The charts above updated monthly here

.

Dividends for November

– TLT 415 x 0.2608 = $114.75

TOTAL $114,75

Update

Just a fairly short update this month as really not much has changed since the October update. The US market has bounced back a bit due to a rumor that the US and China were about to agree a trade deal. We’ll see what happens there, but unlikely right now me thinks.

The REIT’s in the Growth Portfolio really came back and supported the rest of the portfolio in November. VTI came back a bit too, notice how gold is also still slowly gaining, but still at the bottom of the pack. If things get any more heated with the US, China, Russia & Iran, and the world becomes even more unstable, gold will start to rally. Just watch.

BREXIT is also making things unstable globally. You wouldn’t think it would effect anywhere but the UK, or maybe the UK and Europe, however it does. Even USA markets can get nervous about BREXIT as they don’t know how it’s going to work, what it will do to the UK and European markets, which of course many USA companies trade with. This in turn could impact USA corporate profits, not only because of trade, but because of currency fluctuations. If Europe is in turmoil, then the US Dollar (the worlds reserve currency) is strong, as capital flees into it for safety. If the Dollar is strong, then US goods are expensive to European citizens for purchasing as USA imports, so you can do the math from there. On top of that, if USA companies are paid in Euros or GB Pounds, and those currencies are weak, that also takes from their profits as they report earnings to the US Stock Market in US Dollars.

Currency Fluctuations

Speaking of currency fluctuations, I have been waiting to change some US Dollars into Euros in order to make a large purchase. So, I’ve been trying to figure out what is going to happen with the EUR/USD pair. I really believe that in the long term, the Euro will come down hard against the USD. Economically speaking, I believe that the Euro is hanging on by the skin of its teeth. The Euro is a failed experiment which will eventually end, and I think that many of the countries in Europe will end up going back to their own currencies, and will likely be better off for it. That’s in the long term though (5 to 10 years). There are many, many reasons for my beliefs here, but they are beyond the scope of this post. Of course they are all just personal opinions 🙂

Chart Patterns

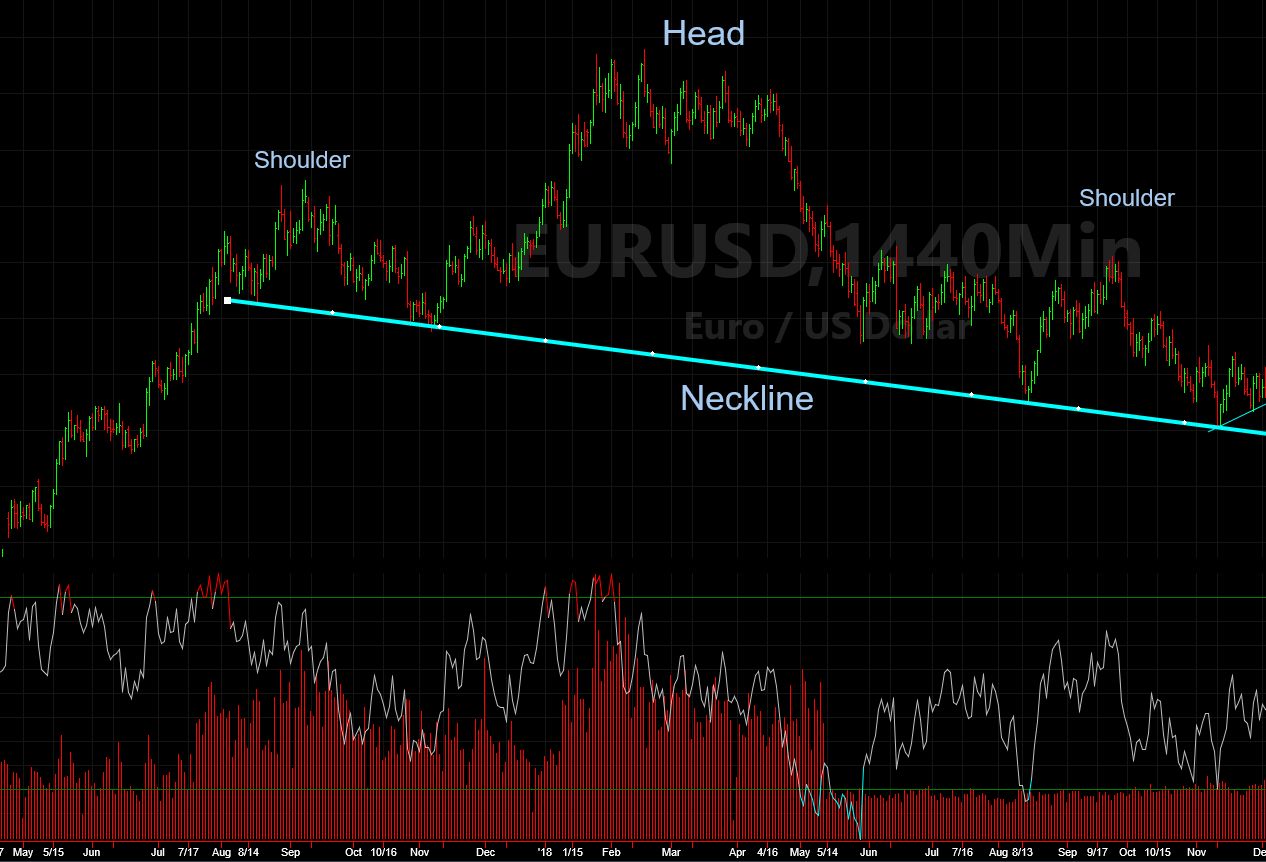

The other reason for thinking the Euro will come down a good bit against the Dollar fairly soon (next 6 – 12 months) is the technical analysis side (charts). First of all, there is a large “head and Shoulders” pattern that is just completing.

Typically if the price penetrates the neckline of a head and shoulders pattern, it means it is coming down. To get an idea of where it might go (price target) I typically measure from the highest point of the head, to the neckline,

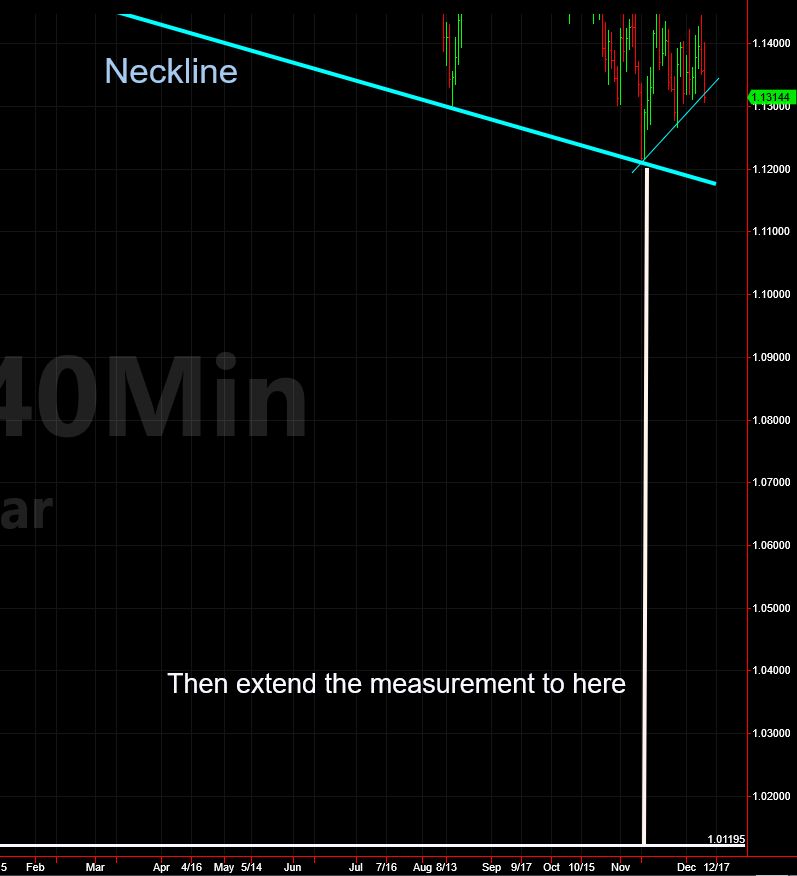

then extend down from the neckline to get a target price.

Often price will make that line when it brakes below the neckline. In this case, it would give us a price of around 1.01 Euros to the Dollar.

The second “technical” reason for thinking the Euro is coming down in the long term, is the long term chart (monthly). Take a look at the chart below. The Euro has been coming down against the Dollar for 10 years now, so in the long term, that’s the trend. What would prevent it from carrying on down? They always teach new traders “the trend is your friend”. Price would need to close monthly above about 1.25 to change the long term trend.

All we can do is wait and see what happens.As mentioned previously, I see no reason why this couldn’t happen over the next 6 – 12 months considering the economics in play.

Summary

That’s all for this month. I expect December to be a very volatile month in the markets with everything going on politically. Add to that the year end profit/loss taking (for tax purposes) and it could shape up to be a very interesting month.