I’ve received quite a few emails asking why I haven’t been posting for the last few months (10 months to be exact, eek!). The only real answer I have is that I’ve had a few other projects going on, and also with the state of the general markets right now, we’re kind of in a “wait and see” phase with many assets, so rather than try to find things to waffle on about, I decided to focus my energy elsewhere.

If you were paying attention you would have noticed that I have updated my investment portfolio and charts/graphs at the end of every month so you could always see most of what I’m doing, there was just no commentary with it.

The truth is, P2P has kind of lost its luster with me now banks are paying better rates. Also many of the platforms I used to love have either gone, or appear to be on their way out. When I look at my overall XIRR (return) through P2P (not including any future possible losses) over the 9+ years I have been investing, it’s around 5.40%. Considering I just opened a 2 year bond with Vanquis Bank at 6.20%, which is FSCS insured, and over the last year I’ve also opened bonds at 5%, 5.5% and 6%, it just appears to be the way forward (for now at least). P2P has served me well when banks were paying virtually nothing, however when I can get 6%+ with FSCS insurance (so near zero risk) with virtually no hassle, that’s what I’ve decided to do which much of my income based capital while bank rates are still decent. I will come back to P2P if bank rates start to subside again (I always look here for the best bank rates in case you were wondering).

Adding to the above is the fact that a lot of UK P2P platforms are moving to institutional investment, are in trouble, or appear to be in trouble. I’ll give you a quick rundown of where I’m sitting with my current platforms, what my feelings are about them, and where I still have capital invested. These are just my opinions and are subjective of course. My perception can be wrong so please do your own research before investing or pulling money out of an account in a hurry.

Peer to Peer Lending

Ablrate – what I mess this platform is. They decided to basically wind the company down and of course since then I’ve seen pretty much nothing in repayments. I currently have £3,500 stuck in there that I’ll likely never see again. I do hold out hope that perhaps I’ll see “some” of it back. There’s kind of a stir with this platform right now as it appears the CEO has run off to Dubi and is enjoying himself on a beach there if you believe what you read. Just hearsay of course 🙂

Assetz Capital – Closed to retail lenders – £560 stuck in 2 loans through the old Property Secured Account and Great British Business Accounts that had a “discretionary” provision fund incase things went bad. That fund didn’t get used unfortunately so we’ll see if I ever get that back. As it is asset secured, hopefully I’ll get some part back at some point (hopefully I’m still alive, or at least my heirs are). 🙂 Very disappointed with Assetz Capital overall. Business was very badly run but they did a brilliant job of “spinning” it. Of course once they went to institutional lending, basically two fingers up to the retail investors that had given them their hard earned money over many years to that point. They are charging investors all sorts of fees now to “manage” their investments while they wind down the individual lender loans (that investors had no choice about paying). There are actually a couple of law suits filed against them for this I believe.

Assetz Exchange – still a reasonably safe investment I think, however because I can get comparable rates from banks now, I decided to start to move out what I could. Unfortunately I still have about £16k stuck in there that I can’t get out without taking a loss at the moment even if I could find a buyer, (because property values go up and down with AE, and some are more valuable than others depending on income etc. which means for some there are no buyers at all). I don’t worry too much about this platform as the properties are still paying monthly income at around 6%’ish, so either the property values will rise again and I will sell out, or they will be sold by AE when the lease term ends and hopefully at that point I should get most of the investment back. The other thing that worries me about AE is that the Assetz Capital CEO still has ownership in this company and after what they did to investors of course who knows what could happen. Although AE say they are a totally separate company, the facts still remain.

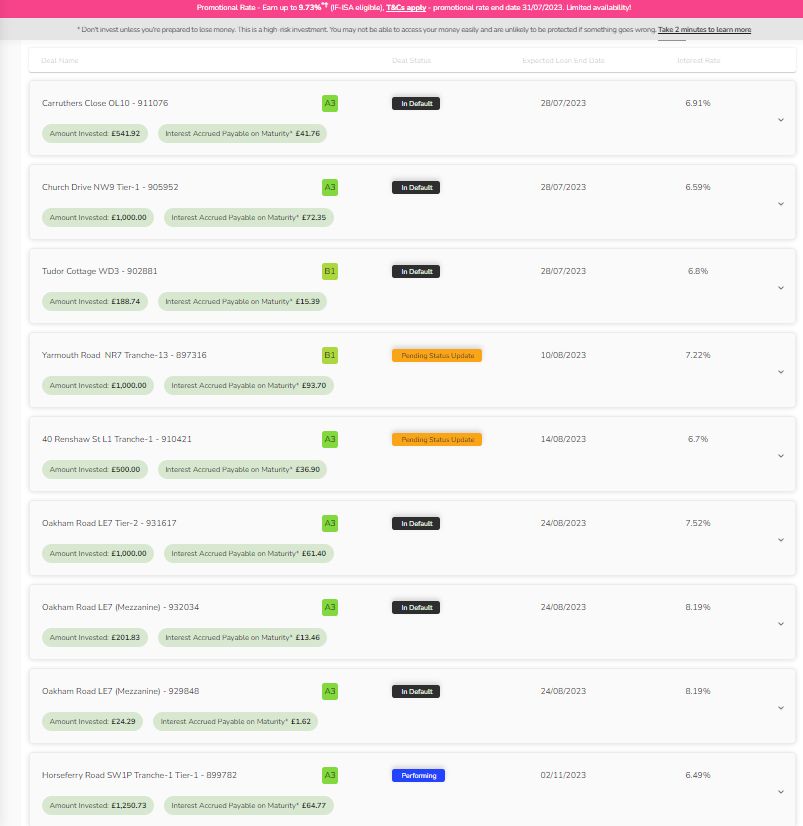

CrowdProperty – turned out to be a “less than appealing” platform. I started trying to pull money out of there in April 2022. I had about 33k invested at the time and I started to “think” I was smelling something bad (not sure what but I get gut feelings about things and I’ve learned “ignore them at my peril”). Roll on 15 months later and I’ve been able to get about half of the money out but the rest I have to say I’m concerned about. Here is my account as of July 2023.

As you can see, not particularly encouraging with over 70% of the loans overdue (some more than 2 years overdue believe it or not). They are secured by property but when the property goes into administration it can take a lot of time and legal costs etc. a lot to get your money back. On the bright side there are (savvy investors) people who still have faith in CP (Ace, that one’s for you if you’re reading this) so perhaps I’m just being paranoid? Time will tell. Take a look just how late some of the loans are in the screenshot below:

easyMoney – to be honest, this is a platform that I thought was “decent” but over time they have become one of my favorite and moved from “decent” to “great”. I still have about £20k with easyMoney, some of which I will likely move to banks, only because I can get basically the same rate from a bank with FSCS protection and I’m reducing my overall exposure to P2P. Every time I’ve decided to sell loans or move money in or out of easyMoney, never a problem with liquidity. There was one little thing that I didn’t realize; when you want to sell loans, if any loans are within 1 month of redemption, your money is stuck for that month as they won’t let you sell the loan. Not a big deal but it is something to note if you think you can get every penny out the same day if you need it. Apart from that, very decent platform which I won’t hesitate to come back to if the risk/reward warrants it.

Funding Circle – I started exiting Funding Circle in May 2019 after I noticed an increase in defaulted loans. When I started exiting I had £31k in that account. After 4+ years finally I’m down to £480. The XIRR on that account ended up at 3.41% which I guess was better than banks at the time. Every month I get a few pounds from repayments.

Kuflink – “was” one of my most favorite platforms for the last 5 years which I (only very recently) decided to reduce my exposure to. They have raised their rates recently (8-9% fairly easy to get now) which is great, and they still have plenty of new loans coming online. I have noticed though that they started to have several defaults now (which I had literally never seen before with Kuflink in the last 5 years). Here is what the first page of loans in my account look like now (there are 2 other pages with good performing loans after this to be fair, so take this as just a sample of due and upcoming due loans):

At the same time Kuflink recently announced bringing in a bank (Paragon) to start funding loans, which is worrying for many investors after what has happened to other “well known” platforms after bringing in institutional funding (although Paragon is offering Kuflink a line of credit as I understand it, not actually funding the loans as a Paragon investment). Add to this the minimum investment requirements (also recently announced which have caused a bit of a stir in the P2P world) and it appears the writing “could be” on the wall for small investors (i.e. they don’t want them anymore, let’s hope I’m wrong). Either way I’ve decided that 6.2% in a FSCS insured bank is more comfortable at the moment than 8-9% with a platform making so many (seemingly negative towards individual investors) changes with exposure to the bridging and development loan market, which could get (/is perhaps starting to get with all the defaults?) hit hard if interest rates keep rising. It would only take a couple of biggish losses to turn that 8-9% into 5-6% or worse.

Kuflink also started to do a bit of “spinning” on the way they advertise their auto-invest interest rates which irritated me a bit, therefore lowering their credibility (like what else do we need to watch out for that they are spinning?). You can see here what I mean. Really silly business decision in my mind for a platform that had such a good reputation. Hello Kuflink – did you ever hear the saying “if it ain’t broken, don’t fix it”?

LendingCrowd – stopped allowing new investment during COVID but have paid back honestly since. I still have just £165 in this platform which I’ll probably get back in the next couple of years.

Loanpad – undoubtedly still the best and safest platform out there in my opinion. Their rates keep rising but unfortunately banks are in front of them just a bit. I just opened a 2 year 6.20% bond as you know, Loanpads’ Premium Account is paying 5.80% (moving to 6% on August 1st, and 6.2% on the 15th). I’ll be leaving some money with Loanpad as they pay “about” the same as banks but I can get money out with 60 days notice from the Premium Account or next day from the Standard Account (under normal market conditions). Their rates are rising every month, however as an example, as I’m writing this update, Loanpad’s Standard Account (next day access under “normal market conditions”) is paying 4.80% (moving to 5% in August) and Chip (an instant access bank account I opened) is paying 4.51% and I can get access to the funds immediately (within minutes) which are FSCS insured of course. What makes most sense for instant access to larger amounts of capital right now with all the uncertainty in the world?

Unbolted – last but by no means least is our old friend Unbolted who have just raised their rates to 10.2% per annum (0.85% per month). I really like Unbolted as they don’t deal with property as most of the other lenders do (although they do have a sister company that does). They are used to defaults (pawn shop loans) and are absolutely experts at dealing with them, selling the items and recovering capital (not always covering everything, but generally returning capital and some interest). Over the whole time I’ve been investing in P2P Unbolted have consistently been the top of the XIRR tree, usually well over 8%. The problem of course is that everyone in P2P knows this so it’s always a case of more capital waiting to be invested than loans. I just looked back and I currently have more invested now at £15k than I have ever had with Unbolted in 6+ years. This is not because I limit it, it’s because it’s difficult to get large amounts of capital invested with them. I’d love to be able to get 50 or 60k with them but it would probably never happen without massive cash drag that would reduce the overall rates considerably. I’ll likely start to slowly run down the account a bit over time as I reduce my general exposure to P2P, probably leaving some in there just because I love them 🙂

Other Investments

Just a quick word about some of the other investments and what I’m doing with them:

Crypto – this account is down over 50% so not a great investment so far. For now I’ll just keep hold and let the staked tokens keep building. Perhaps one day it will come back. For now I don’t need the money I have left in this investment & I don’t like the idea of accepting a loss for no reason so I’ll just leave it and see what happens. Who knows, maybe it will storm back one day? In the long term I think Crypto (and especially Bitcoin, yes I’ve changed my view on that) will become very important as our economies falter under the weight of printing fiat currency and the mess most governments are making of our countries.

Stocks/Bonds/Gold – the growth portfolios are doing just what they have always done. Currently making their way back up from a drawdown (which happens every couple of years) but eventually they’ll get back to where they were. Probably as soon as inflation starts to curb (which apparently is starting already) and the central banks start to loosen their hold on interest rates. I think we’ll see bonds take off big time at that point too and pull the portfolios up (TLT). The stock market is almost back to where it was anyway if you look at VTI. REIT’s are still a long way from recovered though.

Find UK Property – this hands off, buy-to-rent opportunity turned out to be a great investment so far. They pay income usually a couple of weeks before due (they pay quarterly), and the value of the property I purchased has already gone up about 11% (plus the 6% income for the year). I’m actually going to buy a couple more properties over the next couple of years I think. Just waiting to see if prices dip anymore before I do (UK property prices already down 5% as I write this).

Whisky – I took profit on several months ago. It’s never wrong to take profit I was taught but in this case I left a bunch of money on the table. Oh well, can’t win em all 🙂

With that short update I’m going to say “until next time”, whenever that may be. No sense in posting updates with nothing to say. If/when I get other interesting investments or something happens worth talking about, I’ll post an update and let you know about it (assuming you stay subscribed to my list of course). You can always email me if you have specific questions on anything. Contact info is at the bottom of the page.

Take care and I wish good health and happiness to you and your families.

All the best,

Mark – The Obvious Investor

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.

Good to hear from you again Mark with your current update. You have been surely missed.I always looked forward to your updates,so please keep them coming even if there is very little to say. Yes we are living in changeable times,so it good to hear anothers opinion.You have such an easy writing style and the updates are a joy to read.

Best wishes

Pete

Thanks for the kind words Pete. I’ll try my best to update when anything worth talking about comes along.

Cheers,

Mark