Growth Portfolio Update for August 2018

August was a great month for the portfolios we are following! My Personal Portfolio is still heading up now REIT’s have found themselves, and we have finally passed the Permanent Portfolio for the year!

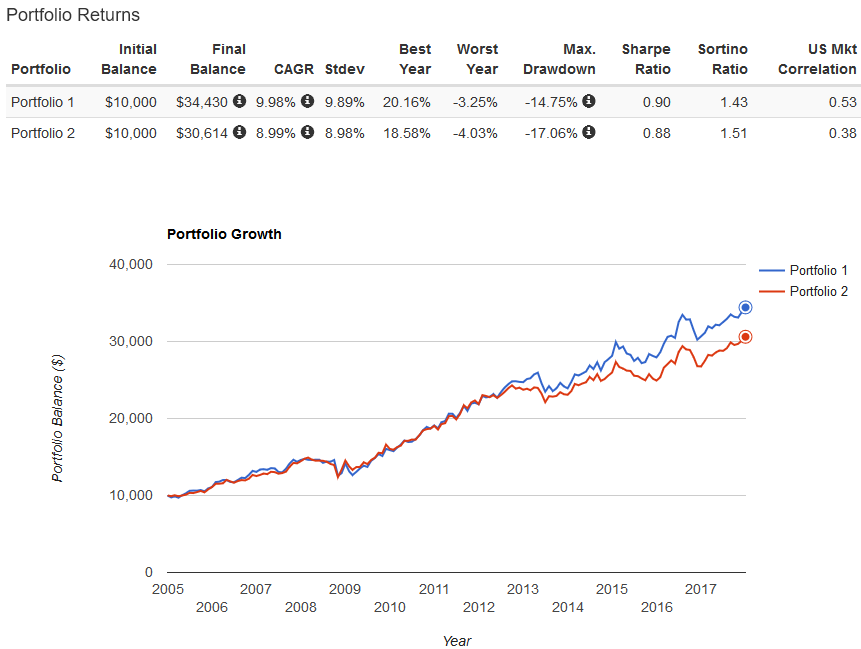

My Personal Portfolio (Portfolio 1 below) is where my capital is invested and it did very well in August and overtook The Permanent Portfolio (Portfolio 2) for the first time this year.

Cash values have no relation to actual portfolio values, and are just for demonstration purposes (obviously).

The drawdown earlier in the year in my Personal Portfolio was mainly due to the REITs taking a dive. However once the REIT’s got back in the game they came back with a vengeance! I keep most of my REIT investments in a tax free retirement account so the higher dividends on these investments (around 4% combined) won’t be subject to tax until I decide to withdraw the money.

Here is how the actual Growth Portfolio we started in June looks as of today.

I’ll start and put some graphs together next month now we have a little data to work with. These are the actual figures for August though.

Bonds

Our Bond ETF almost completed an inverted head and shoulders formation, which actually supported the portfolio for August. Although as I write this on Sept 4th they are not looking so good.

It just goes to show that we never really know what’s going to happen in any of the markets. That’s why we use a portfolio of loosely correlated assets and don’t put all of our eggs in one basket.

Watching Investments?

A suggestion, based on 25 years of watching these portfolios, is DON’T WATCH THEM! I only look at the portfolios at the end of the month, so I can publish the information on my blog here, and talk about it a little. I’ve learned that watching them day in, day out can drive you crazy. It’s like an emotional roller-coaster. Especially if you have a significant amount of capital invested.

In just one day portfolios can be up tens of thousands, and the next day down just as much. A big problem with watching every little move is that it can cause some investors to panic and start to sell assets. This is a BAD IDEA (ask me how I know). Inevitably the asset you sell comes right back, right after you’ve just sold it, and you’re left holding a big loss that you can’t recuperate.

Our portfolios have been invested in, with real capital, and also backtested for many years, so we have to trust that, and hope that they’ll continue to do what they’ve always done and keep making us a good return.

When I start to feel the pain of drawdowns, I go back to Portfolio Visualizer, load up my portfolios, and remind myself what they have done over the past 25 years or more. It helps to remind me this is most likely just another drawdown that will come back soon.

So, having lectured everyone about not watching portfolios, I will go back to not watching them myself now, for another month at least 🙂

Next update on the Growth Portfolio will be at the beginning of October (for September 2018).

An update on the Income Portfolio will follow in a couple of days, when I get all of the numbers together.

More about My Investments here