Overview

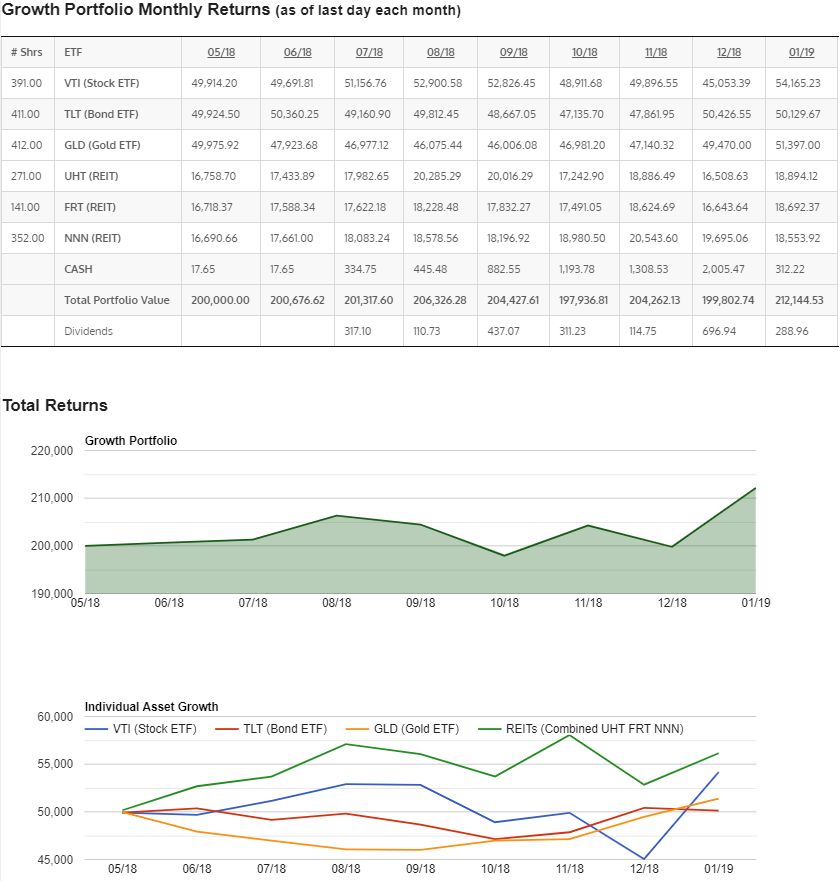

After a lackluster 2018, and a pullback last month, the Growth Portfolio came roaring back in January making gains of over 6% in a single month! Even Harry Browne’s Permanent Portfolio came back at almost 5%. You can see by the Individual Asset Growth chart that the gold and bond ETF’s started up in December after the stock market panic pullback, and then continued up (gold at least did). The stock market ETF (VTI) came back huge, as did the REITs. For me this portfolio is still the best asset allocation & portfolio out there. I just haven’t come across anything that consistently returns the same numbers without the big drawdowns.

Annual Re-balance

On January 2nd I re-balanced the portfolio which is done annually to take profit from assets that have risen, and put it in to assets which have fallen in value. This is what I did to balance out the values (cash from dividends from 2018 was also reinvested at this time):

Sold 54 x NNN

Sold 4 x TLT

Bought 2 x UHT

Bought 38 x VTI

Bought 4 x GLD.

This leveled out all of the assets to around the 25% each asset class which we should start with each year.

Dividends

Dividends for January 2019 are as follows:

TLT – 112.96

NNN – 176.00

TOTAL $288.66

Backtesting

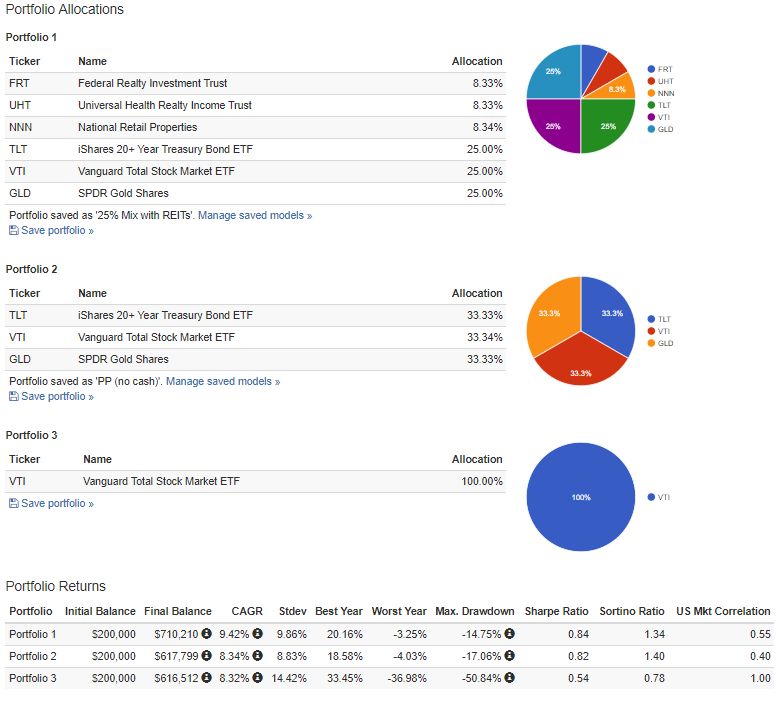

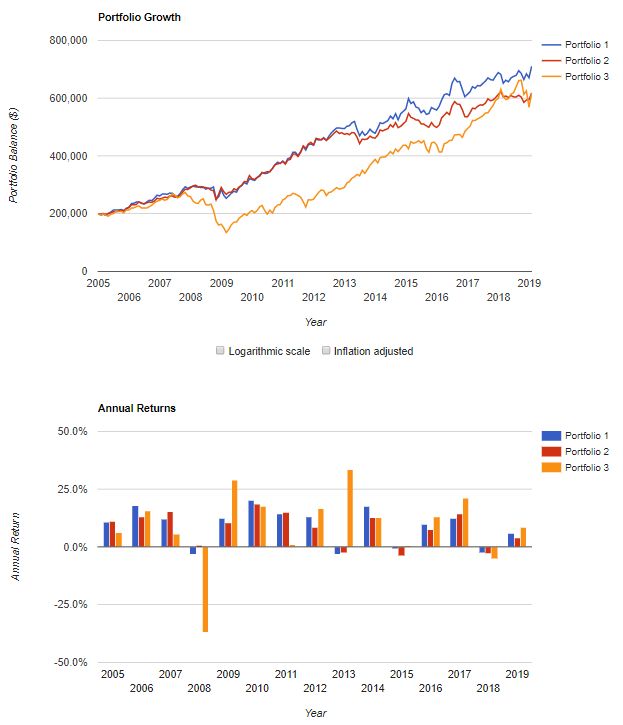

Updating the backtest of our portfolio and comparing it to other popular portfolios, we can still see that we outperform. Even considering 2018 was a minus year for all 3 portfolios, we can still see that our portfolio drew down the least of the 3, Harry Browne’s Permanent Portfolio was second. A portfolio of just stocks (using VTI – Vanguard Total Stock Market Index Tracker on it’s own ) was the worst. This is why I like to use different assets. In the long run our portfolio always comes out on top with the least amount of drawdown.

Wolfe Wave

If any of you are following the Wolfe Wave in the Dow Jones still, you’ll see that it is actually still heading for the target line, and if we stuck to the Wolfe Wave rules exactly, we would still be in the trade. This is all hypothetical of course as I didn’t buy anything and I don’t trade waves (or anything else for that matter) anymore. But it is fun and interesting to watch them develop. I just stick to the Growth Portfolio and my P2P investments.

Summary

That’s really all the is to say about the Growth Portfolio for this month. It’s doing as it has done for the past 30+ years. It goes up, pulls back, goes up etc. however it always seems to come out on top of other popular portfolios averaging well over 9% per annum growth which is nothing to complain about. I’m happy with it and that’s where most of my money will stay, as it has for 20+ years.

Nice portfolio and nice returns! Keep it up!

Thanks! I have been investing in these exact assets for over 20 years.