Zopa are no longer lending to retail through their Peer to Peer platform. This review left for historical purposes.

What is Zopa?

Zopa is the oldest and one of the largest Peer to Peer lenders in the world.

Providing personal loans to consumers around the United Kingdom, they offer their investors the option to invest with one of the most experienced lenders in the world.

The platform offers targeted returns of 2% – 5.3% on mostly unsecured personal loans for terms from 1 to 5 years through their auto-invest portfolios.

They also offer a tax efficient Individual Savings Account account (Zopa ISA) for potential tax efficient investing.

Detailed Overview – Zopa Review

When Did Zopa Launch? – History

They launched in 2005 in the United Kingdom. In the time they have been in business, they have lent in excess of £5 billion from almost 80,000 active investors.

In January 2017, the platform became the first United Kingdom based peer-to-peer lending company to lend more than £2 billion worth of loans.

Their management team originally started off in banking (Egg Internet Banking), and then helped start the P2P lending revolution leading Zopa to become one of the biggest Peer to Peer Lenders in the world.

However now it appears they are trying to be a bank again. They separated part of the company to create a “Challenger Bank” in the United Kingdom.

Is Zopa Regulated? – Are They Safe?

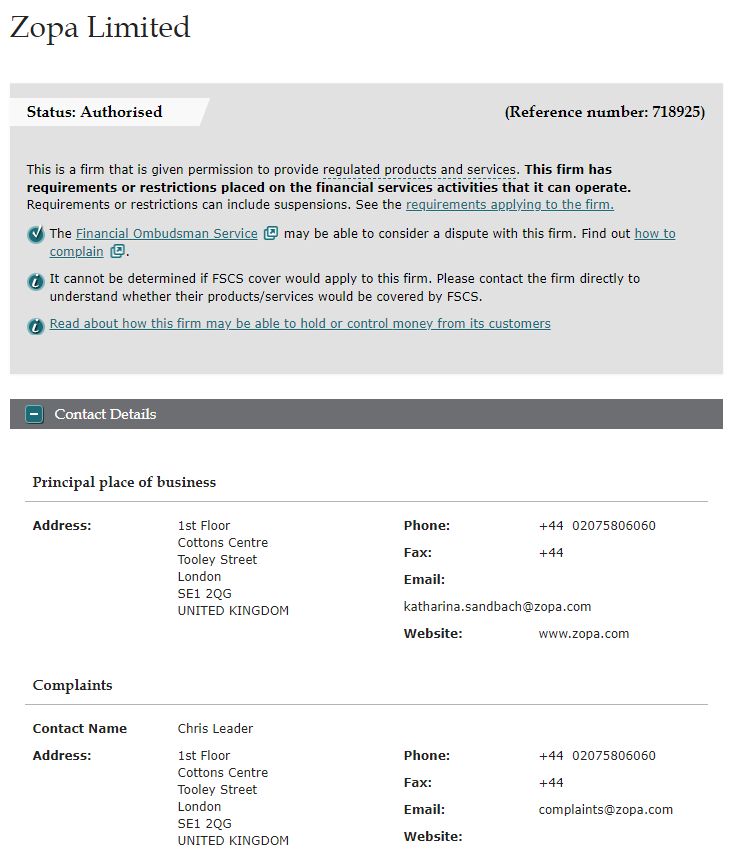

The platform is regulated by the United Kingdom’s Financial Conduct Authority (FCA) with full permissions under FCA number 718925.

They gained FCA permissions in May, 2017.

It’s important to note in this Zopa review that the FCA is not the same as the FSCS (Financial Services Compensation Scheme), so capital is not protected as it would be in a bank.

How Can I Signup with Zopa? – Signup Process

Opening an account is fairly easy. Just the usual ID & anti money-laundering checks.

If they can verify you though one of the United Kingdom’s credit agencies, you will be approved immediately. If not, you may need to send them a copy of your passport or driving license, and a utility bill or bank statement.

United Kingdom residents with a United Kingdom address and bank account can invest..

How Can I Make Deposits & Withdrawals?

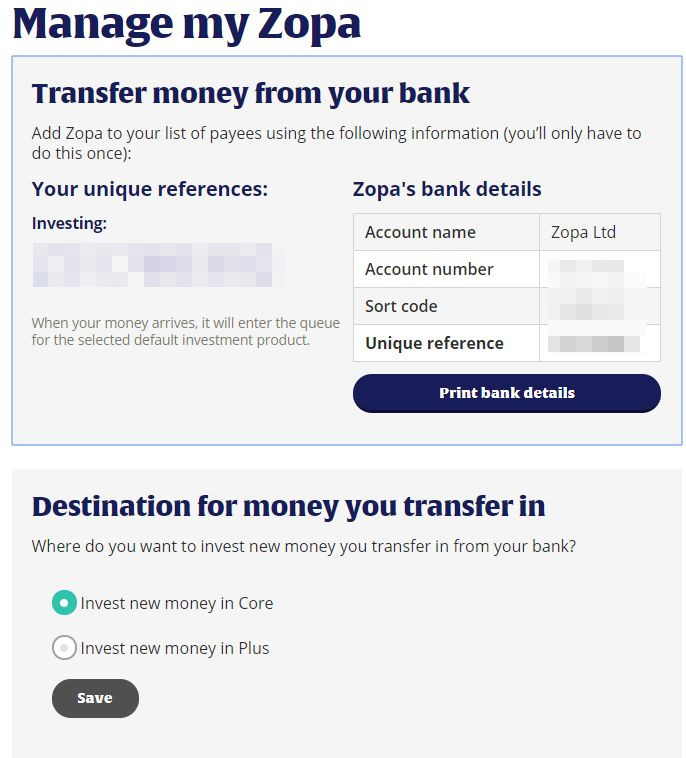

Deposits and withdrawals are made by bank transfer from a United Kingdom bank.

Bank deposits usually show up in your account the same or next working day.

Withdrawals are only to a verified bank account and typically take 2 – 3- business days.

How Long Does it Take to Become Invested?

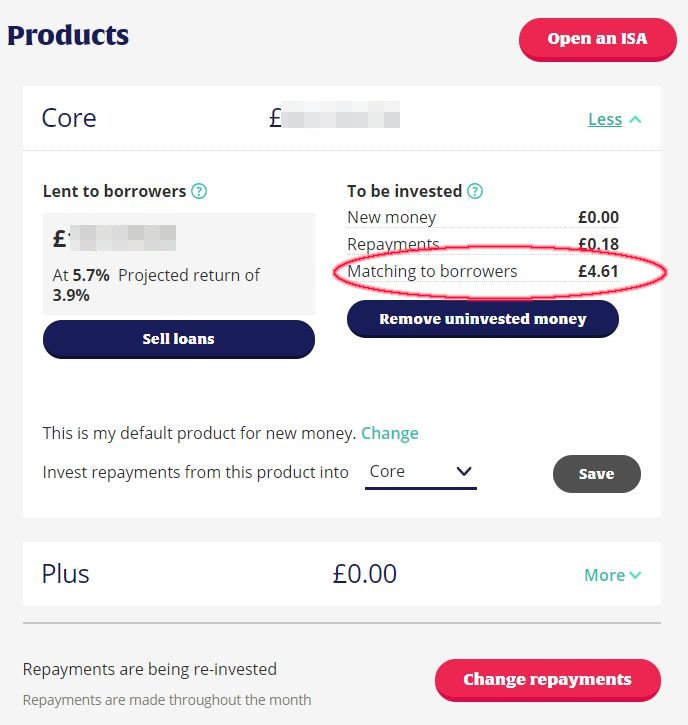

Even though the platform has a huge loan book, it can take a few days, to a couple of weeks to get funds completely invested.

Zopa loans are in heavy demand so there can be a lot of money in the queue before you.

The platform does not pay interest on un-invested funds unfortunately, so you won’t get a return while funds are not invested.

It’s always easy to see if capital is invested or not. When it is “Matching to Borrowers” it is not yet invested.

Who are we lending to?

Zopa is a true Peer to Peer Lending platform.

Loan agreements are directly between the lender and the borrower. The platform just acts as a middle man, managing loans, payments and debt collection etc.

Zopa provides loans to consumers for personal loans, debt consolidation, car finance, home improvement, wedding loans and holiday loans among others for terms of up to 5 years.

Is Zopa Safe? – Loan Security

Zopa loans are mostly unsecured personal loans to credit-worthy borrowers. So they are not as safe as platforms like Loanpad, easyMoney or Kuflink which offer property secured loans with low LTV’s (Loan to Value ratios) so if a borrower doesn’t pay back the loan, the property can be seized and sold to recover funds.

The platform takes in to consideration a certain number of defaults when they do their return projection calculations. These calculations are done mostly under “normal market conditions”, so if market conditions are not “normal”, they could be significantly different to the projections.

Zopa Default Rates

Actual loss rates as of this Zopa review sit at around 3.5%. The chart below shows actual loss rates vs. expected loss rates.

You can always see up-to-date statistics on the companies website statistics page.

Do Zopa Loans Amortize?

Generally their personal loans all amortize.

When loans amortize, it minimizes the risk when compared to a non-amortizing loan, in which interest or capital is repaid until the completion of the loan, or interest is only received month by month and then capital is repaid at the end of the loan period.

Amortization is paying off a debt with a standard repayment schedule in set amounts over time. It is a book keeping technique used to reduce the cost value of an intangible asset little by little through scheduled payments.

If you list the loans that your capital is invested in on the their website, you can see that a list of loans, and capital that has been repaid.

How Can I Sell Loans and Withdraw Capital?

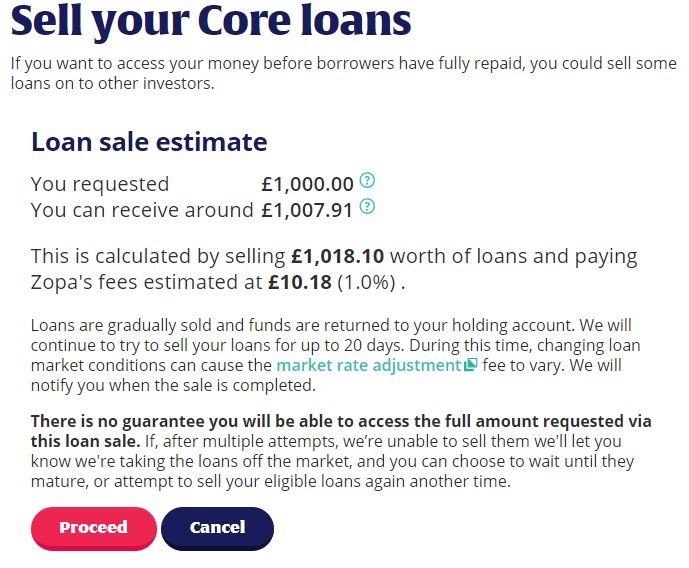

The platform charges an exit fee for withdrawing capital early.

It is 1% of the amount, plus any difference between current rates, and the rates your loans are at.

It can take anywhere from a few minutes to a few days to sell loans and withdraw capital in normal market conditions.

How are Zopa Loans Diversified?

Diversifying loans is something the platform does automatically.

Because of the way their platform works, diversification is all done in the background.

The platform’s website has lots of interesting information on loan diversification and distribution.

Although it is interesting, it is not really of any use as their auto-invest portfolios do everything behind the scenes.

Does Zopa have a Provision Fund?

They used to have a provision fund called “Safegaurd”.

Unfortunately loans covered by this fund are no longer provided, so now we rely on diversification and the companies experience to deliver their promised interest rates.

Is there a Tax Efficient Zopa ISA Account?

The platform offers a tax efficient ISA account (Zopa ISA) which was launched in January 2017 for United Kingdom residents.

The Zopa ISA can be easily opened from the main dashboard screen.

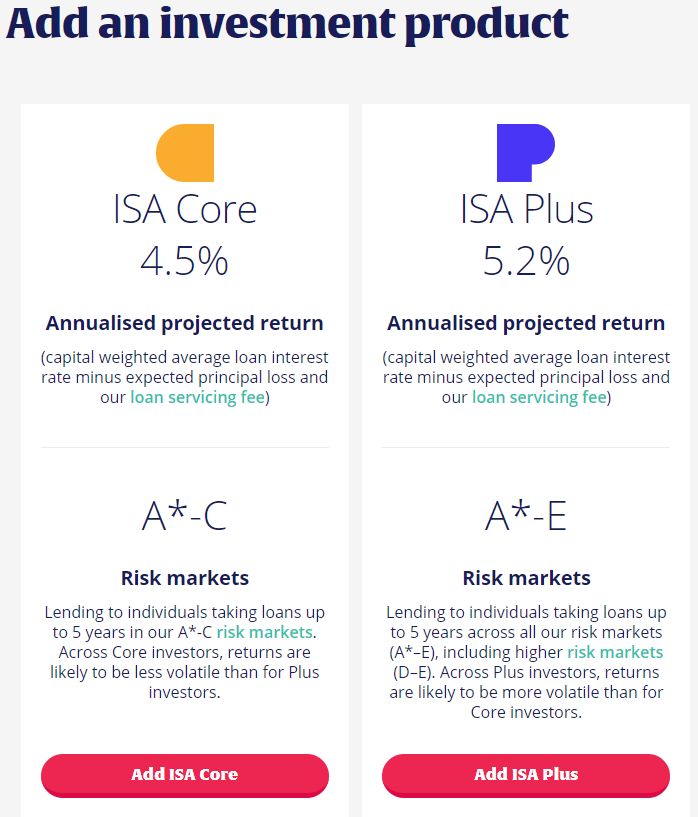

Then just choose which product you want to be part of your Zopa ISA.

What Investment Accounts Does Zopa Offer?

There are two investment portfolios in their standard account:

Zopa Core which offers from 2% to 4% projected returns, and Zopa Plus, which offers from 2.1% to 5.3% projected returns (as of the date of this Zopa review).

What Returns Can I Expect from Zopa?

As per above, Zopa is matching loans at returns from 2% to 4% projected in their Core portfolio and 2.1% to 5.3% in their Plus portfolio.

The Core Account is made up of the higher rated lenders (from A*-C Risk Markets they quote).

The Plus Account is a little more risky lending to their A*-E Risk Markets.

The interest rates don’t seem that much greater for the extra risk to me so I just kept my money in core when I invested with the platoform.

The Zopa ISA retirement account has the same rates available. Read more about ISA’s here.

How Easy is Zopa’s Website to use?

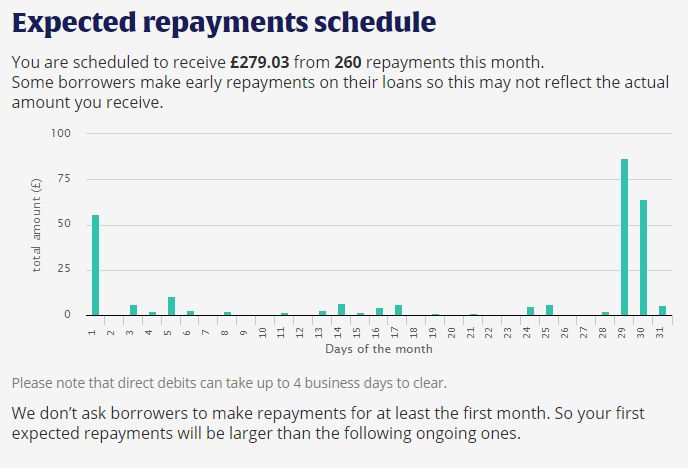

The website is generally easy to use. It has all of the information on account balances, loans and income. It also has some handy pages which show how loans are distributed and when repayments are due.

Summary – Zopa Review

Is Zopa a good investment? Overall I think Zopa is a good option for investors who want to diversify with a well established company, although return rates are low for the risk involved. Zopa does have a successful lending history and low default rates, and let’s face it, 5.3% is better than you’re going to get out of any bank right now.

I like the platform, however in December 2019 I decided to exit their portfolios for the most part and move the investment capital to other lenders. Not because the platform is a bad investment, I still believe they are a viable investment with a well established lender if you need them for diversification. However with rates so low now on unsecured loans, with no provision fund, I think there are safer lenders out there which pay batter returns for the risk, such as Loanpad, Kuflink & CrowdProperty to name but a few.

I may come back to the platform at a later date if their rates improve significantly, or if they re-implement a provision fund to guarantee returns. Currently the offered rates are just “projected rates”, so there is no guarantee that you’ll get the rates they are targeting. The other lenders mentioned above do have provision funds and/or asset security, so their rates are more likely to be realistic. And all of their rates are higher than Zopa.

Click Here to See My Current Zopa Investment >>

Points to Take in to Consideration Before Investing

Thumbs Up Points

- Safety – large company with good history of providing loans to consumers and was able to weather the 2008 financial crisis and come out of it relativity unscathed.

- Auto-Invest –very easy to invest with, and hands off investing once set up and reinvestment enabled.

- Fast Investment time – investment is typically quite fast as they have a huge loan book. Large sums can be gobbled up quite quickly minimizing cash drag, dependent upon their loan book.

- Website – very easy to use and understand. Many statistics available to see where your money is invested.

- Diversification – capital is invested over many loans, in fact they try not to put more than £10 of an investors portfolio in to any single loan, so they abide by the “Prime Directive” very well. This of course would be dependent on the size of investment account as wall as Zopa’s loan book at the time of investment.

- Low minimum investment – £1000 to start. If your portfolio is still small, it’s still easy to invest.

- Financial Conduct Authority(FCA) Regulated.

- IFISA Tax Free Account – Zopa ISA available for UK investors.

Thumbs Down Points

- No Provision Fund – if default rates rise on unsecured loans, it could throw off the projected return rate very quickly.

- Lower Returns – the platform offers lower returns than many competitors. Loans are still unsecured with no provision fund.

- Exit Fee – The platform charges a 1% exit fee plus any difference in interest rates for both accounts if you need to withdraw your money early.

- No Quick Access Account – depending on demand, you could have to wait a while to withdraw funds early.

Obvious Investor Risk Rating*

– 4/10 – Low – Medium

– 4/10 – Low – Medium

Is Zopa safe? I consider them to be at the lower to medium end of the risk scale.

Taking in to consideration that all loans are unsecured, and there is no Provision Fund, if they were a new lender I would be very cautions.

They have been around for a while though and have a wealth of experience qualifying borrowers and even weathered the worst financial crisis in modern history.

Even after 14 years in business; they still get excellent ratings on TrustPilot from their customers.

Who Can Invest with Zopa?

United Kingdom resident investors with a United Kingdom bank account and address & phone number can invest.

Only U.K. investors can invest in the Zopa ISA. Contact them for further information.

Zopa Cashback Offers & Signup Links**

No Cashback Offers Currently

Click here to check for Zopa cashback offers >>

Signup for standard account >>

Similar Lenders to Zopa

These lenders have asset secured loans or provision funds (most with better return rates) so I consider them to be a little safer that Zopa:

Loanpad, Kuflink, Assetz Capital, CrowdProperty, easyMoney

Other UK Peer to Peer Lender Reviews

No post found!

Disclaimers:

This page is presented for informational purposes only. I am not a Financial Adviser and therefore not qualified to give financial advice. Please do your own research and make your own investment decisions. Do not make investment decisions based solely on the information presented on this website.

* My opinions, reviews, star ratings and risk ratings are based on my personal investing experience with the company being reviewed. These ratings are personal opinions and are subjective.

** Some of the links on this website are affiliate referral links. When you click on these links, I can sometimes receive a commission, at absolutely no cost to you. This helps me to continue to offer new reviews & monthly portfolio updates here on my website. I don’t receive commissions from all platforms and it has no effect on my ongoing opinions on investments & investment platforms. Income from my investments and capital preservation are my main motivations.

Platforms reviewed on this website I am currently investing with, or I have invested with in the past. You can see with full transparency on my Portfolio Returns page which assets & platforms I am invested with (or have previously been invested with) at any point in time. I am not paid a fee by any of the companies to write reviews, so the reviews are unbiased and purely based on my own personal experiences.

Please read my full website Disclaimer before making investment decisions.