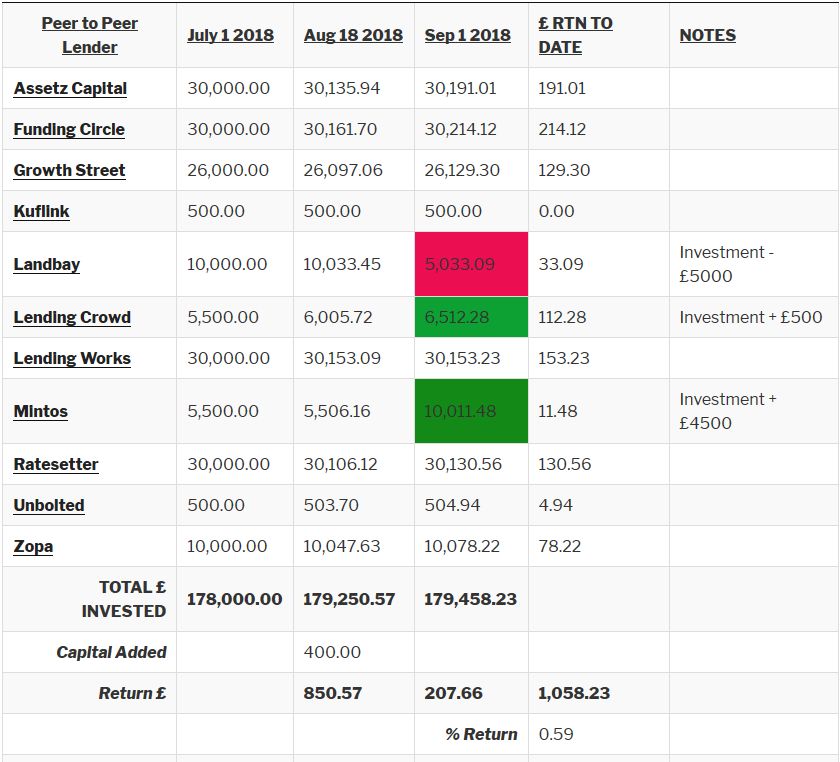

Here are the Peer to Peer Lending Portfolio results for the month of August 2018

Just as a reminder, this was less than half a month returns because of the late update in August for July. Moving forward I promise to keep the updates monthly at the beginning of the following month.

Updates

Landbay

I decided to take some of the capital out of Landbay and place it in to other investments. This was money from the tracker account so there was no penalty for withdrawing it. My reasoning for withdrawing was because I’m getting more and more comfortable with Mintos. The 3.14% from the Landbay tracker account, although very safe, is just a little less than I would like.

Mintos

Even though there are only car loans from Mogo available on Mintos in GBP. I can still get good diversification over them (no more than £50 per loan, so only 0.5% of the account in any one loan, which I like). So I sent £4,500 to Mintos to round out an even £10k. I feel like, although Landbay is one of the safer lenders, I can do much better than the 3.14% their tracker account pays. Even though the Mintos account is not a quick access account as such. I think it should still be relatively easy to sell loans if I need to. There always seems to be a good market for the loans made in GBP, as there are not so many of them. My Mintos account is currently targeting 9.54% return on the car loans. Just couldn’t resist 3x the return of Landbay on the money.

Lending Crowd

I sent another £500 to Lending Crowd because the money sent last month was already invested in to new loans. I’m getting good diversification here and also good rates on new loans with the bidding feature.

Funding Circle is the top lender for me at the moment. They have returned the most to date and continue to impress. I do need to expect some losses soon though. I notice there are a couple of loans outstanding as of Sept 2nd so they could turn in to collections or total losses. I hope they will get them up to date for me but we have to expect some losses in the lending business.

Growth Street

Although Growth Street are doing well for me, I’ve noticed a little bit of cash drag as of late (few days). I’ll keep an eye on it to see if that improves. One of the problems with a short term lender is; if they don’t have enough loans to put money in to, money can sit around for a while when old loans are paid off or new investors come in to the lender. This is called cash drag, and it has an effect on the overall return rate of the portfolio if cash is sat there not earning interest.

Kuflink

You may have noticed that Kuflink has no returns to date. This is because I invested the £500 in their 12 month auto-invest at 3.99% in order to a get cash back bonus. Their auto-invest portfolios only pay interest annually so I won’t get anything until the loans mature. I should however get a cashback bonus from them next month so I’ll invest that in their manual select-invest account. I may also send more money to Kuflink as we move forward.

I intend to do a review on Kuflink at some point in the future. I’ve been working on reviews on other lender reviews too.

Summary

Short update again this month. Still waiting to get some time under the portfolio so I can start and publish some charts. Hopefully next month I’ll start to do that.

If you have any questions on this, or any other part of the site, please don’t hesitate to contact me