Swaper – Pros & Cons

PROs 👍

- Part of Larger Group – being part of the larger and profitable Wadoo Finance Group gives Swaper P2P extra stability.

- Good Returns – 12% for loans in Euros with (mostly) 30 days access is a decent rate.

- Buyback Guarantee – the “Swaper buyback guarantee” will buy back the loans if they are delayed more than 30 days.

CONs 👎

- No Regulation – may make Swaper a riskier proposition.

- Currency Risk – investing in a currency other than your home currency can have it’s own inherent risks.

- No retirement account – for interest free investing.

12% Annual Returns Available Investing In Short Term European Loans. – Swaper Review. Is Swaper Safe? Find Out!

What is Swaper?

Swaper is a European short term Peer to Peer Lender, providing loans to consumers around Europe.

With loan terms from a few days up to 12 months (however most are between 14 – 30 days), and offering easy, hands-off returns of around 12%. They are an excellent option for diversification when investing in short term Euro currency loans.

Swaper P2P also offer a “buyback guarantee” on most of their loans, which means it will buyback loans and repay principal and interest if payments are delayed more than 30 days.

Swaper is owned by the Wandoo Finance Group who is a professional IT systems developer. Wandoo also originates loans and uses the Swaper platform to publish pre-funded consumer loans for Peer to Peer investment. Wandoo Finance Group employs more than 100 people and has developed and launched over 30 financial services and IT ecosystems in Europe and North America.

My Experience with Swaper so far

I have only been investing with Swaper P2P for a short time, however I have been watching them for over a year so I feel like I know them quite well. Swaper is another great option for short term Euro capital storage. Personally I invest in loans up to 12 months in length, but typically most are still under 30 days.

All loans on Swaper currently come with a 12% yield. My current XIRR is a little over 9% but it is still climbing. I expect it to be up around 12% in the next few weeks. XIRR on short term loans can vary up and down depending on defaults and how long buybacks take to kick in.

Since I first invested with Swaper, I have not needed to touch anything as far as settings are concerned. Their auto-invest system works well and funds seem to stay invested making for low cash drag.

Latest Update

Swaper seem to have been largely unaffected by the pandemic. Some loans faced delays of course but the buyback guarantee kicked in and paid the loans back as normal. Now we’re coming out of the lockdowns I can only see Swaper getting better.

My Swaper Strategy

I’ll continue to invest with Swaper as usual. I drew down some of my loans when the pandemic first hit for safety but I think now all seems to be ok. As I get Euros freed up to invest, I’ll have no problem placing some of them with Swaper.

The Obvious Investor – Easy-Info Table© – Swaper Review

The Obvious Investor – Easy-Info Table© – Swaper Review

Overall Rating*:  (3.7 / 5)

(3.7 / 5)

Who can invest: ![]()

![]()

Loan Currencies: €

![]()

Estimated Return: Up to 13%

Target Annual Return

(Platform Number): 11.06%

My Calculated XIRR: 10.71%

Risk Rating*: 5/10 - Medium

Early Exit: Yes

Loans can be sold on secondary market.

Min. Investment: €10

Deposit Funds: Bank account (SEPA Transfer).

Typically 1 -2 days.

Auto-Invest: Yes

Manual Invest: No

Lending To: Borrowers (through originator)

Loan Types: Payday/Consumer Loans.

Loan Security: No.

Provision Fund: No provision fund.

See review for "Buy Back Guarantee"

Loans Amortize: No. Short Term (30 day) Loans.

Time to Invest: Fast: large loan book.

Time to Mange: None (auto-invest).

Lender Fees: No.

Payments Received: Monthly, weekly. Various times.

Amount Lent: €80 million+

Number of Investors: 2,500+

Loan/Dflt Stats: Not Published.

Regulated: No

Location: ![]() Riga, Latvia

Riga, Latvia

Launched: 2016

Website: https://www.swaper.com

Email: info@swaper

Telephone: +372 6000393

IFISA/IRA: No

Cashback**: See Current Offers >>

How to Sign Up**: Sign Up Here!

Overview

History

Swaper is part of the Wandoo Finance Group. The Peer to Peer platform was launched in October 2016 in Riga, Latvia.

In the 3 or so years the Swaper P2P platform has been up and running, it has lent out over 80€ million Euros from 2,500 investors to consumers in 5 countries. Swaper currently provides consumer loans to consumers in Poland, Georgia, Denmark, Spain & Russia

Regulation

Swaper is not regulated as the UK Peer to Peer lenders are by the FCA, however they are actively scrutinized by the Latvian government and also they will need to adhere to European financial laws.

With many of the European lenders, investors look more at the history and strength of the lender to assess the safety of the investments. Instead of relying on a regulator.

Signup Process – Swaper Review

Opening an account with Swaper is relatively easy. Just the usual ID & anti money-laundering checks.

They typically need a copy of your passport or ID card and a utility bill or bank statement to show your current address will also be required.

Residents of any EU country can signup with Swaper. You’ll also need a Euro currency bank account with IBAN number.

If you don’t currently have a Euro bank account, take a look at this post I did on Currency Exchange and Moving Money which might give you a few ideas.

Deposits & Withdrawals

Deposits and withdrawals are made by bank transfer (SEPA transfer so IBAN number required).

You will be provided with the relevant bank details when you go to the deposits screen.

Deposits usually show up in your account the next working day depending on what time you send it, worse case 2 days.

Withdrawals are only to a verified bank account, and typically take 1 – 2 business days.

Time to Become Invested – Swaper Review

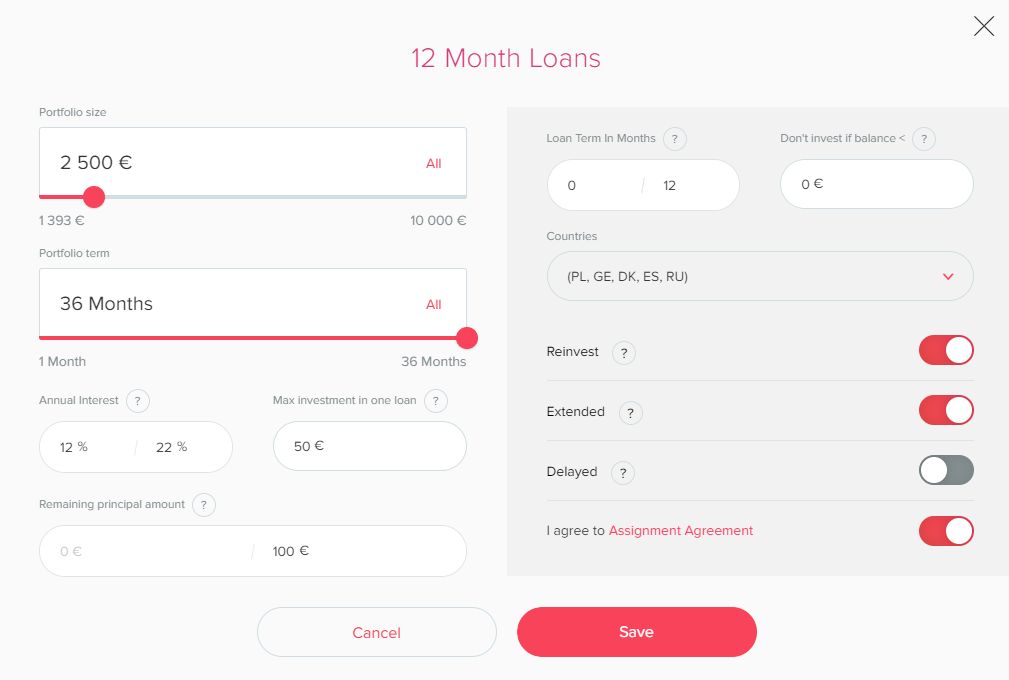

Swaper P2P has a large loan book provided from its parent company and loan originator Wandoo Finance Group. Once you’ve set up your auto-invest strategy (the only option with Swaper, no manual invest) it usually takes just a few hours for your capital to get distributed in to loans. I have seen reinvestment take a couple of days but typically it does not take that long.

Who are we lending to?

Swaper is a true Peer to Peer Lending Platform. Lenders are lending directly to borrowers. Loan agreements are directly between the lender and the borrower. Swaper just acts as a middle man, managing loans, payments and debt collection etc.

Similar to Mintos, Robocash & Grupeer – Swaper itself doesn’t originate the loans. The Swaper platform is just used to present the loans for individual lenders to invest in.

Loan Types

Swaper provides mostly short term (14 – 30 days) consumer loans. These types of loans can be for anything from a personal payday loan, to auto-finance and everything in-between. Most are payday loans it appears from my lending thus far.

Loan Security – Swaper Review

Typically there is no loan security with short term consumer loans, so we’re reliant on the Swaper buyback guarantee to make sure we receive our capital and interest back in the event of defaults.

Default Rates – Swaper Review

Swaper don’t publish their default rates. However speaking with them, it appears that the average is between 12% to 14% which is really high. However this is normal for the payday loan industry and is easily covered by the spread between rates charged to consumers, and the rates paid to investors.

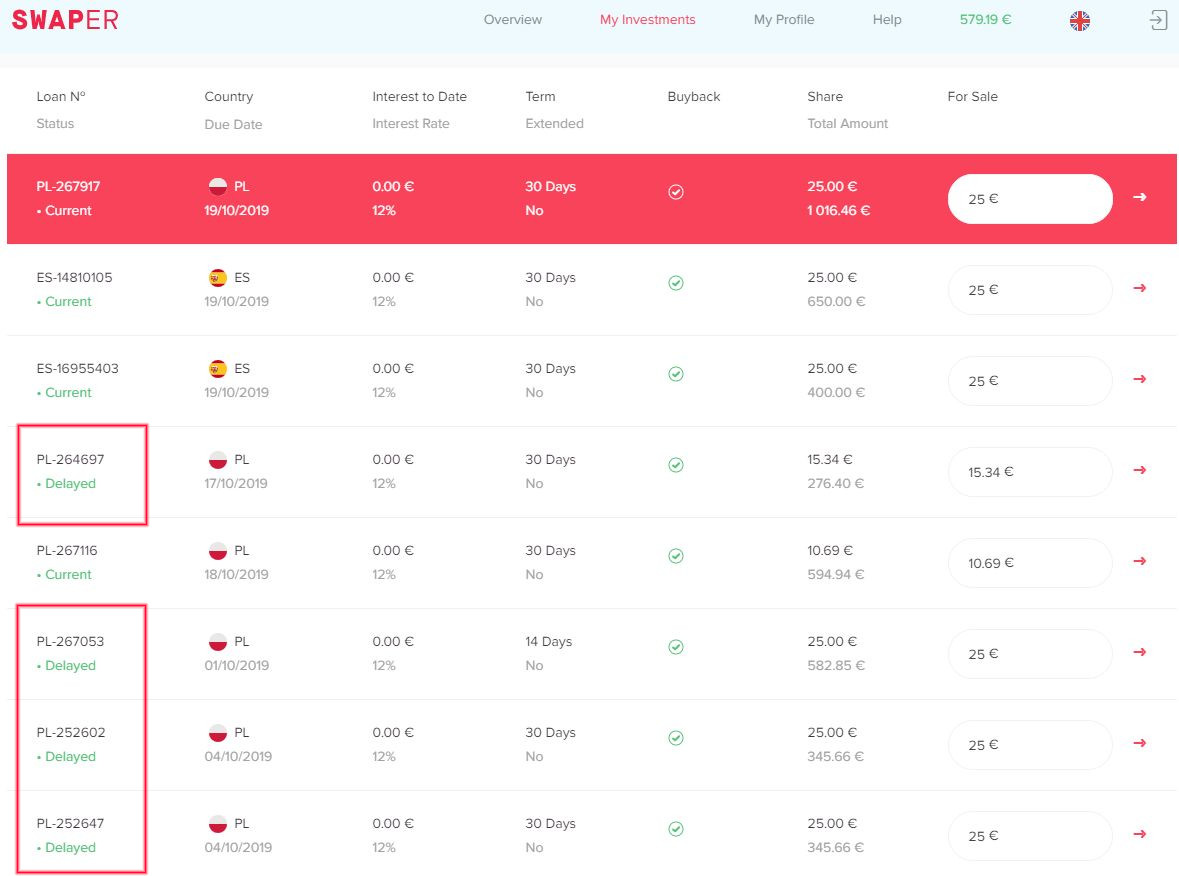

If you look at your investments at any point in time, you’ll see a fairly large percentage of loans are overdue. This is typical with short term loans though so I don’t worry about it as it is all taken care of with the Swaper buyback guarantees.

Amortization

As most of the loans on Swaper P2P are less than 30 days in duration, they do not amortize as they are basically paid back in full at the end of the term.

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over time. It reduces the risk of the loan compared to a non-amortizing loan in which nothing is received until the end of the loan period, or only interest is received monthly, and then the capital repaid at the end of the loan period.

Selling Loans and Withdrawing Capital -Swaper Review

You can sell loans on Swaper by clicking on the arrow from the loans listing page. This will present a popup asking how much of the loan you would like to sell.

Remember though that most of the loans are less than 30 days long, so unless you’re in a huge rush, just turn off the auto-invest feature and wait for the loans to be repaid.

Diversification – Swaper Review

Diversifying capital into loans is easy. The auto-invest diversifies your capital automatically based on the settings you give them, so you decide the amount you put into each loan.

Provision Fund

There is technically no provision fund with Swaper. However the previously mentioned “Swaper buyback guarantee” really helps to put more confidence in Swaper loans.

Tax Free Innovative Finance ISA (IFISA)

No tax free account options with Swaper.

Website – Swaper Review

The Swaper P2P Website is simple but effective. It’s fairly easy to figure out where everything is and how to set up auto-invest portfolios.

Return Rates – Swaper Review

Swaper return rates are very reasonable for a Euro lender. Their website says all loans are 12% but I often see a bit more. You’ll notice on the screenshot above, the the rate indicated is 12.68% with an XIRR of 9.26% which is low because the account is new and will increase as more payments come in. It should get to 12%+ within a couple of months. This is right up there with Grupeer, Robocash and Mintos, and the loans are only for 30 days, which gives easier access to capital if needed.

My Personal Swaper Investment Strategy

My Investment strategy with Swaper is simple. I just choose all countries & loans which offer a buyback guarantee (which is all of them currently), and set the interest rates between 12% and 22%. Basically I just accept the default settings, except I set the loan period to 12 months (even though most loans are less than 30 days). I also don’t buy delayed loans as that would be silly in my opinion. Some people don’t buy extended loans either, I think however that as long as the borrower is paying, I am earning interest. The fact that a borrower needed a little more time to pay is not a huge issue.

I make the portfolio size larger than the amount I have invested to make sure interest is reinvested as it comes in.

Swaper Review – Summary

Swaper is certainly a viable platform for lending out Euros for short term access. Their return rates are very good for auto-invest loans with little to no time required to manage, and short term capital access.

The Swaper buyback guarantee and the size of the Wandoo Finance Group in my opinion it makes Swaper one of the safer Euro lenders out there.

I intend to increase my investment in Swaper as I get to know them better. I have no hesitation investing in Swaper as part of my diversified Euro portfolio, and I can definitely recommend them as part of an overall investment strategy.

Thumbs Up Points for Swaper P2P

-

Part of Larger Group – being part of the larger and profitable Wadoo Finance Group gives Swaper P2P extra stability.

-

Unique Diversification – focusing on consumers in many different countries in Euro currency. Makes for good diversification out of business loans.

-

Good Returns – 12% for loans in Euros with (mostly) 30 days access is a decent rate.

-

Auto-Invest – auto-invest options are nicely configurable enabling hands-off investment.

-

Buyback Guarantee – the “Swaper buyback guarantee” will buy back the loans if they are delayed more than 30 days, therefor making investments safer.

Thumbs Down Points for Swaper

-

No Regulation – may make Swaper a riskier proposition, however having a good history, and being part of the larger Wandoo Finance Group helps to lower the risk.

-

Currency Risk – investing in a currency other than your home currency can have it’s own inherent risks if it falls. If your home currency is Euros then this is not an issue.

-

No retirement account – for interest free investing.

Risk Factor – 5/10 – Medium

Is Swaper Safe? I consider Swaper P2P to be in the medium risk category.

Even taking in to consideration Swaper is part of the larger Wandoo Finance Group, which is profitable, it is still an unregulated business in a foreign (to many people) county.

Who Can Invest with Swaper?

![]()

![]() Safe?

Safe?

Residents of EU countries can invest with Swaper. Contact Swaper for more information

Swaper Cashback Offers, Promo Codes & Signup Links**

No offers currently.

Disclaimers: This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website. * My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective. ** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations. Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences. Please read my full website Disclaimer before making investment decisions.