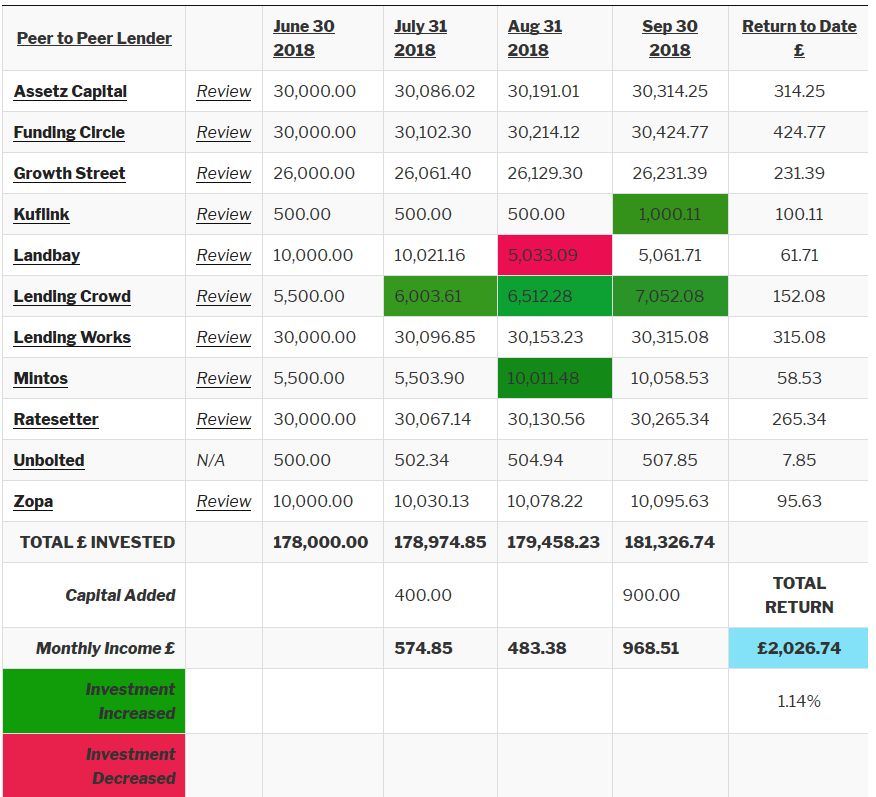

P2P Lending Portfolio Return Figures for September 2018

We are starting to see some of the loan payments kick in from most of the loans made over the past couple of months. The returns are starting to become more as expected.

I added funds to two of the lenders this month; £400 to Kuflink bringing my investment there up to £900 (plus £100 cashback bonus this month). I also sent another £500 over to Lending Crowd so I can keep bidding on loans to get the best rates.

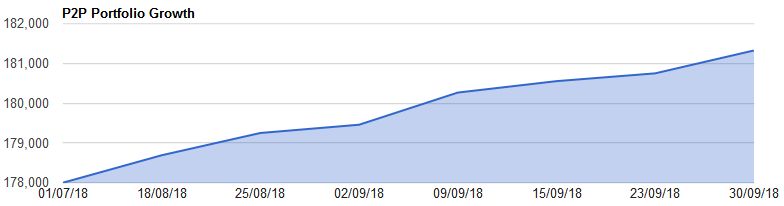

This month will be a more extensive update with some more account information so you can see how returns are made up. If you would like to see more charts you can go over to the Peer to Peer Lending Portfolio Returns Page where I update the charts weekly.

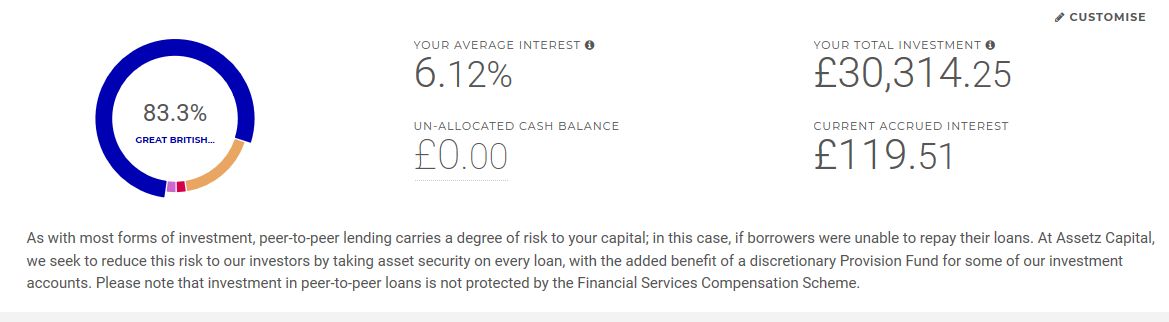

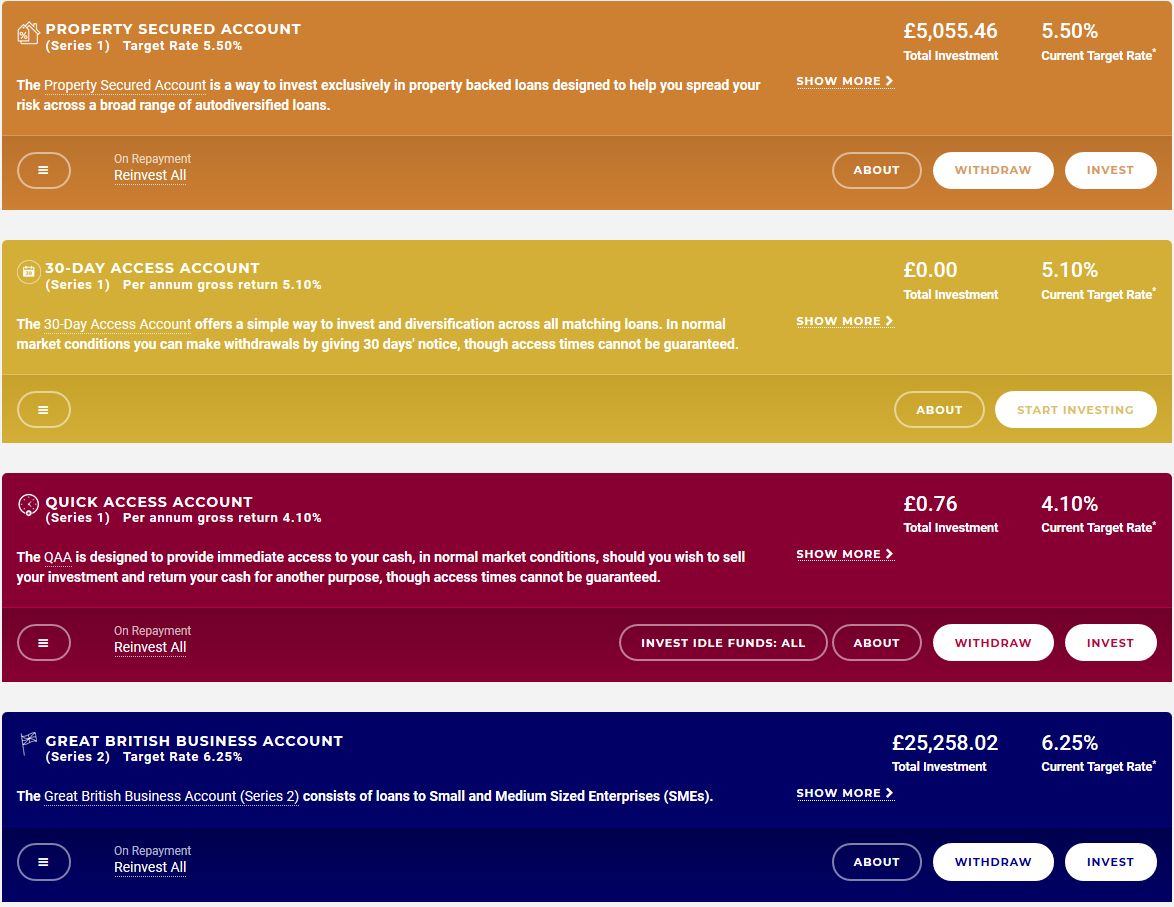

Assetz Capital**

With Assetz Capital I am invested in the PSA and the GBBA which are auto-invest accounts. I don’t even look at the loan parts on these investments as they don’t really matter because they are covered with the Provision Fund so if the accounts go late or in to default, the fund should pay out. Also because most of the loans are covered with property, Assetz should be able to get back most of any principle eventually.

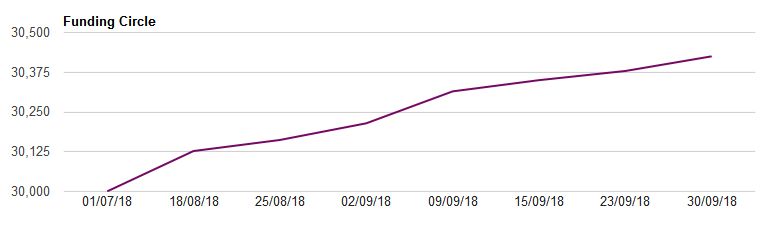

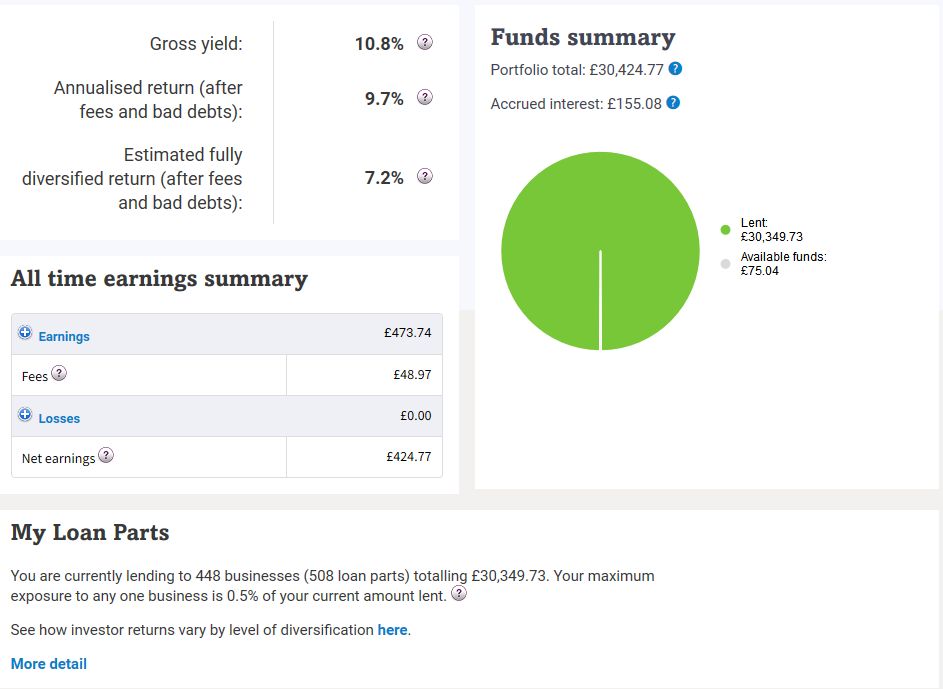

Funding Circle**

As you can see from the screenshots above, Funding Circle continues to deliver. It has produced the top actual returns to date, plus there is another £155 interest accrued but not yet paid.

All of the loans are up to date so far with the next payment due in October.

I really like the way Funding Circle automatically diversifies my investment. My capital is currently distributed between 448 separate businesses with 508 different loan parts.

Growth Street**

The Growth Street account summary screen shows the capital invested, returns and money waiting to be loaned out. It is possible to see the loans you’re invested in, but really it makes no difference. It all happens automatically and even if a loan goes bad Growth Street has a provision fund so under normal market conditions we should continue to get the rate shown (currently 5.3%).

Kuflink**

As you can see in the account summary screenshot, I’m invested in both the auto-invest and the select invest portfolios.

I increased my investment in Kuflink by £400 in September as I decided to start and get more into the Select-Invest portfolio. Kuflink also gave a £100 cashback in September, which helped. I rounded off the account to £1000. Kuflink’s loan flow is variable but as new loans come up, I’ll keep investing in them and send more capital as required. Because Kuflink has a very good default recuperation record (no lender has lost money with them to date), and they invest 20% of their own capital into each loan on a first loss basis, I could place a larger amount into each loan. As they are still relativity new to me, I’ll take it easy and keep good diversification for now though.

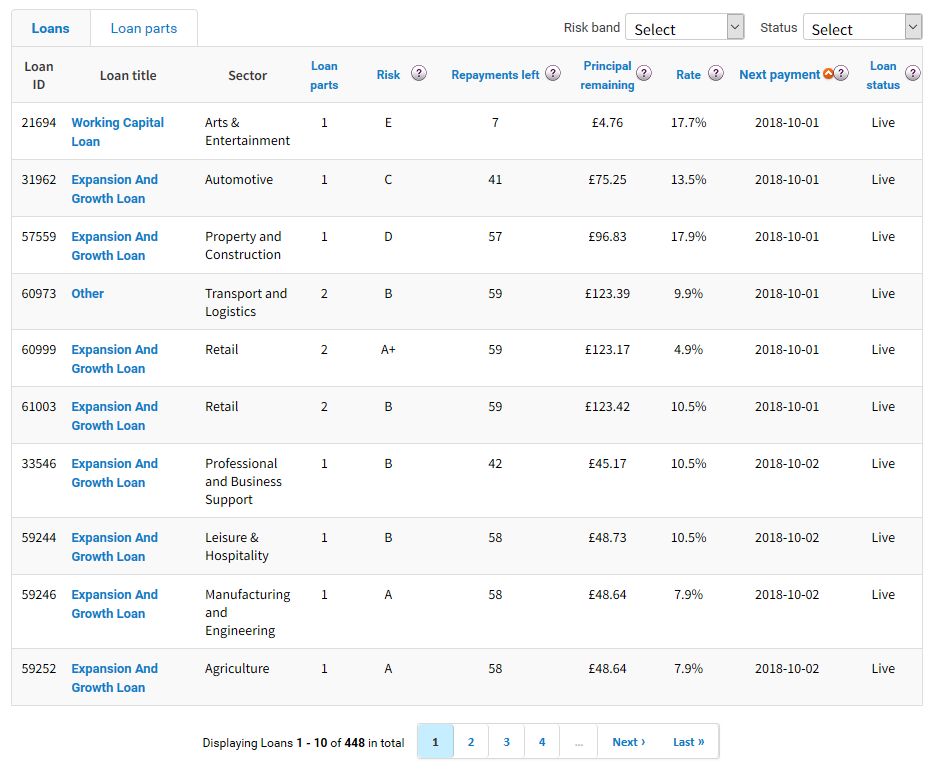

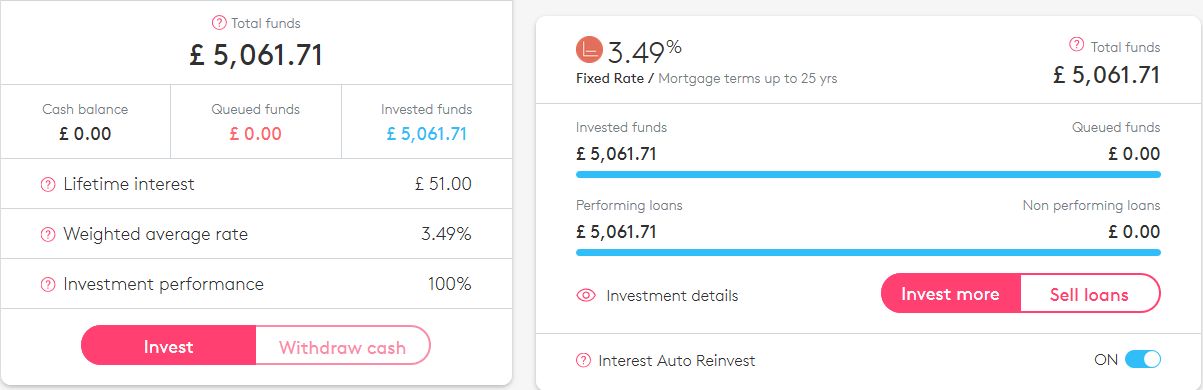

Landbay**

Landbay is the epitome of “set it and forget it” Peer to Peer investing. Lower risk = lower return, but it’s easy investing if you want a better return than a bank. Risk is as good as it gets with Peer to Peer investing as all loans are secured with “buy to let” properties with low LTV’s (Loan to Values).

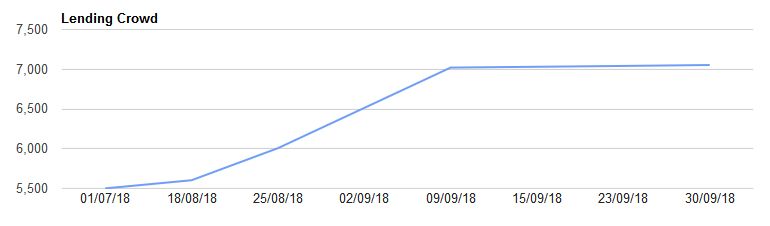

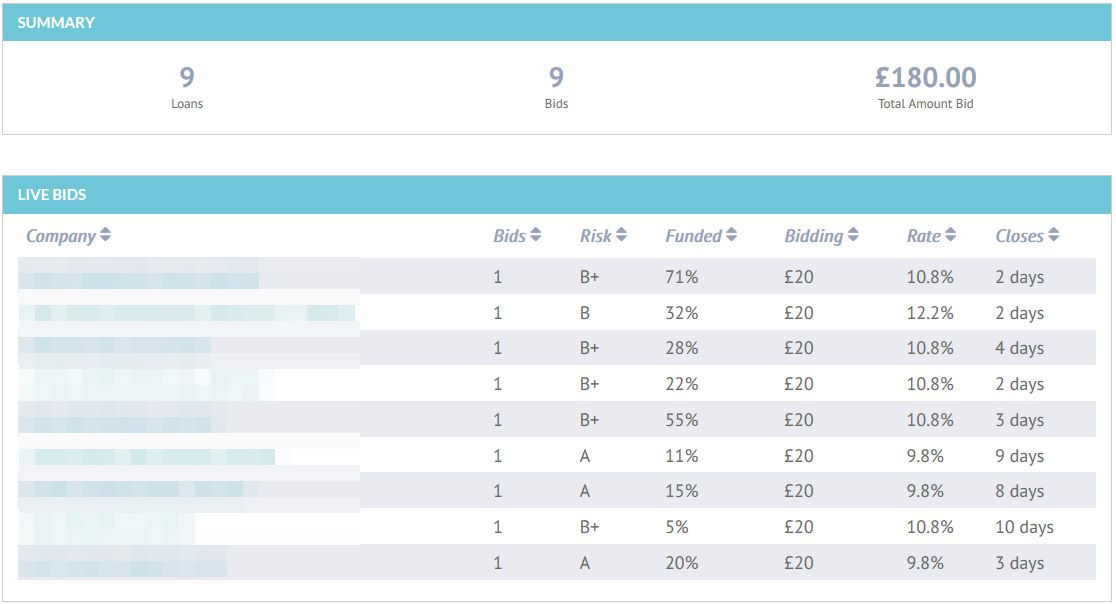

Lending Crowd**

I increased my investment with Lending Crowd by £500 again in September so I can continue to bid on the self-select loans. You can see by the summary screenshot that I am well diversified into Lending Crowd loans with a total of 274 to date.

I have the Auto-Bid feature set to automatically bid on new loans. I’m really happy with the Lending Crowd new loan flow. The 9 loans in the screenshot above have been bid on automatically. My strategy is to wait until a few minutes before each loan closes, and see where the bids are, then bid again on each loan at the highest rate available. Typically using this strategy helps to get a higher rate than the overall rate accepted on the loan.

Unfortunately there are a couple of loans in arrears. This is bound to happen with any lender. I will watch to see how well Lending Crowd recoup any defaulted loans to ensure they are getting capital back in a timely manner.

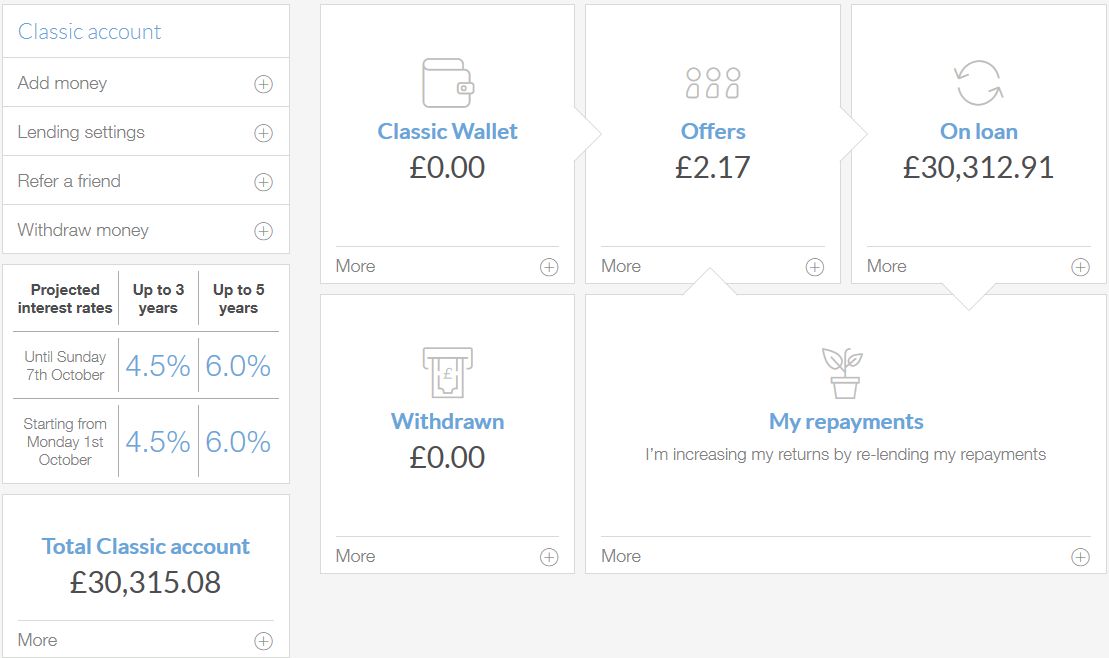

Lending Works**

Lending Works is another “set it and forget it” investment. Providing you have reinvestment set, everything is automatic after the initial deposit and offer to lend is initiated.

As you can see above, it’s possible to list the loans you’re invested in, but it really doesn’t matter as everything is managed by Lending Works. If there is a default you likely won’t even know about it as the “Lending Works Shield” comes in to play and everything is taken care of in the background.

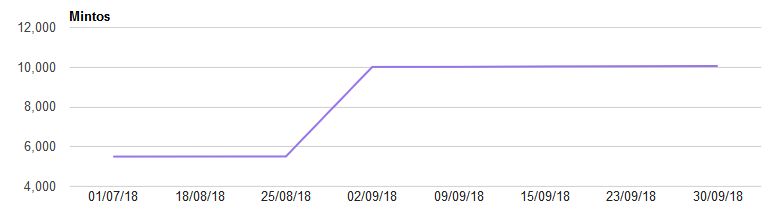

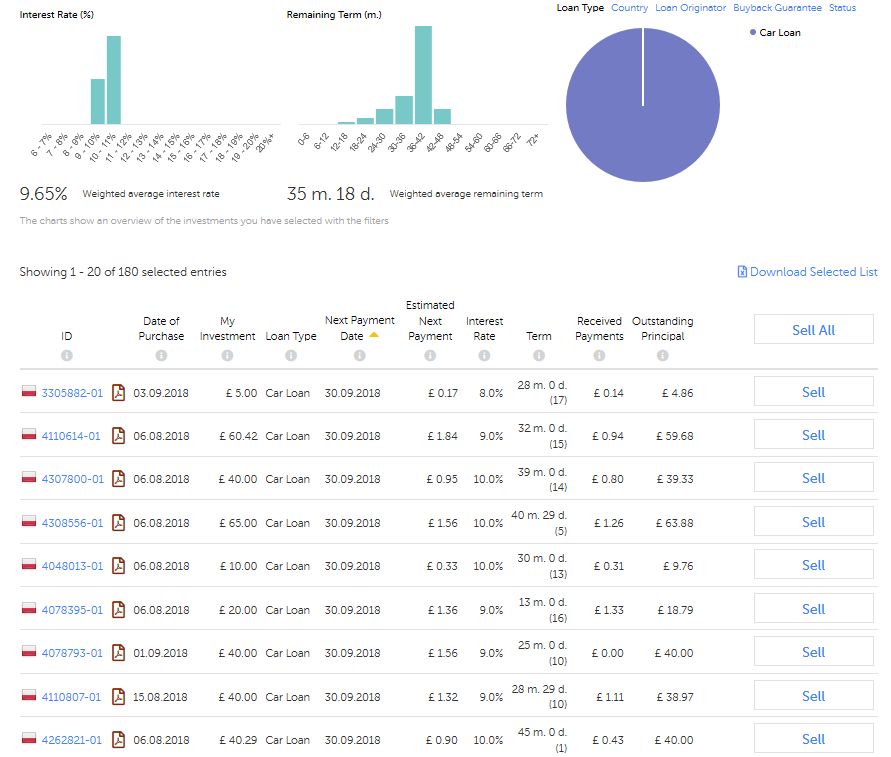

Mintos**

The Mintos account screen shows all of the investments I’m in, as well as investments which are late. I don’t worry too much about the late loans with Mintos as the originator my loans are with (MoGO) offers a buyback guarantee, so when loans go to 60 days late they buyback the loan and credit your account.

If you click on any of the links under “My Investments” you can see the loans that you’re invested in, along with a summary of the information on each loan.

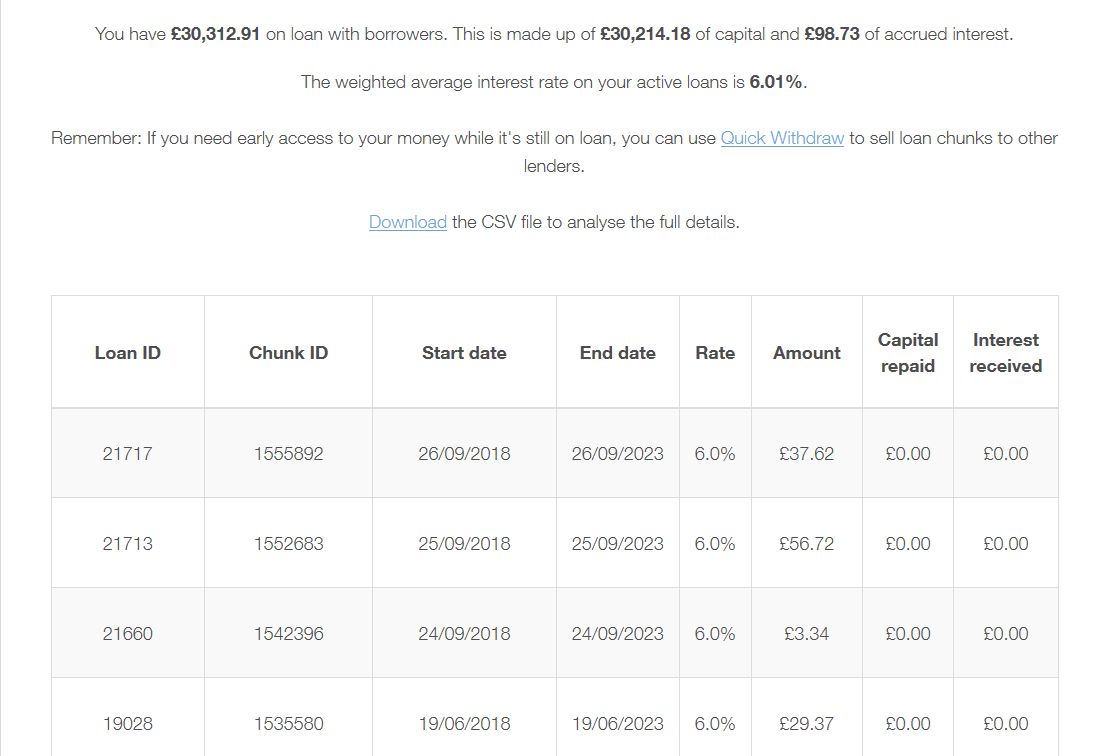

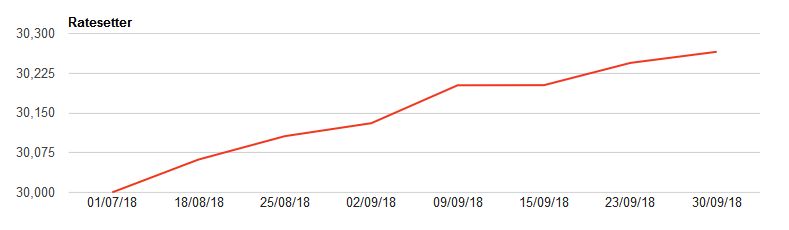

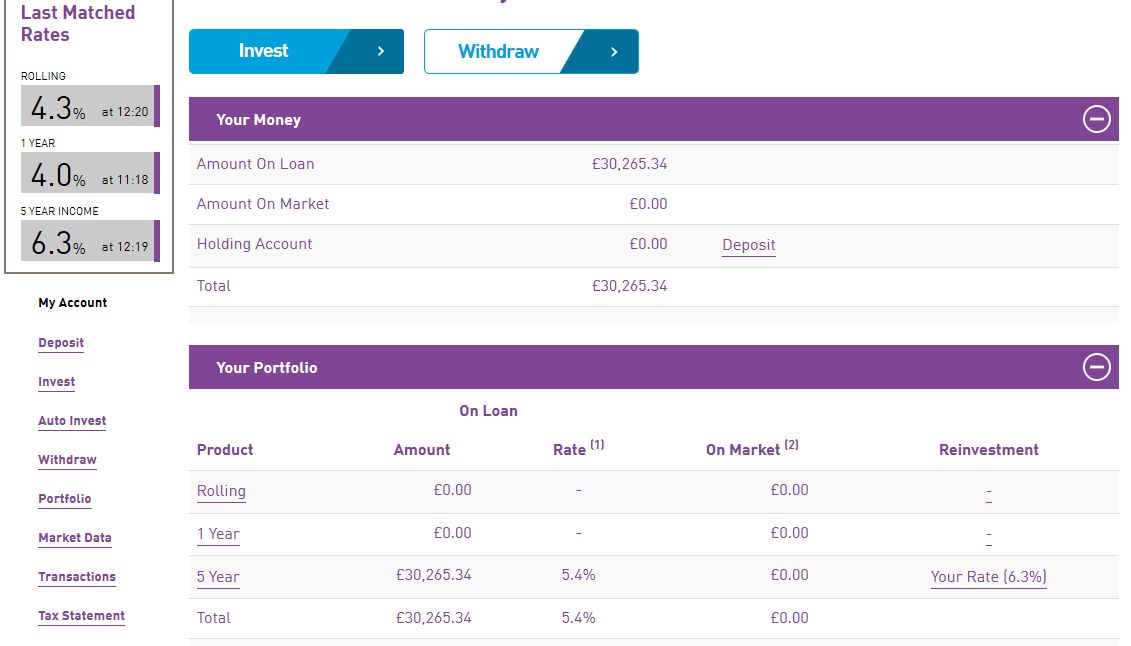

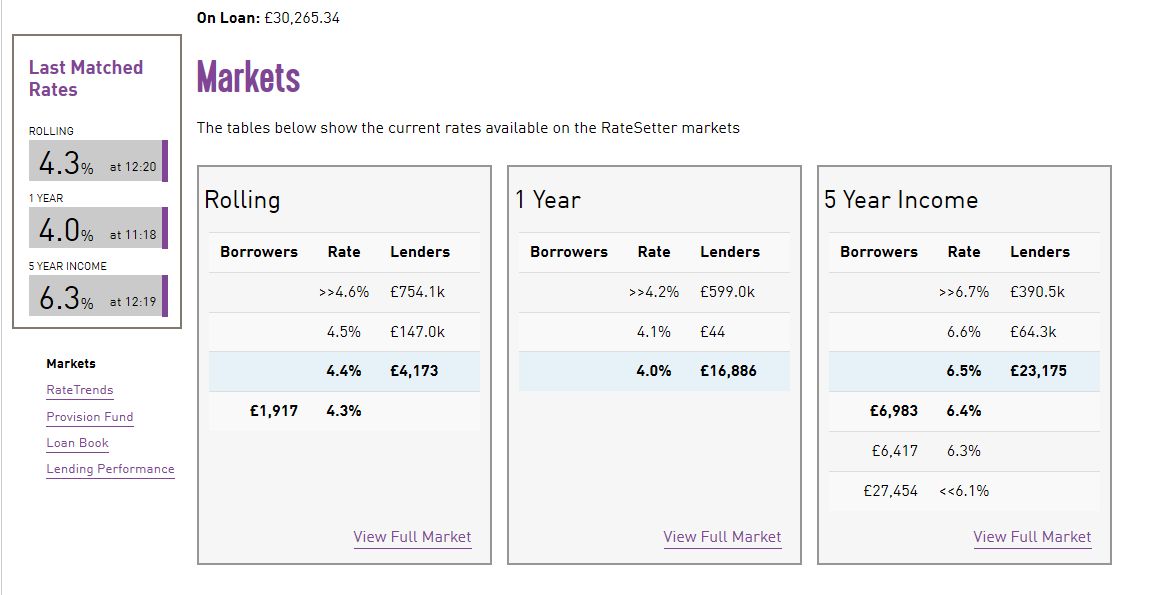

Ratesetter**

Ratesetter rates have been climbing significantly lately. When I first invested with this portfolio I thought I was lucky getting 5.4% as rates had been trading below 5% for a while. Now people are seeing 6.3%+ which is a great rate for a lender as large and well established as Ratesetter. I have my reinvest rate set at 6.3% now and it keeps getting filled so I’ll watch it and keep increasing it as needed.

Rates are up at 6.5% as of today (30th September).

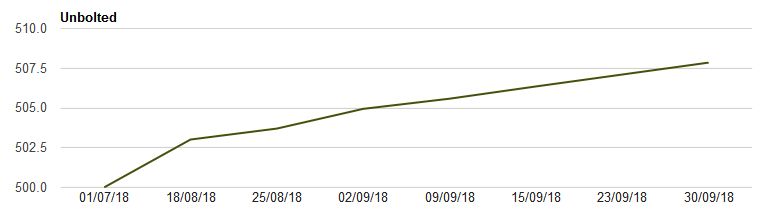

Unbolted**

No Review Yet

I have mixed feelings about Unbolted. I originally sent 2.5k over there to try them out, but after 1 month only £400 of the capital had been invested so I withdrew the rest and invested it elsewhere. Cash drag is not a good thing. The account is set to auto-invest so there is nothing to do with it except watch. I will do some more research on Unbolted moving forward and see if I can figure out how to get more capital invested with them. I like the unique short term loans they have for a little more overall portfolio diversification.

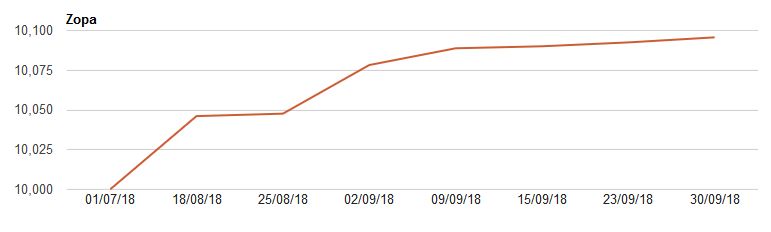

Zopa**

Last off is Zopa. Another “set it and forget it” investment. Since Zopa discontinued its safeguard fund, I’m waiting to see how their loan retrieval team do when I start to see some defaults. I do want to keep capital here as part of my diversification plan, but the rates are not great for unsecured loans. Zopa is the oldest P2P lender in the UK though so hopefully they will continue to deliver the returns as advertised.

That’s all for this month. I’ll continue to update the charts on the main Peer to Peer Lender Portfolio Returns page weekly and do a full report again next month.

Click here for reviews on all Peer to Peer Lenders in this update.

My opinions on ratings and risk rating factors refer to my personal experiences with these lenders. Including factual data such as interest rates, loan types, security, platform history, default numbers etc. Read my Disclaimer before making investment decisions.

**Affiliated! I am an investor with these lenders! (I only review companies I invest with so I can provide an honest evaluation). If you click on an affiliate link, I may receive a small commission, at no extra cost to you. It helps me to run this website and continue to offer new reviews and updates.