

Some bullet.

Time to Invest: Fast: huge loan book.

Time to Mange: None (auto-invest) to medium (manual invest)

Lender Fees: No.

Payments Received: Monthly, weekly. Various times.

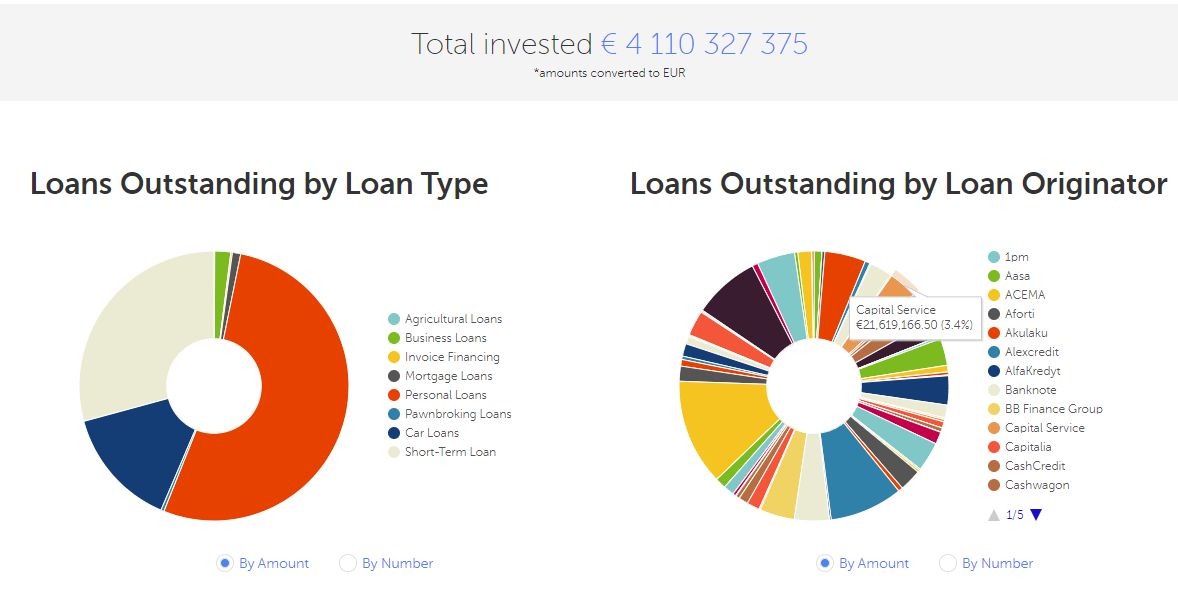

Amount Lent: €4 billion+

Number of Investors: 221,000+

Loan/Dflt Stats: Click Here for Stats

Regulated: No

Location: ![]() Riga, Latvia

Riga, Latvia

Launched: 2015

Website: https://www.mintos.com

Email: support@mintos.com

Telephone: 0157 893 0033 (UK)

+371 66 164 466 (Latvia)

IFISA/IRA: No

Cashback**: Yes! 0.50% of average daily balance cashback

for first 90 days.

Learn More >>

How to Sign Up**: Sign Up Here!

Mintos Marketplace

Overview – Mintos Review

Mintos Marketplace is the largest European Peer to Peer lender, offering higher returns (up to 19%) on loans to consumers and businesses mostly in the EU, including Denmark, Latvia, Sweden, Spain, UK and more.

Mintos also lends to other countries around the world, Russia, Ukraine and many of the old Soviet Union countries included.

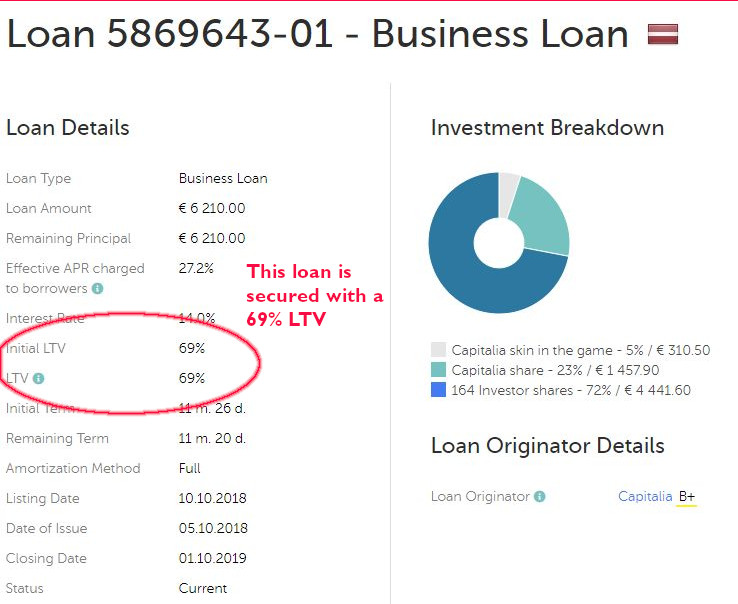

Many (but not all) loans are secured on anything from property, cars, pawn shop assets and various other items.

For extra security, many of Mintos loans also offer the “Mintos buyback guarantee”. This is where Mintos loan originators will buy back loans that fall behind in payments more than 60 days.

Also added security from “Skin in the Game“, where some of the loan originators invest a percentage of their own cash in loans on a first loss basis, which means in the event of a default, they take the first loss on the loan.

Mintos Marketplace is an interesting proposition for anyone wanting to invest in their own currency. Or to diversify into other currencies.

Mintos is a little different to many other Peer to Peer lenders because, for the bulk of its loans, Mintos acts more like a “middle man”. Meaning that Mintos connects “originators” (local loan providers) to investors, instead of making its own loans.

History

Mintos Marketplace was launched in 2015 in Latvia.

Currently they work with over 60 loan originators connecting them to lenders around the world.

In the 4 or so years Mintos has been in business, it has lent out over 4€ billion euros from over 221,000 registered investors.

Those figures are very good by any standard. And when you also hear that Mintos is already a profitable company, it becomes even more impressive!

I really like Mintos Marketplace. Having invested cautiously with them at first.

I have since expanded my portfolio, more than doubling it in GBP investments, and more recently increasing that investment by another 50% in Euro based loans.

My feeling is, even though their head office is located in a country that is maybe not so well known to some people. They are a good business, a relativity safe investment, and have become one of my largest lending accounts.

Regulation

Mintos Marketplace is not regulated as the UK Peer to Peer lenders are by the FCA, however they are actively scrutinized by the Latvian regulator and it wouldn’t surprise me if regulation in Latvia came soon.

Mintos’ sheer size adds as much, if not more safety than regulation to their offerings in my opinion. That is just my opinion though and no doubt some would disagree.

Many of the European P2P platforms have settled in Latvia as the authorities there are friendly to the P2P business model. So far I don’t know of any fraud or other serious problems related to any Latvian lender. Hopefully that record will continue.

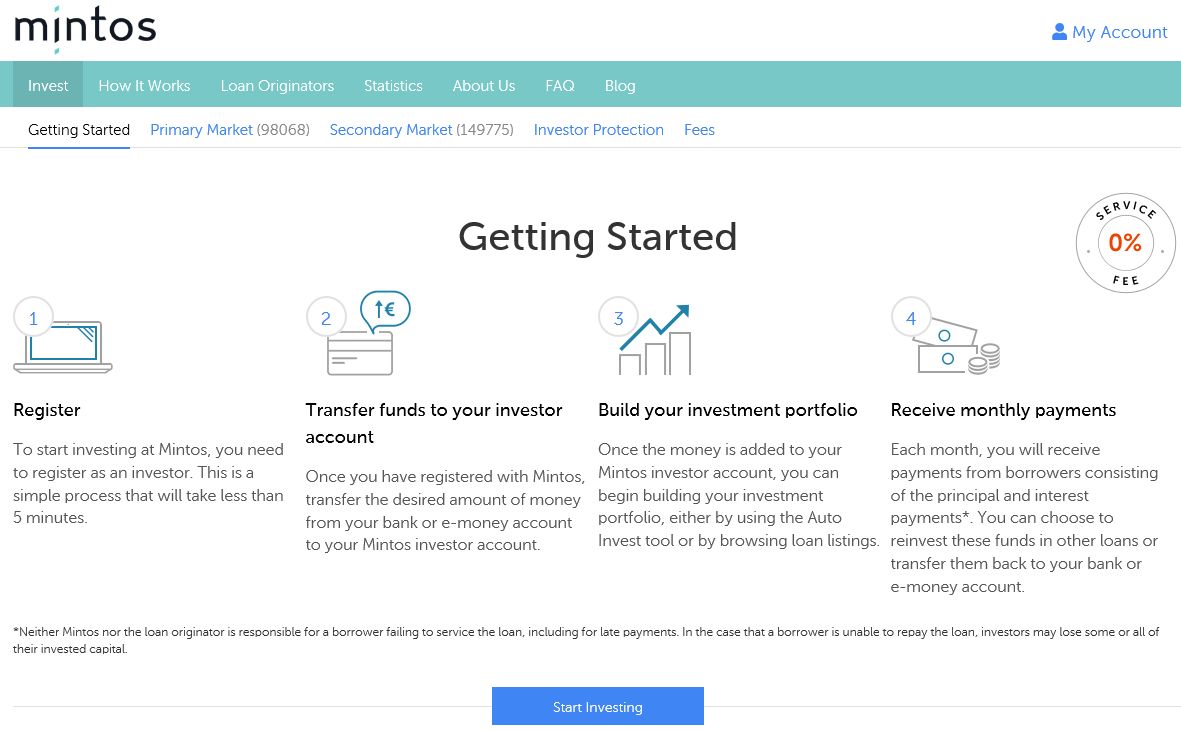

Signup Process – Mintos Review

Opening an account with Mintos is relatively easy. Just the usual ID & anti money-laundering checks.

They typically need a copy of your passport or driving license, and a utility bill or bank statement to show your current address.

Residents of any country that can comply with the ID checks can signup with Mintos, except the USA for some reason. I believe it has to do with some US regulation though, not the platform rules.

If you don’t currently have a Euro bank account, take a look at this post I did on Currency Exchange and Moving Money which might give you a few ideas.

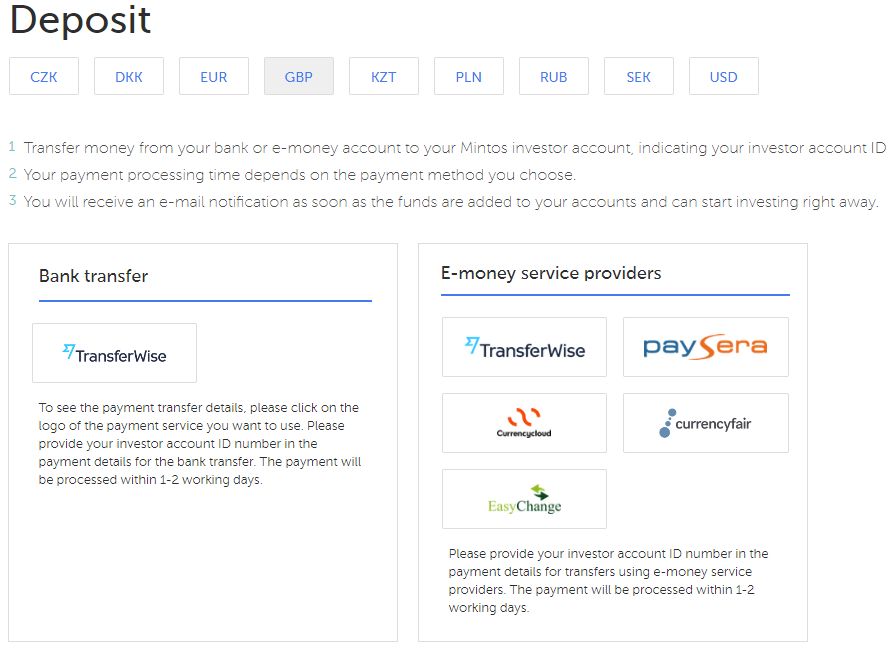

Deposits & Withdrawals

Deposits and withdrawals are made by bank transfer, which bank is dependent on the currency you are depositing.

You will be provided with the relevant bank details when you select the currency you will be sending.

Deposits usually show up in your account the same or next working day.

Withdrawals are only to a verified bank account, and typically take 2 – 3- business days.

Time to Become Invested – Mintos Review

Mintos Marketplace has a huge loan book, mostly in Euros.

If you are investing in Euros you literally have hundreds of thousands of loan options, so getting invested in any of the predefined and regular auto-invest portfolios takes minutes.

With the regular loan listings, it will take as long as it takes you to decide on which loans you want to be invested in.

In GB pounds there are two main options available for investment, they are MoGo car loans which have buyback protection, or 1pm business loans which don’t have buyback.

Personally I only invest in the MoGo loans in GBP as I like the buyback guarantee .

Even just with MoGo there are usually a few hundred loans available, so it possible to get invested quite quickly.

Who are we lending to?

Mintos Marketplace is a true Peer to Peer Lending Platform. Lenders are lending directly to borrowers. Loan agreements are directly between the lender and the borrower. Mintos just acts as a middle man, managing loans, payments and debt collection etc.

Although something which is a little different with Mintos is that Mintos itself doesn’t originate most of the loans like most P2P companies.

It has over 60 “loan originator companies” it works with, and they originate the loans locally, then provide the loans to Mintos Marketplace for individual lenders to invest in.

Mintos Marketplace provides loans to consumers for personal loans, debt consolidation, car finance, home improvement, wedding loans, holiday loans, pawn shop loans.

Just about any type of loan you can imagine. It also provides secured and unsecured business loans.

Loan Security

Both secured and unsecured loans are available on the platform.

It is easy to see on their website which loans have security and which don’t, as well as the LTV’s (Loan to Value Ratios).

Remember the Mintos buyback guarantee and some of the loan originators’ “skin-in-the-game” offers further security.

It’s easy to see which loans offer buyback guarantees. The little yellow shield on the “Invest” button signifies the loan is protected.

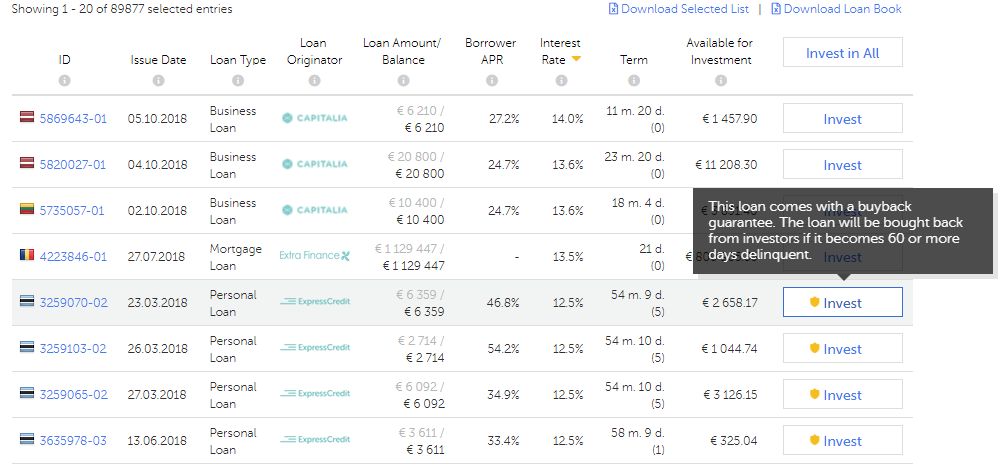

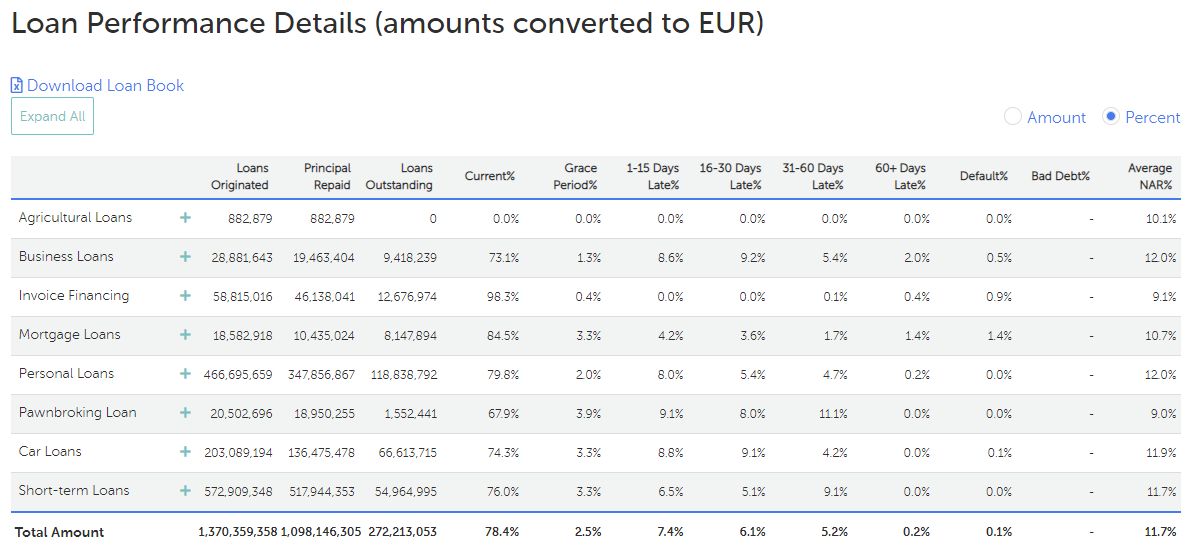

Default Rates – Mintos Review

Mintos Marketplace default rates change daily because of their sheer size, loan types and currencies.

You can see here what they are now as the figures in this Mintos review will likely be old ten minutes after writing it.

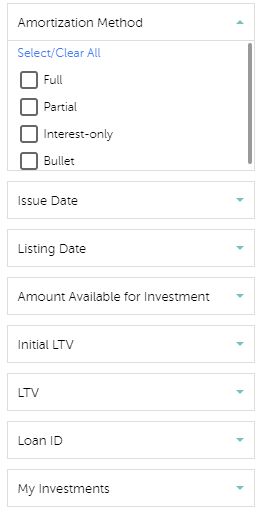

Amortization

There are all types of loans on Mintos Marketplace; fully amortizing, partially amortizing, interest only and bullet loans (balloon payment).

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over time. It reduces the risk of the loan compared to a non-amortizing loan in which nothing is received until the end of the loan period, or only interest is received monthly, and then the capital repaid at the end of the loan period.

If you choose non-amortizing loans, please make sure you understand the risk-reward and also double check asset security values.

When listing loans with Mintos, it’s easy to select the loan types you want from the loans filter.

Selling Loans and Withdrawing Capital

It’s easy to sell Mintos Marketplace loans on the secondary market.

Mintos do not charge a fee for selling loans, however in some cases you may need to sell loans at a discount in order to sell them quickly.

Mintos enables you to sell loans at either a discount, or at a premium.

If loans are in demand, you will often see them listed at a premium of up to 3% (which is the most that Mintos allows).

Diversification – Mintos Review

Diversifying capital into loans is easy with Mintos because of the sheer size of their loan book.

Their predefined auto-invest portfolios diversify automatically, and with the self-select loans, you can create an auto-invest rule which only places a predefined amount into each loan.

Provision Fund

There is technically no provision fund with Mintos. However the previously mentioned “Mintos buyback guarantee” really helps to put more confidence in Mintos loans.

This in my eyes is as good as, if not better than a single provision fund. This is because we are not relying on just one company to step in if a loan goes in to default.

Each originator is responsible for it’s own guarantee which Mintos regulates to an extent. The risk of course is if an originator goes out of business, which has happened once in the past (see “Originator Default” below).

I still think Mintos’ sheer size adds a lot of security to their loans.

On top of that, most of the loan originators offer what Mintos refers to as “skin in the game”. Meaning they invest their own capital in a percentage of the loan (typically from 5% – 15%).

So if the loan goes bad, they lose money as well as, and before the Mintos lenders.

This helps to ensure appropriate levels of due diligence on borrowers and adds just another level of security.

Originator Default

One of the dangers to be aware of investing in Peer to Peer lending companies, Mintos Marketplace experienced back in 2017 when Eurocent, one of it’s originators went out of business and was suspended from trading on the platform.

Eurocent was one of the many originators offering “Mintos buyback guarantee”, so with them gone now, no knows if lenders can expect to get all of their capital back or not on defaulted loans originated by them.

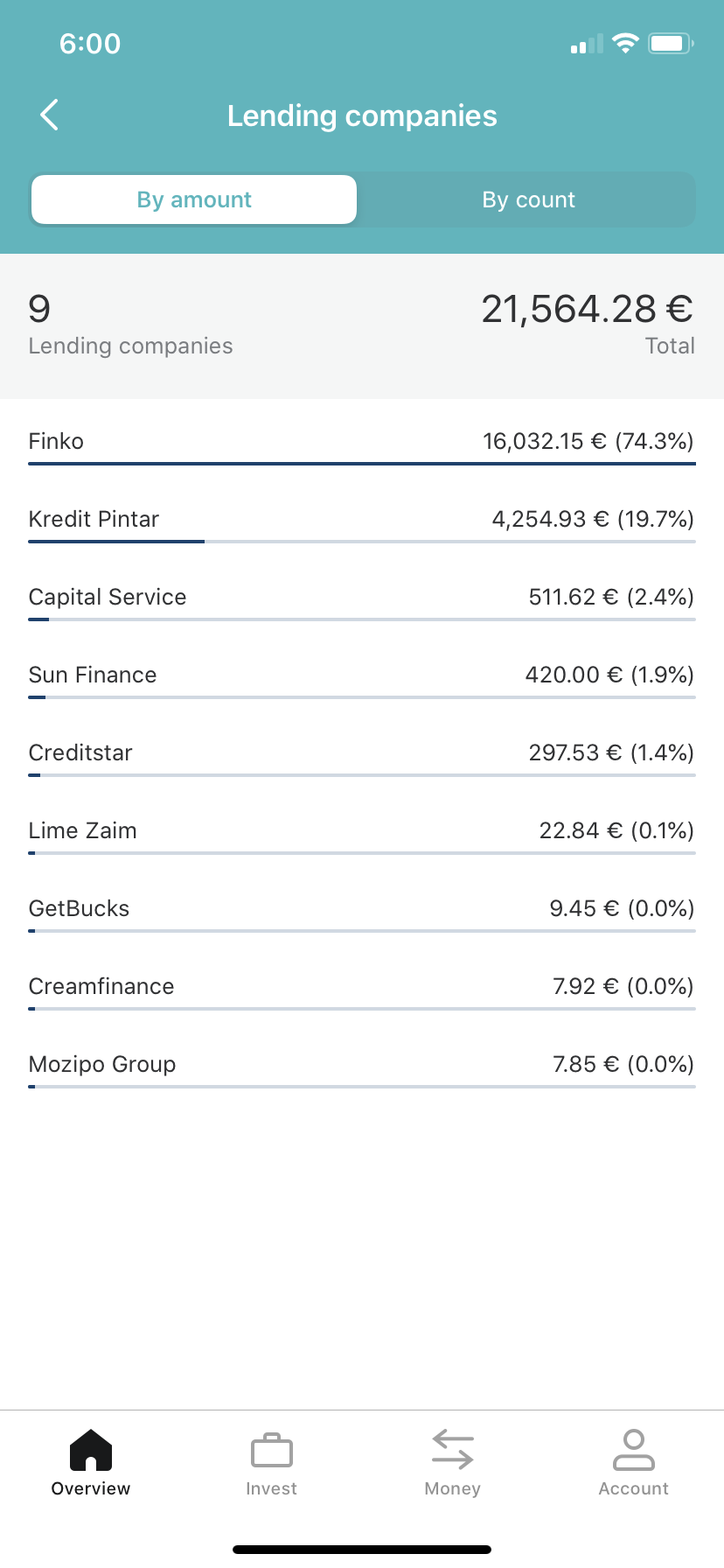

Here again, the “Prime Directive” comes in to play; not only diversify between loans, but also make sure you are diversified between originators.

Even in the Eurocent situation, I would think investors would still get most of their money back, simply because the loans we make through P2P platforms are usually directly with the borrower.

So just because a platform goes bust doesn’t mean that all borrowers will cease to pay their loans (I would hope).

It’s always important to remember when investing in P2P businesses that your capital is always at risk and there is no government backed insurance programme to protect your capital in the event a platform goes out of business.

Tax Free Innovative Finance ISA (IFISA)

No tax free account options with Mintos.

Website – Mintos Review

The Mintos Website is one of the best I’ve seen from all of the P2P lenders. And their loan supply is out of this world.

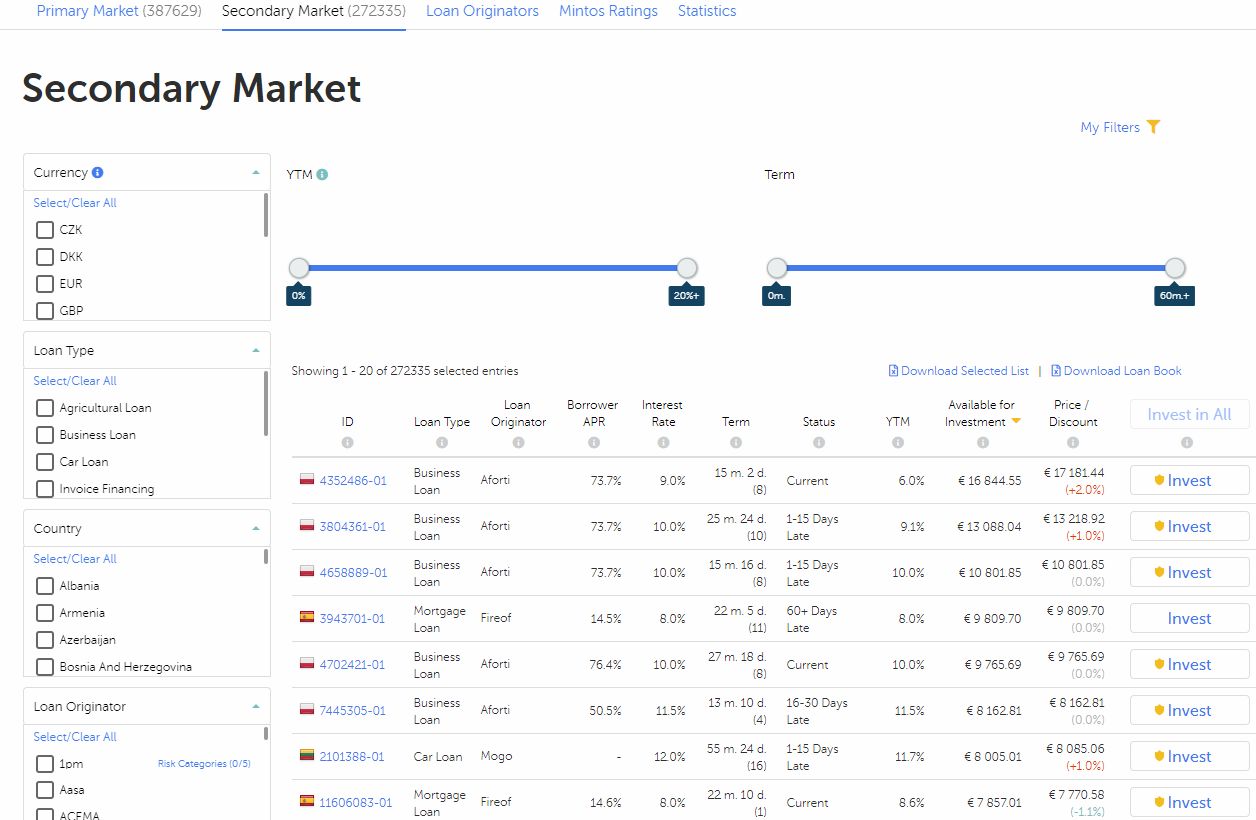

Currently (May 2019) there are 387,629 loans available to invest in on the primary market.

There are 272,335 on the secondary market.

Most loans are in Euros. So for larger investors with Euros, Mintos can gobble up huge amounts of investment capital, which means you can still only have a small amount invested in each loan.

Easy to conform to the “Prime Directive” for huge diversification.

Even in GBP there are usually enough loans available to diversify into.

Return Rates – Mintos Review

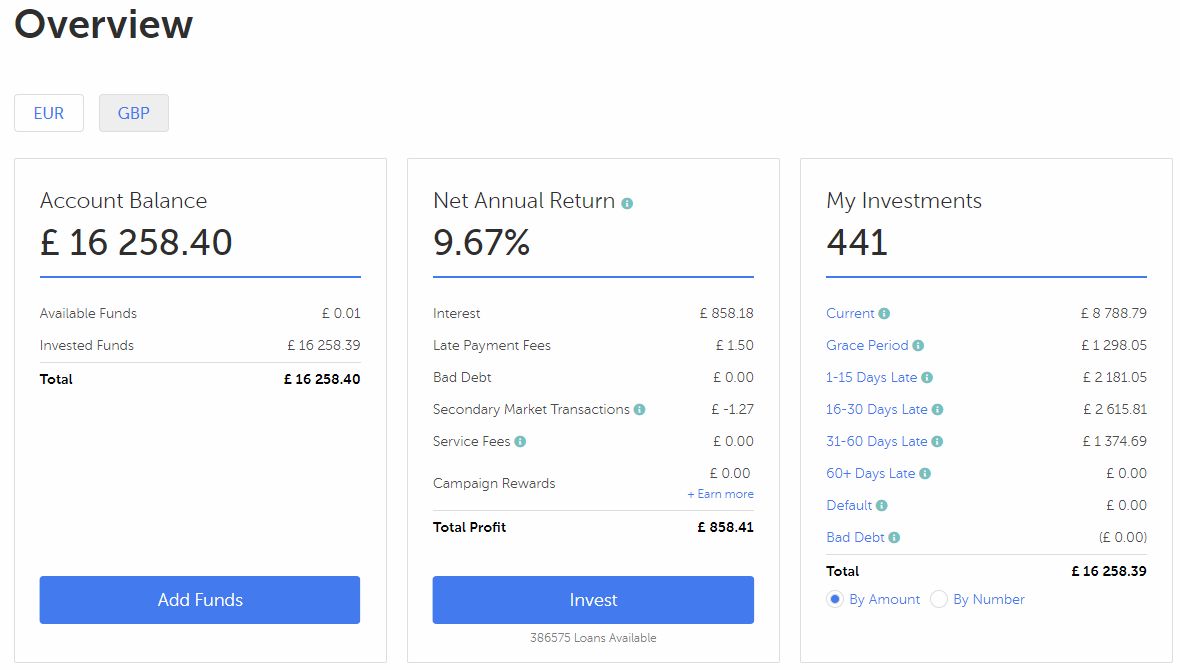

Mintos Marketplace return rates are very good, at an average of around 9.60%+ in GBP, and typically a little more in other currencies (typically upward of 12% – 15.0% in euro loans).

They actually used to offer interest rates much higher (up to 20%). However recently the rates have come down due to increased investor demand and the growing safety of the platform.

Also MoGo (one of the largest originators of car loans) stopped offering their higher paying car loans. These loans made a big difference to the return rate.

It is still possible though to find loans in the 13% – 15% range, although most are available only in euro. 10.5% is about the most you’ll find in GBP which really isn’t bad.

Buying Loans

Selecting loans to invest in through the Mintos Marketplace website is very easy.

Their loan filters make it simple to drill down to just loans that meet your criteria in both the primary and secondary markets:

Auto-invest – Mintos Review

Another thing I really like about Mintos are their auto-invest portfolios which are very flexible in enabling us to pick the loans we want to invest in automatically as money is added to the account, and as new loans are added through the platform.

Mintos does offer some “pre-packaged” auto-invest portfolios. However I don’t feel the rates are so great.

They are good if you really don’t want to put any time in to configuring Mintos investments though, and just start earning a good rate from day 1.

If you’re willing to spend a few minutes doing research, I think you can do better. Plus then you also get control of if the loans include the Mintos buyback guarantee and “skin-in-the-game” from the Mintos loan originators.

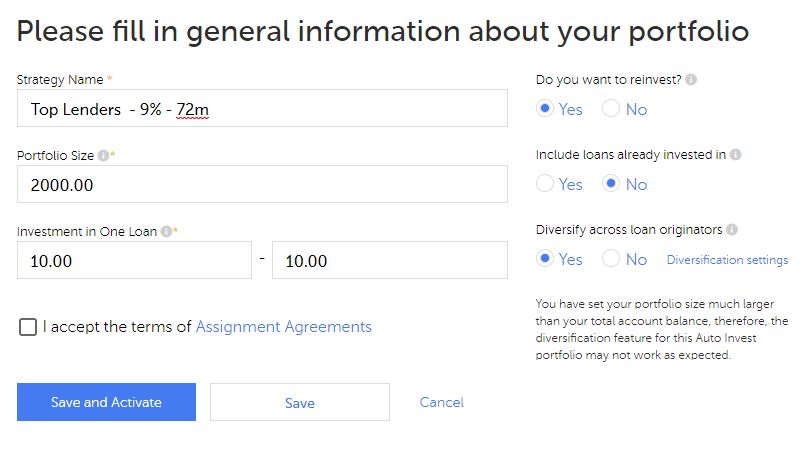

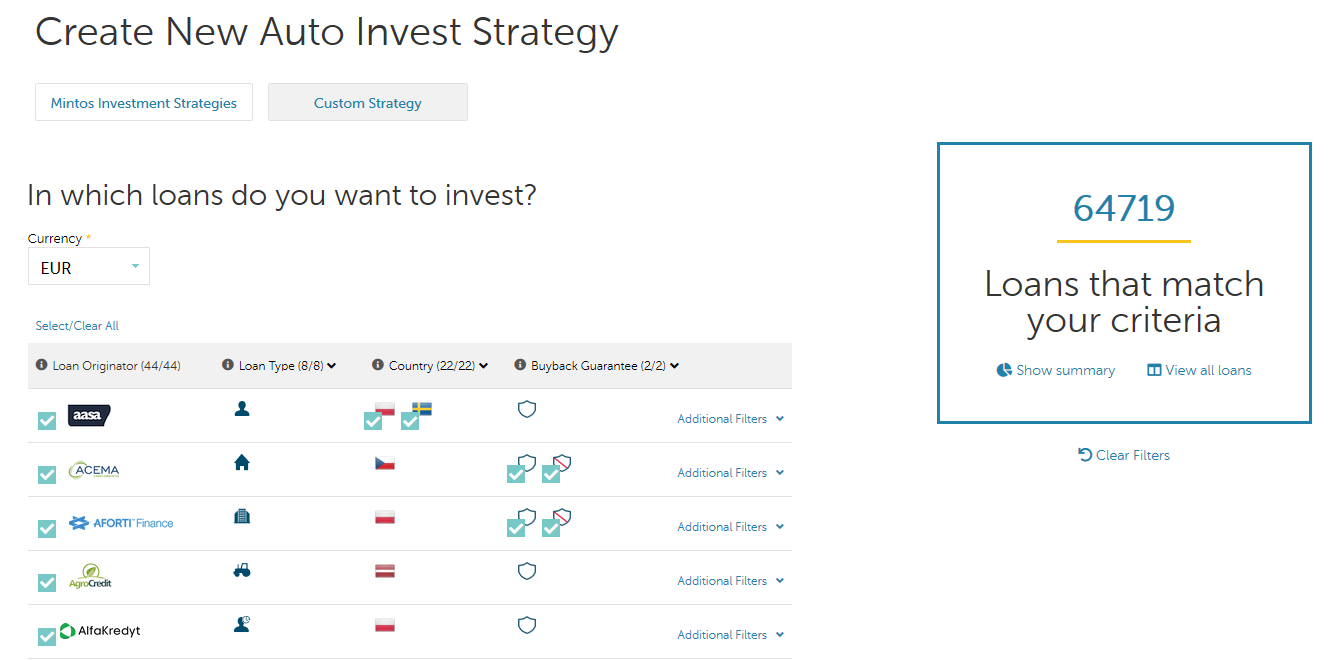

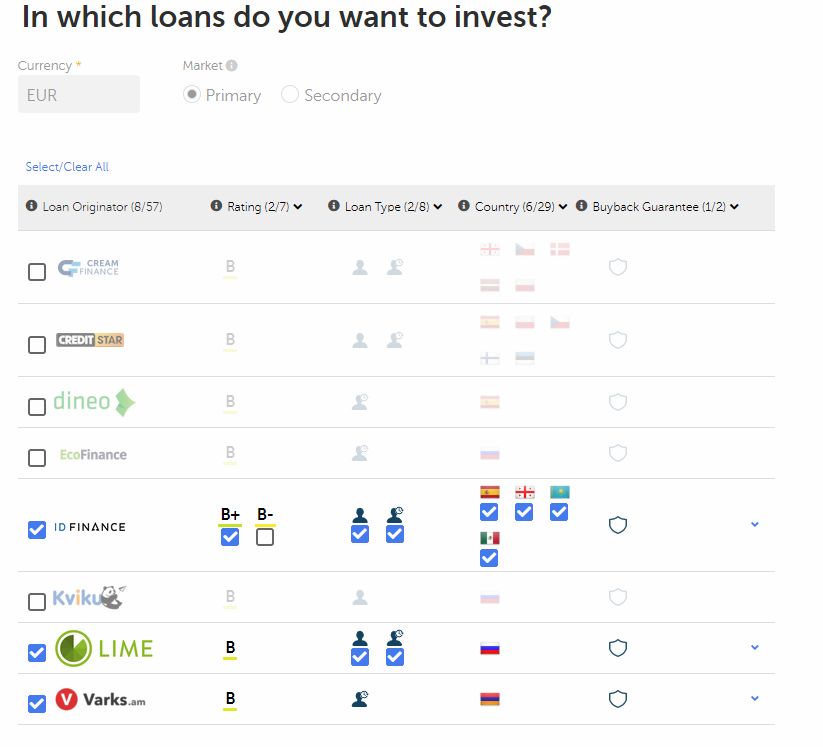

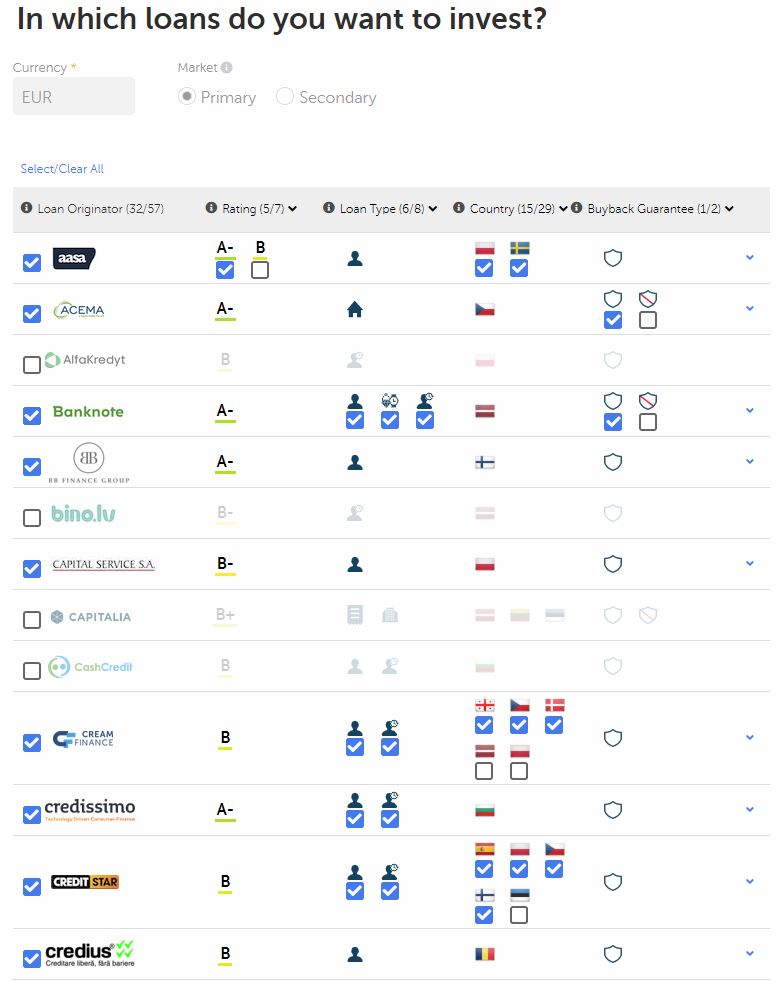

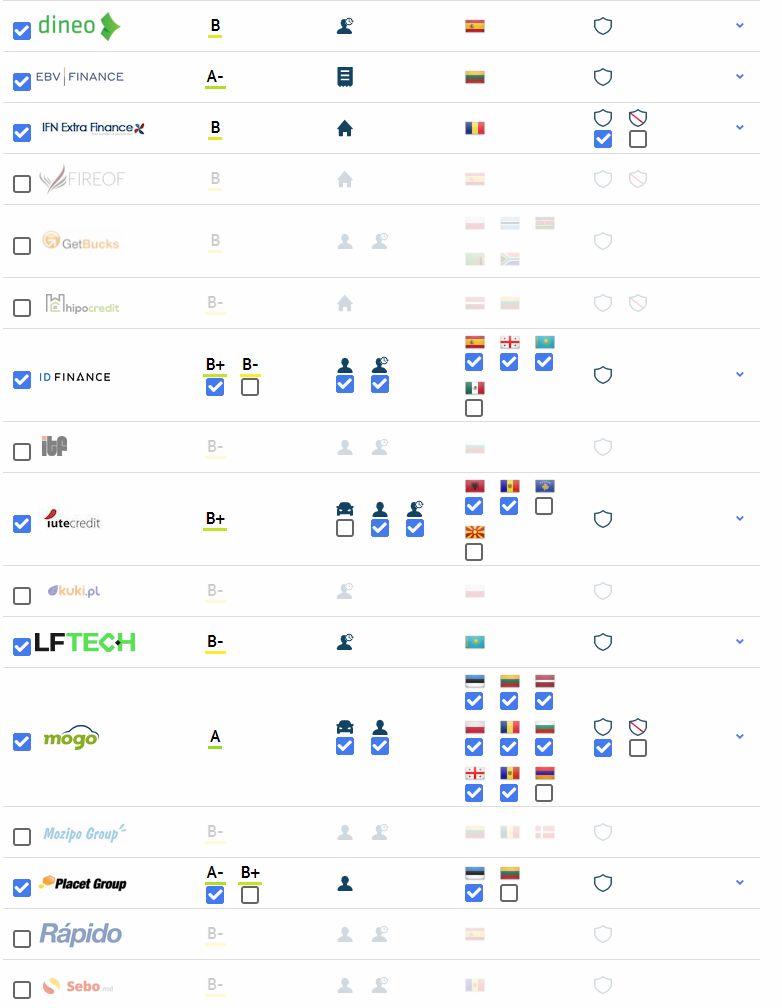

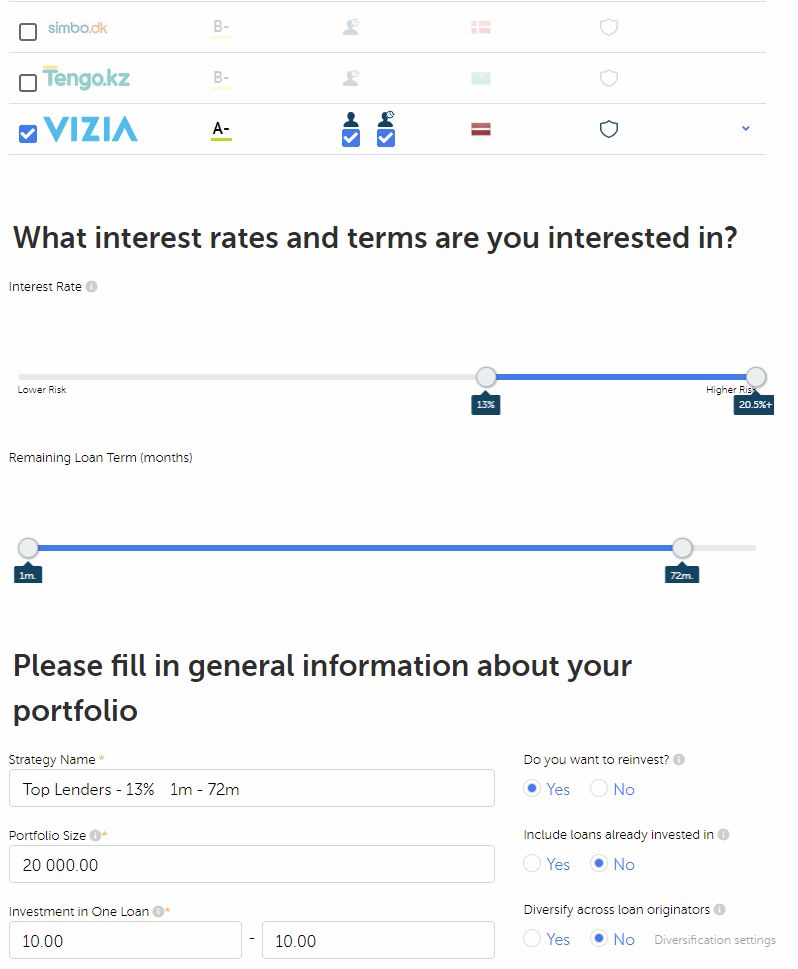

If you use the Mintos “Custom Strategy” tool, you have a lot more flexibility on which loans you want, how much interest you want to earn, and how much diversification you would like. As well as several other settings:

My Personal Mintos Marketplace Auto-Invest Strategies – Mintos Review

Here explained are my personal Mintos strategies. I don’t pretend to be a master at developing Mintos strategies, and frankly I don’t have the time or the inclination to do so. I have simple settings that net me almost 10% in GBP and over 13% in Euros which I am very happy with.

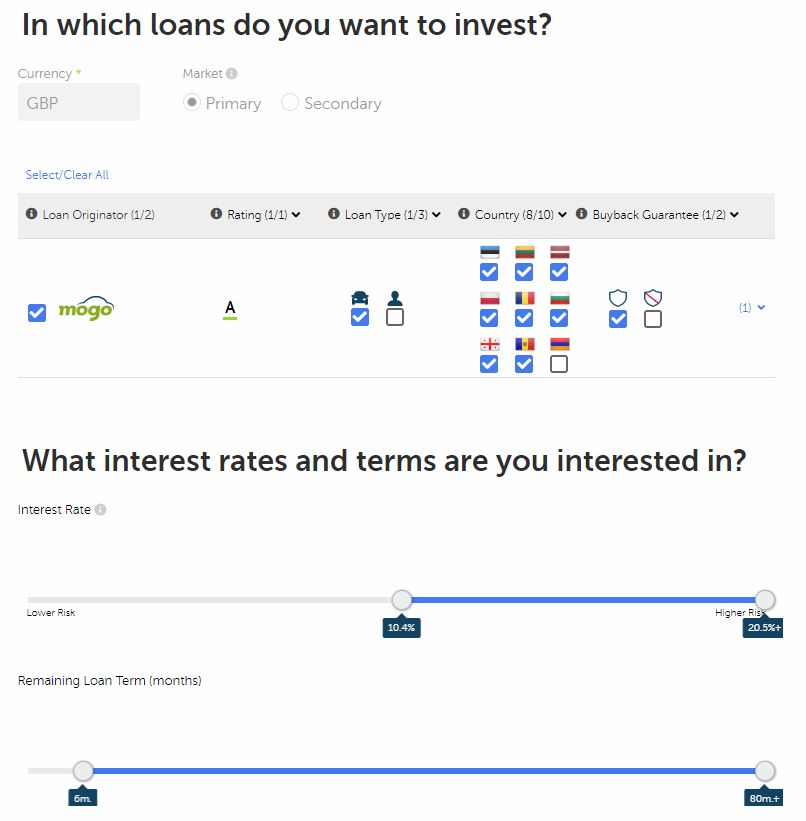

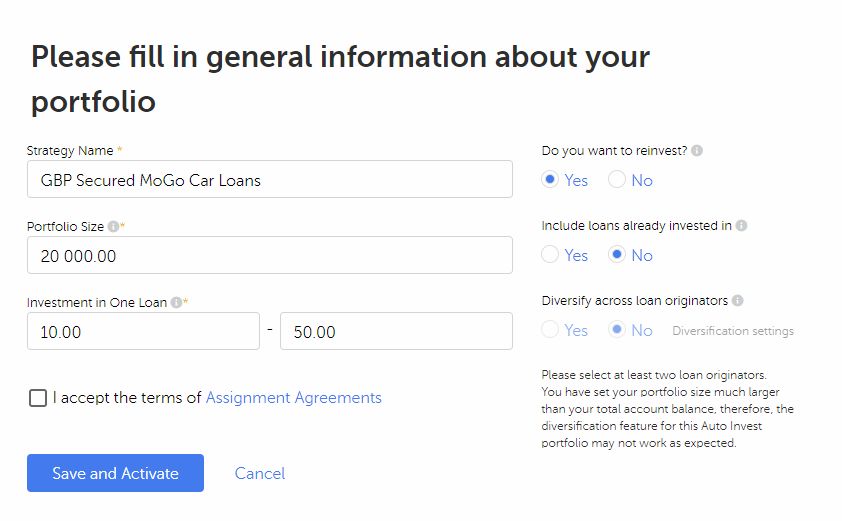

Mintos GBP Strategy.

For GBP I currently only use MoGo car loans. I consider these loans the best for GBP as MoGo (a big company with a strong financial background) offers buyback guarantees and the loans are asset secured with some type of vehicle, usually cars.

This strategy gets adjusted at times based on the available return rates of the loans, and the flow.

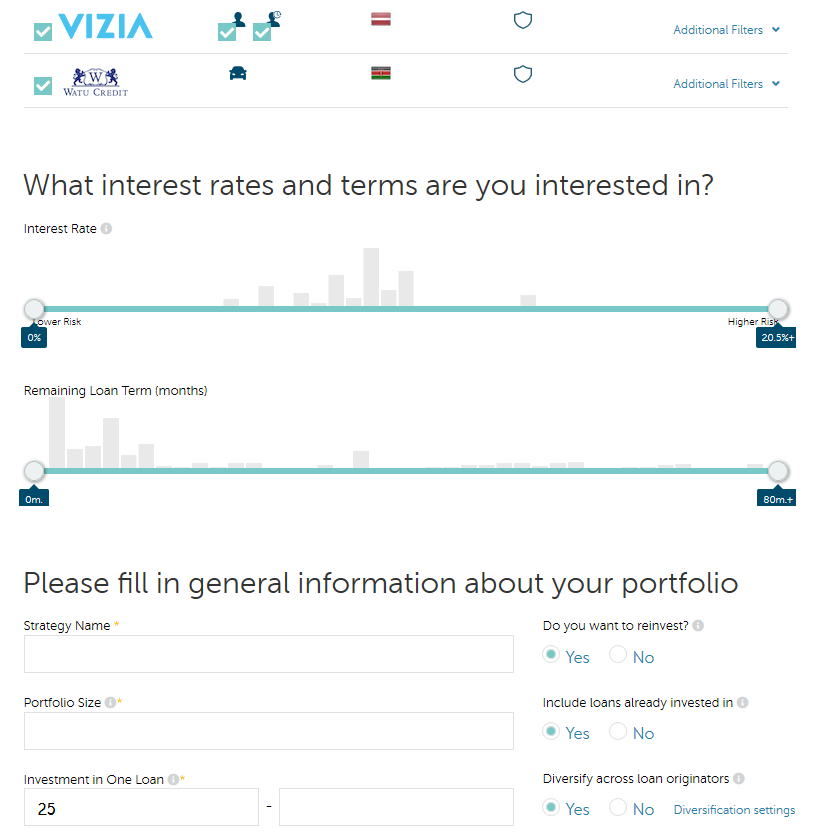

Mintos EURO Strategies – Mintos Review

I have a few Euro strategies which I use in combination to pick up the highest paying loans that meet my personal criteria. Each of them can get updated or switched on and off depending on the loans that are coming through and their ROI.

These are the strategies I use. Could be all at the same time, or just one at any time dependent on how long I want to tie Euros up for and also how much I’m investing. You can see below in this screenshot I’m mostly picking up 15% longer term loans and 12% short term.

The strategies above cycle between interest rates and loan terms. So by priority #1 will catch any 16% loans to 3 months, then #2 will catch 16% loans from 3 to 72 months and so on down.

I like the short term loans at the moment so the short term strategies are set to catch loans (mostly) from Varks who are a strong short-term lender offering buyback guarantees, and who also pay interest on late or delayed loans (very important if you want to reach target interest rates). There are also other short term lenders in there but Varks loans are the loans I mostly pick up.

This is how one of the short term strategies setup looks.

The longer term strategies are what I call my “Top Lenders Strategies”. This is a list of lenders that not only Mintos rates as high, but other sources I have researched also say the same.

Hopefully the above makes sense to you (if not, email me and I’ll be happy to explain). But basically I’m just trying to pick up higher rate short term loans first, then the longer term loans after at each interest rate level. At the lower levels (12%-13%) I only want short term loans so that when the higher interest rate loans come back, my capital if freed up quickly so my auto-invest setting will pick them up.

Mintos iPhone App

Mintos recently brought out its new iPhone App (Andriod App Coming Soon). After toying with it for a while, I have to say it’s one of the best apps from any lender. It’s not difficult to use, but still shows most of the data you might want to see on a daily basis. You can also withdraw funds from the Mintos iPhone App & alter account details & settings.

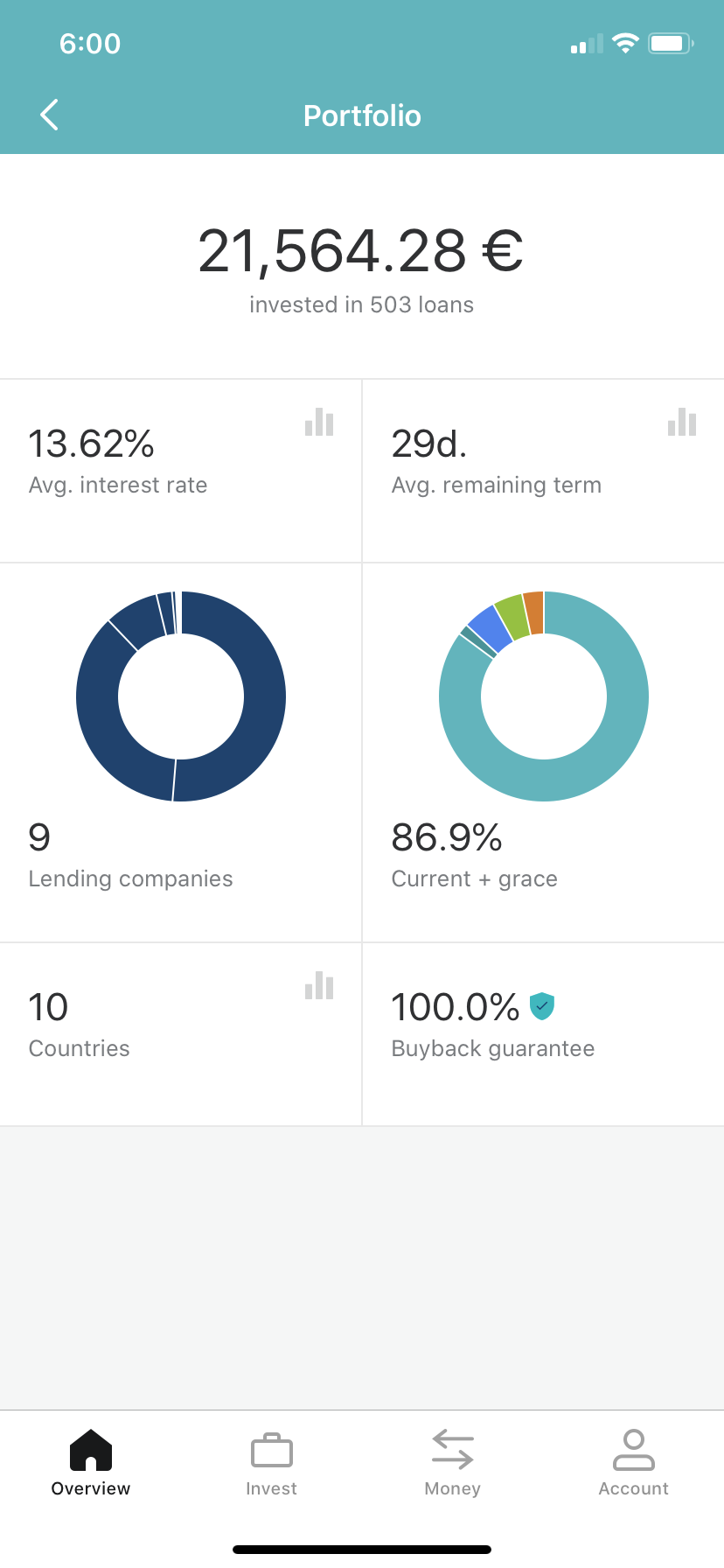

Here are a few screenshots which basically speak for themselves.

Mintos Review – Summary

Mintos Marketplace is certainly one of my most favorite platforms. Their return rates are unmatched by any other lender I know of this size who is also profitable.

The Mintos buyback guarantee and Mintos originators “skin in the game“, in my opinion it makes Mintos one of the safer – high-return lenders out there.

I have no hesitation investing a significant portion of my lending portfolio in Mintos, and I can definitely recommend them as part of an overall investment strategy.

The Mintos staff are always professional whenever I need to contact them for anything, and they all speak English very well.

I enjoy investing through Mintos and I hope they continue on the road they are currently on. Returns of 9% to 15% are always welcome on my monthly income list 🙂

Thumbs Up Points for Mintos

-

Unique Diversification – focusing on consumers and businesses in many different countries and in many different currencies really is enticing.

-

Great Returns – 12%+ in Euro investments, is nothing to sniff at.

-

Multi-Currency – lots of options for currencies to invest in. Mintos also offer a reasonable money exchange service for changing money into other currencies.

-

Huge Loan Book – there should never be any cash drag with Mintos loans, especially if you invest in Euros.

-

Great Filters – very easy to drill down to loans you want to invest in

-

Auto-Invest – auto-invest options are (I believe) the most configurable of all of the P2P platforms I invest with. You can literally choose anything you like.

-

Skin in the Game – most lenders have their own interest in loans so they should take more care in loans they write.

-

Mintos Buyback Guarantee – Is Mintos safe? Most originators offer the “Mintos buyback guarantee” and will buy back the loans if they go in to default, therefor making Mintos safer.

-

Zero Early Exit Fees – there is no charge for selling loans early on the secondary market, and you can even sell at a premium or discount if you so see fit.

-

Website – very easy to use and understand, and still very configurable.

-

Mintos also won AltFi’s “People’s choice award” in 2016 and 2017 which adds a little more confidence around them for me. There are also many Mintos Reviews out there to refer to. This gives Mintos more credibility too.

Thumbs Down Points for Mintos

-

No Regulation – may make Mintos Marketplace a riskier proposition, however their sheer size and multiple Mintos loan originators makes up for it in my mind.

-

Lavian Based – for UK investors this may not be as comfortable as investing in UK companies. European investors don’t seem to see this as an issue though.

-

Currency Risk – investing in a currency other than your home currency can have it’s own inherent risks if it falls.

-

No retirement IFISA – for interest free investing for UK investors.

Risk Factor – 4/10 – Low to Medium

Is Mintos Safe? In my Mintos Review, I consider Mintos to be in the low to medium risk category.

Even taking in to consideration that some loans are secured, originators have “skin in the game” and the “Mintos buyback guarantee”, Mintos is still an unregulated business with a short track record.

However the longer Mintos are in business, the better they seem to get having lent almost €3 billion Euros.

Who Can Invest with Mintos?

![]() Safe?

Safe?

Residents of most countries in the EU can invest with Mintos, and also other countries that conform to the EU’s money laundering regulations. Unfortunatley UK residents can no longer invest in Mintos.

Unfortunately (as far as I can understand) our USA friends aren’t able to invest in the platform at this time. This is because of some US regulation (not the platform’s rules).

If you need help moving money, or exchanging currencies; see my review on the Wise Borderless Account. Contact Mintos for more information.

Mintos Cashback Offers & Signup Links**

PLEASE NOTE: MINTOS IS NOT CURRENTLY ACCEPTING U.K. RESIDENTS. HOPEFULLY THIS IS TEMPORARY AND WILL BE RATIFIED SHORTLY.

New Mintos Marketplace customers receive 0.5% of their daily balance in a Mintos cashback reward for the first 90 days by using links here on ObviousInvestor.com!

Similar Lenders to Mintos Marketplace

Mintos Marketplace Promo Video

Disclaimers: This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website. * My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective. ** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations. Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences. Please read my full website Disclaimer before making investment decisions.